How to grow your CPF for retirement adequacy

Retirement

By Gerald Wong, CFA • 31 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

We explore how can you grow your CPF savings to ensure you have enough to retire.

What happened?

Retirement adequacy has, therefore, become a more pressing concern for Singaporeans.

The key question that many ask is – how much is sufficient for retirement?

Is S$550,000 enough, or should you accumulate S$1 million or more?

Here’s where the Central Provident Fund (CPF) comes in.

CPF plays a key role in helping Singaporeans to save and grow their retirement funds.

Let’s explore how we can make use of your CPF to maximise our retirement adequacy and ensure that we have enough to live on during your golden years.

How to grow your CPF for retirement adequacy?

There are a few ways to grow our retirement savings using CPF, including the following:

- Contributing towards CPF

- Saving more with CPF

- Earning higher returns on your CPF savings

#1 - Contributing towards CPF

First off, let’s start with a basic understanding of how the CPF scheme works.

From the day you begin full-time work, you already start saving for your retirement.

Your employer and you must contribute monthly towards your CPF.

As an employee, you need to contribute your share of CPF, which is deducted from your gross salary.

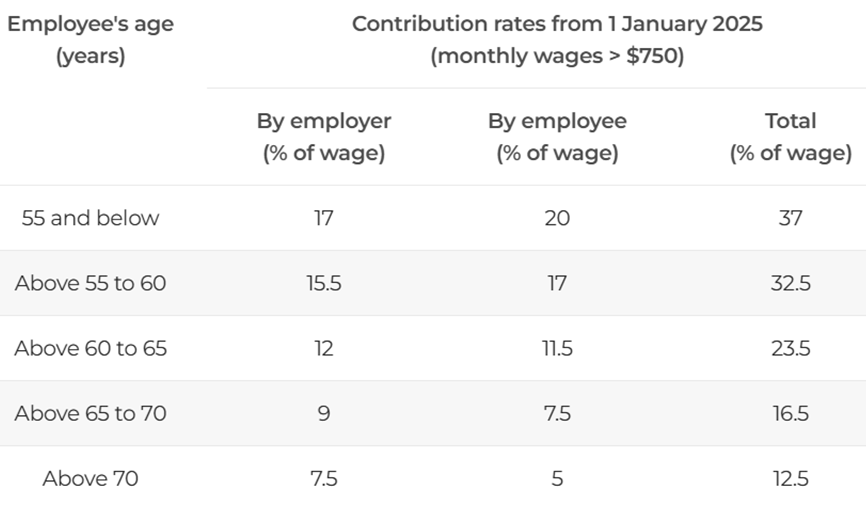

In turn, your employer needs to contribute its share of your CPF on your behalf. The rates for both employee and employer are summarised in the table below, based on age.

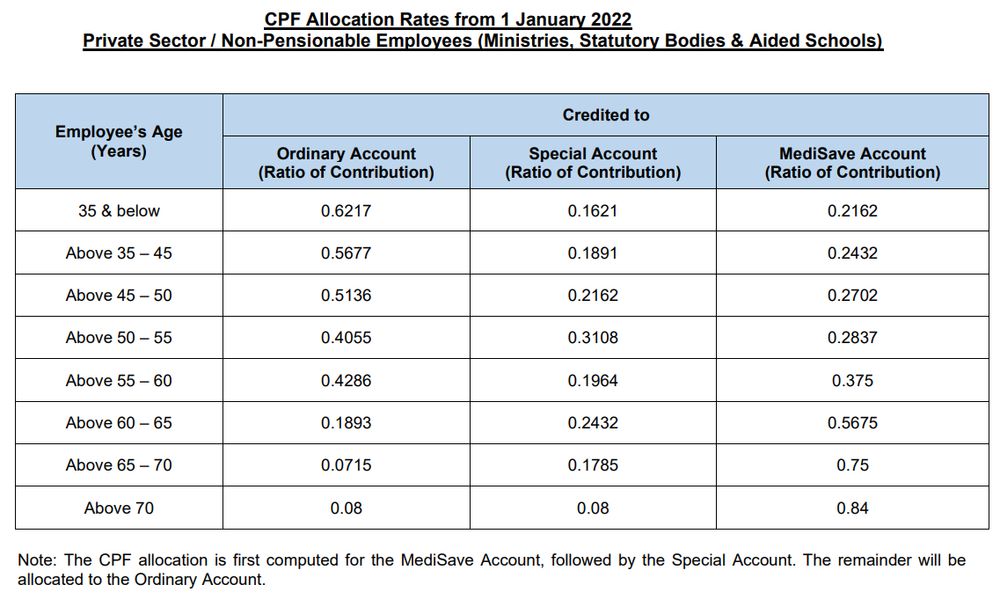

It’s important to note that CPF itself is broken up into three separate accounts – the Ordinary Account (OA), Medisave Account (MA), and Special Account (SA).

The allocation to each account is based on the formula as shown in the table below, also broken down by age.

A simple example can help to illustrate the above.

If you are earning a gross salary of S$2,000 and are aged 35 and below, you need to contribute S$400 (i.e. 20% x S$2,000) into your CPF account.

This amount will be deducted from your gross salary, and your take-home salary will be S$1,600 (S$2,000 minus S$400).

Your employer needs to contribute S$340 (i.e. 17% x S$2,000) into your CPF account, taking the total contribution to S$740 (S$400 employee + S$340 employer).

This S$740 will be split into S$160 for your MA, S$120 for your SA, and S$460 towards your OA, according to the table above.

You should also note that there is a salary limit known as the “ceiling” which attracts CPF. If you earn an amount that is higher than this ceiling, it will not attract any CPF contributions.

As of 1 January 2025, this CPF ceiling is S$7,400 and will be raised to S$8,000 next year.

You can read more about CPF contribution changes in this guide.

#2- Saving more with CPF

CPF contributions are a useful way to save for your retirement, but these contributions may not be sufficient, especially when you have just started working and are earning a low gross salary.

Fortunately, there are various methods you can utilise to save more for your CPF.

Top up to enjoy higher retirement payouts

The first is called the Retirement Sum Topping-Up Scheme (RSTU), which involves making cash top-ups to your own or loved ones’ special or retirement account*.

Note: The retirement account (RA) is formed at age 55 by transferring funds from both your OA and SA. The purpose of the RA is to provide you with regular payouts during your retirement.

By doing so, you or your loved one can enjoy higher monthly payouts from the RA.

You can also enjoy a tax relief of up to S$16,000 for cash top-ups per calendar year.

However, do note that such top-ups are irreversible and cannot be withdrawn for any other purpose.

Learn more about the Retirement Sum Topping-Up Scheme (RSTU) here.

Matching grant for seniors who top up

Then there is also the Matched Retirement Savings Scheme (MRSS) for senior Singapore citizens.

Launched in 2021, this scheme helps seniors with lower retirement savings to save more, with the government matching their cash top-ups to their RA.

Enhancements were made to the MRSS this year, with the matching grant cap being raised from S$600 per year to S$2,000.

However, there is a S$20,000 cap over an eligible member’s lifetime.

The government has also removed the age cap so that any member aged 55 and above can enjoy the MRSS.

Learn more about the Matched Retirement Savings Scheme (MRSS) here.

Top up to build your MediSave savings

A third method is to voluntarily top up your MA to grow the account balance more quickly.

This is recommended as life expectancy increases alongside rising healthcare costs.

Learn more about MediSave Account top-ups here.

Make voluntary housing refund

Finally, you can consider making a voluntary housing refund if you use your OA to service your mortgage.

By doing so, you can increase the funds you have in your OA so that you will need to refund a lower amount when you sell or transfer your property.

Learn more about voluntary housing refund here.

#3 - Earning higher returns with CPF

Earn higher CPF interest

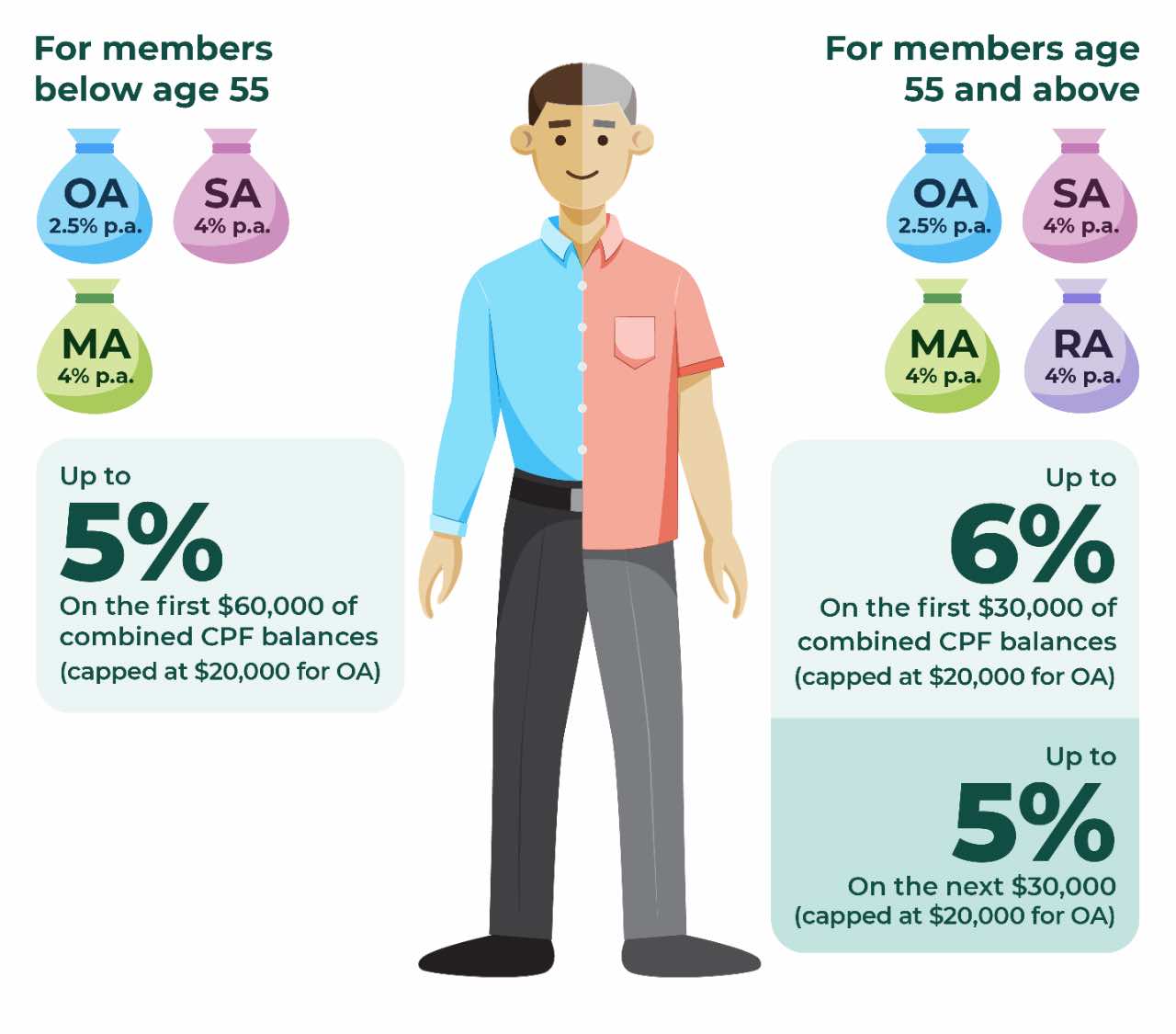

The OA earns an interest rate of 2.5% while the interest rate for the SA, MA, and RA is 4% per annum.

To help boost your retirement savings, the government will pay extra interest on the first S$60,000 of your combined balances, with a cap of S$20,000 for the OA.

So, if you are 55 and below, you can earn up to 5% interest on the first S$60,000 of your combined CPF balances.

Those aged 55 and above can earn up to 6% interest on the first S$30,000, with 5% on the next S$30,000.

You can also maximise the interest you earn from your SA by doing cash top-ups to this account, or by transferring your OA funds to your SA.

By doing so, you are earning an almost risk-free, higher interest rate on your funds, and this will help to grow your retirement savings at a faster pace.

However, do note that this transfer is irreversible, meaning you can no longer use the funds for housing downpayments, mortgage payments, or education.

Also, you will have limited investment options as there are more restrictions placed on SA funds compared to OA funds.

Learn more about cash top-up to your CPF Special Account (SA) here.

Learn more about transferring your OA funds to your SA here.

Investing your CPF savings

On the topic of investments, CPF allows you to use a portion of funds within your OA or SA to invest in various investment products.

This scheme is known as the CPF Investment Scheme (CPFIS) and involves the opening of a CPF Investment Account.

To do so, you cannot be an undischarged bankrupt and need to have more than S$20,000 in your OA and/or more than S$40,000 in your SA.

To invest your CPF OA balance, you need to open a CPFIS-OA account with any of the three major local banks – DBS, UOB or OCBC.

The CPFIS allows you to invest in unit trusts, Singapore Government Bonds, equities, treasury bills, and many more. You can find a full list of eligible products here.

Do note that you can only use up to 35% of investible savings to buy shares, property funds, or corporate bonds.

Your investible savings are computed as the OA balance minus the net amounts withdrawn for both investments and education.

As for gold exchange-traded funds (ETFs) and other gold products, just 10% of investible savings can be utilised.

Investments may allow you to generate higher potential returns for your OA and SA savings, but note that there are risks associated with investments and that your principal will not be protected.

There is a risk that you may suffer from permanent loss of capital if your investments go awry.

By carefully weighing the risks and rewards of each investment option, you can then make a more informed decision on whether you wish to make use of the CPFIS.

Learn more about CPF Investment Scheme here.

Beyond the CPF: Other useful tools for retirement adequacy

#1 - Supplementary Retirement Scheme or SRS

Apart from the CPF, there are other tools you can use to increase your retirement nest egg.

One of these is the Supplementary Retirement Scheme or SRS.

The SRS is a voluntary savings scheme that allows you to save more for retirement while reducing your income tax burden.

This is a complementary scheme to the CPF and is open to Singapore citizens, permanent residents (PRs), and foreigners living in Singapore.

For Singaporeans and PRs, you can contribute a maximum of S$15,300 yearly to your SRS account, and this amount can be claimed as income tax relief.

The maximum SRS contribution for foreigners is S$35,700.

It is also a good idea to invest the funds within your SRS account, as it only earns you a measly 0.05% interest per annum.

You can invest your SRS funds in shares, REITs, ETFs, endowment insurance plans, unit trusts, and/or Singapore government securities.

Learn more about Supplementary Retirement Scheme (SRS) here.

#2 - Generating passive income streams

Aside from both the CPF and SRS, you can also choose to invest any spare cash you have in income-generating investments such as shares and REITs.

Such investments help to create a passive stream of income through dividends that will boost the cash you receive from your SRS and CPF.

Learn about the different ways to generate passive income streams here.

What would Beansprout do?

To grow our retirement savings, we should use the CPF as the foundation for retirement planning.

While relying on consistent contributions to slowly build up our balances, we can consider the various methods described above to increase our OA, MA, and SA balances and maximise the interest earned.

We can also complement our CPF savings with SRS contributions and passive income strategies to ensure retirement adequacy.

So, to summarise, here’s how you can achieve a blissful, worry-free retirement.

- Contribute to your CPF account consistently through your earned income (i.e. salary and bonuses).

- Explore ways to increase our CPF savings and earn a higher interest.

- Rely on savvy investments with the CPFIS to further grow your balance(s). Learn more about CPF Investment Scheme here.

- Complement your CPF with SRS contributions Learn more about Supplementary Retirement Scheme (SRS) here.

- Build passive income strategies with spare cash. Learn more about building passive income stream here.

Above all, you must start early, as it will give compounding more time to work its magic.

Compounding can be described as “interest on interest” and can snowball to significant amounts once the sums within your CPF balances become larger.

So, remember to start compounding your wealth early and make full use of these CPF strategies to ensure a happy retirement.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments