DBS reports 1% profit before tax growth and maintains healthy dividend payout: Our Quick Take

Stocks

By Gerald Wong, CFA • 06 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

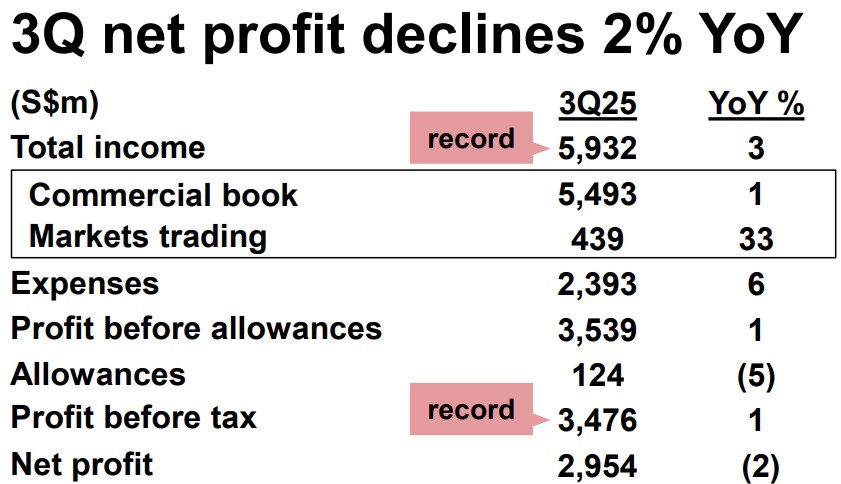

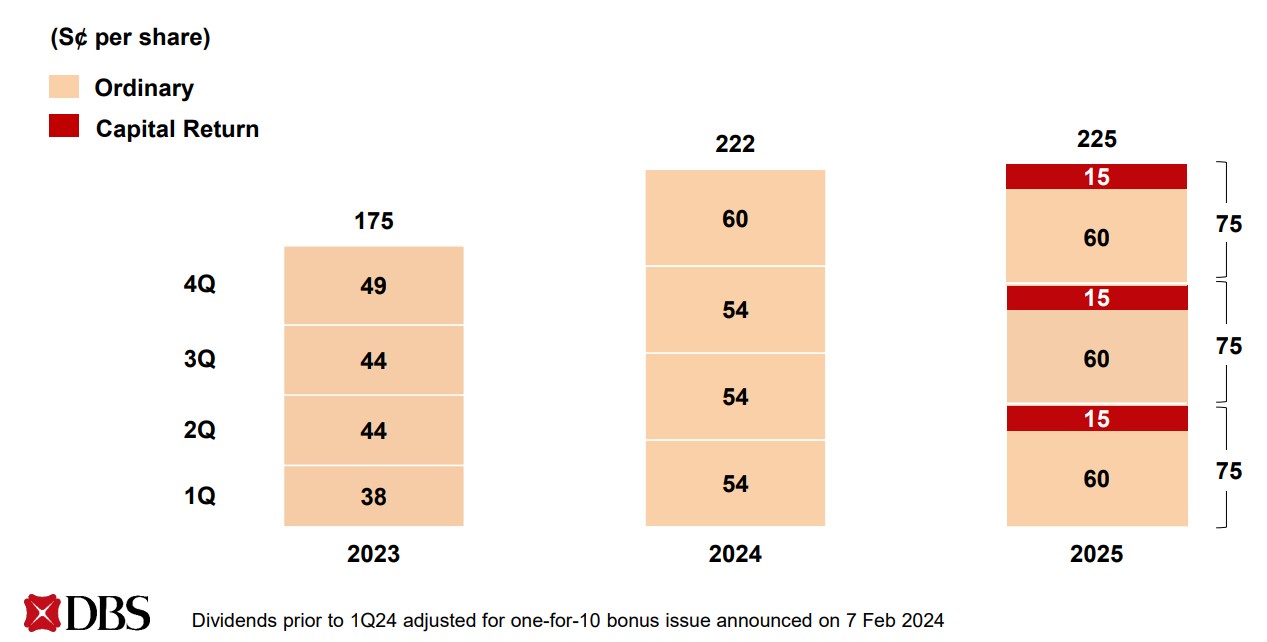

DBS reported profit before tax of S$3.48 billion in 3Q 2025, an increase of 1% year-on-year. The bank also announced an ordinary dividend of S$0.60 and a Capital Return dividend of 15 cents per share for 3Q 2025.

DBS 3Q25 earnings and dividend highlights

DBS has announced its earnings for third quarter of 2025. Key highlights include:

- Q3 2025 pre-tax profit: SGD 3.48 billion (+1% year-over-year)

- Q3 2025 net profit: SGD 2.95 billion (-2% year-over-year)

- 9-month 2025 profit: SGD 8.68 billion (-1% year-over-year)

- Interim dividend of 60 cents per share for 3Q 2025

- Capital Return dividend of 15 cents per share for 3Q 2025

DBS reported a 1% year-over-year (YoY) increase in profit before tax for the third quarter, totaling SGD 3.48 billion.

This growth was driven by higher fee income, stronger treasury customer sales, and markets trading gains, offsetting a modest decline in net interest income amid lower benchmark rates.

The bank’s annualised ROE stood at 17.1%, in line with its record levels last year.

Total income rose 3% year-over-year to SGD 5.93 billion, due to balance sheet growth, higher fee income, treasury customer sales, and stronger markets trading income.

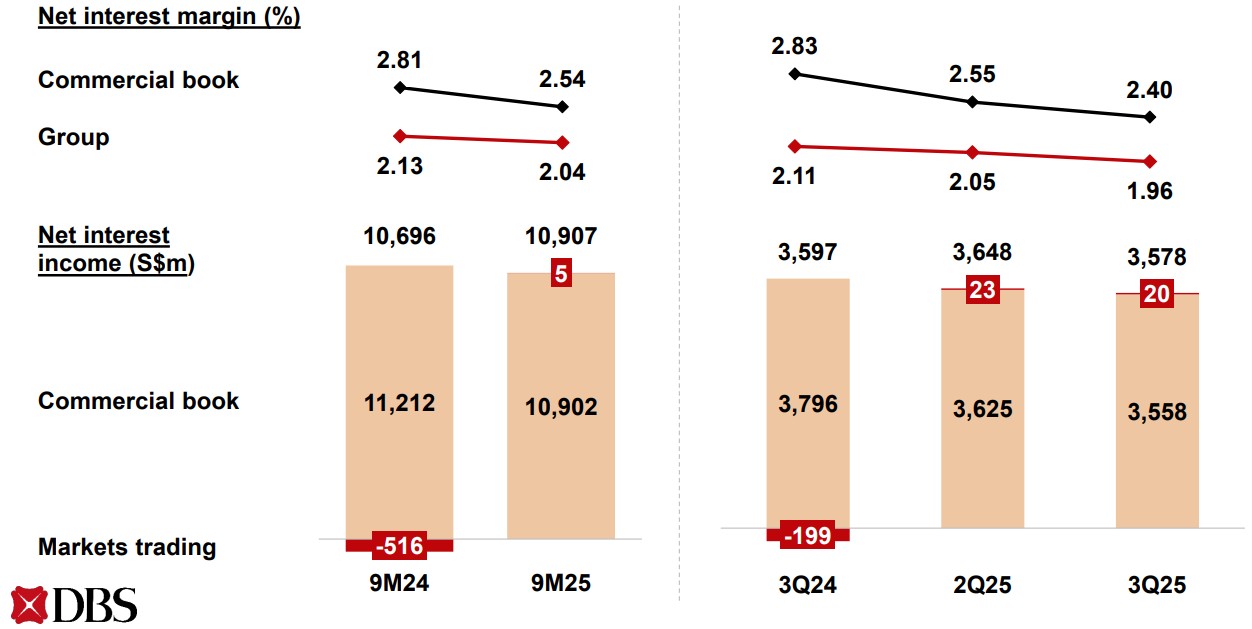

DBS reported net interest income (NII) which came in at S$3.58 billion, broadly unchanged from the same quarter last year, as strong deposit growth and active balance sheet hedging helped offset the impact of lower SORA and HIBOR rates.

The net interest margin (NIM) eased 0.15% to 1.96%, reflecting the lower rate environment.

Within the commercial book, interest income fell 6% to S$3.56 billion, as the commercial book NIM contracted 0.43% to 2.40%.

Loans grew S$17 billion (+4% YoY) in constant-currency terms to S$437 billion, driven by broad-based expansion in non-trade corporate loans.

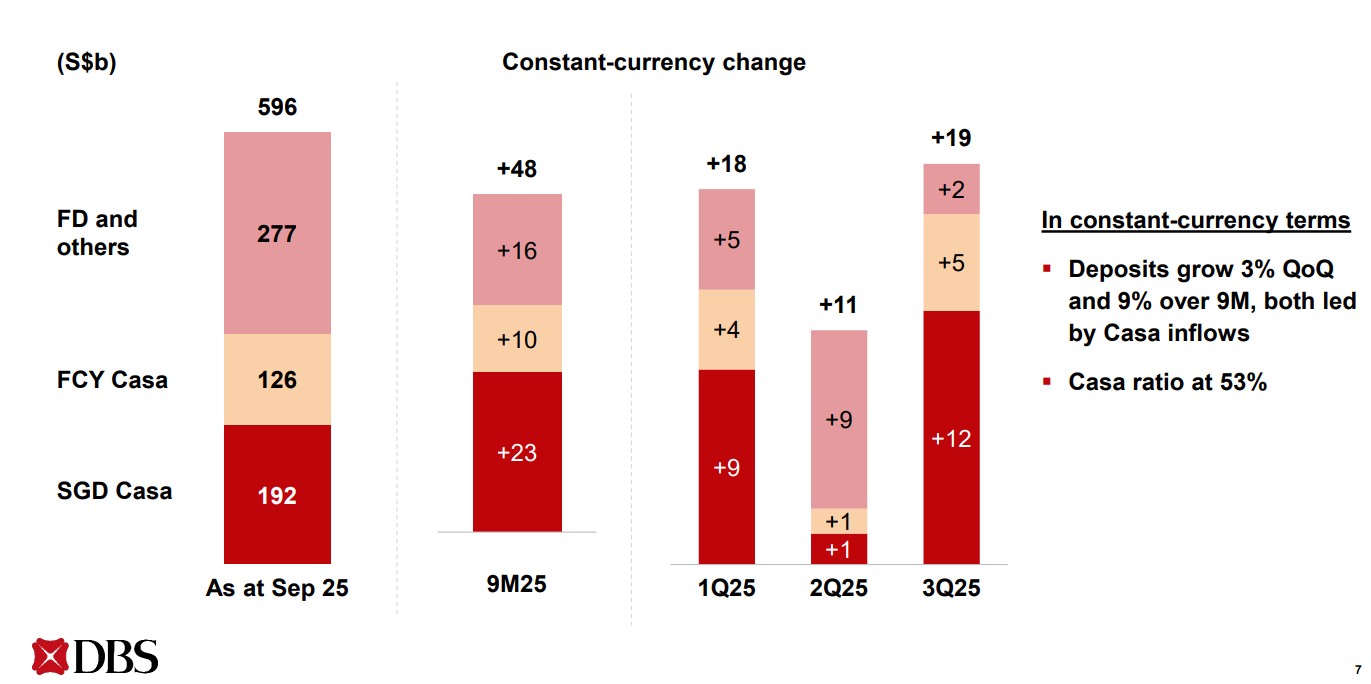

Deposits rose S$50 billion (+9% YoY) to S$596 billion, supported by healthy inflows across both CASA and fixed deposits.

The surplus liquidity was channelled into liquid assets, which lifted overall net interest income and return on equity, though it modestly compressed net interest margin.

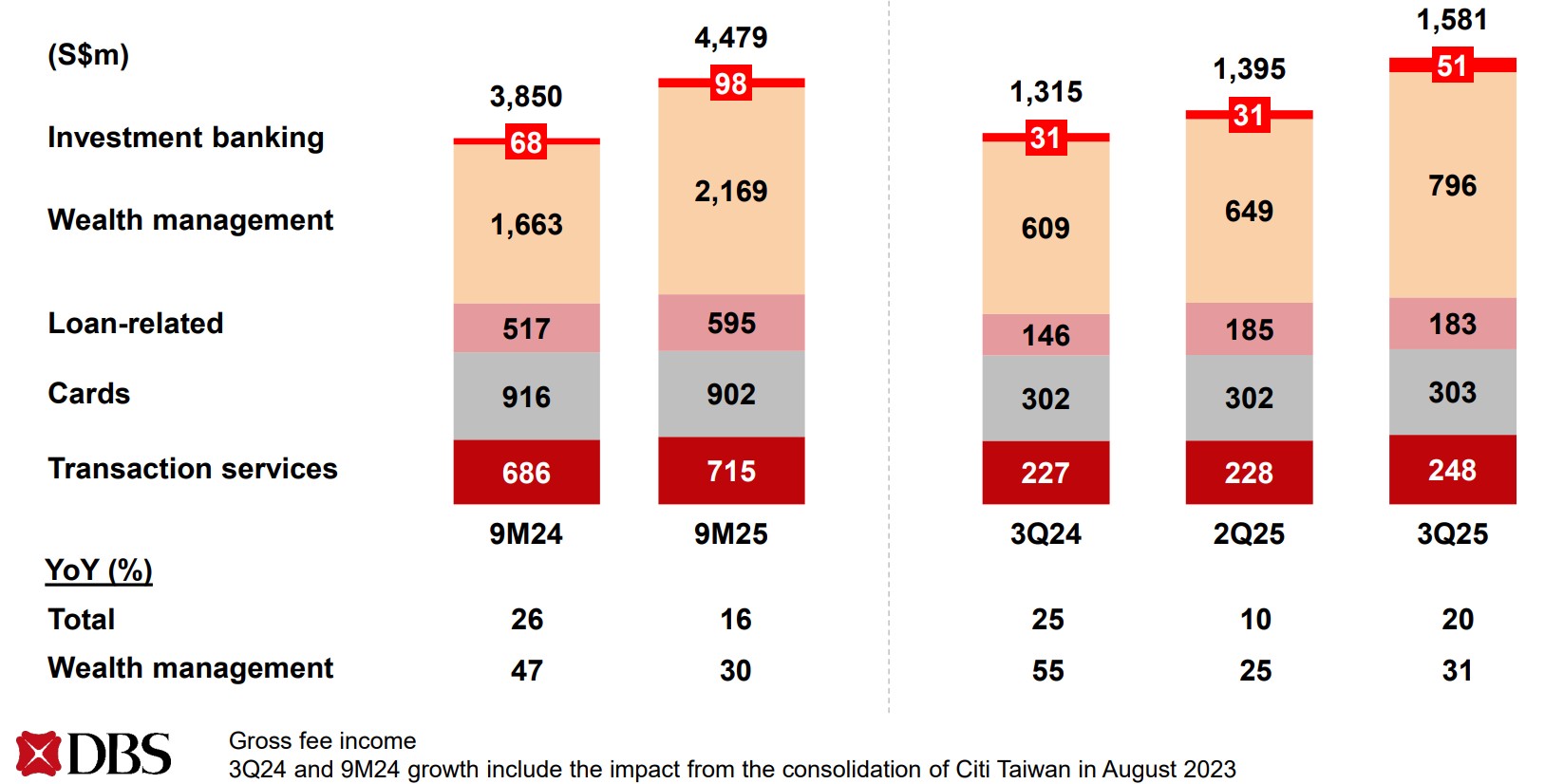

Commercial book net fee income climbed 22% year-on-year to a record S$1.36 billion, reflecting strong momentum across all major segments.

Wealth management fees led the growth, surging 31% to S$796 million on the back of robust demand for investment products and bancassurance solutions.

Loan-related fees also gained 25% to S$183 million, driven by higher deal activity amid improved market sentiment.

Meanwhile, transaction services income rose 9% to S$248 million, supported by increased business volumes, and investment banking fees jumped 65% thanks to stronger debt and equity capital market activity.

Fee income rose 20% YoY, driven primarily by a 31% rise in wealth management fees to SGD 796 million, supported by stronger sales of investment products and bancassurance.

Loan-related fees was up 25% YoY on higher deal activity, while transaction service fees rose 9% YoY to SGD 248 million.

Investment banking fees also jumped 65% YoY, reflecting increased activity in both debt and equity capital markets.

The bank's asset quality remains resilient, with the non-performing loan (NPL) ratio remained stable at 1.0%. New non-performing asset formation stayed low and was more than offset by higher repayments and write-offs.

The board proposed an ordinary of SGD 60 cents per share and a Capital Return dividend of SGD 15 cents per share for 3Q 2025, translating to a total 9M 2025 dividend of S$2.25 per share, a 39% increase over the previous year.

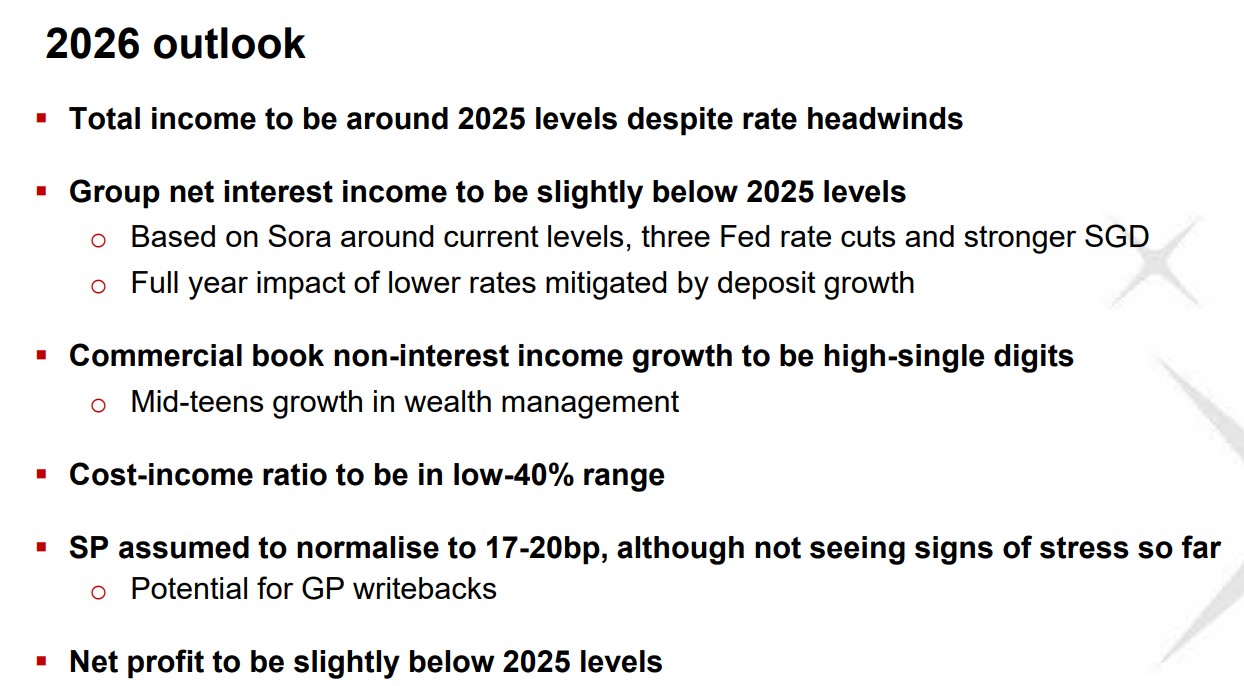

DBS expects FY2026 total income to remain around FY2025 levels despite potential rate cuts, as deposit growth and hedging gains offset margin pressure.

Fee income is projected to continue growing in the mid-teens, led by wealth management and institutional banking.

Beansprout’s Quick Take on DBS earnings

DBS' share price gained 4% to reach a record high of $55.55 following the announcement of the results, reflecting the resilient set of results reported as record fee income has helped to to offset softer net interest margins.

This continues the trend where DBS has outperformed UOB and OCBC so far this year.

The continued strength in wealth management and treasury income demonstrates the success of DBS’s diversified business model.

The steady 75-cent quarterly dividend reflects management’s confidence in sustainable capital returns.

Based on an annualised ordinary dividend of S$2.40 and capital return of S$0.60, the total potential full-year dividend of S$3.00 implies a 5.6% dividend yield based on the closing price of S$53.50 (as of 5 Nov 2025).

This remains above DBS’s historical average yield and ahead of peers UOB and OCBC, underscoring DBS’s strong shareholder returns despite rate normalisation.

This would be above DBS’ historical average dividend yield and UOB’s dividend yield, and OCBC’s dividend yield.

DBS currently trades at a price-to-book valuation of 2.3x, above its historical average of 1.2x.

Despite the more elevated price-to-book valuation of DBS, its higher dividend yield may continue to make DBS more attractive compared to UOB and OCBC for income-seeking investors.

Related links:

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in DBS.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments