Toku Ltd. - Singapore-based AI-powered customer experience platform

Stocks

By Ng Hui Min • 02 Feb 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Toku is a Singapore-headquartered provider of a cloud-native customer experience (CX) platform that helps enterprises manage customer interactions across multiple channels such as voice, chat and email within a single workflow.

AI-powered customer experience (CX) platform

Toku is a Singapore-headquartered provider of a cloud-native customer experience (CX) platform that helps enterprises manage customer interactions across multiple channels such as voice, chat and email within a single workflow. It is designed to solve omnichannel fragmentation, where customer conversations and service tools are spread across disconnected systems. By consolidating customer touchpoints into one view, Toku aims to help service teams respond faster, handle channel switches more smoothly, and improve overall service quality.

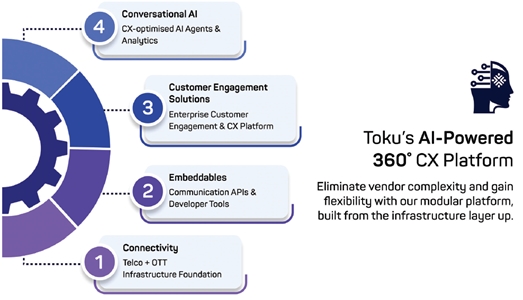

Founded in December 2017, Toku set out to build a platform for complex and fast-changing markets, where customer service operations often face stricter regulations, diverse languages and uneven connectivity infrastructure. The company began by acquiring and developing its own communications infrastructure, creating a network layer that supports its broader product suite today. That suite includes communication application programming interfaces (APIs) and developer tools, end-to-end engagement solutions, and conversational AI capabilities, which customers can adopt modularly depending on their needs.

Toku differentiates itself from global incumbents by combining telecommunications expertise with localised artificial intelligence (AI) and a delivery model built around compliance requirements. Its cloud-agnostic architecture and hybrid deployment options allow enterprises to choose how and where systems run, including in-country data processing and hosting when required. This flexibility is intended to help customers meet data sovereignty and regulatory obligations without sacrificing performance or reliability.

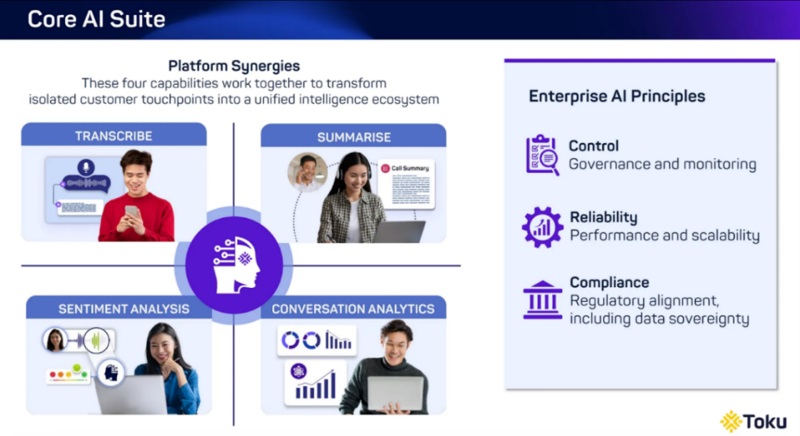

Toku embeds AI features across the platform to support both agents and supervisors that can help during and after customer interactions. These include call transcription, conversation summarisation, sentiment analysis, and conversation analytics, with a particular focus on handling multiple languages, regional accents and code-switching scenarios that are common in many markets. Deployments are supported by professional services to help enterprises implement, integrate and scale the platform effectively.

Toku serves major enterprises and government agencies, supporting end-customers with operations across multiple markets, in more than 30 countries. More recently, it has expanded into Latin America through a strategic partnership with a leading food delivery platform, which it presents as a step toward scaling beyond APAC and capturing global growth opportunities.

Business model and product offerings

Toku provides an enterprise customer experience (CX) platform that consolidates customer interactions across channels such as voice, chat and email into a single workflow. This gives service teams unified customer history across channels, smoother handovers and service analytics from day-to-day interactions.

It targets enterprises handling high volumes of customer communications, especially those operating across multiple markets with varying compliance and operational requirements. Common use cases include complaints, cancellations, refunds and service recovery, where having complete context across channels helps improve consistency and speed of resolution.

The platform includes AI-enabled capabilities such as transcription and summarisation of conversations, sentiment analysis and real-time agent support, alongside analytics for service quality and performance monitoring. Over time, Toku aims to evolve from summarising interactions to deeper context interpretation across interactions, and eventually to more automated, permissioned service actions.

A simple way to visualise how Toku supports a customer service team is to imagine a customer who complains via chat about a late order. The conversation is captured in the system so the context is not lost. If the customer later escalates to a phone call, the agent can immediately see the full history, including a short summary of what was discussed on chat. During the call, the conversation can be transcribed and the system can flag potential sentiment issues, helping the agent respond appropriately and enabling supervisors to identify interactions that may require follow-up. After the case is resolved, the outcome and service metrics flow into analytics and quality monitoring, allowing teams to track performance and improve service processes over time.

How Toku makes money

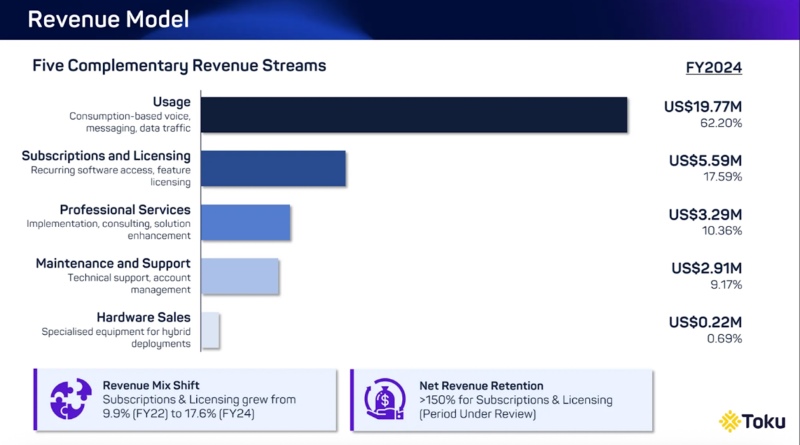

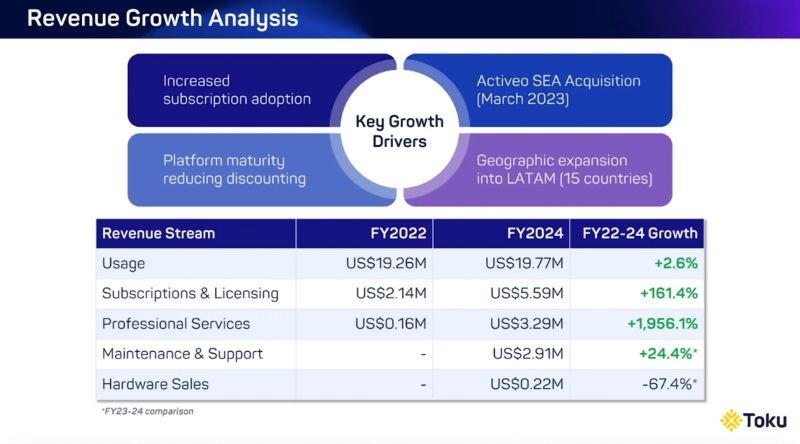

Toku makes money through five revenue streams. Toku does not rely on just one “product fee”; it earns money from both recurring platform access and usage that increases when customers send more traffic through the system.

- Subscriptions and licensing revenue comes from providing enterprise customers time-bound access to the platform and licensing specific features. This can include per-seat or concurrent licences for contact centre, omnichannel and AI capabilities, as well as subscriptions to related services such as number leasing. The company describes this as a higher-margin stream because it is based on proprietary technology and can scale efficiently. These contracts are typically annual or multi-year, which supports more predictable recurring revenue. Revenue is generally recognised over time across the contract period, while perpetual software licences and related hardware are recognised when delivered. Toku reports net revenue retention of over 150% for its Subscriptions and Licensing segment, indicating that existing customers, on average, increased their spending with the company over time.

- Usage made up most of revenue during the period under review and mainly reflects voice, messaging and data traffic carried through Toku’s connectivity platform. Although margins can be affected by infrastructure costs and price competition, the company views this stream as strategically important because it embeds Toku into customers’ day-to-day operations and reduces vendor complexity through its one-stop modular approach. Usage revenue is generated mainly from voice and messaging APIs, wholesale carrier services and network interconnection. It is billed monthly based on actual activity, such as call minutes and message volumes, which means revenue tends to scale in line with how much customers use the platform. Additionally, AI usage is progressively becoming part of Toku’s usage-based revenue stream, which the team sees as an important aspect of how the business model continues to evolve over time.

- Professional services revenue is project-based and comes from implementation, consulting and enhancement work across the customer lifecycle. This can include system integration, digital transformation support and custom development. Toku states that this capability was strengthened through the Activeo SEA acquisition and positions services as a way to accelerate adoption, support expansion and deepen customer relationships. Professional services revenue is typically recognised over time based on project progress, which requires judgement in assessing milestones and completion.

- Maintenance and support revenue is earned after implementation through technical support, account management and ongoing platform optimisation. It is delivered through tiered support packages and service level agreements and is described as a recurring stream that helps protect customer success and retention. This revenue is recognised evenly over the period the services are provided.

- Hardware sales are a smaller, ancillary revenue stream from specialised equipment used in hybrid or custom deployments, such as IP phones, network gateways and on-premise appliances. Hardware revenue is recognised when the equipment is delivered and control passes to the customer.

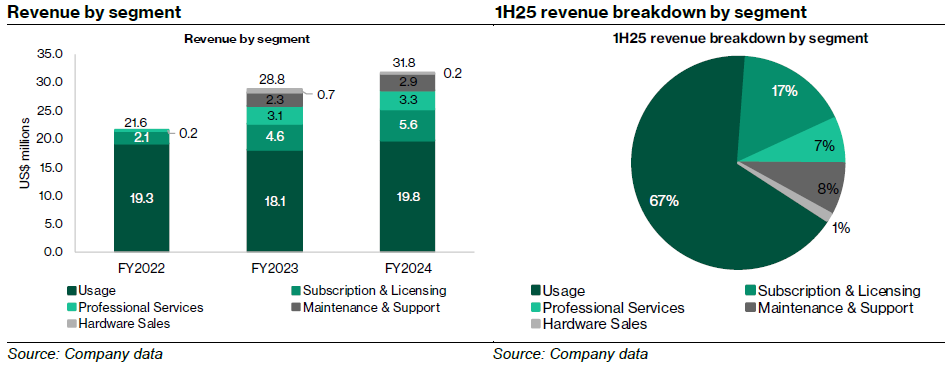

The biggest contributor to revenue is usage, representing 62.0% in FY2024 revenue. While Toku is heavily dependent on usage-based revenue, it has been building a larger base of recurring subscription and licensing revenue over time, as the contribution to revenue increased from 9.9% in FY22 to 17.6% in FY24.

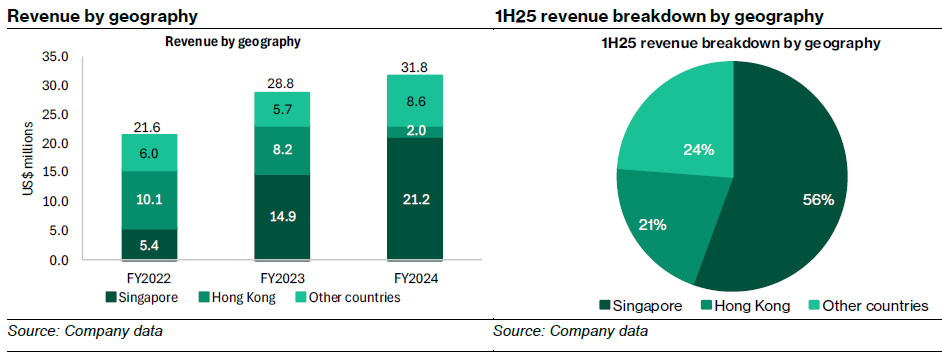

In terms of revenue by geography, Singapore became the dominant contributor in FY24, contributing 66.6% of full-year revenue. Hong Kong used to be the biggest contributor in FY22 revenue, contributing 46.9% but its revenue share has since declined to 6.3% in FY2024. Other countries contributed 27.1% in FY2024.

Operations and delivery model

Toku typically implements its CX platform through configuration, integrations and user onboarding, with rollout timelines varying depending on customer readiness and deployment complexity. Implementations may be faster for enterprises with established digital customer-support processes, while more complex migrations can take longer, including edge cases of up to around 18 months for customers starting with limited digital infrastructure. Toku also earns professional services revenue from implementation and migration work.

Toku positions its platform for regulated enterprise environments and jurisdictions with differing data requirements. The company has highlighted deployment flexibility across private infrastructure, government cloud and hyperscaler cloud environments, with stricter compliance and approval processes typically required for higher-assurance environments (e.g., government cloud). It also emphasises data sovereignty and privacy considerations, supported by operational controls intended to improve auditability in customer-service workflows.

Financial Performance

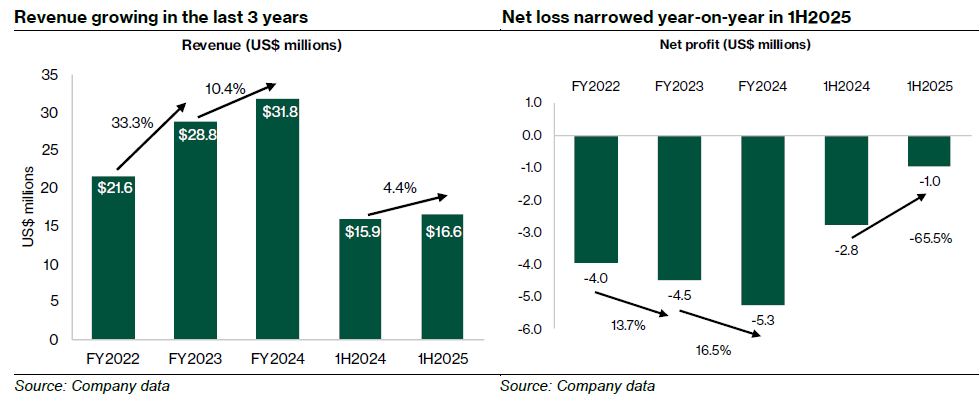

Toku delivered revenue growth over FY2022–FY2024, with revenue increasing from US$21.6 million in FY2022 to US$28.8million in FY2023 (+33.6% year-on-year) and US$31.8million in FY2024 (+10.4% year-on-year). In 1H2025, revenue rose 4.4% y-o-y to US$16.6million, from US$15.9million in 1H2024.

During the same period, gross profit rose from US$4.47million in FY2022 to US$7.87million in 2023 (+76.0% year-on-year), and to US$8.70million in FY24 (+10.5% year-on-year). Gross margin expanded from ~20.7% in FY2022 to ~27.3% in FY2023, and was broadly stable at ~27.4% in FY2024, before easing to ~24.5% in 1H2025 based on disclosed gross profit and revenue figures.

Toku explains that overall gross margins may be lower than pure software companies because it combines connectivity infrastructure with higher-margin software and services. Usage services represented 62.2% and 67.0% of total revenue in FY2024 and 1H2025 respectively, yet these services operate at single-digit gross margins. In other words, some parts of its revenue inherently come with large pass-through costs, but the company is of the view that this integrated approach creates customer lock-in and differentiation.

Over the same period, the company remained loss-making, with net losses of US$4.0m (FY2022), US$4.5m (FY2023) and US$5.3m (FY2024). However, 1H2025 net loss narrowed to US$1.0m, from US$2.8m in 1H2024 (a reduction of ~65%).

As at the Latest Practicable Date, Toku disclosed an order book of approximately US$23.44 million. This represents future secured revenue backed by signed customer contracts and covers three revenue streams, namely Subscriptions and Licensing, Professional Services, and Maintenance and Support. Usage-based revenue is excluded because it is consumption-driven and therefore not contractually committed. Of the total order book, around 88% is non-invoiced revenue relating to contracted services that have not yet been billed, while the remaining 12% is deferred revenue that has been invoiced but relates to services still to be delivered.

Cash flow from operations remained negative between FY2022 and FY2024 and in 1H25. As of 30 June 2025, Toku has US$1.02 million cash and cash equivalents. Working capital had been tight, as of 1H25, the group’s current liabilities exceeded current assets by US$5.57million.

The company explains that after 30 June 2025 it reached agreements with certain shareholders to extend loan maturities, resulting in US$1.56m being reclassified from current to non-current liabilities. It also explains why it adjusts working capital analysis by adding back contract liabilities, since those represent obligations to deliver services already paid for rather than cash debts. After these adjustments, it presents a pro-forma view showing positive working capital.

Industry outlook supported by cloud migration, AI adoption and platform consolidation

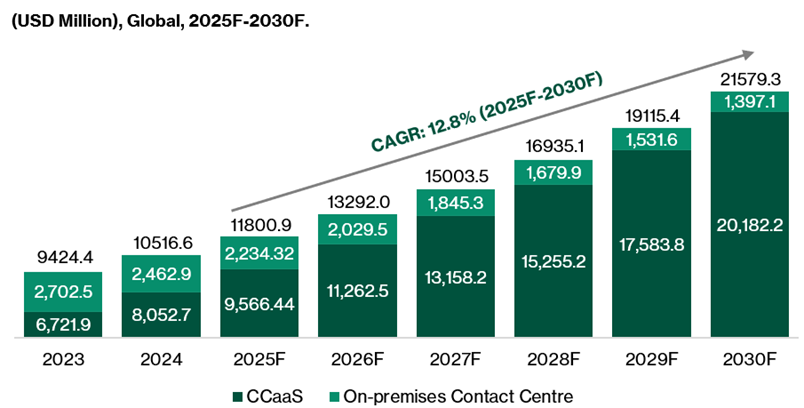

Toku operates in the broader market for cloud contact centre solutions and customer experience platforms. According to Frost & Sullivan, the global contact centre solutions market is projected to expand from US$11.8 billion in 2025 to US$21.6 billion by 2030, implying a 12.8% CAGR. Over the same period, the market mix is projected to tilt further towards Contact Centre as a Service (CCaaS), with CCaaS expected to grow materially while on-premises contact centre spending declines.

Note: The base year is 2024. All figures are rounded. The total may not be equal to the sum of the segments due to rounding off.

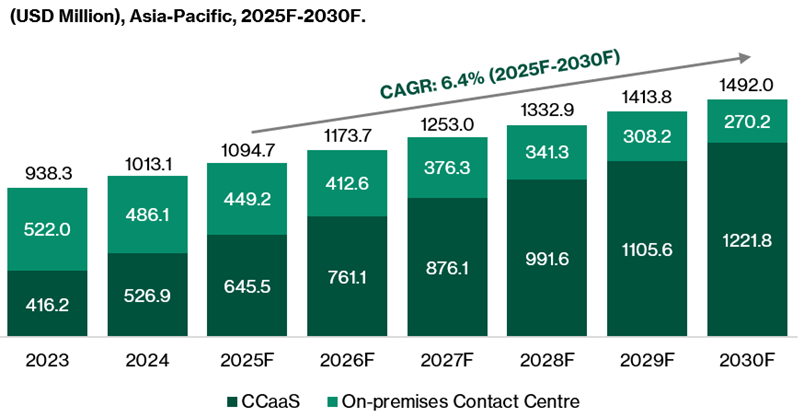

In Asia-Pacific, Frost & Sullivan forecasts the contact centre solutions market to increase from US$1.09 billion in 2025F to US$1.49 billion by 2030F, representing a 6.4% CAGR. Similar to the global trend, APAC’s projected growth is driven mainly by CCaaS expansion, alongside a declining contribution from on-premises deployments.

Frost & Sullivan attributes industry growth to enterprise digital transformation initiatives, wider adoption of AI in customer service workflows, and the continuing shift from on-premises deployments to cloud-based solutions. It also notes that 44% of global organisations and 39% of APAC organisations plan to migrate applications to the cloud within two years, indicating ongoing momentum in cloud adoption.

Note: The base year is 2024. All figures are rounded. The total may not be equal to the sum of the segments due to rounding off.

Beyond contact centre software, Frost & Sullivan describes a broader convergence across customer experience tools, where boundaries between contact centre solutions, unified communications and communications platforms are increasingly blurred. This has supported a shift from point solutions towards integrated enterprise CX platforms, as organisations seek to reduce vendor complexity and improve operating efficiency.

Competitive landscape and how Toku positions itself

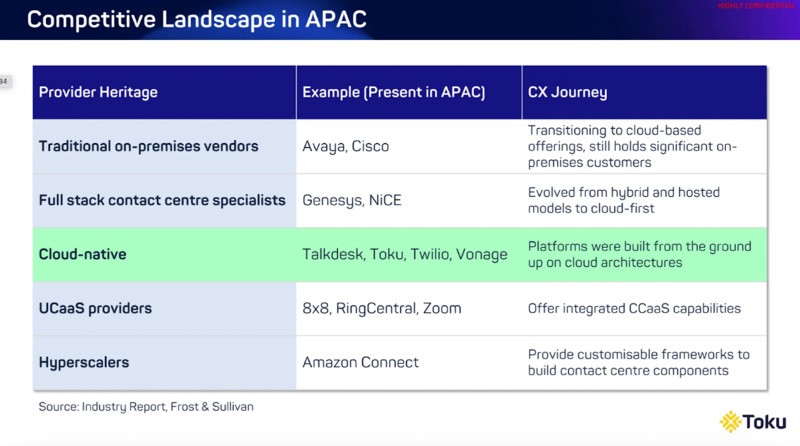

According to Frost & Sullivan, the contact-centre and customer experience landscape can be grouped into several broad competitor categories. These include legacy on-premise contact-centre vendors such as Avaya and Cisco, full-stack contact-centre specialists such as Genesys and NICE, and cloud-native contact-centre platforms such as Five9 and Talkdesk. The competitive set also includes communications platform providers and CPaaS-style players such as Twilio and Vonage, UCaaS providers expanding into contact centre such as 8x8, RingCentral and Zoom, hyperscalers such as AWS, Google and Microsoft, and CRM/IT platforms with embedded customer-service capabilities such as Salesforce, Zendesk and ServiceNow.

Structural dynamics in APAC and complex markets

Frost & Sullivan notes that while global leaders offer broad product suites, execution in APAC and other complex markets can be shaped by local realities such as cost sensitivity, the need for local carrier integration, and reliance on partner ecosystems. In enterprise tenders, requirements such as data residency, in-country connectivity and compliance can be non-negotiable, which creates opportunities for providers that can meet these constraints more directly.

Note: The list is non-exhaustive

Competitive strengths

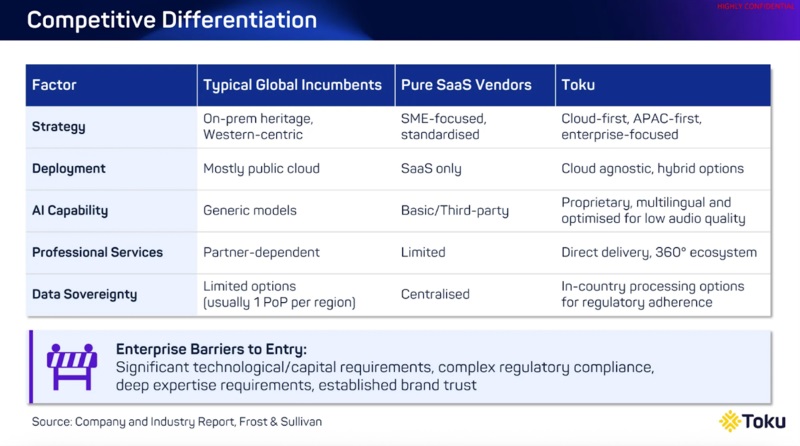

Within the competitive landscape, Toku positions itself as an enterprise-focused provider built for complex and regulated environments, particularly in APAC. Its strategy combines telecommunications expertise with localised AI and a compliance-led delivery approach, supported by flexible deployment options that span cloud-agnostic and hybrid setups. The company also emphasises connectivity control, including local Public Switched Telephone Network (PSTN) integration, OTT (Over-the-Top) connectivity, and alignment with numbering and regulatory requirements, to support customers operating across multiple jurisdictions.

Management frames these complex markets as places where regulatory constraints, linguistic diversity and infrastructure variability shape how contact-centre platforms must be deployed and operated. In practice, this often means enterprises need in-country data processing and hosting, more configurable architectures, and stronger on-the-ground implementation support than standardised rollouts designed for more uniform markets.

Toku’s differentiation is anchored in four main areas. First, it emphasises an enterprise AI layer embedded directly into customer-service workflows, supporting capabilities such as transcription, summarisation, sentiment and agent-assist to improve consistency and generate analytics for supervisors. Second, it highlights operating expertise in complex markets, including optimisation for multilingual environments and low/variable audio quality, while supporting region-specific requirements. Third, Toku describes an end-to-end approach across the CX value chain (from connectivity and engagement to AI and services), with the intent of reducing dependence on third parties and enabling a more integrated platform experience. Fourth, it positions its architecture for enterprise-grade deployment, citing flexible options across public, private and government cloud environments and highlighting security/compliance readiness for regulated customers.

Company outlook & strategy

Management outlines a growth strategy built around six interconnected pillars.

The first pillar is an enterprise AI focus, with the aim of positioning Toku as an AI-powered customer experience platform for complex, multilingual markets, guided by principles of control, reliability, and compliance. The roadmap is described as progressing along two tracks. One track expands the Core AI Suite across new languages and industry verticals and includes no-code customisation tools to support faster localisation. The second track advances an Agentic AI programme that is currently in customer pilots and is intended to introduce AI chat and voice agents that can handle more autonomous, context-aware interactions while operating within governance controls expected by regulated industries.

The second pillar is margin enhancement through revenue mix optimisation and operational improvements. While connectivity infrastructure remains a strategic differentiator, the company intends to improve gross margins by increasing the share of higher-margin subscriptions and licensing revenue. It also expects profitability to improve as brand awareness reduces the need for aggressive discounting, as proprietary technology replaces third-party components, and as platform maturity supports more premium pricing.

The third pillar is scaling through channel partners. Management describes the Activeo SEA acquisition as having strengthened professional services and maintenance capabilities, which now form a meaningful part of revenue. The strategy going forward is to make these services more scalable by shifting delivery toward certified partners, supported by standardised methodologies, training and certification, joint go-to-market activity, and revenue-sharing structures. The stated aim is to expand services revenue and market reach without requiring proportional increases in headcount, while maintaining consistent delivery quality.

The fourth pillar is product innovation and technology advancement, framed around a layered AI architecture. The Core AI Suite, which includes transcription, summarisation, conversation analytics and sentiment analysis, is positioned as the intelligence layer already deployed in production. Conversational AI is described as adding dialogue and intent understanding across chatbot and voicebot implementations. Agentic AI, currently in pilots, is intended to add reasoning, API-driven actions and multi-step autonomy for more complex resolutions. Across these layers, the company emphasises maintaining enterprise requirements for control, reliability, compliance, data sovereignty and scalability. Key initiatives include replacing third-party components with proprietary technology, improving journey orchestration, deepening integrations with enterprise systems, and strengthening predictive analytics.

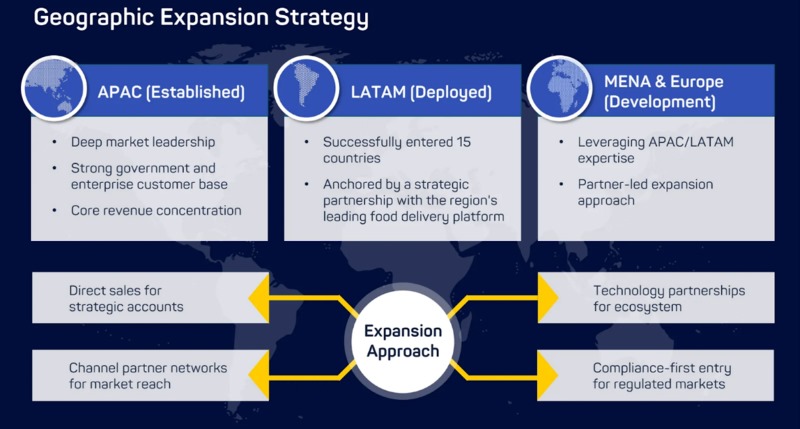

The fifth pillar is geographic expansion. Management highlights that in 2025 the Group entered LATAM through a 15-country deployment and strengthened its APAC footprint, while also developing initial Middle East opportunities. For 2026 to 2027, the stated priorities include establishing a Middle East presence as opportunities materialise, entering Europe, and exploring North America. The go-to-market approach is described as partner-led for new market entry, complemented by direct enterprise sales for strategic accounts, with the intention of reducing capital requirements while expanding reach through channel partners. The company also indicates that part of the IPO proceeds is intended to accelerate expansion of its AI-powered platform, including investments in proprietary technology development, R&D, talent acquisition, partner ecosystem development and strategic market expansion across APAC, LATAM, MENA and Europe.

The sixth pillar is an opportunistic strategic M&A programme. While management states it believes its goals can be achieved organically, it views acquisitions as a potential accelerator, citing the Activeo SEA acquisition as evidence of impact. The company’s acquisition criteria include targets that strengthen market positioning, open new markets, expand the customer base, improve technology capabilities and broaden the services and solutions portfolio. Management also highlights an integration approach that maintains core leadership teams for continuity while accelerating cross-selling and integrating acquired capabilities into a unified platform architecture. It intends to allocate a portion of IPO proceeds toward potential acquisitions, partnerships and general corporate purposes.

Geographically, Toku highlighted expansion beyond its APAC base into markets such as LATAM and MENA, with Europe and North America referenced as part of its broader expansion plan, using a combination of partner-led approaches and direct enterprise sales. The company also stated that it may pursue strategic acquisitions to add customers, markets or technology, using an integration approach intended to maintain continuity and accelerate cross-selling opportunities. In its investor materials, Toku disclosed an order book of US$23.44 million, comprising approximately 88% non-invoiced revenue and 12% deferred revenue.

Path to Profitability

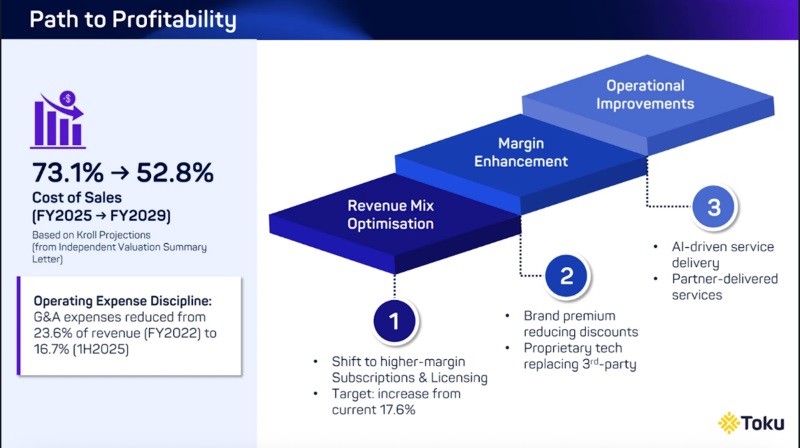

Management outlines several levers to improve margins over the medium term, with the aim of delivering meaningful expansion within about three years from the latest practicable date. The plan rests on three main drivers.

First, the company intends to improve its revenue mix by increasing the contribution from higher-margin subscriptions and licensing.

Second, it expects margins within existing segments to rise as brand awareness reduces the need for heavy discounting and as proprietary technology replaces third-party components, which should lower licensing costs while strengthening product capabilities.

Third, it aims to reduce cost-to-serve through operational leverage and automation, including AI-enabled service delivery, automated provisioning, and a greater shift toward partner-delivered services through its channel programme.

Management also notes that the Activeo SEA acquisition provides the methodologies and frameworks to scale services more efficiently via certified partners.

Overall, the company expects margin expansion to accelerate as these investments mature, supported by broader platform adoption, stronger brand recognition, and continued substitution of third-party technologies with in-house solutions.

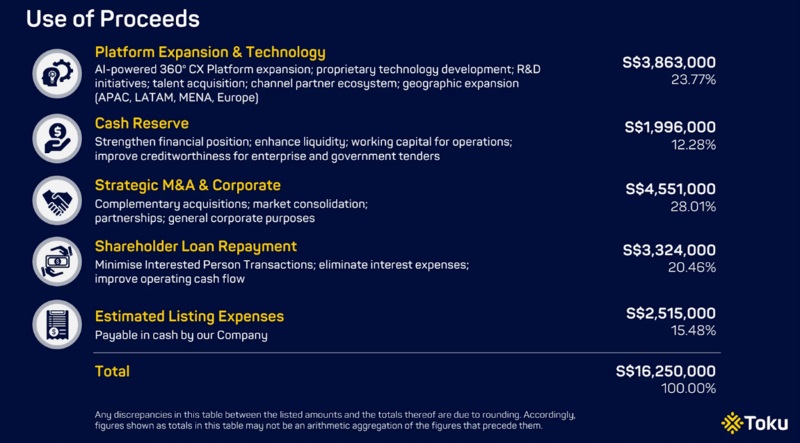

Use of Proceeds

Toku expects to raise gross proceeds of S$16.25 million from its IPO, intended mainly for strategic M&A and general corporate purposes (S$4.551m, 28.0%), platform expansion and technology initiatives (S$3.863m, 23.8%) such as product/R&D, talent and channel ecosystem build-out and geographic expansion, and shareholder loan repayment (S$3.324m, 20.5%) to reduce related-party exposure and interest costs. The remaining allocations include estimated listing expenses (S$2.515m, 15.5%) and a cash reserve (S$1.996m, 12.3%) to support liquidity and working capital needs.

Valuation

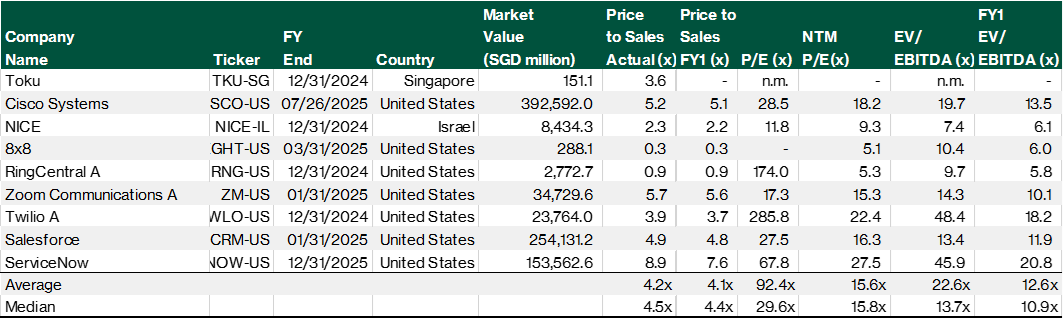

Toku is priced at 3.6x trailing price-to-sales, which is below the peer average of 4.2x, suggesting a modest discount on a revenue-multiple basis. However, valuation is harder to benchmark beyond sales because Toku is loss-making at both EBITDA and net profit levels, making P/E and EV/EBITDA comparisons not meaningful.

Key Risks

Liquidity, working capital and funding risk

Toku remains in a scaling phase and has historically recorded net losses and negative operating cash flows. The offer document highlights tight liquidity conditions and working capital pressures, including periods where current liabilities exceeded current assets. This increases sensitivity to any slowdown in collections, unexpected cost spikes, or delays in contract ramp-ups. While the IPO proceeds and refinancing actions can improve near-term flexibility, the longer-term risk is that the business may require ongoing funding if it does not progress toward sustainable cash generation.

Revenue quality and margin volatility

A significant portion of revenue is usage-based and linked to customer activity volumes. While this can scale with adoption, it is typically more exposed to pricing pressure and upstream cost movements than subscription revenue. Toku also relies on third-party networks and platform owners in parts of its connectivity and messaging stack, which can create margin volatility if input costs rise or commercial terms change. The company’s margin improvement plan depends on shifting mix toward higher-margin subscriptions and licensing, replacing third-party components with proprietary technology, and improving operating leverage. If these initiatives do not materialise at pace, profitability may remain constrained.

Customer concentration and contract renewal risk

The business serves large enterprise and government customers, which can create revenue concentration. Loss of a small number of major accounts, reductions in usage volumes, or weaker renewals could meaningfully impact revenue and cash flows. In addition, procurement cycles for enterprise contracts can be long and competitive, and contract expansions may not be linear. The order book provides visibility for contracted subscription, services and support revenue, but usage-based revenue remains consumption-driven and therefore less committed.

Implementation, delivery and service-quality risk

Toku’s platform is implemented through configuration, integrations and migration work that can vary widely in complexity. Longer deployments increase the risk of delays, scope changes and higher delivery costs, which can affect customer satisfaction and project economics. As the company scales, it must maintain consistent service quality across more markets, customers and partners. Any deterioration in delivery performance, uptime, or support standards could damage customer relationships and reduce renewal and expansion potential.

Execution risk in geographic expansion and channel scaling

Toku’s strategy includes expansion into new regions and increased reliance on channel partners to scale service delivery. Entering new markets can bring unfamiliar regulatory requirements, higher operating complexity, and increased competition from established players. Channel expansion introduces additional risk around partner quality control, governance and execution consistency. If the partner programme scales slower than expected, or if partner-delivered projects underperform, the company may not achieve the intended “scale without proportional headcount” outcome.

Competitive intensity and displacement risk

The customer experience and contact centre software market is highly competitive. Toku competes with global CCaaS leaders, cloud-native platforms, CPaaS providers, hyperscalers, and CRM vendors embedding customer-service capabilities. Larger competitors may benefit from stronger brand recognition, broader product suites, larger ecosystems and greater pricing flexibility. Customers may standardise on global platforms or hyperscaler building blocks, particularly where compliance and localisation requirements are less stringent. This could limit Toku’s win rates, or retention in certain segments.

Regulatory, licensing and compliance risk

Operating across multiple jurisdictions creates ongoing regulatory exposure, particularly where telecom licensing, numbering rules, and data sovereignty requirements differ by country. Compliance failures, even if not financially material in the short term, can lead to restrictions, penalties, reputational damage, or loss of ability to operate in certain markets. Regulatory frameworks may also tighten over time, raising compliance costs or requiring changes to product architecture and deployment models.

Cybersecurity and data privacy risk

Toku’s platform processes sensitive customer communications. A cybersecurity breach, data leakage incident, or service compromise could materially damage trust with enterprise and government customers and lead to legal, regulatory and commercial consequences. The cost of maintaining enterprise-grade security is also ongoing and may increase as requirements evolve.

Technology and product roadmap execution risk

The company’s growth strategy includes expanding AI capabilities and replacing third-party components with proprietary technology. These initiatives require sustained R&D investment and successful execution. Development delays, performance gaps, or inability to meet enterprise governance standards could reduce product competitiveness or limit adoption. AI-related risks also include model quality, language coverage, and customer acceptance, especially in regulated environments where explainability and control are important.

Acquisition and integration risk

Toku intends to remain opportunistic with acquisitions. While acquisitions can accelerate capability building, they also introduce integration risk, including cultural alignment, system integration, retention of key staff, and achieving planned cross-selling. If integration underdelivers, acquisitions can create cost burdens and distract management from core execution.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Toku Ltd.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments