Soon Hock - Pure-play Singapore industrial property developer

Stocks

By Goh Lay Peng, CFA • 28 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

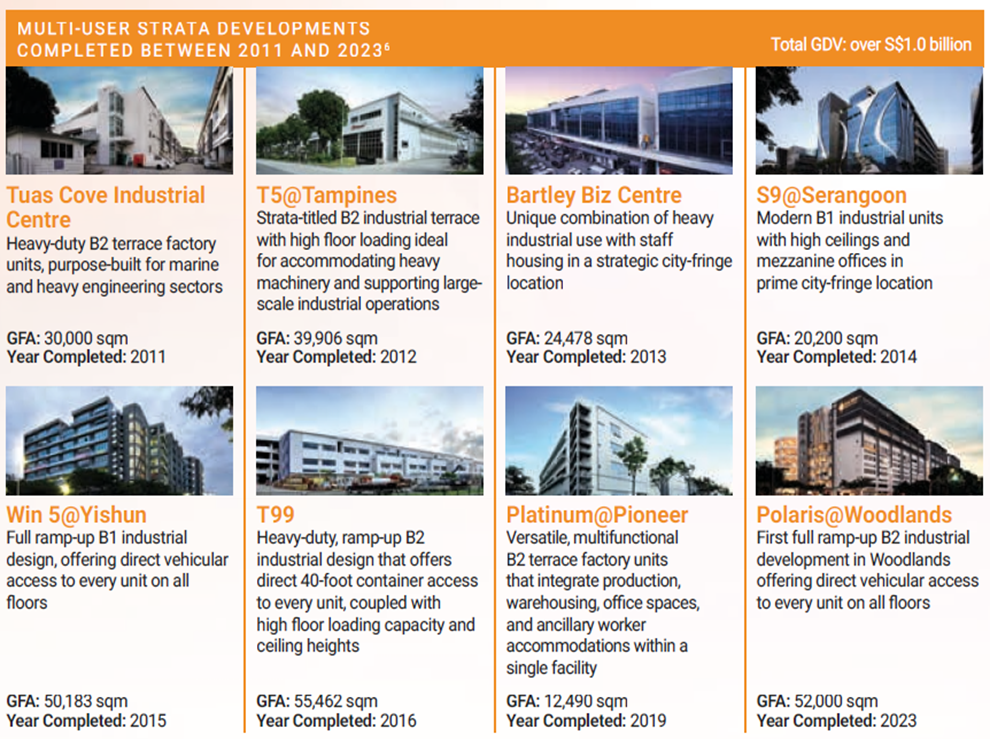

Soon Hock is a specialised industrial property developer focused on Singapore and has successfully developed industrial properties valued at over S$1.0 billion.

A pure-play Singapore industrial property developer (SGX: SHE) - Not Rated

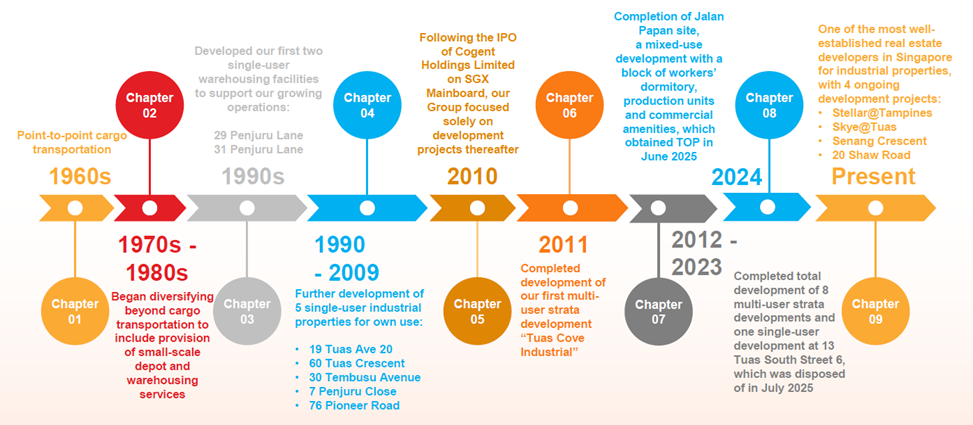

Soon Hock’s property development history dated back to the 1980s when the Group decided to develop its own warehousing facilities for its own operational needs. The Group delivered the first developments at 29 and 31 Penjuru Lane, in 1991 and 1993, respectively.

Soon Hock’s property development history dated back to the 1980s when the Group decided to develop its own warehousing facilities for its own operational needs. The Group delivered the first developments at 29 and 31 Penjuru Lane, in 1991 and 1993, respectively.

Helmed by Tan Yeow Khoon, a veteran with over 50 years of experience in in logistics and transportation management services. Soon Hock has successfully developed industrial properties valued over S$1.0 billion.

Soon Hock was listed on the Singapore Stock Exchange on 16 October 2025. Its single largest shareholder remains the Founder’s family, who owns 70.2% shareholding.

The group operates entirely in Singapore, with activities governed by Jurong Town Corporation (JTC) policies and industrial zoning regulations, which creates high barriers to entry but also limits speculative land banking.

Strategic locations maximize the projects’ return on investment

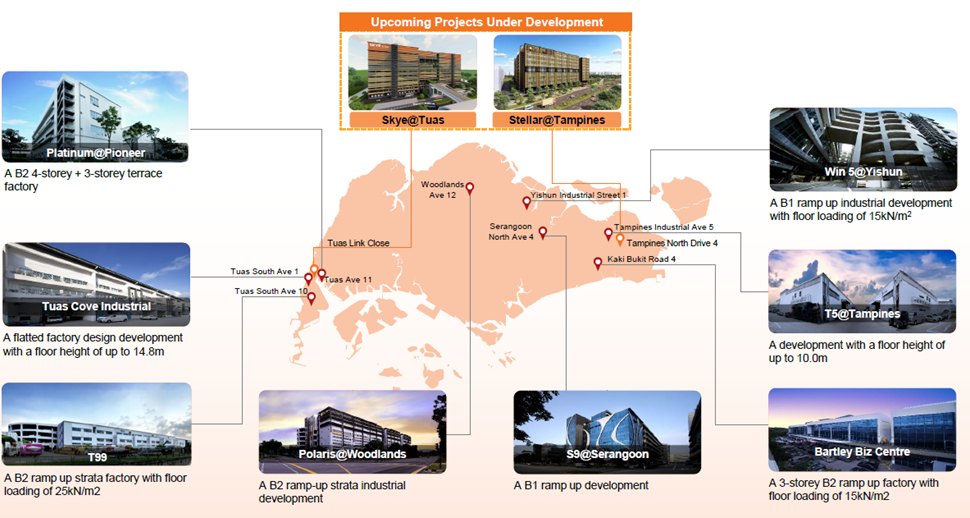

Soon Hock’s properties are located in established industrial estates such as Kaki Bukit and Jalan Papan, with close access to major expressways and transport nodes. This positioning is intentional. It targets end-users who value connectivity, efficiency, and proximity to labour and supply chains.This enhances the assets’ leasing appeal and potential capital appreciation.

Management with strong proven track record

Beginning his entrepreneurial career back in the 1960s, founder and Executive Chairman, Mr. Tan Yeow Khoon, is among the pioneers shaping Singapore’s development as a regional logistics hub.

Mr Tan Yeow Khoon brings decades of experience as an end-user of industrial properties, including his tenure as Executive Chairman of Cogent Holdings Limited, a Singapore-based logistics service provider formerly listed on the SGX Mainboard. Cogent was sold to COSCO Shipping International (Singapore) Co, Ltd in a S$490 million cash deal in 2018 and subsequently delisted from the Singapore Exchange.

With a strong understanding of end-user requirements, the management drives a user-centric development strategy with a forward-thinking design philosophy. This has translated into features that enhance functionality and usability, such as wide driveways and ramps, as well as column-free or minimal-column layouts incorporated across most of the group’s industrial projects.

Soon Hock’s management, led by Executive Chairman Tan Yeow Khoon, has launched more than 1,200 units of strata-titled industrial properties across various projects in Singapore. Between 2011 and 2019, the group completed eight industrial developments and all were fully sold.

Business segments

Building on its strengths in capital investment, construction expertise, and proven management controls, the group aims to establish itself as a leading industrial property developer in Singapore.

Soon Hock has two business segments – property development and property investment. Focused on multi-user strata industrial developments, Soon Hock’s mature development platform has a sizeable pipeline already under construction, while providing capital to recycle into new land acquisitions.

Property development

As at 31 December 2024, development properties under construction amounted to S$281.6m, reflecting a significant ramp-up in activity compared to prior years. The development projects anchors near-term development profits.

The total gross development value of the four projects in the pipeline is estimated at S$1.0bn. Stellar@Tampines and Skye@Tuas are under development and scheduled for completion by 1Q26 and 1Q27, respectively. 20 Shaw Road and Senang Crescent are projects under planning and have been substantially funded.

Stellar@Tampines

Located at Tampines North Drive 4, Stellar@Tampines is a 30-year lease, 9-storey multi-user ramp-up B2 industrial factory (total 307 units) and industrial canteen (4 units) with a basement carpark. Gross development value of Stellar@Tampines is estimated at S$326.5 million.

Stellar@Tampines is positioned as a modern multi-user industrial development in a prime industrial hub, designed to capture sustained demand from end-users and investors seeking functional space with strong connectivity.

Its location in Tampines places it close to major expressways and established industrial catchments, which supports take-up, pricing, and divestment.

On 11 December 2025, the project has obtained a partial Temporary Occupation Permit (TOP) for phase 1 and a full TOP is expected by March 2026. Phase 1 comprises entire development excluding 9th storey and covered linkway extension at 1st storey only.

With the Temporary Occupation Permit, Soon Hock will start to recognise the revenue from the sale of strata titles in 2025. Gross margin for the project is estimated at 25% or around S$81.6 million.

Skye@ Tuas

Located in Tuas, Skye@Tuas is a B2 industrial property (over 300 units), with 3 levels of parking. Gross development value of Skye@Tuas is estimated at S$354.0 million.

Skye@Tuas is positioned to capture demand from industrial users that prioritise scale, efficiency, and proximity to Singapore’s western manufacturing and logistics corridor.

The project benefits from deep industrial clustering, port connectivity, and established infrastructure, supporting take-up from owner-occupiers and investors despite its non-city-fringe location.

20 Shaw Road

20 Shaw Road is a freehold industrial redevelopment project located in the Tai Seng industrial area, a city-fringe precinct with strong connectivity and a long-established industrial and commercial catchment.

In April 2025, Soon Hock acquired 20 Shaw Road through an en-bloc transaction for S$118.8 million. The estimated gross development value is estimated at S$235.4 million.

The project involves the redevelopment of an existing industrial building into a modern multi-user industrial property, designed to meet current specifications and occupier requirements. Its city-fringe location supports stronger demand from owner-occupiers seeking proximity to the CBD, workforce accessibility, and efficient logistics links.

Target to start in Mid-2026, the project is scheduled to complete by end-2028. The project will have a workers’ dormitory with 900 beds.

Senang Crescent

The Senang Crescent project is an industrial redevelopment and asset enhancement initiative located within an established industrial estate in the eastern region of Singapore.

The site benefits from proximity to mature industrial catchments and transport infrastructure, supporting continued relevance for industrial users. The completion is scheduled in 2027.

Property investment

Soon Hock owns a portfolio of two income-generating industrial properties, providing stable recurring income. They are 2F Jalan Papan and Premier @ Kaki Bukit.

2F Jalan Papan

The 20-year leasehold Jalan Papan property includes a purpose-built factory block and an accompanying workers’ dormitory, obtained its TOP in January 2025. In October 205, the committed occupancy was 37%.

Jalan Papan also features a workers’ dormitory on master lease. The workers’ dormitory is currently approved to accommodate up to 300 beds which is fully leased to Range Construction Pte. Ltd. In 1QFY2025, Soon Hock recorded revenue in S$0.27 million from the master lease.

The asset generates stable cash flows for the group, supported by on-site amenities, with the first level of Block 1 of the factory block occupied by a canteen operator and a minimart that provide daily conveniences to tenants.

8 Kaki Bukit Avenue 4

This refers to two strata-titled 60 years (commencing 15 December 2010) leasehold factory units at Premier @ Kaki Bukit.

The Kaki Bukit properties are located within a well-established industrial estate and are held primarily for investment purposes. Their strategic location supports stable occupancy and recurring rental income, providing income visibility and balance to Soon Hock’s otherwise development-driven earnings profile.

As part of the capital recycling implementation, the two units have been divested in November 2025. The selling price was S$1.5 million each unit and Soon Hock will report total net gain on disposal of S$0.72 million.

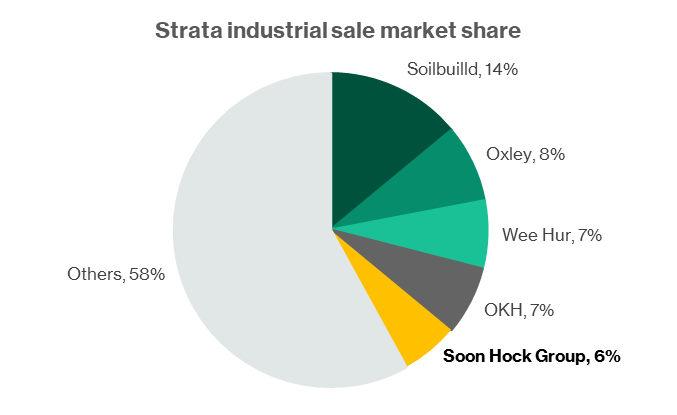

Competitor

Soon Hock Group ranked among the top 5 developers in Singapore’s strata industrial sale market with a market share of approximately 6%.

Industry outlook

Singapore’s economic outlook remains supportive of a healthy outlook for the industrial property market. In 2024, Singapore’s economy expanded by 4.4% year-on-year. For 2025, the Ministry of Trade and Industry (MTI) forecasts the Singapore economy to grow 4.0% year-on-year.

While global economic conditions turned out to be more resilient than expected, Singapore’s economic growth benefitted from stronger demand from key trading partners, stronger demand for semiconductor exports tied to the artificial-intelligence boom and the de-escalation in U.S.-China trade tensions.

The long-term outlook for Singapore’s factory market remains positive, underpinned by the country’s strong economic fundamentals and the continued expansion of the manufacturing sector.

Manufacturing investment commitments rose 27% y-o-y in 2024 to S$11.1 billion, driven mainly by strong inflows into the electronics and biomedical clusters. As these commitments are progressively realised over the next five years, more than 10,000 jobs in manufacturing, R&D and innovation are expected to be created, supporting sustained demand for industrial space across both production and R&D uses.

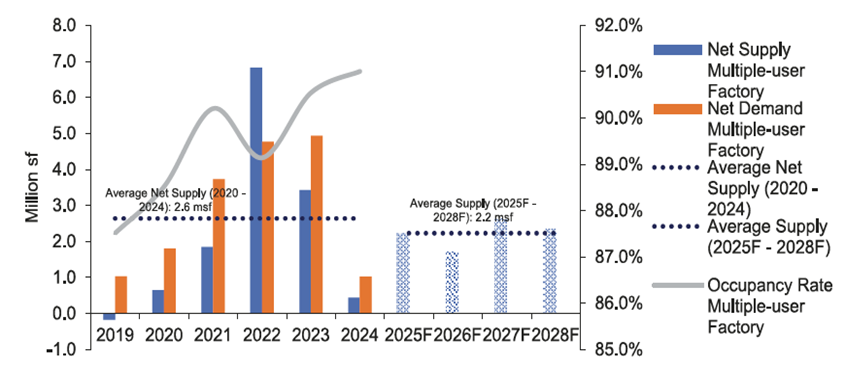

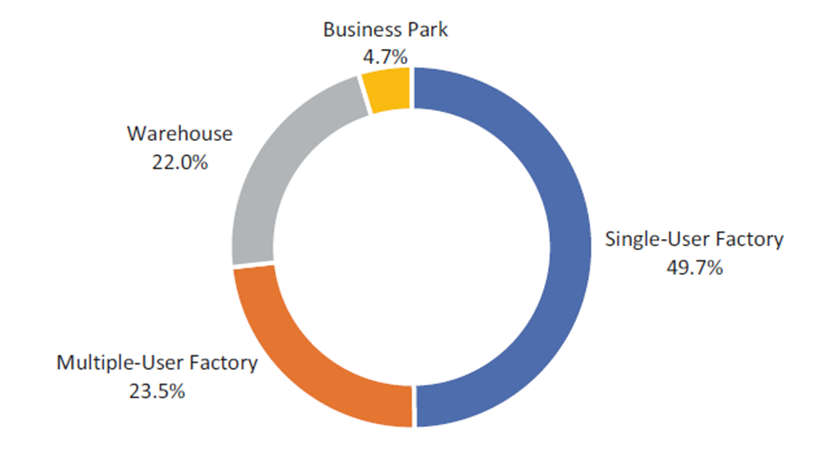

As at Q4 2024, overall industrial stock in Singapore totalled 574.1 million square feet (sf) of available floor area. Single-user factory space and multiple-user factory contributed 49.7% and 23.5% to the total industrial stock, respectively.

According to independent market study, the supply of factory space in the next two years will be skewed towards single-user factory. Jurong Town Corporation (JTC) projected 18.1 million square feet of single-user factory but only 8.9 million square feet of multiple-user factory to be completed between 2025 and 2028.

Rent estimated to grow 2.4% per annum between 2025 and 2027

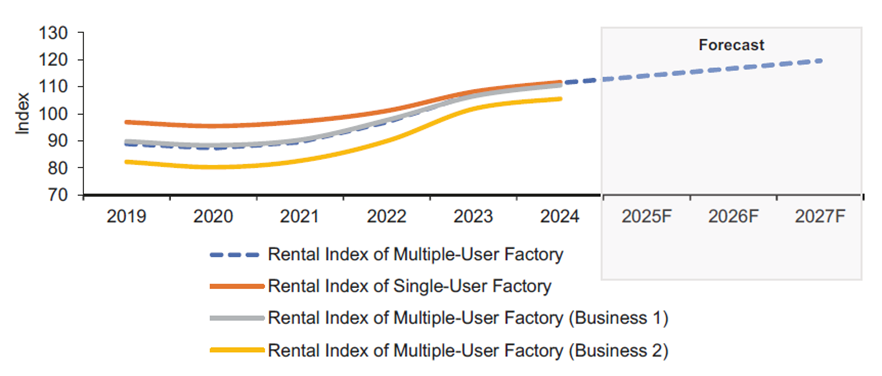

In 2024, rents for single-user and multi-user factories recorded stable year-on-year growth of 3.2% and 3.8%, respectively. Against a positive long-term outlook and stable demand for the Singapore factory market, a sustained uptrend in rents is expected. Rental growth is expected to continue over 2025F–2027F, with multi-user factory rents projected to rise by an estimated 2.4% per annum.

Rents for multi-user B1 and B2 factories followed an upward trend over the period, with B2 factory rents recording higher cumulative growth of 31.5% from 2020 to 2024, compared with a 25.1% increase for B1 factories. This highlights steady demand for factory space, particularly for B2-zoned properties, which typically accommodate a broader range of industrial activities and uses.

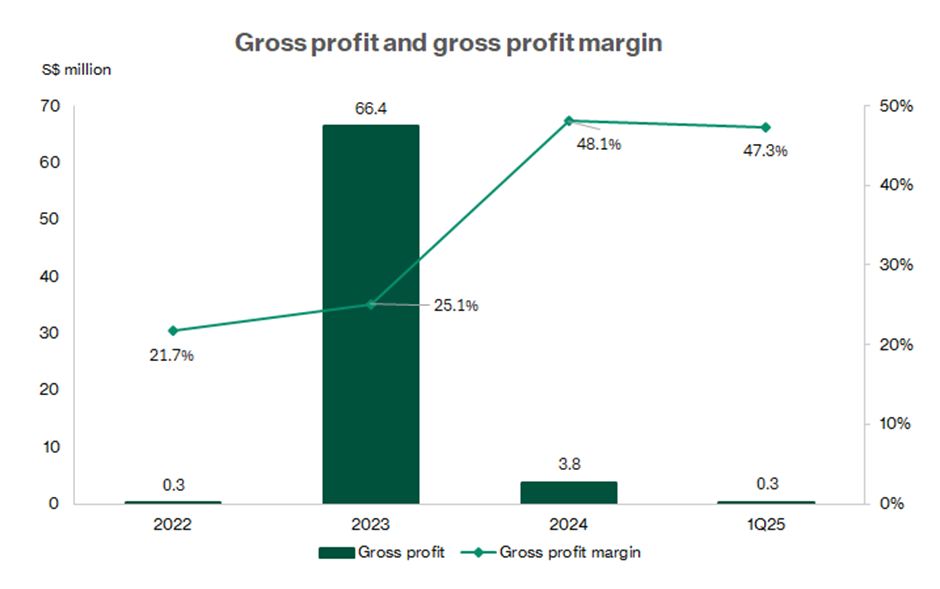

Financial highlights

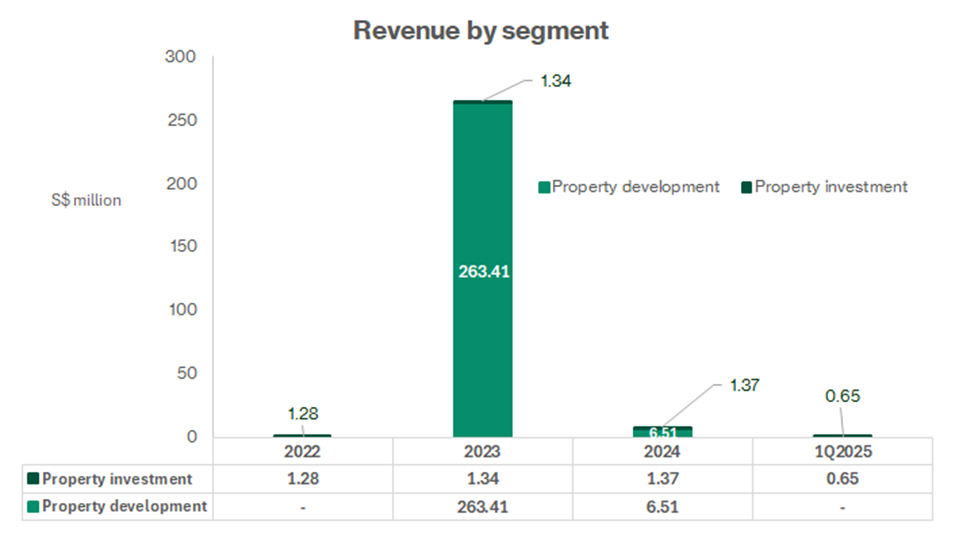

Soon Hock’s earnings are driven by development project completions and sales, resulting in uneven revenue and profit recognition across financial periods.

1Q2025

In 1Q2025, the group recorded revenue of S$0.7 million, derived entirely from rental income from its investment properties. This represented an 87.6% increase from S$0.3 million in 1Q2024, mainly driven by the commencement of the master lease at the newly completed workers’ dormitory, canteen, and minimart at Jalan Papan in February 2025.

Jalan Papan asset was still under construction in 1Q2024. In addition, rental income continued to be contributed by existing leases at the Kaki Bukit units and the leasehold industrial property at 13 Tuas South Street 6, which was fully divested in July 2025.

FY2024

Revenue declined to S$7.9 million in FY2024 from S$264.7 million in FY2023, reflecting the absence of development property sales as no new projects obtained Temporary Occupation Permit during the year.

FY2024 revenue was mainly driven by the sale of a heavy vehicle park at Polaris@Woodlands, which contributed S$6.5 million. Rental income from investment properties remained relatively stable at approximately S$1.4 million in FY2024, compared with S$1.3 million in FY2023, derived from leases at 13 Tuas South Street 6 and four leasehold strata-titled industrial units at Premier@Kaki Bukit.

Profit after tax declined to S$3.3 million in FY2024 from S$29.4 million in FY2023, reflecting a year-on-year decrease of S$26.1 million.

Key Risks

Demand for industrial space depends on economic activity

Macroeconomic uncertainty could weigh on industrial occupier sentiment and capital expenditure, potentially slowing demand for industrial space and affecting pricing, sell-through rates, and leasing activity. A weaker economic environment may also delay investment decisions by owner-occupiers, lengthen sales cycles for development projects, and place pressure on valuations. In addition, tighter financial conditions could raise financing costs and constrain liquidity, amplifying the impact on development margins and cash flow.

Exposure to industrial property policy changes

Operating within Singapore’s tightly regulated industrial property framework. Changes in Jurong Town Corporation (JTC) policies, zoning rules, or worker accommodation regulations could affect project feasibility and asset values.

Earnings volatility due to project-based revenue recognition

Earnings are driven by development project completions and sales, resulting in uneven revenue and profit recognition across financial periods. This is structural to the business model and can lead to short-term volatility in reported results.

High gearing during construction phases

Soon Hock’s development projects are capital-intensive and are typically funded through a combination of internal cash and bank borrowings. The project’s gearing is around 70% to 80%. As a result, gearing tends to rise during construction phases before sales proceeds are realised upon TOP and unit sell-through. Elevated leverage during these periods increases exposure to interest rate movements and refinancing risk may constrain financial flexibility if project timelines are delayed or market conditions weaken.

Dividend constraints from subsidiary-level borrowing covenants

Although the listed entity intends to distribute dividends of at least 25% of net profit after tax, certain subsidiaries may be subject to banking covenants that restrict dividend upstreaming until specified financial thresholds are met. As a result, dividend payouts may be uneven and closely linked to project completion and cash realisation rather than recurring earnings.

Trading at FY2024 P/E 60.6x and P/B 2.34x

Currently trading at S$0.63, Soon Hock is trading at market cap of S$195 million and FY2024 PE 60.6x. The high price-to-earnings ratio is due to the timing of the revenue recognition. The company does not have completed projects in 2024.

With the profit recognition on the newly completed projects in the next three years, the earnings visibility is supported by the revenue recognition from sales of units in completed projects.

For FY2025E and FY2026E, Soon Hock will start recognising revenue from Stellar@Tampines, which has a gross development value of S$326.5 million.

From FY2027E, Skye@Tuas will be completed with a gross development value of S$354 million.

The company’s stated dividend policy is to maintain dividend payout ratio of at least 25% on the net profit after tax.

Based on the reported NAV of 26.86 cents as of 31 March 2025, Soon Hock is trading at Price-to-book ratio 2.34x.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Soon Hock Enterprise Holding Limited.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments