4 ways this AI tool helped me to invest smarter

Brokerage Account

Powered by

By Nicole Ng • 17 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

From market headlines to stock research, here’s how TigerAI helps investors save time and make informed decisions.

This post was created in partnership with Tiger Brokers Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

As a retail investor building passive income in Singapore, investing can sometimes feel like information overload.

Between watching the markets, reading the news, and researching companies, I’d often feel like there weren’t enough hours in the day to do it all.

And in the process, I was worried I might be missing out on opportunities.

Curious to see if technology could help, I tried out TigerAI, an AI-powered investing assistant by Tiger Brokers.

It can digest financial data and news, then explain it to you in plain English.

I wasn’t sure what to expect, but to my surprise, TigerAI turned out to be a practical tool that’s made my investing process smoother.

Here are four ways it’s helped me invest smarter (and worry less).

#1 – Cut through the noise

News headlines can be overwhelming, especially when it comes to Fed rate cut decisions, where different news outlet and commentator seems to have a different take.

It can become hard to tell what’s fact, what’s commentary, and what’s just noise.

And because the narrative changes almost daily, keeping up can feel almost impossible.

That’s where TigerAI comes in for me.

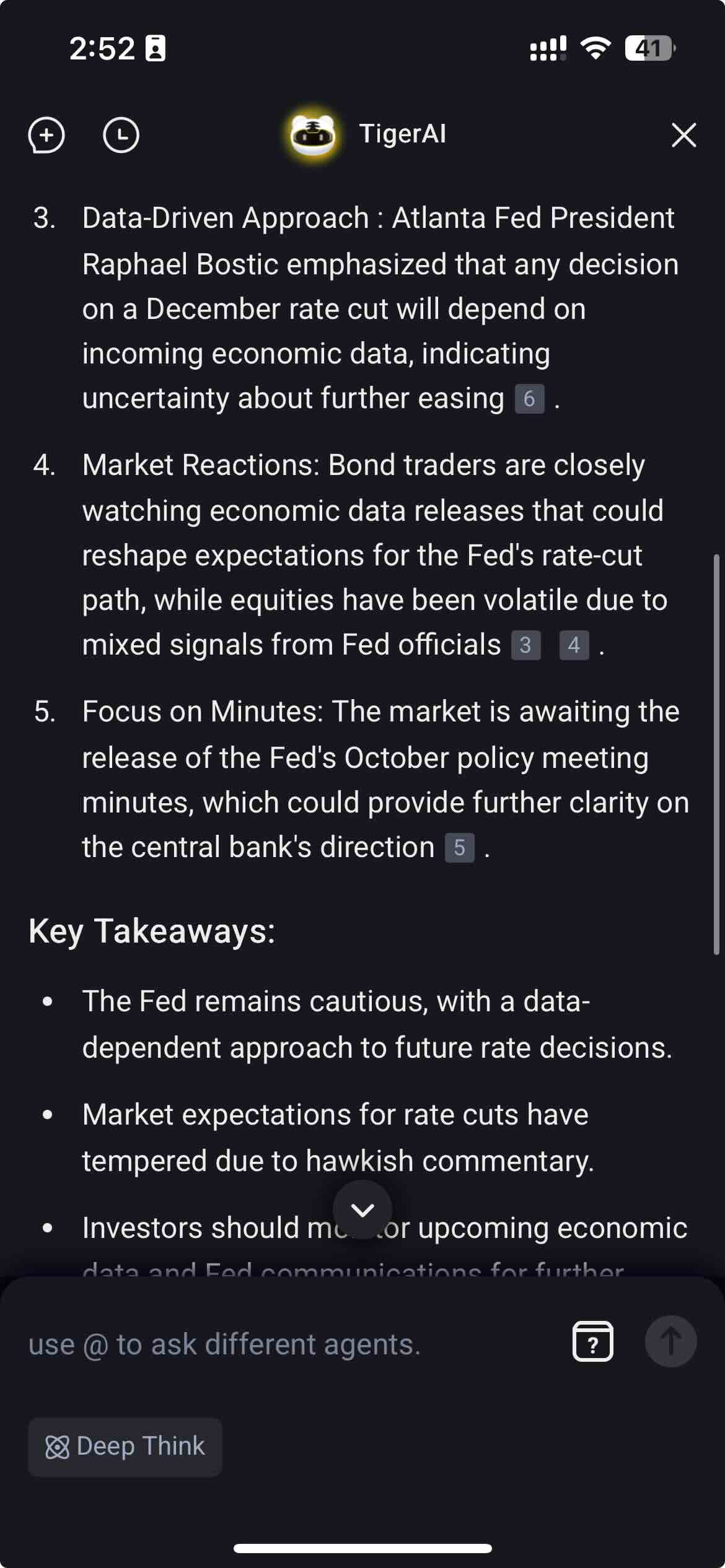

Instead of jumping between articles, opinions, and market blogs, I can simply ask:

“What’s going on with the Fed rate decision?”

Within seconds, it pulled together a clear summary using real market data, summarising the situation in plain English

TigerAI gives me a clear summary of the latest Fed stance, the sentiment behind the decision, and what key data the Fed is watching.

It also surfaces practical updates, like when the next Fed meeting is, what markets are expecting, and how different sectors might react to the Fed’s move.

In a world where headlines shift by the hour, having one place that cuts through the noise makes it much easier to stay grounded and informed.

#2 – Saved me hours of research

Stock research can mean juggling multiple websites for financial news, including Yahoo Finance for statistics, brokerage reports, and more. It can get time-consuming.

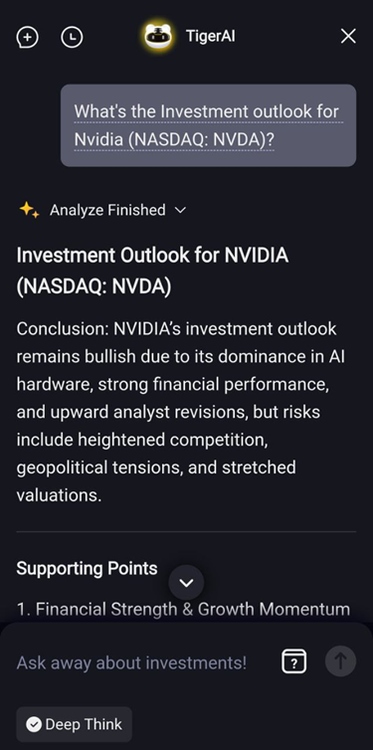

Recently, I wanted to take a closer look at Nvidia, the hyped AI chipmaker.

There were a lot of reports and news on the stock that, I’ll admit, I wasn’t looking forward to the time sink that usually comes with compiling all that information.

Instead, I decided to let TigerAI do the heavy lifting.

I asked for a quick summary of Nvidia’s outlook, and within seconds, it pulled together everything I needed in one place.

I got a clear snapshot of Nvidia’s outlook, highlighting its strong profitability and dominant position in AI, while flagging key risks like growing competition, rich valuations, and ongoing US and China tensions.

It didn’t just list numbers; it also helped me connect the dots, showing me what analysts were watching, price targets, and how the market was reacting, all in plain English.

Normally, gathering that kind of context would’ve taken me at least an hour of reading and cross-checking.

Of course, tools like TigerAI don’t replace in-depth research or due diligence.

But they offer a useful starting point.

It gives you a clear overview before you decide whether it’s worth digging deeper, saving time, and helping you focus your attention where it matters most.

#3 – Break down company updates

For many retail investors, especially beginners or those short on time, earnings season can feel like information overload.

Every quarter, companies release pages of reports packed with numbers, ratios, and jargon. It’s valuable information, but not always easy to digest.

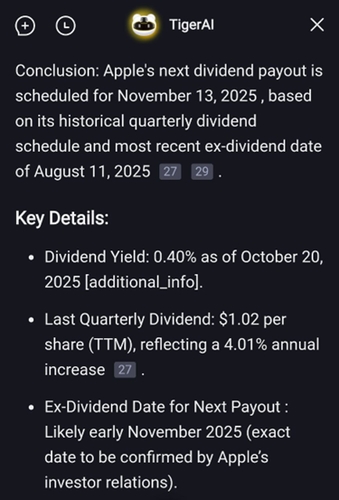

Take Apple, for example. Its quarterly results often span dozens of pages, and the headlines don’t always capture the full story.

This time, instead of scrolling through multiple sites or waiting for analysts to publish summaries, I asked TigerAI to break it down for me.

From the response, I got a clear snapshot of Apple’s earnings. TigerAI highlighted the company’s steady profit growth, rising margins, and strong iPhone 17 sales, while also pointing out potential risks such as supply-chain challenges and regulatory scrutiny.

It even flagged Apple’s next dividend payout when I asked a follow-up question.

For retail investors, this instant clarity felt almost like cheating (in a good way!).

You can grasp the key takeaways without spending hours reading through PDFs or financial statements, especially if you’re pressed for time.

#4 – Learn and make sense of investing

Beyond news and numbers, I’ve also been using TigerAI as a learning tool.

Let’s face it, investing has its own language.

When I started investing, terms like P/E ratio, net margin, or PEG ratio made my eyes glaze over.

I’d Google definitions, but often got textbook explanations that were hard to relate to real investing situations.

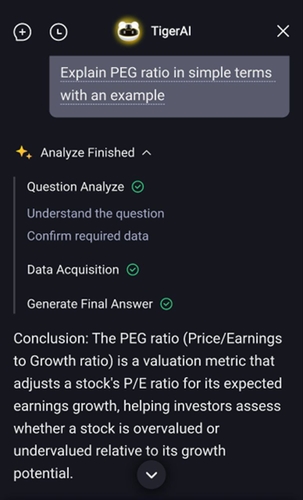

Using TigerAI, when I come across a concept I don’t understand, I can just ask it.

For example, I recently saw an analyst mention a stock’s PEG ratio and wasn’t quite sure how to use it in making an investment decision.

When I asked, TigerAI explained that the PEG ratio, short for Price/Earnings to Growth, helps compare a stock’s valuation to its expected earnings growth.

It even gave an easy example:

If a stock has a P/E of 20 and an expected earnings growth rate of 20%, its PEG is 1 — which generally suggests it’s fairly valued.

But if another stock has a P/E of 15 and a growth rate of 30%, its PEG would be 0.5 — possibly a better deal if the growth holds up.

This was explained in simple terms, almost like how a friend would explain it over coffee, which helped me grasp the concept quickly.

What would Beansprout do?

For many retail investors, especially those just starting out or juggling busy schedules, investing can feel overwhelming.

Between the constant stream of headlines, lengthy company reports, and confusing jargon, it’s easy to feel lost or unsure where to begin.

TigerAI aligns well with the idea of doing your homework, but in a far more efficient way.

TigerAI combines both simplicity and depth as it’s easy enough for a beginner to ask basic questions (“What’s a dividend?”) and get a useful answer, yet it also has the depth for experienced investors who want to drill into a stock’s fundamentals or discuss macroeconomic events.

Importantly, TigerAI doesn’t replace critical thinking or personal judgment (and it’s not a crystal ball for stock picks), but it does make the research process a lot faster and less overwhelming.

By having key information at our fingertips, we feel more confident and in control of our investing decisions instead of panic-selling during market noise or jumping on a hype train blindly.

If you’re curious to see how TigerAI works in action, Tiger Brokers is bringing the experience to life at Tiger Trade Experience 2025, happening 22–23 November at Plaza Singapura Atrium.

You’ll get to try TigerAI firsthand, explore interactive investing zones, chat with Tiger specialists, pick up some exclusive Tiger merchandise, and stand a chance to win prizes with Lucky Draws such as an iPhone 17 Pro and a Steigen Smart Laundry Mat.

Admission is free, and if you register before 21 November, you can earn 150 Tiger Coins too.

Register for Tiger Trade Experience 2025 here.

If you’re interested in signing up for Tiger Brokers, sign up through Beansprout to get S$50 FairPrice voucher and up to S$1,000 welcome rewards. Promo details here.

Disclaimer: The TigerAI’s reply is for reference only and does not constitute investment advice. Always do your own research or consult a licensed financial adviser before making investment decisions.

Investment involves risk. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments