A simple way to diversify passive income beyond Singapore stocks

ETFs

Powered by

By Gerald Wong, CFA • 20 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Looking beyond Singapore for passive income? Learn how the UOBAM Ping An FTSE ASEAN Dividend Index ETF offers ASEAN diversification and dividend potential.

This post was created in partnership with UOB Asset Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

I’ve been thinking more about how to build passive income, especially as interest rates decline and market volatility remains.

Like many investors in Singapore, most of my income exposure comes from Singapore REITs and blue-chip stocks.

While they’ve played an important role in my portfolio, I realised that a large part of my passive income was still concentrated in one market and a few sectors.

That led me to look more closely at regional diversification, and one region that has stayed on my radar is ASEAN.

The region offers an interesting mix of dividend income potential and long-term structural growth.

Recently, UOB Asset Management launched the UOBAM Ping An FTSE ASEAN Dividend Index ETF, which has stated a target dividend of at least 6%* per annum in 2026 and 2027.

For income-focused investors, this naturally raises the question of how such an ETF might fit into a broader passive income strategy.

In this article, I take a closer look at what the ETF offers, the risks involved, and how it could complement an income-focused portfolio alongside existing Singapore holdings.

Introducing the UOBAM Ping An FTSE ASEAN Dividend Index ETF

The UOBAM Ping An FTSE ASEAN Dividend Index ETF is an ASEAN-focused dividend ETF listed on the Singapore Exchange (SGX).

It offers investors a convenient way to invest in a diversified basket of dividend-paying companies across the ASEAN region through one instrument.

The ETF tracks the FTSE ASEAN ex REITs Target Dividend Index, which is jointly developed by FTSE Russell and UOB Asset Management, combining global index construction expertise with ASEAN market insight.

Explore the UOBAM Ping An FTSE ASEAN Dividend Index ETF here.

It is structured for income-focused investors, aiming to replicate the performance of the index before fees and expenses, while providing exposure to ASEAN’s regional champions and the region’s longer-term growth potential.

Why investors may like the UOBAM Ping An FTSE ASEAN Dividend Index ETF

#1 – Strong dividend income potential

A key feature of the ETF is its focus on delivering higher dividend income compared to the broader ASEAN equity market.

The ETF tracks the FTSE ASEAN ex REITs Target Dividend Index, which is designed specifically to prioritise income.

Instead of weighting stocks purely by market size, the index places higher weights on companies with stronger dividend characteristics, with the aim of delivering approximately double the dividend yield of the broader FTSE ASEAN Index.

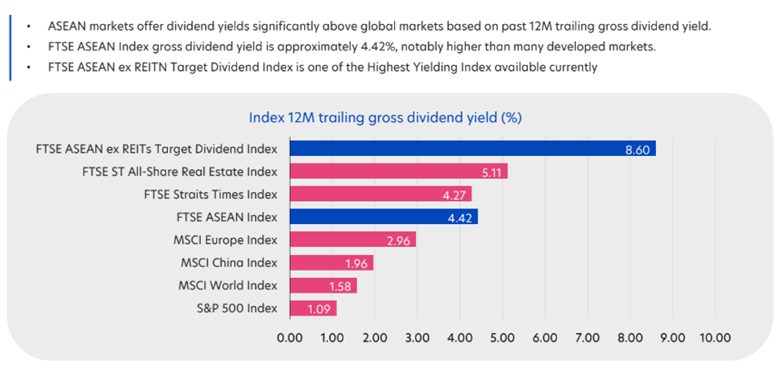

As of 28 November 2025, according to FTSE Russell, the target dividend index recorded a gross dividend yield of 8.6% p.a*, compared with 4.4% p.a. for the FTSE ASEAN Index.

When viewed alongside other global equity benchmarks, ASEAN dividend yields also stand out.

As shown in the chart above, the target dividend index offers a meaningfully higher yield than major indices such as the FTSE Straits Times Index, MSCI World Index and the S&P 500, which may appeal to investors who are finding it harder to generate income from traditional equity markets.

The ETF has also stated a target to pay dividends of at least 6%* per annum in 2026 and 2027.

This makes the ETF particularly relevant for investors seeking equity income as part of their overall portfolio.

However, do note that while there is a dividend target, distributions (in SGD) are not guaranteed. Distributions may also be made out of income, capital gains and/or capital.

#2 – Capture ASEAN’s mid-to-long-term growth

Beyond income, the ETF also provides exposure to ASEAN’s structural growth potential.

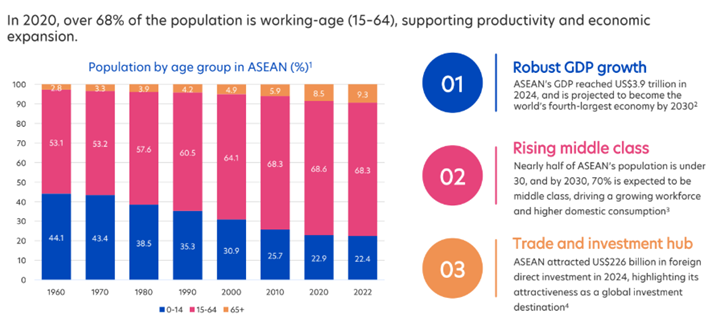

ASEAN benefits from favourable demographics, with a large and productive working-age population.

As of 2020, more than 68% of ASEAN’s population was aged between 15 and 64, supporting productivity and economic expansion (source: Population Pyramid; World Bank, as of 28 November 2025).

Looking ahead, nearly 70% of ASEAN’s population is expected to be middle class by 2030, according to ASEAN Statistical Highlights 2025, helping to drive domestic consumption across sectors such as financial services, telecommunications, and utilities.

These trends provide a more self-sustaining growth engine, reducing reliance on external demand over time.

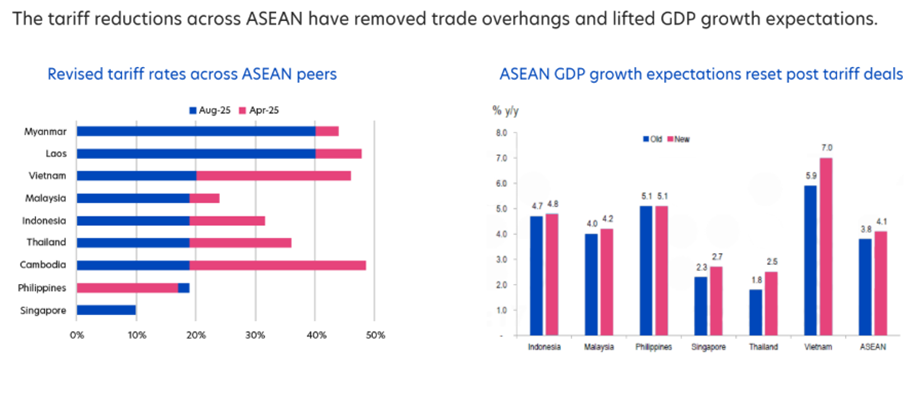

The region’s growth outlook has also strengthened as tariff-related uncertainties ease.

Following recent tariff reductions across ASEAN, GDP growth expectations have been revised upwards.

This improvement has reinforced ASEAN’s position as a trade and investment hub, with the region attracting about US$226 billion in foreign direct investment in 2024, highlighting continued investor confidence, according to ASEAN Statistical Highlights 2025 as of 12 November 2025.

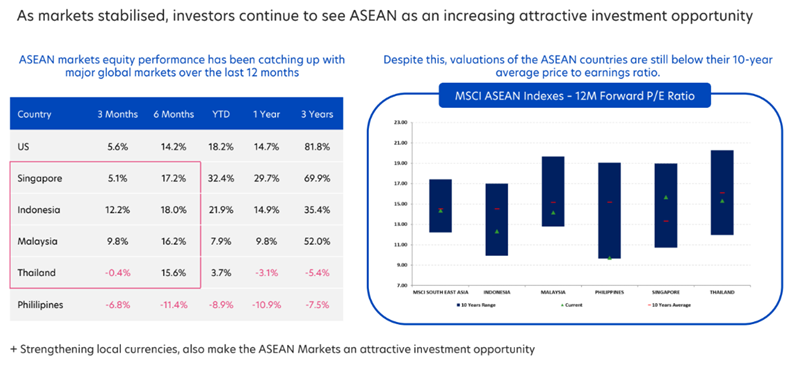

From a market perspective, several ASEAN equity markets, including Indonesia, Malaysia, Thailand and the Philippines, continue to trade below their long-term valuation averages.

This offers investors a potentially more attractive entry point compared to developed markets.

Over the past 12 months, ASEAN equity markets have begun to catch up with major global markets, after a prolonged period of underperformance.

While short-term volatility remains, the narrowing performance gap suggests a gradual re-rating as growth prospects improve.

This combination of growth and relatively attractive valuations allows investors to participate in the region’s longer-term economic expansion while collecting dividends along the way.

#3 – Diversification across markets

Another reason investors may find the UOBAM Ping An FTSE ASEAN Dividend Index ETF interesting is its emphasis on income sustainability and diversification.

The ETF tracks the FTSE ASEAN ex REITs Target Dividend Index, which focuses on ASEAN’s regional champions, which are companies with established businesses, strong fundamentals, and proven dividend track records.

As of 28 November 2025, the index’s largest constituents include well-known names such as DBS Group, Bank Mandiri, Bank Rakyat Indonesia, Oversea-Chinese Banking Corporation, United Overseas Bank, and Singapore Telecommunications.

These are companies operating in core sectors of their domestic economies.

This tilt towards established businesses helps reduce reliance on more speculative or early-stage companies, which can be more vulnerable during periods of market stress.

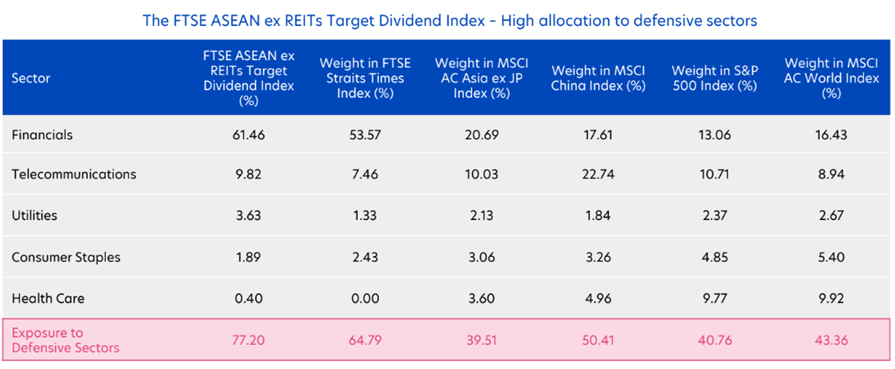

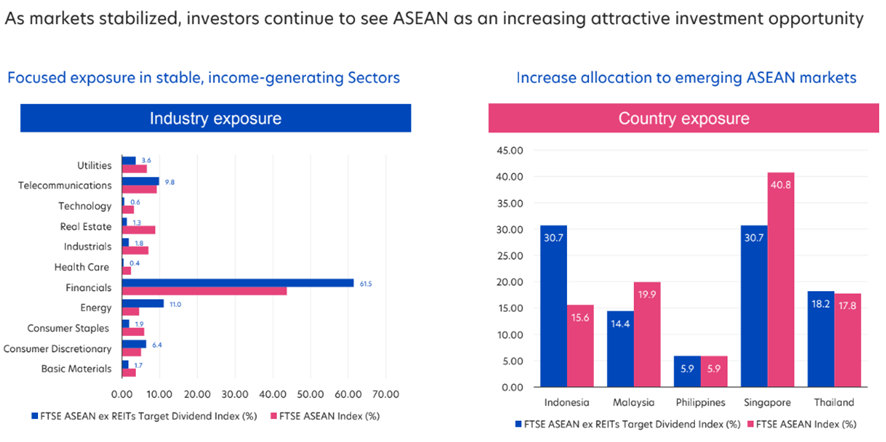

The ETF also has a higher allocation to income-generating sectors, such as:

- Financials (around 61% of the index, as of 28 November 2025)

- Telecommunications

- Utilities

Together, these sectors make up about 77% of the index, compared with roughly 43% in the MSCI AC World Index as of 28 November 2025.

From a country perspective, the index also provides diversified exposure across ASEAN markets, with meaningful allocations to Indonesia, Singapore, Malaysia, Thailand and the Philippines, rather than being concentrated in a single country.

This helps reduce reliance on any one domestic economic cycle or policy environment.

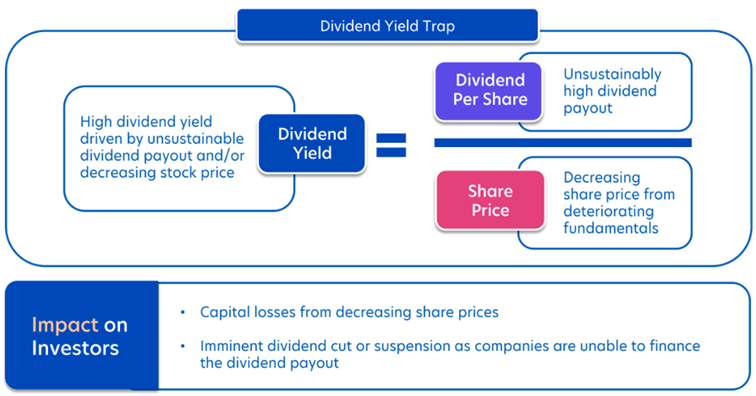

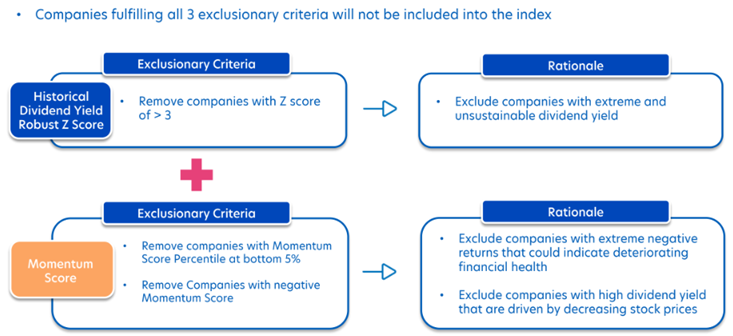

Importantly, the index methodology includes explicit safeguards to avoid so-called “dividend yield traps”, where high yields are driven by falling share prices or unsustainable payouts.

Companies may be excluded if they:

- Have extremely high dividend yields that are statistically abnormal (historical dividend yield z-score above 3)

- Show negative price momentum, indicating deteriorating fundamentals

- Fail liquidity or market-capitalisation requirements

In addition, ongoing screens help manage concentration, liquidity and turnover, ensuring the index remains investable and diversified over time.

This combination of established dividend-paying companies, regional diversification, and disciplined index safeguards means the ETF is structured with an eye towards allowing investors to participate in ASEAN’s income and growth opportunities over the medium to long term.

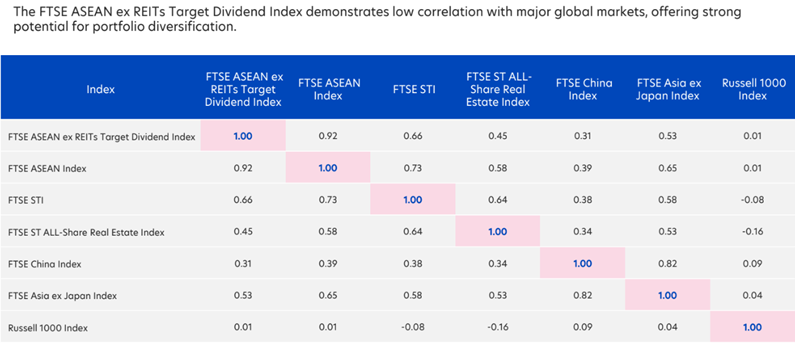

Historically, the FTSE ASEAN ex REITs Target Dividend Index has shown low correlation with major global markets, which may further enhance portfolio diversification.

#4 – Backed by ASEAN investment expertise

The FTSE ASEAN ex REITs Target Dividend Index is jointly developed by FTSE Russell and UOB Asset Management, combining global index construction expertise with deep regional market knowledge.

UOB Asset Management brings on-the-ground ASEAN insights, supported by a team of more than 70 investment professionals across the region, who specialise in understanding local companies, sectors and market cycles.

ASEAN is not a single market. Each country has different regulations, business environments, and economic drivers.

Having regional expertise helps ensure that dividend selection is not based on headline yield alone, but also considers local market conditions, sustainability of dividends, and risk factors unique to each country.

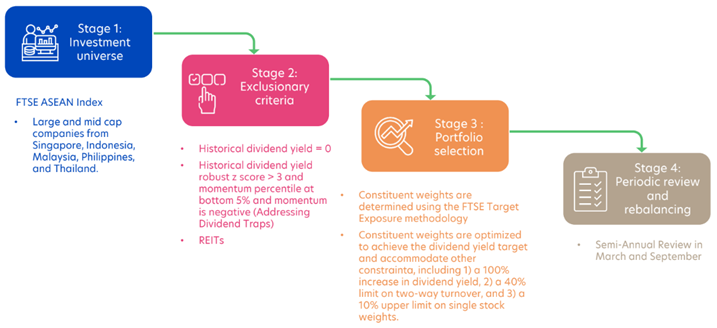

The index follows a clear, step-by-step process:

- Start with a broad universe of ASEAN stocks

- Apply exclusion rules to remove companies with unsustainable dividends

- Select stocks with stronger dividend characteristics

- Construct and rebalance the portfolio regularly

This disciplined approach helps ensure that the ETF stays focused on its income objective over time.

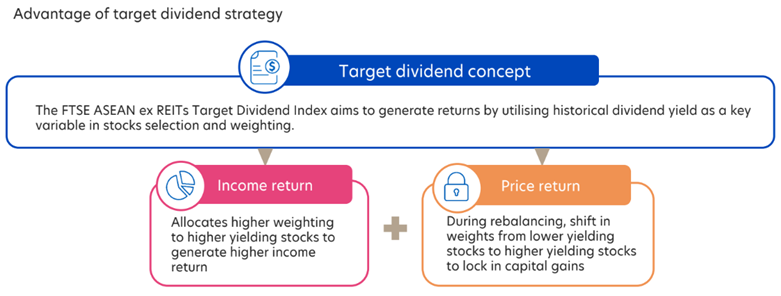

The index also uses a target dividend approach, which aims to balance income generation with price discipline:

- Stocks with stronger dividend histories are given higher weights to support income

- During rebalancing, weights are adjusted to avoid overpaying for stocks whose prices have risen too much

For investors, this means the ETF is not simply chasing the highest yields at any cost but is designed to generate income while managing risk in a systematic way.

Considerations and key risks

#1 – Sensitivity to global demand and commodity cycles

ASEAN economies can be sensitive to changes in global demand, commodity prices, and overall market sentiment. This can lead to short-term fluctuations in earnings and market returns.

In particular, the financials sector makes up about 61.5% of the FTSE ASEAN ex REITs Target Dividend Index as of 28 November 2025.

This means in the event of a sharp economic downturn, we may see potential market risks as the earnings of these companies are impacted.

That said, dividend-focused ASEAN strategies have historically been less volatile than several major global equity benchmarks over longer periods, as income can help cushion returns over time*.

#2 – Currency fluctuations

As the ETF invests across regional markets, returns may be affected by movements in ASEAN currencies against the Singapore dollar. Currency swings can either enhance or reduce returns when converted back to SGD.

#3 – Management fee

The ETF charges a management fee of 0.45% per annum, which investors should factor into overall return expectations, particularly for longer holding periods.

How investors can access the UOBAM Ping An FTSE ASEAN Dividend Index ETF

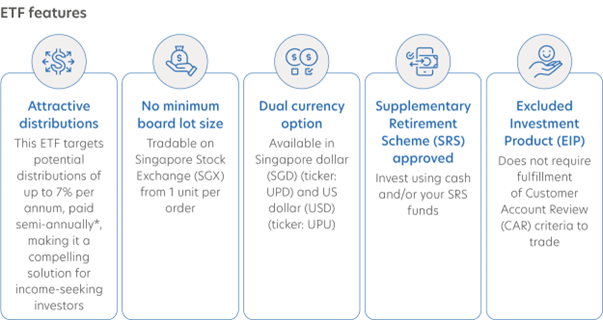

The UOBAM Ping An FTSE ASEAN Dividend Index ETF is designed to be easy to access and flexible for retail investors.

- Listed and tradable on SGX, just like a stock

- Dual-currency trading available in SGD (ticker:UPD) and USD (ticker:UPU)

Eligible for SRS investments, making it suitable for long-term retirement planning - Classified as an Excluded Investment Product (EIP) under MAS guidelines, with suitability requirements to help ensure appropriate investor understanding

Together, these features make the ETF accessible for investors looking to add ASEAN income exposure within a diversified portfolio.

What would Beansprout do?

From a portfolio perspective, I see the UOBAM Ping An FTSE ASEAN Dividend Index ETF as a diversification tool.

If most of my passive income already comes from Singapore REITs, local bank stocks, or cash instruments, this ETF could be a way to broaden income sources across the ASEAN region, while still staying focused on dividends.

The regional diversification helps reduce reliance on any single market or income stream.

The ETF’s stated target to pay dividends of at least 6%* per annum in 2026 and 2027 is especially relevant in an environment where yields are coming down.

That said, this is still an equity investment. ASEAN markets can be cyclical, and returns may be affected by market volatility and currency movements. Also, I would be mindful that the distributions are not guaranteed.

Overall, I would take a closer look at the ETF if I’m looking to balance income and longer-term growth potential through regional diversification beyond Singapore

Learn more about the UOBAM Ping An FTSE ASEAN Dividend Index ETF here.

Where can I buy UOBAM Ping An FTSE ASEAN Dividend Index ETF?

You can access the UOBAM Ping An FTSE ASEAN Dividend Index ETF through the following distributors:

- Phillip Securities

- UOB Kay Hian

- Tiger Brokers Singapore

- Moo Moo Singapore

- iFAST Financial

- Maybank Securities.

You can also invest in the ETF via UOB’s ATMs and Internet banking, and OCBC’s ATMs and Internet banking.

*Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus.

Important Notice and Disclaimers

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it.

The information contained in this document, including any data, projections and underlying assumptions, are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and UOB Asset Management Ltd’s (“UOBAM”) views as of the date of the document, all of which are subject to change at any time without notice. In preparing this document, UOBAM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was otherwise reviewed by UOBAM. While the information provided herein is believed to be reliable, UOBAM makes no representation or warranty whether express or implied, and accepts no responsibility or liability for its completeness or accuracy. Nothing in this document shall, under any circumstances constitute a continuing representation or give rise to any implication that there has not been or there will not be any change affecting the Fund. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOBAM and any past performance or prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund.

Investors should note that the Fund is not like a conventional unit trust in that an investor cannot redeem his Units directly with UOBAM and can only do so through the participating dealers if his redemption amount satisfies a prescribed minimum that will be comparatively larger than that required for redemptions of units in a conventional unit trust. An investor may therefore only be able to realise the value of his Units by selling the Units on the Singapore Exchange Limited (“SGX”). Investors should also note that any listing and quotation of Units on the SGX does not guarantee a liquid market for the Units.

An investment in unit trusts is subject to investment risks and foreign exchange risks, including the possible loss of all or part of the principal amount invested. Investors should read the Fund's prospectus and product highlights sheet, which are available and may be obtained from UOBAM or any of its appointed agents or distributors, before deciding whether to subscribe for or purchase any Units. You are responsible for your own investment decisions. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you.

The UOBAM Ping An FTSE ASEAN Dividend Index ETF has been developed solely by UOBAM. The UOBAM Ping An FTSE ASEAN Dividend Index ETF is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE ASEAN ex REITs Target Dividend Index vest in the relevant LSE Group company which owns the FTSE ASEAN ex REITs Target Dividend Index. “FTSE®” is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license.

The FTSE ASEAN ex REITs Target Dividend Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the FTSE ASEAN ex REITs Target Dividend Index or (b) investment in or operation of the UOBAM Ping An FTSE ASEAN Dividend Index ETF. The LSE Group makes no claim, prediction, warranty, or representation either as to the results to be obtained from the UOBAM Ping An FTSE ASEAN Dividend Index ETF or the suitability of the FTSE ASEAN ex REITs Target Dividend Index for the purpose to which it is being put by UOBAM.

The inclusion of “Ping An” in the name of the UOBAM Ping An FTSE ASEAN Dividend Index ETF reflects the collaboration between us and Ping An Fund Management Company Limited in relation to the Sub-Fund (which a Ping An feeder ETF in China is expected to feed into in the future). For clarity, Ping An is not a sub-manager or advisor in relation to the Sub-Fund, and the Sub-Fund is solely managed by us.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments