Longbridge Singapore Review (2026): My likes and dislikes of this online trading platform

Brokerage Account

By Nicole Ng • 12 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Longbridge Singapore offers lifetime zero commission trading, but is it really as good as it seems? We review the broker covering its features and benefits, and whether it's the right platform for retail investors.

What happened?

When Longbridge, an online brokerage platform, launched in Singapore recently, I found myself wondering:

With so many brokers in Singapore, what’s so different about this one?

So I was intrigued when I found out that Longbridge was offering lifetime zero-commission trading on Singapore, US and Hong Kong stocks.

In this review, I take a closer look at Longbridge’s offerings, what’s great about the platform, and where the platform is lacking.

Read on to find out if the platform suits your investing needs!

What I like about Longbridge Singapore: Lifetime zero commission trading for US and Hong Kong stocks, user-friendly mobile app interface, access to bonds and funds.

What I would like to see on Longbridge Singapore: Limited market access and educational resources

🎁 Want to get started with Longbridge and receive an exclusive S$50 FairPrice voucher? Find out how to claim it.

What is Longbridge Singapore?

Longbridge positions itself as a "new-generation internet brokerage" which focuses on a mobile-first, zero-commission trading experience.

The company was founded in 2019 and is now headquartered in Singapore, combining financial expertise with tech talent from companies like Alibaba and ByteDance.

It has raised more than US$150 million in funding, including investments from PhillipCapital Singapore.

Recently, Longbridge secured another US$100 million in late 2024 to accelerate its regional growth.

What I like about Longbridge Singapore

#1 – Lifetime zero commission trading and no other fees

Longbridge offers permanent zero-commission trading for Singapore, US and Hong Kong stocks.

Unlike competitors who typically offer commission-free trading as temporary promotions, Longbridge has made this a cornerstone of their service.

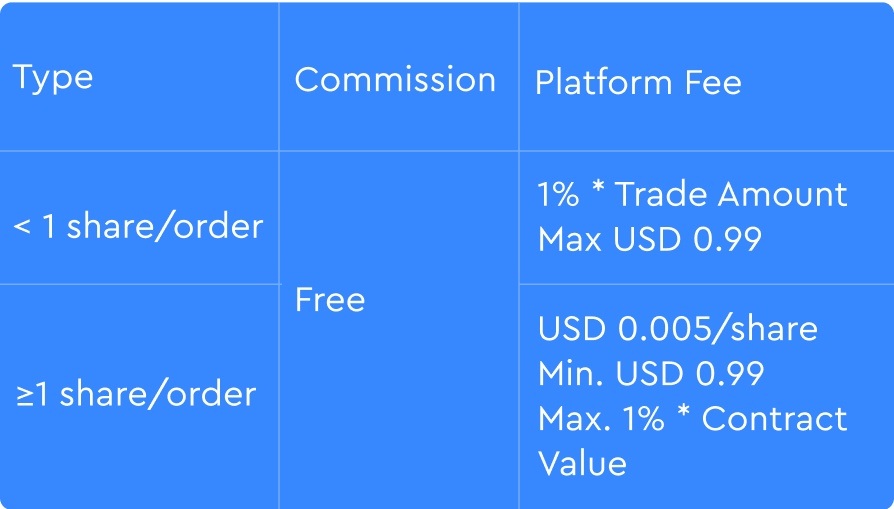

Below is a detailed breakdown of the fees that they charge for stocks, exchange-traded funds (ETFs), and Warrants:

| Market | Commission | Platform Fee | Minimum Fee per Order | Market Data |

| Singapore (including DLCs) | S$0 | 0.03% per order (min. S$0.99) | S$0.99 | Free Level 1 real-time data |

| Hong Kong (including CBBCs) | HK$0 | HK$15 per order | HK$15 | Free Level 1 real-time data |

| United States | US$0 | US$0.005 per share (min. US$0.99) | US$0.99 | Free Level 1 real-time data |

| Source: Longbridge Singapore, as of 10 December 2025 | ||||

Plus, you won’t have to worry about extra charges like custody fees, deposit or withdrawal fees, currency conversion costs, inactivity penalties, or account maintenance fees.

For those who are looking at US Options, Longbridge offers $0 commission on US Options with a platform fee (typically min. US$0.50 - 0.99 per order).

#2 – Invest in US stocks for as low as USD 1

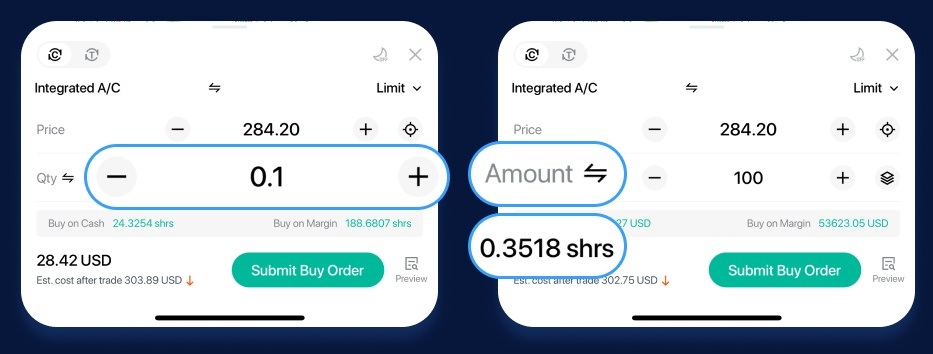

Longbridge also supports fractional trading for selected US stocks, allowing you to buy high-priced stocks like Nvidia or Microsoft with as little as US$1.

This provides beginners with an easy entry point into the US market.

The fee structure is also very friendly for small trades. While commissions are free, the platform fee is calculated at 1% of the trade amount, capped at a maximum of US$0.99.

This ensures that fixed minimum fees don't eat up your capital on small buy-ins. For example, if you invest just US$10, your platform fee is only US$0.10.

Crucially, owning fractional shares doesn't mean you miss out on the benefits of stock ownership.

These shares are eligible for mandatory corporate actions, including dividend distributions and stock splits. This means I can effectively build my position over the long term and collect dividends even before I own a full share.

You can place these orders in two ways: either by entering the specific number of shares you want or simply keying in the dollar amount you wish to invest.

Just keep in mind that fractional trading is only available during regular US market hours (9:30 AM to 4:00 PM ET) and currently supports Market and Limit orders, but not pre-market or after-hours trading.

#3 – User-friendly mobile app interface

One of the first things that stood out to me about Longbridge was how polished and well-thought-out the app felt.

It’s clean, modern, and designed for mobile-first investors.

The platform is structured around five main tabs, covering everything from watchlists and market insights to news and portfolio tracking.

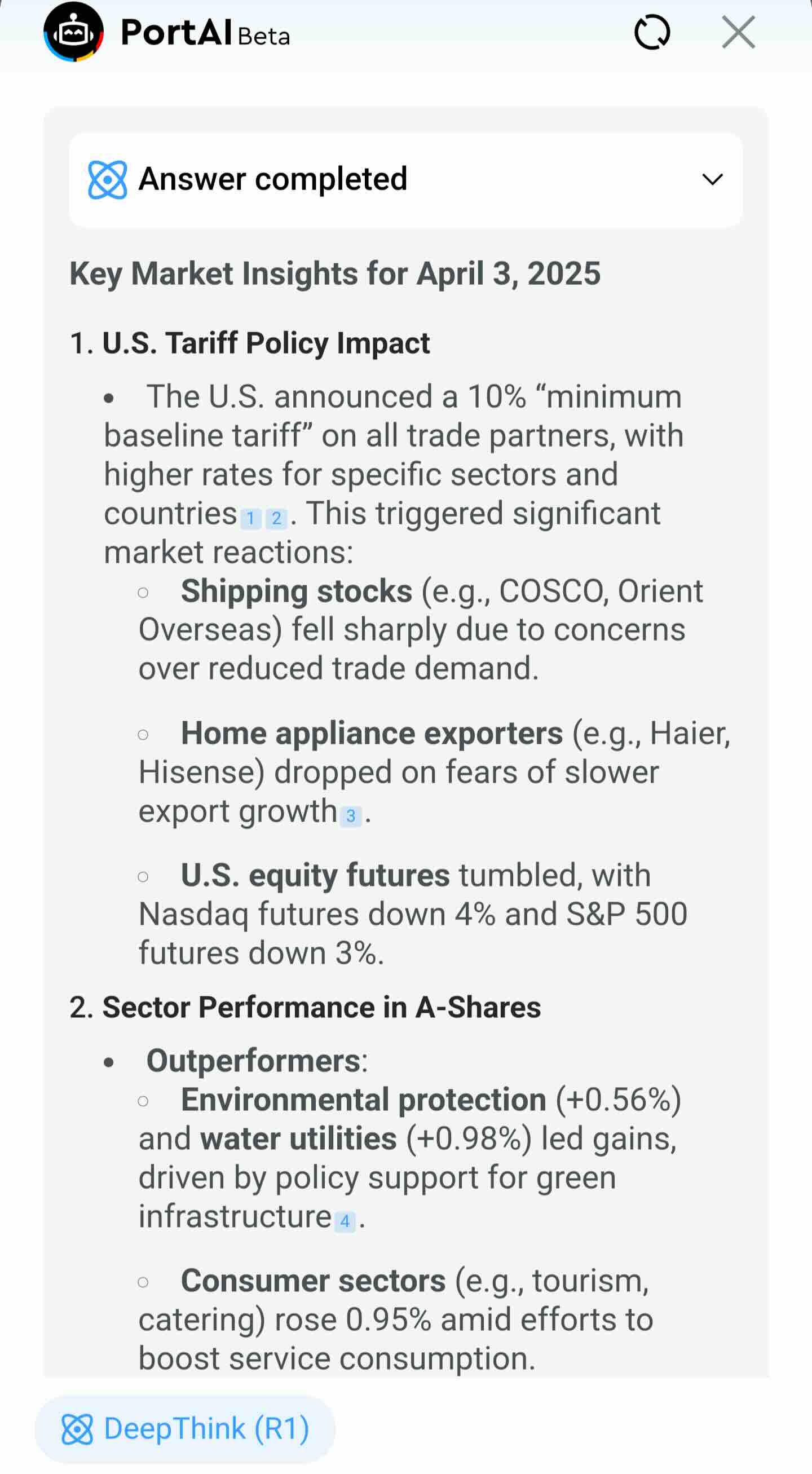

The layout makes it easy to move between research and execution, and I found the News tab especially useful, where it pulls together analyst reports, personalised AI-curated content, and market updates in one place.

A standout feature within the app is PortAI, an "AI-powered investment knowledge platform" created by the Longbridge team using large language model technology.

Think of it like an AI platform, only that PortAI actually answers your queries using real-time financial data:

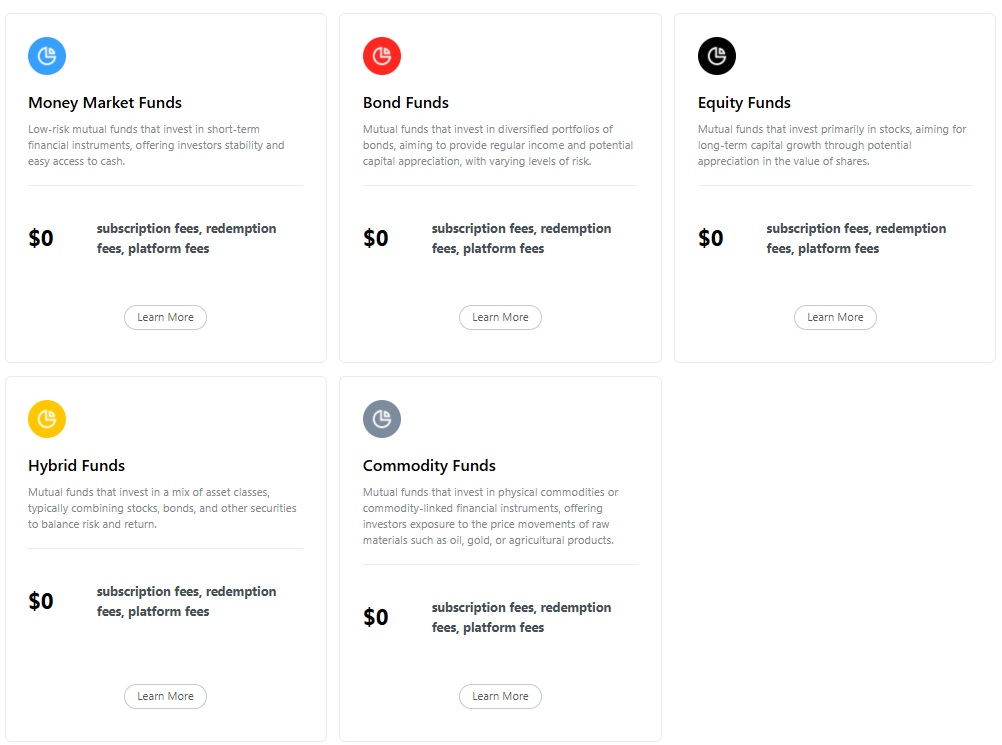

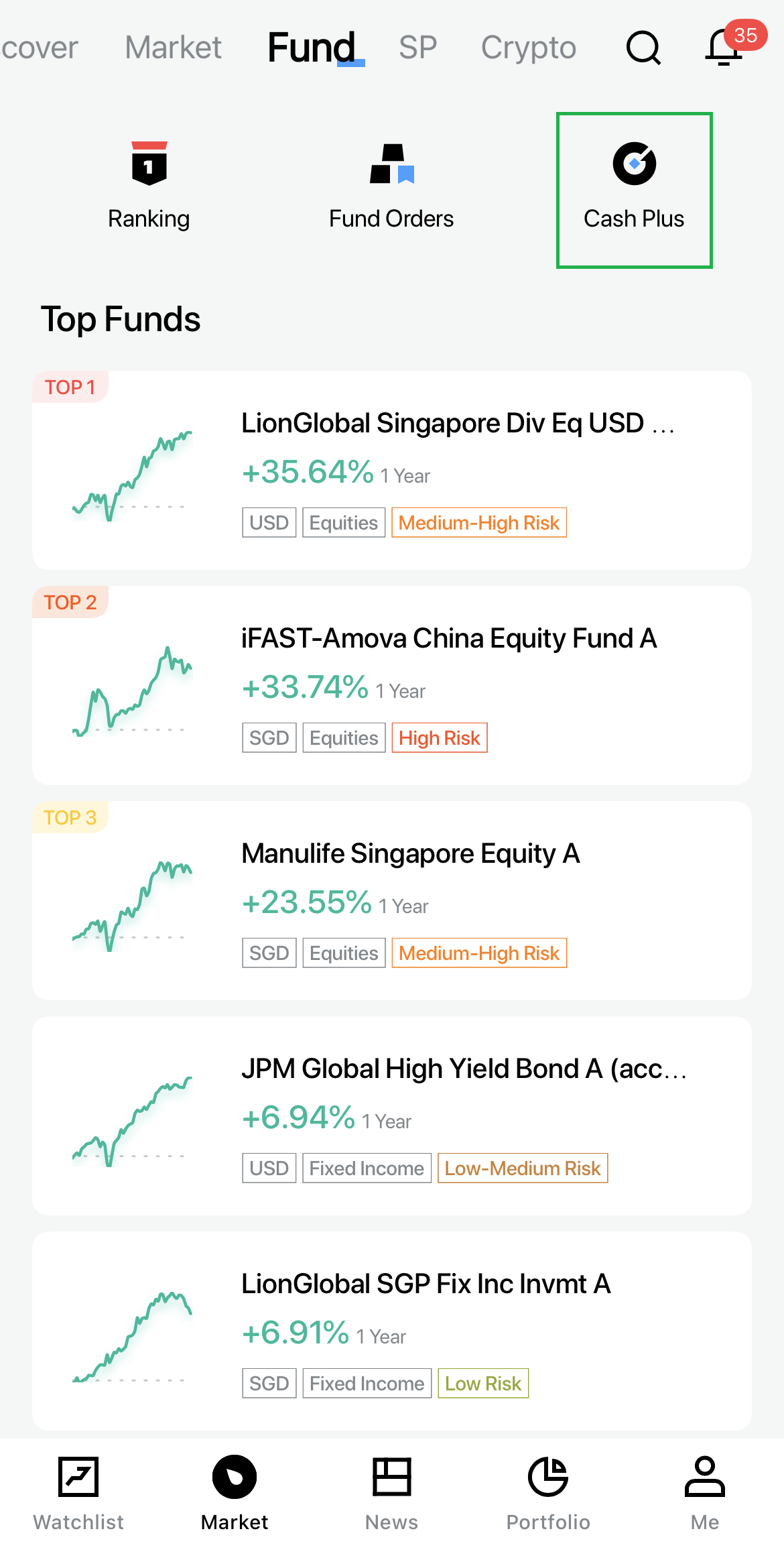

#4 – Access to funds and bonds

Beyond stocks and ETFs, Longbridge Singapore also offers access to funds and bonds from the best fund houses, allowing investors to diversify their portfolios within a single platform.

The platform features a range of professionally managed funds with underlying instruments, covering equities, fixed income, commodities and balanced strategies.

On the fixed income side, Longbridge provides access to retail and corporate bonds, which can appeal to more conservative investors seeking stable income.

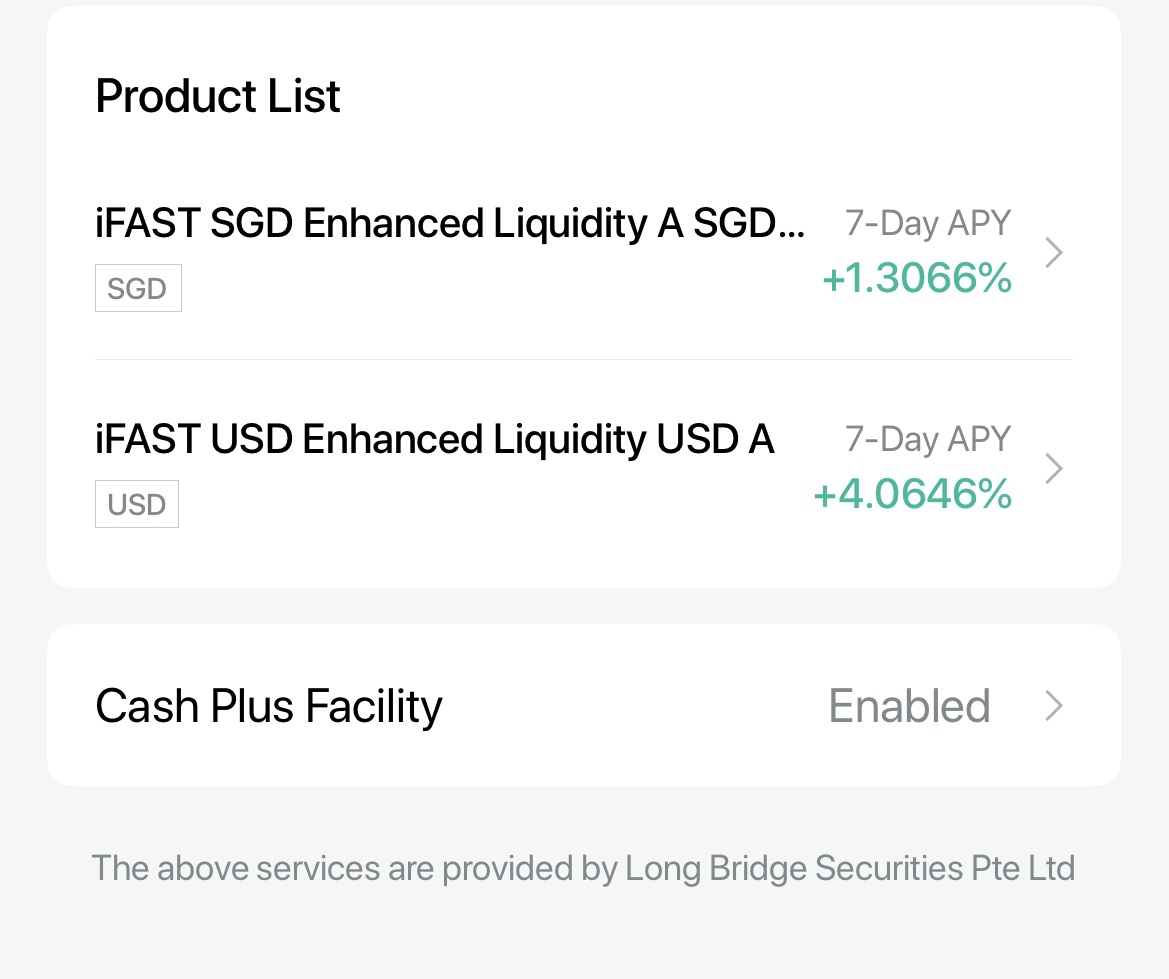

Longbridge also allows you to earn interest on your idle cash through Longbridge Cash Plus.

When you activate Cash Plus, your SGD cash is invested in the iFast SGD Enhanced Liquidity Fund and your USD cash in the iFast USD Enhanced Liquidity Fund.

These are money market funds that invest in low-risk bank deposits and high-quality bonds.

The standout feature for me is the “Auto-Sweep” capability, as I don’t need to manually redeem funds to trade, which makes the trading experience seamless and allows me to earn a better return on my idle cash when it isn’t invested.

For new users who sign up through Beansprout, Longbridge is also offering a 5% interest boost coupon on the first S$5,000 in Cash Plus for 365 days. Find out more about the promotion here.

This access to multi-asset investing makes Longbridge more versatile than other low-cost trading platforms that focus solely on equities.

Their platform supports over 32,000 tradable financial products, including stocks, ETFs, REITs, funds, options, and warrants.

#5 – Easy signup process

Signing up with Longbridge Singapore is one of the smoothest onboarding experiences I’ve had with any brokerage.

Everything is done within the Longbridge app, and the use of MyInfo via Singpass makes it incredibly fast and convenient.

After downloading the app, you register with your mobile number, verify it via SMS, and tap “Open an Account,” selecting Singapore as your region, and use your MyInfo to populate your signup information.

Most accounts are approved within a few hours or by the end of the day.

Once you’re in, you can fund your account through Direct Debit Authorisation (DDA) with local banks like DBS, OCBC, or UOB and WISE transfers, or use FAST/Swift or PayNow for near-instant transfers.

🎉 Bonus for new users: Get a S$50 Fairprice voucher within 5 working days when you open a Longbridge account via Beansprout.

Is Longbridge Singapore safe and legit?

Longbridge is licensed with MAS and holds a Capital Markets Services License.

Longbridge also maintains custody of customer securities through authorised third parties, segregating client assets from their own capital.

Additionally, they've appointed DBS Bank (Singapore's largest bank) as their custodian for client money.

💡 Thinking of joining Longbridge, see how I stacked S$208 in rewards with Longbridge promo.

What I think could be improved on Longbridge Singapore

#1 – Still a relatively new platform

As a relatively new player (established in 2019), Longbridge doesn't have the decades-long track record of traditional brokers.

While their rapid growth and substantial funding are positive indicators, some investors might prefer platforms with longer operational histories, especially for larger portfolios.

That said, their regulatory compliance and institutional backing do mitigate much of this concern.

#2 – Limited educational resources

From the available information, there seems to be room for expanding their educational content.

For newer investors especially, comprehensive learning resources can be crucial in building investment confidence.

Enhanced tutorials, market insights, and strategy guides would strengthen their offering for beginner to intermediate investors.

Longbridge vs Moomoo vs Webull: Which would I choose?

If you're curious about how Longbridge stacks up against other popular brokers like Moomoo and Webull, I’d recommend checking out the comparison table below.

When it comes to trading Singapore stocks, Longbridge offers lifetime commission-free trading. In comparison, Moomoo SG and Webull only offer zero commissions for the first year.

After the first year, Longbridge users continue to pay only the platform fee of 0.03% (minimum S$0.99).

Moomoo SG users would likely pay a total of 0.06% of the transaction amount (0.03% commission + 0.03% platform fee), with a combined minimum of roughly S$1.98 per trade.

Whereas, Webull users would pay a total of 0.05% of the total trade amount (0.025% commission + 0.025% platform fee), with a combined minimum of roughly S$1.60 per trade.

For US stock trading, Longbridge charges a platform fee of US$0.005 per share with a minimum of US$0.99. This makes it competitive with Moomoo SG, which charges a flat US$0.99 platform fee per order.

| Online Broker Platform | Longbridge | Moomoo SG | Webull |

| Commission fee | US stocks: S$0 | US stocks: US$0 | US stocks: US$0.90 per order (limited time only) or 0.025%, min. US$0.50 |

SG stocks: S$0

| SG stocks: S$0 for 1 year. Thereafter, 0.03%, min S$0.99 | SG stocks: S$0 for 1 year. Thereafter 0.025%, min S$0.80 | |

| Platform fee | US stocks: US$0.005 per share (min. US$0.99 per order; max 1%* trade value per order) | US stocks: US$0.99 per order | US stocks: US$0 |

SG stocks: 0.03%, min. S$0.99 | SG stocks: 0.03%, min S$0.99 | SG stocks: 0.025% (min S$0.80) | |

| Markets accessible | Singapore, US, Hong Kong | Singapore, US, Hong Kong, Japan | US, HK, Singapore, China |

| Products offered | Stocks, ETFs, REITs, bonds, mutual funds, options, warrants & CBBCs | Stocks, ETFs, options, futures, FX, mutual funds | Stocks, ETFs, options, mutual funds, DLCs, ADRs |

| Source: Longbridge, Moomoo, Webull, as of 10 December 2025 | |||

💡 Thinking of joining Longbridge, sign up via Beansprout to get S$50 Fairprice voucher.

What would Beansprout do?

Longbridge Singapore’s combination of zero commissions, technological innovation, and regulatory compliance creates a compelling package worth considering for your investment toolkit, especially if you’re a tech-savvy mobile-first investor.

Longbridge Singapore is still one of the lowest cost trading platforms for Singapore stocks.

For Singapore-based investors seeking global exposure without the burden of high trading fees, Longbridge is one of the more innovative options in our local market.

If you’re looking to compare Longbridge to other brokers in Singapore, check out our guide to the best online brokerage platforms.

Longbridge Exclusive Promotion

Learn more about the Longbridge welcome rewards promotion here.

Learn how I earned S$230 in rewards with Longbridge promo – here's how I stacked it.

If you have a question about Longbridge Singapore, ask us in the Q&A section below.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

2 questions

- Jason • 20 May 2025 02:49 PM

- Jason • 20 May 2025 02:49 PM