Stocks vs options: Which works better for your portfolio?

Brokerage Account

Powered by

By Nicole Ng • 01 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Explore the key differences between stocks and options, practical options strategies, and why use Tiger Brokers Singapore as your go-to platform for options trading.

This post was created in partnership with Tiger Brokers Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

For many investors like myself, stocks are the most familiar way to participate in the market and ideally earn passive income.

They are straightforward: buy a share, own a piece of a company, and if it performed well, so did my investment portfolio.

But it only offers one way to express my market view.

In recent years, however, options have gained popularity as an additional tool for investors to express their view on whether the market will rise, fall, or even stay flat.

However, options can appear complex and intimidating for those new to them.

But by offering user-friendly tools and education, platforms such as Tiger Brokers have made it easier for investors to take their first steps into options.

In this article, I’ll share how options can be used to complement an existing stock portfolio, highlighting what we should consider when trading options trading.

What’s the difference between stocks and options?

Stocks enable you to own a part of a company, receive dividends (if any), and potentially benefit from capital gains over time.

With options, on the other hand, you can express market views beyond simply buying or staying out of the market. You can go directional, hedge against downside risks, or structure strategies tailored to different conditions. This gives you more flexibility.

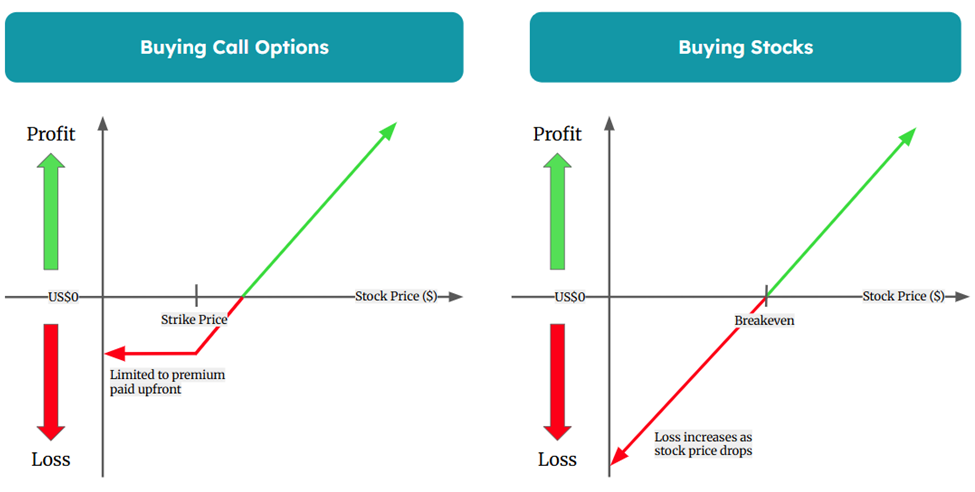

Options also allow you to define your risk and reward upfront. Unlike stocks, where losses can theoretically go all the way to zero, options made it possible to set clearer boundaries and limit potential downside.

While both stocks and options are tools for investing, the way they work and the opportunities they offer are quite different.

Below, I’ve outlined the key differences between stocks and options:

| Stocks | Options | |

|---|---|---|

| Capital Efficiency | Require a larger upfront capital to build a meaningful position. | Allow you to control larger exposure with a smaller initial investment (leverage) |

| Strategies | Focus on buy-and-hold, dividend investing, dollar-cost averaging, and value investing. Possible to short-sell in some markets. | Income generation (e.g., covered calls, cash-secured puts) and risk management through hedging (e.g., protective puts) |

| Risk Profile | Downside risk is tied to the full value of the stock—you could lose everything if the company goes to zero. | Risk can be predefined, such as being limited to the premium paid when buying calls or puts. |

| Time Horizon | Involves long-term investing and compounding. Can also be used to trade short-to-medium opportunities. | Typically applied to short- to medium-term opportunities, though some strategies can support longer horizons. |

| Complexity | Straightforward, fewer variables to monitor and accessible for most investors. | Requires a deeper understanding of strategies, the Greeks, volatility, and expiry risks. |

Despite the differences, stocks and options share some similar features in that both are traded on regulated exchanges, are highly liquid, and are ultimately tied to the company’s underlying performance and broader market conditions.

Practical scenarios where options add value

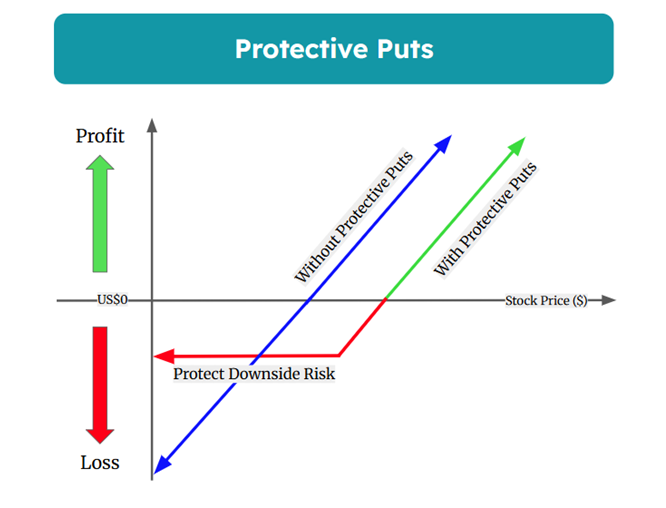

#1 - Hedging a stock portfolio with protective puts

A protective put involves holding a stock while buying a put option, which gives you the right to sell the stock at a predetermined price. If the stock declines, the put increases in value, helping to reduce potential losses.

As shown, a protective put strategy limits losses during a market decline but raises the breakeven point due to the put premium cost.

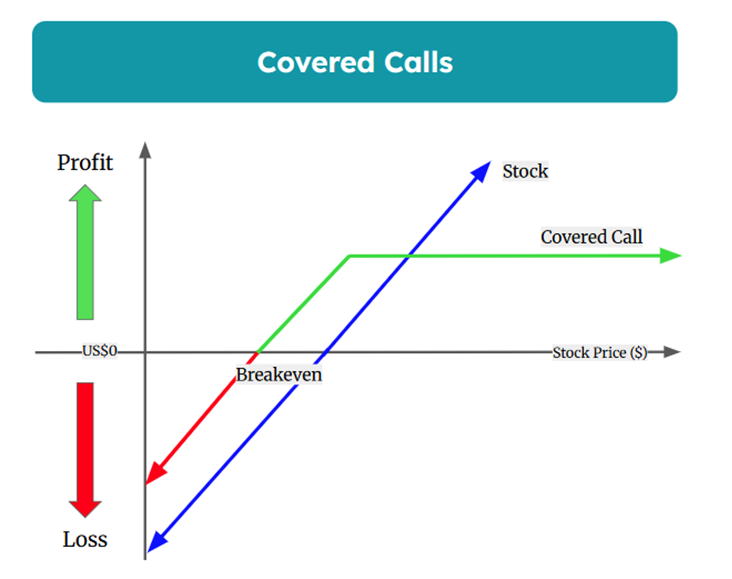

#2 – Generating income with covered calls

This strategy involves owning the stock and selling a call option on it, which is the right to buy the underlying stock.

By selling the call, you collect a premium.

If the stock doesn’t rise above the strike price, the option expires worthless, and you keep the premium.

Some investors may use this strategy as a way to potentially generate more consistent premium income from their stock holdings.

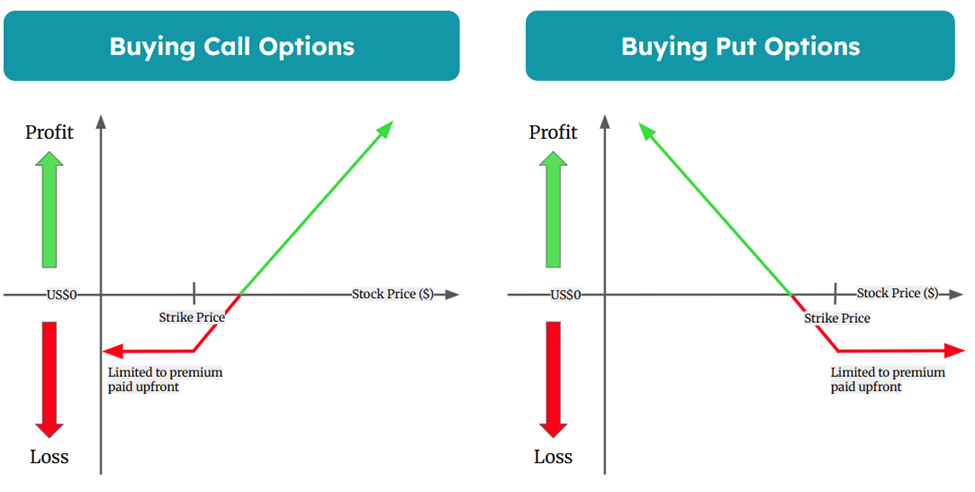

#3 – Speculating tactically using long call/put

Options also let you capitalise on accurately identifying the direction of stock movements:

- Buy a call if you think the stock will go up.

- Buy a put if you think the stock will go down.

The best part is that your maximum loss is limited to the premium you paid for the option.

When you buy a call or put option, the most you can lose is the premium paid upfront for the contract.

This makes the risk defined before entering the trade.

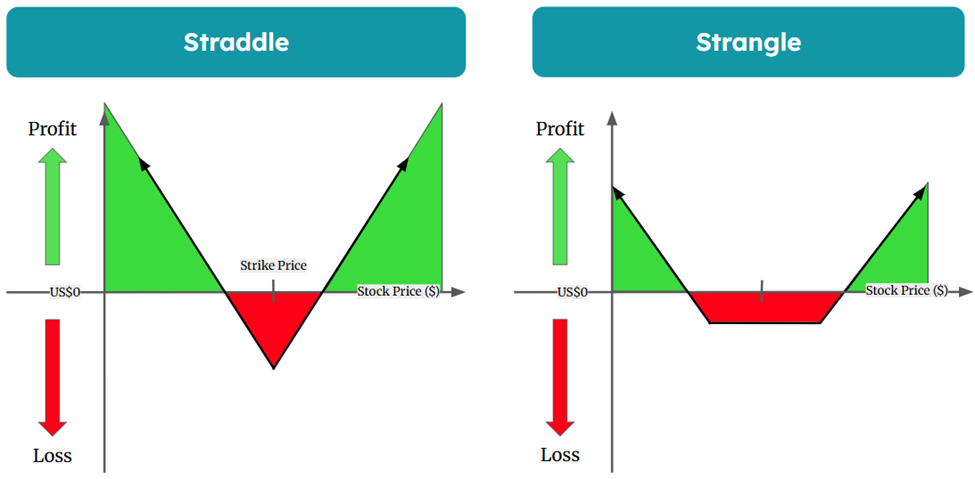

#4 – Volatility plays (Strangle/Straddles)

A slightly more advanced strategy is trading based on volatility rather than direction.

A strangle/straddle involves buying a call option and a put option at the same time.

This means the stock price needs to move a lot, either up or down, for the strategy to make a profit.

Such big moves often happen around important events, like company earnings announcements or major economic news that can affect the stock.

Why use Tiger Brokers for options trading?

When trading options, some of the key considerations include choosing a platform that is easy to use, offers transparent pricing, and provides access to a range of markets.

Here are a few reasons why Tiger Brokers is worth considering when trading options:

#1 – Low fees

One of the main attractions of Tiger Brokers is its competitive pricing.

For US options trading, Tiger charges just US$0.65 per contract on its fixed commission plan.

The fee structure is transparent with no hidden charges for account maintenance, inactivity, or deposits.

New users get to enjoy zero commission on US share trading, which makes the platform a cost-efficient way to get started without worrying about additional overheads.

On top of that, you can also enjoy welcome rewards up to S$1,000 and a S$50 FairPrice voucher when signing up through Beansprout. Find out how you can earn rewards here.

#2 – Variety of options markets

While most investors are familiar with US-listed options, Tiger Brokers goes further by also offering options trading on the Hong Kong market.

This gives investors access to more diverse opportunities beyond the US.

And if you want to trade beyond options, Tiger provides access to multiple markets, including the US, Hong Kong, Singapore, China A-shares, and Australia, as well as other asset classes such as futures and funds.

It’s a versatile platform for anyone who wants to manage different parts of their portfolio in one place.

You can also check out our full Tiger Brokers review here.

#3 – User-friendly options interface

The Tiger Trade app feels smooth and intuitive, which makes a big difference when navigating the complexity of options.

Key features include:

- Advanced trading tools for options strategies

- Real-time options market data

A built-in community section where investors share insights on the underlying stocks to support informed decisions on options trades

#4 – Options educational resources

Options can feel daunting when you’re just starting out. That’s why I see Tiger’s focus on education as one of its biggest strengths.

The Tiger Brokers Options Handbook, available via the Tiger Trade app, serves as a practical guide with insights and real-world examples from experienced traders.

The platform offers a demo account, enabling users to simulate options trading in a controlled environment.

Beyond digital resources, Tiger hosts events such as the Options Seminar on 18 October 2025, where investors can learn directly from professionals.

All of these resources have been designed to make options more approachable, helping users deepen their understanding while building confidence in how to use the platform.

What would Beansprout do?

Options can be a useful addition to an investor’s toolkit, offering flexibility and the ability to manage risk in ways that stocks alone cannot.

But they also come with added complexity and the potential for losses if not used carefully. That’s why it’s important to approach them with the right knowledge, strategy, and platform.

For investors who are considering options, starting small, perhaps even with a demo account, can be a good way to build familiarity before committing real capital.

Platforms like Tiger Brokers make the learning process more approachable, with transparent fees, access to multiple markets, and dedicated educational resources such as the Options Handbook and upcoming seminars.

Options can be a complementary strategy to stock investing for investors who want to expand their toolkit.

Learn more about options and sign up with Tiger Brokers here. Get S$50 FairPrice voucher and up to S$1,000 welcome rewards when you sign up for a Tiger Broker account via Beansprout. Promo details here.

You can also join Tiger’s upcoming options seminar to gain practical insights directly from the experts:

The Right Call, The Smart Put – Insights into Options

📅 Date: Saturday, 18 October 2025

⏰ Time: 9.30am – 12.30pm (registration from 9am)

📍 Venue: Guoco Midtown Bugis, The Work Boulevard (MICE Room)

🎟 Admission: SGD 10 (includes an exclusive goodie bag worth SGD50)

Attendees will also receive a SGD30 cash rebate in CBOE Options after the event.*

*T&Cs apply. For more information refer to the Eventbrite Page.

This ticketed event, held in collaboration with CBOE, will feature expert speakers and Tiger users sharing strategies, live demos, panel discussion, and practical tips for trading US options.

Important Information

Not financial advice. Investment involves risk. Trading options can carry a high level of risk and may not be suitable for all investors. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward and downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives, and circumstances. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions