4 things I’m doing to stay invested and build long-term wealth

Robo Advisor

Powered by

By Nicole Ng • 16 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Struggling to stay invested? Here are 4 principles I use to build long-term wealth and how DBS CIO Insights Funds can help you stay on track.

This post was created in partnership with DBS. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Many of us begin a new year with the best intentions, such as investing more consistently.

Yet before long, market uncertainty and short-term headlines can make it tempting to delay decisions until things feel clearer.

But markets continue to move, and investing rarely offers a perfect moment to begin, or to stay invested.

Over time, I realised that long-term wealth and reaching retirement adequacy are not built by reacting to noise, but by remaining invested through market cycles and sticking to a clear and disciplined framework.

Here are four things I do to stay invested for the long term, and how the DBS CIO Insights Funds can help me do that with more structure and discipline.

Explore a curated list of funds through the DBS CIO Insights Funds here

How I’m staying invested to build long-term wealth

#1 – Have a clear framework

One of the biggest challenges about investing today is choice overload.

With thousands of stocks, funds, and strategies available, it can be easy to feel overwhelmed, which can lead to delayed decisions, scattered portfolios, or chasing “trends” that don’t fit into my long-term plan.

I find that having a clear investment framework helps narrow down my universe of options to high-quality choices that align with my objectives.

In practice, I start by clarifying my investment goal and time horizon, then decide on a broad mix of growth and defensive assets that I am comfortable holding through market cycles.

Then, I limit my investable universe to funds or assets that fit those criteria.

This way, I am deciding within a framework rather than reacting to short-term market fluctuations or headlines.

#2 – Seek expert research

Confidence in a portfolio rarely breaks down because investors lack information.

It breaks down because too much information arrives in fragments in the form of headlines, price moves, and opinions that change day to day.

When every development feels urgent, it becomes difficult to tell what actually matters for long-term returns.

That is why I place more weight on structured macro and thematic research than on daily news flow.

Having a consistent view of how interest rates, growth, inflation, and long-term themes interact gives me a stable reference point when markets become volatile.

For example, during periods dominated by recession fears or geopolitical headlines, structured research helped me contextualise risks instead of reacting to each new development in isolation.

It allowed me to distinguish between short-term shocks and longer-term trends that shape investment outcomes.

#3 – Diversification

Diversification remains one of the most important principles in investing.

A portfolio concentrated in a single sector or geography is vulnerable to specific risks.

No one asset class or market performs well all the time.

By spreading my investments across different asset classes and regions, I reduce the impact of any single market downturn on my portfolio, smoothing out returns.

This makes it easier to stay invested through different market cycles.

#4 – Focus on long-term goals

When prices swing, I remind myself why I am investing in the first place, whether it is for retirement, to generate passive income, or for my future family needs.

When my investments are aligned with long-term goals such as retirement, short-term market moves feel less threatening.

This reinforces the idea that time in the market matters more than timing the market.

But following the above is often easier said than done, especially for those of us who are just starting our investment journey.

How the DBS CIO Insights Funds make it easier to stay invested

Ultimately, having a clear framework and access to professional research can make a meaningful difference in how investors experience market volatility.

For those looking for a more structured, long-term approach, the DBS CIO Insights Funds bring these elements together in a single solution.

The DBS CIO Insights Funds is a curated selection of high-conviction ideas investments backed by the DBS Chief Investment Office (CIO) team and the Fund Selection Team.

Learn more about the DBS CIO Insights Funds here

#1 – A curated list to cut through the noise

One of the benefits of having a clear investment framework is knowing where to focus, and just as importantly, what to ignore.

Without this structure, it is easy to be pulled in different directions by headlines, market commentary, or short-term performance.

This is where the DBS CIO Insights Funds can help.

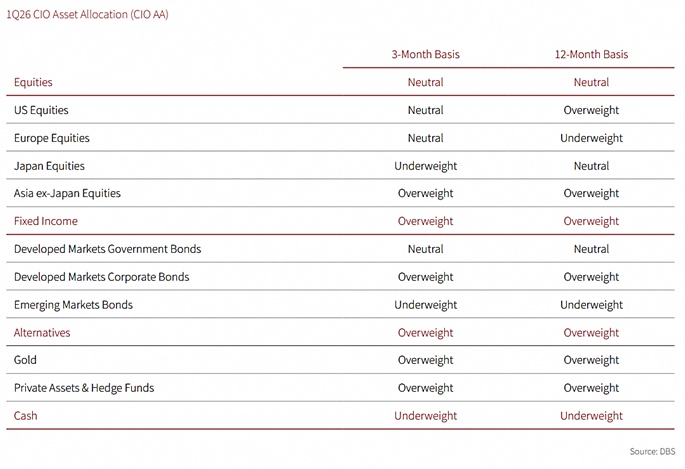

Instead of choosing from thousands of global funds, I can start with a curated selection built around DBS’ house view, shaped by the CIO team’s ongoing assessments of macroeconomic conditions, market risks, and long-term themes.

The CIO’s research is distilled into a focused set of portfolios aligned to a clear objective, such as growth, income, or a balance of both, and tailored to different risk profiles and time horizons.

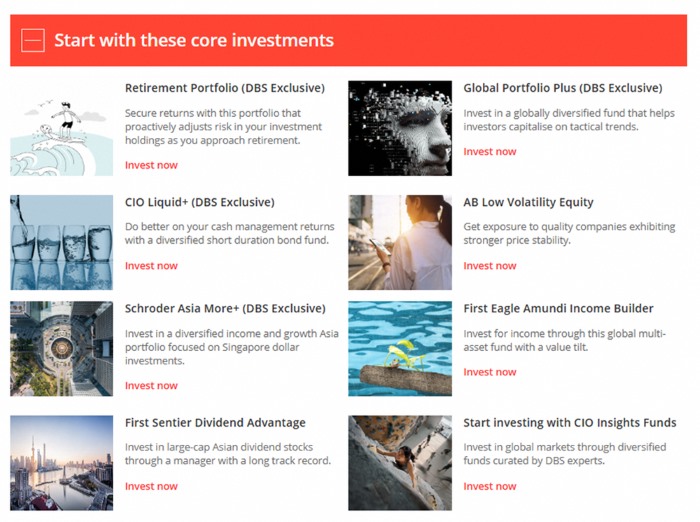

The curated list spans bonds, global and regional equities, thematic strategies, and retirement-oriented portfolios that adjust allocations as goals evolve.

By anchoring decisions to this disciplined shortlist, I can avoid decision paralysis and invest with greater clarity and purpose.

It simplifies the process without sacrificing rigour.

#2 – Guided by expert research and the CIO team

What gives me confidence in the DBS CIO Insights Funds is the expert research behind their selection by DBS’s Chief Investment Office and Fund Selection Team.

There are broadly two different types of fund categories available:

For funds not managed by DBS, the bank selects top-tier global funds that meet its strict safety and performance standards.

These are often "best-in-class" funds from renowned global asset managers.

Examples include:

- PIMCO GIS Income Fund aims to provide steady, consistent income through a diverse mix of bonds.

- Fidelity Global Dividend Fund aims to provide consistent payouts from high-quality global companies.

- First Sentier Dividend Advantage aims to provide exposure to stable, dividend-paying Asian stocks.

DBS managed funds go a step further, with portfolios created to address specific investor needs or gaps in the market.

Some examples include:

- DBS CIO Liquid+ Fund aims to earn a return better than a savings account but without taking on major risks. It focuses on short-duration bonds to provide better yield with high liquidity.

- Schroder Asia More+ is a fund tailored for Singapore-based investors with the aim to provide a mix of income and growth, specifically focused on Asian assets and Singapore dollar investments.

- Retirement Portfolio is a specialised portfolio that automatically adjusts its risk level—becoming more conservative—as we get closer to our retirement age.

For these DBS-managed options, the DBS CIO team applies both quantitative and qualitative assessments to ensure each fund has a competitive edge.

Furthermore, these selections reflect DBS’s broader macro views and long-term investment themes, allowing you to invest with the backing of institutional-grade research.

Personally, this provides a level of structure and consistency that is hard to replicate on my own.

With the CIO Insights Funds, I have the choice to pick individual funds that fit my goals and build my own portfolio.

Knowing that each fund has been through this rigorous selection process gives me reassurance that I’m investing in quality options.

If you prefer a completely hands-off approach, you may opt for the selection of DBS managed portfolios.

It utilises the same high-level CIO research but actively manages the portfolio for you, handling all the asset allocation and rebalancing based on your risk profile and changing market conditions.

Read more about DBS Retirement Portfolio here.

#3 – Built-in diversification

Whether I’m looking for income, capital growth, or a balance of both, the DBS CIO Insights Funds curated list offers robust diversification options.

Rather than betting on a single stock or sector, these funds allow me to access multi-asset portfolios or specific strategies that provide broad exposure to global and Asian markets.

Here is a quick look at how some of the different funds in the curated list:

| Fund Example | Fund objective |

| DBS CIO Liquid+ Fund | Focuses on short‑duration bonds to provide higher yields than a savings account while adding stability when markets get choppy. |

| First Eagle Amundi Income Builder | Combines bonds and equities with a balanced approach, giving a multi‑asset foundation that aims for both steady income and long-term capital growth. |

| First Sentier Dividend Advantage | Leans into dividend‑paying Asian equities (excluding Japan) to capture the region's growth while generating regular potential income. |

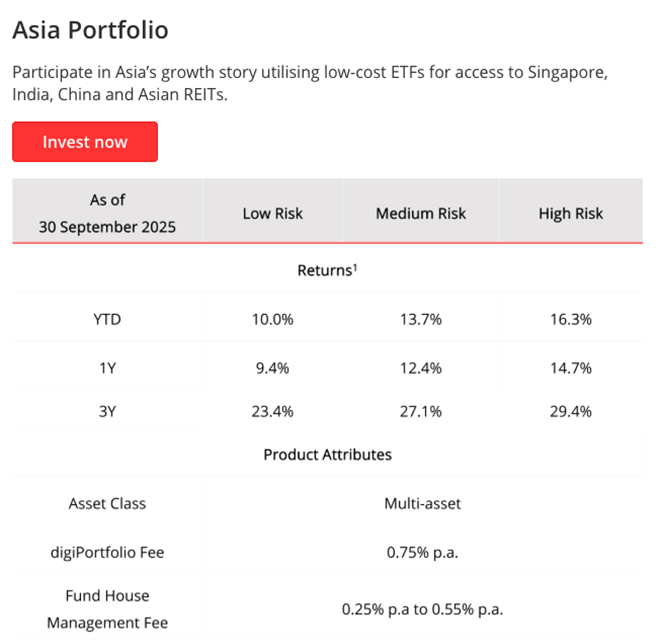

| DBS Asia Portfolio (digiPortfolio) | Provides instant diversification across Asian heavyweights (China, India, Singapore). You can even choose your desired risk level and see projected returns before investing. |

For DBS-managed portfolios, such as the Asia Portfolio mentioned above, the platform even allows you to customise the experience further.

I can select my risk appetite (Standard, Moderate, or Aggressive) and get a projection of my potential returns based on whether I invest a lump sum or on a recurring monthly basis.

This built-in diversification helps me to ride through market cycles without overconcentrating in any one area, making it easier to stay invested for the long term.

#4 – Regularly reviewed

I often lack the bandwidth to constantly monitor the stock market.

This usually means I may miss key shifts or let my portfolio drift.

With the regular reviews and updates behind DBS CIO Insights Funds, it bridges the gap between my busy schedule and the need for a dynamic portfolio.

Markets evolve, and new opportunities emerge constantly.

It is important that our investments stay aligned with long-term goals without us having to watch every single move.

The CIO team continuously assesses the funds, looking at performance, market conditions, and macroeconomic trends.

They make adjustments when needed, such as rebalancing allocations, rotating between asset classes, or adding funds that reflect emerging themes.

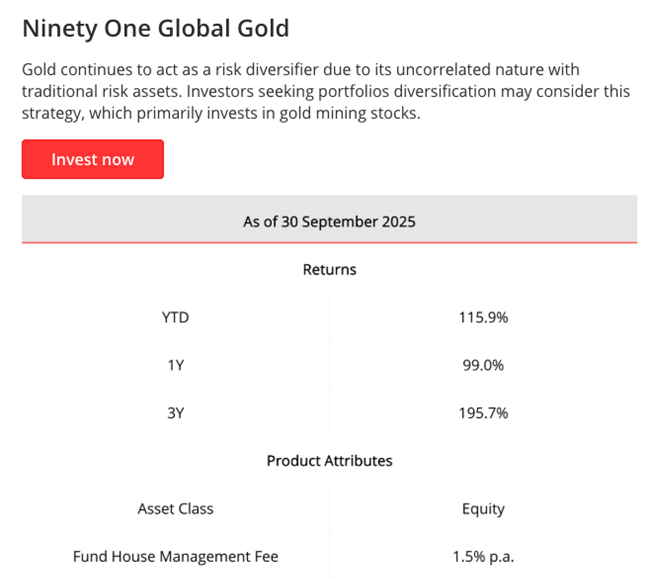

For example, thematic funds featured like the Ninety One Global Gold Fund allow you to tap into trends in gold and commodities.

This ongoing oversight means the funds remain consistent with DBS’s research-backed views, which then helps avoid panic decisions during volatile periods.

By investing in funds that are regularly reviewed, I can stay confident that my portfolio is adapting to changing market conditions while still focusing on long-term wealth accumulation.

What would Beansprout do?

If we were investing with a long-term mindset, our focus would be simple: build a portfolio we can stay invested in, not one that needs constant reacting.

We would start with a clear framework: defining our goals, time horizon, and risk tolerance upfront, so decisions are made within structure rather than in response to headlines.

When markets turn volatile, that framework acts as an anchor.

To cut through the noise, we would rely on expert research that provides context, not commentary.

Structured macro views and long-term themes help us focus on what matters, even when information becomes overwhelming.

Diversification would be non-negotiable, helping reduce reliance on any single asset and anchoring our investments to long-term goals like retirement, allowing us to consistently stay invested.

For a long-term investor, tools that combine framework and research can play a useful role.

The DBS CIO Insights Funds offer a practical solution by providing a curated list of high-conviction ideas that align with the bank’s top-tier investment views.

By leveraging these funds, we can instantly access professional diversification and ongoing portfolio management without the heavy lifting.

This allows us to look past short-term headlines and remain focused on our long-term financial goals with greater confidence.

If you are looking to build a resilient portfolio without the stress of constant monitoring, exploring the DBS CIO Insights Funds is a great next step.

You can view the CIO Insights Funds by logging in to your DBS digibank app and navigating to digiWealth.

Important Information

The article herein is published by Beansprout and is for general information only and should not be relied upon as financial advice. This article may not be reproduced, reposted or communicated to any other person without the prior written permission from DBS Bank.

This information does not take into account the specific investment objectives, financial situation or needs of any particular person. Before entering into any transaction involving any product mentioned in this information, where applicable, you should seek advice from a financial adviser regarding its suitability for your own objectives and circumstances. If you choose not to do so, you should make an independent assessment and do your own due diligence on the product.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation.

DBS Bank, its related companies, their directors and/ or employees may have positions or other interests in, and may effect transactions in the product(s) mentioned in this article. DBS Bank may have alliances or other contractual agreements with the provider(s) of the product(s) to market or sell its product(s). Where DBS Bank’s related company is the product provider, such related company may be receiving fees from investors. In addition, DBS Bank, its related companies, their directors and/ or employees may also perform or seek to perform broking, investment banking and other banking or financial services for these product providers.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment.

Any past performance, prediction, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments