City Developments in focus: Weekly Review with SIAS

Stocks

Powered by

By Gerald Wong, CFA • 21 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We share about City Developments in the latest Weekly Market Review.

What happened?

In this week's Weekly Market Review in partnership with Securities Investors Association Singapore (SIAS), we discuss key developments in the global equity market alongside City Developments.

Watch the video to learn more about what we are looking out for this week.

Weekly Market Review

1:47 - Macro Update

- The S&P 500 is nearing 6,300 with a 0.6 percent gain for the week, while the STI is close to 4,200 after rising 2.5 percent.

- US core inflation rose 2.2 percent year on year, slightly below expectations, marking the fifth straight month of muted CPI growth.

- Despite tariff concerns, US inflation remains subdued, leading to a slight dip in the US 10-year bond yield to 4.42 percent from 4.25 percent.

- Singapore’s 10-year bond yield has fallen below 2.1 percent and has been declining steadily since the start of the year.

- The STI has surged from 3,400 in April to 4,200, with a sharp climb especially since end June.

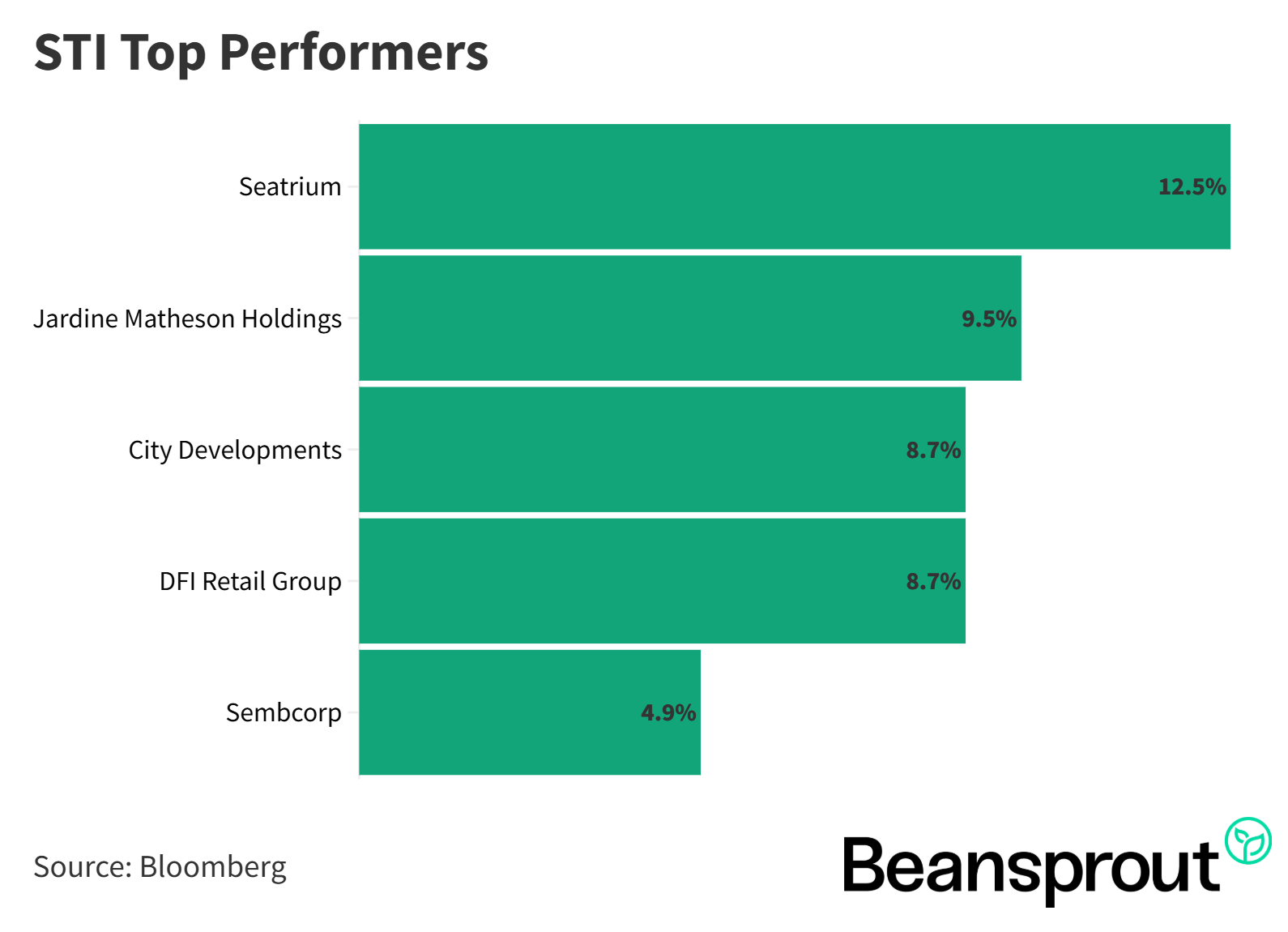

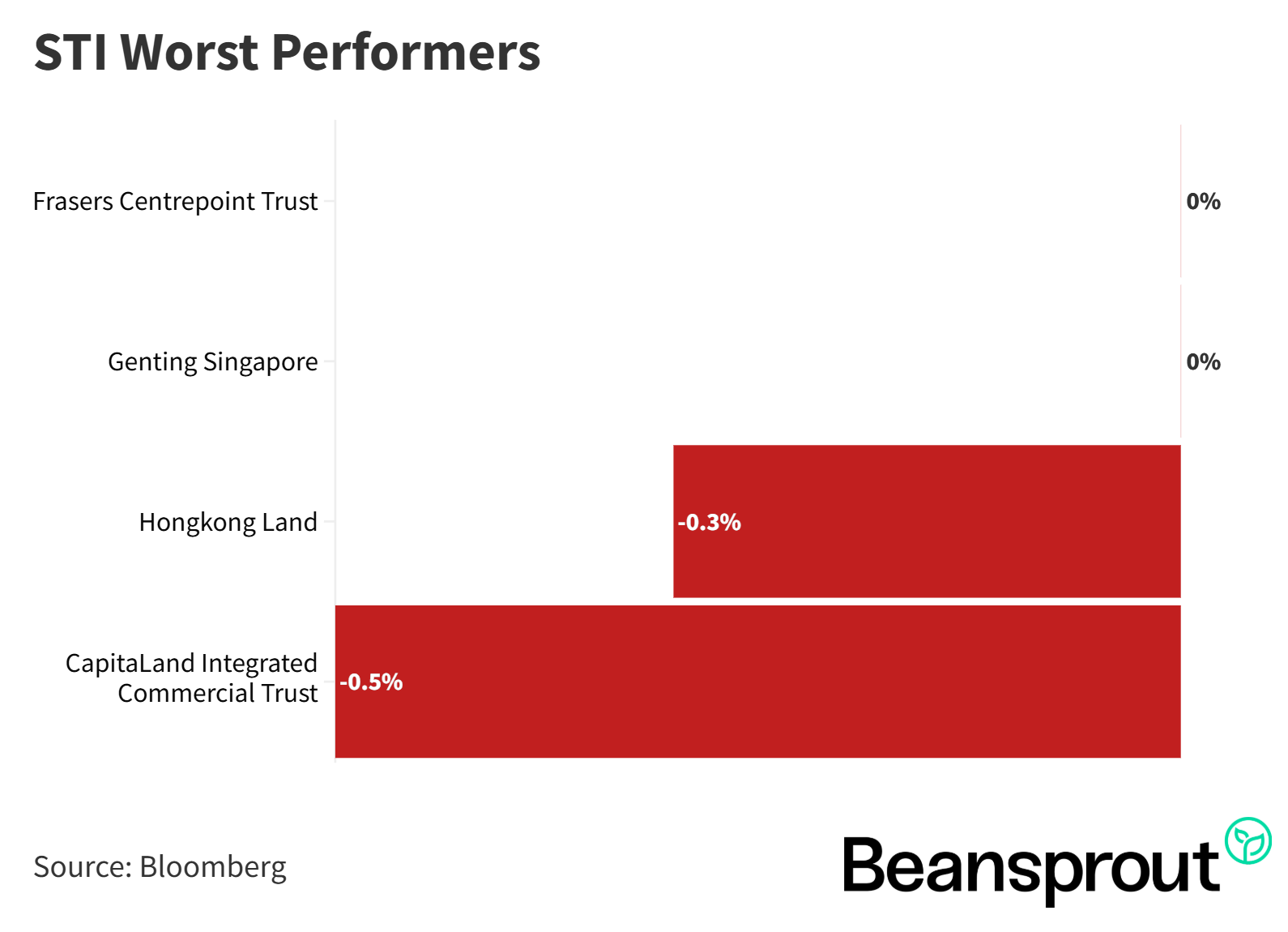

- Top weekly gainers include Seatrium, Jardim Matheson, and City Developments, while only CICT and Hong Kong Land posted minor losses.

STI Top performers:

STI worst performers:

5:00 - City Developments

- City Developments' share price hit a 52-week high of $5.90 after board changes improved investor sentiment.

- FY2024 revenue fell to $3.3 billion from $4.9 billion in 2023, while profit after tax dropped to $201 million from $317 million.

- Slower property sales in early 2024 led to weaker fundamentals, with 1,500 units sold and a market share of 20 percent.

- Four projects were launched in 2024 with an average sell-through rate of 70 percent, ranging from 96 percent at Lumina Grand to 33 percent at Union Square Residences.

- Investors are watching the 2025 launch pipeline, especially the Zeon Road site, following strong take-up of the Ori project.

- Commercial portfolio in Singapore remains strong with office occupancy at 97.7 percent and retail at 98 percent, supported by asset enhancements like City Square Mall.

- Global hospitality assets show improving performance in occupancy, room rates, and revenue per available room; living sector units in Singapore reached 926.

- Net gearing stands at 69 percent, with $2.8 billion in cash, interest cover at 2.1 times, and current price-to-book valuation below 0.6 times based on NAV of $10.17 and RNAV of $17.57.

Read also:

12:00 - Technical Analysis

Straits Times Index

- The STI has been outperforming global indices and could reach 4,600 in the second half of the year, according to a report by Meibang Securities.

- This bullish outlook is driven by Singapore’s safe haven status and potential trade flow benefits amid US tariff tensions.

- With the STI at all-time highs, technical indicators are limited, but the Bollinger Band upper bound currently sits at 4,220, acting as immediate resistance.

- The previous April high of around 4,025 now serves as a support level, alongside the 20-day moving average at 4,048.

- MACD remains bullish with a positive trajectory, but RSI has entered overbought territory, showing mixed signals.

Dow Jones Industrial Average

- The Dow Jones Index declined 0.32 percent last Friday and ended the week slightly negative, with the all-time high still at 45,073 points.

- Profit taking occurred after major banks reported earnings in line with expectations, with the index possibly entering consolidation.

- The MACD turned negative over the past three sessions, signaling weakening momentum from the April rally.

- Key support levels include the 20-day moving average at 43,983 and a stronger support around 42,700 to 42,900, where the 50- and 200-day moving averages converge.

- The RSI peaked above 70 in early July but has since eased to 59, indicating continued positive momentum without being overbought.

- A drop below the 43,000 level may trigger technical buy signals, though a deep correction is unlikely for now.

S&P 500

- The S&P 500 is trading near its all-time high of 6,382 points, closing last Friday at 6,296 points.

- The index ended slightly negative on Friday, down just half a point, suggesting minor profit taking.

- Earnings season will be critical for sustaining momentum at these elevated levels, with analysts expecting broadly positive results.

- The MACD indicator is slightly negative, showing price consolidation over the past week.

- The RSI stands at 69, just below the overbought threshold of 70, indicating limited but present upward momentum.

- The index may still have room to reach the 6,400 level in the near term if earnings, especially from the Magnificent Seven, exceed expectations.

Nasdaq Composite Index

- The NASDAQ Composite was the best performer last week among the US indices, closing at 20,895, just 20 points shy of the 21,000 mark.

- The near-term resistance is at the Bollinger Band upper bound of 21,136 points.

- Key support levels include the 20-day moving average at 20,372 and the 50-day moving average at 19,628, which aligns with the lower Bollinger Band.

- The MACD is neutral to slightly negative, suggesting limited upside as most gains are already priced in ahead of earnings.

- The RSI is at 73, signaling overbought conditions and raising the risk of a short-term pullback.

What to look out for this week

- Monday, 21 July : CSOP iEdge S-REIT Leaders Index ETF ex-dividend

- Wednesday, 23 July: Digital Core REIT, Mapletree Logistics Trust, OUE REIT, Alphabet, and Tesla earnings

- Thursday, 24 July: Frasers Centrepoint Trust, Suntec REIT earnings, Singapore 1-year T-bill Auction

- Friday, 25 July: Keppel DC REIT earnings

Get the full list of stocks with upcoming dividends here.

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments