AvePoint - Global leader in data security and governance

Stocks

By Gerald Wong, CFA • 19 Sep 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

AvePoint is the global leader in data security and governance, and the first B2B SaaS stock to be listed on SGX.

AvePoint (Not Rated) - Global leader in data security and governance

AvePoint is a global leader in cloud-based data management, with a core focus on data governance, security, and compliance.

Through the AvePoint Confidence Platform, AvePoint helps over 25,000 customers globally to prepare, secure, and optimise their critical data across Microsoft, Google, and other collaboration environments.

The company serves a wide range of industries, including professional and administrative services, financial and insurance, and others.

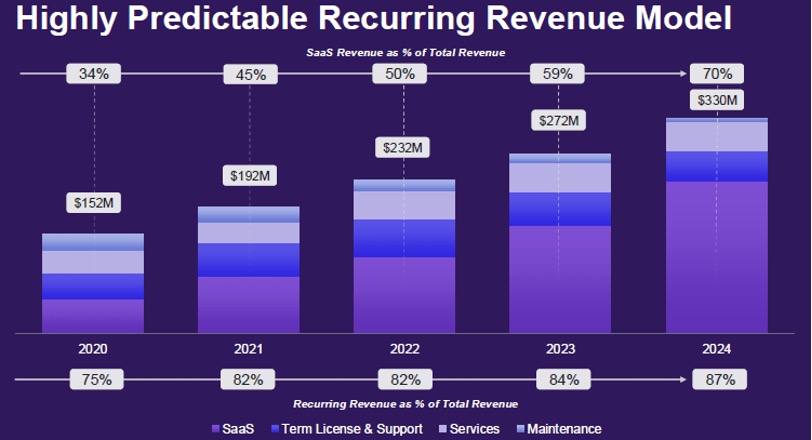

Reflecting increasing customer adoption of the company’s cloud-based data management solutions, software-as-a-service (SaaS) represented 70% of its total revenue in 2024, up from 34% in 2020.

By offering end-to-end data management capabilities, AvePoint enables organisations to confidently migrate, secure, and govern their data in increasingly complex and regulated digital environments.

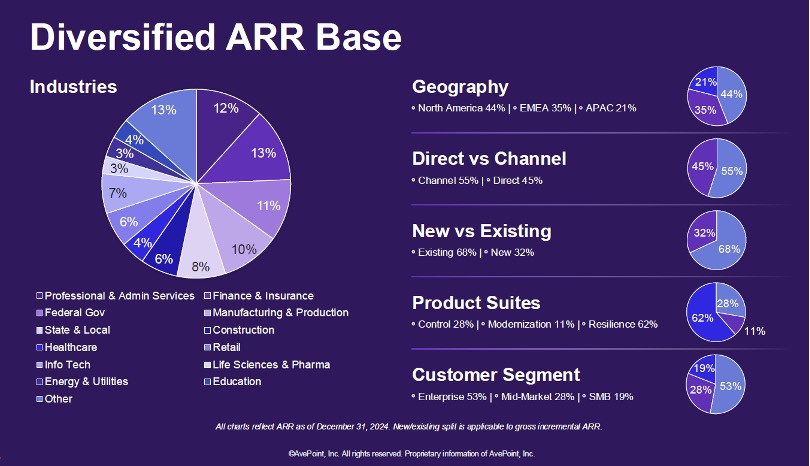

Well-balanced across geographies and industries

AvePoint’s business model is characterised by strong diversification across geography, industry, and go-to-market strategy.

From a geographic standpoint, the company maintains a well-balanced Annual Recurring Revenue (ARR) distribution, with North America accounting for 44%, EMEA for 35%, and APAC for 21%, underscoring its established global footprint.

In terms of growth, EMEA and APAC have been the fastest-growing regions from 2020 to 2024, recording CAGRs of 32% and 31% respectively. North America, while still the largest contributor, saw a comparatively lower CAGR of 24% over the same period.

Industry exposure is equally broad, with no single vertical representing a dominant share of ARR. Instead, revenue is spread across sectors such as professional and administrative services (12%), finance and insurance (13%), and manufacturing and production (10%), among others—reducing the company’s dependence on any one segment.

AvePoint also benefits from a balanced go-to-market approach, with 45% of revenue coming from direct sales and 55% via channel partnerships. This mix supports scalable growth while enabling flexible customer acquisition strategies across different markets.

Strong leadership position within Microsoft ecosystem

The company serves over 25,000 customers worldwide, covering a diverse set of industries including Financial Services, Insurance, Healthcare, Energy, and Utilities.

AvePoint supports multi-cloud environments such as Microsoft 365, Google Cloud, AWS, and Salesforce.

As of March 2025, AvePoint maintains a strong leadership position within the Microsoft Cloud ecosystem, having been recognised six times with the Microsoft Partner of the Year Award—most recently in the Education category.

SaaS contributes the majority of revenue

AvePoint has demonstrated strong momentum in scaling its recurring revenue base.

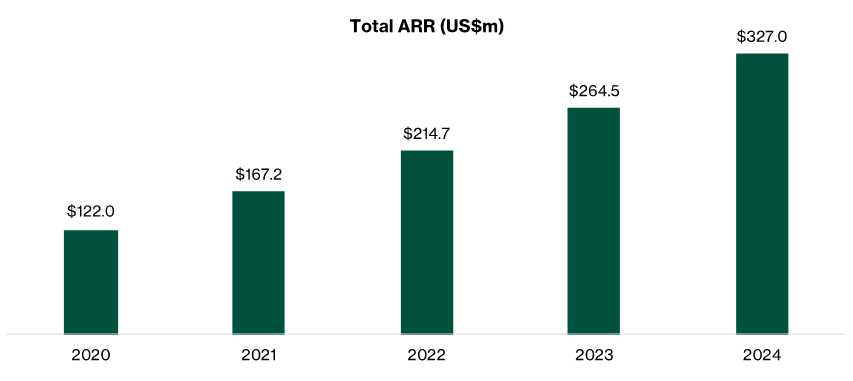

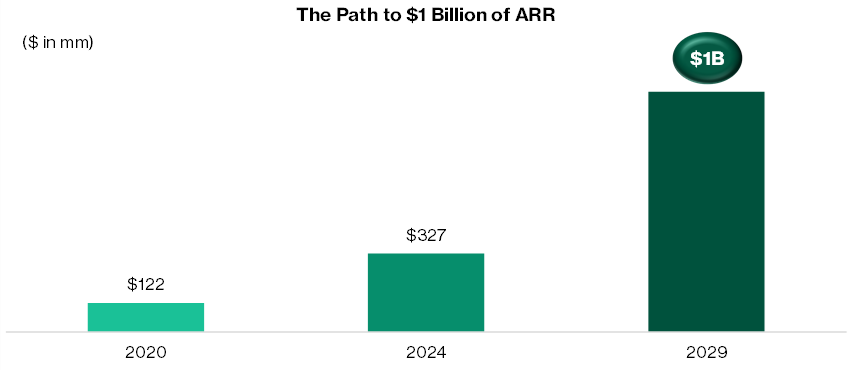

Annual Recurring Revenue (ARR) increased from US$122 million in 2020 to US$327 million in 2024, representing a compound annual growth rate (CAGR) of 28%.

The company generates revenue across four key segments: SaaS, Term License & Support, Services, and Maintenance. ARR is primarily driven by the SaaS, Term License & Support, and Maintenance segments.

Growing addressable market

The total addressable market for data governance, security, and related services is currently valued at US$52.2 billion and is projected to grow at a compound annual growth rate (CAGR) of 17.4% to reach US$99.0 billion by 2028, according to IDC.

The growing demand is supported by the need for better data governance and security solutions with the surge in the use of generative artificial intelligence (AI), as well as greater focus on cybersecurity.

Improving reported financial performance

Revenue Growth

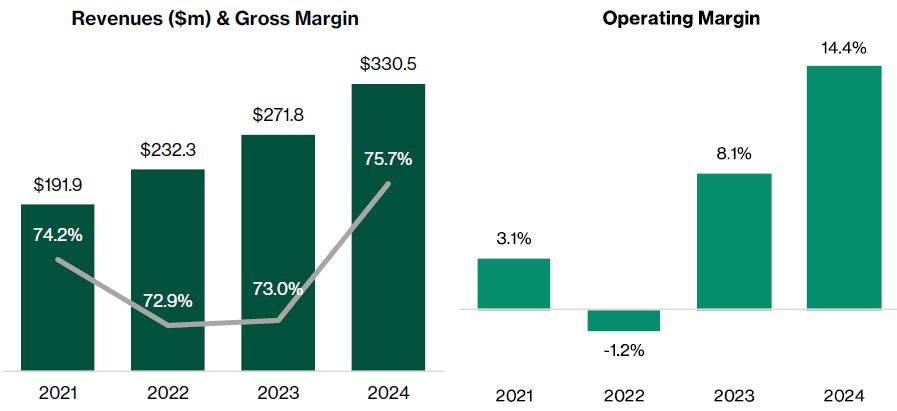

With increasing adoption of the Confidence Platform and a growing customer base, AvePoint’s revenue increased sharply from 2020 to 2024.

In 2024, the company’s revenue grew by 21.6%, and annual recurring revenue grew by 23.6%, reflecting improving momentum in its business.

From 2020-2024, AvePoint achieved a 28% CAGR in its annual recurring revenue to reach US$327 million in 2024.

Improving margins

From 2021 to 2024, AvePoint’s non-GAAP operating margin rose from 3.1% to 14.4%. This was largely driven by stronger operating leverage, with Sales & Marketing expenses reduced from 44.3% to 34.3% of revenue over the same period.

Meanwhile, investment in Research & Development increased from 8.4% to 12.2%, underlining AvePoint’s ongoing focus on innovation and long-term product development.

General & Administrative expenses also declined from 18.4% to 14.7%, benefiting from economies of scale and tighter operational controls.

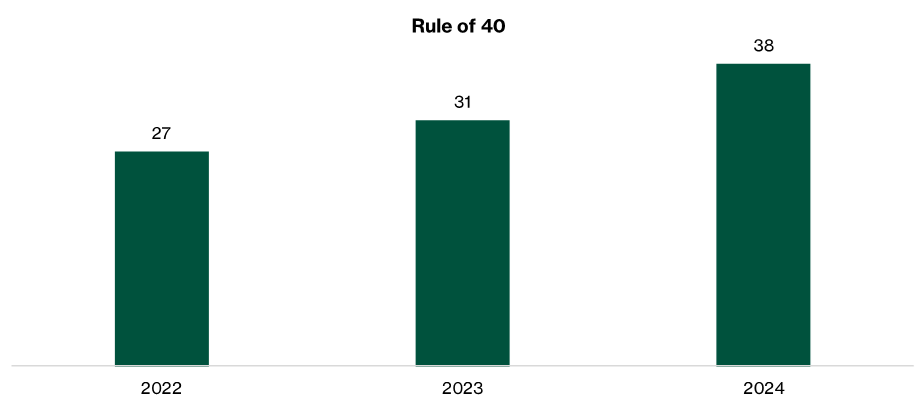

Close to Rule of 40 benchmark

AvePoint is nearing the SaaS industry’s Rule of 40 benchmark, with its 2024 score reaching 38%, up from 31% in 2023.

This metric, which combines ARR growth with operating margin, highlights the company’s progress in balancing growth with profitability.

AvePoint targets US$1 billion ARR in FY29

AvePoint has set a target of reaching US$1 billion in Annual Recurring Revenue (ARR) in 2029, supported by a rapidly expanding addressable market projected to grow to US$99 billion by 2028.

This growth is being driven by accelerating demand for data intelligence, security, and AI-ready infrastructure. To achieve this milestone, AvePoint is focused on scaling its interoperable Confidence Platform, deepening cross-sell opportunities within its customer base, and expanding its channel ecosystem—aiming to generate 75% of ARR through channel partners.

The company also plans to diversify beyond its core Microsoft ecosystem by increasing integrations with platforms such as Google Cloud and AWS, broadening its market reach.

Additionally, AvePoint is pursuing a measured M&A strategy to strengthen its capabilities and extend its global footprint.

In parallel with top-line growth, AvePoint has a long-term operating margin target of 27.5%. This reflects a disciplined focus on profitable growth, underpinned by increasing scale, a high proportion of recurring revenue, and ongoing improvements in operational efficiency.

Key Risks

Key risks include significant exposure to Microsoft ecosystem, macroeconomic uncertainty, competition, amongst others.

- Significant exposure to Microsoft ecosystem: A key risk for AvePoint lies in its substantial reliance on the Microsoft ecosystem. This tight integration has been a core growth driver, capitalising on widespread adoption of Microsoft’s cloud collaboration tools. However, it also introduces platform concentration risk. Any material changes to Microsoft’s product roadmap, partner strategy, or native feature offerings could potentially reduce AvePoint’s relevance, limit pricing flexibility, or create competitive headwinds.

- Competitive Pressure in the SaaS Ecosystem: AvePoint operates in a highly competitive environment. This intense competition can lead to pricing challenges, longer sales cycles, and reduced differentiation.

- Macroeconomic Headwinds and Budget Constraints: Ongoing macroeconomic uncertainty—including inflationary pressures, elevated interest rates, and concerns about a potential global slowdown—may lead organisations to scale back IT spending.

- Cybersecurity and Data Integrity Risks: As a provider of data governance and compliance solutions, AvePoint’s reputation and customer trust are closely tied to the security of its platform. A cybersecurity breach could have significant financial and reputational repercussions, including regulatory fines and customer attrition.

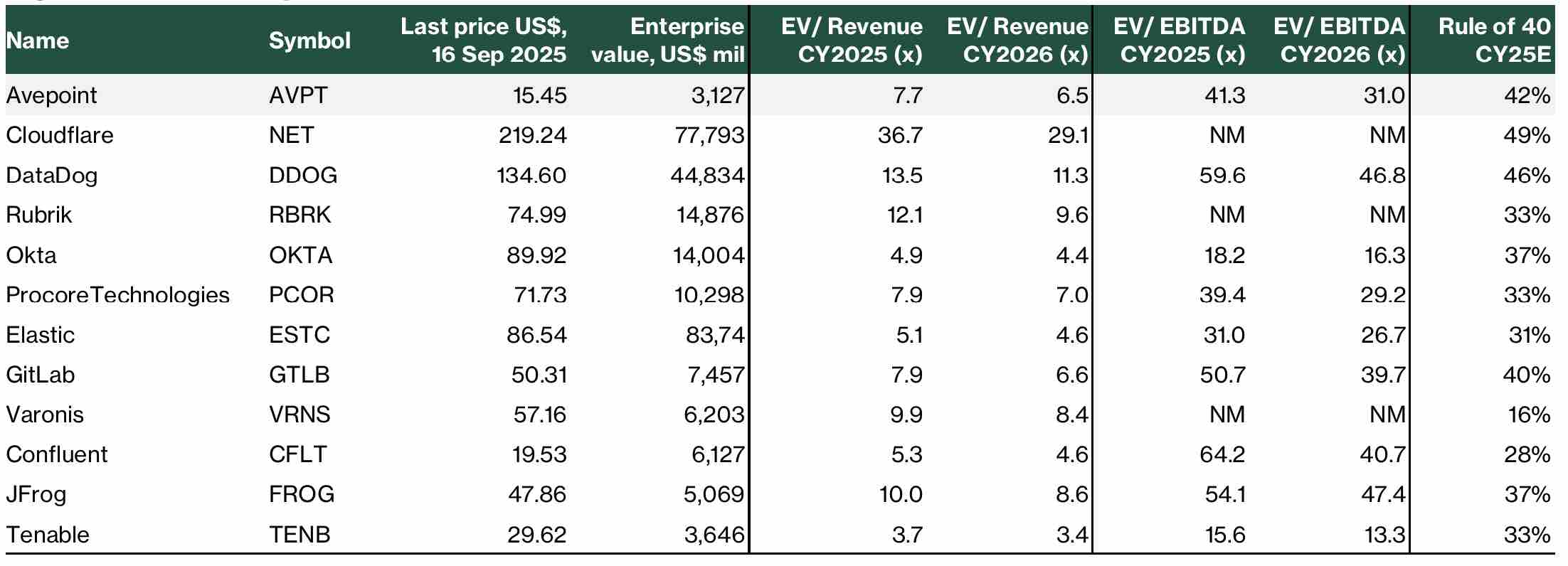

Trading at 2026 EV/Revenue multiple of 6.5x

At a share price of US$15.45 on 16 September 2025, AvePoint’s Nasdaq-listed stock (AVPT) is valued at 7.7x 2025 Enterprise Value-to-Revenue (EV/Revenue) and 6.5x 2026 EV/Revenue.

On an earnings basis, it trades at 41.3x 2025 EV/EBITDA and 31.0x 2026 EV/EBITDA.

Find out key operational and valuation metrics to evaluate SaaS companies in this guide for investors.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to invest in AvePoint.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Beansprout was appointed by Singapore Exchange Limited via a third party platform provider and received monetary compensation from SGX via such third party platform provider to provide independent research. Beansprout is solely responsible for the contents of this document. Singapore Exchange Limited and/or its affiliates, including Singapore Exchange Regulation Pte. Ltd. (collectively, SGX Group Companies) assume no responsibility (whether under contract, tort (including negligence) or otherwise), directly or indirectly, for the contents of this document. The general disclaimers and jurisdiction specific disclaimers found on SGX’s website at http://www.sgx.com/terms-use are also incorporated into and applicable to this document.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments