5 ways I’m investing my SRS savings for yield or growth

ETFs

Powered by

By Nicole Ng • 17 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Discover how to make your SRS savings work harder with these ETF options, from Singapore equities to bonds and regional growth funds.

This post was created in partnership with Amova Asset Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

When I first opened my Supplementary Retirement Scheme (SRS) account, my main motivation was the tax relief.

Every dollar I contributed lowered my taxable income, and those immediate tax savings were appealing.

So I dutifully deposited money into SRS each year.

However, I didn’t take the next step of investing those funds.

They remained in cash, earning the default 0.05% per annum interest.

As I began thinking more seriously about retirement and building passive income, I realised that leaving my SRS savings idle wasn’t helping me make the most of this account.

With inflation outpacing the SRS account’s interest rate, my money’s real value was quietly diminishing over time.

To make the most of my SRS savings, I began exploring different investment options, including those that could help me earn potential yield, or capture growth over the long term.

In this article, I’ll share five ways I can invest my SRS savings for yield or growth, from Singapore-focused ETFs and regional ETFs, to bond ETFs.

A glance at SRS and why I started looking at ETFs

For those unfamiliar, the SRS is a voluntary retirement savings scheme in Singapore aimed at helping Singaporeans, PRs, and foreigners boost retirement savings while reducing taxable income.

Here are the key features:

- Tax relief on contributions: Every dollar contributed gets dollar-for-dollar tax relief

- Annual caps: S$15,300 for Singapore Citizens/PRs, or S$35,700 for foreigners

- Tax-advantaged growth: Your SRS investments grow tax-free

- Favourable withdrawal terms: When you withdraw at retirement age, only 50% of the withdrawal is taxable

When I first opened my SRS account, I’ll admit I was focused mainly on the immediate tax relief.

As I started thinking about how to invest my SRS funds, ETFs became one of the options I explored.

They offer a simple way to put my money to work while keeping things cost-efficient.

- Low cost: Passive ETFs typically have much lower fees than traditional unit trusts, with many having expense ratios well below 1%. So more of my returns stay invested.

- Diversification: Buying an ETF gives me instant exposure to a basket of securities, helping reduce the risk of relying on an individual stock or bond.

- Convenience: ETFs trade on the stock exchange, so I can buy them easily through my brokerage using my SRS funds, just like buying any stock during market hours.

- Wide choice: Most Singapore Exchange (SGX)-listed ETFs are SRS-eligible (typically those that are SGD-denominated or have SGD trading currency), giving me a broad menu of options. It's worth verifying SRS eligibility with your bank or checking the SGX list.

With these advantages in mind, I set out to find which ETFs I could buy using SRS.

What ETFs can I buy with SRS?

I can invest my SRS funds in eligible mutual funds in Singapore and SGX-listed securities.

As I prefer to invest using ETFs, the SGX is where I started looking.

The ETFs below are traded on the SGX, SRS-eligible, and offer a convenient way to diversify.

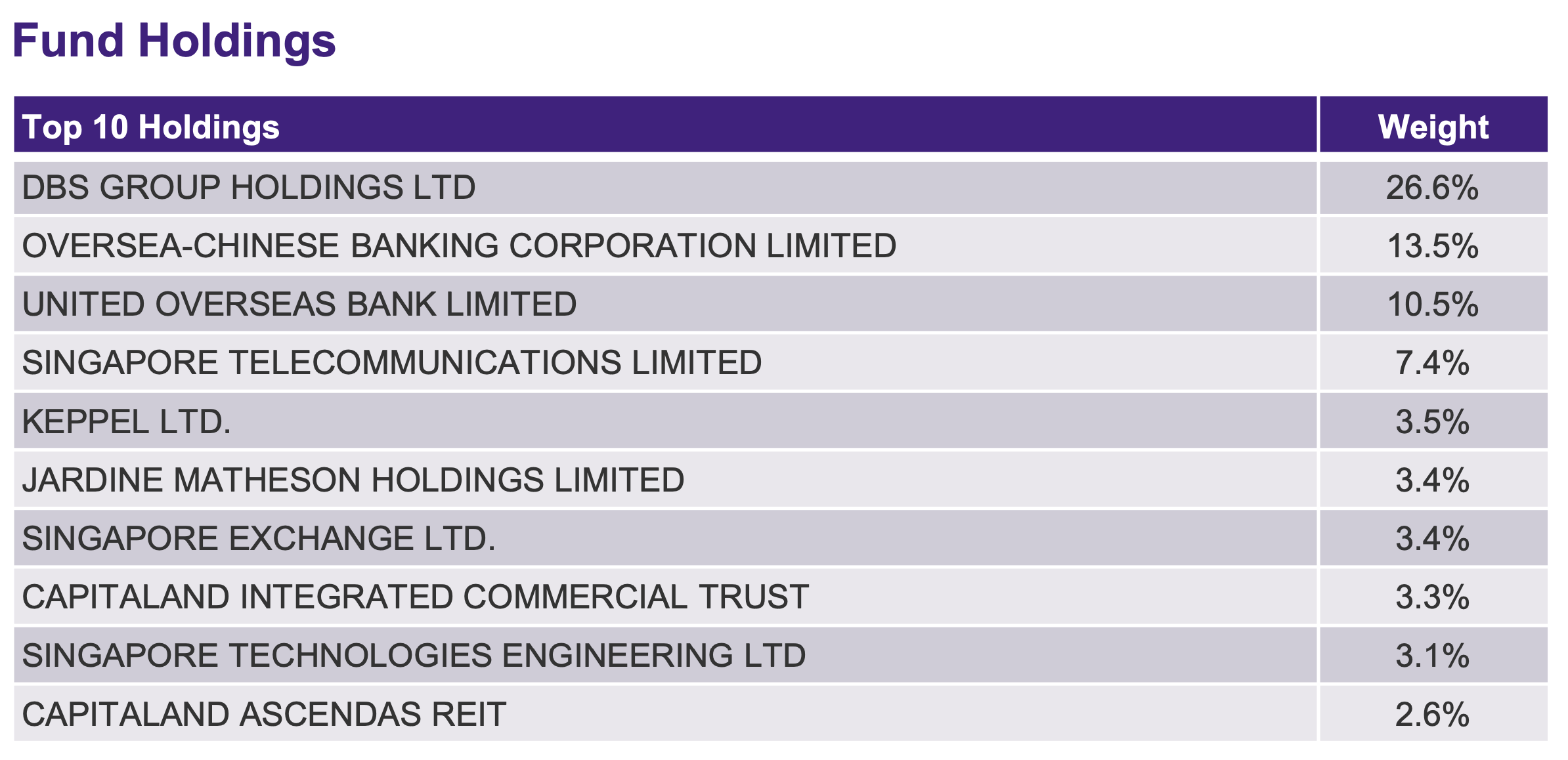

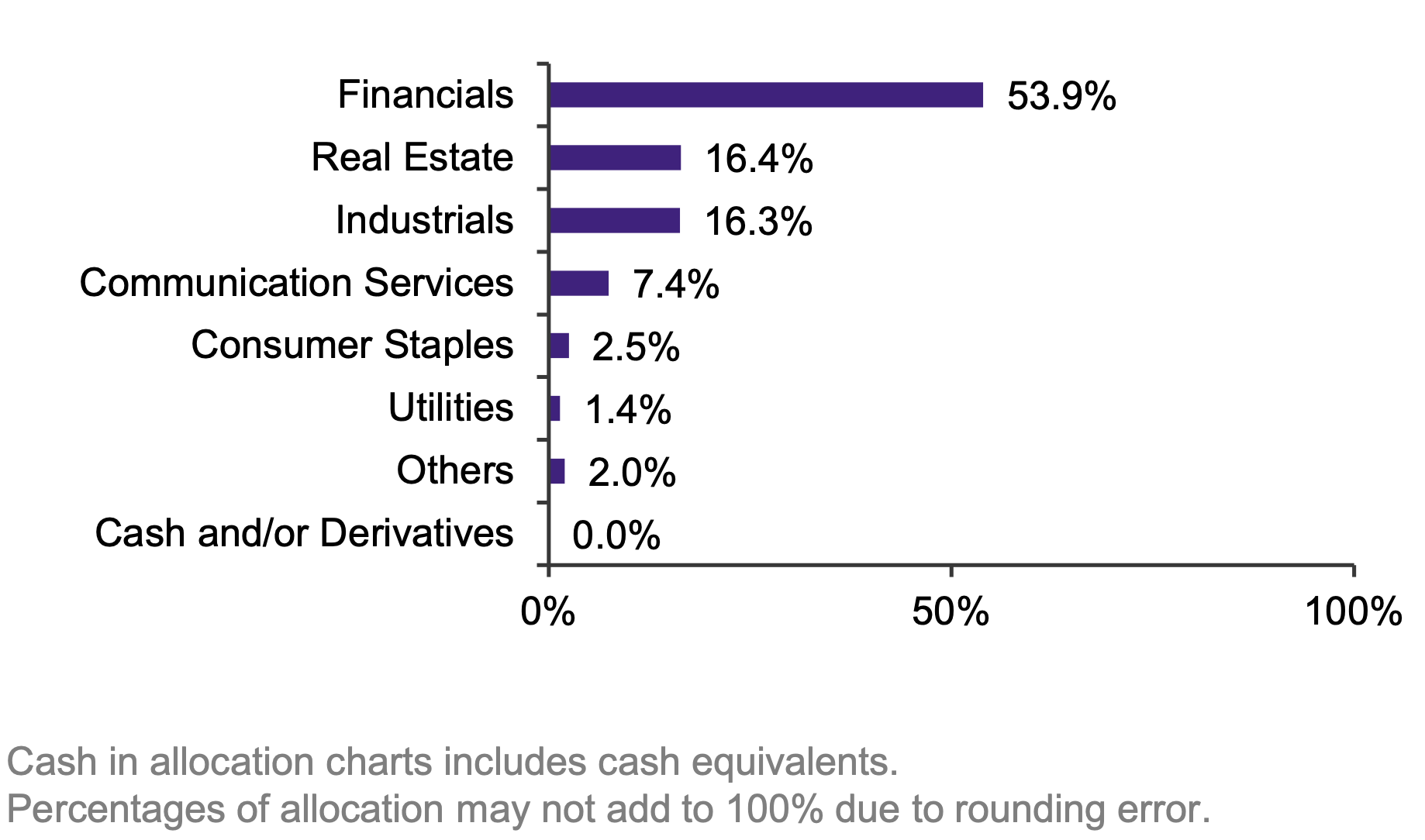

#1 – Singapore-focused ETF: Amova Singapore STI ETF

To capture growth in the Singapore economy, benefiting from local blue-chip companies, I may consider the Amova Singapore STI ETF for my SRS funds.

The Amova Singapore STI ETF (formerly Nikko AM Singapore STI ETF, ticker: G3B.SI) tracks the Straits Times Index (“STI”), which represents the top 30 largest blue-chip companies by market capitalisation listed on the Singapore Exchange Main Board.

It's a convenient way to invest in Singapore's largest banks, telcos, real estate, and consumer companies, the stalwarts of the local economy, all in one fund.

Beyond potential capital growth, the STI has historically offered a consistent dividend yield, giving investors a blend of both growth and income.

As of 31 October 2025, the STI delivered an average yield of around 4.34%1, and the ETF may also distribute dividend payouts semi-annually, at the discretion of the fund manager2.

Here’s a quick summary of the Amova Singapore STI ETF:

| Fund manager | Amova Asset Management Asia (formerly Nikko AM) |

| Listing date | 24 February 2009 |

| Fund size | S$1,074.33 million |

| Total expense ratio | 0.25% per annum |

| Performance (as of 31 October 2025) | 1-year: 30.04% |

| 3-year: 18.04% | |

| 5-year: 17.45% | |

| Since inception: 9.66% | |

| Source: Amova Asset Management Asia Limited as of 31 October 2025. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance. | |

For those who are looking to reinvest their dividends, you can take a look at the newly launched accumulation share class of this ETF (Stock Code: GAB.SI).

Unlike the existing distribution share class which pays out dividends semi-annually2 in cash, this accumulation share class automatically reinvests dividend payouts2 back into the fund and accumulates towards the investors’ holdings.

By doing so, it helps investors to compound returns over time without needing to manage the cash payouts on their own.

This offers greater convenience and may be particularly attractive for long-term investors who prefer capital accumulation.

Learn more about Amova Singapore STI ETF here

#2 – Bond ETFs for stability and passive income

For a lower risk option compared to equities, I may choose to allocate my SRS funds to bond ETFs such as the ABF Singapore Bond Index Fund and the Amova SGD Investment Grade Corporate Bond Index ETF.

These bond ETFs provide stability, are generally less volatile than stocks, and have historically distributed payouts3 that can be reinvested.

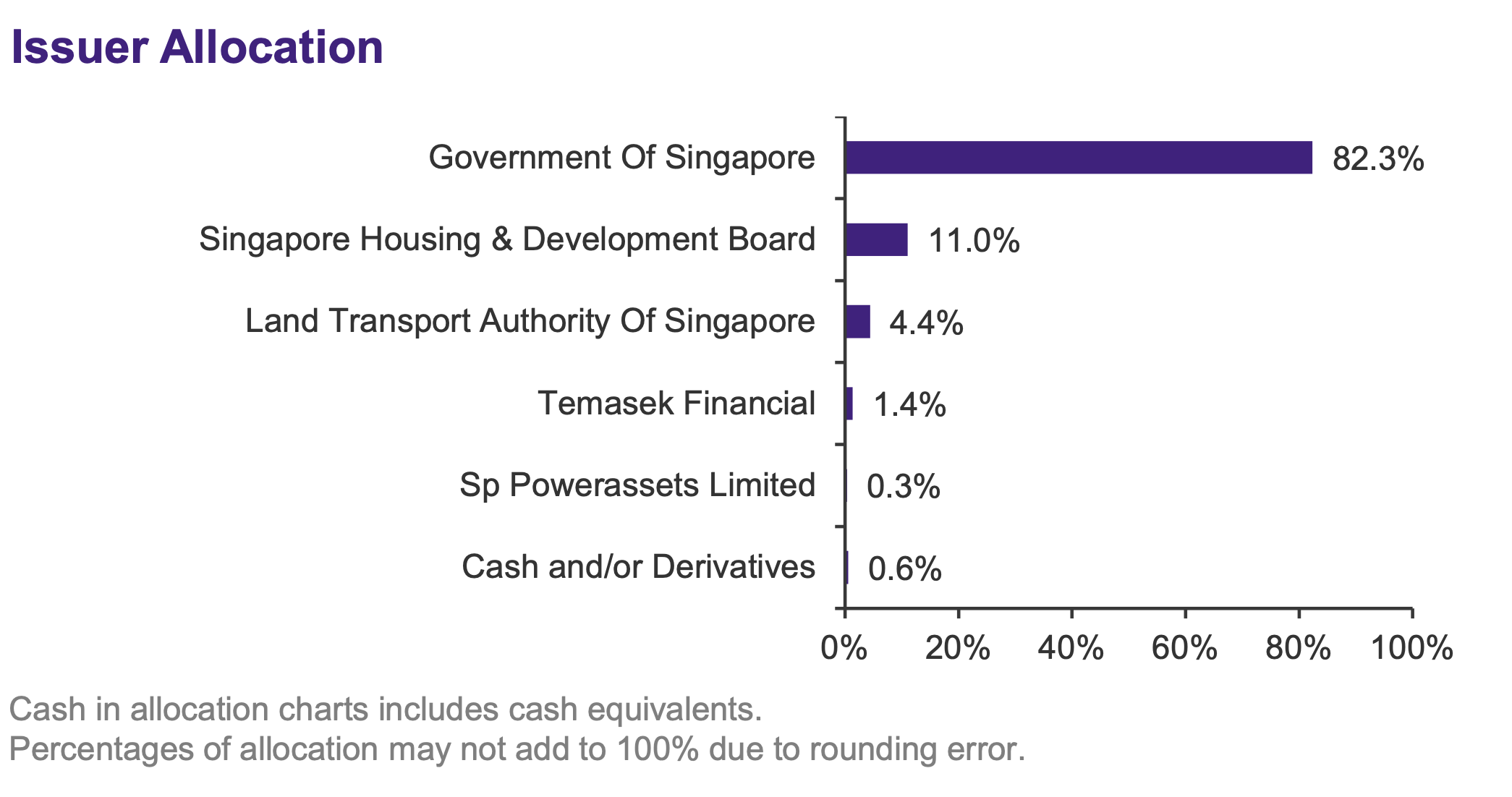

ABF Singapore Bond Index Fund

The ABF Singapore Bond Index Fund (A35.SI) is Singapore’s first and most established Singapore bond ETF, making it a solid lower-risk option compared to equities.

The ABF fund invests in a portfolio of SGD-denominated Singapore Government Securities (SGS) and high-quality government-linked bonds.

The average credit rating of the underlying bonds in the ETF is AAA4, the highest possible rating, which means that credit rating agencies view these bonds as having very low likelihood of default.

Here are some key features of the fund:

| Fund manager | Amova Asset Management Asia (formerly Nikko AM) |

| Listing date | 31 August 2005 |

| Fund size | S$1,181.62 million |

| Total expense ratio | 0.25% per annum |

| Weighted average yield to maturity^ | 2.02% |

| Performance (as of 31 October 2025) | 1-year: 9.18% |

| 3-year: 6.74% | |

| 5-year: 0.64% | |

| Since inception: 2.51% | |

Source: Amova Asset Management Asia Limited as of 31 October 2025. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance. ^Yield to Maturity (YTM) of a bond is the average annualised rate of return expected if held to maturity. Weighted Average YTM (%) is calculated by weighting the bonds with market capitalisation and duration. Figure is in local currency yield terms and on unhedged foreign exchange basis. Please note that weighted average YTM does not represent the fund’s actual rate of return or distribution yield. | |

Learn more about ABF Singapore Bond Index Fund

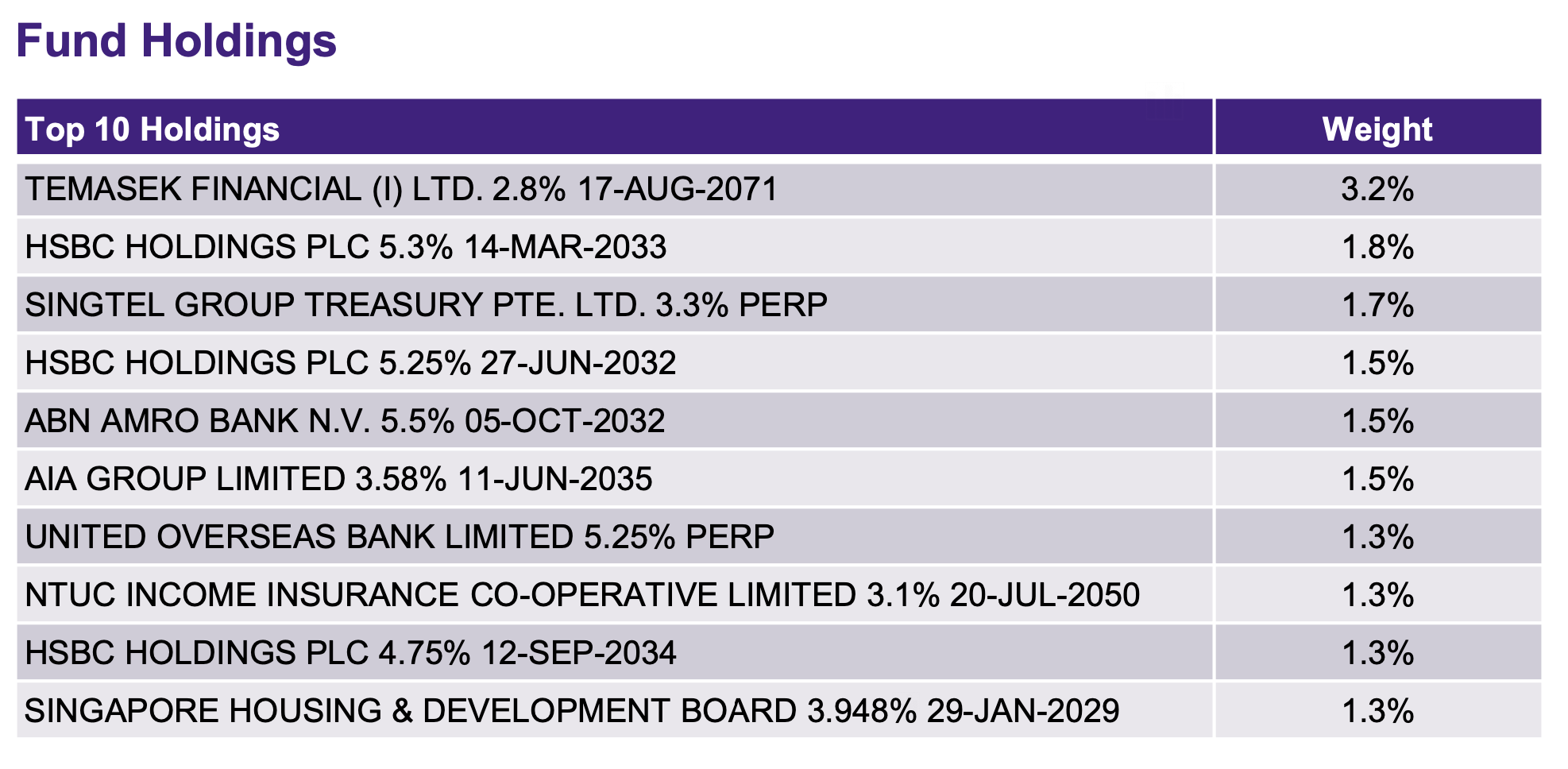

Amova SGD Investment Grade Corporate Bond Index ETF

Another way to introduce stability and income potential into my SRS portfolio would be through the Amova SGD Investment Grade Corporate Bond Index ETF (MBH.SI).

This ETF holds a basket of SGD-denominated investment-grade corporate bonds, offering exposure to high-quality issuers such as Singapore banks, utilities, and government-linked firms that have strong credit ratings.

As of 31 October 2025, the underlying bonds in the ETF have an average credit rating of A5, reflecting the ETF’s focus on quality.

Because the ETF invests in corporate bonds rather than government bonds, it generally offers a potentially higher yield.

The weighted average yield to maturity6 of the ETF is 2.50% as of 31 October 2025.

The bonds in the ETF are also denominated in Singapore dollars, minimising exposure to foreign currency risk.

Here are some key details of the Amova SGD Investment Grade Corporate Bond Index ETF:

| Fund manager | Amova Asset Management Asia (formerly Nikko AM) |

| Listing date | 27 August 2018 |

| Fund size | S$943.18 million |

| Total expense ratio** | 0.26% per annum |

| Weighted average yield to maturity^ | 2.50% |

| Performance (as of 31 October 2025) | 1-year: 6.88% |

| 3-year: 7.73% | |

| 5-year: 2.45% | |

| Since inception: 3.16% | |

Source: Amova Asset Management Asia Limited as of 31 October 2025. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance. **Total expense ratio audited as of financial period ended 30 June 2024 ^Yield to Maturity (YTM) of a bond is the average annualised rate of return expected if held to maturity. Weighted Average YTM (%) is calculated by weighting the bonds with market capitalisation and duration. Figure is in local currency yield terms and on unhedged foreign exchange basis. Please note that weighted average YTM does not represent the fund’s actual rate of return or distribution yield. | |

Learn more about Amova SGD Investment Grade Corporate Bond Index ETF

#3 – Regional ETFs: Diversifying into Asia

To diversify beyond Singapore while still tapping into Asia’s growth potential, I’ve been exploring regional ETFs such as the Amova MSCI Asia ex Japan ex China Index ETF and the Amova E Fund ChiNext Index ETF.

Amova MSCI AC Asia ex Japan ex China Index ETF

The Amova MSCI AC Asia ex Japan ex China Index ETF gives broad exposure across Asia-Pacific markets, excluding Japan and China.

It tracks the MSCI AC Asia ex Japan ex China Index, and it also covers large- and mid-cap companies in South Korea, Taiwan, India, Australia, and Southeast Asia, spanning sectors such as tech, financials, and commodities.

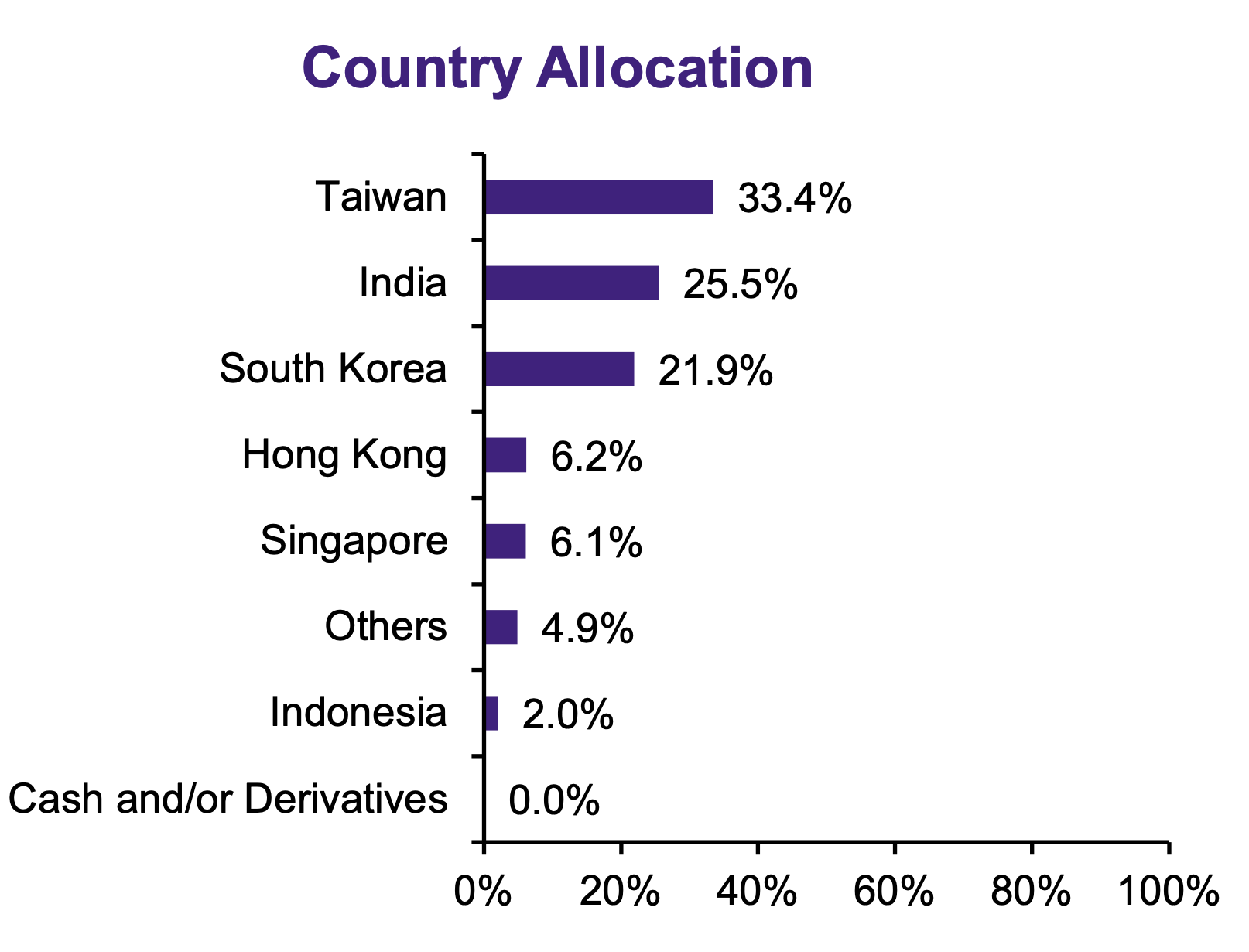

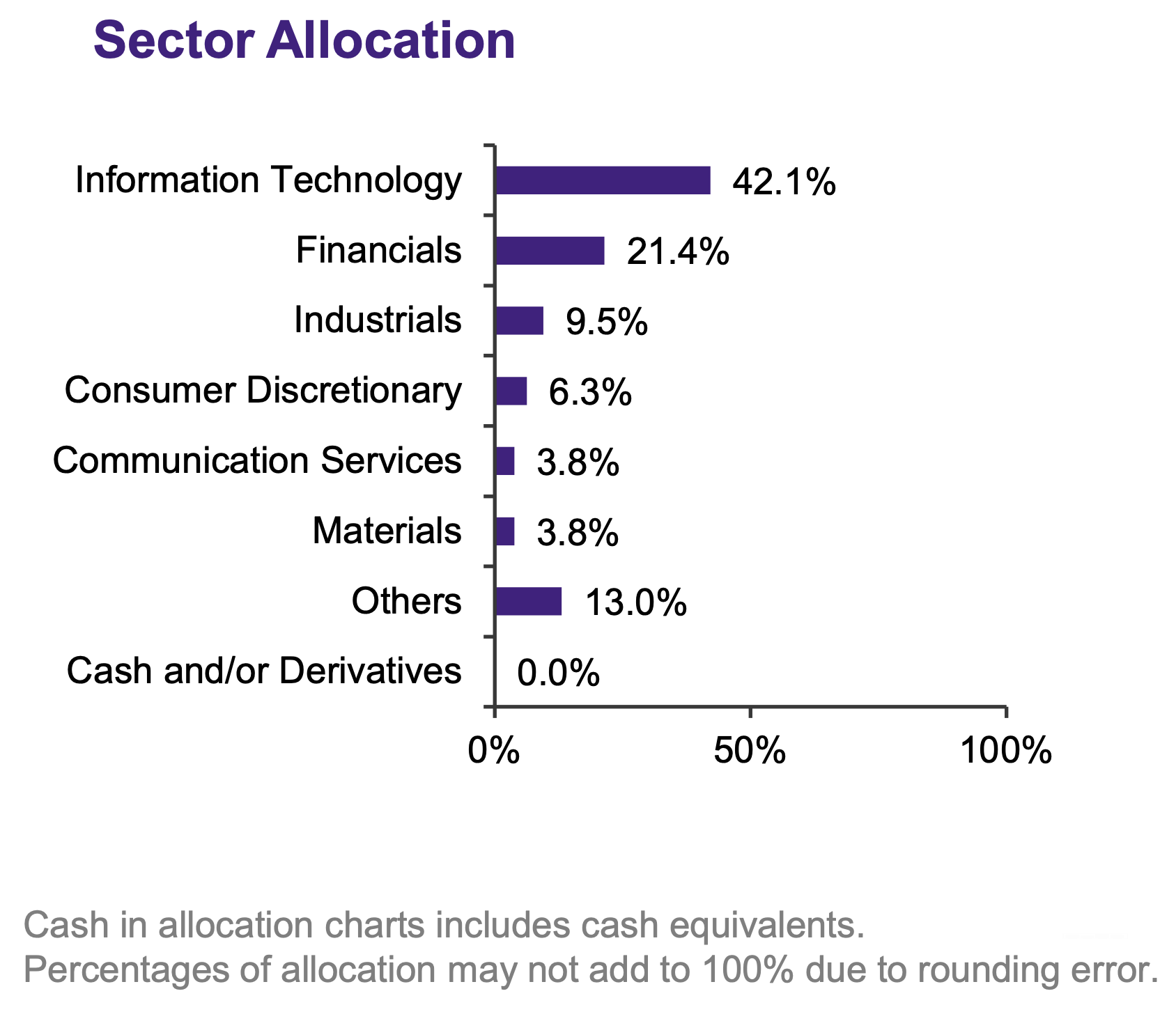

Chart: Sector and country allocation of Amova MSCI AC Asia ex Japan ex China Index ETF

By leaving out Asia’s two largest economies (China and Japan), which often dominate regional funds, this ETF provides a more balanced allocation across the rest of Asia.

It’s a simple way to gain regional diversification without being overly concentrated in China or Japan.

The ETF can be traded in SGD (A93.SI) and USD (A94.SI) on the SGX.

| Fund manager | Amova Asset Management Asia (formerly Nikko AM) |

| Listing date | 2 April 2025 |

| Fund size | S$51.84 million |

| Total expense ratio | Capped at 0.60% per annum |

| Weighted average yield to maturity^ | 2.50% |

| Performance (as of 31 October 2025) | Since inception (April 2025): 29.35% |

| Source: Amova Asset Management Asia Limited as of 31 October 2025. Returns are calculated on a NAV-NAV basis and assuming all dividends and distributions are reinvested, if any. Returns for period in excess of 1 year are annualised. Past performance is not indicative of future performance. | |

Learn more about Amova MSCI Asia ex Japan ex China Index ETF

Amova E Fund ChiNext Index ETF

For targeted growth exposure to China’s innovation economy, the Amova E Fund ChiNext Index ETF focuses on the ChiNext board.

This index features growth-oriented Chinese companies in sectors like technology, biotech, new energy and consumer.

The ETF aims to replicate the ChiNext Total Return Index by investing in an onshore ETF managed by E Fund in China through the China-Singapore ETF Link scheme.

The ETF can be traded in SGD Hedged (CXT.SI), USD (CXO.SI) and RMB (CXN.SI)

| Fund manager | Amova Asset Management Asia (formerly Nikko AM) |

| Listing date | 22 July 2025 |

| Fund size | RMB 73.98 million as of 24 October 2025 |

| Source: Amova Asset Management Asia Limited, Yahoo Finance | |

Learn more about Amova E Fund ChiNext Index ETF

How these SRS-eligible ETFs compare

To sum up the above choices, here's a quick comparison table outlining each ETF's category and objective.

| ETF | Category | Objective |

| Amova Singapore STI ETF | Singapore equity | Replicate as closely as possible, before expenses, the performance of the Straits Times Index (STI), which represents the top 30 companies listed on SGX |

| Amova MSCI AC Asia ex Japan ex China Index ETF | Regional equity | Track the MSCI AC Asia ex China ex Japan Index, which comprises of large and mid-cap companies across developed and emerging markets in Asia (excluding China and Japan) |

| Amova E Fund ChiNext Index ETF | China equity | Track the performance of the ChiNext Total Return Index, which tracks the top 100 largest innovative Chinese companies on the ChiNext Board of Shenzhen Stock Exchange |

| ABF Singapore Bond Index Fund | Government bond | Closely replicate the total return of the iBoxx ABF Singapore Index, before fees and expenses by investing primarily in Singapore government or quasi-government bonds |

| Amova SGD Investment Grade Corporate Bond Index ETF | Corporate bond | Closely tracks the total return of the iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index, before fees and expenses, by investing in SGD investment grade corporate bonds |

As the table shows, each ETF serves a different role. And more importantly, all these ETFs are approved for SRS so I can invest in them directly through my SRS investment account.

Key things to consider when investing using SRS

When deciding how to invest your SRS funds, it’s important to keep these factors in mind:

# 1 – Risk appetite

Build a portfolio that aligns with your comfort level.

For instance, ETFs that offer exposure to higher growth markets such as China may be more volatile, which means there may be more ups and downs over the short-term.

While a larger allocation to bonds may have lesser volatility.

#2 – Time horizon

SRS is meant for retirement, so understanding your time horizon can also help you determine your investment decision.

If you take on more growth-oriented investments in the earlier years, you could benefit from compounding of your potential returns.

As withdrawal age approaches, the focus often shifts toward generating retirement income, making income-producing assets a potentially useful addition to the portfolio.

#3 – Market risks

Each market comes with its own risks, from China’s regulatory environment to currency fluctuations in emerging economies.

Diversifying across regions and asset classes may help manage these risks and reduce dependence on any single market.

What would Beansprout do?

While the SRS offers meaningful tax savings today, its true purpose lies in helping you build for retirement.

Leaving those savings idle at 0.05% interest means missing the opportunity to grow them meaningfully over time, or earn a potential yield for passive income.

The real value of SRS comes from putting your money to work through investments.

SRS-eligible Exchange Traded Funds (ETFs) can be a simple and effective way to do so.

If growth is the goal, the Amova MSCI Asia ex Japan ex China Index ETF or the Amova E Fund ChiNext Index ETF offer exposure to markets with potential long-term growth.

If you’re seeking income, the Amova SGD Investment Grade Corporate Bond Index ETF or the ABF Singapore Bond Index Fund can provide more stability and yield potential.

And for a blend of both potential growth and income, the Amova Singapore STI ETF offers exposure to Singapore’s blue-chip companies with historically consistent dividend payouts7.

You can get diversified exposure, and you can directly buy these ETFs on the SGX.

By combining different types of SRS-eligible ETFs, such as equity ETFs for growth and bond ETFs for stability and yield, investors may even construct a balanced portfolio for their SRS savings that aligns with their risk appetite, time horizon, and long-term goals.

Enjoy great perks when you invest your SRS with FSMOne between 1 November 2025 and 30 January 2026!

New SRS investors earn 2X rewards and get an additional $5 when investing in the featured Amova ETFs.

FSMOne has been an advocate for low-cost investing. It is the first in the industry to offer flat-fee pricing for SGX-Listed ETFs. Check out the promotion here and trade with only a Flat Fee of $3.80.

Footnotes

1Source: FTSE Russel Index Factsheet as of 30 September 2025. Dividend yield of the Straits Times Index is not the same as that of the Amova Singapore STI ETF. Past dividend yields are not indicative of future dividend yields.

2Distributions are not guaranteed and are at the absolute discretion of the Manager. Any distribution is expected to result in an immediate reduction of Fund’s NAV. Distributions may be paid out of capital which will result in capital erosion and reduction in the Fund’s NAV, which will be reflected in the redemption price of the Units. Please refer to the Fund Prospectus and Product Highlight Sheet for further details.

3Distributions are not guaranteed and are at the absolute discretion of the Manager. Please refer to the Fund Prospectus and Product Highlight Sheet for further details.

4Source: Amova Asset Management Asia Limited as of 31 October 2025. Cash is included in the calculation of the average credit rating and is rated as AAA regardless of currencies held. The credit ratings of the underlying fixed income securities are determined by S&P and/or Moody’s, and where official credit ratings are unavailable, Amova Asia’s internal credit ratings are used.

5Source: Amova Asset Management Asia Limited. Cash is included in the calculation of the average credit rating and is rated as AAA regardless of currencies held. The credit ratings of the underlying fixed income securities are determined by S&P and/or Moody’s, and where official credit ratings are unavailable, iBoxx implied credit rating followed by Amova Asia’s internal credit ratings are used.

6Source: Amova Asset Management Asia Limited. Yield to Maturity (YTM) of a bond is the average annualised rate of return expected if held to maturity. Weighted Average YTM (%) is calculated by weighting the bonds with market capitalisation and duration. Figure is in local currency yield terms and on unhedged foreign exchange basis. Please note that weighted average YTM does not represent the fund’s actual rate of return or distribution yield.

7Dividend yield of the Straits Times Index is not the same as that of the Amova Singapore STI ETF. Past dividend yields are not indicative of future dividend yields.

Disclosure: This post is brought to you in collaboration with Amova Asset Management. All research and opinions are that of my own, and should not be taken as financial advice for your specific situation(s) as I know nothing about your individual financial circumstances, risk tolerance or investment objectives. I highly recommend that you use this as a starting point to understand more about Amova’s STI ETFs – including their accumulating and distributing class - which you can use for cash, CPF or SRS investing. Be sure to click into the respective links above to retrieve the fund prospectus and performance so as to help you decide whether it fits into your investment objectives.

Important Information by Amova Asset Management Asia Limited:

The Amova MSCI AC Asia ex Japan ex China Index ETF, and Amova E Fund Chinext Index ETF are sub-funds of Nikko AM Asia Limited VCC, an umbrella variable capital company incorporated in Singapore. These funds are managed by Nikko Asset Management Asia Limited.

This document is purely for informational purposes only with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. Any securities mentioned herein are for illustration purposes only and should not be construed as a recommendation for investment. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. Investments in funds are not deposits in, obligations of, or guaranteed or insured by Nikko Asset Management Asia Limited (“Nikko AM Asia”) or Nikko AM Asia Limited VCC.

Past performance or any prediction, projection or forecast is not indicative of future performance. The Fund or any underlying fund may use or invest in financial derivative instruments. The value of units/shares and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or our website (www.nikkoam.com.sg) before deciding whether to invest in the Fund.

The information contained herein may not be copied, reproduced or redistributed without the express consent of Nikko AM Asia. While reasonable care has been taken to ensure the accuracy of the information, Nikko AM Asia does not give any warranty or representation, either express or implied, and expressly disclaims liability for any errors or omissions. Information may be subject to change without notice. Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The performance of the ETF’s price on the Singapore Exchange Securities Trading Limited (“SGX-ST”) may be different from the net asset value per unit/share of the ETF. The ETF may also be suspended or delisted from the SGX-ST. Listing of the units/shares does not guarantee a liquid market for the units/shares. Investors should note that the ETF differs from a typical unit trust and units/shares may only be created or redeemed directly by a participating dealer in large creation or redemption units/shares.

The Central Provident Fund (“CPF”) Ordinary Account (“OA”) interest rate is the legislated minimum 2.5% per annum, or the 3-month average of major local banks' interest rates, whichever is higher, reviewed quarterly. The interest rate for Special Account (“SA”) is currently 4% per annum or the 12-month average yield of 10-year Singapore Government Securities plus 1%, whichever is higher, reviewed quarterly. Only monies in excess of $20,000 in OA and $40,000 in SA can be invested under the CPF Investment Scheme (“CPFIS”). Please refer to the website of the CPF Board for further information. Investors should note that the applicable interest rates for the CPF accounts and the terms of CPFIS may be varied by the CPF Board from time to time.

Neither Markit, its Affiliates or any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the data contained herewith nor as to the results to be obtained by recipients of the data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the data for any inaccuracies, errors or omissions in the Markit data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Markit has no obligation to update, modify or amend the data or to otherwise notify a recipient thereof in the event that any matter stated herein changes or subsequently becomes inaccurate. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the content, information or materials contained herein. Copyright © 2023, Markit Indices Limited.

The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index are marks of Markit Indices Lmited and have been licensed for use by Amova Asset Management Asia Limited. The Markit iBoxx SGD Non-Sovereigns Large Cap Investment Grade Index referenced herein is the property of Markit Indices Limited and is used under license. The Amova SGD Investment Grade Corporate Bond ETF is not sponsored, endorsed, or promoted by Markit Indices Limited.

The units of Amova AM Singapore STI ETF are not in any way sponsored, endorsed, sold or promoted by FTSE International Limited ("FTSE"), the London Stock Exchange Plc (the "Exchange"), The Financial Times Limited ("FT") SPH Data Services Pte Ltd ("SPH") or Singapore Press Holdings Ltd ("SGP") (collectively, the "Licensor Parties") and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Straits Times Index ("Index") and/or the figure at which the said Index stands at any particular time on any particular day or otherwise. The Index is compiled and calculated by FTSE. None of the Licensor Parties shall be under any obligation to advise any person of any error therein. "FTSE®", "FT-SE®" are trade marks of the Exchange and the FT and are used by FTSE under license. "STI" and "Straits Times Index" are trade marks of SPH and are used by FTSE under licence. All intellectual property rights in the ST index vest in SPH and SGP.

Amova Asset Management Asia Limited. Registration Number 198202562H.

Nikko AM Asia Limited VCC. Registration Number T21VC0223L.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments