Singapore, US, and China: Where to invest in 2026 for income and growth?

Stocks

Powered by

By Gerald Wong, CFA • 06 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Where should you invest in 2026? Learn how Singapore, US, and Asian markets compare, key risks to watch, and how to build income and growth from the FSM Invest Expo 2026.

This post was created in partnership with FSMOne. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Markets have been moving higher, and for many investors, that has triggered a mix of excitement and caution.

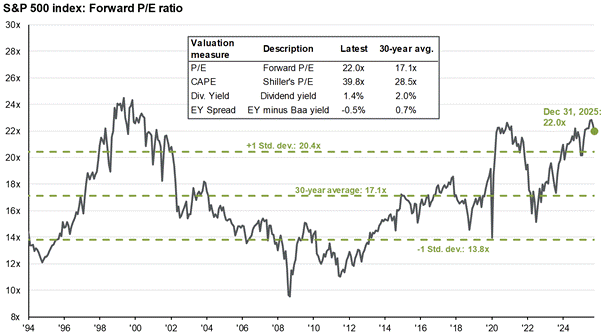

Valuations today look very different from a few years ago.

This leaves many investors asking a familiar question: is it still sensible to invest now, especially if you're trying to build passive income and also grow your wealth long term?

And if so, where?

I attended the recent FSMOne Expo, where fund managers across equities, fixed income, and multi-asset strategies all addressed this same underlying concern.

Rather than treating markets as “in or out”, many speakers framed 2026 as a year of geographic differentiation.

The opportunity set looks very different depending on whether you’re looking at the US, Singapore, or China, and each plays a distinct role in a diversified portfolio.

Here’s what I learned.

The US: Still in play but more selective in 2026

One of the clearest messages from the Expo was that US markets are no longer cheap, but they’re also not irrelevant.

The strong rally in 2025, driven largely by excitement around artificial intelligence, has pushed US valuations higher.

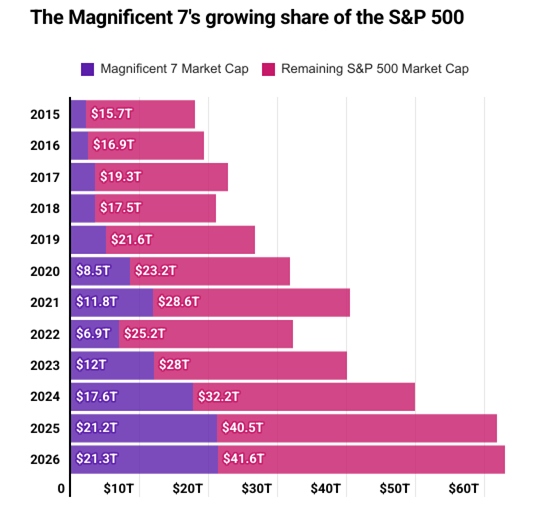

FSMOne’s You Weiren pointed out that a small group of large technology companies, often called the “Magnificent 7”, have pushed market valuations to high levels.

Check out Weiren’s presentation here.

These companies now make up a big portion of major stock indices, which means just a few names increasingly drive index returns.

AllianceBernstein’s David Wong highlighted that while these companies remain profitable, they are also spending aggressively on data centres and computing infrastructure.

Watch the presentation here

Much of this capex is defensive, aimed at protecting market share, and may not translate into immediate earnings growth.

In simple terms, companies are spending more, but not necessarily earning more yet.

Several speakers noted that future returns are likely to depend less on further multiple expansion and more on:

- Whether AI monetisation improves

- Whether free cash flow margins stabilise

- Whether market leadership broadens beyond the Mag 7

A useful framework shared was the AI “risk ladder”:

- Semiconductors (highest beta)

- Data-centre infrastructure

- Cloud service providers

- Software

- Professional services (lower risk, “picks-and-shovels” exposure)

This suggests that staying constructive on US technology doesn’t require taking maximum risk at the top of the chain.

Singapore: A smoother ride with early re-rating potential

If the US is about selectivity, Singapore was framed as a market entering a new phase altogether.

Multiple panellists pointed to Singapore equities trading at roughly 14x P/E, materially cheaper than global peers, with improving structural support.

Watch the panel discussion here

One major catalyst is MAS’s S$5 billion initiative to revitalise the SGX, which fund managers see as a longer-term tailwind rather than a short-lived stimulus.

Institutional money has been flowing into mid- and small-cap stocks for five straight months, with inflows materially outweighing outflows by approximately 600%.

Amova Asset Management’s Kenneth Tang highlighted another important signal: the yield spread between the STI dividend yield and the Singapore 10-year government bond yield remains elevated.

Amova also said the market appears poised for another period of yield spread compression. Historically, periods of yield-spread compression have preceded strong STI rallies:

- +22% (2011–2013)

- +23% (2016–2018)

- +32% (2020–2022)

Beyond valuation and the MAS catalyst, panellists also framed Singapore as a relative “safe-haven” market, supported by:

- a resilient economy,

- strong fiscal policy,

- a pro-business environment,

- and a regional trade and investment hub, supported by infrastructure and rule of law.

Because of this, Singapore stocks were often described as offering a “smoother ride” compared to other Asian markets.

FSMOne shared that investor interest in Singapore equities has been picking up over the past 8 to 9 months, reflecting this defensive appeal.

From an investment style perspective, one manager explained that a sensible approach is to blend income and recovery:

- Companies with strong, sustainable dividends that can provide regular income

- Undervalued companies where fundamentals are improving, and profits have room to recover

Importantly, Singapore is no longer just banks and REITs. Managers highlighted growing exposure to “New Singapore” sectors such as data centres and logistics, renewable energy, and technology and digital infrastructure

When it comes to stock picking, Lion Global noted that smaller and mid-sized companies can sometimes offer better opportunities.

These stocks are often less closely followed by analysts, which means there can be more chances to uncover “hidden gems”, especially when business quality has improved, but share prices haven’t caught up yet.

That said, there was an important caveat.

Small and mid-cap stocks tend to perform best after large Singapore companies start attracting consistent foreign investment. In other words, strength in the big names often needs to come first before it spreads to the rest of the market.

For retail investors, the key things to watch going forward are:

- Whether foreign money continues to flow into large Singapore stocks

- And whether any rise in share prices is driven by real earnings growth, rather than just investors paying higher prices for the same profits

Asia offers valuation, income, and diversification

Many speakers at the Expo highlighted Asia as one of the more attractive regions heading into 2026 because it offers a better balance of value, income, and diversification.

Put simply, Asia looks cheaper than many global markets, and investors are being paid to wait.

Eastspring noted that Asian equity markets offer a deep pool of dividend-paying companies, often at more reasonable valuations than their US counterparts.

For investors who care about cash flow and not just price gains, this matters.

On top of that, Asian currencies and bonds delivered about 8% returns in 2025, with Asian bonds standing out for providing steadier income with lower price swings.

This makes them useful as a stabilising part of a portfolio, especially when equity markets feel unpredictable.

PineBridge also pointed to strong demand for SGD corporate bonds, where returns are largely driven by local interest rates (SORA and Singapore Government Securities).

For retail investors, this means Asian credit can act as a lower-volatility income anchor, complementing higher-risk equity investments.

Beyond valuation and income, speakers framed 2026 as a year where fundamentals matter more than headlines.

Economic recoveries across Asia are uneven.

Interest rates are moving in different directions. And policy support varies from country to country.

This creates bigger gaps between winners and losers, which is good news for investors willing to be selective.

Rather than thinking “Asia versus the US”, the opportunity may lie in choosing the right parts of Asia, based on where earnings are improving and policies are supportive.

Another potential tailwind is the US dollar.

A less restrictive USD environment could support Asian assets, though speakers cautioned that results are still likely to differ widely by country and sector.

Importantly, Asia is no longer moving as a single block:

- Many Asian central banks are nearing the end of rate cuts

- Japan is already raising rates

- Australia may even consider hiking

This mixed backdrop means returns will depend more on company quality, balance sheets, and pricing power, rather than broad market momentum.

Speakers also highlighted improving trade dynamics.

New trade deals have reduced tariffs and uncertainty, while ASEAN and the EU are becoming increasingly important export markets for China as US-bound exports decline.

Schroders’ Reginald Tan noted that Asia has handled tariff shocks, geopolitical tensions, and fiscal challenges better than expected, strengthening its investment case.

Looking longer term, Asia’s growth story is becoming more structural:

- Global leaders like BYD are emerging

- Patent activity is rising

- The region is building leadership in batteries, critical technologies, and AI

Technology spending across APAC is expected to grow faster than in the US and Europe

With parts of the global market showing signs of AI-driven excess in 2025, several speakers suggested that Asia’s more grounded valuations and fundamentals could offer a “home-ground advantage” heading into 2026.

For retail investors, the key signals to watch include:

- Whether Asia’s valuation gap closes through earnings growth (healthier), rather than investors simply paying higher prices

- The direction of the US dollar and Federal Reserve policy

- Japan’s reforms and capital return discipline

- Signs of stabilisation in China’s policies and corporate earnings, which could trigger global investors to reduce underweights

Taken together, Asia may not deliver the fastest gains, but it offers something many portfolios need in 2026: reasonable valuations, income, and diversification when global outcomes become more uneven.

What risks should you watch out for?

While the outlook across markets remains constructive, speakers at the Expo were clear that 2026 is unlikely to be a smooth, one-way ride. The risks are more nuanced than in past years and differ by market.

US: Concentration and execution risk

US market performance remains heavily driven by a small group of mega-cap technology stocks.

If these companies fail to deliver earnings growth or meaningful returns from heavy AI spending, market pullbacks could be sharper than expected.

Policy uncertainty, including the risk of renewed trade tensions, may also add volatility.

A key signal to watch is whether market leadership broadens beyond the largest tech names, which would suggest a healthier and more sustainable rally.

Singapore: Flow-dependent re-rating

In Singapore, much of the upside depends on whether recent foreign inflows into large-cap stocks remain steady.

Smaller and mid-cap stocks typically perform best only after large names attract sustained international interest.

If inflows fade or prove short-lived, any broader market re-rating may stall.

Investors should also watch whether rising valuations are supported by real earnings growth rather than sentiment alone.

Asia: Selective opportunities, uneven outcomes

Across Asia, risks stem from divergence rather than outright weakness.

Economic recoveries, interest-rate paths, and policy support vary widely by country, meaning returns are likely to be uneven.

Asia’s valuation advantage is most durable if it closes through earnings growth, not just higher investor optimism.

Currency moves and the US dollar path also matter, as a stronger-than-expected USD could limit upside and reinforce the need for selective, active positioning.

What would Beansprout do?

The key takeaway from the FSM Invest Expo is simple: passive income and growth are still achievable in 2026, but investors need a more deliberate approach.

With market outcomes likely to be uneven across countries and sectors, and US returns concentrated in a few mega-cap stocks, diversification matters more than ever.

A diversified portfolio gives you more ways to stay invested, whether markets are driven by earnings, interest rates, or volatility.

The bigger risk isn’t investing at higher market levels, it’s sitting in cash and losing purchasing power as rates fall.

Over US$7.7 trillion remains parked in money market funds globally, highlighting the opportunity cost of staying on the sidelines.

If you’d like to learn more, you can watch the FSM Invest Expo session replays on YouTube and explore FSMOne’s post-event investing promotion, where you’ll receive S$10 cashback for every S$10,000 invested across a selection of funds.

For a more systematic approach, FSMOne’s 0% processing fee Regular Savings Plans on funds and ETFs offer a practical way to build wealth steadily over time.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments