Standard Chartered eSaver: Earn up to 1.65% p.a. for fresh funds

Savings Account

By Beansprout • 02 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The Standard Chartered eSaver (e$aver) account is offering a promotional interest rate of up to 1.65% p.a. for fresh funds.

What happened?

The Standard Chartered eSaver (e$aver) account is offering a promotional interest rate of up to 1.65% p.a. for fresh funds deposited into the savings account.

The bonus interest rate will be applicable through the promotion period from 1 February 2026 to 31 March 2026.

Read on to find out more about the Standard Chartered eSaver account promotion if you are looking out for a bank account to earn a higher interest rate for your savings.

What is the interest rate on the Standard Chartered eSaver (e$aver) savings account?

The Standard Chartered eSaver account is offering an interest of up to 1.65% p.a. on eligible deposit balances of up to S$2 million.

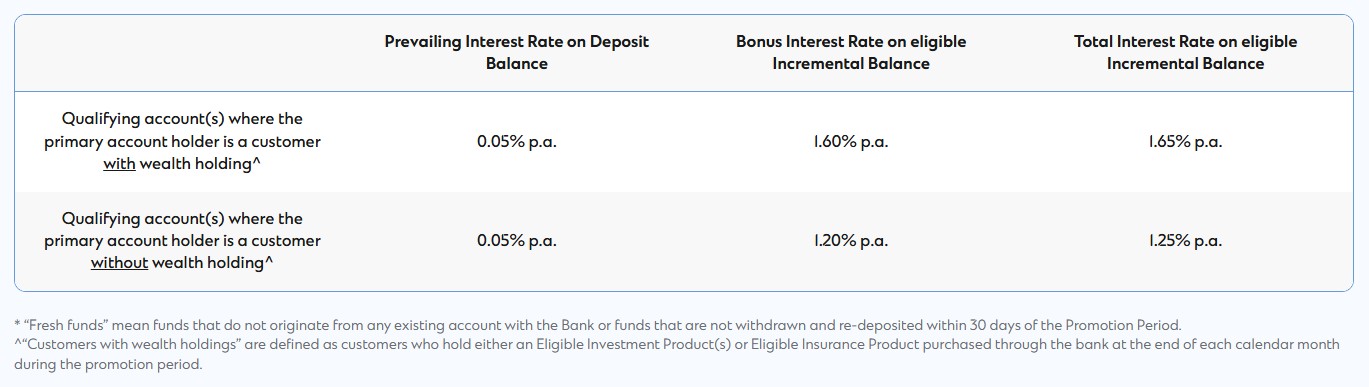

This would include a prevailing interest rate of 0.05% p.a. on your deposit balance, and bonus interest rate on eligible incremental balance of up to 1.60% p.a.

This would mean that you would earn a total interest rate of up to 1.65% p.a. on your eligible incremental balance.

However, do note that the 1.65% p.a. rate applies only to wealth customers.

Customers without wealth holdings earn 0.05% p.a. base and up to 1.20% p.a. bonus on incremental balance, totalling up to 1.25% p.a.

You will only earn the bonus interest rate during the promotional period through 1 February 2026 to 31 March 2026.

After the promotional period, you will earn just the prevailing interest rate i.e. 0.05% p.a on the entire deposit balance.

How does the Standard Chartered eSaver (e$aver) savings account work?

The Standard Chartered eSaver account is a relatively fuss-free account, so you do not have to fulfil multiple criteria to be able to earn the higher interest rate.

To be eligible for a Standard Chartered eSaver account, you would need to be 18 years old and above.

The minimum average daily balance required for the Standard Chartered eSaver account is S$1,000.

More importantly, you would need to make sure that your deposits are considered “fresh funds” to qualify for the bonus interest rates.

Fresh funds here refer to funds that do not originate from any existing account with Standard Chartered.

And the eligible incremental balance will be compared to January 2026 average daily balance.

Also, the funds must not be withdrawn and re-deposited within 30 days of the promotional period.

You can find out more about the full terms and conditions of the Standard Chartered eSaver promo here.

How to apply for Standard Chartered eSaver account?

You can apply for the Standard Chartered eSaver account online here.

The good news is that you can pre-fill your application via SingPass, and your account will be opened instantly after your details are verified.

What would Beansprout do?

If you have some spare cash and are looking at a high yield savings account to park your savings for a short period of time, then it might be worth considering depositing your fresh funds in the Standard Chartered eSaver account for its bonus interest rate of up to 1.65% p.a. until 31 March 2026.

Do note that if you don’t meet the wealth criteria, you would only earn a total bonus interest of 1.25% p.a.

If you're looking to explore more options, check out our guide to the best savings account in Singapore to find out which savings account offers the highest interest rate.

If you would prefer to lock in interest rates for a longer period of time, find out which are the best fixed deposit interest rates currently.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

If you’re looking for Beansprout Exclusive ongoing promotions, you can check them out here.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions