Centurion Accommodation REIT - Visible growth and attractive dividend yield

REITs

By Gerald Wong, CFA • 25 Sep 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Centurion Accommodation REIT is Singapore's first pure-play purpose-built living accommodation REIT. Based on the IPO price of S$0.88, Centurion Accommodation REIT offers a projected dividend yield of 7.5% for 2026.

What happened?

There has been more listings on the SGX recently.

In July, we saw the listing of NTT DC REIT, Singapore’s largest REIT IPO in a decade.

We also shared about the upcoming listing of the LionGlobal Short Duration Bond Fund (Active ETF SGD Class).

I have seen much discussion about the listing of Centurion Accommodation REIT. Investors in Singapore looking for passive income might be familiar with the Singapore REITs sector.

Centurion Accommodation REIT is Singapore's first pure-play purpose-built living accommodation REIT. This has led to questions in the Beansprout community about the fundamentals of the segment, as well as key drivers to look out for before investing in the REIT.

Let us dive deeper to understand more about Centurion Accommodation REIT, including its portfolio, risks and projected dividends.

Centurion Accommodation REIT - A pure-play on purpose-built accommodation

Centurion Accommodation REIT is the first pure-play purpose-built accommodation REIT listed on the SGX.

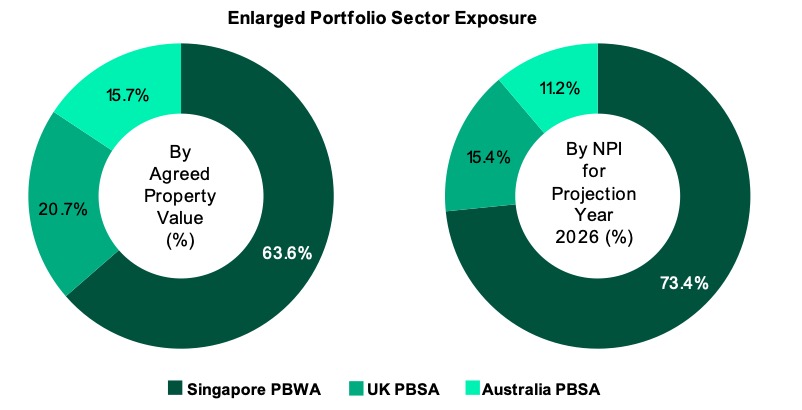

Centurion Accommodation REIT’s initial portfolio consists five purpose-built worker accommodation (PBWA) assets located in Singapore, eight purpose-built student accommodation (PBSA) assets located in the UK, and one PBSA asset located in Australia. In total, the 14 assets are valued at S$1.8 billion.

Centurion Accommodation REIT has entered into a forward purchase agreement to acquire Epiisod Macquarie Park, a PBSA asset in Australia.

Following the completion of the acquisition, which is subjected to conditions and expected on or around February 2026, the enlarged portfolio of Centurion Accommodation REIT will consist of 15 assets valued at S$2.1 billion.

|

Source: Company Data |

Centurion Accommodation REIT is sponsored by Centurion Corporation Limited, a specialised accommodation owner-developer-operator with a global platform and listed on the SGX since 1995.

Strong operating metrics and track record of the sponsor

The Initial Portfolio recorded a PBWA occupancy rate of 96.9% and a PBSA occupancy rate of 96.8% for the three months ended 31 March 2025.

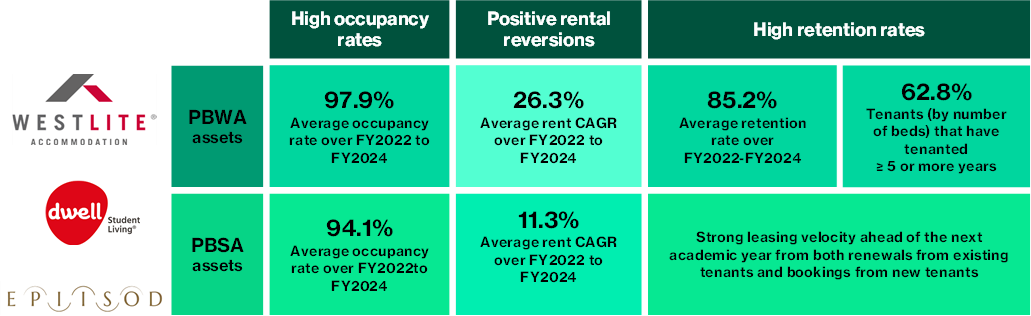

Through active management and operational discipline, the assets have delivered strong operating performance. Its PBWA properties in Singapore achieved an average occupancy of 97.9% between FY2022 and FY2024, with renewals typically secured more than three months before lease expiry.

During the same period, PBWA rents grew at a 26.3% CAGR, supported by high tenant loyalty, with 85.2% retention and nearly 63% of beds occupied by tenants for at least five years.

The PBSA assets also showed resilience, recording a 94.1% average occupancy and 11.3% rent CAGR over FY2022–FY2024, underpinned by strong pre-leasing each academic year and a balanced mix of renewals and new bookings.

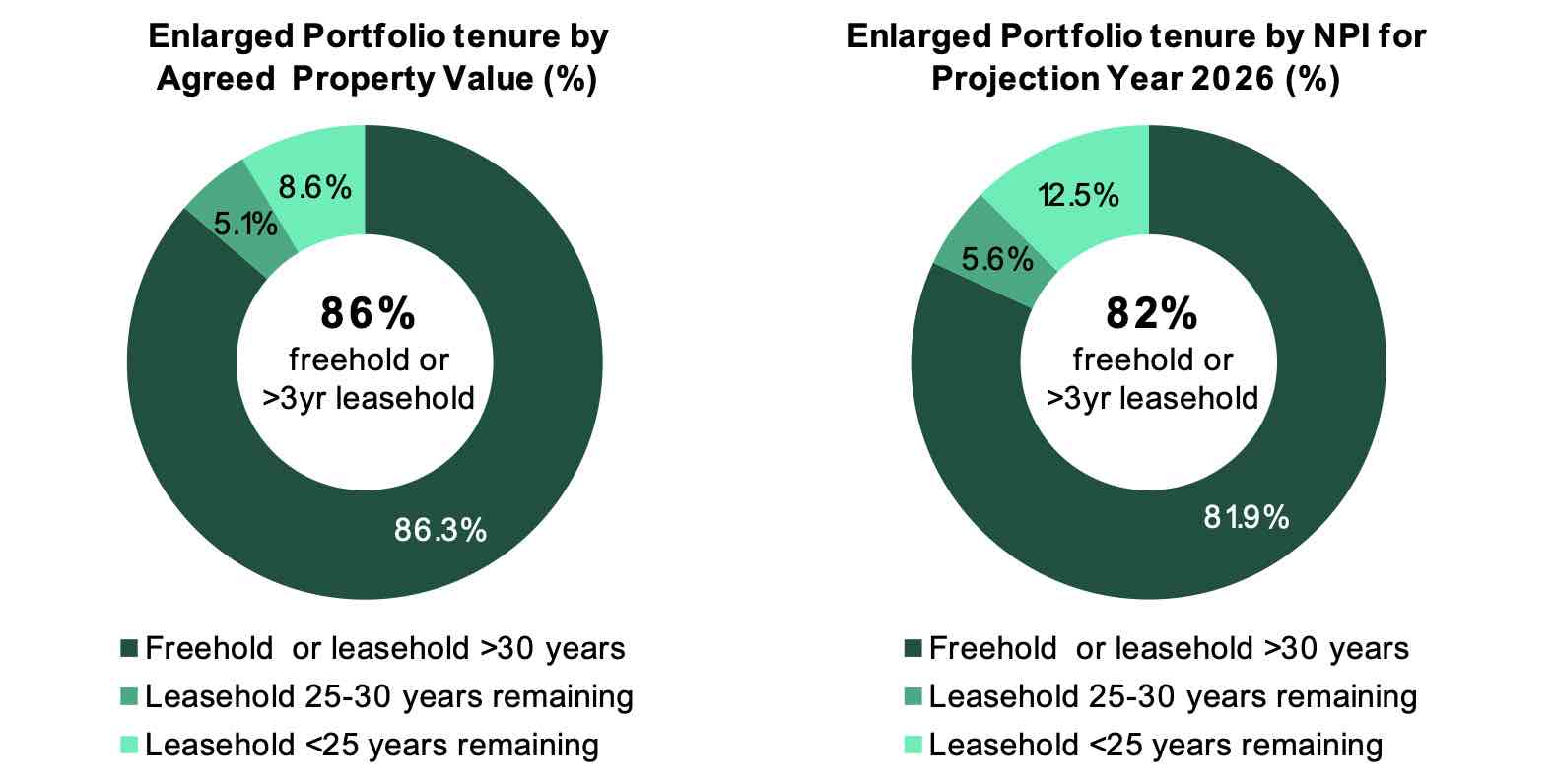

High proportion of freehold or leasehold assets of more than 30 years

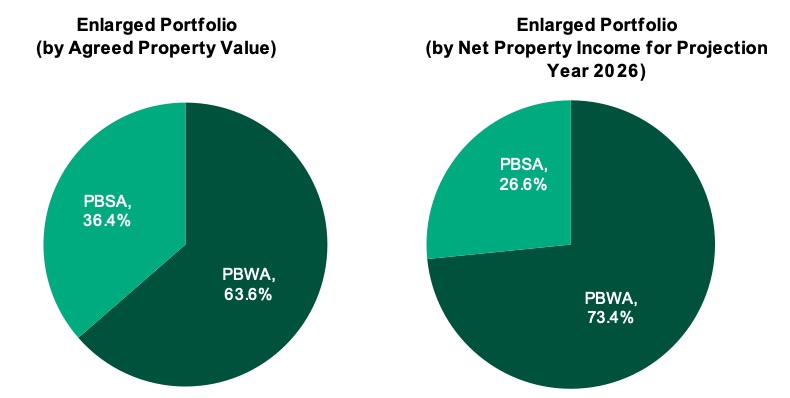

The enlarged portfolio of Centurion Accommodation REIT comprises 86.3% property value of assets that are freehold or leasehold of more than 30 years and 81.9% by FY2026 Net Property Income (NPI).

Attractive end market exposure to the PBWA and PBSA sectors

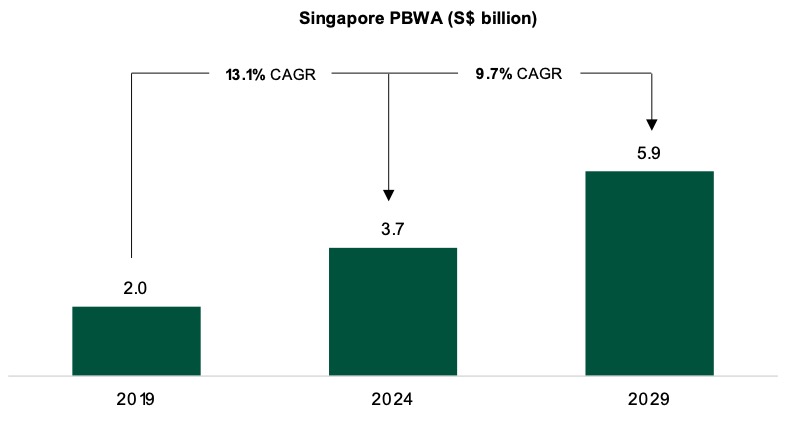

The Singapore PBWA market remained resilient during the pandemic, with market size growing at a CAGR of 13.1% from 2019 to 2024. Looking ahead, the market is projected to expand at a 9.7% CAGR to reach S$5.9 billion by 2029.

Demand is underpinned by government infrastructure and private-sector projects that require a large foreign workforce, while dormitory supply remains tightly regulated. The number of CMP work permit holders is expected to rise to 515,495 by 2029, representing a 2.4% CAGR over 2024–2029.

On the supply side, PBWA bed capacity was 225,700 in 2024 and is forecast to grow modestly at a 1.0% CAGR over the same period. With the completion of ongoing projects, total bed capacity is projected to reach 150,300 beds by end-2029, reflecting a 3.8% CAGR.

JLL projects rental growth of 3–4% annually through 2029, taking rents to between $570 and $630 per bed per month, with occupancy consistently above 95%.

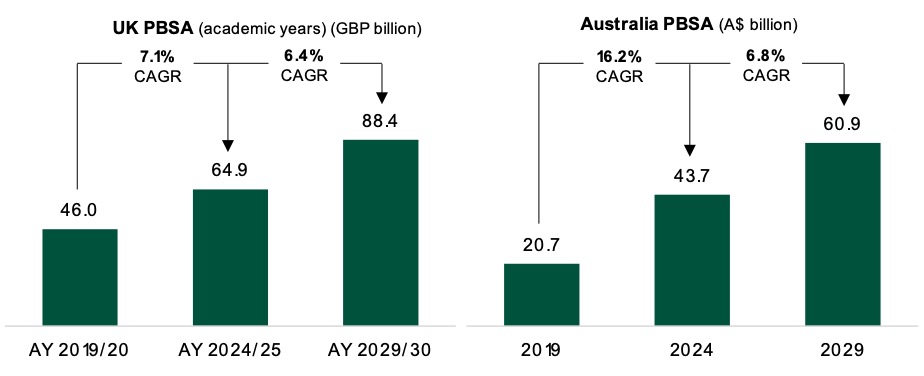

The PBSA markets in the UK and Australia also show favourable fundamentals. According to the 2025 Global Education Report, the UK and Australia rank as the second and third most attractive destinations for higher education.

In the UK, full-time higher-education enrolments continue to rise while supply of purpose-built student housing remains limited, supporting projected rental growth of about 3.9% CAGR through 2029.

In Australia, demand for PBSA is driven primarily by international students, who make up around 74% of the market. With international student inflows rebounding post-pandemic, PBSA rents are expected to increase at around 5% CAGR over the same period.

Visible inorganic growth pipeline

To support near-term growth, Centurion Accommodation REIT has signed a Forward Purchase Agreement to acquire Epiisod Macquarie Park, a PBSA asset in Australia. The acquisition will be fully funded through existing committed loan facilities.

To provide steady rental income, the REIT will lease the properties to Centurion Properties Pte. Ltd. (CPPL), along with the Sponsor, under an agreement that runs until 31 December 2027. The arrangement includes safeguards such as a two-month rent deposit and the Sponsor’s guarantee.

The property, which is currently under construction, will only be acquired after practical completion is achieved, expected around February 2026 and no later than six months following the prospectus registration date.

With the completion of the acquisition of Epiisod Macquarie Park, the Enlarged Portfolio, comprising the Initial Portfolio and Epiisod Macquarie Park, will comprise 15 Properties with an appraised value of S$2,118.4 million.

Centurion Accommodation REIT has a global ambition to own a portfolio of quality accommodation assets mainly serving the PBWA and PBSA purposes. Beyond the forward purchase of Epiisod Macquarie Park, Centurion Accommodation REIT had adopted a multi-pronged growth strategy.

It benefits from a right of first refusal (ROFR) on suitable assets owned by its sponsor, ensuring a pipeline of potential acquisitions aligned with the REIT’s mandate. Centurion Accommodation REIT’s sponsor is Centurion Corporation Limited (OU8.SI). Centurion is an established accommodation owner-developer-operator, managing 37 operational accommodation assets totalling 70,291 beds across six countries globally (as at 30 June 2025). As of end-April 2025, the sponsor is the largest PBWA operator in Singapore.

Centurion Accommodation REIT has been granted the right of first refusal (ROFR) on a strong pipeline of assets owned by the Sponsor, valued at S$2.6 billion. Going forward, potential acquisitions of these assets will support Centurion Accommodation REIT’s inorganic growth.

On the development front, the REIT plans for continued asset enhancement and redevelopment. By implementing selective asset enhancement initiatives, Centurion Accommodation REIT could achieve organic growth in the bed capacity.

Ample debt headroom to drive future growth opportunities

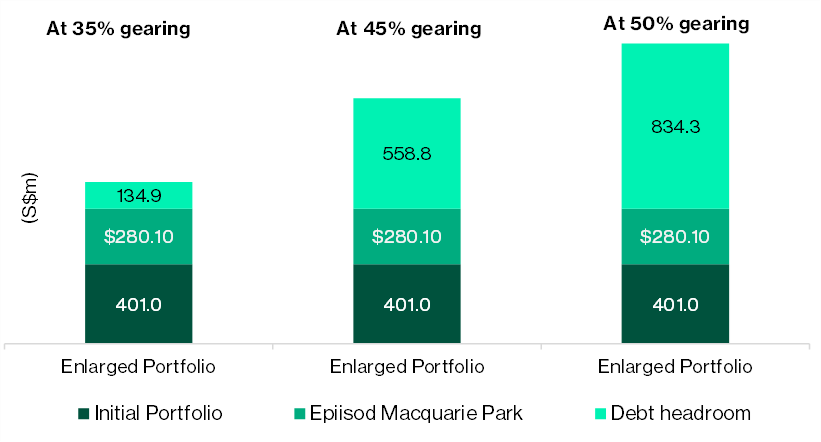

At the time of its IPO, Centurion Accommodation REIT will have a low leverage ratio of 20.9%. Following the planned acquisition of Epiisod Macquarie Park, this leverage is projected to increase to 31.0%.

Importantly, the REIT retains substantial debt headroom, with capacity to raise up to S$558.8 million in additional borrowings before reaching a gearing of 45% leverage. This financial flexibility positions the REIT to pursue future growth opportunities while maintaining prudent capital management.

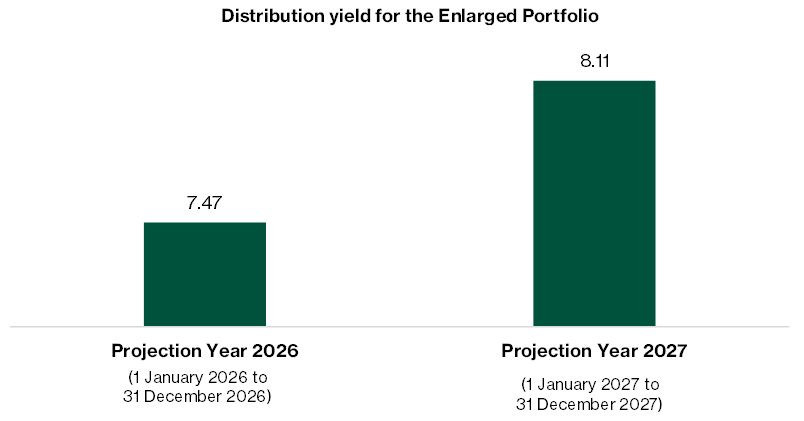

Projected distribution yield of 7.5% for 2026

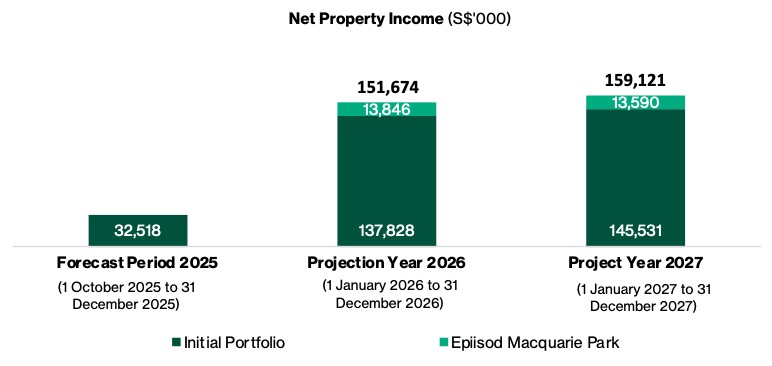

The net property income (NPI) of the enlarged portfolio of Centurion Accommodation REIT is projected by the manager to be S$151.7 million in projection year 2026 (1 January 2026 to 31 December 2026), assuming that Epiisod Macquarie Park is acquired on 1 January 2026.

The corresponding distributable income is projected at S$113.6 million. The net property income (NPI) is projected by the manager to increase 9.5% year-on-year S$159.1 million in projection year 2027 (1 January 2027 to 31 December 2027), driven by the full-year contribution from Epiisod Macquarie Park.

Based on the net property income projections and IPO price of S$0.88, Centurion Accommodation REIT offers a projected distribution yield of 7.5% for 2026 and 8.1% for 2027.

Centurion Accommodation REIT’s projected yield is higher than the yield of other REITs and business trusts in the broader living sector, including Far East Hospitality Trust (7.0%), CapitaLand Ascott Trust (6.6%) and CDL Hospitality Trust (6.0%), with a significantly lower gearing level.

Key risks for Centurion Accommodation REIT

#1 – Concentrated exposure to two key assets, Westlite Toh Guan and Westlite Mandai

While the enlarged portfolio of Centurion Accommodation REIT comprises 15 assets, two key assets, Westlite Toh Guan and Westlite Mandai is projected to represent 26.2% and 25.4% of Net Property Income (NPI) of the REIT in projection year 2027 respectively.

Collectively, the two assets represent more than half of the NPI of the REIT, with future distributions subject to the leasing conditions of these assets and any associated asset-specific risks.

Moreover, there are plans to redevelop three of the existing blocks at Westlite Toh Guan by demolishing them and constructing a new mega block in their place.

The Westlite Toh Guan works are expected to commence around 2029 and be completed by December 2030, which may result in future downtime when the redevelopment works commence.

#2 – Leasehold interests in Singapore properties

Since the Singapore properties are held on leasehold terms, their lease periods will gradually decrease and ultimately expire.

When these leases end, Centurion Accommodation REIT will be required to return the properties to the President of the Republic of Singapore, JTC, or private lessors.

As the remaining lease term shortens and properties are surrendered, the REIT's net asset value (NAV) could decline in the future as the properties approach the tail end of their leases, potentially leading to a decrease in the value of its units.

86% of the enlarged portfolio by agreed property value comprises assets which have land titles which are either freehold or leasehold of more than 30 years.

However, Westlite Toh Guan and Westlite Mandai, collectively representing 45% of the portfolio value, have a remaining leasehold of around 32-33 years.

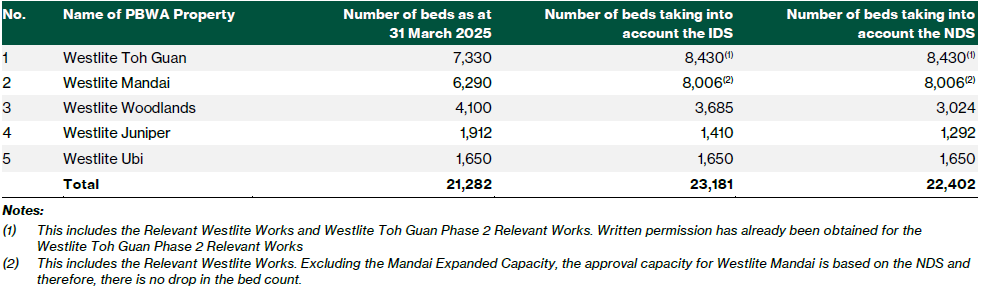

#3 – Impact of Interim Dormitory Standards and New Dormitory Standards

The COVID-19 outbreak in Singapore prompted authorities to tighten regulatory standards for purpose-built dormitories.

New dormitory applications submitted after 18 September 2021 must comply with the New Dormitory Standards (NDS).

Existing dormitories approved before this date are required to meet the enhanced Interim Dormitory Standards (IDS) by 2030 under the Dormitory Transition Scheme (DTS), with full compliance to NDS required by 2040.

While IDS requirements are less extensive than NDS due to infrastructure constraints, operators will still need to undertake retrofitting and adjustments to meet regulatory timelines.

Number of beds under the PBWA portfolio under IDS and NDS scenarios

#4 – Payment of REIT management fees in units rather than in cash

For Forecast Year 9M25/26 and Projection Year FY26/27, it has been assumed that the REIT manager will receive 100% of the Base Fee and 100% of the Performance Fee in units, rather than in cash.

This may lead to potential future dilution for unitholders, as more units are issued, though near-term distributions would be higher as a result.

Initiate with Buy and Target Price of S$1.09

We like Centurion Accommodation REIT for its attractive projected yields, ample debt headroom with gearing at 31.0%, and potential for yield compression given its unique positioning as a pure-play living sector REIT.

The REIT provides investors with direct exposure to the PBWA and PBSA sectors, supported by Centurion, a leading PBWA operator in Singapore.

Over time, the platform could expand into other accommodation segments such as build-to-rent, co-living, and senior housing.

Centurion Accommodation REIT also offers income visibility, underpinned by consistently high occupancy, strong tenant retention, and positive rental reversions, reflecting the robust fundamentals across both PBWA and PBSA markets. Growth in distributions is supported by the forward purchase of Epiisod Macquarie Park in Australia, alongside upside potential from the Mandai Expanded Capacity, which is not yet included in the enlarged portfolio.

We derived the target price of S$1.09 per unit based on the dividend discount model, assuming a cost of equity of 8.7% and terminal growth rate of 1.0%. Based on our target price of S$1.09, Centurion Accommodation REIT will offer a distribution yield of 6.0% for 2026.

Learn more about Singapore REITs here.

Download the full report here.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Centurion Accommodation REIT.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments