Zijin Gold International - Global expansion and higher production amid rising gold prices

Singapore Depository Receipts

By Gerald Wong, CFA • 30 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

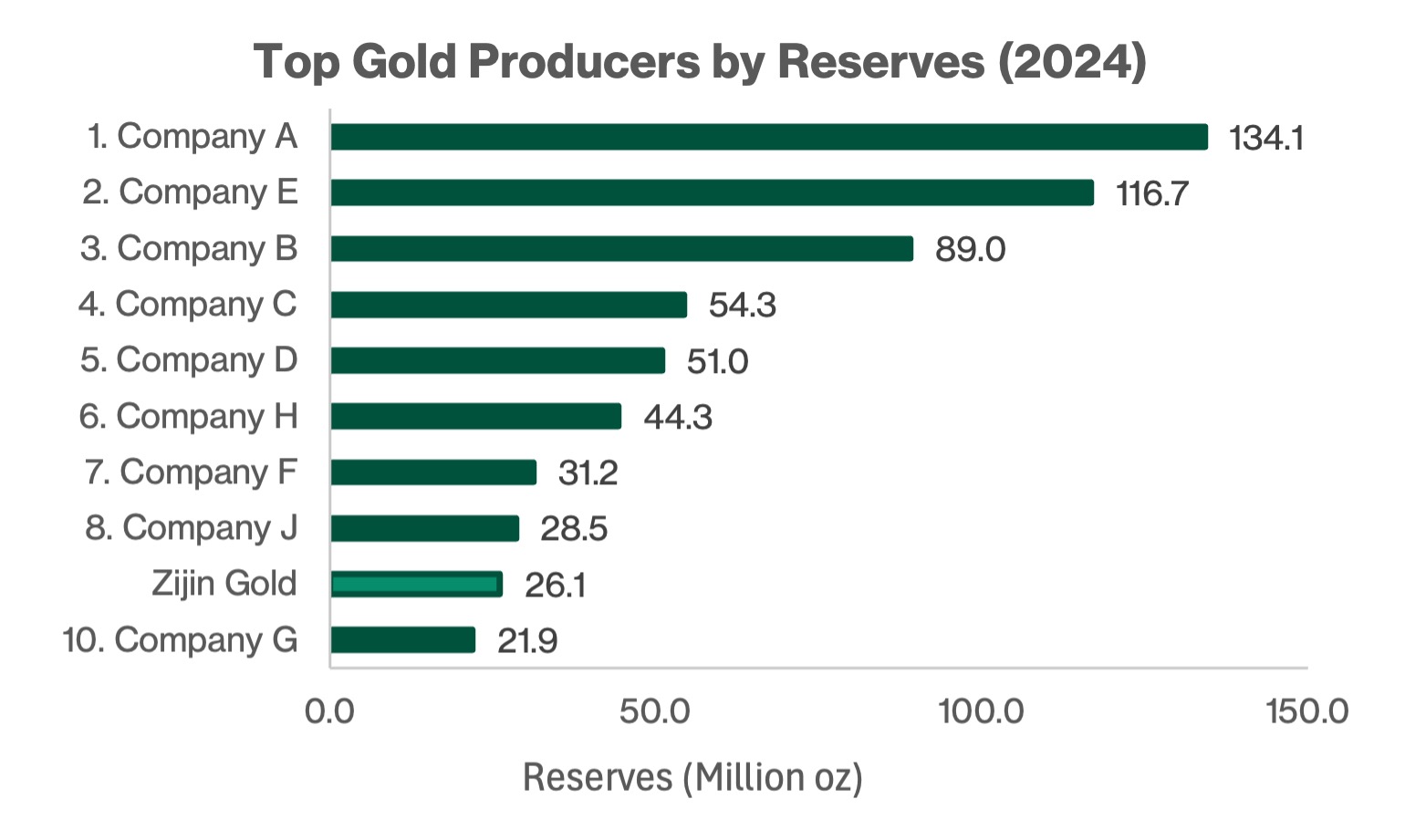

With 26.1 million ounces of gold reserves, Zijin Gold International is one of the largest gold miners globally.

Zijin Gold International HK SDR 10to1 (SGX: HZGD) - Not Rated

Zijin Gold International (ZJI) was formed through the consolidation of Zijin Mining’s international gold mining assets outside of China. The company operates an integrated gold production platform spanning exploration, mining, processing, smelting, and the eventual sale of gold. Zijin Gold International currently controls and owns eight mines, and also holds a 24.5% minority interest in the PNG Porgera Gold Mine.

With total gold reserves of 26.1 million ounces, Zijin Gold International is currently the world’s ninth largest gold mining company by reserves. It is also the eleventh largest gold producer globally, with an estimated 1.2% share of global production volume.

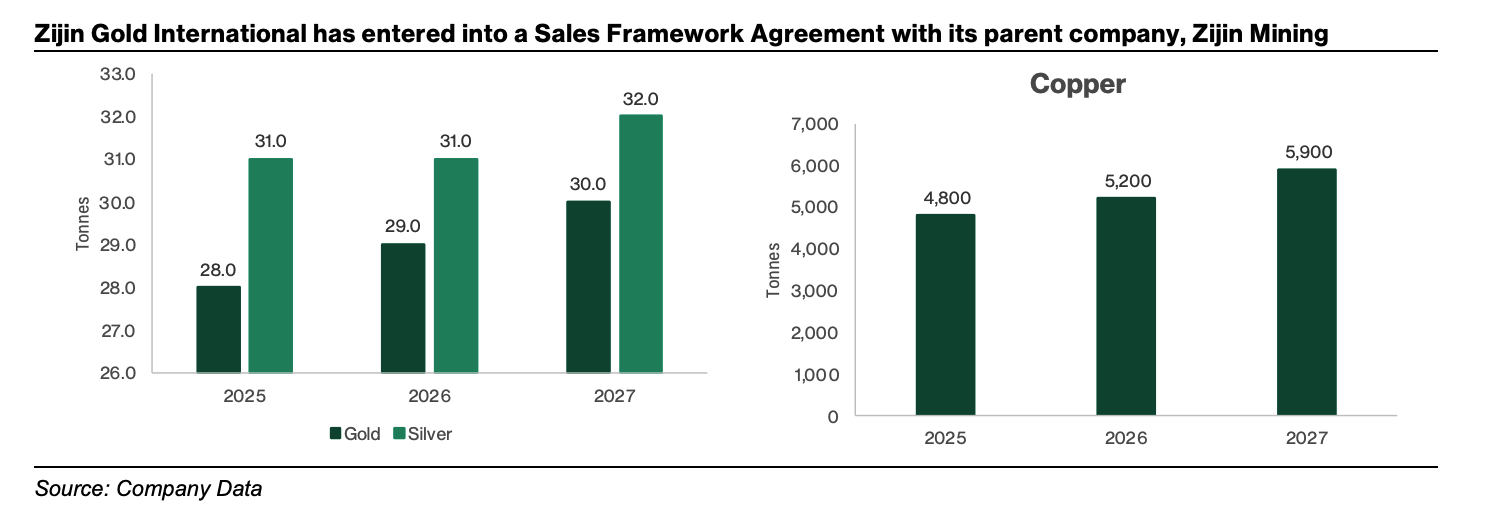

Zijin Gold International has entered into a Sales Framework Agreement with its parent company, Zijin Mining, under which Zijin Gold International will sell gold and other by-products such as copper and silver, subject to a capped transaction volume for the period from 2025 to 2027. In 2024, Zijin Mining was Zijin Gold International’s largest customer, accounting for 42.6% of total revenue.

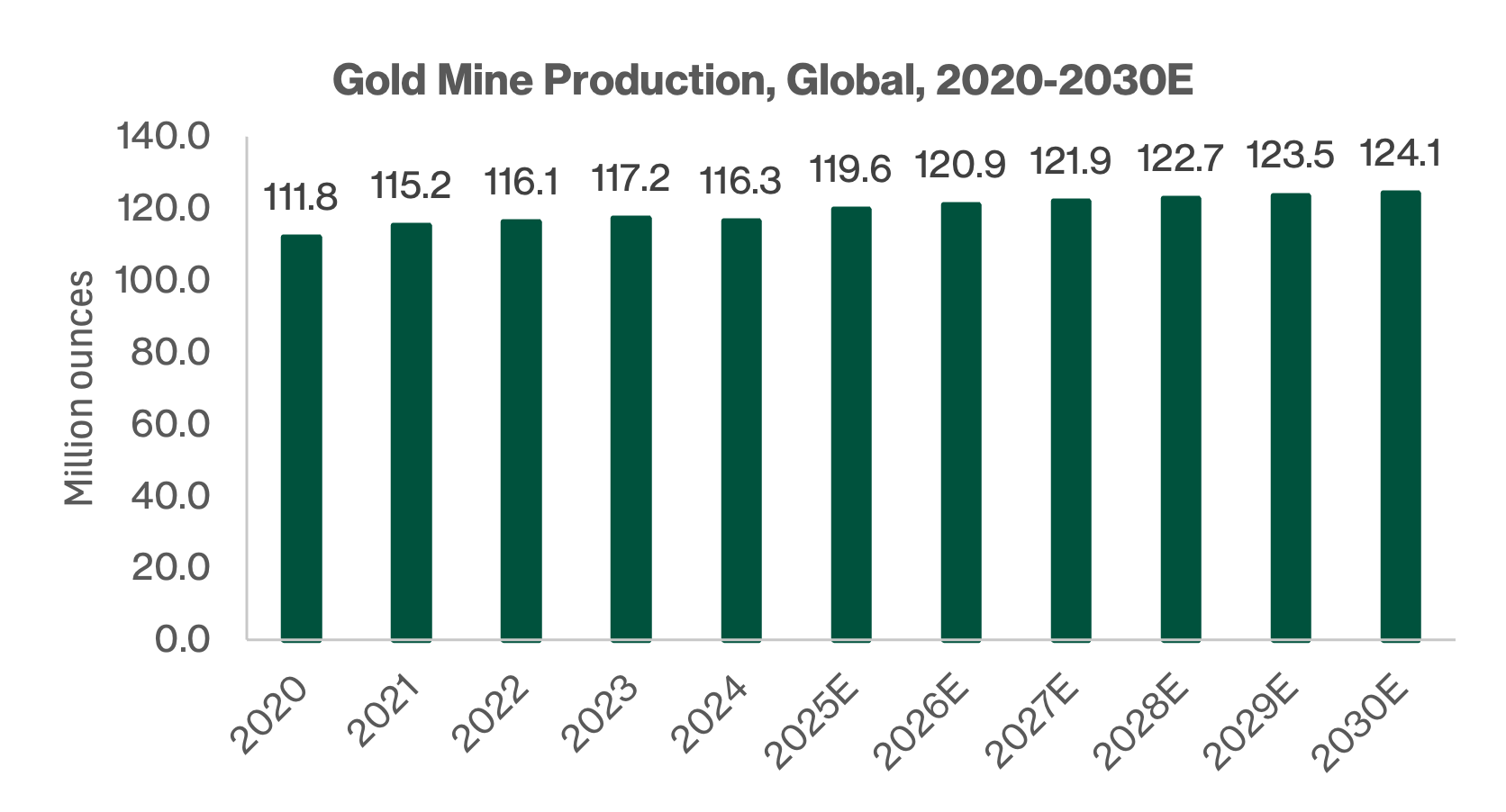

Muted gold supply growth globally despite strong gold prices

Global gold mine production has remained relatively muted over the past five years, with industry output growing at a modest 1.0% CAGR to an estimated 119.6 million ounces in 2025. Looking ahead, gold production growth is projected to stay broadly stable over the next five years, rising by around 1.1% CAGR, with no meaningful acceleration expected despite the current elevated gold price environment.

Zijin Gold International’s gold production projected to outgrow industry

Zijin Gold International has grown its gold production at a 21.4% CAGR between 2022 and 2024, making it the fastest-growing producer among the world’s top 16 gold miners. According to Zijin Gold International’s IPO prospectus, the company is expected to continue increasing its gold output over the next five years, based on the Competent Person’s Report prepared by an independent international consulting firm that provides advice and solutions for resources projects.

Zijin Gold International’s production growth has been driven by its strategy of acquiring undervalued gold mines. The company leverages its in-house acquisition experience, alongside its operational and technical expertise, to identify and secure high-quality assets. Between 2019 and 2024, the average acquisition cost of mines purchased by Zijin Gold International was US$61.3 per ounce, which is 52% lower than the industry average of US$92.9 per ounce, based on Frost & Sullivan’s estimates.

Ability to turn around loss making mines after acquisitions

Following its acquisitions, Zijin Gold International has been able to improve the profitability of acquired assets within a relatively short period. The company cited examples such as the Rosebel mine in Suriname and mines in Tajikistan, which turned profitable within one to two years after being acquired.

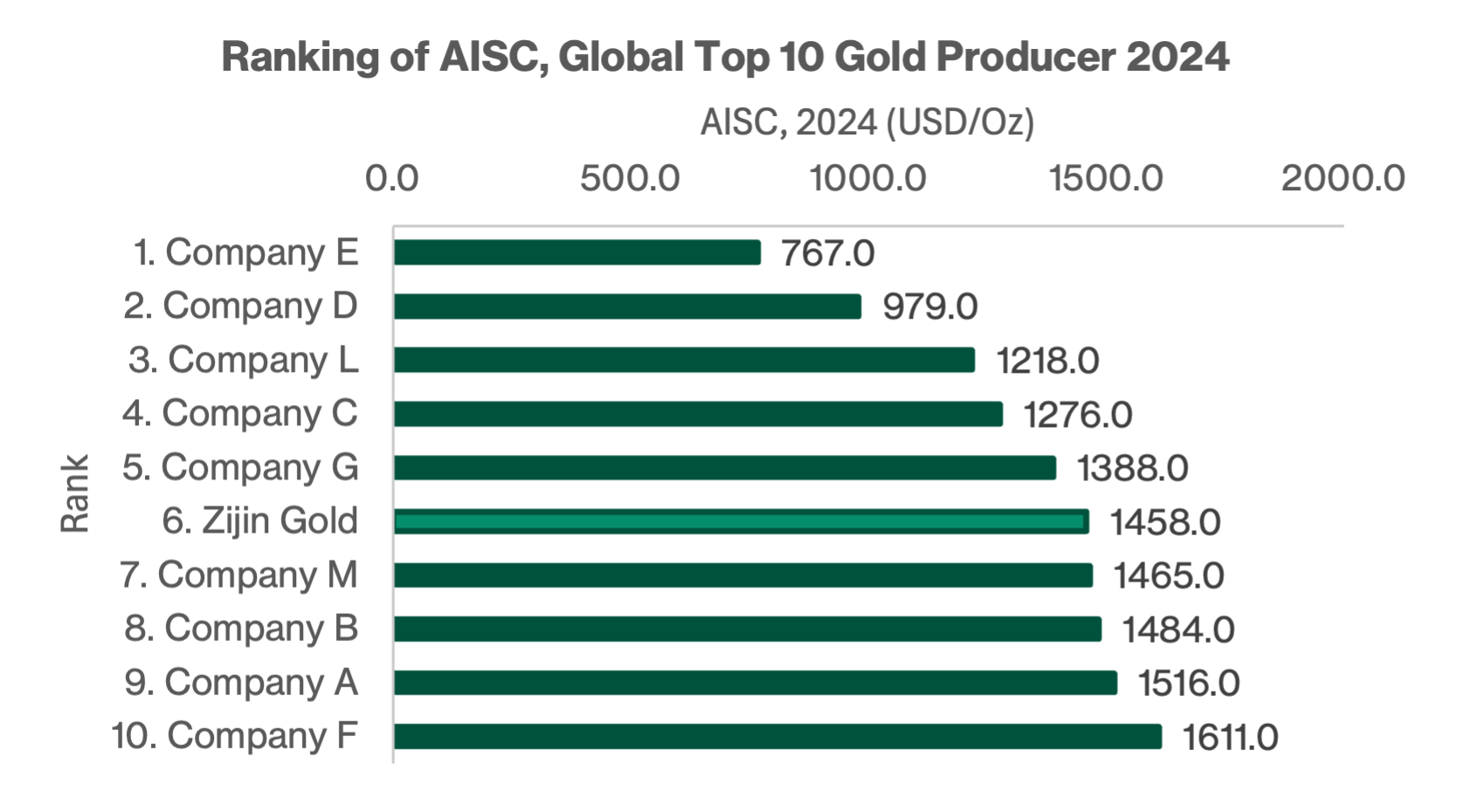

Zijin Gold International also highlighted its focus on cost discipline and operational efficiencies. The company reduced its average mining cost from US$38.7 per tonne of ore in 2022 to US$34.3 per tonne in 2024. In 2024, its all-in sustaining cost (AISC) was US$1,438 per ounce, ranking as the sixth lowest among the top 15 global gold miners.

Lower capex intensity than peers

Zijin Gold International highlighted its technical capabilities in developing and processing low-grade gold resources, supported by ongoing progress in handling low-grade and refractory gold ores. For example, the company developed partial oxidation (POX) technology for arsenic and carbon-bearing gold concentrates, as well as copper concentrates, to address challenges in processing refractory gold ores.

The company also benefits from its relationship with its parent, Zijin Mining, which owns the only State Key Laboratory for Comprehensive Recovery of Low-grade and Refractory Gold Resources in China’s gold mining industry.

These capabilities have supported improvements in gold recovery rates across its portfolio. For instance, the recovery rate at Taror Gold Mine increased from 78% in 2022 to 81% in 2024. Zijin Gold International also disclosed that its weighted average capital expenditure intensity is approximately US$1,666 per ounce, which is lower than the industry average of US$3,500 to US$4,000 per ounce.

Key Risks

Gold Price Volatility

Zijin Gold International’s earnings are sensitive to movements in gold prices, as its operating cost base is largely fixed and does not vary significantly with changes in the gold price. As a result, higher gold prices can translate into stronger profitability, as the increase in revenue flows through more directly to earnings.

This operating leverage can also work in the opposite direction. A decline in gold prices may lead to a sharper reduction in earnings, given the relatively fixed nature of operating costs. In this context, gold price volatility is likely to influence investor sentiment toward Zijin Gold International’s shares, as market expectations for the company’s earnings may adjust more sharply during periods of rapid price fluctuations.

Political and Geopolitical Risk

Zijin Gold International operates mines across multiple countries, which exposes the group to country specific risks. These include political uncertainty, security concerns, and the risk of civil unrest, which could affect the operating environment and the mining licences held by Zijin Gold International.

In addition, gold miners such as Zijin Gold International face regulatory and policy risks in their host jurisdictions. These may include changes to mining royalties and tax regimes, nationalisation risks, and import or export controls. Operating across multiple jurisdictions can therefore add complexity to the group’s business and increase execution risk.

You can now trade Zijin Gold International through Hong Kong Singapore Depository Receipts (SDRs). These HK SDRs offer investors a more accessible way to invest in Hong Kong-listed companies.

The introduction of Singapore Depository Receipts allows investors to purchase Zijin Gold International shares with a lower minimum investment outlay compared to buying Hong Kong-listed shares directly.

Additionally, SDR holdings will be custodised within investors’ Central Depository (CDP) accounts, providing seamless integration with their existing Singapore-based portfolios.

Download the full report here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Zijin Gold International HK SDR 10to1.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments