There are many paths to financial freedom, and that’s perfectly okay

Retirement

By Julian Wong • 09 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

In this personal reflection, we explore how your financial personality shapes your habits, how these traits evolve with time, and why self-awareness (not perfection) is the real key to long-term success.

Years ago, when I first started working, I barely saved anything. I didn’t earn much at the time, and my thinking was: if I'm only saving $100-200 a month, why even bother?

Later, when my salary grew, I thought things would get easier. Yet instead of saving more, I found myself still stuck in old habits. Investing remained a daunting prospect, and I just kept telling myself I'm "not a numbers person".

It wasn't that I didn’t care. I just didn’t know where to start.

When I began thinking about longer-term goals—buying a home, supporting my parents, building a cushion for the future—I finally realised the need to be more intentional.

With a new sense of urgency, I began building structure. That was when I started first tracking my expenses, then automating my savings, and eventually investing in index funds.

Even then, it wasn’t a clean, upward journey. By my own standards, I still don't consider myself financially free.

During stressful months, I gave in to impulse spending. For a short period when I went on sabbatical, I stopped automating my investments.

Today, while I feel secure in the portfolio I've managed to build, there are still days when I worry if it will be enough when I eventually decide to retire.

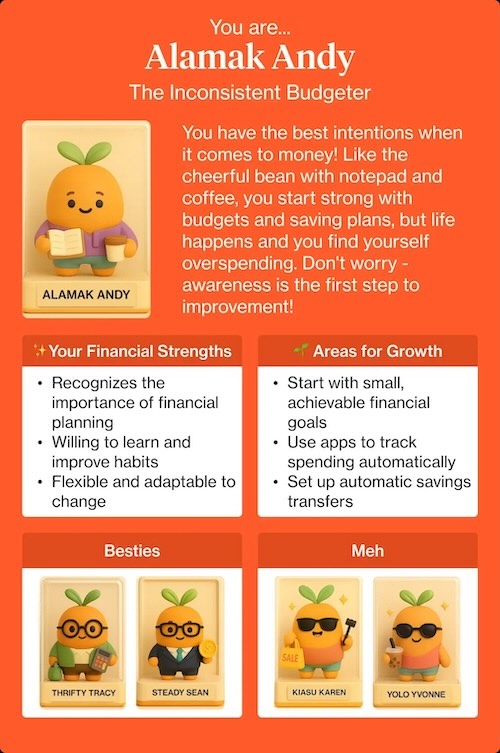

Last week, we launched a quiz asking readers, "What's your Singaporean money personality?"

Many of you tagged us after taking it, telling us how much you resonated with the different characters. Some of you were clearly further along on your financial journey, while others shared about feeling like you've still got lots to improve on.

When it comes to our finances, the reality is: we all have parts of these different personalities. And our paths all look different depending on where we are in life and in our personal investment journeys.

Money struggles are part and parcel of the journey

Being good with money isn't about mastering a single skillset. It’s about developing awareness and recognising that different personalities reflect different challenges we all face. Read about how different everyone's journey can be in our Money Diaries series.

Alamak Andy, who starts strong with budgets and spreadsheets, veers off track mid-month. This is us sometimes when life catches us off-guard, and he reminds us that willpower is not enough. We all need systems that catch us when life gets chaotic.

Or perhaps you see yourself more in Kiasu Karen, the deal hunter who knows how to stretch every dollar. You’ve got discount alerts set up, use promo codes religiously, and live for cashback.

But Karen’s challenge is knowing that you don't have to seize every bargain. Saving 20% on something you don't need is still spending 80%.

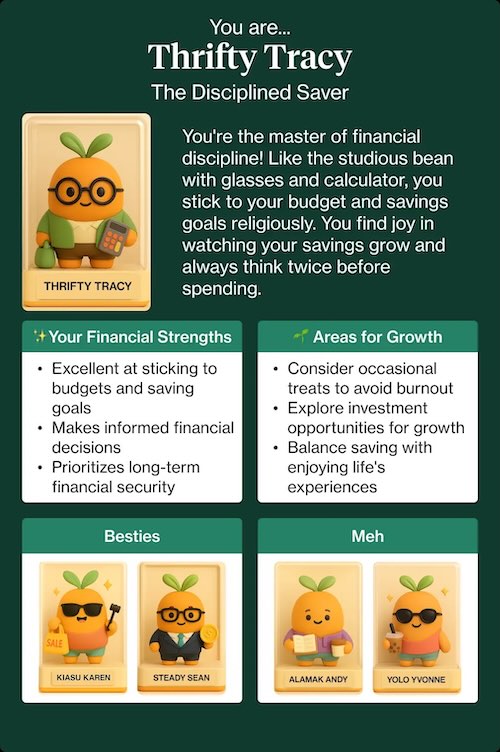

And then there's Thrifty Tracy, the disciplined saver who tracks every expense, never pays full price, and finds joy in seeing her bank balance grow.

Tracy’s strength is focus, but she needs to remember that money is also meant to be enjoyed—not just hoarded. It's okay to spend on yourself every once in a while.

Though that said, we all need to be careful not to take it to the extreme like YOLO Yvonne, who’s all about living life to the fullest. Yes, money is meant to be used, but Yvonne’s blind spot is forgetting to plan for rainy days and longer term aspirations. Joy should not come at the cost of security.

Or maybe you're Steady Sean, the long-game strategist. You read up before investing, understand market cycles, and aren’t rattled by short-term noise. But Sean’s challenge is realising that the stock market isn't the only area of life worth investing in.

Understanding the real ‘why’ behind why we invest

These personalities are fun to read about, and maybe we all know someone that fits one of these characters exactly. But the truth is, most of us don’t fit neatly into just one personality.

Find out which Money Personality you are with our quiz.

On any given day, we might be a little bit of Alamak Andy and a little bit of Kiasu Karen. Or we might start the year as a Steady Sean and end it like YOLO Yvonne.

This is because our relationship with money isn’t fixed—it’s constantly shifting, responding to the seasons of our lives and our shifting priorities.

The version of me who couldn’t save in my early twenties is a version who still exists (though he shows up a lot less these days). So was the version of me who feared investing, which is why I still stick only to the asset classes that I know.

I’ve learned that the goal isn’t to become the perfect investor—whatever that means—or even to "get rich". Instead, it's about staying curious: about money, myself, and what I want my life to look like.

With investing, it is always tempting to compare, whether to others or to where we expect to be. But remember: we are all navigating our own unique mix of experiences, habits, fears, and hopes!

At the end of the day, there are many paths to financial freedom.

This SG60, as we celebrate how far we have come, we're also reminded that there is no single path forward in our journey towards growing our wealth.

Whether it's through saving or investing, the best route is the one that works for you.

Check out SG60 Promos - 9 promotional deals to celebrate Singapore’s National Day

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments