Astrea 9 Bond - Full allocation for Class A-1 applications of up to S$11,000

Bonds

By Gerald Wong, CFA • 07 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Investors who applied for S$11,000 and below of Astrea 9 Class A-1 Bonds received full allocation.

What happened?

The Astrea 9 PE Bond allocation result is finally out.

Since this afternoon, there has been a lot of chatter in the Beansprout community about the allocation for the Astrea 9 PE Bond.

Some investors were sharing the refund they were getting in the DBS, UOB or OCBC accounts, which provided an indication of how much allocation they were getting.

It then became clear that the allocation for the Astrea 9 Class A-1 and Class A-2 Bonds was lower than what most investors had applied for.

This was confirmed by the allocation result that just came out.

Let us dive deeper to find out more about the allocation of the Astrea 9 bonds.

What we learnt from the Astrea 9 Bonds allocation result

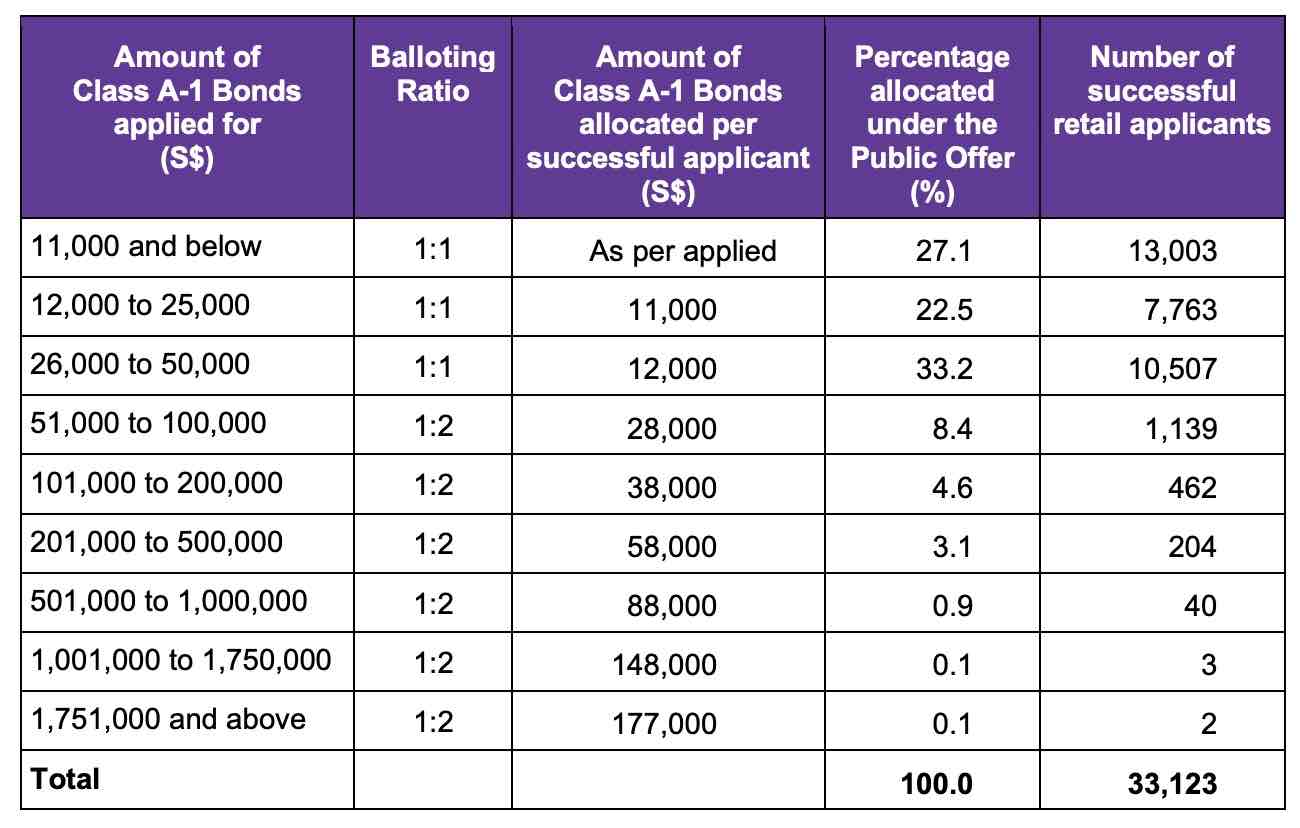

Allocation of Astrea 9 Class A-1 Bonds

Based on the balloting ratio of 1:1, all valid applicants who applied for up to S$50,000 of Class A-1 Bonds received allocations either in full or in part.

Investors who applied for S$11,000 and below of Class A-1 Bonds received full allocation.

Investors who applied for S$12,000 to S$25,000 of Class A-1 Bonds received S$11,000 allocation.

Investors who applied for S$26,000 to S$50,000 of Class A-1 Bonds received S$12,000 allocation.

Balloting was conducted for investors who applied for S$51,000 or more of Class A-1 Bonds.

In total, there were valid applications of over S$1,206 million for the Class A-1 Bonds from a total of 34,969 valid applicants.

This represents a subscription rate of 3.2x based on the public offer of S$380 million for the Class A-1 bonds.

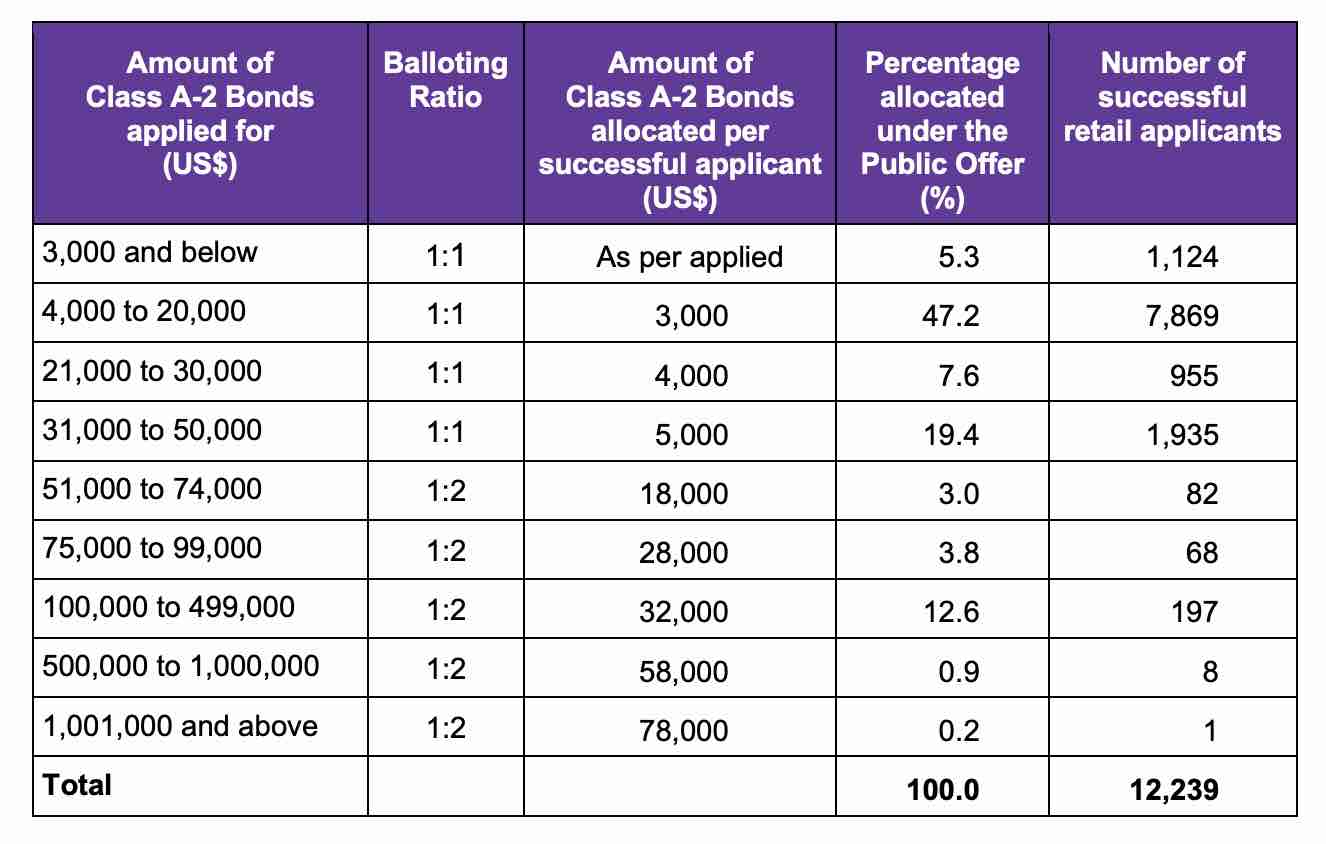

Allocation of Astrea 9 Class A-2 Bonds

Based on the balloting ratio of 1:1, all valid applicants who applied for up to US$50,000 of Class A-2 Bonds received allocations either in full or in part.

Investors who applied for US$3,000 and below of Class A-2 Bonds received full allocation.

Investors who applied for US$4,000 to US$20,000 of Class A-2 Bonds received US$3,000 allocation.

Investors who applied for US$21,000 to US$30,000 of Class A-2 Bonds received US$4,000 allocation.

Investors who applied for US$31,000 to US$50,000 of Class A-2 Bonds received US$5,000 allocation.

Balloting was conducted for investors who applied for US$51,000 or more of Class A-2 Bonds.

In total, there were valid applications of over US$280 million for the Class A-2 Bonds from a total of 12,592 valid applicants.

This represents a subscription rate of 5.6x based on the public offer of US$50 million for the Class A-2 bonds.

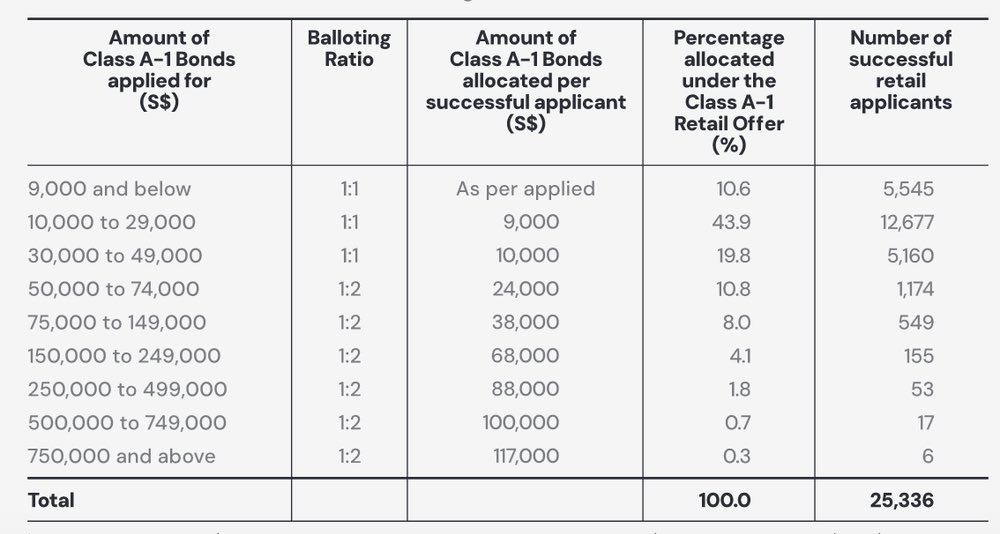

How is the Astrea 9 Bonds Allocation different from the Astrea 8 Bond Allocation?

Let us now compare the allocation of the Astrea 9 Bonds with the allocation of the Astrea 8 Bonds.

There were S$763 million applications by 27,287 applicants for public offer of the Astrea 8 Class A-1 bonds.

Based on the S$260 million of the Class A-1 bonds in the public offer, this would represent a subscription rate of 2.9x.

From the comparison, there appears to be an increase in demand for the Astrea 9 Class A-1 bonds compared to the Astrea 8 Class A-1 bonds.

However, the larger public offer size of S$380 million for the Astrea 9 Class A-1 bonds, compared to S$260 million for the Astrea 8 Class A-1 bonds, helped boost the allocation for investors who applied for S$50,000 or less of Class A-1 Bonds.

| Astrea 8 Class A-1 | Astrea 9 Class A-1 | |

|---|---|---|

| Number of applicants | 27,287 | 34,969 |

| Total applications (S$ million) | 763 | 1,206 |

| Subscription rate | 2.9x | 3.2x |

Investors who applied for US$11,000 and below of Astrea 9 Class A-1 Bonds received full allocation, compared to just S$9,000 and below of the Astrea 8 Class A-1 Bonds.

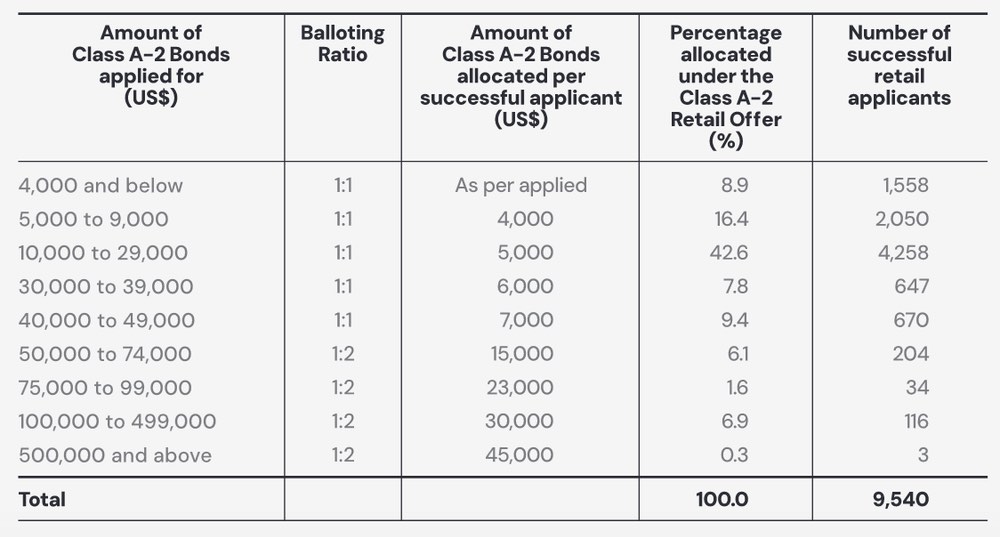

Let us now compare the allocation for Astrea 9 Class A-2 bonds with the allocation for Astrea 8 Class A-2 bonds.

There were US$193 million applications by 9,894 applicants for public offer of the Astrea 8 Class A-2 bonds.

Based on the US$50 million of the Class A-2 bonds in the public offer, this would represent a subscription rate of 3.9x.

From the comparison, there appears to be more demand for the Astrea 9 Class A-2 bonds compared to the Astrea 8 Class A-2 bonds.

| Astrea 8 Class A-2 | Astrea 9 Class A-2 | |

|---|---|---|

| Number of applicants | 9,894 | 12,592 |

| Total applications (US$ million) | 193 | 280 |

| Subscription rate | 3.9x | 5.6x |

With the higher demand for the US dollar denominated Astrea bonds, allocation for the Astrea 9 Class A-2 bonds was lower than for the Astrea 8 Class A-2 bonds.

Investors who applied for US$49,000 of Astrea 9 Class A-2 Bonds received just US$5,000 allocation, compared to US$7,000 allocation for the Astrea 8 Class A-2 Bonds.

Listing of the Astrea 9 PE bonds

The Astrea 9 Class A-1 Bonds and Class A-2 Bonds will commence trading on the Singapore Exchange Securities Trading Limited (“SGX-ST”) at 9:00am on Monday, 11 August 2025.

The Class A-1 Bonds will trade on the Mainboard under the trading name “Astrea9A1 3.4%400808” with SGX-ST stock code “YA1B”, in board lot sizes of S$1,000.

The Class A-2 Bonds will trade on the Mainboard under the trading name “Astrea9A2 5.7%400808” with SGX-ST stock code “YA2B”, in board lot sizes of US$1,000.

Once trading starts, you may buy or sell the bonds on the SGX at the prevailing market price.

To learn more about the Astrea 9 PE bonds, you can read our detailed analysis on the Astrea 9 PE bonds here.

Also, find out other ways that you can generate passive income in Singapore.

Join our Beansprout Telegram group to get the latest updates on Singapore bonds, stocks and REITs.

Learn more about passive income opportunities in Singapore

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments