UOB One vs OCBC 360: Which is the best savings account in Singapore?

Savings

By Nicole Ng • 03 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The UOB One and OCBC 360 accounts offer attractive interest rates to make your savings work harder. We find out which is the best savings account in Singapore.

What happened?

High-yield savings accounts in Singapore aren’t as “high-yield” as they used to be.

Both UOB One and OCBC 360, two popular savings accounts, cut their rates last year, to the disappointment of many savers.

Even so, these accounts continue to offer some of the most competitive rates in the market in 2026.

The UOB One account now offers an effective interest rate of up to 1.90% p.a., while OCBC 360 offers up to 2.45% p.a. if you're able to meet the save, spend, and salary credit criteria.

Though both require you to meet certain conditions to unlock the highest tiers.

Naturally, this raises the question: between UOB One and OCBC 360, which gives you the better deal?

In this article, I’ll compare UOB One and OCBC 360 head to head to see which helps your savings work harder.

What you need to know about UOB One Savings Account

The UOB One account lets you earn tiered interest of up to 3.40% p.a. with just two simple steps.

- Spend at least S$500 monthly on eligible UOB credit or debit cards.

- Credit your salary via GIRO, or make at least three GIRO transactions per month.

Unlike some other high-yield accounts, there’s no need to buy insurance or investment products to unlock the highest interest rate tier.

All you have to do is spend a minimum of $500 monthly on eligible UOB credit/debit cards and credit your salary via GIRO or make 3 GIRO transactions a month.

For young working adults and anyone who doesn't want to complicate things too much, these requirements are easy to meet.

If you’re already using a UOB card for daily spending and crediting your salary, you’ll find it easy to qualify for the higher interest tiers.

If you can’t credit your salary into your UOB One account, the good news is, setting up three recurring GIRO debits is a straightforward alternative to still enjoy higher interest rates.

A GIRO debit transaction is an automatic deduction made directly from your UOB One account to pay a billing organisation such as utilities, telco bills, or insurance premiums.

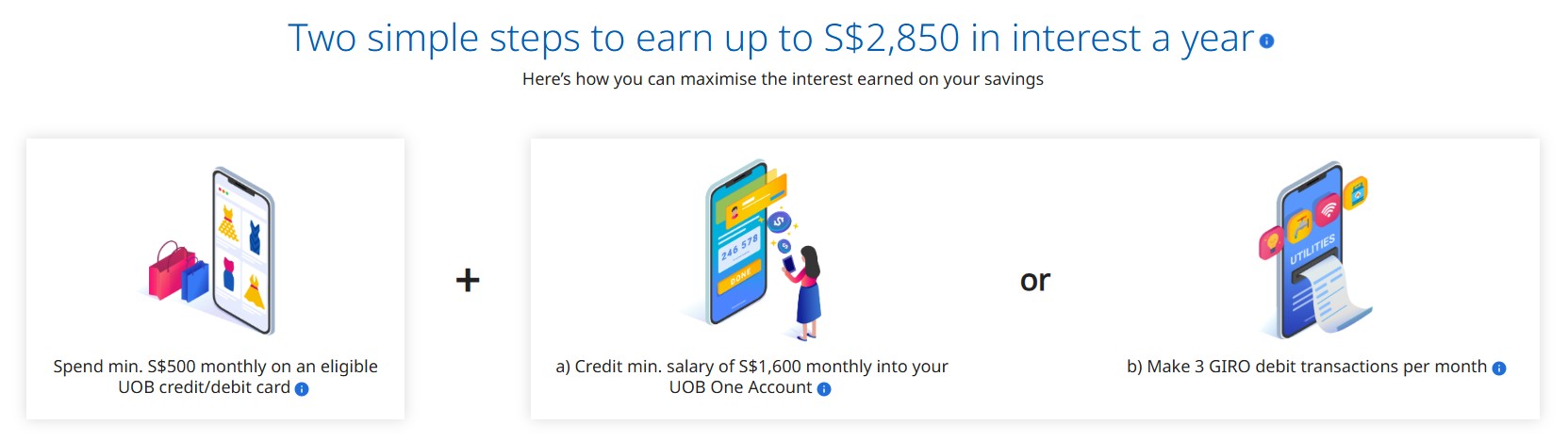

To understand how the interest rate on the UOB One account works, let's look at the breakdown below.

As you can see from the table, simply spending S$500 on your UOB card each month will earn you 0.65% p.a. interest on your first S$75,000.

If you make three GIRO transactions on top of your card spend, your rate increases to between 1.0% p.a. and 2.0% p.a., depending on your account balance.

To unlock the highest rates, you’ll need to credit your salary via GIRO on top of your card spend.

We illustrate the interest rate earned below on the UOB One account if you are able to credit your salary via GIRO.

| Account monthly average balance | Interest earned when you spend minimum S$500 on eligible UOB card and credit salary via GIRO (p.a.) |

| First S$75,000 | 1.00% |

| Next S$50,000 | 2.50% |

| Next S$25,000 | 3.40% |

| Above S$150,000 | 0.05% |

| Source: UOB, as of 3 February 2026 | |

This allows you to earn up to 1.00% p.a. on your first S$75,000, 2.50% p.a. on the next S$50,000, and 3.40% p.a. on the final S$25,000, before the rate resets to 0.05% p.a. above S$150,000.

Note that the interest rates are tiered, meaning they apply only to portions of your balance rather than your entire deposit.

For example, if you have S$80,000 in your account, the first S$75,000 will earn 1.00% p.a., while the next S$5,000 (from S$75,000 to S$80,000) will earn 2.50% p.a.

The higher rate does not apply to your full balance, only to the portion within that tier.

To understand your actual returns, it’s useful to calculate the effective interest rate (EIR), which combines the total interest earned across all tiers to show the average rate on your overall balance.

| Total Balances | Effective interest rate earned when you spend minimum $500 on eligible UOB card and credit salary via GIRO (p.a) |

| S$50,000 | 1.00% |

| S$75,000 | 1.00% |

| S$100,000 | 1.38% |

| S$125,000 | 1.60% |

| S$150,000 | 1.90% |

| Source: UOB, Beansprout Compare Savings Accounts tool, as of 3 February 2026 | |

As you can see when worked out as a whole based on the interest earned on the balances, the highest effective interest rate works out to 1.90% p.a. if you have a balance of S$150,000.

Read our detail review of the UOB One account here.

What you need to know about the OCBC 360 savings account

The OCBC 360 savings account offers an interest rate of up to 2.45% p.a. on the first S$100,000 of deposits when you meet three conditions: crediting your salary, saving more each month, and spending on an OCBC credit card.

On top of that, you can earn an additional 3.00% p.a. when you insure and invest through OCBC.

This makes the OCBC 360 one of the highest-yielding accounts in the market but also one of the harder ones to fully maximise.

Like the UOB One, the OCBC 360 uses a tiered interest structure, where the rates apply only to portions of your balance and are tied to specific categories.

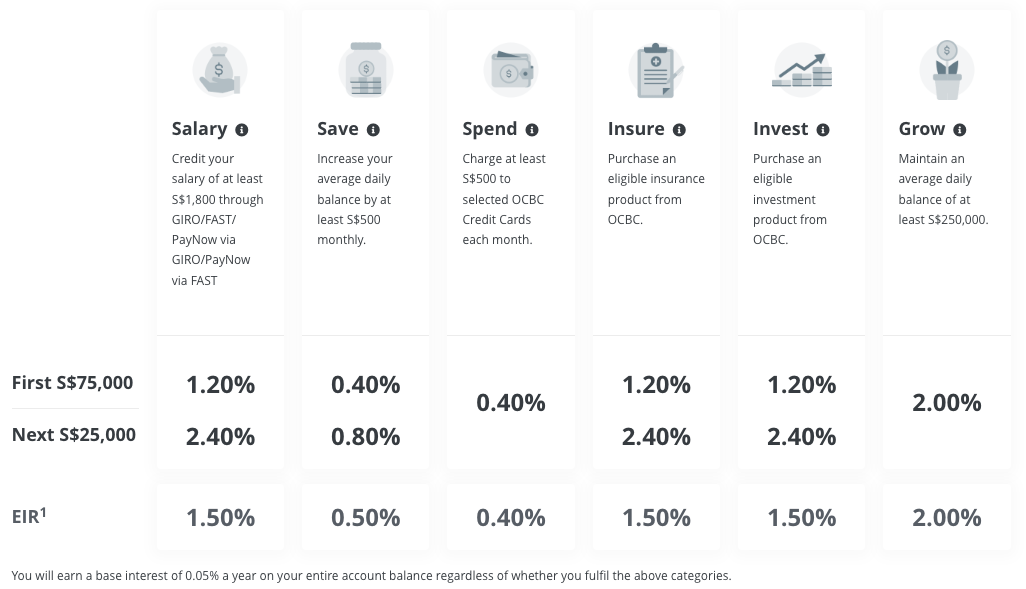

These categories are:

- Salary: Credit your salary of at least S$1,800 through GIRO/FAST/PayNow via GIRO/PayNow via FAST

- Save: Increase your average daily balance by at least S$500 monthly

- Spend: Charge at least S$500 to selected OCBC credit cards each month

- Insure: Purchase an eligible insurance product from OCBC

- Invest: Purchase an eligible investment product from OCBC

- Grow: Maintain an average daily balance of at least S$200,000

The interest you earn on the OCBC 360 account depends on two things: how many categories you fulfil and how much you have in your account.

The interest is tiered—applied first on balances up to S$75,000, and then on the next S$25,000, for a maximum of S$100,000 eligible for bonus interest.

Assuming you maintain a balance of S$100,000, here’s the maximum effective interest rate (EIR) you can achieve:

- Salary + Save: Maximum EIR of 2.05% a year.

- Salary + Save + Spend: Maximum EIR of 2.45% a year.

- Salary + Save + Spend + Insure / Invest: Maximum EIR of 3.95% a year

- Salary + Save + Spend + Insure + Invest: Maximum EIR of 5.45% a year

If you’re able to maintain at least S$250,000 in the account, you’ll unlock the Grow category, which adds an extra 2% p.a. on your first S$100,000. However, the remaining S$150,000 earns only the base interest of 0.05% p.a.

For most working adults, it’s relatively easy to hit the Salary, Save, and Spend categories, which brings the EIR to up to 2.45% p.a.

However, it can be much harder to achieve the higher tiers, as they require you to purchase OCBC’s insurance or investment products.

Read our detail review of the OCBC 360 account here.

UOB One vs OCBC 360 – Which is the best savings account in Singapore?

To find out whether the UOB One or OCBC 360 is the better savings account in Singapore, we compare the effective interest rate (EIR) across both accounts.

The EIR is the average interest you earn across your entire deposit balance, taking into account the tiered structure of each account.

For this comparison, we assume that you are someone who:

- Saves at least $500 a month

- Credits salary of at least S$1,800 every month

- Spends at least S$500 on eligible credit cards

- Does not buy insurance/investment products from the bank

Based on these conditions, the OCBC 360 account offers a higher effective interest rate than UOB One for balances up to S$140,000.

However, once balances exceed S$140,000, UOB One pulls ahead, offering better returns up to S$150,000.

| Total Balances | UOB One | OCBC 360 | Winner |

| Max EIR (p.a.) | Max EIR (p.a.) | ||

| S$50,000 | 1.00% | 2.05% | OCBC |

| S$75,000 | 1.00% | 2.05% | OCBC |

| S$100,000 | 1.38% | 2.45% | OCBC |

| S$125,000 | 1.60% | 1.97% | OCBC |

| S$150,000 | 1.90% | 1.65% | UOB |

| Source: UOB One, OCBC 360 calculators as of 3 February 2026. | |||

How does OCBC 360 compare to UOB One when adding insurance and investment products?

The OCBC 360 account already offers competitive returns with just the salary, save, and spend categories.

But what happens if you also take up OCBC’s insurance and investment products?

By doing so, the maximum effective interest rate (EIR) on the first S$100,000 can go up to 3.95% p.a. if you add either insurance or investments, and as high as 5.45% p.a. if you take up both.

To find out how it stacks up against UOB One, let’s calculate the effective interest rate for someone who:

- Saves at least S$500 a month

- Credits a salary of at least S$1,800 every month

- Spends at least S$500 on eligible OCBC credit cards

- Buys an insurance and/or investment product with OCBC

From the comparison below, the OCBC 360 account offers a higher effective interest rate compared to the UOB One account if you are looking to purchase a investment or insurance product (or both) from OCBC, regardless of your account balance.

| Total Balances | UOB One | OCBC 360 (invest OR insure) | OCBC 360 (invest AND insure) |

| Max EIR (p.a.) | Max EIR (p.a.) | Max EIR (p.a.) | |

| S$50,000 | 1.00% | 3.25% | 4.45% |

| S$75,000 | 1.00% | 3.25% | 4.45% |

| S$100,000 | 1.38% | 3.95% | 5.45% |

| S$125,000 | 1.60% | 3.17% | 4.37% |

| S$150,000 | 1.90% | 2.65% | 3.65% |

| Source: UOB One, OCBC 360 calculators as of 3 February 2026. | |||

What would Beansprout do?

Both the UOB One and OCBC 360 are among the best high-yield savings accounts in Singapore, but which one works better for you depends on your priorities.

If you have a balance of S$150,000, the UOB One account might be your choice.

With just two straightforward requirements (card spend and salary credit) you can unlock competitive returns of up to 1.90% p.a. effective interest per annum (EIR) on balances of S$150,000, without having to commit to additional financial products.

For balances below S$140,000, however, the OCBC 360 generally offers better returns, with an EIR of up to 2.45% p.a.

And if you are willing to take up OCBC’s insurance and investment products, the EIR can climb significantly, reaching as high as 5.45% p.a. on the first S$100,000.

As an added note, UOB is currently running its Leap of Fortune Savings Promotion until 31 March 2026, offering up to S$380 in guaranteed cash for eligible account holders.

You can read our in-depth reviews to learn more about the UOB One account and the OCBC 360 account, depending on which is better suited to your needs.

Check out our guide to the best savings account in Singapore to find out which saving account offers the highest interest rate.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest tips on making your savings work harder.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments