Wee Hur Holdings: Investing in multi-asset property portfolio

Stocks

By Goh Lay Peng, CFA • 27 Jan 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

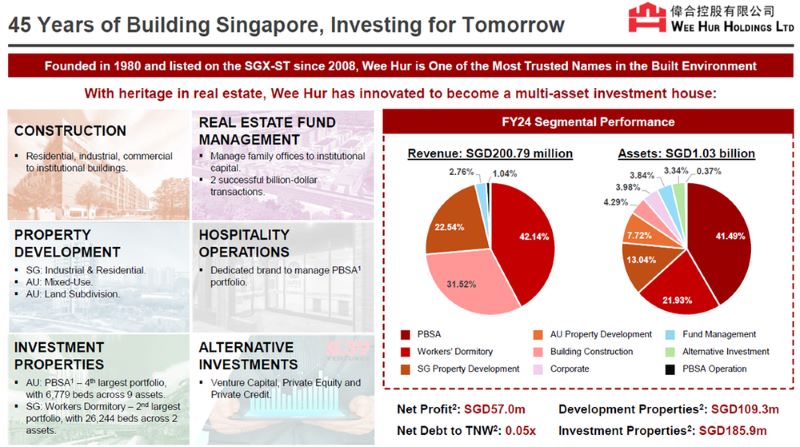

Wee Hur is an established property developer and construction company in Singapore, with over 45 years of proven operating track record.

Proven expertise in driving expansion across segments

About Wee Hur Holdings

Established in 1980, Wee Hur Holdings has a long operating history in construction, property development, and investment. Listed on the Singapore Stock Exchange on 30 January 2008, Wee Hur is trading at market capitalisation of S$0.68 billion.

Earlier phases of growth were driven by residential and mixed-use development projects across Singapore and overseas markets.

Over time, the group has deliberately pivoted toward income-generating assets, particularly in the purpose-built student accommodation (PBSA) segment. This strategic evolution reflects management’s preference for recurring cash flows and lower earnings volatility.

Business segments

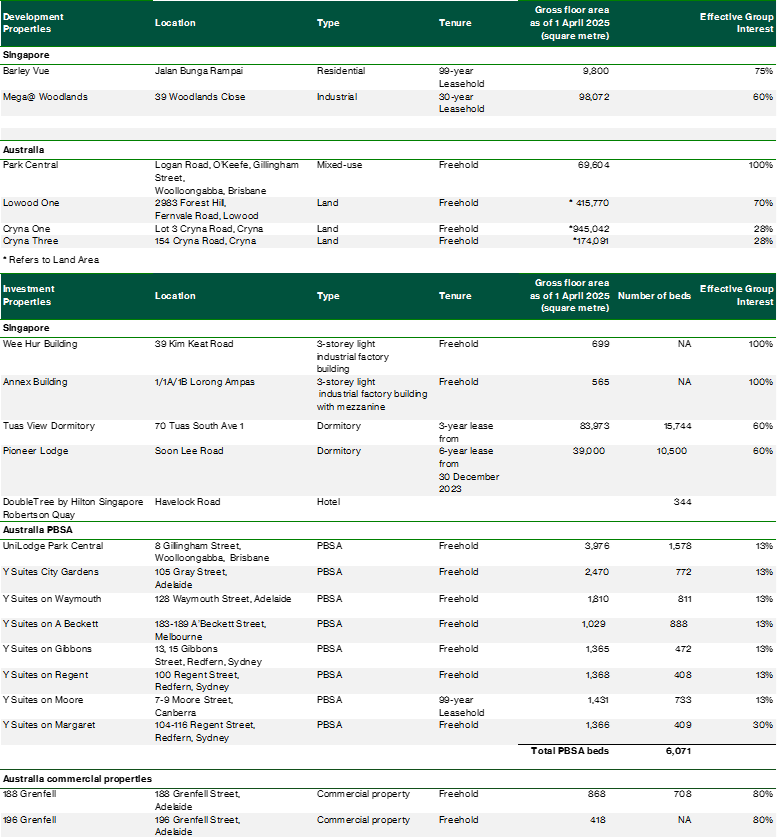

The core businesses are construction, property development, fund management, and alternative investment. In addition, Wee Hur operates workers’ dormitory and purpose-built student accommodation businesses.

Property development - Singapore

The group’s property development business in Singapore involves the development and sale of residential and industrial properties. The completed units are either sold or retained for recurring income.

Beginning in 2009 with a 469-unit strata-titled industrial development, Harvest@Woodlands, Wee Hur has since completed industrial and residential development projects such as Mega@Woodlands, Premier@Kaki Bukit, Parc Centros, Parc Botannia, Villas@Gilstead and Urban Residences.

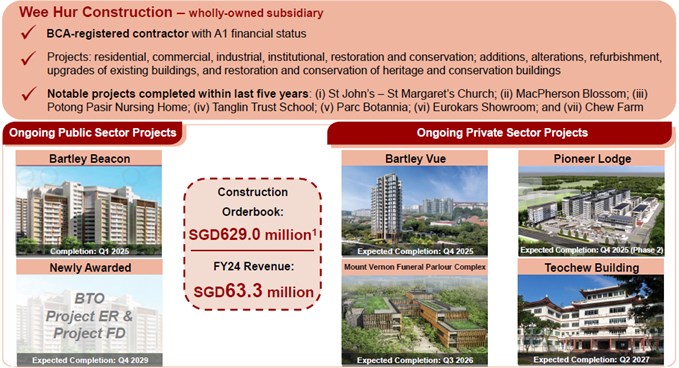

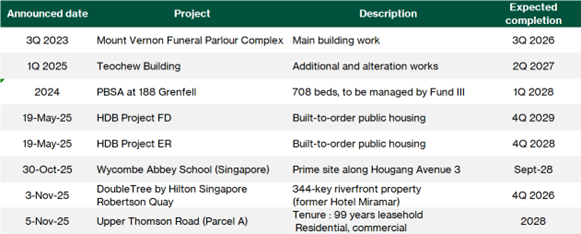

On 19 May 2025, Wee Hur Holdings announced that Wee Hur Construction had been awarded the following new projects by the Housing & Development Board: (1) building and contingency works for Project ER, with a contract value of $203.0 million; and (2) building and contingency works for Project FD, with a contract value of $236.4 million.

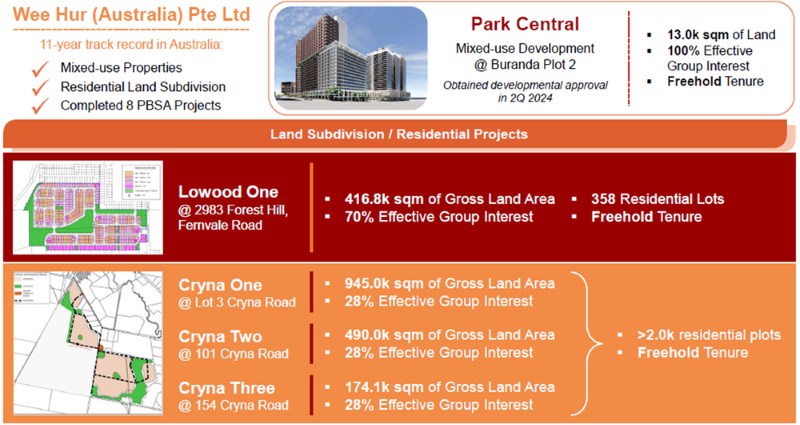

Property development – Australia

Wee Hur has over 11 years of track record in Australia, Wee Hur is involved in development and sale of mixed-use properties and residential land subdivision. All the land acquired are of freehold tenure.

In 2014, Wee Hur entered the Australian property development market with the acquisition of three land parcels totalling 1.69 hectares in Brisbane for A$56.5 million.

Wee Hur has expanded into residential land subdivision projects in Queensland. As at 15 April 2025, it has acquired three land parcels and is completing the acquisition of another. Development approval has been secured for the Lowood site, where the plan is to develop 358 residential lots.

For Cryna One and Cryna Three, Wee Hur intends to obtain development approval for more than 2,000 residential lots by 1H2026. Site selection is guided by location, proximity to infrastructure, and planning suitability.

Building construction

A reputable contractor with a Building and Construction Authority (BCA) A1 rating. As a BCA-registered contractor with A1 financial status, Wee Hur Construction is eligible to participate in public sector construction tenders for projects of unlimited value.

The company undertakes a wide range of public and private sector projects, including residential, commercial, industrial, and institutional works, as well as refurbishment and conservation projects. Its track record across diverse project types reflects strong execution capability and project management experience.

The successful delivery of projects such as Tanglin Trust School, Parc Botannia, and Potong Pasir Nursing Home underscores the group’s technical depth, project management discipline, and ability to meet stringent quality and regulatory standards.

As at 30 June 2025, the Group has seven ongoing projects, and the Group’s construction order book stands at approximately $629.0 million with project completions scheduled through 4Q 2029.

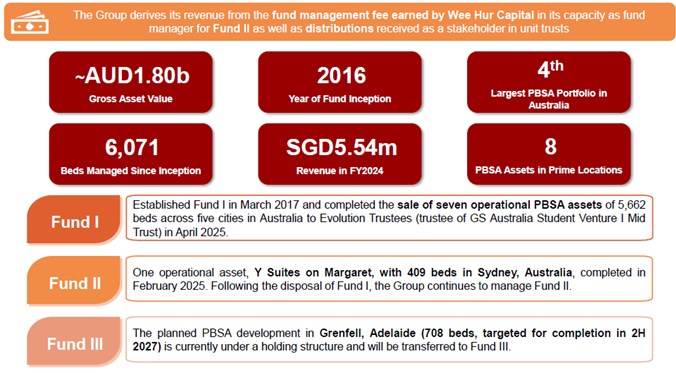

Fund Management

Wee Hur has an established track record of operating experience in fund management. Leveraging the management team’s experience, network, and track record, the group is well positioned to scale this business, which was designated as a core business in April 2024.

The fund management business covers the full real estate investment lifecycle, including sourcing and acquiring assets aligned with fund objectives. It focuses on establishing and managing real estate investment funds, including the purpose-built student accommodation (PBSA) space in Singapore and Australia.

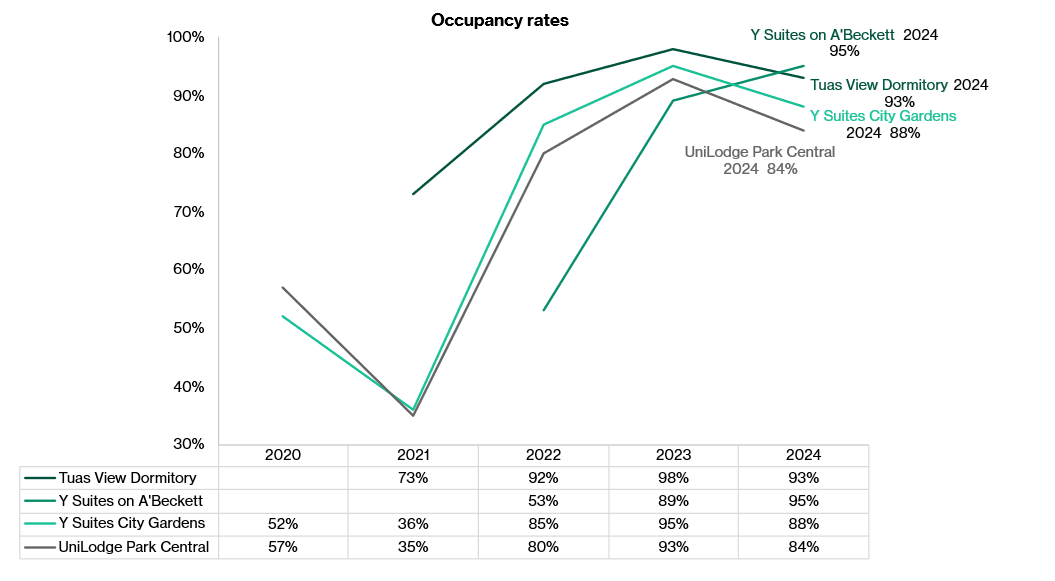

In 2017, Wee Hur started Fund I as an Australia-focused PBSA private trust with a portfolio of seven PBSA assets comprising 5,662 beds. Wee Hur successfully executed its partial exit strategy for Fund I in April 2023 at a valuation of approximately A$1.14 billion. In April 2025, Wee Hur further monetized its stakes in Fund I at a valuation of approximately A$1.6 billion. Following disposal in April 2025, Wee Hur retains a 13% residual stake in the assets. This represents a key equity value realization event which provides capacity for capital recycling into higher-return opportunities, supporting shareholder returns and future growth.

Fund II is a single-asset fund with assets under management of approximately A$225.9 million as at 31 December 2024. The asset, located at 104–116 Regent Street in Sydney, is a 409-bed PBSA development. The asset commenced on 17 February 2025.

Following disposal of Fund I, the Group has established PBSA Fund III for a new development at 188 Grenfell, Adelaide. The 708-bed PBSA project is targeted to complete by end-2027 and operate by 2028.

Alternative investment

Since 2018, alternative investment business invests across multiple asset classes, including private credit, private equity, and venture capital, with exposure across sectors such as technology, sustainability, and education.

The alternative investment business deploys the group’s proprietary capital into medium-to-long term investments in private credit, private equity, and venture capital investments. As at 31 December 2024, the Group has invested a total of approximately $33.5 million into alternative investments, which represents approximately 5.1% of the Group’s net asset value. Revenue from this segment is derived from capital gains and recurring dividend income from the investments.

Workers’ dormitory

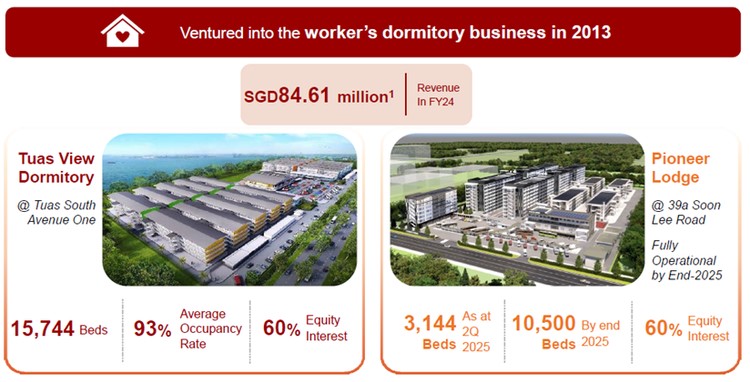

Started in 2013, Wee Hur to acquire or lease land which has been approved for building workers’ dormitories and develops the land parcel into a workers’ dormitory complex. There are two properties in this segment – Tuas View Dormitory and Pioneer Lodge.

In 2013, Wee Hur’s 60%-owned joint venture developed Tuas View Dormitory, at Tuas South Avenue One. Currently, Wee Hur operates Tuas View Dormitory, which has 15,744 beds. The second property, Pioneer Lodge has 10.500 beds and will be fully operational by end of 2025.

Purpose-built student accommodation (PBSA) operations

The PBSA operation segment is in the business of managing student accommodation, which include reservation and sales, marketing, customer service, property management, and business development.

The property management segment started in 2020 when Wee Hur launched its premier global student accommodation under the brand, “Y Suites”. The partnership with UniLodge is a white label agreement where Y Suites is the strategic brand driver while UniLodge is the property manager.

Wee Hur adopts various digital solutions to improve renewal rates and lead-to-booking conversion rates, driving the portfolio’s outperformance in a fast-paced leasing environment.

Following the sale of Fund I, the PBSA operation segment will transfer the Y Suites properties under Fund I to the new manager. The team is also managing Y Suites on Margaret, a 409-bed property in Sydney held under Fund II.

Purpose-built student accommodation (PBSA)

Wee Hur’s PBSA business provides purpose-built accommodation for tertiary students. These properties are strategically located near key institutions in Sydney, Melbourne, Adelaide, and Canberra. They are also strategically located near public transport nodes and key amenities.

For example, Y Suites on Margaret, Y Suites on Gibbons and Y Suites on Regent are situated in the inner-city Sydney suburb of Redfern. The University of Sydney, University of Technology Sydney, TAFE NSW-Ultimo and TAFE NSW-Eora are all within a 20-minute walking distance. In addition, Y Suites on Regent is close to Central Park Mall, Haymarket, and Chinatown.

The portfolio is grown primarily through a greenfield development strategy, targeting stable recurring income and capital appreciation. Developments are designed with student end-users in mind, featuring generous communal areas and supporting amenities to foster a conducive living environment.

The PBSA business is conducted through Fund I and Fund II.

Key investment highlights

Integrating property development, construction and fund management

By controlling the two stages of the value chain, Wee Hur gains economies of scale, efficient resource deployment, and tighter control over quality, costs, and delivery timelines. Collaboration across both divisions also facilitates resource sharing and enhances execution certainty, providing a competitive edge over peers.

Property development projects further support the growth of the construction order book, strengthening the group’s track record and market standing as a contractor.

In evaluating development opportunities in Singapore and overseas, the group may also retain selected sites as investment properties where commercially viable, reinforcing its long-term income base.

Proven investment track record in purpose-built accommodation

Wee Hur’s first asset in workers’ dormitory, Tuas View Dormitory, has been operational since 2014. Tuas View Dormitory is a large-scale purpose-built facility with 15,744 beds. The second dormitory, Pioneer Lodge with 10,500 beds, is under construction and expected to be partially operational by 2Q2025 and fully operational by end-2025.

In Australia, Wee Hur has sold a majority stake in Fund I which held seven properties, successfully realising the uplift in the portfolio value. Fund II is a single-asset fund anchored by Y Suites on Margaret in Sydney with 409 beds. The asset has been operational since Feb 2025.

Wee Hur continues to grow its PBSA portfolio through a greenfield strategy. Currently, Wee Hur is developing the ninth asset in the development pipeline. To be held in Fund III, the 708-bed purpose-built student accommodation (PBSA) at 188 Grenfell, Adelaide, is targeted to complete by early 2028.

This established track record underscores the ability to adapt to market dynamics, execute at scale, and capture value across evolving accommodation segments.

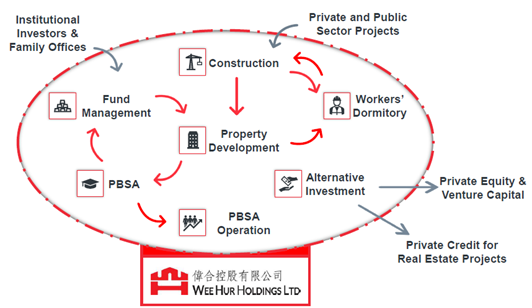

Sustaining high occupancy rates

Following the disruption faced during the pandemic, occupancy rates have recovered from the 2021 lows. Wee Hur has sustained the occupancy rates at the high levels. Worker dorm occupancy in Singapore has been consistently high, at 93% in 2024 and 1H 2025, reflecting tight supply and strong demand in that segment.

PBSA assets in Australia also maintained strong occupancy in the student housing segment, although the exact figures vary by property and cohort, with many falling comfortably in the 80% to 88% occupancy ranges.

Experienced management team

Led by an experienced and well-qualified management team with a proven track record of execution, most of the executive directors and senior management have been closely involved in the group’s development since inception. Founding members, including Executive Chairman and Managing Director, Mr Goh Yeow Lian, has played a central role in shaping the group’s growth. As the next generation of leaders step up, the founding members provide continuity and deep institutional knowledge.

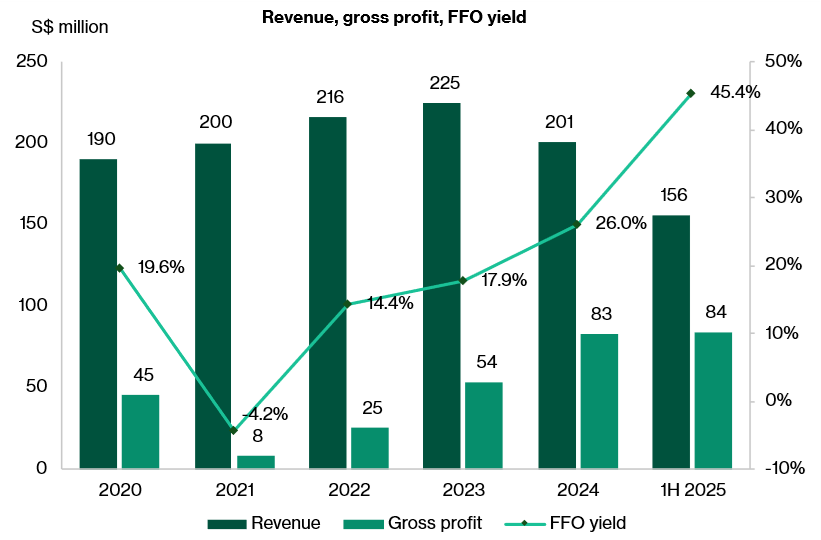

Track record of generating stable operating cash flows

Wee Hur has expanded its business meaningfully in recent years, particularly in the purpose-built student accommodation segment, while executing value-accretive strategies for investors.

In 2022, the group monetised part of Fund I through the sale of a 49.9% stake to RECO Weather, followed by the disposal of a 37.1% indirect interest in a seven-asset Australian PBSA portfolio in April 2025. These transactions highlight the group’s ability to actively manage assets, time exits and recycle capital.

This disciplined approach has underpinned strong financial performance, with the group consistently delivering profits and generating stable operating cash flows.

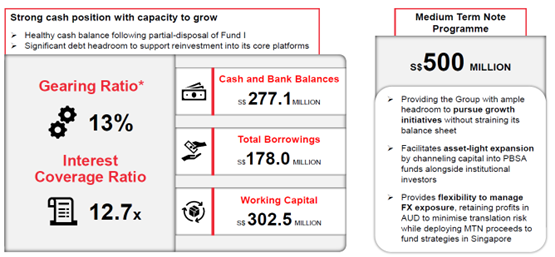

Capital Management

As of 30 June 2025, the gearing ratio was at only 13%, improving from 27% as of 31 December 2024. Cash balance increased by S$175.3 million year-to-date, to S$277.1 million as of 30 June 2025. The increase was due to the net proceeds of S$299.6 million received from the partial stake sale in Fund I. As part of its liquidity management framework, the Group holds sufficient cash and short-term deposits to meet working capital needs.

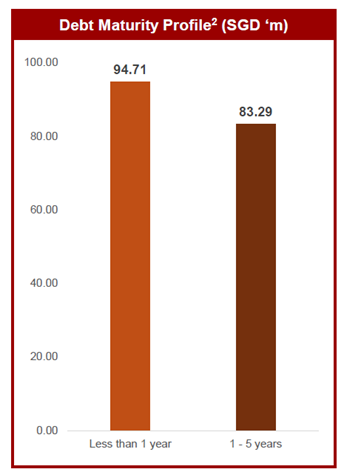

The Group adopts a prudent financial management approach that underpins a solid credit profile, a disciplined investment strategy, and a strong balance sheet. It maintains conservative gearing, a long weighted average debt maturity, and a diversified lender base, giving it greater financial flexibility.

It also projects cash flows in major currencies, assesses the level of liquid assets required to meet these obligations, monitors liquidity ratios, and maintains forward-looking debt financing plans to ensure funding resilience.

In order to strengthen the funding base, Wee Hur established the S$500 million medium term note (MTN) in May 2025. As of end-2025, Wee Hur has issued 5-year debt of amount S$205 million at 4.8%. As a result, the undrawn amount available is S$295 million.

As at 30 June 2025, the Group’s debt maturity profile is illustrated in the diagram below.

Competitors

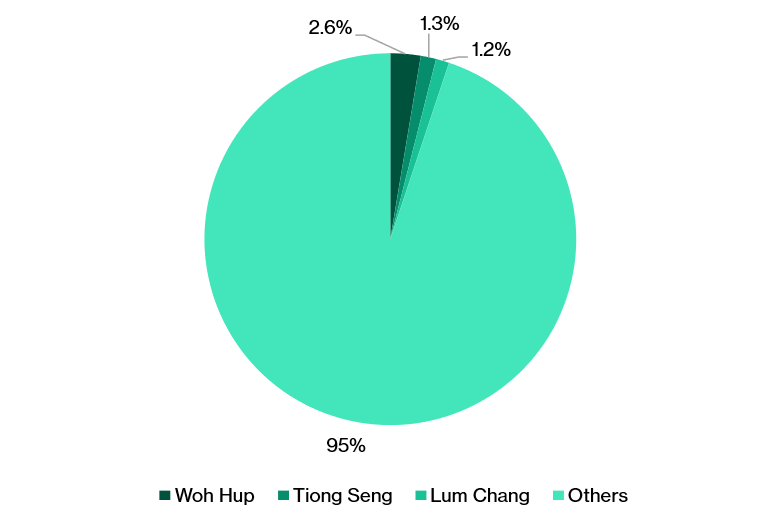

Singapore construction industry

The construction industry in Singapore is competitive with highly fragmented revenue distribution. Main contractors with Building and Construction Authority (BCA) A1 rating include Woh Hup (Private) Limited, Tiong Seng Holdings, Lum Chang, Lian Beng and Soilbuild Construction. Based on the estimated total construction industry revenue of S$40 billion in 2025, the total market share of Woh Hup, Tiong Seng and Lum Chang is approximately 5%.

Based on the business composition and scale, Wee Hur is comparable with mid-cap, diversified contractors like Soilbuild Construction Group, Lian Beng Group Pte Ltd and Centurion Corp Ltd.

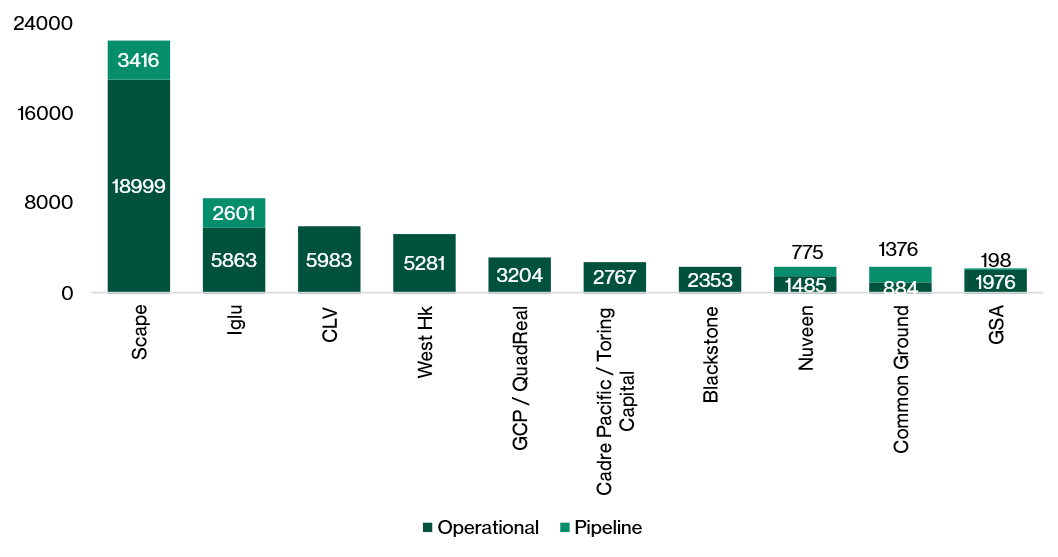

Australia PBSA industry

In the Australian PBSA market, Wee Hur was one of the top five operators prior to its exit from Fund I. Currently, Wee Hur is managing Fund II, which is a single-asset comprises the 409-bed Y Suites on Margaret.

Fund III was established to develop the new 708-bed PBSA at 188 Grenfell, Adelaide. Construction of 188 Grenfell has started and targeted to complete in early-2028. Building on the success of its first two funds, Wee Hur intends to continue capitalising on opportunities in the Australian PBSA market.

In recent years, more Singapore-based companies have entered the purpose-built accommodation space, including Centurion Corporation, City Developments Limited, CapitaLand Investment, and Mapletree Investments.

Financial results

1H FY2025 Financial performance

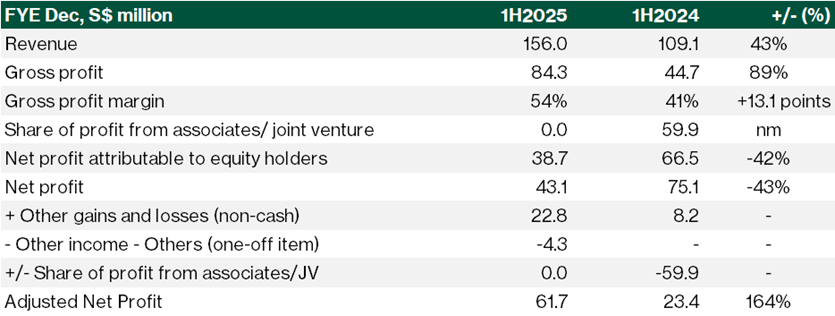

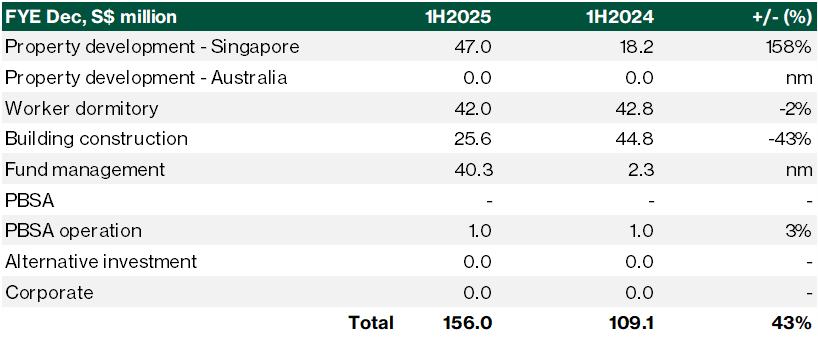

Revenue increased by 43% year-on-year to S$156 million in 1H25, driven by one-off performance fee following the successful exit of Fund I. The amount of performance fee received was S$38.4 million.

Gross margin was lifted by a one-off performance fee recognised as revenue from the partial disposal of Fund I. Contributions across the core business segments remained resilient, underscoring Wee Hur’s proven execution capabilities.

At the same time, share of profit from associates and joint ventures declined following the disposal, with only a 13% minority stake retained.

As a result, net profit attributable to equity holders was lower, mainly due to the absence of profit contributions from the Fund I joint venture. Net profit fell by 43% year-on-year to S$43.1 million in 1H 2025.

On an adjusted basis, net profit excludes fair value movements, foreign exchange losses, one-off gains and share of profit, providing a clearer view of underlying growth across the group’s core businesses. Adjusted net profit jumped 164% year-over-year to S$61.7 million in 1H 2025.

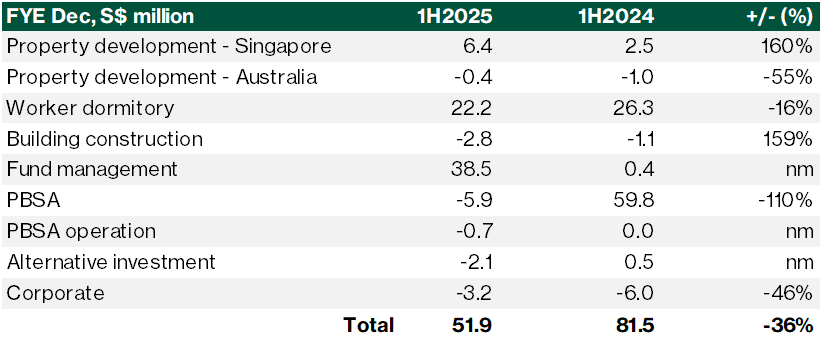

Building construction

Segment results were mixed. Construction revenue fell 42.8% year-on-year to S$25.6 million in 1H2025 due to higher inter-segment sales. Total segment revenue increased by 23% year-on-year to S$73.6 million in 1H2025, led by sustained business activity and demand. However, inter-segment sales surged to $48.0 million (1H 2024: $15.1 million). After eliminating these internal transactions, consolidated revenue from external customers came in lower at the Group level.

Singapore Property development

Property development stood out, with revenue surging 157.8% year-on-year to S$47.0 million. Wee Hur started progressive revenue recognition from the Bartley Vue project, due for completion by end-2025. Profit jumped to $6.42 million in 1H 2025 from $2.47 million a year earlier, fuelled by stronger revenue recognition from ongoing projects while margins stayed stable at 13.6% in 1H 2025.

Australia Property development

Recorded loss of S$0.4 million due to staff costs and general expenses.

Worker accommodation

Worker accommodation revenue declined 1.9% year-on-year to S$42.0 million, reflecting softer occupancy at Tuas View Dormitory at 93%, while rental rates held firm. Profit was relative resilient, at S$22.2 million in 1H 2025, lower by 16% year-on-year.

Fund management

Fund management delivered a strong uplift in revenue to S$40.3 million, underpinned by a one-off S$38.0m performance fee from the successful exit of Fund I.

PBSA and PBSA operations

The PBSA segment reported a loss of S$5.9 million in 1H 2025, due to S$5.7 million in fair value loss of investment properties. PBSA operations reported 3% higher in revenue in 1H 2025, to S$1.04 million, reflecting continued stabilisation in PBSA operations. Higher staff costs pushed PBSA operations into losses.

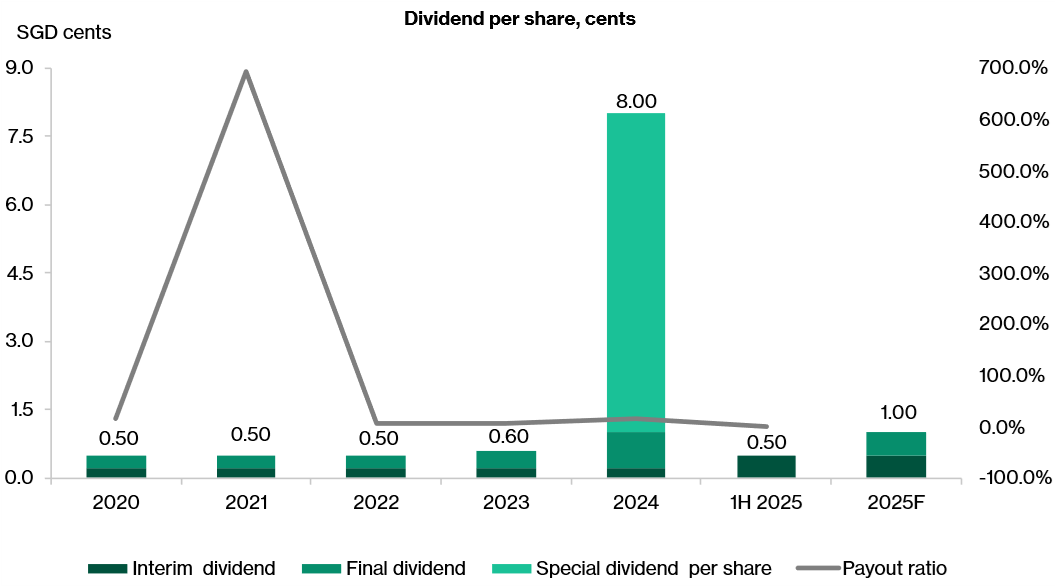

Dividend and dividend yield

Wee Hur has been paying dividend per share of 0.5 cents per year. The dividend increased in 2024 to 8.0 cents per share. The increase was due to a special dividend of 7 cents per share declared after Wee Hur exit a majority stake in Fund I. The amount of special dividend paid was S$64.3 million, funded from the net proceeds of S$299.6 million received from the divestment of Fund I.

For the period 1H FY2025, Wee Hur declared interim dividend of 0.5 cent per share. Assuming a stable dividend amount in 2H FY2025, full year FY2025 dividend per share is estimated at 1.0 cent per share. At the current share price S$0.75, Wee Hur offers a potential dividend yield of 1.3%, versus the peers’ average of around 3.0%.

Industry outlook

Singapore construction industry

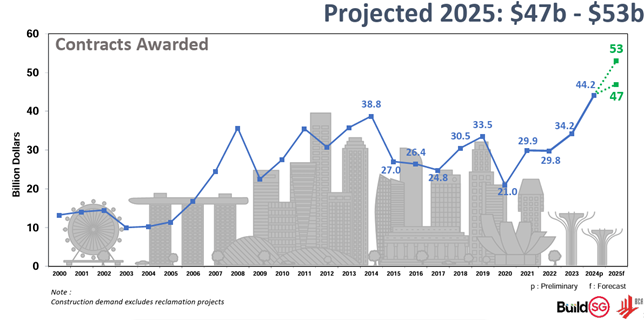

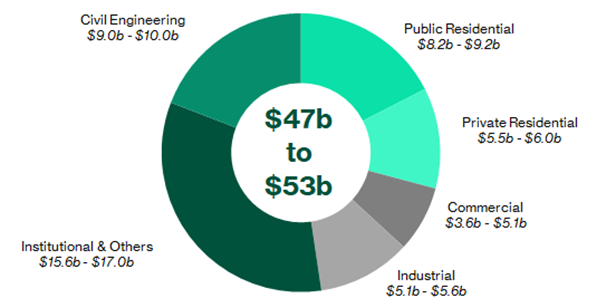

With strong macro environment, Singapore’s construction outlook remains strong. According to the Building and Construction Authority (BCA), total construction demand is expected to reach S$47–53 billion in 2025, up from S$44.2 billion last year.

Public-sector projects — which now account for about 60% of total construction — will remain the key driver. Major upcoming works, including Changi T5, MRT lines, new healthcare campuses and a ramp-up in public housing, provide a strong pipeline into 2H25 and beyond.

| BCA’s outlook for 2026 - 2029 | |

|---|---|

Major Pipeline Projects | |

|

|

|

|

|

|

|

|

| Source: BCA | |

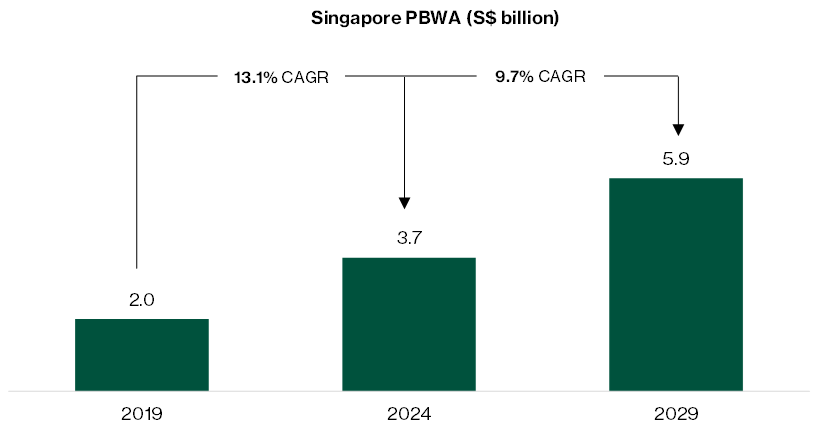

Singapore purpose-built workers’ accommodation (PBWA)

The Singapore PBWA market remained resilient during the pandemic, with market size growing at a CAGR of 13.1% from 2019 to 2024. Looking ahead, the market is projected to expand at a 9.7% CAGR to reach S$5.9 billion by 2029.

Demand is underpinned by government infrastructure and private-sector projects that require a large foreign workforce, while dormitory supply remains tightly regulated. The number of CMP work permit holders is expected to rise to 515,495 by 2029, representing a 2.4% CAGR over 2024–2029.

On the supply side, PBWA bed capacity was 225,700 in 2024 and is forecast to grow modestly at a 1.0% CAGR over the same period. With the completion of ongoing projects, total bed capacity is projected to reach 150,300 beds by end-2029, reflecting a 3.8% CAGR.

Independent research commissioned for the prospectus projects rental growth of 3–4% annually through 2029, taking rents to between $570 and $630 per bed per month, with occupancy consistently above 95%.

Australia purpose-built student accommodation (PBSA)

The PBSA markets in Australia also show favourable fundamentals. According to the 2025 Global Education Report, Australia ranks as the third most attractive destinations for higher education.

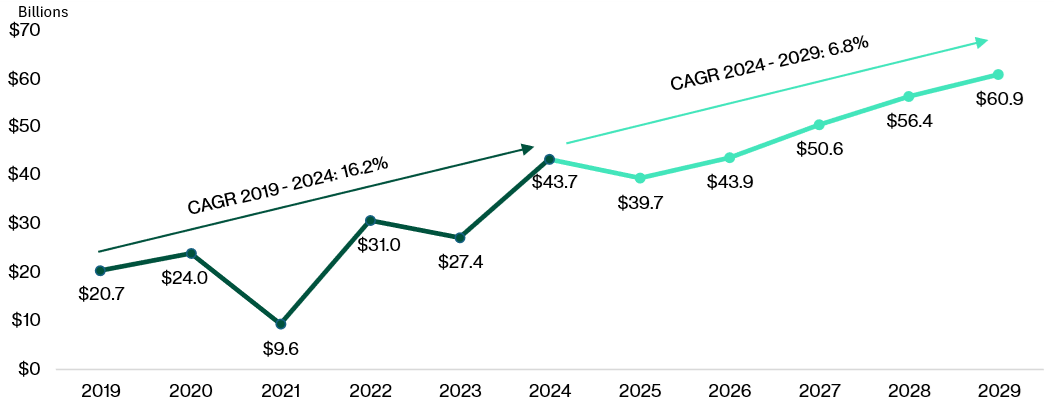

During the period 2019-2024, the market size of Australia private Purpose-built student accommodation (PBSA) grew by CAGR 16.2%. For the period 2024-2029, the market is expected to grow a CAGR 6.8%.

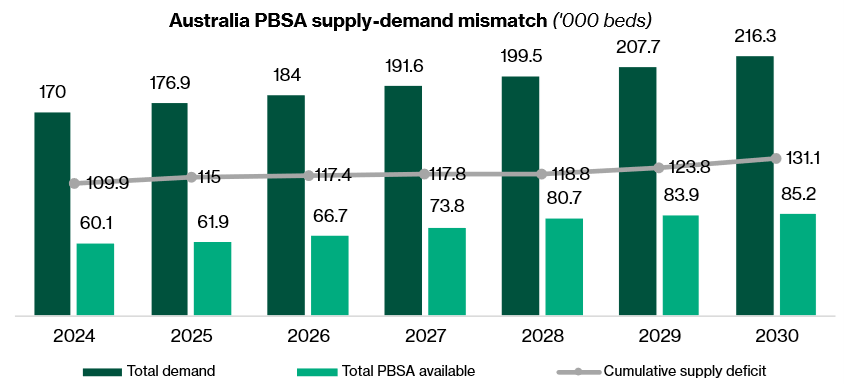

In Australia, PBSA demand is largely driven by international students, who account for around 74% of total demand, as domestic students typically study in their home cities.

Australia’s nationwide PBSA market has a student-to-bed ratio of 15 students per bed in 2025. In Sydney, the PBSA market is extremely tight, with a student-to-bed ratio of 55 students per bed in 2025. Adelaide PBSA market is also undersupplied with a student-to-bed ratio of 20 students per bed in 2025.

Due to structural undersupply, Australian PBSA occupancy levels are expected to remain high, in the 92.5% to 98.0% range for stabilised and established assets across Australia. Sydney will continue with high rates of occupancy, in the range between 92.5% and 98.0%. Adelaide’s occupancy levels have surpassed pre-COVID levels, currently ranging between 90.0% and 97.0%.

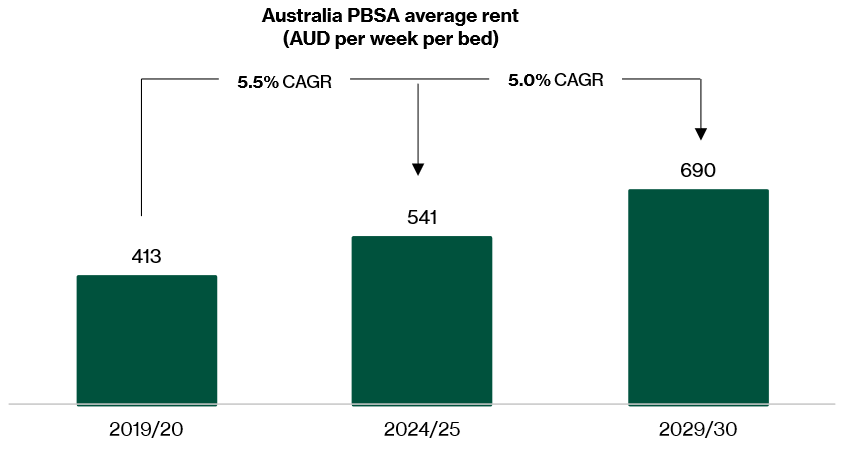

The tight supply and high occupancy rate are supportive to stable rental growth. For the period 2019 to 2024 rents grew at a CAGR of 5.5%. PBSA rents are expected to increase at around 5% CAGR over the period 2024 to 2029.

https://www.education.gov.au/higher-education-statistics/student-data/selected-higher-education-statistics-2023-student-data; JLL

Initiate at Buy

We initiate coverage on Wee Hur Holdings at Buy. The management has established proven track record in generating steady recurring income from the purpose-build accommodation portfolios. This partly offset the cyclicality of the construction and property markets that the company is exposed to. Furthermore, Wee Hur has been able to realise the uplifted value of its PBSA portfolio. The capital recycling initiatives provide source of funds for other profitable opportunities.

Looking ahead, the outlook for the group’s core business segments remains solid.

In FY2026, revenue from the following completed projects will be recognised or begin to generate revenue.

- Purpose built workers’ accommodation : Pioneer Lodge, 10,500 bed capacity is fully operational, increasing the total bed capacity from 15,744 beds to 26,244 beds, or an increase of 66.7%.

- Mount Vernon Funeral Parlour Complex : Project completion in 3Q 2026 with progressive revenue recognition.

- Progressive recognition on the HDB projects and Wycombe Abbey School.

Several new projects were announced in 2H2025, lifting the construction order book to over S$1.0 billion as at end-2025, from S$629.0 million as at 30 June 2025. With these project wins, earnings and cash flow visibility have strengthened further, providing a firmer foundation for execution in the coming years.

Here is a recap of the pipeline of projects :

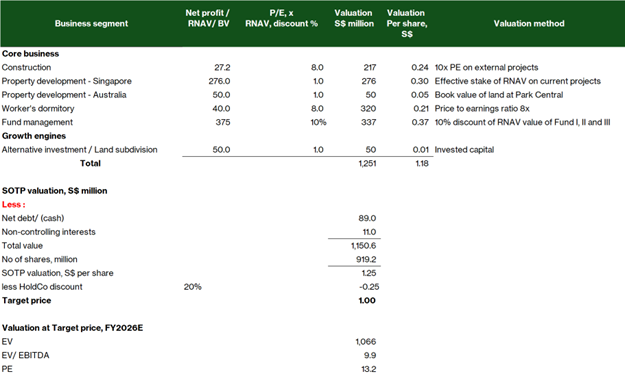

Target price of S$1.00

Currently trading at FY2024 PE 15.3x and PB 1.27x, potential gains are not fully reflected. These include successful stabilisation of Fund III, contribution from international school at Hougang and land rezoning projects in Australia. As the projects develop, the potential contribution from these businesses will become clearer. Cash flows from PBSA and PBWA will remain resilient against economic uncertainty. Our target price at S$1.00 is based on sum-of-parts on the core business and growth engines. At S$1.00, Wee Hur is trading at FY2026E PE of 13.2x and FY2026E PB of 1.5x. This is in line with the companies in the construction industry.

Wee Hur is an attractive investment with quality assets to support steady cashflow from diversified sources. By recycling capital, management aims to pursue new revenue streams in order to achieve a higher return on equity for the shareholders.

Key risks

Key risks include economic, regulatory, interest rate, execution, and concentration.

Economic and demand risk

A slowdown in economic activity, changes in employment conditions, or weaker student inflows could reduce demand for worker and student accommodation, affecting occupancy and rental growth. Currently, the elevated tariffs imposed by the United States, trade tensions between the United States and China and other geopolitical conflicts have led to heightened economic uncertainty. The company’s financial position may be affected if the demand for purpose-built accommodation is adversely affected, slowdown in new customers acquisition and longer receivables days, amongst others.

Regulatory and policy risk

Worker dormitories and student accommodation are subject to evolving regulations on zoning, operating standards, levies, and foreign student policies. Any tightening could raise compliance costs or limit capacity and returns. The company has to be mindful of the regulatory and policy risk in Singapore and Australia, the two key markets which they operate in. For example, in 2024, Australia implemented a cap on international students in order to reduce the overall migration to pre-pandemic levels. The average occupancy rate fell to 82.7% in 2024, from 90% in 2023. However, the proposed cap on international students did not pass into legislation, resulting in a surge in demand for Semester 1 of 2025.

Interest rate and financing risk

Higher interest rates increase borrowing costs and may pressure earnings, especially during development phases when gearing is elevated. Refinancing risk could also arise in volatile credit markets. Higher interest rates also raise the cost of acquisition, restricting the options to pursue opportunistic acquisitions.

Execution and development risk

Construction delays, cost overruns, or delays in achieving stabilised occupancy could defer cash flow generation and impact project returns, particularly for assets under development. In Australia, the company has obtained the development approval for Buranda Plot 2, Brisbane in 2024. However, the project is not viable for development due to the high construction costs. The company is exploring alternative options for the land parcel.

Concentration and operational risk

Earnings are exposed to specific asset types and geographies. Operational disruptions, tenant concentration, or weaker-than-expected leasing performance at key assets could have a disproportionate impact on results. The company’s recurring income are mainly generated from workers’ dormitories in Singapore and students’ accommodation in Australia. In order to diversify the source of recurring income, the company is entering the hospitality business by acquiring Hotel Miramar at Robertson Quay. The company plans to upgrade and rejuvenate the asset with the launch of DoubleTree by Hilton in 2026.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Wee Hur Holdings.

Download the full report here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments