CapitaLand China Trust - Lower DPU after divesting retail asset

REITs

By Gerald Wong, CFA • 09 Feb 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

CapitaLand China Trust reported FY2025 DPU at 4.82 cents, down 14.7% year-on-year, following the divestment of CapitaLand Yuhuating.

Lower distribution per unit after divestment

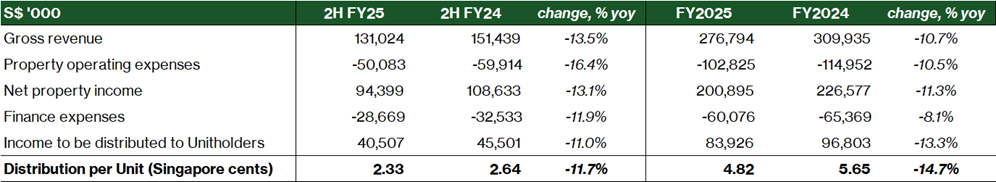

Distribution per unit (DPU) decreased by 11.7% year-on-year to 2.33 cents in 2H FY25. This includes 0.03 cent in distribution top-up. The FY2025 distribution top-up effectively replaced the income lost from the divestment of CapitaMall Yuhuating, keeping DPU from falling more sharply. The distribution top up will be funded by debt with minimal impact to the gearing ratio which will increase by 0.1x.

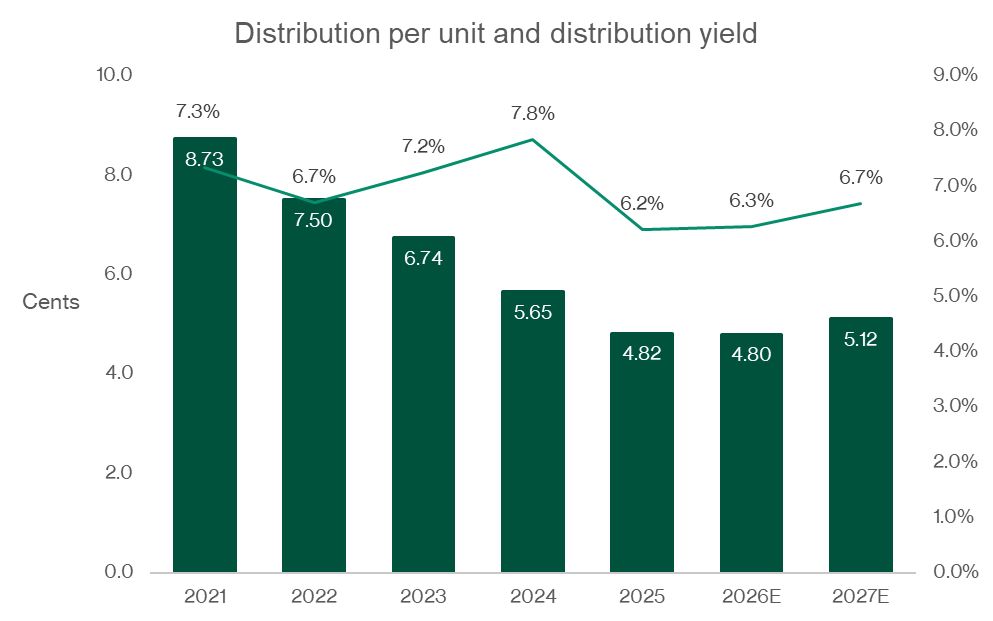

For the full year FY2025, DPU fell 14.7% year-on-year to 4.82 cents, translating to a distribution yield of 6.2% based on the closing price of S$0.78 as at 5 February 2026.

Weaker financial performance due to operating headwinds

CapitaLand China Trust reported 13.5% year-on-year decline in revenue to S$131.0 million in 2H25. The lower revenue was due to sale of CapitaMall Yuhuating and asset enhance initiatives (AEI) downtime. Several malls which were under asset enhancement works reported lower rental. Business parks also weighed on the top line as leasing conditions stayed soft, with weaker demand and lower renewal rents. Logistics held up better and provided some stability, but it was not large enough to offset the declines. On top of that, a weaker renminbi reduced the SGD value of earnings.

Net property income fell by 13.1% year-on-year to S$94.3 million in 2H25, due to slower leasing and lower rent renewals in business parks. For the full year FY2025, net property income decreased by 11.3% year-on-year due to absence of contribution from Yuhuating. This was partially offset by cost reduction of 4.3% year-on-year on same store basis.

Interest expense decreased by 8.1% year-on-year to S$60.0 million in FY2025, led by continual increase in proportion of RMB denominated debt.

Portfolio performance improving gradually

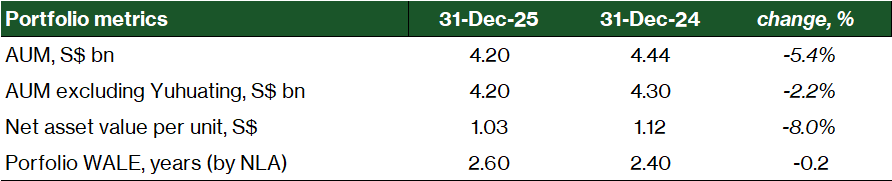

Weighted average lease expiry (WALE) improved to 2.6 years as at 31 December 2025, from 2.4 years as at 31 December 2024.

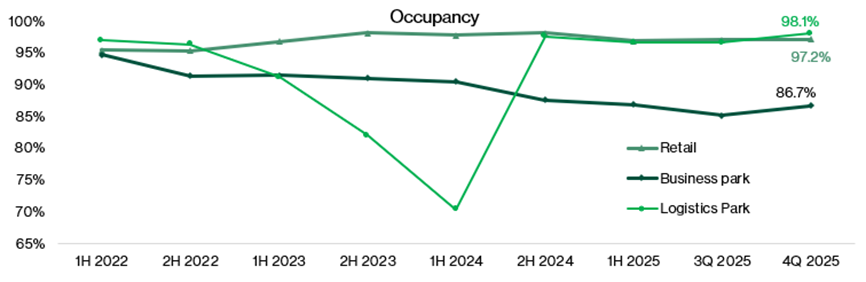

The REIT maintained strong occupancy levels overall, with retail properties holding up best at around 97.2%.

Business parks saw occupancy dip to 86.7%, reflecting continued leasing softness in office and business park space. Management has been signed new lease with two major electronics and ICT tenants for Ascendas Innovation Towers.

Logistics parks continued to deliver very high occupancy at 98.1%, supported by strong demand from distribution and e-commerce tenants.

The valuations as at 31 December 2025 fell by 5.4% year-on-year to S$4.2 billion. The decline reflects the sale of Yuhuating. On a like-for-like basis, the portfolio valuation declined 2.2% year-over-year.

Updates on retail portfolio, shopper traffic and tenant sales

Shopper traffic up 2.7% in FY2025 and 4.1% in 4Q 2025. Tenant sales rose 2.1% in FY2025 and a stronger 4.8% in 4Q 2025, signalling improving momentum into year end. Sales in key trade sectors continued to improve, with Toys & Hobbies, Jewellery & Watches, Information & Technology and Food & Beverages growing 52.3%, 18.3%, 9.3% and 5.8% year-on-year, respectively.

Tenant health also improved with occupancy cost falling to a healthy level at 17.5%, giving the trust more room to stabilise rents and rebuild income as consumer sentiment in China continues to normalise.

The asset enhancement initiatives at CapitaMall Xizhimen, Rock Square, CapitaMall Wangjing and CapitaMall Xuefu have completed. With the opening phased in, performance of the retail portfolio could improve moderately in 2026.

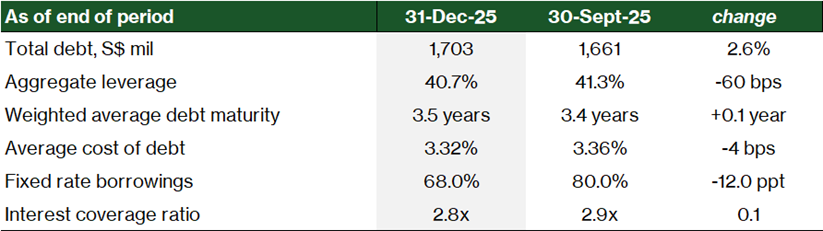

Healthy balance sheet

The debt maturity profile looks well laddered. Only 6.7% of total debt falls due in 2026, rising gradually to a peak in 2029 at 26.9% before tapering off again, which gives management time to refinance opportunistically or adjust the currency of funding. The mix of SGD and RMB borrowings across bank loans and bonds also spreads funding sources, reducing reliance on any one market while keeping currency exposure aligned with the underlying China-focused assets.

In FY2025, the REIT has increased the proportion of RMB denominated debt from 35% to 60%, above the 50% guided earlier. By refinancing SGD loans with CNH loans, the REIT registered interest costs savings of 8.1%.

Gearing declined to 40.7% as at 31 December 2025, from 41.3% as at 30 September 2025. CapitaLand China Trust maintains adequate liquidity with S$250.0 million of available undrawn committed facilities.

Cost of debt declined to 3.32% as at 31 December 2025, from 3.36% as at 30 September 2025.

In order to diversify the funding sources and reduce cost of debt, the REIT has been switching to RMB denominated debt by refinanced SGD loans with CNH loans. Proportion of RMB denominated debt increased to 60% as at 31 December 2025, from 35% as at 31 December 2024. Going forward, the REIT plans to increase the proportion of RMB to match its RMB-based operations.

Maintain BUY and target price at S$0.88

Currently, CapitaLand China Trust is trading at S$0.88, implying FY25 distribution yield of 6.2%. Comparing with other commercial REITs, CapitaLand China Trust offers an attractive distribution yield.

Click here to download the full report.

Related links:

- CapitaLand China Trust share price and share price target

- CapitaLand China Trust dividend history and forecast

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in CapitaLand China Trust.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments