Xiaomi - Strategic expansion into premium smartphones and electric vehicles

Singapore Depository Receipts

Powered by

By Gerald Wong, CFA • 04 Mar 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Xiaomi is expanding into premium smartphones and electric vehicles, positioning itself for long-term growth.

The world’s third largest smartphone brand

Xiaomi was founded in 2010 by Lei Jun and seven co-founders, all of whom had strong backgrounds in global technology companies such as Google and Motorola.

Known for its value-for-money home appliances and smartphones, the company went public in 2018 on the Hong Kong Stock Exchange and has since established itself as one of the world’s leading technology firms.

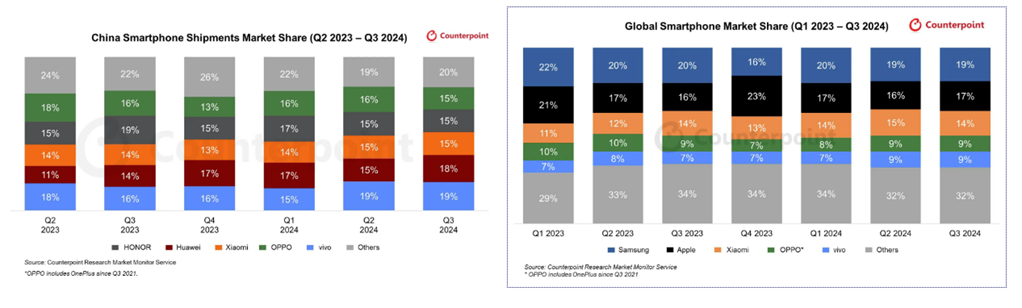

Xiaomi has firmly positioned itself as the third-largest smartphone brand in the world, holding a 13.8% market share as of the third quarter of 2024, behind only Samsung and Apple.

The company entered the smartphone market in 2011 with the launch of the Mi 1, which was priced at $300 but offered premium specifications.

This aggressive pricing strategy allowed Xiaomi to compete directly with higher-priced brands like HTC, which sold smartphones with similar specifications for $500.

Over time, Xiaomi’s ability to provide high-quality devices at competitive prices contributed to its market expansion, while competitors like HTC saw their market share decline to nearly zero by 2019.

Moving up the premium category

In recent years, Xiaomi has moved beyond its initial reputation as a budget-friendly smartphone brand and has shifted towards the premium market segment.

The growing demand for high-end smartphones has played in Xiaomi’s favour, with premium smartphones, defined as those priced above 3,000 RMB (approximately $470), accounting for 21.3% of all smartphones sold in China in the first nine months of 2024.

This marks an increase from 17% in previous years, showing that even in a weaker economic environment, consumer preference for premium devices remains strong.

On 27 February 2025, Xiaomi launched its latest flagship model, the Xiaomi 15 Ultra, which is equipped with the Qualcomm Snapdragon 8 Elite chipset and a 200-megapixel periscope camera.

The device is priced at 6,499 RMB (approximately $892), making it a competitive option compared to premium models such as Samsung’s Galaxy S25 Ultra at $1,299 and Apple’s iPhone 16 Pro Max at $1,199.

Despite moving into the premium category, Xiaomi has remained committed to its core value proposition of providing high-quality devices at attractive price points.

Electric Vehicles as the next growth driver

Beyond smartphones and home appliances, Xiaomi has now entered the electric vehicle market, marking its most ambitious expansion yet.

China has already established itself as a global leader in EV manufacturing, with significant expertise in EV supply chains.

However, this also means that competition within the sector is intense. Xiaomi has embraced this challenge with a strong product strategy, launching its first EV model, the SU7, in March 2024.

Priced at $30,000, the SU7 has quickly gained traction, becoming one of the best-selling EV models of the year.

It reached 100,000 production units in just 230 days since launch, making it the fastest EV model to achieve this milestone.

With continued strong demand and deliveries, Xiaomi has now positioned itself as a serious contender in the EV industry, even outselling established Chinese brands such as BYD and Xpeng.

Xiaomi’s approach to the EV sector follows the same philosophy that made it successful in the smartphone market.

The company aims to offer affordable electric vehicles with premium features, including autonomous driving solutions, while also planning to introduce higher-end models to cater to a broader consumer base.

With the global EV market currently valued at approximately $500 billion, Xiaomi’s entry into this space significantly expands its total addressable market.

By comparison, the home appliance sector is valued at $743 billion, while the smartphone market is estimated at $600 billion.

The EV business presents an opportunity for Xiaomi to replicate its success in consumer electronics, potentially becoming a major player in the industry.

Strong growth in both Smartphone and EV businesses

Despite its expansion into new markets, Xiaomi has maintained strong financial performance. In the third quarter of 2024, the company reported a net profit of 6.3 billion RMB, reflecting a year-on-year growth of 4.4%.

This figure takes into account a 1.5 billion RMB loss from its EV business, which is expected as production scales up.

The company’s revenue for the quarter reached 92.5 billion RMB, marking a 30.5% increase year-on-year.

The smartphone segment contributed 16.8% growth, while the newly launched EV division generated 9.7 billion RMB in revenue during the quarter, a significant contribution considering it did not exist in 2023.

Strong cash position

Despite the high capital expenditure required to expand its EV business, Xiaomi’s financial position remains strong.

The company reported a cash balance of 151.6 billion RMB as of the third quarter of 2024, representing an 18.7% increase year-on-year. Xiaomi continues to return excess cash to shareholders through share buybacks, further strengthening investor confidence.

Key risks

While Xiaomi has demonstrated strong growth, there are several risks that investors should be aware of.

Geopolitical tensions between the United States and China remain a concern, particularly as Xiaomi operates across various technology sectors.

The company has previously faced scrutiny, having been blacklisted by the US Department of Defense in 2021 under the Trump administration, before being removed later that year.

Any future regulatory actions could pose risks to Xiaomi’s global operations.

Additionally, the competitive nature of the EV market means that continued losses in this segment could impact Xiaomi’s overall profitability.

If the EV business struggles to achieve sustainable margins, it could raise concerns about the long-term viability of Xiaomi’s expansion strategy.

Trading at 43x P/E ratio

Xiaomi’s share price has seen an impressive rally, rising 288% over the past 12 months, significantly outperforming the Hang Seng Index, which gained 38% during the same period. The stock currently trades at a price-to-earnings (P/E) ratio of 43 times, reflecting investor confidence in Xiaomi’s ability to grow its smartphone market share while successfully entering the EV sector.

Going forward, it will be important to monitor Xiaomi’s execution in the EV market, particularly its ability to achieve profitability while maintaining momentum in its core smartphone business.

You can now trade Xiaomi through Hong Kong Singapore Depository Receipts (SDRs). These HK SDRs offer investors a more accessible way to invest in Hong Kong-listed companies.

Apart from Xiaomi (HXXD), Meituan and Ping An insurance would also be accessible through Hong Kong SDRs for investors from 5 March 2025.

- Meituan (HMTD): Online food delivery giant in China; owns 69% market share of the 1 trillion yuan delivery platform market

- Ping An Insurance (HPAD): Leading integrated financial, healthcare and elderly care service provider in China.

It might be worth noting that Xiaomi can be purchased with a lower minimum outlay through SDRs. These SDRs will also be custodised in your CDP account.

This adds to a growing list of SDRs on the SGX. Earlier, we saw the launch of five HK SDRs, including Alibaba, Tencent, BYD, HSBC and BOC.

In addition, there are eight Thai Singapore Depository Receipts, including Airports of Thailand and CP All.

Click here to learn more about SDRs.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Download the full report here.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments