Keppel Infrastructure Trust - Stable DPU supported by divestment gains

REITs

By Goh Lay Peng • 11 Feb 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

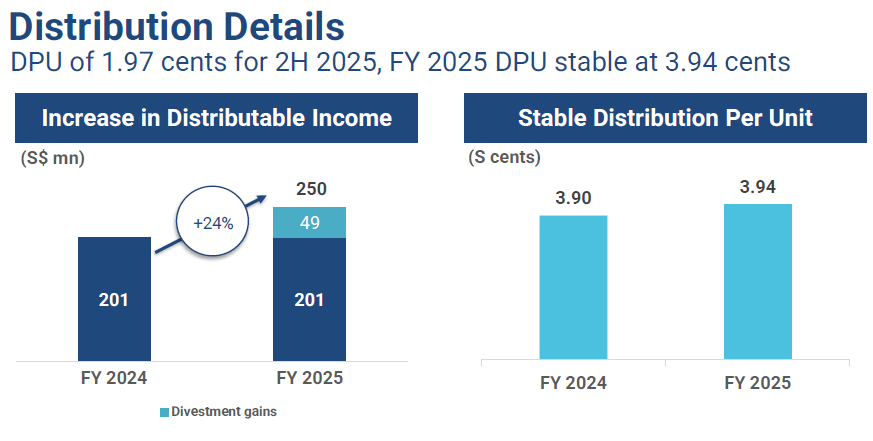

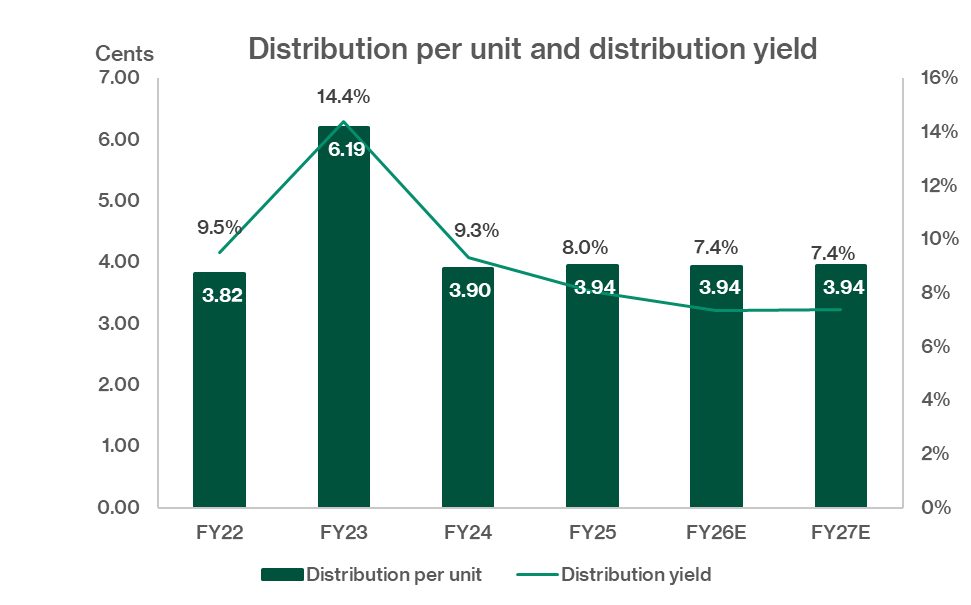

Keppel Infrastruure Trust reported distribution per unit (DPU) at 1.97 cents in 2H FY25, an increase of 1.0% year-on-year. This would bring total FY2025 DPU to 3.94 cents.

Stable 2H 2025 distribution per unit (DPU)

Distribution per unit grew by 1.0% year-on-year to 1.97 cents in 2H FY25.

In FY2025, divestment gains of S$49.0 million or equivalent to 0.8 cent per unit contributed to the stable DPU. As such, FY2025 DPU grew 1.0% year-on-year to 3.94 cents, translating to a distribution yield of 7.4% based on the closing price of S$0.535 as at 6 February 2026.

Mixed financial performance across business segments

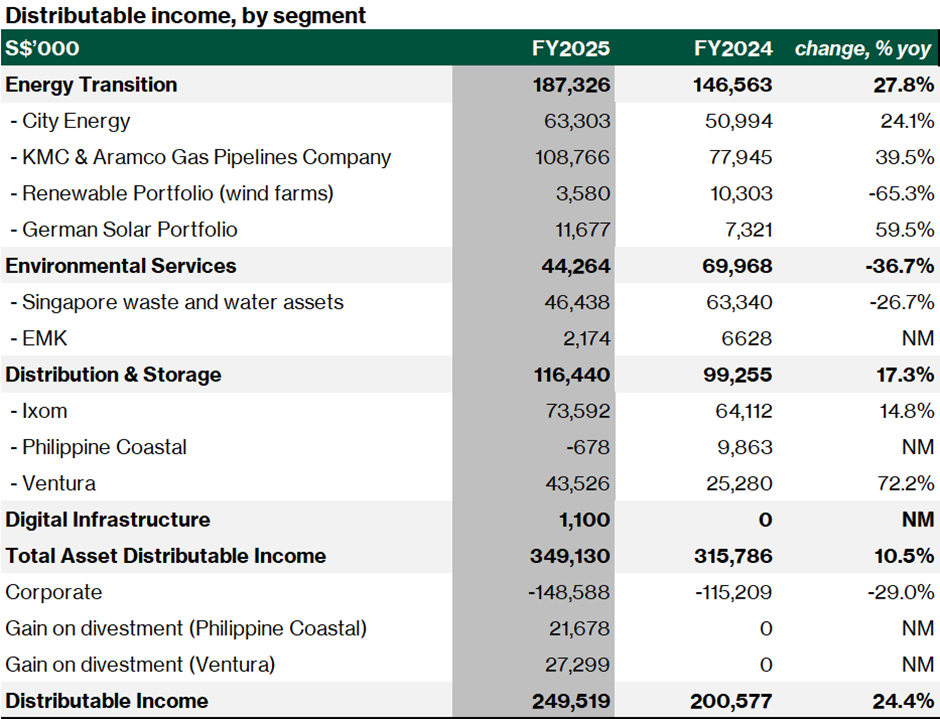

FY2025 Distributable income increased 24.4% year-on-year to S$249.5 million. The key drivers of the higher distributable income were the divestments of Philippine Coastal and partial stake in Ventura. Keppel Infrastructure Trust received S$301 million.

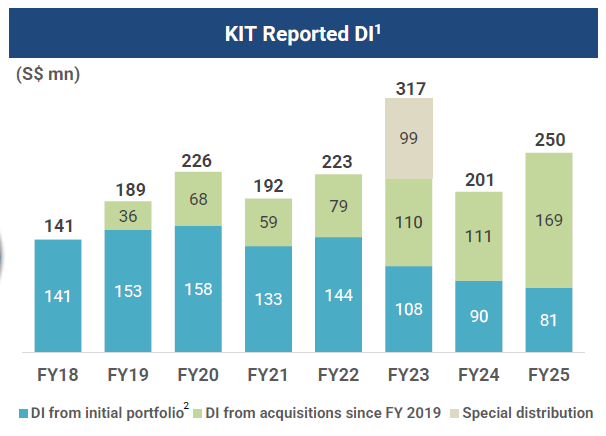

Since 2019, Keppel Infrastructure Trust has actively rejig the portfolio constitution with new assets. Currently, the distributable income from the initial portfolio and new acquisition are fairly balance.

Energy transition recorded 27.8% growth in distributable income in FY2025. The increase was led by Aramco Gas Pipelines Company whose capital management generated a cash surplus of S$51.0 million in FY2025. City Energy registered 24.1% year-on-year increase in distributable income in FY2025, due to fuel cost over-recovery and higher town gas volume,

Energy transition recorded 27.8% growth in distributable income in FY2025. The increase was led by Aramco Gas Pipelines Company whose capital management generated a cash surplus of S$51.0 million in FY2025. City Energy registered 24.1% year-on-year increase in distributable income in FY2025, due to fuel cost over-recovery and higher town gas volume,

Environment services underperformed. Distributable income of this segment decreased by 36.7% to S$44.3 billion in FY2025. Senoko waste-to-energy reported S$31.8 million lower in contribution. Eco Management Korea reported losses. On the other hand, Keppel Infrastructure Trust booked S$9.9 million in full year contribution from Keppel Marina East Desalination Plant.

Distribution and storage achieved higher distributable income despite divestment. Distributable income grew by 17.3% to S$116.4 billion in FY2025. This was despite the sale of Philippine Coastal in March 2025 and 25% stake sale in Ventura in August 2025. Ixom reported 14.8% year-on-year growth in EBITDA, supported by demand from mining, oil and gas and diary customers.

Digital infrastructure consist of the newly acquired GMG. The purchase was concluded in November 2025. Keppel Infrastructure Trust deployed S$120m to acquire a 46.7% interest in GMG. GMG started to contribute in December 2025, with a distribution of S$1.1 million.

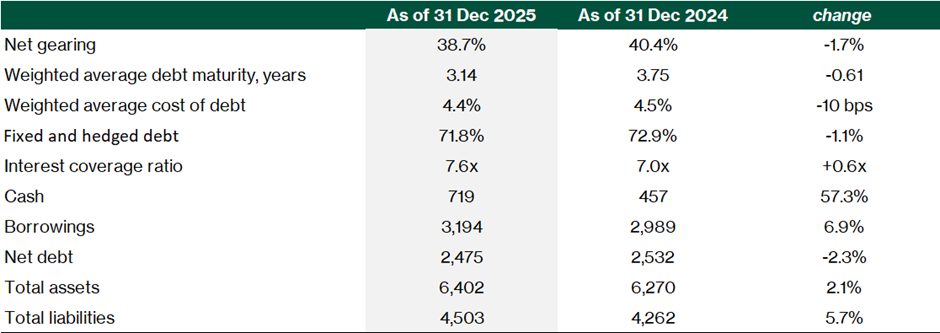

Improved balance sheet

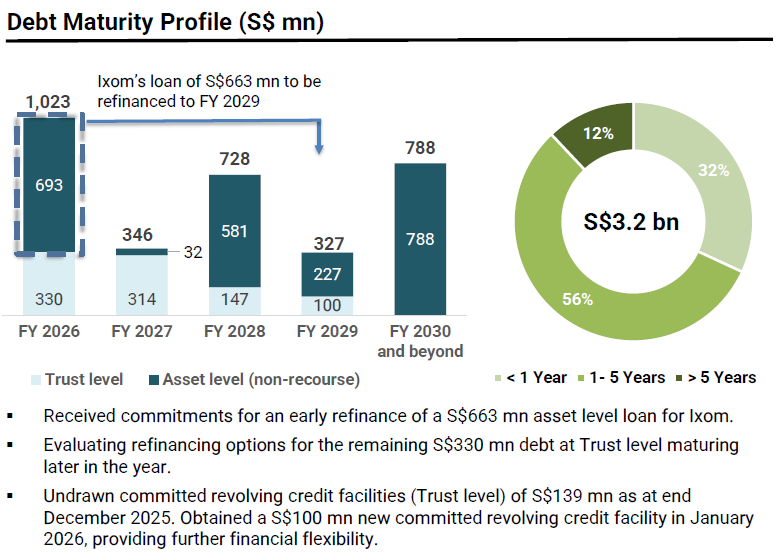

The debt maturity profile is well staggered, with 56% of S$3.2bn falling due over the next one to five years and only 32% within the next year. For FY2026, the Ixom loan has been refinanced to FY2029, which materially reduces near term refinancing risk. Maturities are light till FY2029.

Gearing improved to 38.7% as at 31 December 2025, from 40.4% as at 31 December 2024. Keppel Infrastructure Trust utilised about 60% of the S$301 million divestment proceeds to repay debt.

Cost of debt declined slightly to 4.4% as at 31 December 2025, from 4.5% as at 31 December 2024.

Total borrowings increased by 6.9% year-on-year to S$3.19 billion. Of which 72.3% consists of non-recourse loans at the asset level. The balance, or S$891 million are debt at the Trust level.

The recent capital recycling exercise has enhanced financial flexibility. With access to an undrawn committed credit facilities of S$239 million, Keppel Infrastructure Trust could pursue accretive acquisitions.

Maintain Neutral and revise target price to S$0.50

Based on its FY2025 DPU of 3.94 cents and closing price of S$0.535, Keppel Instructure Trust offers a distribution yield of 7.4%. To sustain its distributions, Keppel Infrastructure Trust will have to acquire new assets to support further cash flow generation. We maintain our NEUTRAL rating as we await more signs of sustainability in its distributable income. Our target price is raised to S$0.50 (from S$0.45) due to lower interest rate assumptions.

Key risks include interest rate risk, foreign exchange risk, regulatory frameworks in different countries and volatile commodity or energy prices, amongst others.

Download the full report here.

Related links:

- Keppel Infrastructure Trust share price and share price target

- Keppel Infrastructure Trust dividend history and forecast

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Keppel Infrastructure Trust.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments