Here’s how to trade big US stock moves before the market opens

Brokerage Account

Powered by

By Nicole Ng • 12 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how to trade major US stock moves before the market opens, and how US pre-market options trading works for Singapore investors.

This post was created in partnership with Longbridge. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

For Singapore-based investors, the US earnings season often happens while we are asleep.

Many large US companies release earnings after the US market closes, which means results are published overnight in Singapore.

By the time we wake up, stock prices have often already jumped higher or fallen sharply to reflect the news in the US pre-market trading session.

If I’m holding options, this timing can be tricky. I typically would have to wait for the main US market to open before I can lock in profits, cut losses, or adjust positions as volatility changes.

Now, Longbridge offers access to US pre-market options trading from 17:00 to 22:30 SGT, allowing investors to see how options prices adjust as earnings news is digested before the main US market opens.

Here, I’ll walk through what typically happens between the US market close and the next open, how options prices react during this window, and how pre-market options trading can fit into a broader trading or risk-management approach.

Why earnings timing matters

Most companies release earnings results before or after normal US trading hours.

Institutional investors, analysts, and derivatives markets begin processing the information immediately after earnings are released.

We tend to see related instruments, such as futures and options, start adjusting expectations before the market opens.

In short, the market is already “deciding” what the news means.

By the time the US market officially opens, prices often gap up or down, reflecting information absorbed while the market was closed.

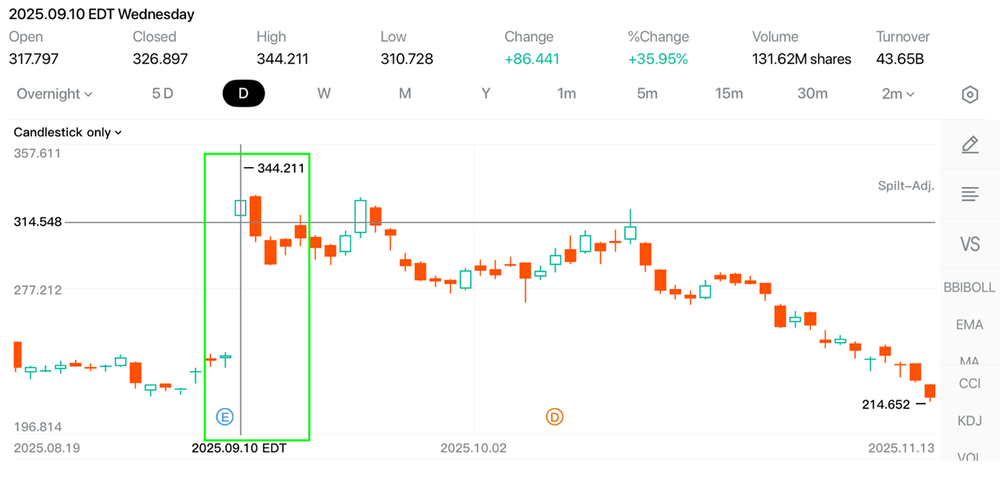

For example, Oracle (ORCL.US) saw its stock price rise more than 30% in post-market trading last year following its earnings report and news of a deal with OpenAI.

Earnings announcements often create fast price movements and higher volatility.

This presents opportunities to tap into the momentum, either profiting from strong buyer/seller activity in the short term or positioning ahead of a potential rebound in the longer term.

How options prices respond during earnings release

Options premiums are heavily influenced by implied volatility (IV):

| Implied Volatility (IV) | Options Price (Premium) | Reasons |

| High | Expensive | Higher swings due to the volatility, offering higher profit potential |

| Low | Cheaper | Lesser swings, expecting smaller price movement |

Before earnings, IV is often high because the market expects something big to happen.

Even if the underlying stock has not officially opened, options premiums can change.

Market makers often use futures prices and IV to derive pre-market options pricing.

This means options reflect both the underlying’s expected future price and IV, not just the reported earnings numbers.

By the time the market opens, a large part of the earnings reaction may already be priced into the options.

These adjustments can occur independently of the stock’s official opening price.

Illustrative Example

Imagine a large US tech company, Company ABC, is trading at US$100 before earnings release.

The company releases its earnings after the US market closes, and the results come in stronger than expected, with positive forward guidance.

Overnight, as analysts review the details, the stock jumps to around US$125 in after-hours trading.

Options prices begin adjusting to reflect the new outlook.

When pre-market options trading opens for Singapore-based investors, those changes are clearly visible.

A call option with a US$110 strike that previously traded at around US$3 before earnings may now be priced at US$15 or more.

This isn’t just because the stock is expected to open higher, it’s also because the market is rapidly recalibrating volatility and future expectations.

At this point, investors who already held options can lock in profits early, before the main market opens and emotions take over.

Others may use the elevated volatility to sell options at higher premiums, or hedge existing stock positions while pricing is still favourable.

How investors could use Longbridge pre-market options during earnings release

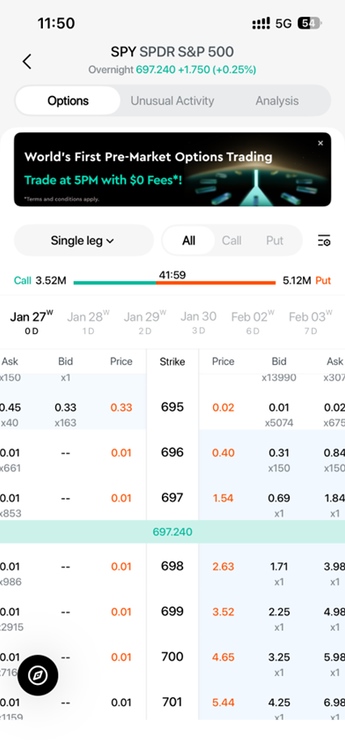

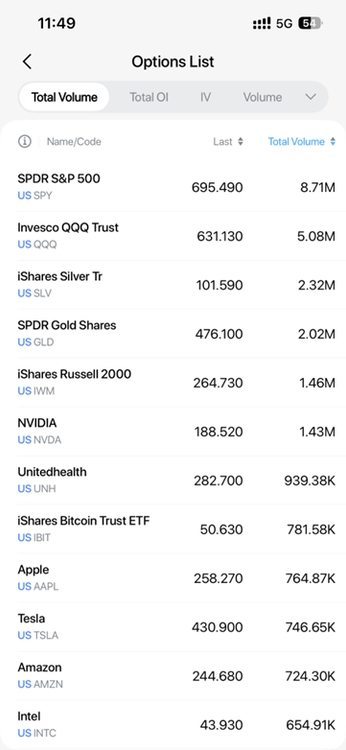

You can trade a range of major U.S. stocks and ETFs like QQQ, SPY, AAPL, TSLA, and more during the pre-market session with Longbridge Singapore, which is offering the world's first U.S. pre-market options trading at $0 fees*.

#1 – Trade in Singapore time zone

For most Singapore investors, US options trading has traditionally meant late nights and limited flexibility with standard US options hours.

Longbridge changes this by offering US pre-market options trading, giving investors access to the market before the main US session begins, and during Singapore-friendly hours.

With Longbridge, you can trade select US stock and ETF options from 5:00pm to 10:30pm SGT, adding an extra 5.5 hours of trading time ahead of the regular market open.

Learn more about Longbridge Singapore with our review here.

#2 – First mover advantage during earnings and news events

Pre-market trading is when price discovery begins. Futures move, implied volatility adjusts, and options premiums start reflecting new expectations, even though stocks haven’t officially opened yet.

With Longbridge’s free OPRA real-time data, investors can see these changes as they happen and react earlier than most retail participants who only trade during standard hours.

This can be particularly useful if you’re managing options around earnings, holding overnight positions and looking to take advantage of elevated volatility.

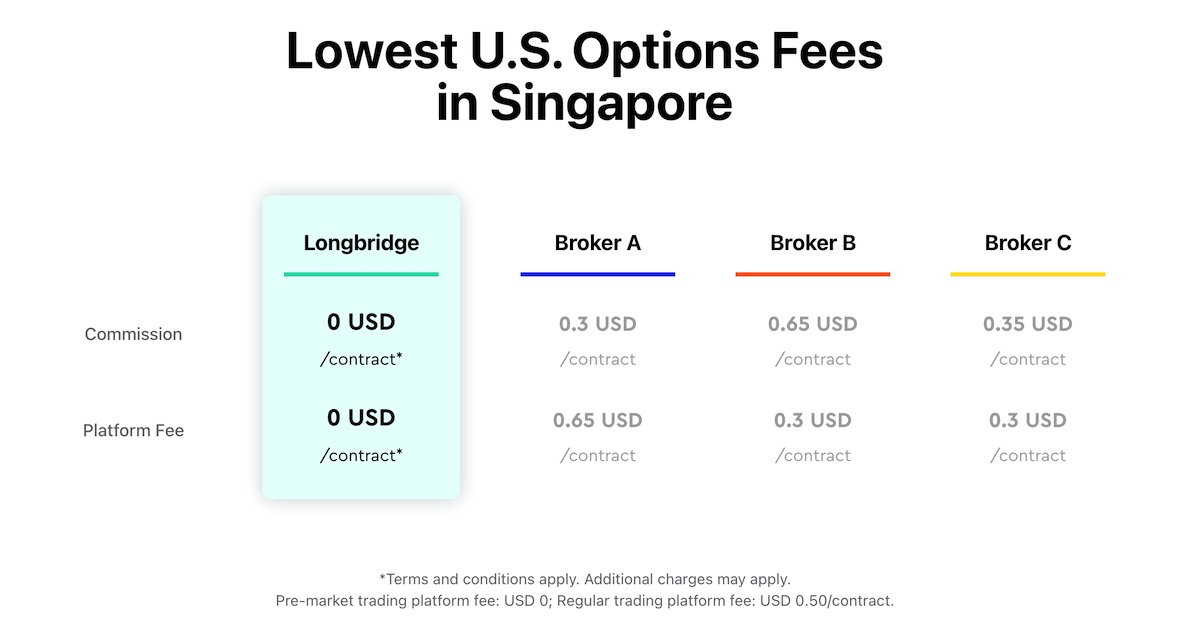

#3 - Trade options with zero commission and platform fees

Longbridge offers pre-market options trading with zero commissions and zero platform fees.

Eligible investors can trade major US ETFs such as SPY and QQQ, as well as popular US stocks such as Apple (AAPL), Tesla (TSLA), Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN) and more during the pre-market session.

Key risks to be aware of

Pre-market options trading offers more flexibility and earlier access, but it also comes with risks that investors should understand clearly before participating.

#1 – Lower liquidity and wider spreads

Pre-market trading typically has fewer participants than regular market hours.

As a result, options may have wider bid-ask spreads, which can make trades more expensive to enter or exit.

Prices can also move quickly with relatively small trades, increasing execution risk.

#2 – Higher volatility

Earnings announcements and overnight news often cause sharp price swings.

While higher volatility can create opportunities, it can also amplify losses just as quickly.

Options prices may change rapidly as expectations shift, even before the stock market officially opens.

#3 – Pricing dynamics that differ from regular market hours

Options pricing during pre-market hours reflects expectations, not final outcomes.

Early reactions to earnings or news can change as analysts and investors digest more information throughout the day. This can lead to false signals or overreactions.

Pre-market pricing is useful for insight and risk management, but it should not be the only factor driving a trade.

Understanding the strategy, payoff, and worst-case outcome remains essential.

Pre-market options trading can provide a timing advantage, but it is not risk-free.

Investors should size positions conservatively, use appropriate order types, and ensure they fully understand the strategy being used, especially during volatile earnings periods.

What would Beansprout do?

When major US companies release earnings after market close, much of the market’s adjustment happens while most Singapore investors are still asleep, leaving little time to plan the next move.

Pre-market options pricing gives an early signal of how the market is interpreting the results, allowing investors to strategise and position themselves ahead of volatility.

Sometimes, knowing when the market absorbs information is just as important as knowing what the information is. Pre-market accessibility empowers investors to make timely, informed decisions.

For investors who already trade US options regularly, having access during Singapore-friendly hours adds further flexibility.

Longbridge now offers U.S. pre-market options trading at $0* fees.

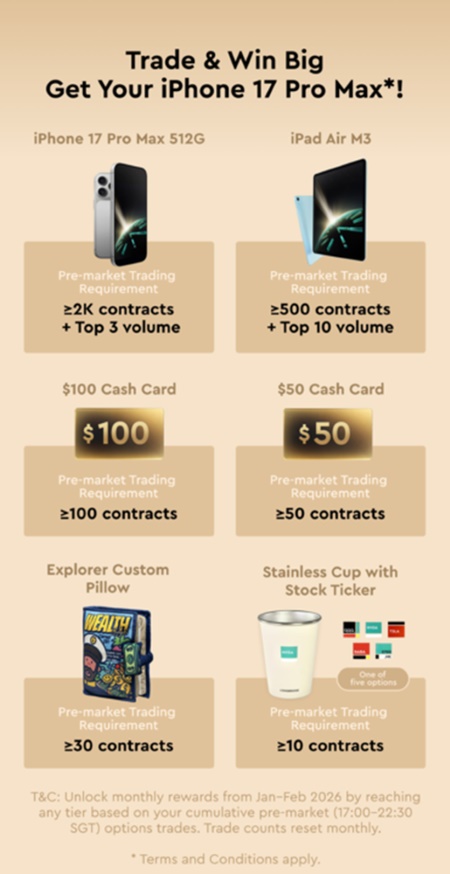

If you’re looking to trade options during the pre-market session, Longbridge is running a Trade & Win Big campaign for Singapore investors.

By trading US options during the pre-market window (5:00pm–10:30pm SGT), you can unlock monthly rewards based on your trading activity from cash cards to lifestyle prizes like custom merchandise and an iPhone 17 Pro Max.

If you’re already a Longbridge options investor, access is already enabled, you can simply log in and trade during pre-market hours.

New users who sign up for a Longbridge account through Beansprout can get a S$50 voucher and up to S$1,366 of Longbridge welcome rewards, and pre-market options access will be granted once eligible.*

Snatch these exclusive rewards when you sign up via Beansprout.

*T&Cs apply. Rewards are based on cumulative pre-market options trades per month.

Disclaimers

This article is a partnership with Longbridge Singapore. It is intended for general awareness and does not constitute investment advice or a recommendation to buy, sell, or otherwise engage with any investment products or financial services.

All views expressed are solely those of the presenter and do not necessarily reflect the views of Longbridge Singapore.

All investments carry risks, may not be suitable for everyone, and you may lose your investment principal. Past performance is not indicative of future results. You should seek independent financial advice if you are unsure about any investment decisions. This advertisement has not been reviewed by the Monetary Authority of Singapore.

🧧Get free $50 FairPrice voucher within 5 working days & 5% p.a. interest boost coupon (worth ~S$100). Claim your Longbridge Angbao with a $888 grand prize*. T&Cs apply.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments