Maybank iSAVvy Savings Account: Earn interest rate of up to 1.40% p.a.

Savings Account

By Beansprout • 05 Jan 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Maybank iSAVvy Savings Account is offering new customers or existing customers with fresh funds a promotional interest rate of up to 1.40% per annum in January 2026.

What's the deal with Maybank iSAVvy Savings Account Promo?

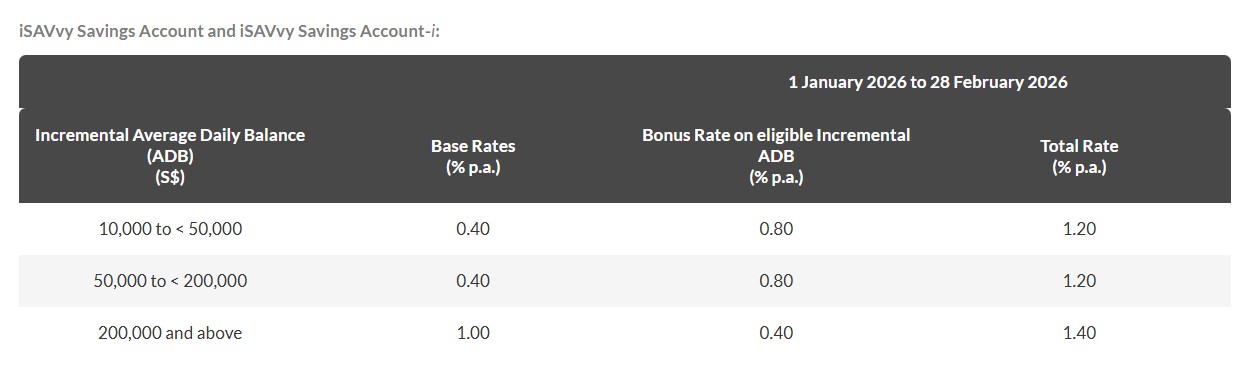

The Maybank iSAVvy Savings Account is offering a promotional interest rate of up to 1.40% per annum for new customers and fresh funds of existing customers from 1 January 2026 to 28 February 2026.

To earn the promotional interest rate of up to 1.40% per annum, you will need to have incremental deposits of at least S$10,000 during the promotional period compared to your December 2025 balances.

For existing customers of Maybank iSAVvy savings account, you will be able to earn a bonus interest of 0.80% p.a. on top of the base interest rate of 0.40% p.a. on your incremental average daily balance (ADB) if your ADB is in the range of S$10,000 to S$200,000.

This means that you would be able to earn an interest rate of 1.20% per annum by increasing your average daily balance (ADB) compared to December 2025.

If your ADB is higher than S$200,000, you will earn a base interest rate of 1.00% p.a., and bonus interest rate earned of 0.40% p.a.

This means that you would be able to earn an interest rate of 1.40% per annum by increasing your average daily balance (ADB) compared to December 2025.

The promotional interest rates on incremental deposits are valid from 1 January 2026 to 28 February 2026.

What is the Maybank iSAVvy Savings Account?

The Maybank iSAVvy Savings Account is a basic savings account which offers a base interest rate of 0.05% to 1.00% p.a. depending on how much is deposited.

The minimum deposit amount is just $500, and you just need to be 16 years of age to open an account.

What are the eligibility requirements for Maybank iSAVvy Savings Account promo?

#1 - The bonus interest is only offered on the incremental average daily balance

For existing customers, the bonus interest rate will be applied to the incremental Average Daily Balance (ADB) compared to December 2025.

If your ADB is between S$10,000 and S$200,000, you will earn a base interest of 0.40% p.a. on funds already in your account, while your incremental ADB, will earn the additional promotional rate of 0.80% p.a.

For example, if you are an existing Maybank iSAVvy Savings Account holder with $10,000 in your bank account in December 2025, and have added $15,000 to your Maybank iSAVvy Savings Account in January 2026, the existing deposits of $10,000 will earn the base rate of 0.40% p.a. while the incremental $15,000 of deposits will earn an interest rate of 1.20% p.a.

On the other hand, if your ADB is above S$200,000, your incremental ADB will earn the promotional rate of 1.40% p.a.

For new customers, the ADB for December is considered as zero. Hence, you will enjoy the interest rate of up to 1.40% p.a. during the promotional period.

#2 – Bonus interest rate only applicable for promotional period

The bonus interest rate will only be applied for the promotional period from 1 January 2026 to 28 February 2026.

Once the promotion ends on 28 February 2026, the interest earned will revert back to the base interest rate.

The credited interest will be processed within 10 business days of the following month. Note that no bonus interest will be granted if the account is closed.

#3 - Incremental ADB must be at least S$10,000

To be eligible for the bonus interest rate, the Incremental ADB must be a minimum of S$10,000 for the iSAVvy Savings Account.

Also, the deposits must come from new funds. This means that cheques or transfers from an Account Holder's existing Maybank account are not eligible.

The full terms and conditions of the Maybank iSAVvy Savings Account Promo can be found here.

How does the Maybank iSAVvy Savings Account compare to the other bank account?

Unlike the Maybank SaveUp Account which offers a higher interest rate when you fulfil certain criteria, the MayBank iSAVvy Account does not require you to jump through multiple hoops.

The promotional interest rate of up to 1.40% per annum is comparable to other fuss-free accounts.

The promotional interest rate is higher than the CIMB FastSaver account with an effective interest rate of up to 1.05% p.a on the first S$75,000.

The Maybank iSaVvy is lower than the promotional interest rate of 1.55% p.a offered by the Standard Chartered e-Saver account for balances above $200,000 without wealth holdings.

However, if we are just considering the prevailing base interest rate of 0.05% to 1.00% p.a., there are other options for hassle-free bank accounts that offer more competitive interest rates for a lower amount of ADB requirement.

How to apply for the Maybank iSAVvy Savings Account

To open a Maybank iSAVvy Savings Account, you will need to be at least 16 years old and have a minimum initial deposit of $500 for Singaporeans and Singapore PRs.

There are a few options that you can use to apply for the iSAVvy Savings Account:

- apply online

- via Maybank2u SG app (for Singaporeans and Singapore Permanent Residents)

- or visit a Maybank branch.

To speed up this whole process, we will recommend using Singpass Myinfo when you apply online.

Step #1 - Submit application with Myinfo

Ensure you have your Singpass ID, password, and an image of your signature ready.

Click on Myinfo, granting Maybank permission to access your personal information and speed up the process.

Step #2 - Receive Account Number

After completing the initial step, you'll receive an email containing your account number. This email includes a password-protected PDF attachment. The password required to open it will be sent to you via SMS.

New bank customers will also receive the following:

- Your Online Banking Access ID in the PDF file

- An additional SMS with your PIN for signing up or performing your first-time login to Online Banking.

What would Beansprout do?

If you have more than S$200,000 of savings, it may be worthwhile considering the promotional interest rate of 1.40% p.a. on fresh funds.

However, we need to be aware that the bonus interest rate is only applicable to the promotional period, and your incremental fresh funds must be at least S$10,000.

If you have less than S$200,000 of savings, the promotional interest rate of 1.20% p.a. on fresh funds would be lower than Standard Chartered eSaver account without wealth holdings.

To find out which savings account allows your money to work harder, check out our guide to the best savings account with highest interest rates in Singapore

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights on savings, investing and retirement planning.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions