Telkom Indonesia ID SDR 1to5 - Riding Indonesia’s Digital Growth Wave

Singapore Depository Receipts

Powered by

By Gerald Wong, CFA • 16 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Telkom Indonesia is the country’s largest telecommunications and network service provider. It is also the parent of Telkomsel, Indonesia’s biggest cellular operator.

About Telkom Indonesia (Not Rated)

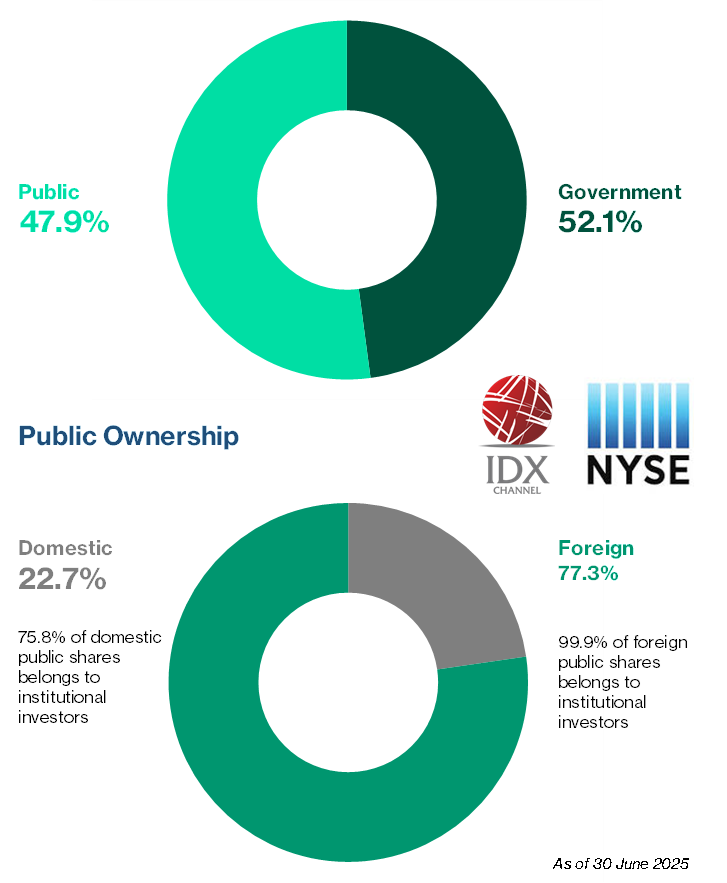

PT Telkom Indonesia (Persero) Tbk, 52% owned by the Indonesian government, is the country’s largest telecommunications and network service provider. It is also the parent of Telkomsel, Indonesia’s biggest cellular operator.

Telkomsel – The Crown Jewel

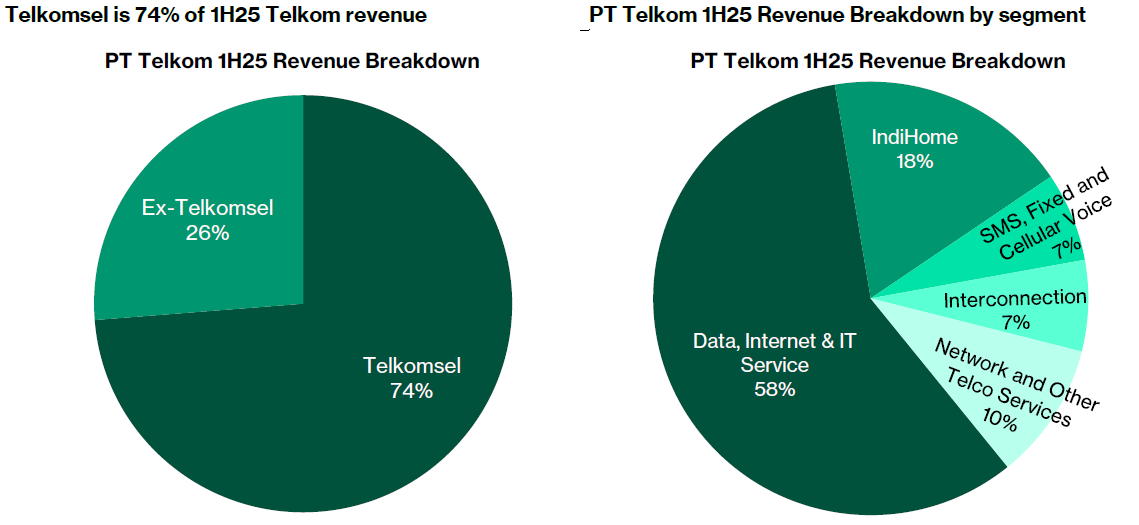

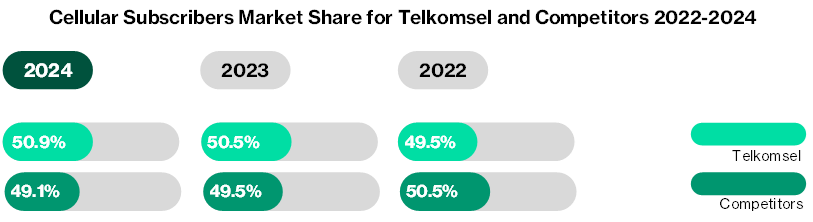

In 1H25, Telkomsel contributed 74% of PT Telkom’s total revenue. It is the market leader in Indonesia with >50% mobile subscriber share as of end-2024.

By the end of 2024, 5G adoption in Indonesia was still in its early stages, with a 3% adoption rate, while 4G dominated the market. Telkomsel have led by building nearly 1,000 5G base stations in 56 cities/regencies at end of 2024. 5G rollout is expected to enable advanced digital use cases (AR/VR, IoT, autonomous vehicles).

Sector Consolidation & ARPU Recovery

In 2024, Indonesia telco operators engaged in an aggressive price war, offering ultra-low-cost starter packs, with some selling 3GB of data for as little as IDR10,000 to drive subscriber growth.

By mid-2025, the situation improved as prices had been significantly revised, with entry-level packs typically ranging from IDR25,000-35,000 depending on the operator and data quota. These pricing moves marked a shift in industry strategy toward revenue recovery and improved average revenue per user (ARPU) following heavy promotional activity the previous year.

Digital business: the anchor of mobile revenue

The proportion of digital business to Telkomsel’s mobile revenue has grown from 89.9% in June’24 to 90.6% June this year, as Telkomsel deepens its transition away from legacy services towards a more value-aligned portfolio.

Its digital business is focused on 3 pillars.

- Digital Lifestyle Services (content, gaming, entertainment, financial services).

- Digital Advertising & Enterprise Solutions.

- Digital Platforms & Ecosystems (through its subsidiary INDICO).

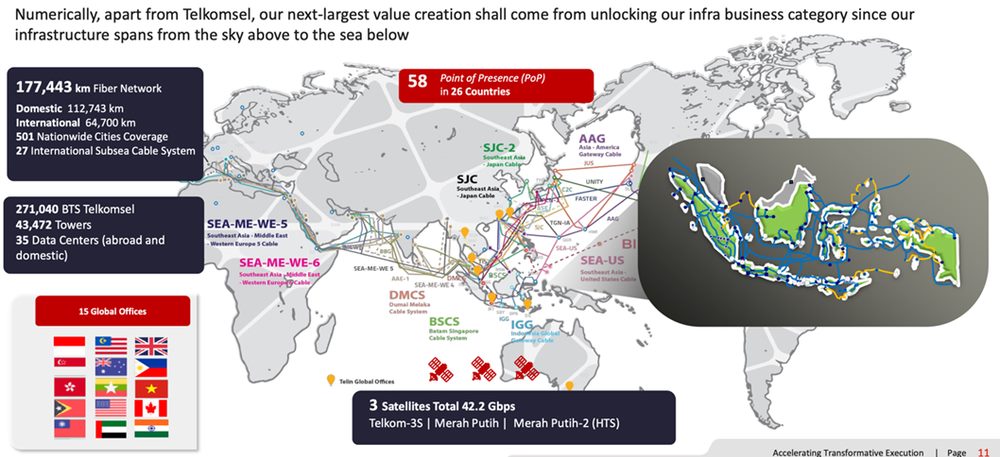

Expanding Digital Infrastructure

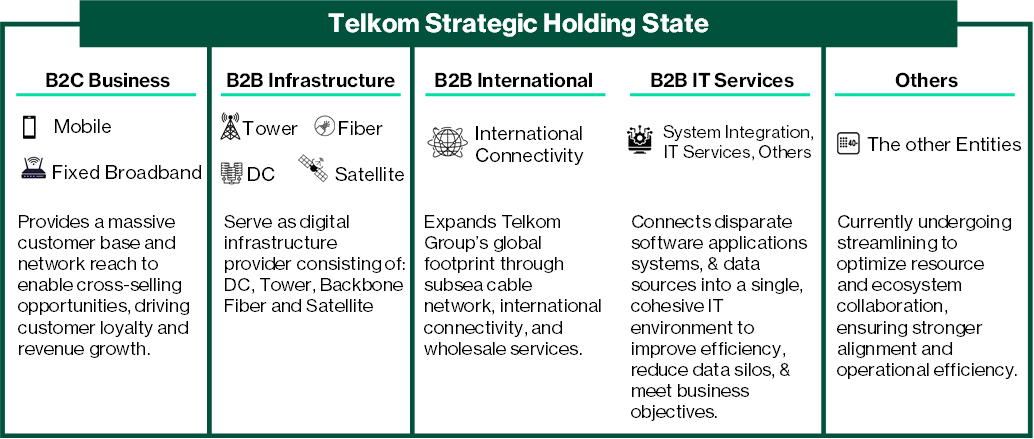

PT Telkom is expecting its aggregate non-consumer business growth to outpace through its diversification efforts.

As part of its “5 Bold Moves” strategy, PT Telkom is aggressively scaling its digital infrastructure and data centres.

Data Centre Network (NeutraDC)

In 2024, Indonesia’s data center industry solidly grew with a total business value of US$3 billion, encouraged by the increasing demand for reliable digital and data storage services. Telkom experienced competition in this industry from several major players, such as DCI Indonesia and Dian Swastika Sentosa. DCI Indonesia is the current market leader in this sector with a target capacity of 119 MW by the end of 2024.

Telkom operates 35 data centres with total capacity of 44MW (enterprise + hyperscale) and 2,420 racks for edge computing.

Its data centre footprint spans 30 Indonesian locations plus 5 international sites (Singapore, Hong Kong, Timor Leste).

The utilization rate of NeutraDC's data center capacity currently stands at approximately 76%, supported by a diverse customer base encompassing government, banking, large enterprises, and global cloud service providers.

Sustainability & Innovation

NeutraDC utilizes solar panels for renewable energy and employs water-based cooling technology to boost energy efficiency. Its data centers are also designed to meet future demands, including the high-power density required for advancements in Artificial Intelligence (AI).

This supports Telkom’s goal to be a leading regional digital infrastructure provider.

Diversification into Digital Platforms

The increasing technology adoption and expansion of internet access have resulted in digital business growth in Indonesia. E-commerce continues to dominate the digital economy, with a projected Gross Merchandise Value (GMV) of US$110 billion in 2025. Indonesia’s digital economy is projected to reach US$210–360bn by 2030.

PT Telkom through Telkomsel’s subsidiary, INDICO, is focused on driving the development of Indonesia’s digital ecosystem and operates in various business lines in multiple sectors, including Fita (health-tech), Kuncie (edu-tech), Majamojo (gaming), and Digital Food Ecosystem (agri-tech).

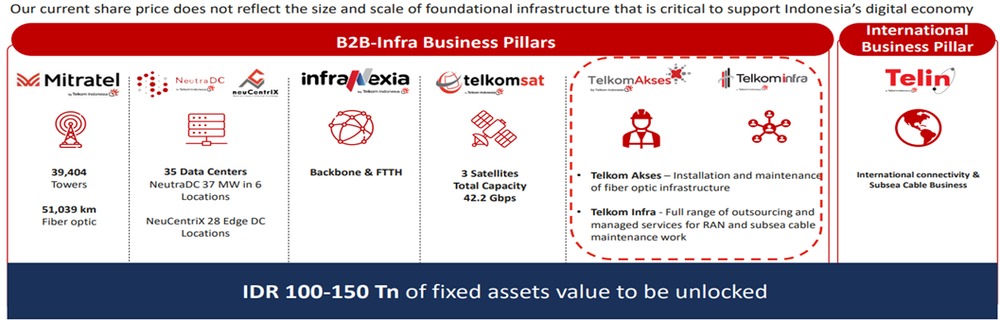

Value Unlocking Initiatives

PT Telkom is looking to restructure/divest non-core units to focus on core telecom & digital infra.

Monetisation targets include Infranexia (fibre) and NeutraDC (data centres) via stake sales or strategic investors.

It also plans to cut the number of subsidiaries from 55 to 22 for efficiency.

Management currently values the InfraCo (which includes data centres, wholesale, infra) at IDR100tn, targeting IDR100–150tn value unlock.

Telkomsel & SingTel Strategic Alliance

Telkomsel is a joint venture between PT Telkom Indonesia (70% ownership) and SingTel (30%).

Established in 1995, the partnership combines Telkom’s local reach and government backing with SingTel’s global telecom expertise.

In the most recent quarter, Telkomsel contribute close to 25% of SingTel’s regional associates’ total profit after tax, the 2nd largest contributor.

INDICO (Telkomsel’s digital subsidiary) and SingTel’s regional associates (Airtel, AIS, Globe, Optus) collaborate through the SingTel Group Digital Ecosystem, sharing insights on fintech, healthtech, and edtech.

In 2024, Telkom and SingTel announced plans to expand data center collaboration via STT GDC (Singtel’s data center arm). This includes developing hyperscale-ready capacity in Indonesia under NeutraDC, aimed at serving global cloud providers and AI workloads.

Recent Financial Performance

2Q25 Results

Telkom reported a 2Q25 revenue of IDR36.4trillion, down 4% compared to a year ago, mainly due to weak mobile ARPU and continued softness in digital revenue.

2Q25 EBITDA (earnings before interest, taxes, depreciation and amortisation) was IDR17.9trillion, down 3% from last year, with margins compressing to 49.1% (from 49.8% in 1Q25).

FY2025 Guidance Revision

Management has revised its FY25 revenue guidance to flat from low single digit growth previously and has reduced its EBITDA margin expectation to 50% from its previous guidance of 50-52%.

Key Risks

Despite earlier expectations for a stronger rebound, recent macroeconomic indicators reflect an uneven and fragile recovery. The recent softer FY2025 guidance reflects continued pressure from subdued consumer spending and broader macroeconomic conditions.

Weak ARPU remains a drag, though stabilisation is underway as the impact from aggressive promotions fade.

Transmission charges and spectrum fees remained critical investments to support the network connectivity and sustained traffic growth, however this high infrastructure outlay for fibre, 5G, and data centres may weigh on free cash flow.

There is a shift from traditional voice and SMS services to Over-the-top (OTT) services such as WhatsApp, Line and Skype which would impact revenue growth.

Other OTT services such as Netflix and Youtube deliver attractive content over telco operators’ networks without providing proportional contributions to infrastructure maintenance costs, adding to the telco operator’s capex burden.

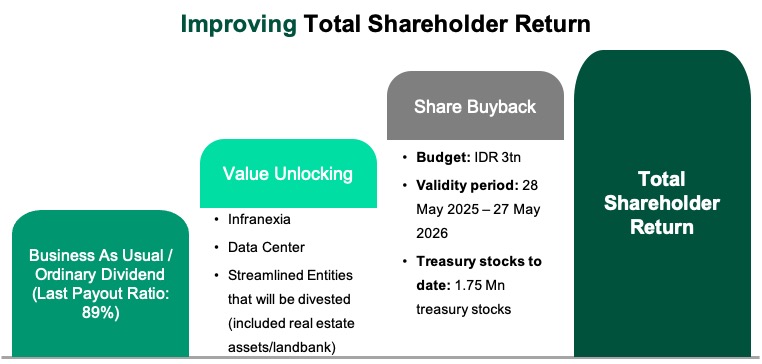

Dividend Appeal

Telkom has one of the highest dividend yields among Indonesian blue chips. The company has a consistent dividend track record and management has committed to a payout ratio of 60–90%. Telkom offers a trailing dividend yield of 6.9%.

In 2025, the management has guided that it intends to pay out approx. 80% of earnings as dividends for FY 2025.

Furthermore, at the recent AGM, PT Telkom announced the approval of a share buyback program of up to Rp 3 trillion, which could potentially further enhance shareholder value.

You can now trade Telkom Indonesia (SGX: ITKD) through Indonesia Singapore Depository Receipts (SDRs).

These Indonesia SDRs offer investors a more accessible way to invest in Indonesia-listed companies.

Apart from Telkom Indonesia SDR, you can also access the following Indonesia companies through Singapore Depository Receipts.

Bank Central Asia (BCA) - Largest private bank in Indonesia (SGX: IBKD)

Indofood CBP - Leading packaged food manufactuer in Indonesia (SGX: IICD)

SDR holdings will be custodised within investors’ Central Depository (CDP) accounts, providing seamless integration with existing Singapore-based portfolios. Learn more about Singapore Depository Receipts (SDRs) here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Telkom Indonesia ID 1to5 SDR.

Download the full report here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Beansprout received monetary compensation from Singapore Exchange (SGX) to provide independent research on Singapore Depository Receipts (SDRs).

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments