Are my CPF savings enough for retirement? Here’s how I found out

Retirement

Powered by

By Beansprout • 18 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Our writer, age 52, shares his experience using CPF Board’s Retirement Payout Planner – from making rough guesses about his future retirement income to discovering a nearly $2,000 shortfall by age 65, and the practical steps he could take to bridge it

This post was created in partnership with CPF Board. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

You’d think that with a career in finance, retirement would have been one of my top priorities.

But like many people, I found myself focused on more immediate needs: paying off the mortgage, raising two kids, and setting aside funds for their education.

Of course, I did the responsible basics – living within my means, saving, investing, and topping up to my CPF whenever I could. But I didn’t approach retirement in a structured, goal-driven way until recently.

Now, with just 3 years to go before I turn 55, that milestone is starting to feel real. My CPF Special Account (SA) will be closed, and my savings transferred to my Retirement Account (RA).

To estimate how much I need for retirement, I relied on online calculators that were often generic, and did not account for my future needs and lifestyle.

I also had my own spreadsheet where I broadly assumed the numbers, but adjusting for inflation, unexpected expenses, and life changes only added to the complexity.

With so much information floating around, I often felt overwhelmed and frustrated, because it wasn’t easy to pin down anything concrete.

Then I came across the Retirement Payout Planner by CPF Board.

I was curious to see how it would compare with the rough estimates I’ve been making on my own, since it pulls from my actual CPF balances and uses assumptions tailored to the Singapore context.

Finally, I might get clarity to the nagging question: will my current CPF savings be enough for retirement?

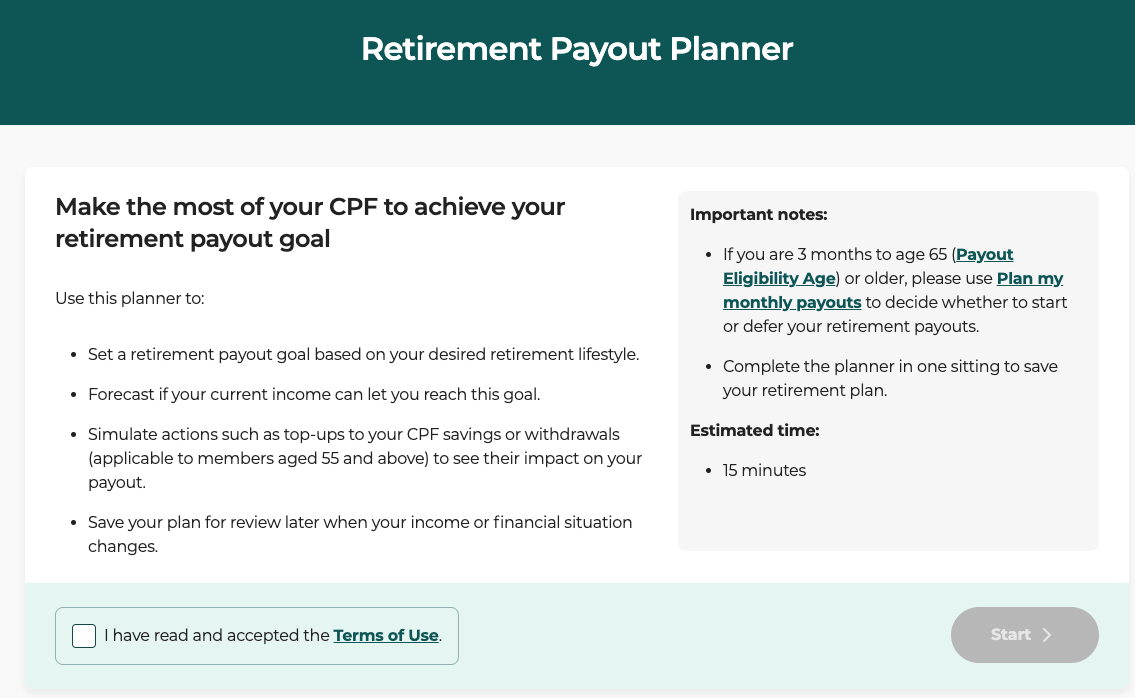

What is the Retirement Payout Planner?

The Retirement Payout Planner helps you make the most of your CPF to achieve your retirement payout goal.

This online tool allows you to set your retirement payout goal based on your desired retirement lifestyle and projects your payouts at age 65, with CPF contributions factored in.

You can also use the planner to simulate actions such as cash top-ups or CPF transfers, and see how they can increase your payouts.

When I logged in with Singpass, I was pleasantly surprised by how simple it was to use.

The prompts were clear, and within minutes I could see projections based on my actual CPF balances.

For the first time, I felt confident that I had concrete numbers to work with instead of rough estimates!

Having these projections gave me a clear reliable starting point, making planning feel more manageable and less overwhelming.

Here’s how the planner helped me shape my retirement plan.

#1 – Determine my monthly retirement income

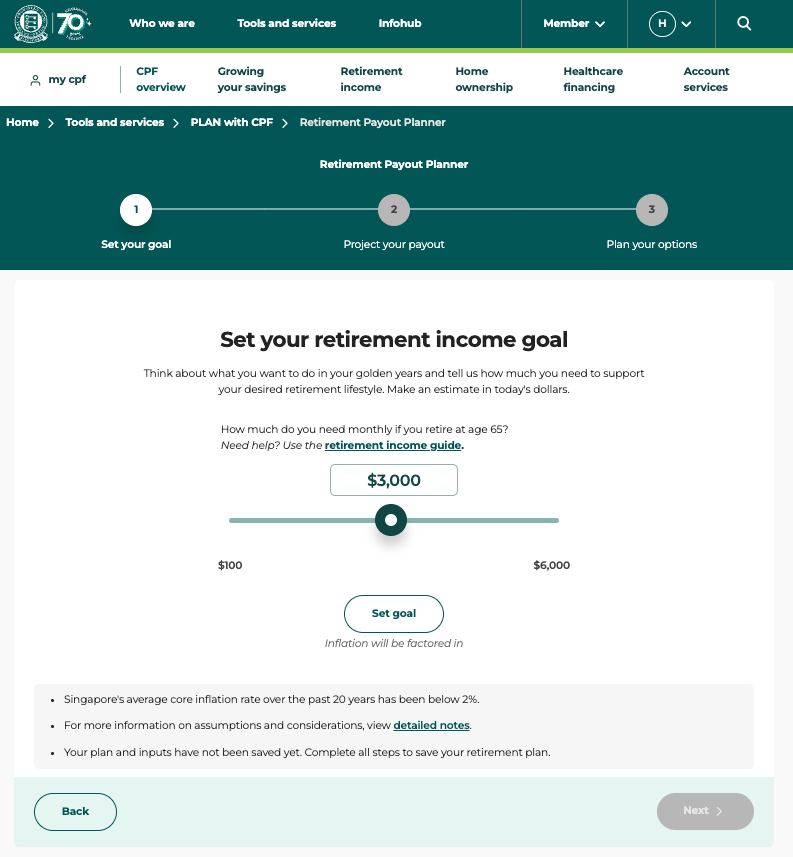

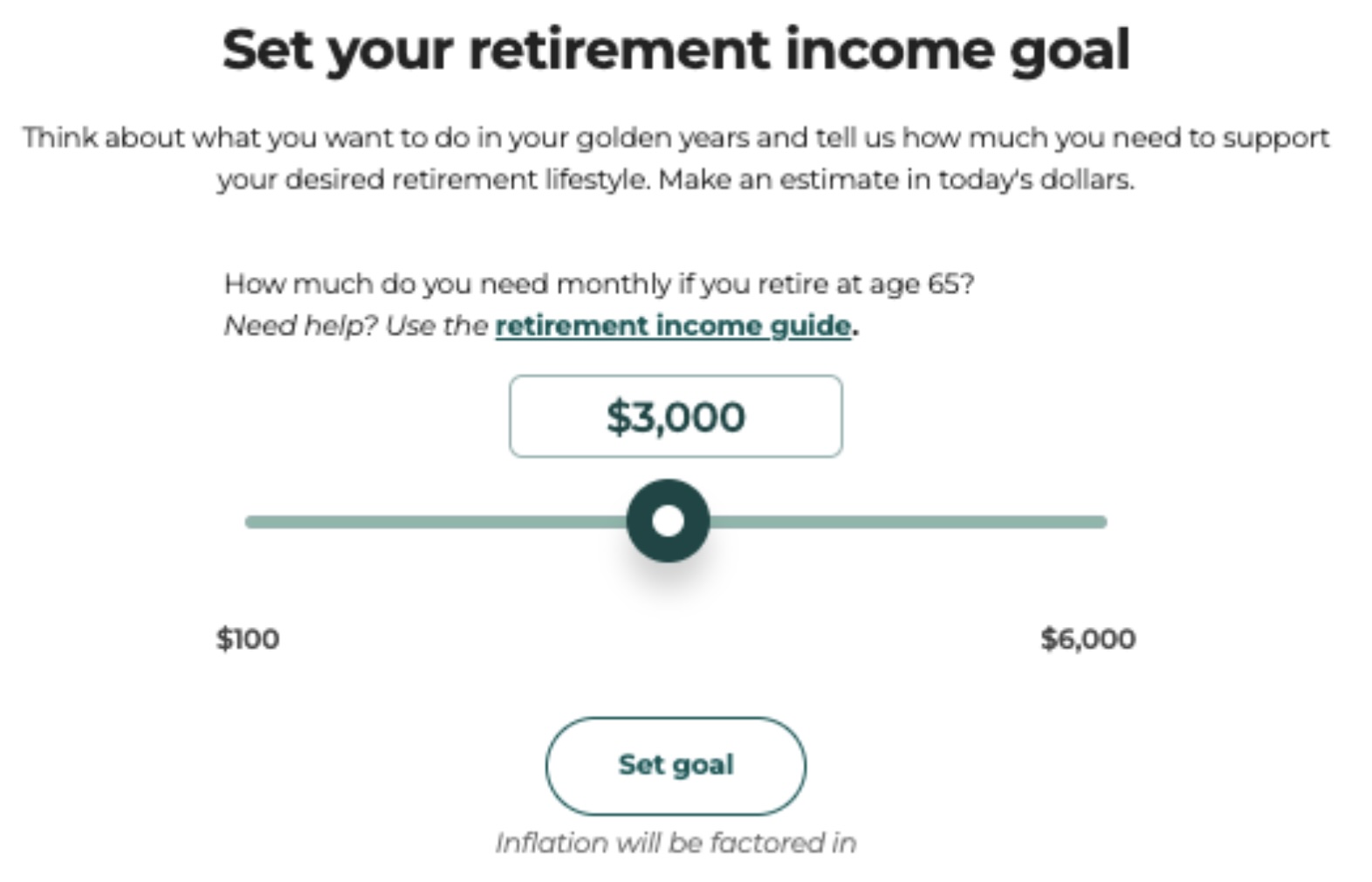

The first question the Retirement Payout Planner asks is simple but crucial: how much do you think you’ll need each month in retirement?

This becomes your retirement income goal; it should reflect the lifestyle you want.

Thinking about this question made me start picturing what my retirement might actually look like.

By the time I retire, I expect my children will likely be self-sufficient, which gives me room to plan my own lifestyle.

I don’t need luxury, and I’m generally prudent with my spending, covering essentials like groceries, utilities, and transport without going overboard.

Beyond the basics, I want the freedom to travel once a year to a nearby Southeast Asian country, enjoy occasional meals out with friends and family, and continue with road cycling, including gear and upkeep.

I want to maintain these activities without worrying about cutting back just to make ends meet.

In short, I want peace of mind, while still spending mindfully.

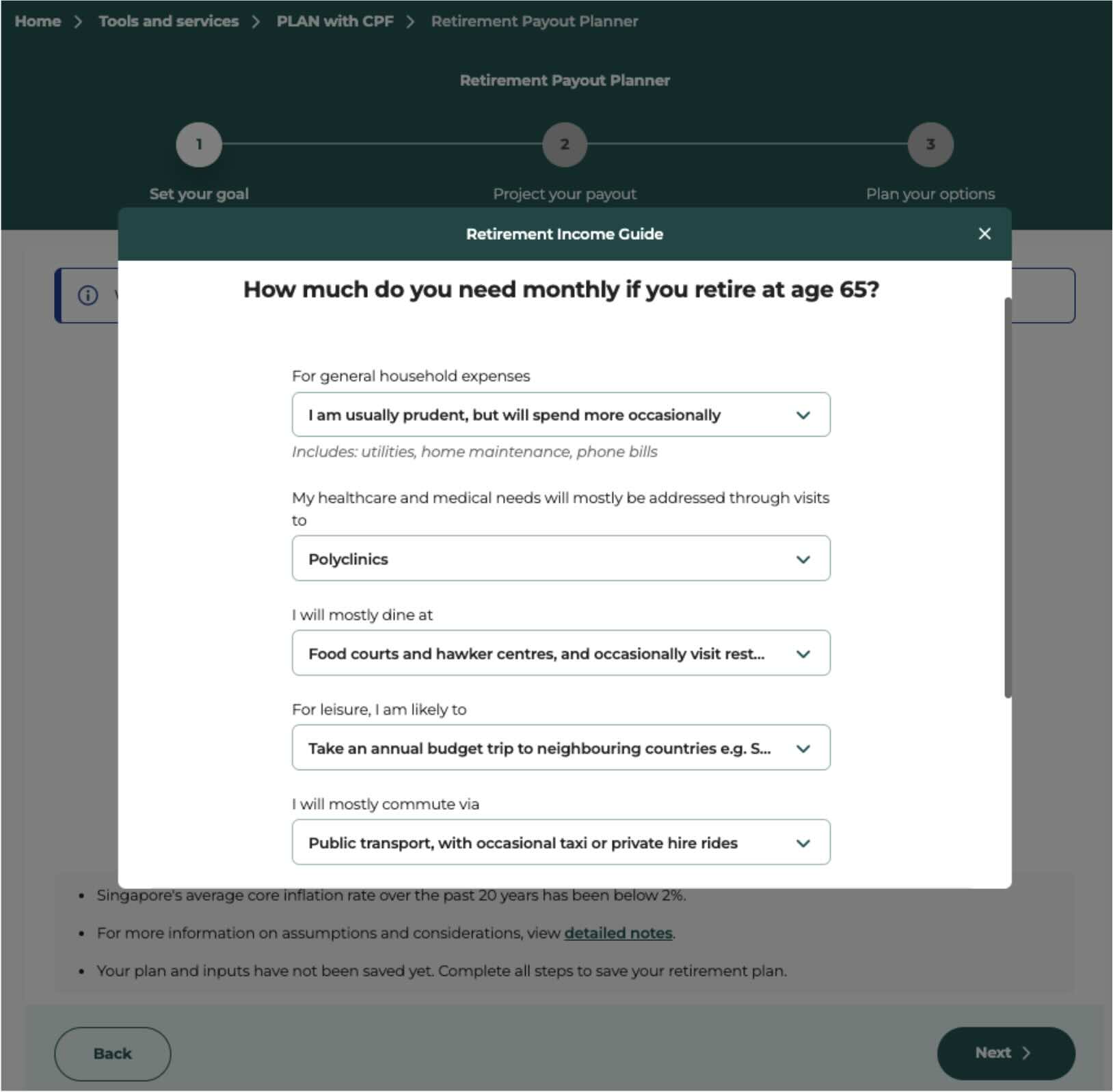

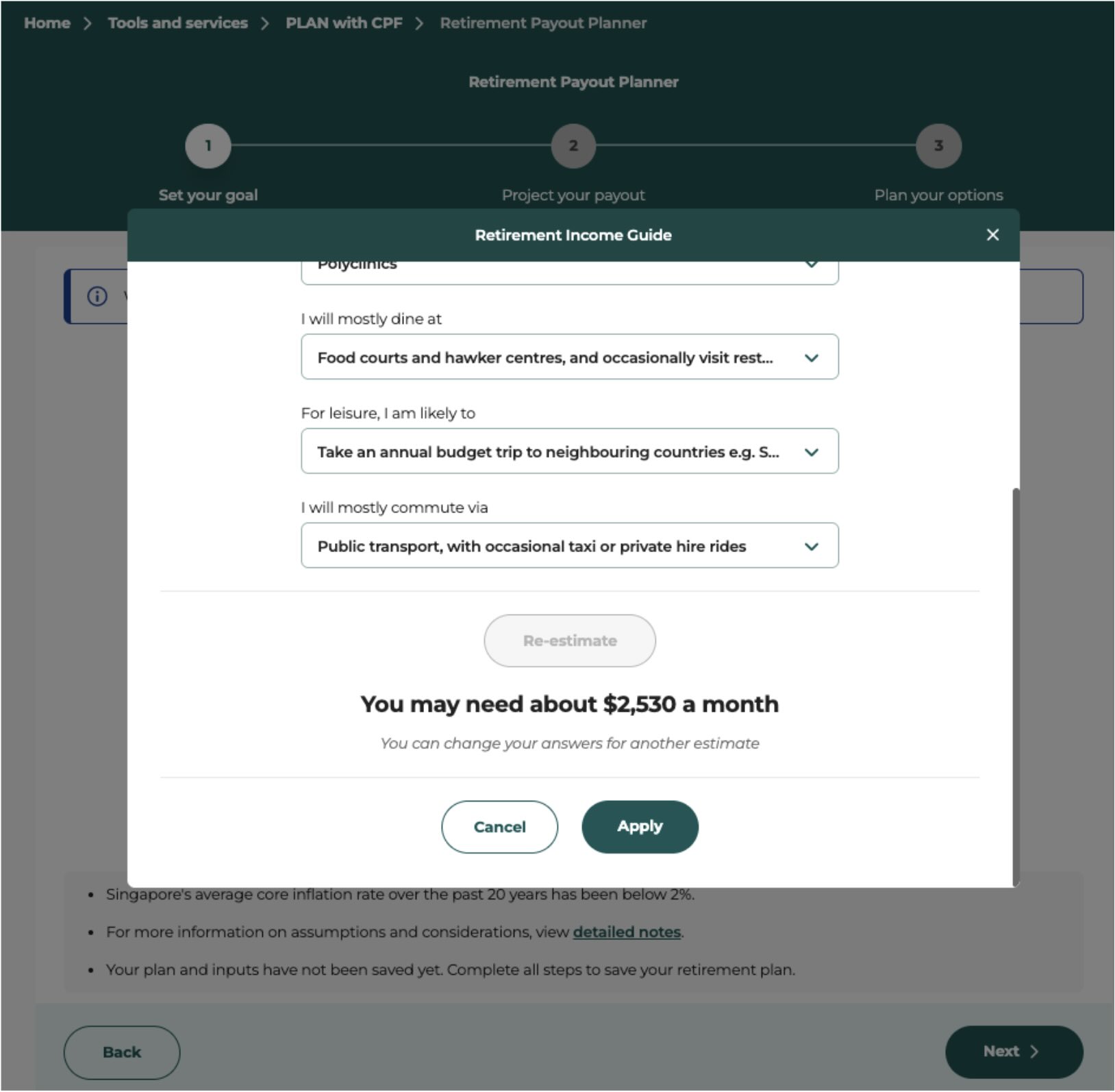

The Retirement Income Guide within the planner makes estimating my retirement income goal easier, prompting me to consider different categories of expenditure such as dining, transport, leisure, and household expenses.

By selecting from simple drop-down menus, I get an estimate of how much I might need each month.

The guide estimated I would need about S$2,530 a month, but considering my desired lifestyle, I set my retirement income goal at S$3,000 a month.

#2 – Accounting for inflation in my retirement income goal

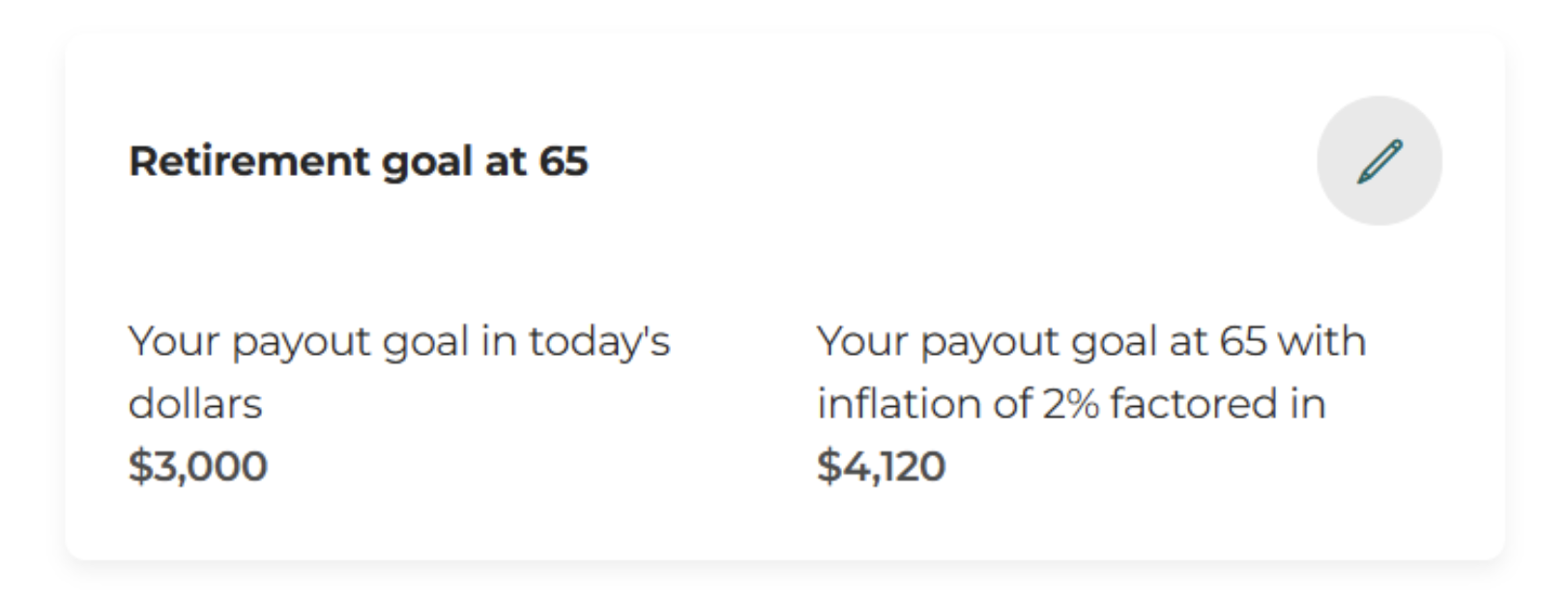

One feature I appreciate about the Retirement Payout Planner is that it automatically factors in inflation over time.

This is something many of us tend to overlook, yet it makes a huge difference in planning.

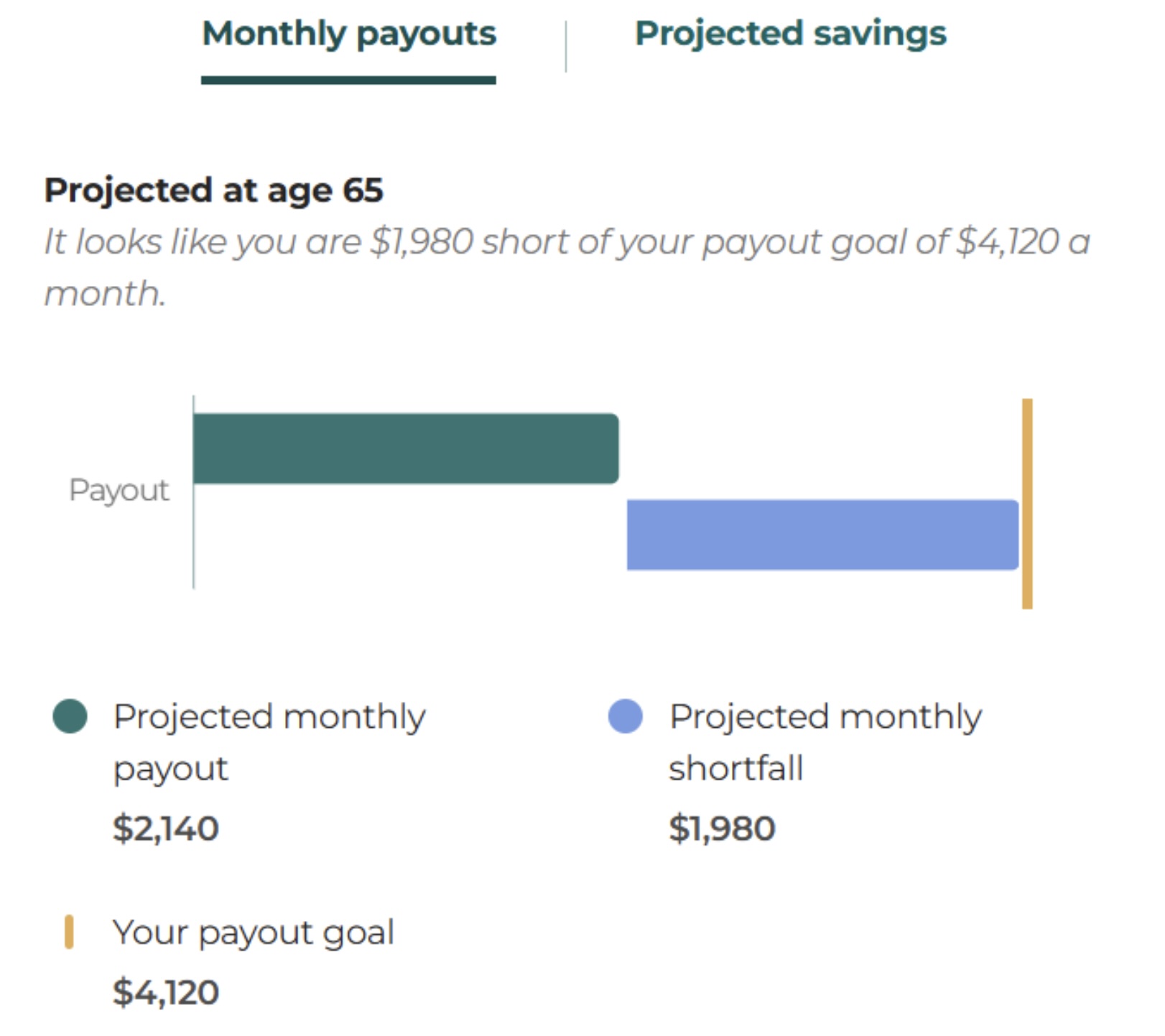

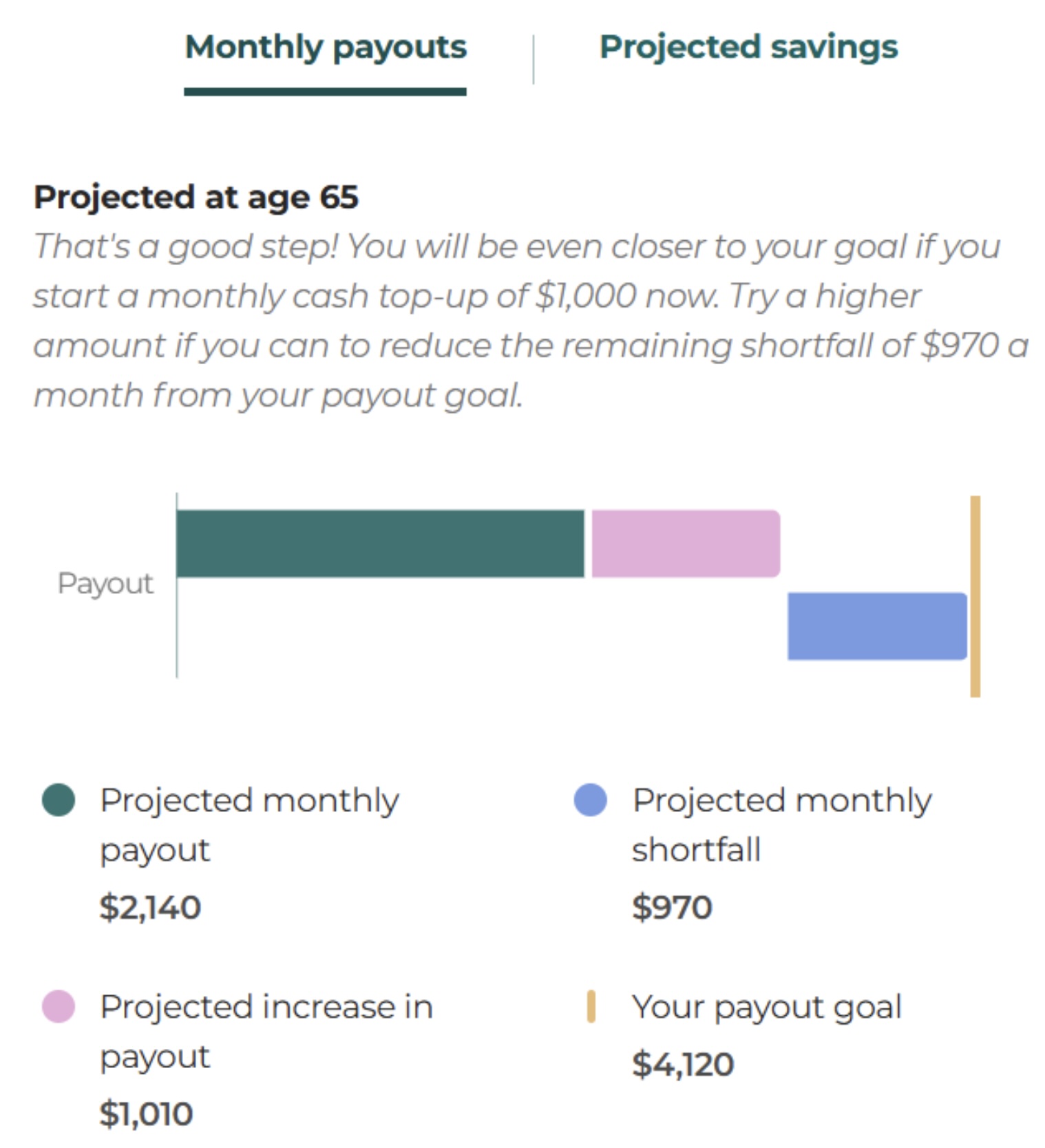

Assuming inflation of 2% per year, the planner showed that my goal of $3,000 per month today would grow to about S$4,120 by the time I turn 65 in 13 years.

Seeing this figure up front gave me a clearer sense of how my retirement savings would need to stretch over time.

It reminded me that the cost of living will naturally rise in the years before my payout begins at 65, and prompted me to think about how I might adapt my lifestyle as prices increase.

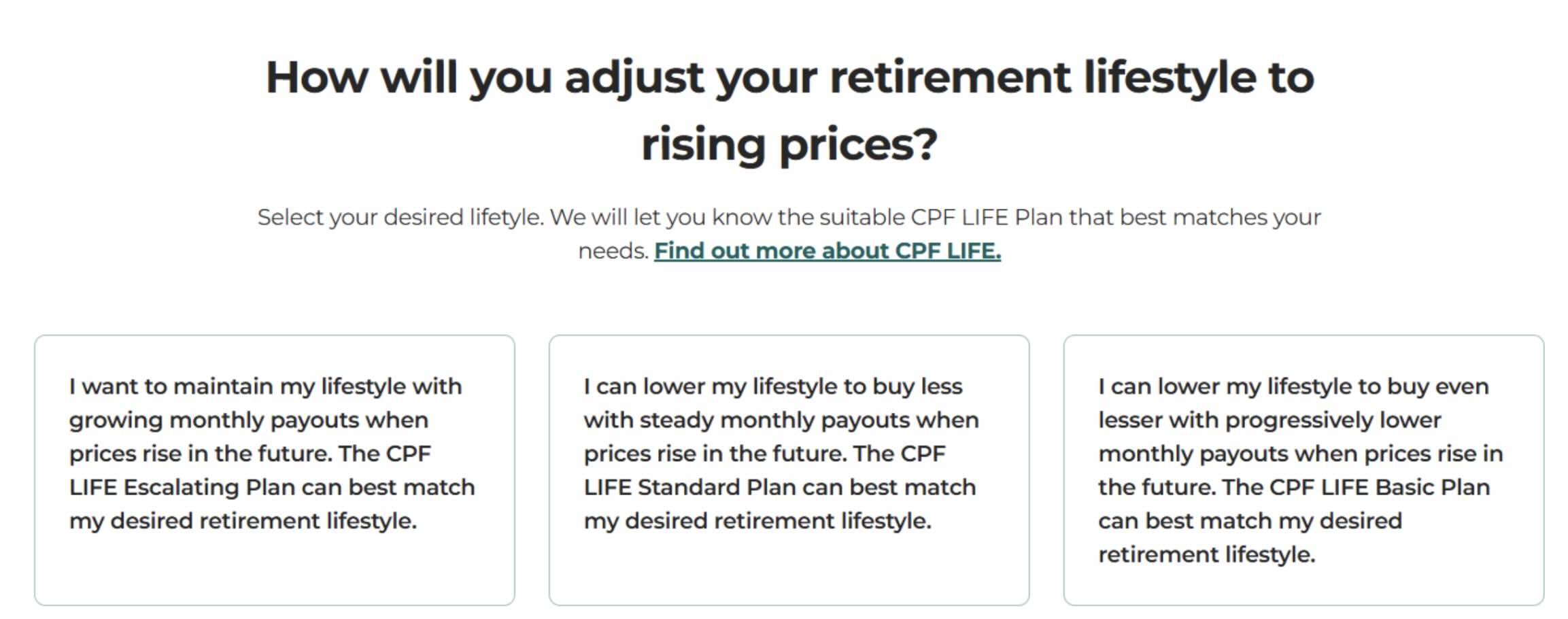

This is also where the planner briefly introduces the three different CPF LIFE plans, each designed to suit a different retirement lifestyle.

After assessing my needs, I found myself leaning towards the CPF LIFE Standard Plan that I’d be able to choose from age 65 onwards.

#3 – Understanding my retirement savings gap

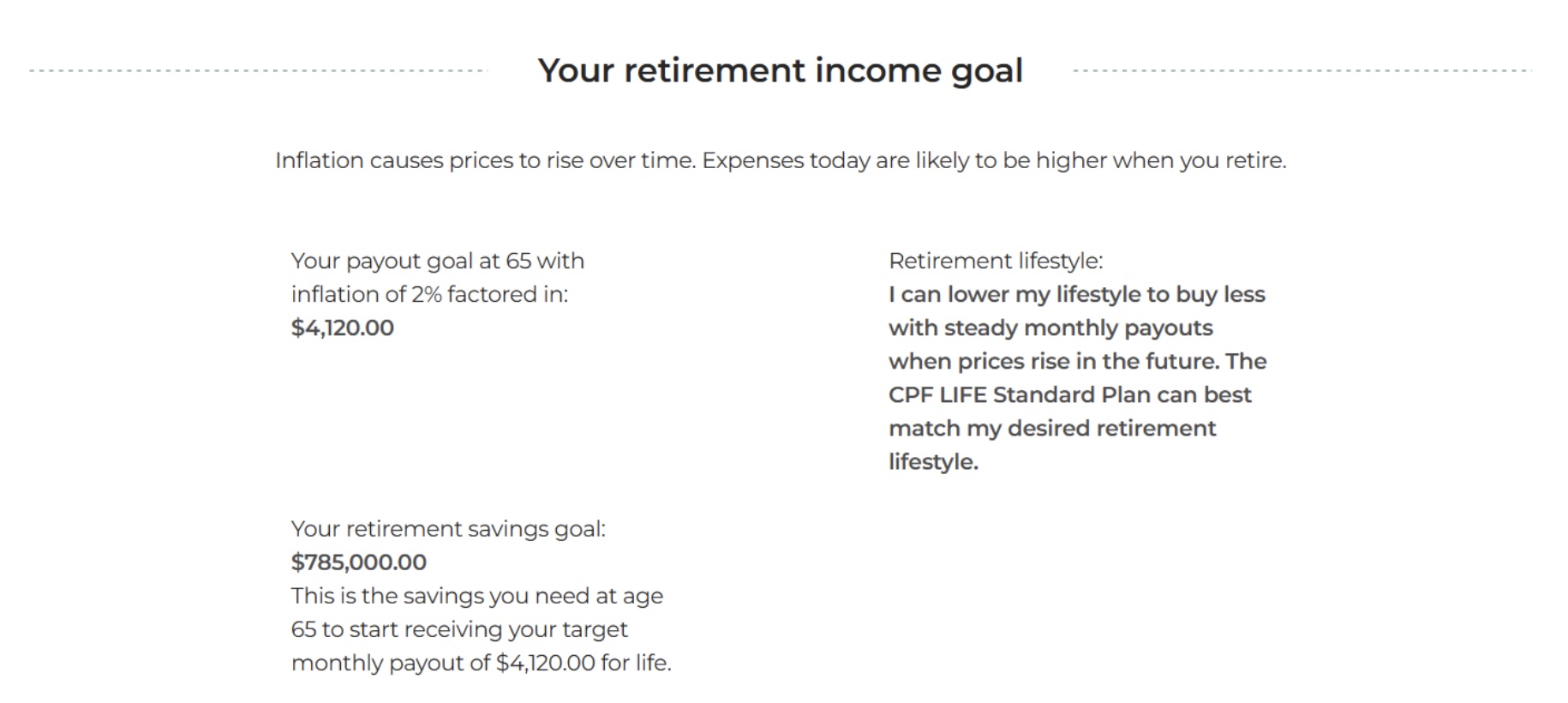

The next section in the Retirement Payout Planner turned out to be one of the most useful for me. It showed me exactly how much my retirement savings gap is.

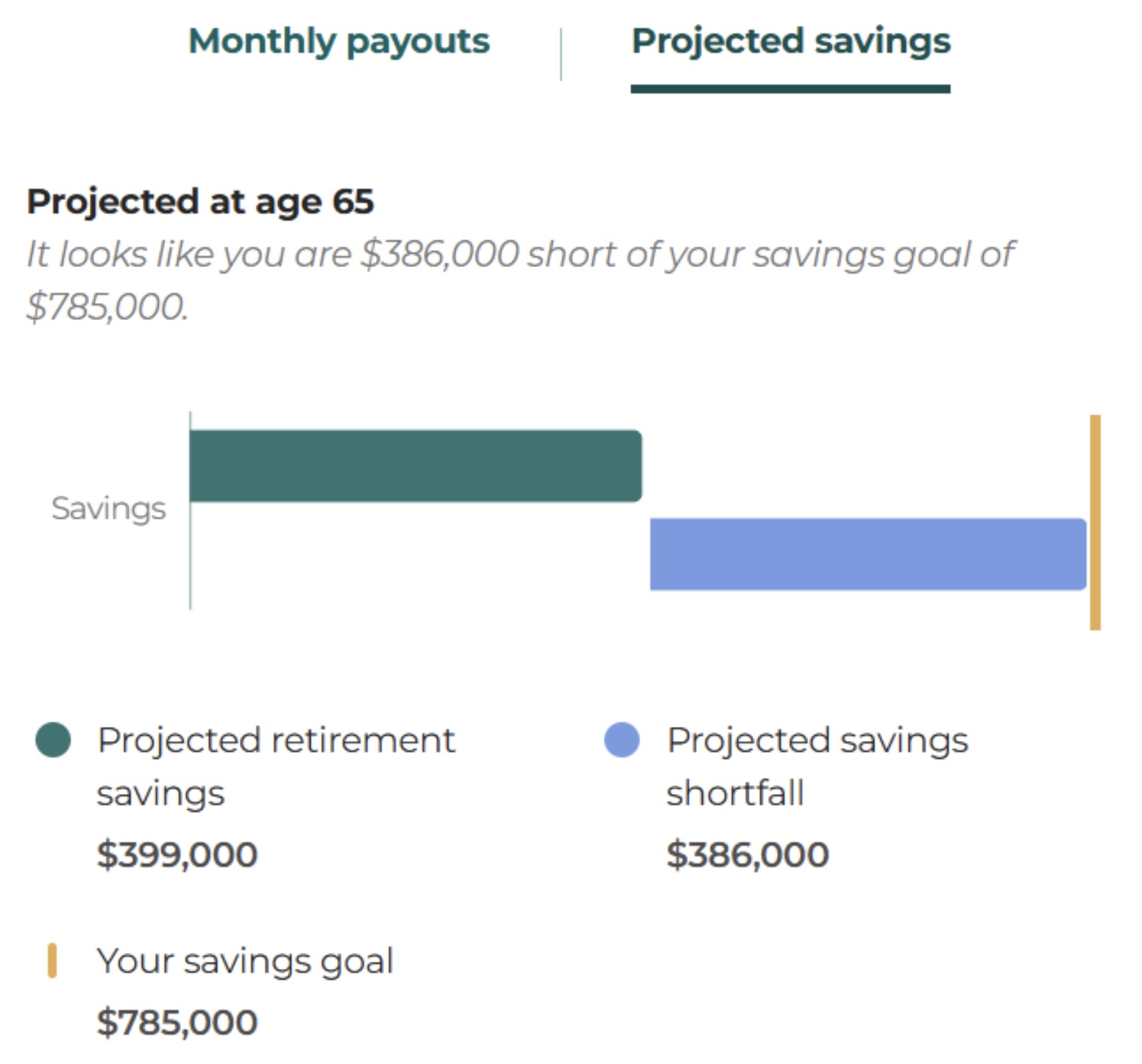

Based on my target payout of S$4,120 per month, the planner showed that I would need about S$785,000 in total retirement savings.

Using my current CPF balances, projected salary contributions (accounting for bonuses and projected increments) and compound interest, it estimated that I am likely to receive around $2,140 per month under my chosen CPF LIFE Standard Plan – leaving a gap of $1,980 per month, or roughly $386,000 in total savings.

Having this visualisation was surprisingly motivating.

I had concrete numbers that showed the gap and gave me options for closing it.

Exploring ways to bridge the gap

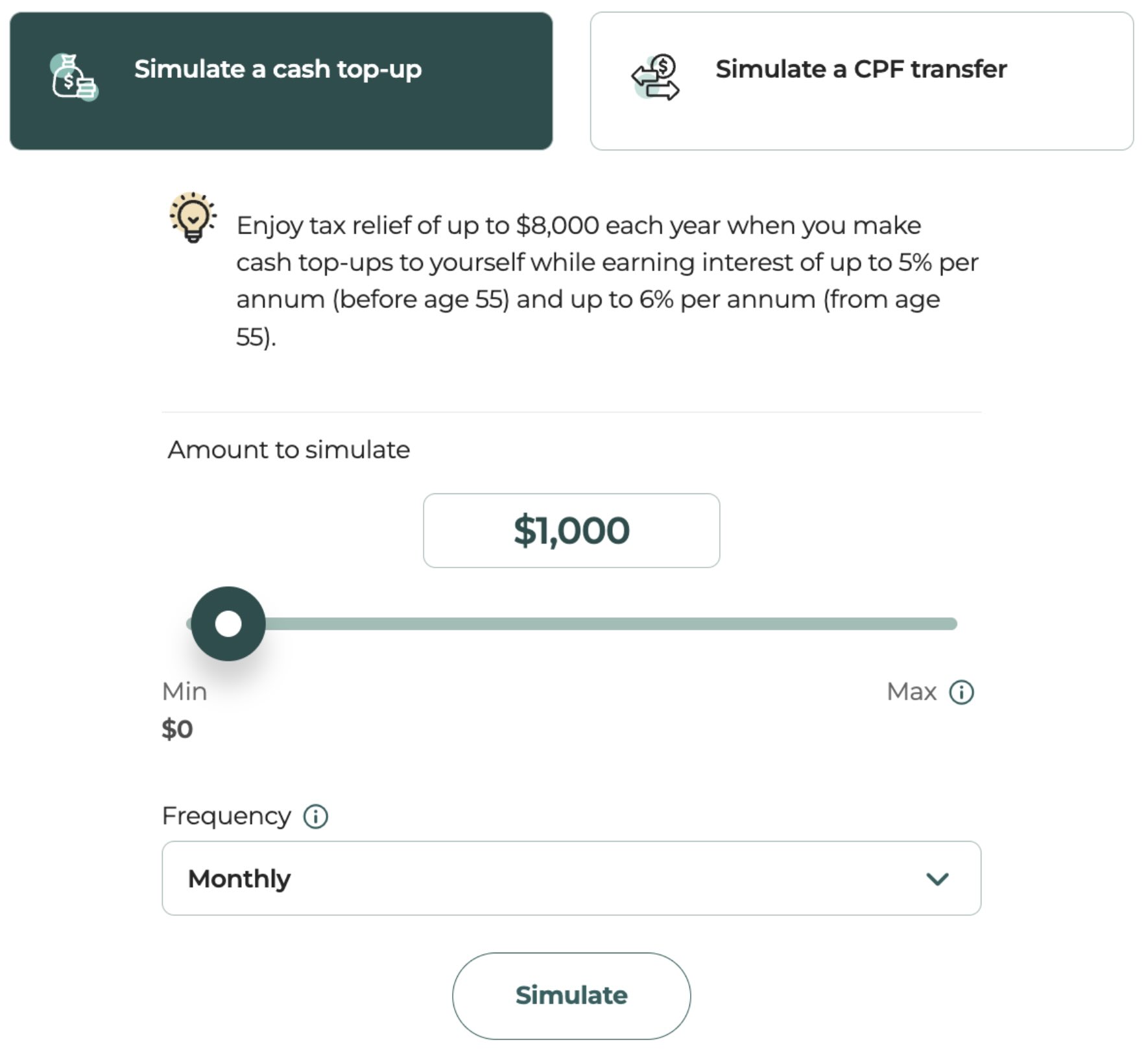

The planner highlighted some practical steps I could take:

- Making top-ups to my CPF Special Account (SA), which allows me to also earn tax relief

- Transferring part of my Ordinary Account (OA) balance to my SA, which earns a higher interest rate of 4% compared to 2.5% in the OA

I tried simulating monthly cash top-ups of S$1,000 in the planner.

This immediately narrowed my shortfall from S$1,980 to about S$970 per month.

The planner also shows how transfers from my OA to SA help further reduce the gap due to the higher interest earned.

I was able to save my current plan and come back any time to review my goals, and make updates if my needs and financial situation have changed.

Besides these two practical steps shared in the planner, I could further reduce my shortfall in other ways including:

- Adjusting my lifestyle expectations and lowering my payout goal if I’m comfortable living more simply

- Defer CPF LIFE payouts until age 70 and increase my payouts by up to 7% for each year deferred

- From age 55, I could also top up my Retirement Account, up to the year’s Enhanced Retirement Sum (ERS)

My final takeaway

What I value most about the Retirement Payout Planner is the clarity it provides. I now have a structured view of:

- What I expect to spend on, and how much retirement income I will need each month.

- How much CPF LIFE monthly payouts I will be receiving, and what’s the gap from my goal.

- What I can adjust (lifestyle expectations or CPF top-ups and transfers) to move closer to my target.

As CPF savings form the foundation of my retirement, the planner helped me visualise how my savings translate to future payouts and how top-ups can enhance them.

Rather than leaving retirement planning to chance, I now have a framework to guide my decisions and revisit whenever life changes.

A year ago, if someone had asked me, “Are your CPF savings enough for retirement?”, I would have given a vague answer filled with “probably” and “I think so.”

Today, I can give exact numbers with confidence.

If you want to move away from making vague guesses to a clearer picture, give the Retirement Payout Planner a try.

Try out the Retirement Payout Planner now and discover tips and resources here.

You can also use Plan Life Ahead, Now! with CPF, a one-stop financial guidance platform that helps you make informed financial decisions as you navigate through life.

With your PLAN with CPF dashboard, you can identify your financial priorities and benefit from a more guided approach to planning, supported by curated resources to help you plan confidently for every stage of life.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments