SSB 10-year return at 2.85%. Better than T-bills and fixed deposits?

Bonds

By Gerald Wong, CFA • 22 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

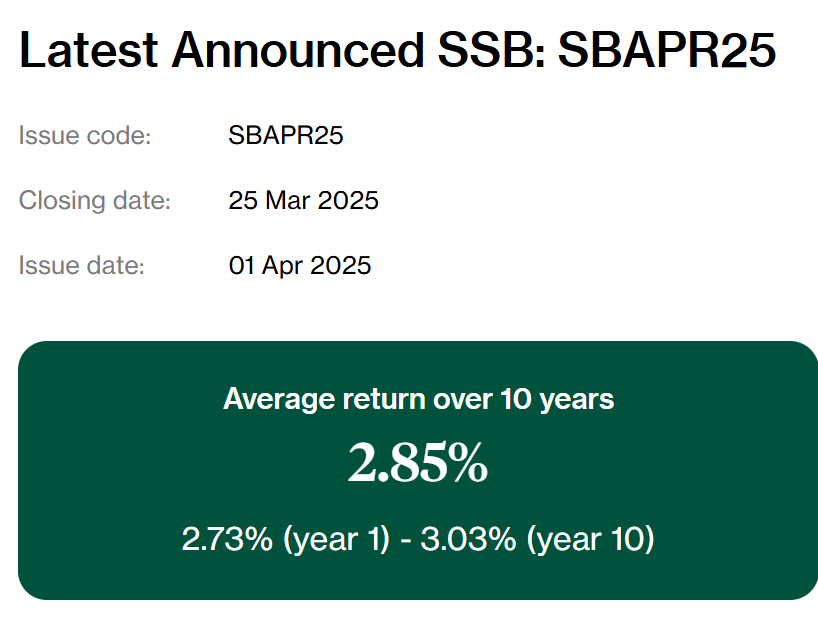

The current issuance of the Singapore Savings Bond (SSB) offers a 10-year average return of 2.85% per year. Applications for the latest SSB will close on 25 March.

What happened?

Interest rates have fallen sharply in the past month.

In recent weeks, we saw the yield on the 6-month Singapore T-bill fall to 2.56%. The best 6-month fixed deposit rate has also fallen to 2.50%.

Hence, when I was updating my comparison of where to park your cash, what stood out to me was that the current issuance of the SSB offers a 10-year average interest rate of 2.85%, above the T-bill yield and fixed deposit rate.

As always, I see questions in the Beansprout community about the projected interest rate for next month’s SSB.

Knowing what the projected SSB interest rate is may then allow us to decide if we should apply for the current SSB or wait for the next one.

As such, I decided to take a look at the latest SSB interest rate projection to see where the interest rate might be heading for the next SSB.

What to expect for the latest Singapore Savings Bonds (SSBs)

#1 – Current SSB offers 10-year average interest rate of 2.85%

The current issuance of the SSB offers a fairly attractive interest rate.

If you hold on to the SSB for 1 year, you will receive an average return of 2.73%.

If you hold on to the SSB for 10 years, you will receive an average return of 2.85% per year.

The 10-year average return of 2.85% is below the rate of 2.97% offered by the previous SSB in Feb. However, it is higher than the 2.82% rate from Jan.

The 1-year rate of 2.73% is also above the best 3-month, 6-month and 1-year fixed deposit rate in Singapore, as banks have cut their interest in March.

#2 – SSB interest rate projected to fall to about 2.72%

If you are new to the SSB, what you would need to know is that SSB interest rates are linked to the yields of Singapore Government Securities (SGS).

Like T-bills, SGS are also bonds issued by the Singapore government. However, they have a longer maturity of 2 years to 30 years.

The interest rates on the SSB are linked to the daily average SGS yields as published by MAS in the previous month.

As an investor in the SSB, your average annual compounded return over any period (eg 10 years) should broadly correspond to the SGS yield of the same holding period (eg 10 year SGS) with a one-month lag.

In other words, the average 10-year return on the next SSB would largely correspond to the yield on the 10-year Singapore government bond or SGS this month.

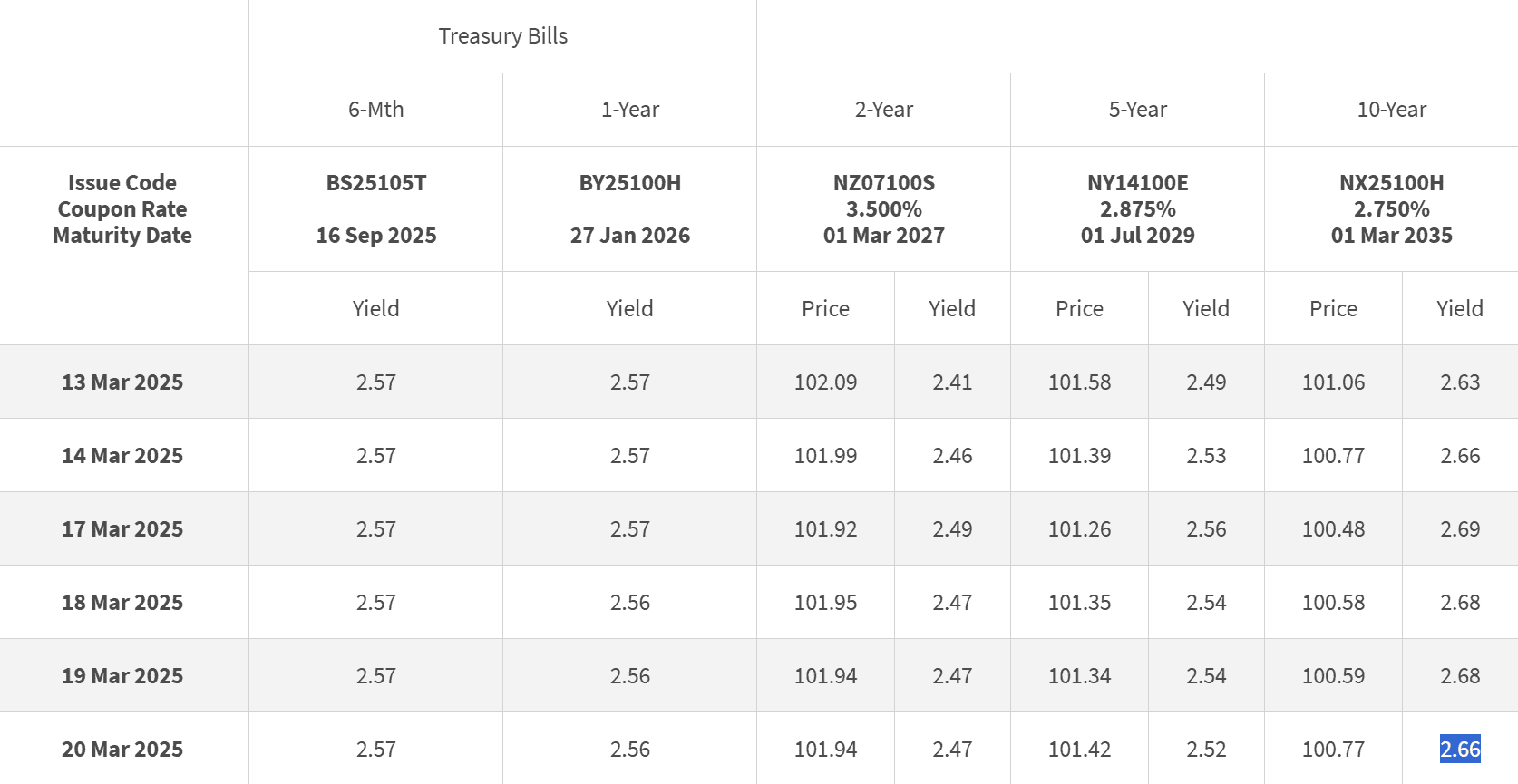

As seen in the chart below, the 10-year Singapore government bond yield is lower in March than in February. This decline could be attributed to a flight to safety, with investors turning to government bonds amid the uncertainty surrounding Trump’s tariffs.

As of 20 Mar 2025, the closing yield on the 10-year Singapore government bond yield was around 2.66%.

This is below the 10-year average return offered by the current SSB.

Taking the average yield in the month of March, this may mean that the 10-year average return for the next SSB may be lower than the current one.

Based on our SSB interest rate projection as of 21 March 2025, the average return over 10 years for the next SSB may be at 2.72%.

This is calculated using the average of the closing yield of the 10-year government bond so far in March, and assuming that the yield will remain at 2.66% for the remaining working days of the month.

#3 – Demand for SSB may increase from previous issuance

With the fairly attractive interest rates offered by SSBs compared to T-bills and fixed deposits, demand has rebounded in the March issuance of the SSB.

In the previous issuance which offered a 10-year average return of 2.97%, there were S$639 million of applications, the highest since September 2024.

There will be S$700 million of Singapore Savings Bonds (SSBs) issued this time.

If demand were to increase significantly from last month, investors may not be able to get full allocation of the SSBs.

What would Beansprout do?

The latest issuance of the SSB offers a 10-year average return of 2.85%, higher than its long term historical average.

With the 10-year average return on the next SSB is projected to fall further to about 2.72%, it might be more worthwhile to apply for the current SSB rather than to wait for the next one.

Apart from offering a higher 10-year average return compared to the 6-month Singapore T-bill yield and best fixed deposit rate, the latest SSB also allows us to lock-in a rate of 2.85% over 10 years, while having the flexibility to redeem prior to maturity.

It might also be worthwhile swapping previous issuances of SSB with the upcoming SSB to earn a potentially higher interest, given the fall in the projected rate for the next SSB. To find out how much more interest you can potentially earning by doing so, check out our SSB swap calculator.

If you are looking for the best place to park your savings, we compare SSBs to T-bills and fixed deposits to find out how to allow our spare cash to work harder.

Applications for the latest SSB close at 9pm on 25 Mar (Tuesday). Redemptions of SSBs will also close at 9pm on 25 Mar (Tuesday).

You can sign up for a email reminder to be reminded of future SSB closing dates.

Learn more about SSBs and how to apply for SSBs using our comprehensive SSB guide.

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments