UltraGreen.ai - A global leader in fluorescence-guided surgery

Stocks

By Ng Hui Min • 28 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

UltraGreen.ai is the world’s leading provider of indocyanine green (ICG), a sterile injectable dye used in fluorescence-guided surgery to visualise tissue perfusion, vascular structures, biliary anatomy and tumour margins in real time.

A global leader in fluorescence-guided surgery (SGX: ULG) - Not Rated

UltraGreen.ai is a global leader in fluorescence-guided surgery (FGS), specialising in the development, contracting manufacture, and commercialisation of indocyanine green (ICG) — a sterile injectable fluorophore that has become integral to modern surgical practice.

ICG illuminates real-time tissue perfusion, vascular structures, biliary anatomy and tumour margins when activated under near-infrared (NIR) light.

Because these visual cues are essential for improving surgical precision, ICG has become a mission-critical consumable across oncology, gastrointestinal, hepatobiliary, cardiovascular, plastic reconstructive, and transplant surgery.

UltraGreen’s leadership is the result of more than a decade of sustained investment in regulatory approvals, quality systems, clinical partnerships, and global distribution capabilities.

The company now has one of the broadest regulatory footprints among fluorescence imaging agents: its ICG product is registered in 35 countries and distributed under exemption pathways in another 33 markets, giving it active commercial presence in 68 countries across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific.

The breadth of this reach is a substantial competitive barrier, as sterile injectables require extensive documentation, validated manufacturing processes, and GMP-compliant facilities—difficult hurdles for new entrants and generics manufacturers.

UltraGreen’s operating model includes reliance on third-party manufacturing and distribution partners.

The company discloses exclusive active pharmaceutical ingredient (API) supply arrangements and an outsourced manufacturing strategy using contract manufacturing organisations (CMOs) with experience in sterile injectables.

Product distribution is conducted through a global network of 55 third-party distributors.

Clinical engagement is described as part of the company’s commercial approach.

The prospectus states that UltraGreen works with over 90 key opinion leaders (KOLs) globally and sponsors the International Society for Fluorescence Guided Surgery (ISFGS).

These activities support surgeon education, training and awareness of fluorescence-guided techniques.

Industry outlook: fluorescence-guided surgery

Global adoption trends and structural underpenetration

Fluorescence-guided surgery (FGS) is a surgical technique that uses fluorescent agents, such as indocyanine green (ICG), together with near-infrared (NIR) imaging systems to enhance intraoperative visualisation.

The typical FGS workflow involves intravenous or local administration of ICG, followed by activation of NIR imaging to visualise blood flow, lymphatic drainage, biliary anatomy, tissue perfusion, and tumour margins in real time.

According to Frost & Sullivan, the use of fluorescence imaging has been validated across a wide range of procedures, including lymphatic mapping, anastomotic perfusion assessment, bile duct identification, organ perfusion assessment, tumour margin visualisation, and minimally invasive surgery.

Despite its documented clinical applications, adoption of FGS remains at an early stage globally.

Frost & Sullivan estimates indicate that penetration of FGS in the United States is below 25% of eligible procedures, reflecting historical constraints such as limited availability of NIR-compatible imaging systems, uneven surgeon training, and differences in reimbursement practices.

Adoption levels are lower across Asia-Pacific, Latin America and Eastern Europe, where hospital infrastructure, standardisation of surgical practices and access to advanced imaging equipment vary significantly by country.

These regional differences are reflected in the penetration data which show materially lower usage rates in several emerging markets compared with the United States, Europe and selected developed Asian markets.

Frost & Sullivan’s analysis further documents the clinical and economic implications of improved visualisation across selected surgical specialties.

For example, in laparoscopic cholecystectomy, visual misperception is identified as a major contributor to bile duct injury, which carries significant financial and medico-legal consequences.

Similarly, in colorectal surgery, anastomotic leaks are associated with extended hospital stays and higher treatment costs, while in breast reconstruction, inadequate perfusion assessment can lead to flap necrosis and re-operations.

Frost & Sullivan attributes reductions in complication rates and associated costs in these procedures to the use of fluorescence imaging, based on published clinical studies.

According to Frost & Sullivan, the expansion of this ecosystem has been supported by increasing installation of NIR-enabled laparoscopic and robotic systems, growing volumes of clinical literature evaluating fluorescence-guided techniques, and wider dissemination of surgeon training and education programmes by industry participants and professional societies.

Regional growth outlook and APAC opportunity

Based on Frost & Sullivan estimates, the Asia-Pacific region is expected to be the fastest-growing market for ICG between 2024 and 2030, with a forecast compound annual growth rate of 16.6%.

The region’s share of the global ICG market is projected to increase from approximately 9% to 14% over the same period.

This growth is driven by increasing surgical volumes, gradual adoption of fluorescence-guided techniques, and ongoing investment in hospital infrastructure.

Frost & Sullivan attributes regional growth to factors including rising procedural volumes in emerging markets, increasing adoption of surgical standards aligned with those used in North America and Europe, continued investment in operating-room modernisation, and the development of medical tourism hubs in markets such as Thailand and Singapore.

Breadth of surgical applications

ICG is currently used across multiple surgical specialties, in ophthalmology, gastrointestinal surgery, oncologic surgery, plastic and reconstructive surgery, gynaecologic surgery, thoracic surgery, urology, neurosurgery, transplant surgery and cardiovascular surgery.

According to Frost & Sullivan, the applications of ICG can be grouped into tissue perfusion assessment, sentinel lymph node mapping, anatomic imaging and tumour mass visualisation.

Penetration of ICG usage differs materially by procedure type and country.

Frost & Sullivan’s forward-looking penetration estimates for 2028 indicate higher expected adoption across most procedures and regions, although penetration remains uneven across countries and specialties.

Penetration varies widely by country. Mature markets such as the U.S. and Europe lead adoption, while markets such as Indonesia and Thailand are catching up rapidly.

Competitive landscape

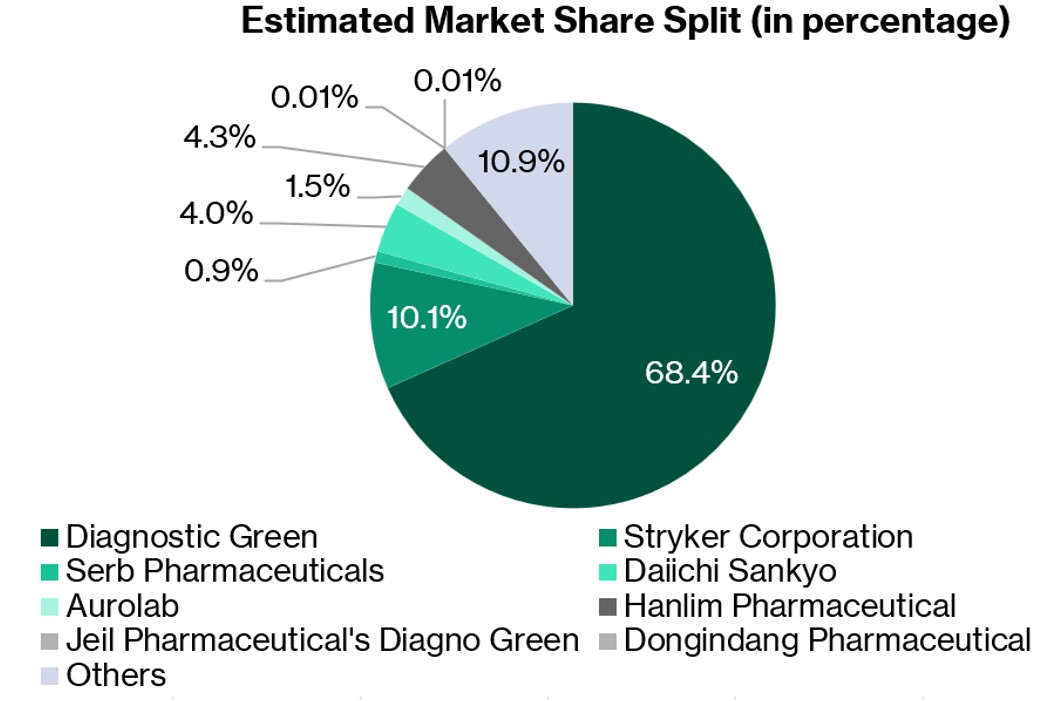

The competitive landscape for ICG includes pharmaceutical manufacturers and, indirectly, medical device companies that offer fluorescence imaging systems bundled with fluorescent agents.

Market participants include Daiichi Sankyo, Hanlim Pharmaceutical, SERB Pharmaceuticals, Dongindang Pharmaceutical, Macsen Laboratories and Auro Laboratories, alongside imaging system manufacturers such as Stryker, which supplies ICG agents together with its fluorescence imaging platforms.

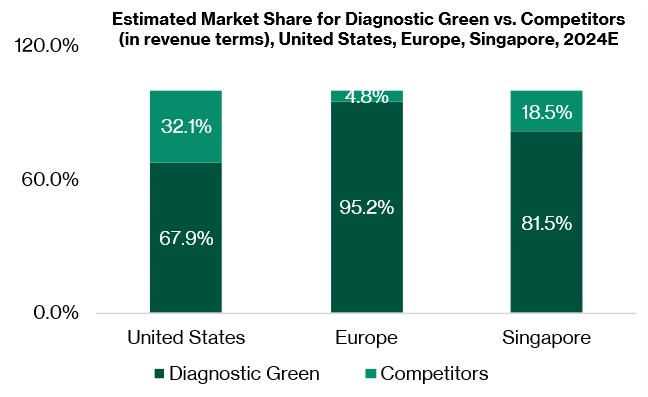

Frost & Sullivan’s market share estimates indicate that UltraGreen holds a leading position globally, with a significantly larger share of ICG vials sold and revenue compared with individual competitors.

Many competing suppliers operate in a limited number of markets, focus on specific clinical indications, or lack broad regulatory approvals across multiple regions.

Business model and strategic focus

UltraGreen’s business model is primarily based on the sale of ICG consumables, which account for more than 90% of its revenue, as disclosed in the prospectus.

Each surgical procedure requires repeat purchase of ICG, which links revenue generation directly to procedural volumes rather than to hospital capital expenditure cycles.

Manufacturing is outsourced to specialised contract manufacturing organisations, allowing the company to focus on regulatory approvals, distributor management and research and development.

This asset-light structure contributed to cash conversion of 76.3% in FY2024, compared with 59.9% in FY2023, and 62.7% in 1H25, compared with 55.2% in 1H24, as disclosed in the prospectus.

The company’s stated strategic priorities include geographic expansion, particularly in Asia-Pacific, Europe and the Middle East; portfolio development through additional vial formats and formulations of ICG; and the development of its digital platform.

The UltraGreen Data Platform, which is already generating early revenue, is intended to support real-time, AI-enabled perfusion quantification through the PerfusionWorks application.

According to the prospectus, development of PerfusionWorks is expected to be completed by 2026, with commercial rollout targeted for 2027.

Rapid top-line growth, exceptional margins, and strong cash generation

UltraGreen has delivered rapid and consistent financial expansion, underpinned by strong pricing power, rising procedure volumes and meaningful operating leverage.

Revenue increased from US$72.0 million in 2023 to US$114.7 million in 2024, representing a 59.3% year-on-year increase.

Growth momentum continued into 1H25, with revenue rising 20.3% year-on-year to US$70.1 million, reflecting continued expansion in ICG volumes, favourable pricing dynamics and sustained demand across core markets.

Earnings growth has been equally strong.

Net profit increased from US$33.0 million in 2023 to US$56.0 million in 2024, representing 69.4% year-on-year growth, driven by margin expansion and disciplined cost control.

In 1H25, UltraGreen recorded net profit of US$25.7 million, a decline of 7.6% year-on-year.

The net profit margin declined from 47.7% in 1H24 to 36.6% in 1H25, primarily due to foreign exchange losses of approximately US$7.0 million.

These losses arose from the weakening of the U.S. dollar, which is the reporting currency, against the euro, the functional currency of its wholly-owned subsidiary, Renew Pharmaceuticals Limited.

Cash flow generation remains a key strength.

UltraGreen generated US$54.3 million in operating cash flow in FY2024, representing a 113% year-on-year increase, and delivered US$27.6 million in operating cash flow in 1H25, up 33% year-on-year.

Cash conversion improved materially to 76% in FY2024, reflecting strong operating leverage and effective working capital management.

IPO highlights and use of proceeds

The IPO raised US$400 million in total proceeds, comprising US$162.5 million from the public offering and US$237.5 million from cornerstone investors. The proceeds are intended to support product development, digital platform investment, Asia-Pacific expansion, and general corporate and working-capital requirements.

Key Risks

Key risks include reliance on concentrated active pharmaceutical ingredient (API) suppliers, regulatory scrutiny in sterile injectables, distributor performance and execution risks related to the AI platform.

Valuation

Ultragreen’s trailing P/E is about 29.3x, based on its closing price of USD1.41 as of 19 December 2025. Its P/B ratio of 11.0x is the highest among its peers.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to invest in UltraGreen.ai.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments