DBS share price at all-time high. Still a better buy than UOB or OCBC at 5.5% dividend yield?

Stocks

By Gerald Wong, CFA • 12 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

DBS reaches record highs, crossing S$150 billion in market cap. With a dividend yield of 5.5%, find out if DBS is still a better buy than UOB and OCBC.

What happened?

Recently, DBS' share price has reached another all-time high of S$54.80.

This would make DBS the first local company with a market value exceeding S$150 billion.

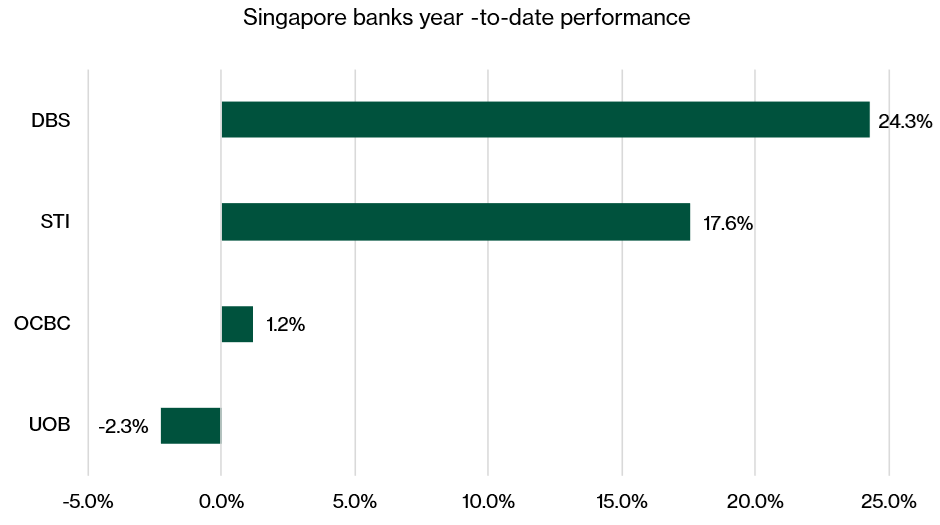

On the other hand, UOB and OCBC's share price have diverged from DBS' share price, posting muted to negative performance year-to-date and underperforming the benchmark Straits Times Index (STI).

Earlier, I shared that DBS remains one of the blue chip stocks in Singapore with a dividend yield of above 5.0%.

However, I have seen questions in the Beansprout community about whether DBS still look attractive compared to UOB and OCBC with its strong share price performance.

Let's compare their financial metrics to understand how DBS compares to UOB and OCBC.

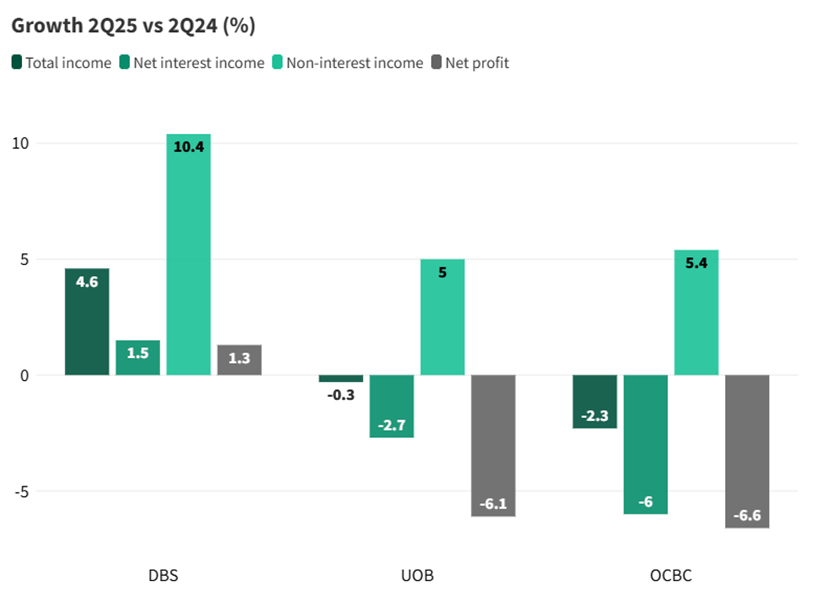

DBS reported positive YoY net profit growth in 2Q2025, while UOB and OCBC saw profit declines

DBS reported a 1% year-on-year (YoY) increase in net profit for the 2Q25, totalling S$2.82 billion.

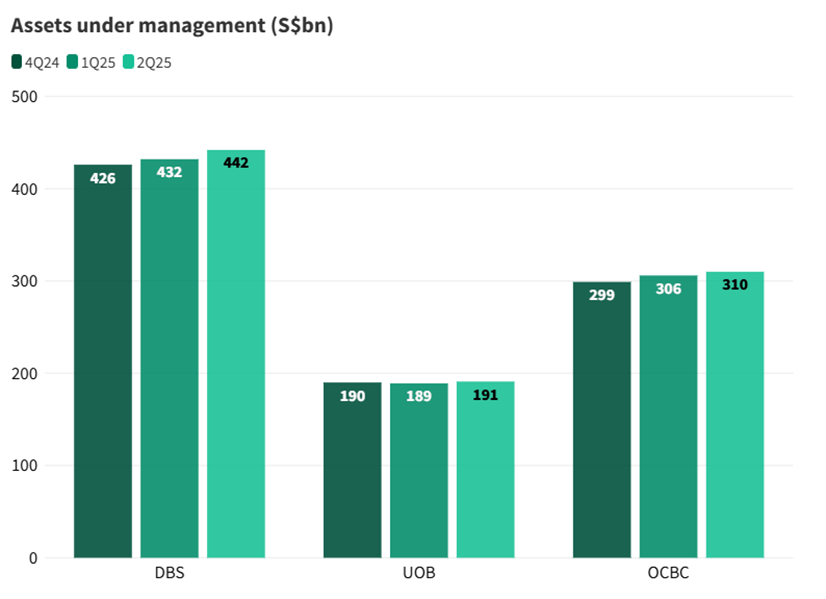

This growth was driven by robust performance in fee income (+10% YoY), driven by wealth management (+25% YoY).

DBS gained market share as wealth management AUM reached record S$442 billion.

UOB reported 2Q25 net profit of S$1.3 billion, down 6% YoY.

This decline was driven by contraction in net interest margin (NIM) (-14bps YoY), higher credit costs (+8bps YoY) and modest growth in wealth management fees (+8.7% YoY).

OCBC net profit of S$1.82 billion in 2Q25 was 7% lower compared to the previous year, led by sharp decline in NIM (-28bps YoY).

Non-interest income increased by modest 5% YoY as insurance income was weaker, -23% YoY.

UOB and OCBC reported lower net interest income, led by NIM compression, SGD appreciation and muted loan growth.

Modest growth in non-interest income was offset by lower net interest income, resulting in lower net income for UOB and OCBC.

Outlook for 2H 2025 should improve even as the banks registered lower net profit in 2Q25.

NIM compression will partly be offset by single digit loan growth.

The banks will also start to benefit from lower funding costs from cut in deposit interest rates implemented in 2Q25.

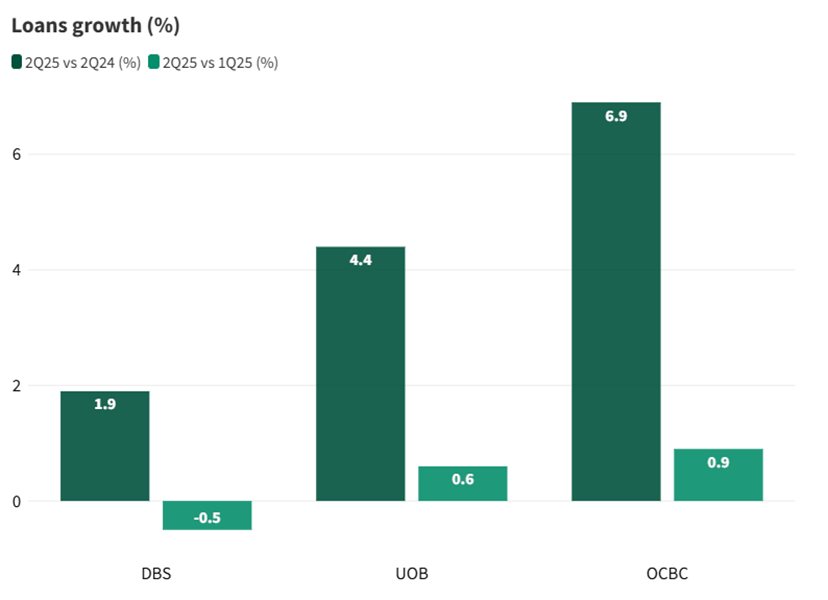

DBS' loan growth weaker compared to UOB and OCBC in 2Q25

Loans growth moderated for all three banks in 2Q25.

UOB and OCBC still managed to see positive loan growth of 0.6% and 0.9% quarter-on-quarter (QoQ), respectively.

DBS reported slight decline in loan, -0.5% QoQ but non-trade loans have been resilient.

DBS saw demand in TMT and data centres, in real estate from Government Land Sales in Singapore, in private assets, logistics and transportation.

For 1H25, loan growth was 7% YoY for OCBC, 4% YoY for UOB and 1.9% YoY for DBS.

Demand from non-trade corporate lending and Singapore mortgages supported the sector’s loan growth.

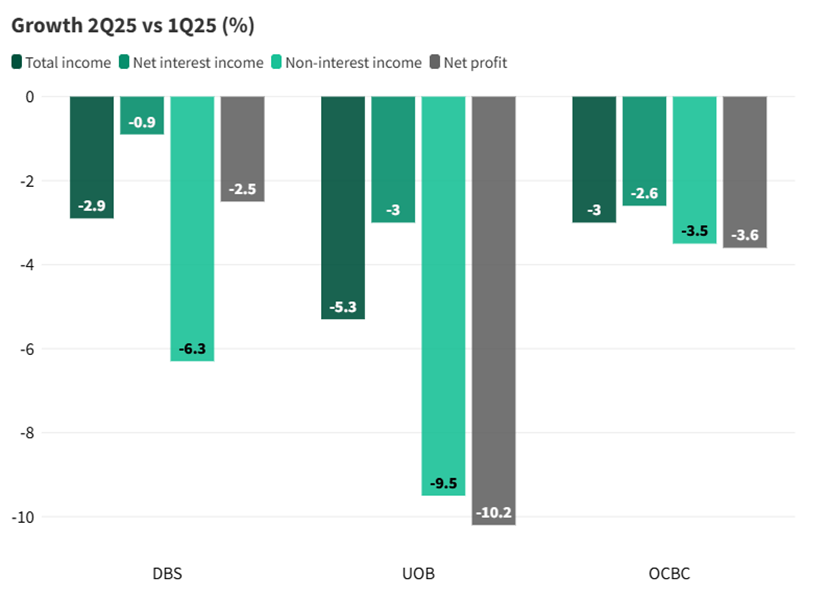

DBS saw more modest QoQ decline in net interest income compared to UOB and OCBC

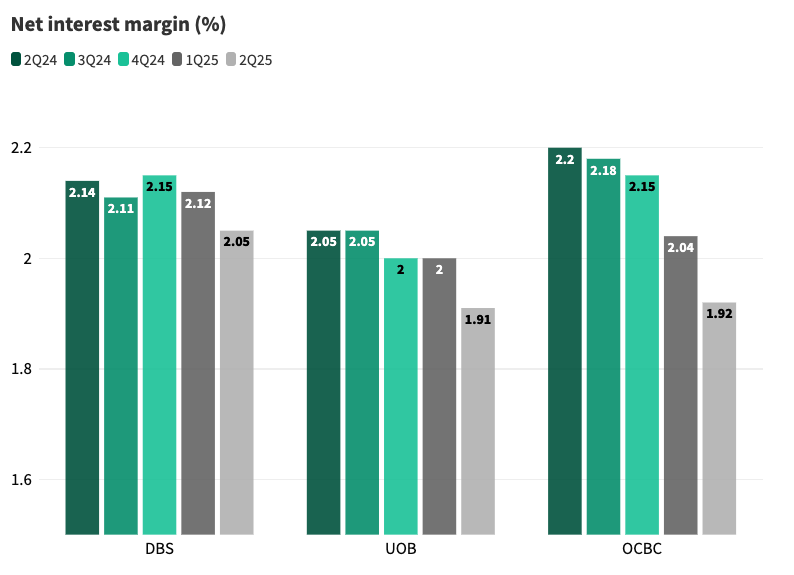

In 2Q25, DBS’ net interest income fell 1% QoQ, driven by decline in net interest margin to 2.05% (from 2.12% in 1Q25).

Net interest income at both UOB and OCBC declined by 3% QoQ. SGD and HKD loans were repriced at lower levels, due to sharp decline in benchmark interest rates.

In 2Q25, benchmark interest rates 3M SORA and 1M HIBOR fell by approximately 50 bps and 195 bps, respectively.

Amidst lower interest rates, UOB and OCBC reported NIM compression to 1.91% (-9bps QoQ) and 1.92% (-12bps QoQ), respectively.

DBS reported strongest YoY growth in non-interest income

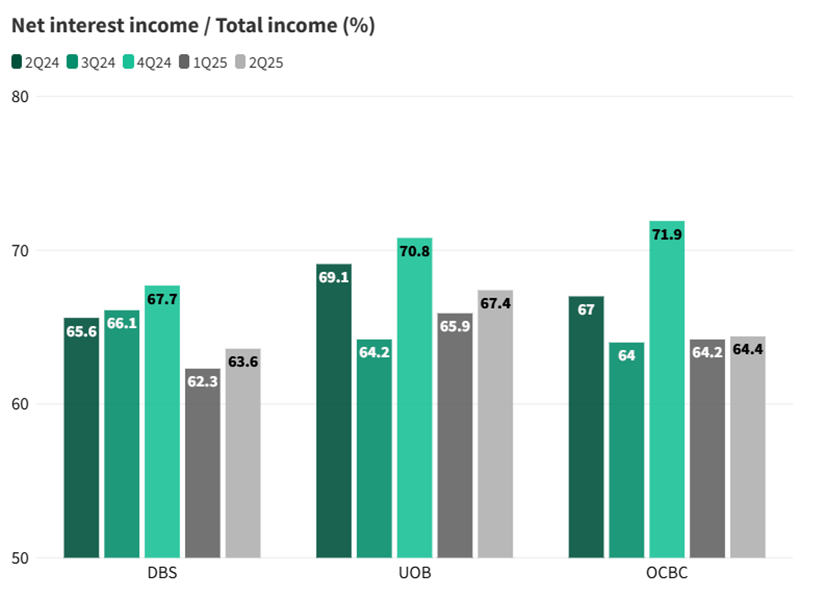

All three banks reported strong YoY growth in their non-interest income in 2Q25, despite moderating QoQ from 1Q25.

DBS’ 2Q25 fee income was up 10% YoY, largely attributed to wealth management fees which was up 25% YoY. For 1H25, fee income rose to a record S$2.9 billion, up 14% YoY on an overall basis and 30% YoY for wealth management.

UOB 2Q25 fee income was likewise up 3% YoY. For 1H25, fee income rose 11% YoY to S$1.7 billion.

For OCBC, non-interest income was up 5% YoY. For 1H25, non-interest income was up 8% YoY to S$2.6 billion.

Across all three banks, net interest income’s share of total income is between 64% and 67%.

Fee income will continue to take a bigger share of total income with larger assets under management.

All three banks gathered more AUM in 2Q25, with 2Q25 AUM increases led by DBS at S$10 billion, followed by OCBC at S$4 billion and UOB S$2 billion.

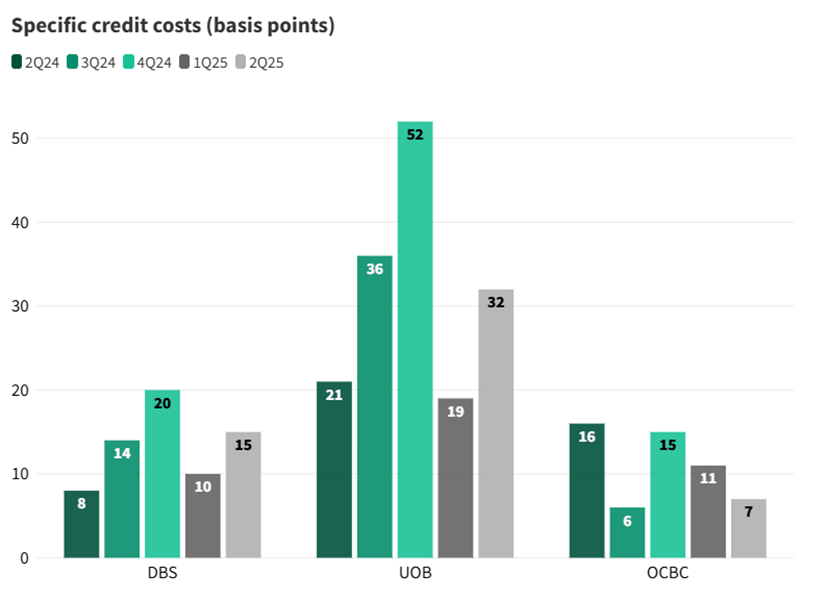

Credit costs remain manageable

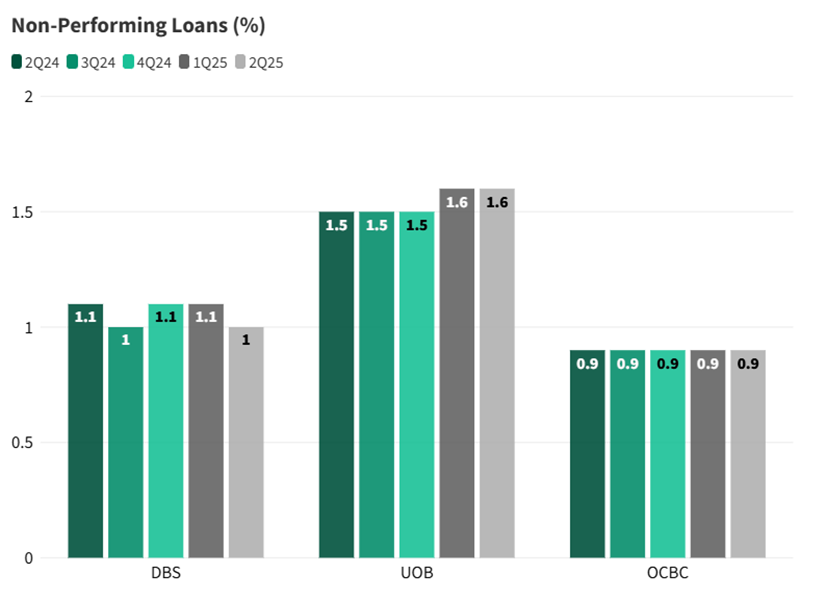

Asset quality remains healthy, with stable non-performing loan (NPL) ratios.

Specific credit costs are within expectations. UOB’s credit cost declined 3 bps QoQ to 32 bps, due to exposure to a single account in US Commercial Real Estate.

DBS eported credit cost of 15 bps, +5 bps QoQ. OCBC’s credit cost was 7 bps, declining from 11 bps QoQ.

Dividends remain healthy

DBS proposed a S$0.15 Capital Return dividend and S$0.60 ordinary dividend for 2Q25, bringing 1H2025 dividend per share to S$1.50. 'Capital Return' dividend is set at 15 cents per share quarterly for the duration of 2025.

In the subsequent two years, it expects to pay out a similar amount of capital either through this or other mechanisms, barring unforeseen circumstances.

UOB declared S$0.85 in ordinary dividend in 1H2025, a decline from S$0.88 in 1H2024. Together with a previously announced special dividend S$0.25, this would bring total dividend per share in 1H2025 to S$1.10.

OCBC proposed S$0.41 ordinary dividend per share for 1H25, representing a payout ratio of 50%. This would represent a decline from the S$0.44 ordinary dividend per share for 1H24.

Despite the macro uncertainty, the banks remain committed to return excess capital via their announced share buyback programmes and capital return plans.

Stable outlook in 2025 despite geopolitical complexities

DBS expects group net interest income in 2025 to be slightly above 2024 levels, with a slight decline in Group NIM offset by loan growth.

While credit costs are expected to normalise to 17-20 bps, management is not seeing signs of stress so far.

Overall, 2025 pretax profits are expected to be around 2024 levels, with net profit lower due to the global minimum tax of 15%.

For UOB, it expects high single-digit loan growth, double-digit fee growth and higher total income in 2025.

At the same time, costs are likely to be contained with the cost-to-income ratio at around 42%, while credit costs are expected to be benign in the 25-30 basis points (0.25-0.3%) range.

OCBC expects a further decline in its net interest margin to about 2% from 2.20% in 2024. The decline in net interest margin is expected to be partly cushioned by mid-single digit loan growth.

OCBC also expects its cost-to-income ratio in 2025 to be in 'low-40s', which will mark a further increase from the 39.7% in 2024.

What would Beansprout do?

DBS has widened its lead over the other Singapore banks, with its share price up 24% this year to recent record-high of S$54.80 and its market cap crossing S$150 billion, almost twice OCBC’s.

Across thee three banks, DBS reported higher year-on-year profit in 2Q25, while UOB and OCBC saw profits fall.

While DBS, UOB and OCBC all saw pressure from lower net interest margins with the lower interest rate environment, DBS' profit was supported by strong fee income growth from wealth management.

With the strong performance in the share price of DBS, it is now trading at a price-to-book ratio of 2.2x, after the price-to-book ratio of 1.2x for UOB and price-to-book ratio of 1.3x for OCBC.

The price-to-book valuations for all three Singapore banks are currently above their historical averages.

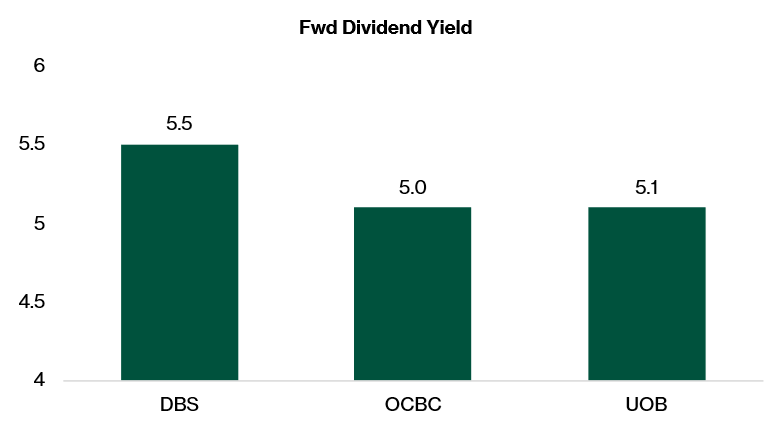

For income-seeking investors, DBS has been more generous in its dividend payout compared to OCBC and UOB.

Its quarterly dividend now stands at 60 cents, topped up by a 15-cent “Capital Return” dividend, bringing 1H25 payouts to S$1.50 per share.

Annualising the last announced ordinary dividends, DBS is projected to provide the lowest yield at 4.4%, while UOB at 5.1% and OCBC at 5.0%. However, If we include DBS’ capital return dividends, then DBS' dividend yield would be the highest at 5.5%.

This would be above UOB's dividend yield of 5.1%, and OCBC's dividend yield of 5.0%.

Despite the more elevated price-to-book valuation of DBS, its higher dividend yield may continue to make DBS more attractive compared to UOB and OCBC for income-seeking investors.

Related links:

- DBS share price and share price target

- DBS dividend history and forecast

- OCBC share price and share price target

- OCBC dividend history and forecast

- UOB share price and share price target

- UOB dividend history and forecast

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in DBS, UOB and OCBC.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments