Webull Review: My likes and dislikes of this trading platform

Brokerage Account

By Nicole Ng • 12 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Explore our Webull review to see how you can trade SG, US, and HK stocks with low fees. Learn about its features, tools, and pricing.

What happened?

With so many brokerage platforms available these days, it can be hard to tell which ones are actually worth your time (and money).

Webull Singapore has been synonymous with trading US stocks.

Since launching in Singapore in 2022, Webull Singapore has become a strong contender for investors who want access to global markets without high fees.

Backed by its parent company, which is listed on NASDAQ just recently in April 2025, Webull Singapore brings the credibility of a publicly traded firm to its Singapore offering.

They are also licensed by the Monetary Authority of Singapore (MAS).

I’ve been using Webull Singapore to trade US and Hong Kong stocks for some time now, testing out the app and its features.

In this review, I’ll walk you through what I like and dislike about the Webull Singapore platform, from fees and features to the overall user experience.

If you’re looking for a low-cost way to invest in overseas markets and want a platform that feels intuitive yet powerful, read on to find out more.

What I like about Webull Singapore:

- Competitive fees across US, Singapore, Hong Kong, and China markets. US stocks and options has zero platform fees, with commission of just US$0.90 per order for US stocks and US$0.55 per contract for US options. Note: USD0.90 per order for US stock is for a limited time only.

- Advanced charting tools that appeal to active and options traders

- Moneybull cash management product supports both USD and SGD, with T+0 availability for trading, allowing me to deploy funds for trading almost instantly.

- Dynamic Regular Savings Plan (RSP): Supports both Dollar-Cost Averaging (DCA) and Dynamic Value Averaging (DVA), enabling automated investing based on market movements.

What I would llke to see on Webull Singapore:

- Access to more markets like the London Stock Exchange

🎁 Want to get started with Webull and receive an exclusive S$50 FairPrice voucher? Find out how to claim it.

Webull Singapore at a Glance

- Webull Singapore is a low-cost digital stock-trading platform that gives users access to US, Hong Kong, and Singapore stocks and ETFs, China A-shares as well as US options

- Fees for US stocks & ETFs: Promotional flat rate of US$0.90 per order or Standard rate of 0.025% commission (min. US$0.50) during regular and extended hours and no platform fee. Note: USD0.90 per order for US stock is for a limited time only.

- Fees for Singapore stocks: 0.025% commission fee, minimum S$0.80; 0.025% platform fee, minimum S$0.80. Free commission for the first year.

What is Webull Singapore?

Webull Singapore entered the local brokerage scene in 2022, building on its popularity in the US where it has become one of the most downloaded trading apps among pure-play brokerages.

Backed by Webull Financial LLC, licensed and registered with the Monetary Authority of Singapore (MAS), Webull Singapore holds a Capital Markets Services (CMS) Licence.

Since its launch, Webull Singapore has positioned itself as a digital trading platform aimed at tech-savvy investors who want low-cost access to global markets.

The platform offers trading in:

- US-listed stocks, ETFs, ADRs, and options;

- Hong Kong-listed stocks and ETFs;

- Singapore stocks, ETFs, REITs, warrants and DLCs;

- China A-shares & ETFs

- Mutual funds

- Fixed income products (U.S. Treasuries)

and more…

Webull also stands out for its 0 platform fees* for US and HK trades, advanced charting tools, and no minimum deposit requirements, making it appealing to both active traders and beginners looking for a modern interface.

What I like about Webull

#1 – Low cost

One of the biggest draws of Webull Singapore is its low-cost structure, which, for the cost-conscious investors like me, is appealing.

For US stocks and options, Webull has zero platform fees.

The charges for US stock commission would be just USD$0.90 per order or 0.025% of the total trade amount (minimum US$0.50) during regular and extended hours.

US options commission are also low at USD$0.55 per contract.

Trading Singapore stocks? You’ll get 1 year of commission-free trades as part of the Welcome promotion.

Thereafter, Webull charges a total fee of 0.05% per trade, with a total minimum of S$1.60. The fee for Singapore stocks breaks down to:

- Commission: 0.025% (minimum S$0.80)

- Platform fee: 0.025% (minimum S$0.80)

There are no account maintenance charges, and no minimum funding required to open an account.

While there are still regulatory fees on sell trades (imposed by the SEC and FINRA), and SGX imposed fees such as clearing, trading and settlement fees, these apply across most brokers and aren’t unique to Webull.

Currency exchange spreads are something to keep in mind, but overall, its pricing remains one of the most competitive in the market.

#2 – Advanced charting features

It’s always insightful to hear what a company’s leadership believes sets its product apart.

In an interview, Webull US CEO Anthony Denier shared that Webull users “tend to use sophisticated analytical tools such as charting and backtesting to decide when to enter and exit their trades.”

If you're someone who relies heavily on technical analysis, Webull Singapore could be a strong fit.

The platform offers a suite of advanced yet intuitive charting tools designed for active traders.

As part of its welcome promotion, Webull also provides free access to Level 2 market data for US stocks, OPRA for US Options and Level 1 data for Singapore stocks for a limited time, which can be further extended by trading.

#3 – Options trading

Webull is well known for its options trading function.

The platform was even awarded the best broker by Investopedia for low-cost options trading.

You’d be able to customise the options chain as well as get single leg options charts and real time charts.

In 2025, Webull launched 11 advanced options strategies. Now with 13 options strategies in total, options traders have the flexibility to trade the way that best fits their goals.

By combining competitive commission* and charting features, Webull has won fans amongst option traders.

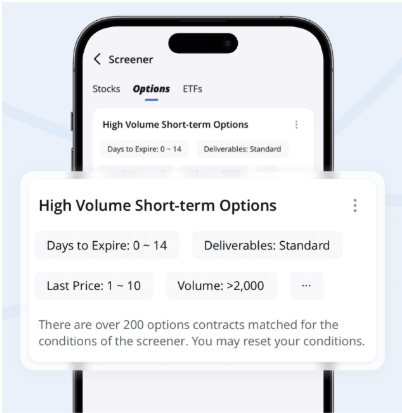

It also now has a screener to identify specific options trade opportunities.

However, Webull doesn’t support certain option strategies if you are using the cash account.

Here’s a warning though - Options trading involves significant risk and is not suitable for all investors as you may be exposed to potentially rapid and substantial losses.

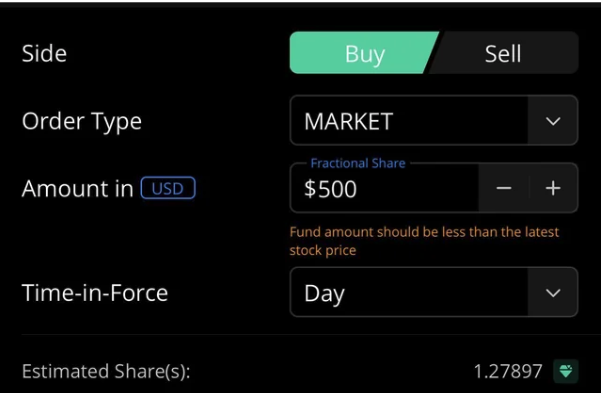

#4 – Offers US fractional shares from just US$1

Webull Singapore makes it easier for investors to get started in the US market with fractional shares trading, available from as little as US$1.

This means you can own a slice of high-priced stocks like NVIDIA, Microsoft or Tesla without needing to buy a full share.

Fractional trading is currently supported for selected US stocks and ETFs, which are marked with a green diamond icon in the app, making them easy to spot.

The feature is mobile-exclusive and only available during US regular trading hours.

To place a fractional trade, simply select a supported stock, choose “Market / Limit – Fractional Shares Trading Enabled” as the order type, and enter the amount in either shares or USD.

It’s one way for investors looking to invest smaller amounts or build a diversified portfolio gradually.

#5 – Regular Savings Plan available

Webull Singapore offers Regular Savings Plans (RSPs), making it easy to invest consistently in US stocks, ETFs, and mutual funds—even with a small budget.

Ideal for long-term investors and dollar-cost averaging strategies, this feature allows you to automate your investments based on your preferred schedule.

There are two types of RSPs available: Fixed Amount and Dynamic Amount.

- Fixed RSPs support US-listed stocks and ETFs, as well as SGD and USD-denominated mutual funds.

- Dynamic RSPs, on the other hand, support both DCA and DVA for US-listed stocks and ETFs only. This enables automated investing based on market movements.

You can set up an RSP for any stock or ETF available for fractional trading, which are clearly marked with a green diamond icon on the stock detail page.

Each security within a portfolio must be eligible for recurring investment, and the green diamond makes them easy to identify.

The minimum investment amount depends on the type of plan and funding method.

For Fixed RSPs, the minimum is US$5 when using Buying Power, or S$10 when funded via eDDA.

For Dynamic RSPs, the minimum is US$10 via Buying Power or S$20 via eDDA.

For more details of Dynamic RSPs, you can refer to the FAQ here.

Mutual funds have varying minimum initial investment amounts, which will be shown at the point of subscription.

Webull also gives you flexibility in how often you want to invest.

You can choose to invest every trading day (only available for fixed amount investments), weekly, every two weeks, or monthly by selecting your preferred date or day of the week.

🎉 Bonus for new users: Get a S$50 Fairprice voucher when you open a Webull account via Beansprout.

#6 – Maximise idle cash with Moneybull

Moneybull is Webull Singapore’s cash management product.

With Moneybull, you can earn up to 4.09% per annum (7-day USD yield)^ as of 29 August 2025 on your idle cash.

There are no fees or minimum balance required to start. You only need US$10 or SG$10 to begin.

How does it work? Moneybull automatically invests your idle cash into underlying low-risk cash funds with competitive yields.

While your money grows, you can still trade stocks, ETFs, options, and mutual funds seamlessly on Webull Singapore.

It is a smart, low-risk way to earn yield while keeping your funds ready for trading.

It supports both USD and SGD currencies for cash accounts and margin accounts.

Your funds have T+0 availability, so you can trade anytime without waiting.

We have covered more about it here.

Is Webull safe and legit?

Webull US is a trusted, Nasdaq-listed brokerage platform serving over 23 million users across 180+ countries.

Being publicly listed on NASDAQ adds transparency and regulatory oversight, making Webull a safe and reliable choice for investors worldwide.

But I guess what you really care about, is whether your money is safe with Webull.

Here, it might be useful to know that Webull Singapore and Webull US are two separate entities under the common ownership of Webull Corporation, a global holding company headquartered in St. Petersburg, Florida, and backed by large private equity funds such as General Atlantic and Coatue.

So while the US entity Webull Financial LLC is a member of the SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash), we were not able to verify if this is also offered to customers in Singapore who are clients of Webull Singapore.

However, what might be helpful to know is that Webull Singapore secured its Capital Markets Services ("CMS") license from the Monetary Authority of Singapore in November 2021.

MAS takes into account the following factors when assessing an application for a CMS licence:

- Fitness and propriety of the applicant, its shareholders and directors.

- Track record and management expertise of the applicant and its parent company or major shareholders.

- Ability to meet the minimum financial requirements prescribed under the Securities and Futures Act (SFA).

- Strength of internal risk management and compliance systems.

- Business model/ plans and projections and the associated risks.

What I would like to see on Webull Singapore

#1 – Access to more markets

While Webull Singapore already offers access to US, Hong Kong, Singapore, and China A-shares, one key market that’s currently missing is the London Stock Exchange (LSE).

This limits access to popular ETFs like CSPX and VWRA, which are widely favoured by long-term investors for their global exposure and tax efficiency.

Given the growing demand among Singapore-based investors for these LSE-listed funds, it would be great to see Webull expand its market coverage to include them.

#2 – More educational content

As investors who like to perform analysis before buying into a stock, Webull does not offer us any research reports to help us make more informed decisions.

It also does not offer advanced portfolio analysis tools.

Webull vs Moomoo Singapore vs Tiger Brokers: How do they compare?

Webull stands out for having the lowest total fees for trading both US and Singapore stocks.

For US stock trades, Webull charges just 0.025% of the order value as a commission fee, with a minimum of US$0.50 per trade for regular and extended hours. Webull charges 0 platform fees for US stocks and ETFs.

For small trades of below US$2,000, the total fees would be lower than Moomoo’s flat US$0.99 platform fee and Tiger Brokers’ US$0.01 per share fee, capped at 1% of order value, with a US$1.99 minimum.

For large trades of above US$4,000, you can choose Webull’s promotional flat fee of US$0.90 per order. So, the total fees would be still lower compared to other brokers.

When it comes to Singapore-listed stocks, Webull also comes out ahead with a total fee of 0.05% of the order value, or a minimum of S$1.60.

In comparison, Moomoo charges a total of 0.06% (0.03% commission + 0.03% platform fee), with a minimum of S$1.98 per trade, while Tiger charges a similar 0.06% (0.03% commission + 0.03% platform fee) with a slightly higher minimum of S$1.99.

| Platform | Webull | Moomoo SG | Tiger |

| Commission fee | US stocks: US$0.90/order or 0.025% of trade value, (min. US$0.50) Note: USD0.90 per order for US stock is for a limited time only. | US stocks: 0 commission | US stocks: US$0.005/share, min. US$0.99/trade, max 0.5%/order |

| SG stocks: 0 commission for 1 year. Thereafter, 0.025% (min. S$0.80) | SG stocks: 0 commission for 1 year. Thereafter, 0.03% of trade value, min. S$0.99 | SG stocks: 0.03% of trade value, min. S$0.99 | |

| Platform fee | US stocks: US$0 | US stocks: US$0.99 per order | US stocks: US$0.005/share, min. US$1 per trade, max 0.5% per order |

| SG stocks: 0.025% (min. S$0.80) | SG stocks: 0.03% of trade value, min. S$0.99 | SG stocks: 0.03% of trade value, min. S$1/order | |

| Markets accessible | Singapore, US, Hong Kong, China | Singapore, US, Hong Kong, Japan, China | Singapore, US, Hong Kong, China, Australia |

| Products offered | Stocks, ETFs, options, mutual funds, warrants, ADRs, DLCs, US Treasuries | Stocks, ETFs, options, mutual funds, warrants, ADRs, DLCs, futures, US treasuries, FX, cryptocurrency | Stocks, ETFs, options, mutual funds, warrants, ADRs, DLCs, futures, US treasuries |

| Source: Webull, Moomoo, Tiger Brokers, as of 15 August 2025 | |||

💡 Thinking of joining Webull, sign up via Beansprout to get S$50 Fairprice voucher.

What would Beansprout do?

Webull Singapore is one of our top choices if you’re looking for a low-cost broker which gives you access to the US, Singapore, Hong Kong stock market and China A-Shares.

What I really like about Webull are the low commissions for US, Singapore, Hong Kong stocks, as well as US options. It also offers advanced charting tools and an options screener for active and options traders.

However, I would love to see Webull offer trading on the London Stock Exchange, as well as more educational resources.

Webull offers an attractive sign-up promotion, which is a bonus for new users who are looking to try out the brokerage platform.

Webull Exclusive Promotion

Learn more about the Webull promotion here.

Ready to start your investing journey? Sign up here.

Step-by-step guide to signing up for a Webull Singapore account

Step 1: Register for a new Webull account

Click here to register a new account

After clicking “Get Rewards Now” you will be directed to registration page.

Here are what you'll need to do next

- Key in your phone number

- Select “Send Code” and you will receive a code via SMS

- Key in the code sent to you

- Read and agree to the Terms & Conditions & Privacy Policy

Step 2: Set up your new Webull account

Next, you can set up your account after successfully registering for a new account.

- Download Webull App from the link provided

- Login using your mobile number and select “Open Account”

- Fill in your personal particulars. You may select to link your Singpass account.

After submitting your details, you will have to wait for approval for your account to be set up.

Step 3: Fund

After your account is approved, it’s time to make a deposit. Inside Webull app, select “Webull” tab at the center bottom of the screen.

There are a few ways to make a deposit: eDDA, Fast or Telegraphic Transfer.

Webull recommends the eDDA Deposit method, where you will authorise Webull to transfer money from your bank account into your Webull account. To use this method, you can select the “eDDA Deposit” option, log in to your internet banking account, and set the transfer limit.

If you'd prefer to manually transfer funds from your bank account, then you can use the FAST method. However, do note that this option is applicable only for SGD deposits.

If your fund transfer has yet to be reflected in your Webull account after 30 minutes, you'll need to remember to notify Webull.

*Terms & Conditions apply.

^Figures shown are based on 4.09% 7-Day Yield P.A. of the USD Cash Fund in Moneybull as of 29 August 2025. Principal is not guaranteed. Returns are not guaranteed and not an indication of future performance.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions