CSE Global - Positioned for structural capex growth

By Ng Hui Min • 28 Jan 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

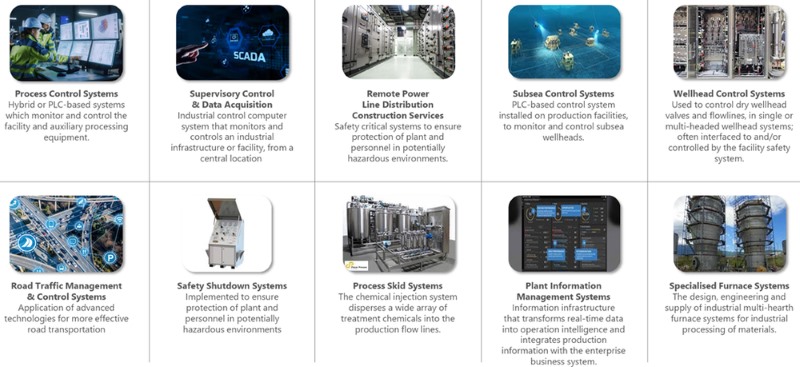

CSE Global provides electrification, critical communications and automation solutions for data centres, utilities and energy, industrial sites and infrastructure, delivering end to end execution from design and procurement through commissioning and maintenance.

Singapore-listed global systems integrator

About CSE Global

CSE Global is a global systems integrator that designs, builds and maintains electrification, communications and automation solutions for customers in data centres, utilities and energy, industrial sites and broader infrastructure.

In simple terms, it helps customers keep complex facilities running safely and reliably by integrating multiple systems into a single end to end solution, covering engineering and procurement, installation, testing and commissioning, and ongoing maintenance.

Strategic repositioning toward data centres and infrastructure

In 2025, management has sharpened its strategic focus on higher growth, longer cycle markets, particularly data centres and general infrastructure, as demand rises for power and reliable digital infrastructure driven by AI and cloud expansion.

At the same time, management is reducing its emphasis on securing new large scale greenfield water and wastewater treatment projects, citing weaker risk reward and less attractive payment and margin outcomes.

Segment mix supports both growth and resilience

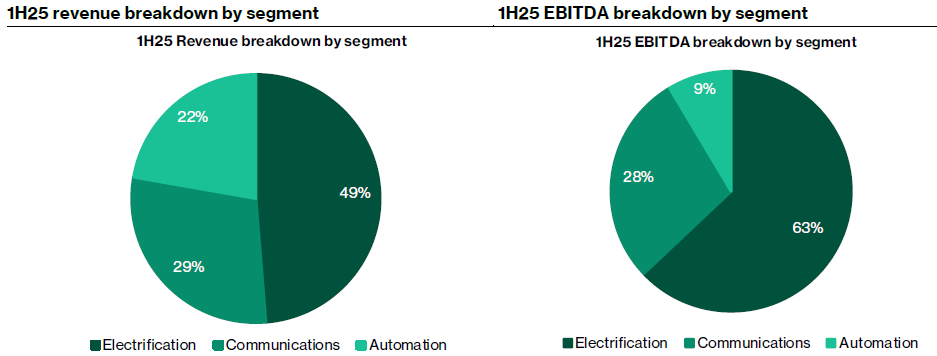

CSE’s segment mix is increasingly geared toward structural growth through Electrification, while Communications provides a steadier recurring.

Communications segment is structurally different from Electrification, with a less project heavy model and a higher mix of recurring revenue from maintenance, time and materials work, equipment rental and ongoing network and radio support.

Management noted that a meaningful portion of Communications orders are short cycle and may not be fully reflected in the order book because they are booked and completed within the same month, which supports a more stable run rate profile.

Automation serves customers with industrial automation and process control needs, typically through smaller modular packages.

Revenue is more service-oriented and includes a meaningful share of time and materials work, with CSE supporting day to day operational reliability through upgrades, troubleshooting, integration and ongoing support.

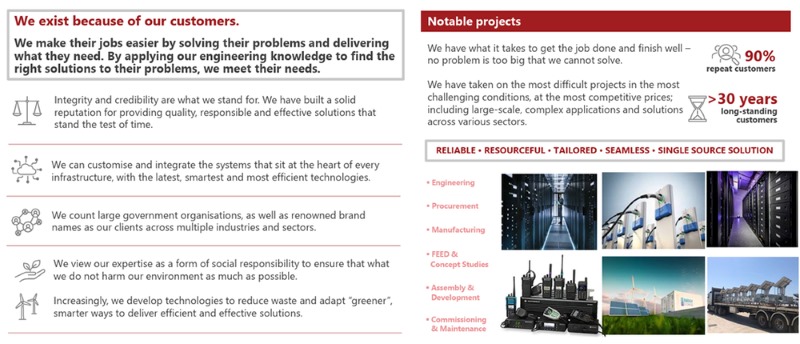

Around 90% of CSE’s clientele are repeat customers, including relationships spanning over 30 years. About 67% of revenue comes from recurring flow work such as maintenance, brownfield projects and quick turnaround jobs, supporting a resilient earnings base.

Electrification: largest segment and key growth engine

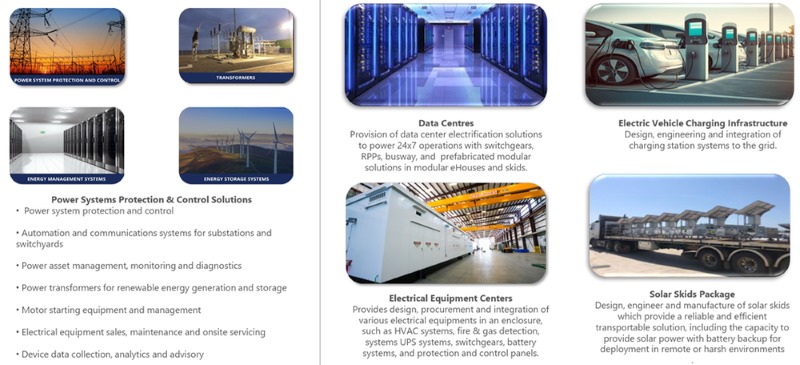

Electrification is CSE’s largest segment, spanning the design, engineering, procurement and integration of electrical distribution and power systems for data centres, industrial/manufacturing and utility/energy applications.

The company highlights a data-centre capability set supporting 24×7 operations, including switchgear, remote power panels, busways and prefabricated modular solutions such as e-houses and skids.

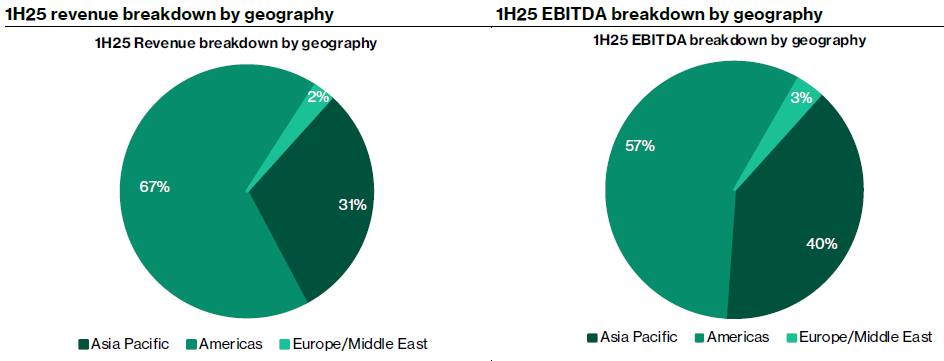

In 2025, management has reinforced Electrification as the primary growth driver, supported by robust demand from data centres and utilities, particularly in the U.S., and has signalled plans to expand capacity to capture opportunities in power distribution and complex electrical systems integration for AI and data centre infrastructure.

This includes initiatives such as securing additional industrial space and land to support future expansion, with management indicating an ambition to more than triple capacity by 2027/2028 to meet demand.

As part of this pivot, CSE is reducing its emphasis on securing new large-scale, greenfield water and wastewater treatment projects, while continuing to execute existing multi-year contracts, including a major ~US$87.3m U.S. wastewater programme that is being delivered across 2023–2027 and is expected to support earnings through completion.

In FY2024, Electrification revenue increased 30.0% year-on-year to S$434.8m, attributed to growth in the data centre, power, utility and energy storage markets and rising demand for power distribution and electrical control systems in the USA and Australia/New Zealand.

Electrification EBITDA rose from S$29.7m in FY2023 to S$42.7m in FY2024, with segment EBITDA margin improving from 8.9% to 9.8%.

In 1H2025, Electrification revenue was broadly stable at S$214.8m (–0.9% YoY), with FX highlighted as a factor in reported performance.

Electrification EBITDA rose 14.4% YoY to S$24.8m, supported by stable gross margins and a one-off gain on disposal of an asset held for sale (S$5.5m), partly offset by higher expansion-related operating costs and higher depreciation following a sale-and-leaseback arrangement.

Consistent with the group’s 2025 strategic shift, management has indicated it will prioritise data centre and general infrastructure-related opportunities for new wins, while allowing legacy water/wastewater exposure to run off as existing multi-year projects complete (around 2027 for the large U.S. wastewater programme).

Communications: more recurring, run rate-oriented segment

Communications provides solutions across two-way radio, conventional and trunked radio systems, satellite communications (VSAT), fibre optic systems and microwave radio systems.

The company also highlights functionality that supports workforce safety and operational resilience, such as personnel tracking and “man down” alerts within two-way radio deployments.

In 2025, Communications remains a key pillar of the group’s infrastructure positioning, with management emphasising integrated safety, security and communications systems that enhance situational awareness and operational safety.

The group continues to leverage partnerships with major manufacturers (e.g., Motorola Solutions) to deliver interoperable communication systems for mission-critical environments.

In FY2024, Communications revenue increased 5.2% YoY to S$232.0m, driven by contributions from acquired subsidiaries.

Communications EBITDA declined 7.8% YoY to S$25.6m, which management attributed to an unfavourable sales mix at lower gross margins in international communications businesses.

In 1H2025, Communications revenue rose 12.7% YoY to S$128.0m, with the company attributing growth mainly to newly acquired subsidiaries.

Communications EBITDA was S$11.2m (+0.3% YoY), while EBITDA margin fell by 1.1pp, which management linked to an unfavourable mix, particularly in Australia and New Zealand.

Operationally, the Communications segment also recorded notable business development progress in 2025. In April 2025, CSE’s U.S. subsidiary secured orders worth ~US$15m to provide critical communications services, including two-way radio systems and Distributed Antenna Systems (DAS), to a major data centre hyperscaler across the Americas, Asia-Pacific and Europe.

CSE also completed the acquisition of Chicago Communications LLC in April 2025, further strengthening its U.S. footprint and capabilities in integrated voice, video and data solutions for public safety and critical infrastructure end-markets.

The group also remained active in industry engagement, with its subsidiary CSE Crosscom exhibiting at Critical Communications World (CCW) 2025 in Brussels (17–19 June 2025) and participating in other relevant industry events including THETA 2025 in Australia, supporting brand presence and pipeline development.

CSE expects the Communications segment to remain a growth contributor, led by critical communications solutions in the US and Australia. Management highlighted that its strategy is acquisition-led, with around 15 to 18 acquisitions completed in Australia, building a network of roughly 16 to 17 operating locations.

In the US, CSE entered roughly three years ago and has expanded across four states including Florida, California, Illinois and Indiana.

Management noted that a key value driver in its past acquisitions has been access to spectrum, which is often obtained through acquiring businesses that already hold the relevant licences and rights.

The customer base for critical communications solution is anchored by government-related users such as public safety agencies, transport-related bodies and infrastructure operators, where reliability and security requirements are high.

Product scope is expanding beyond traditional two-way radio into adjacent areas such as body-worn cameras, integration into surveillance systems, and video analytics.

Management also noted increasing orders from US schools and colleges, and stressed that local technical support is a key differentiator, with technical teams typically retained and scaled following acquisitions.

The management reiterated that for many end-users, critical communications has limited substitution given safety, compliance and operational dependence.

Automation: smaller, service-oriented packages with lower ticket sizes

Automation serves customers with industrial automation and process control needs, typically through smaller, modular packages rather than large multi-year projects.

Revenue is more service-oriented and includes a meaningful share of time and materials work, with CSE supporting day to day operational reliability through system upgrades, troubleshooting, integration and ongoing support.

Management has noted that while the number of jobs has remained broadly stable, average contract values have declined, implying a steadier but lower ticket revenue profile for Automation in the near term.

In FY2024, Automation revenue rose 14.3% YoY to S$194.4m, driven mainly by higher revenue contributions from the Americas and Asia Pacific.

Segment EBITDA improved from S$6.2m to S$13.8m, which management attributed to more favourable mix and the absence of project cost overruns that occurred in FY2023; EBITDA margin increased from 3.6% to 7.1%.

In 1H2025, Automation revenue was S$98.1m (–0.5% YoY) while EBITDA declined 37.3% YoY to S$3.4m, attributed to write-offs of plant/equipment and technical know-how intangibles totalling S$5.1m.

Competitive strengths

Single source delivery for mission critical infrastructure

Customers engage CSE Global because the group is positioned as a single source systems integrator that can deliver end to end solutions for critical infrastructure.

CSE emphasises its ability to translate customer requirements into engineered solutions, supported by in house technical expertise and the capability to customise and integrate systems that sit at the heart of customer operations.

This matters most in complex projects where delivery certainty, safety and uptime requirements are high.

Execution track record and lifecycle coverage

CSE also highlights execution track record as a key differentiator. The company points to its experience in delivering large-scale, complex applications in challenging environments and at competitive price points, which helps reduce implementation risk for customers.

This is reinforced by customer stickiness metrics presented by the company, including a high repeat-customer base and long-standing relationships built over multiple decades, suggesting that customers value reliability and consistent project delivery over time.

Finally, customers benefit from breadth across the project lifecycle. CSE positions its offering as covering engineering, procurement, manufacturing, testing/commissioning and maintenance, which can simplify vendor management and improve accountability on delivery.

Focus on sustainability

The company also frames sustainability and “greener” innovation as an increasing component of its solution development, aligning with customer expectations for more efficient and responsible infrastructure outcomes.

Financial review

FY2024 results show strong growth with stable margins

FY2024 revenue increased 18.8% YoY to S$861.2m, driven mainly by Electrification and Automation.

Gross margin was stable at 28.0% (vs 27.6% in FY2023). The group reported higher operating expenses (up 15.8% to S$187.0m), mainly due to higher personnel costs, depreciation, and professional fees/computer expenses, while also indicating operating leverage supported profitability.

Net profit (excluding the exceptional arbitration settlement item) was S$36.8m, and net profit margin improved to 4.3% (from 3.1%).

1H2025 reflects mix and investment effects

In 1H2025, revenue rose to S$440.9m (+2.8% YoY) and gross profit was S$123.0m, implying gross margin of 27.9% (vs 27.6% in 1H2024).

Operating expenses increased 6.2% YoY to S$101.4m, driven mainly by higher personnel costs, building/equipment expenses and depreciation; operating profit declined to S$21.5m (–6.2% YoY).

Net profit attributable to shareholders increased to S$16.3m (+8.5% YoY).

Management attributed the key 1H2025 segment movements to: (i) Electrification EBITDA improvement driven by stable gross margins and a one-off asset disposal gain, offset by expansion-related opex and higher depreciation; (ii) Communications revenue uplift driven by acquisitions but margin pressure from mix; and (iii) Automation EBITDA pressure from write-offs.

3Q2025 update indicates strong Electrification momentum

CSE reported 3Q2025 revenue of S$257.7m (+20.5% YoY).

The group attributed Electrification growth to progressive revenue recognition from two major Electrification-related projects in the Americas secured in 2024.

Order intake was S$146.1m (–21.7% YoY), reflecting the absence of major Electrification and Automation orders booked in 3Q2024, while Communications order intake increased due to orders from recent acquisitions that expanded footprint and market coverage in the USA.

The order book was S$467.5m as at 30 Sep 2025.

In 2025, management has also reiterated a more selective approach to new order intake, de-emphasising new greenfield wastewater wins while prioritising data centre and general infrastructure opportunities for new orders going forward.

Balance sheet position

As at 30 Jun 2025, CSE reported cash and bank balances of S$49.4m (vs S$57.4m at 31 Dec 2024). The company disclosed loans and borrowings of S$140.4m and lease liabilities of S$40.9m.

Net debt increased to S$91.1m at end-Jun 2025 (vs S$72.1m at end-Dec 2024), with net gearing of 0.36x.

In 1H25, CSE reported a cash outflow from operating activities of S$27.4m, attributed to higher working capital tied up in projects.

Amazon strategic transaction

CSE disclosed that on 10 Nov 2025 it entered into a strategic transaction with Amazon.com, Inc. aimed at strengthening its commercial relationship and unlocking data-centre opportunities, with Amazon granted the right to acquire up to 62,968,580 shares through 2030.

As part of the transaction, CSE could potentially grant 62.97m warrants to Amazon at an exercise price of S$0.767/share, conditional upon Amazon awarding up to US$1.5bn of orders over five years; full exercise would result in 8% ownership and S$48.3m of cash proceeds to fund US expansion.

Strategically, management views this partnership as a catalyst to accelerate CSE’s participation in global data-centre buildouts, further anchoring the group’s shift toward AI-driven infrastructure demand.

Growth outlook

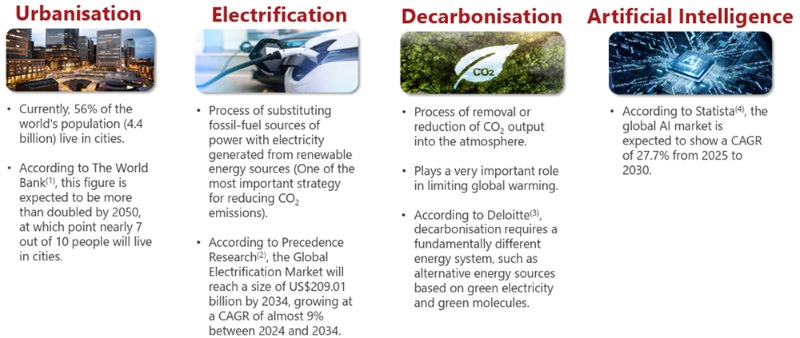

CSE frames its growth strategy around four structural themes, urbanisation, electrification, decarbonisation and artificial intelligence, which collectively underpin rising capex needs for resilient power, communications and automation infrastructure.

As cities expand and infrastructure density increases, customers typically require higher reliability electrical distribution, monitoring and safety systems.

In parallel, electrification and decarbonisation are driving upgrades to power systems and grid-linked infrastructure as customers shift toward cleaner energy and higher-efficiency operations.

Finally, the proliferation of AI workloads is accelerating demand for power-dense, always-on digital infrastructure, which raises requirements for robust electrical systems and mission-critical connectivity.

In 2025, management’s near- to medium-term execution priorities are centred on (i) scaling Electrification capacity to capture data centre and utility demand, (ii) expanding Communications in the U.S. and Australia through organic wins and value-adding acquisitions, and (iii) maintaining a resilient Automation base while focusing incremental growth resources on data centre and infrastructure opportunities.

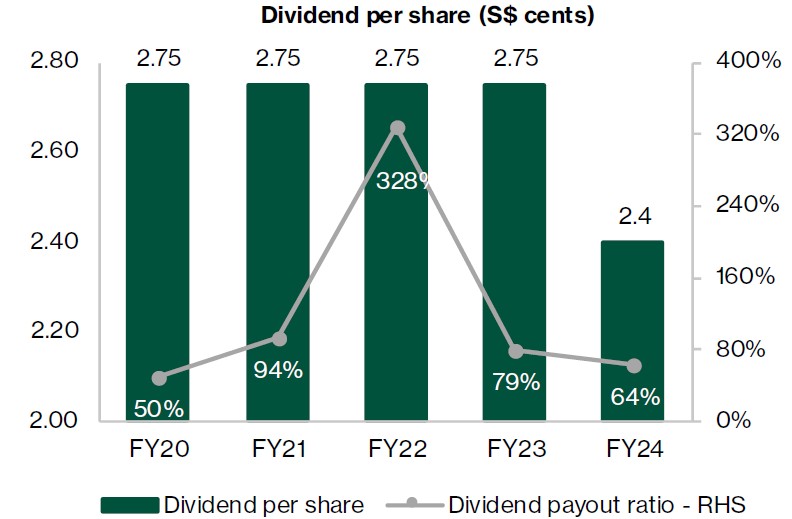

Dividend payout ratio of 50% of earnings

CSE typically targets a dividend payout of around 50% of earnings.

For FY2024, the board recommended a final one tier tax exempt dividend of 1.15 Singapore cents per share and, together with the interim dividend of 1.25 Singapore cents paid earlier in the year, total FY2024 dividends amounted to 2.4 Singapore cents per share, representing 64% of FY2024 net profit.

In FY2025, management declared an interim one tier tax exempt dividend of 1.14 Singapore cents per share, payable on 26 September 2025 with a record date of 21 August 2025.

Initiate with Buy

We initiate coverage on CSE Global with a BUY rating. CSE is strategically positioned at the heart of structural capex themes in data centres, electrification and critical communications, which should support multi year earnings visibility as customers invest in power, grid upgrades and always on digital infrastructure.

CSE’s expanding footprint and increasing exposure to higher growth infrastructure end markets underpin a compelling medium term growth profile.

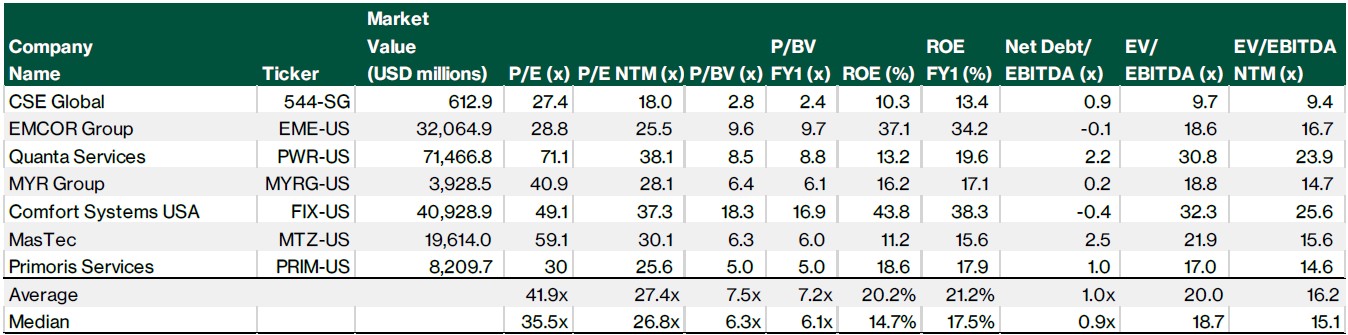

Based on our peer comparison, CSE trades at 7.7x 2026 EV/EBITDA and 14.5x 2026 P/E, representing a meaningful discount to a basket of US-listed electrical and power infrastructure contractors (peer median 15.3x EV/EBITDA NTM and 27.2x P/E NTM).

Target price of S$1.40

Our discounted cash flow valuation yields a fair value of S$1.40 per share, implying 32.1% upside from the current price of S$1.06.

The valuation is based on a 7.9% WACC, derived from an 8.4% cost of equity and a 3.5% cost of debt, assuming a 9.0% debt ratio and a 20% tax rate. Cost of equity is based on a beta of 1.1, a 3.0% risk free rate and an 8.0% market return.

We apply a 3.0% terminal growth rate, reflecting CSE’s exposure to long duration infrastructure themes, and our DCF implies a firm value of S$777m and equity value of S$944m.

At S$1.40, CSE Global trades at 19.2x 2026 P/E, 0.85x PEG (based on 22.6% earnings growth in 2026) and 2.1% dividend yield.

Key risks

Project execution and cost-overrun risk

As a contractor and systems integrator, CSE is exposed to execution risk on complex projects, including potential scope changes, implementation delays, and cost overruns. Management has noted that inaccurate scoping, over-commitments, or inadequate resource allocation and scheduling can lead to overruns, delays and losses, and highlights the need for robust project risk management and monitoring processes.

Working-capital volatility and cash conversion risk

CSE’s cash flow profile can be volatile due to project milestone timing, billing schedules and working-capital requirements.

Customer concentration and programme dependency

CSE’s electrification and communications capabilities are increasingly aligned with large, multi-site customer programmes (including data-centre related demand highlighted in company materials). While these programmes can be sizable, they can also raise concentration risk (pricing, renewal timing, and project phasing), particularly if a small number of customers account for a material share of the order book or revenue in a given period.

Order book / order intake lumpiness and visibility limitations

Order intake can be lumpy and subject to timing effects.

Order-book transparency is typically provided at a segmental level and that granular project-level disclosures are usually limited, which can constrain external visibility on project mix and margin profile.

Capacity constraints and footprint expansion risk

Physical constraints (e.g., land/space) can be a gating factor for scaling prefabrication capacity for e-houses/substations. Execution risk includes the timing and cost of scaling capacity and the ability to staff and ramp operations to match demand.

Acquisition and integration risk

CSE has used acquisitions to expand capabilities and geographic reach. Integration risk includes achieving expected synergies, aligning operating processes, and avoiding margin dilution.

FX exposure and translation risk

Given CSE’s geographic revenue skew to the Americas and Asia Pacific, results can be influenced by currency movements.

Balance sheet and funding risk (including lease and borrowing obligations)

While leverage remained moderate, the risk is that sustained working-capital outflows or execution setbacks could pressure liquidity and funding flexibility.

Click here to download the full report.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in CSE Global.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments