3 Singapore blue chip stocks with dividend yields of above 5%

Stocks

By Gerald Wong, CFA • 24 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here’s 3 stocks listed in Singapore with a high level of dividends to help boost your passive income with falling interest rates.

What happened?

The Straits Times Index (STI) has rallied to new highs in 2025.

The renewed investor interest in Singapore equities has been driven by key themes such as dividends and corporate restructuring.

At the same time, Singapore T-bill yields have been coming down, making it less attractive for investors to depend only on short-term government securities for income.

As such, it may be worthwhile to shift our attention back to dividend-paying blue chip stocks as one of the ways to generate higher passive income.

In this article, we will look at three Singapore blue chip names offering a dividend yield above 5%, and consider how they might fit into an income portfolio.

3 Singapore blue chip stocks with dividend yield above 5%

DBS Group Holdings (SGX: D05)

DBS is the largest bank in Southeast Asia by market capitalisation, with a strong presence across the region including key markets like India and China.

It has consistently been ranked as Asia’s safest bank by Global Finance, cementing its position as a leader in the region.

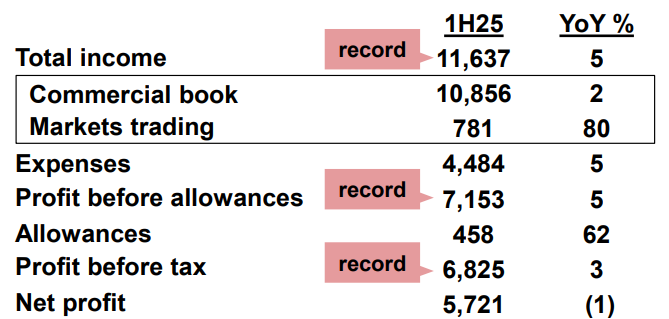

In the second quarter of 2025, DBS reported a steady set of results. Revenue rose 5% year-on-year to S$5.73 billion, while profit before allowances also increased 5% to S$3.46 billion.

Net profit edged up 1% year-on-year to S$2.82 billion, supported by higher fee income but partly offset by a moderation in net interest margins.

For the first half of 2025, both total income and profit before tax reached new highs. Return on equity (ROE) stood at 17.0%, underscoring the bank’s continued ability to generate healthy profitability despite a more challenging macroeconomic environment.

Asset quality remained robust, with the non-performing loan ratio improving to 1.0% from 1.1% in the previous quarter.

DBS’s share price has risen 15.5% year-to-date as of 24 September 2025, following a strong 46% gain in 2024.

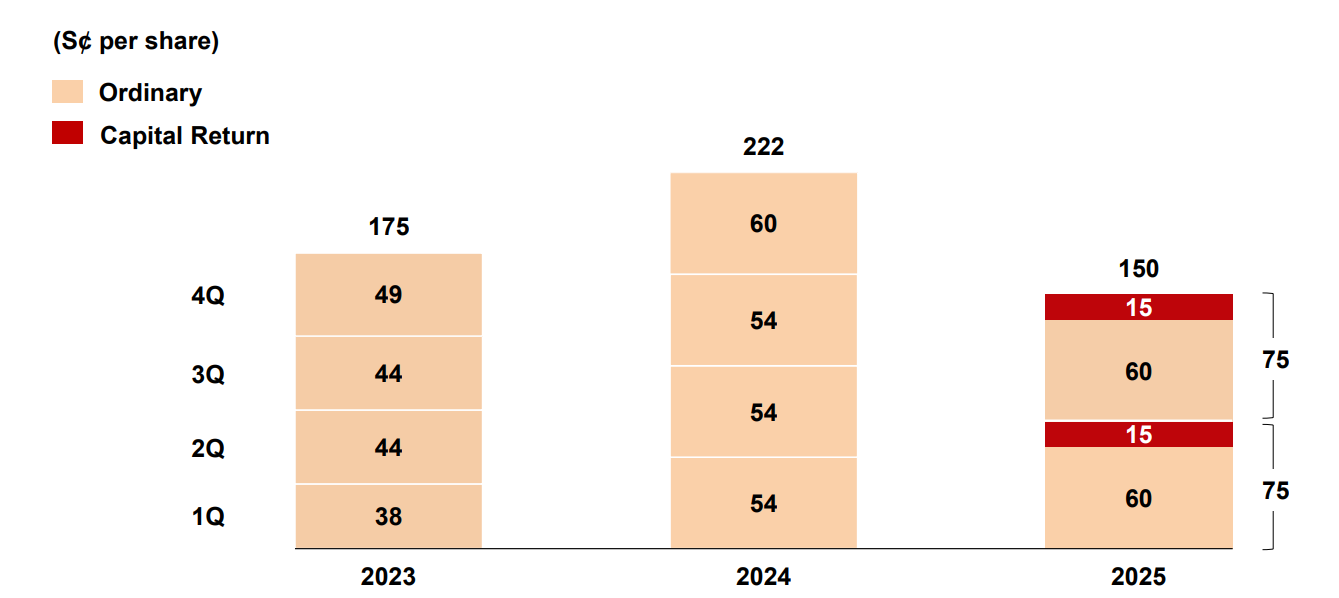

The bank continues to reward shareholders with consistent and growing dividends.

The bank declared a quarterly dividend of S$0.60 per share, alongside a special capital return of S$0.15 per share for 2Q25. This brought the total payout for the quarter to S$0.75 per share, similar to 1Q25.

Annualising the dividend payout of S$0.75 per share translates to a dividend yield of about 5.9%, based on the current share price of S$50.47.

This remains above DBS’s historical average dividend yield of 5.0%.

Find out how much dividends you can potentially receive as a shareholder of DBS Group Holdings Ltd with the calculator below.

Related links:

ComfortDelGro Corporation Limited (SGX: C52)

ComfortDelGro is one of Singapore’s most recognisable transport operators, with businesses spanning buses, rail, taxis and private-hire cars.

Beyond Singapore, the group also has significant operations in the UK, Australia and other overseas markets, which together now contribute more than half of group revenue.

In the first half of 2025, the group reported revenue of S$2.42 billion, up 14.4% year on year, supported by stronger contributions from its overseas businesses.

Net profit came in at S$106 million, representing an 11% year-on-year improvement.

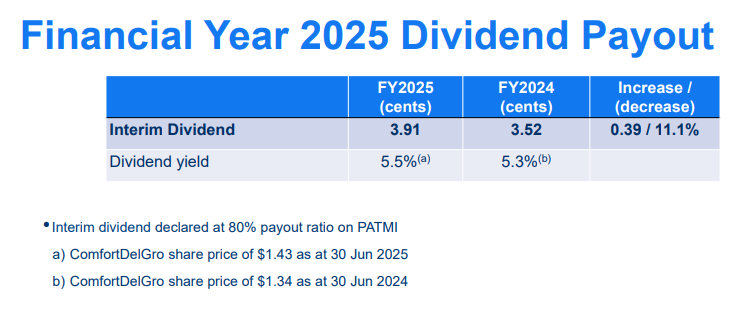

The group declared an interim dividend of 3.91 cents per share, in line with an 80% payout ratio, translating into an annualised yield of about 5.3%, based on the current share price of S$1.47.

Apart from steady dividends, ComfortDelGro has also gained visibility after being included as the largest constituent of the newly launched Singapore Next 50 Index with a 5% weighting.

This may draw increased investor attention and fund flows into the stock.

Find out how much dividends you can potentially receive as a shareholder of ComfortDelGro with the calculator below.

Related links:

- ComfortDelGro Corporation Limited share price and analysis

- ComfortDelGro Corporation Limited dividend history

Singapore Airlines (SGX: C6L)

Singapore Airlines (SIA), Singapore’s national carrier and the largest airline in Southeast Asia by market capitalisation, continues to be a standout in the aviation industry.

Ranked second in Skytrax’s World’s Best Airlines list, SIA consistently maintains its reputation among the top global airlines.

For Q1 FY2026, SIA reported record quarterly revenue of S$4.79 billion, up 1.5% year-on-year, supported by robust travel demand.

Passenger flown revenue edged up 0.9% to S$3.86 billion, supported by record passenger numbers on both SIA and Scoot. The group’s passenger load factor remained strong at 87.6%, surpassing pre-pandemic levels.

Cargo revenue eased slightly to S$530.5 million, reflecting softer freight demand.

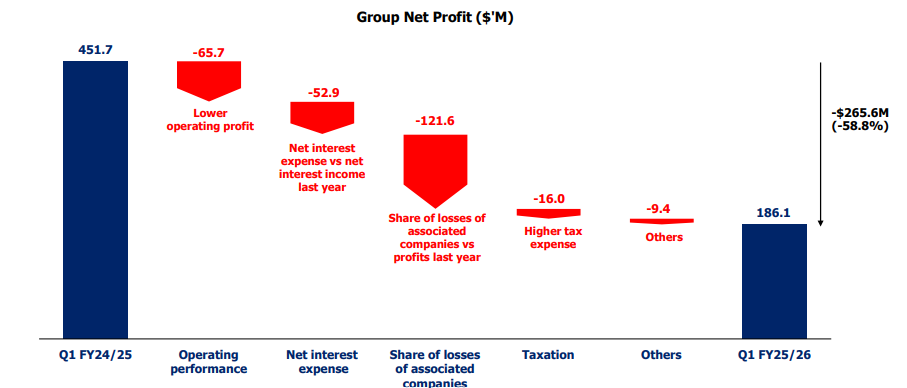

Overall, operating profit declined 13.8% to S$404.5 million as lower fuel costs were outweighed by higher non-fuel expenditure from inflationary pressures.

Net profit fell more sharply, down 58.8% to S$186.1 million, reflecting lower interest income and SIA’s first equity accounting of Air India’s results following Vistara’s merger, which weighed on group earnings in the quarter.

Despite these near-term earnings pressures, SIA has continued to reward shareholders with steady dividend payouts, supported by its improving balance sheet.

Its debt to equity ratio fell to 0.73x as of June 2025, down from 0.82x as of June 2024.

Having bounced back from the COVID-19 pandemic, SIA had already reported record full-year revenue of S$19.6 billion in FY2025, alongside a net profit of S$2.8 billion.

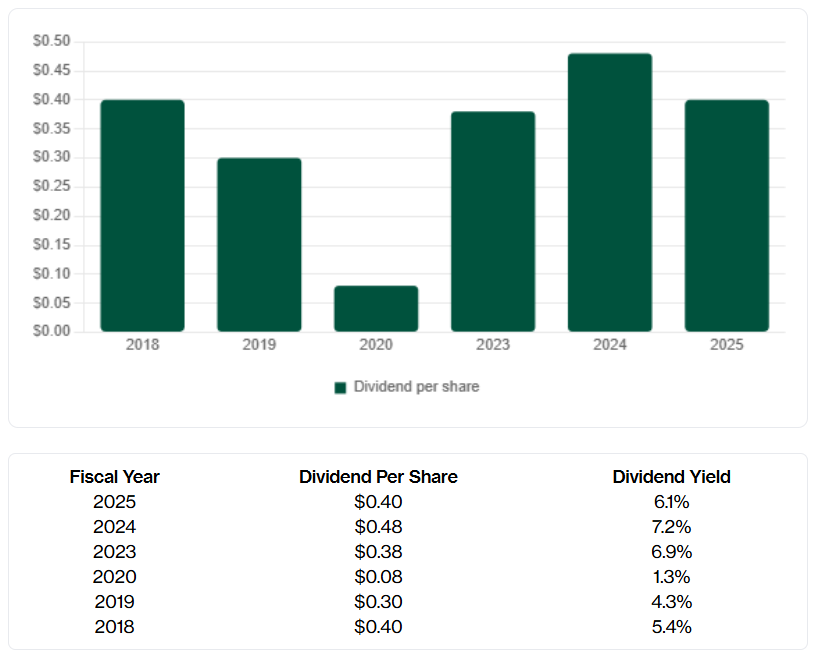

For FY2025, it declared a dividend of S$0.40 per share. Based on its current share price of S$6.50, SIA offers a dividend yield of 6.1%. This is above its historical average dividend yield of 4.9%.

Find out how much dividends you can potentially receive as a shareholder of Singapore Airlines Limited with the calculator below.

Related links:

What would Beansprout do?

With interest rates trending lower, investors may find it useful to explore Singapore blue chip stocks as a way to earn higher dividend income compared to T-bills.

Across the three names, DBS offers the most visible and consistent dividend outlook in 2025 and 2026, backed by its capital return plans.

ComfortDelgro may see increased focus and liquidity with the launch of the iEdge Singapore Next 50 Indices as it is the largest constituent with a 5% weighting.

Although SIA offers the highest historical dividend yield currently at 6.1%, investors should be mindful of the cyclical nature of the aviation industry.

For those looking to build a diversified dividend portfolio, you can screen for the best high dividend stocks here.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies.

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, S$18 cash voucher, plus 2x6% p.a. interest boost on S$2,000 with Longbridge Cash Plus for 90 days (worth up to S$60) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments