A cheaper way to invest in Singapore stocks through your CDP account

Brokerage Account

Powered by

By Nicole Ng • 24 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

moomoo now supports direct CDP buying and selling for Singapore stocks. Learn how to link your account to enjoy lower fees while keeping direct ownership of your dividends.

This post was created in partnership with Moomoo Singapore. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Over the past few months, I have noticed renewed interest in Singapore stocks.

Investors in the Beansprout community have also shared that they are looking to build passive income with Singapore stocks.

Singapore stocks continue to attract long-term investors because they offer a steady mix of dividends and stability.

At the same time, I also hear from readers who prefer to hold their SGX shares directly in their CDP account.

The challenge is that buying and selling Singapore stocks directly into CDP has traditionally been more expensive. For those who invest regularly, these extra costs can add up over time.

This is why a new feature on Moomoo Singapore caught my attention.

Moomoo Singapore now allows users to buy and sell SGX-listed stocks and settle them directly into their CDP account.

In this article, I will cover how CDP-linked trading works on moomoo, who might find this useful, and how to link your CPD account to moomoo.

Why CDP accounts may be preferred over custodian accounts?

Many investors still prefer holding their SGX-listed stocks in their CDP accounts even with the rise of low-cost custodian platforms in recent years.

There are a few reasons for this.

#1 – Direct ownership

Shares bought through a CDP-linked broker are held directly in your name, not under a nominee structure as with a custodian account.

This means you retain full legal ownership of your SGX shares, independent of any platform.

Some investors have peace of mind knowing their shares remain theirs even if they switch brokers.

#2 – Direct flow of dividends, corporate actions, and shareholder rights

When your shares are held in CDP, you’re recognised as the registered shareholder, which means everything is sent straight to you.

Notices on rights issues, preferential offerings, and other corporate actions are sent to you directly, rather than routed through a broker.

Dividends are credited directly to your designated bank account.

For long-term investors, this removes the need to monitor multiple broker accounts for dividend payouts, and ensures you’re informed promptly of corporate actions without relying on a custodian to relay the information.

Finally, you typically can attend AGMs, have voting rights, and receive shareholder communications directly, rather than through your broker.

#3 – Simplicity for long-term investing

Some passive income investors prefer to keep their Singapore dividend stocks separate from their trading accounts.

They see CDP as a long-term vault for their core holdings.

The cost may be higher, but the stability and predictability matter more to them.

Custodian accounts offer lower fees and a wider range of global markets, but the shares are technically held in the broker’s name.

This means if you use multiple brokers, your shares end up spread across several nominee accounts.

For some investors, this difference is minor, but for others it is meaningful.

Why trade Singapore stocks via CDP on moomoo?

moomoo now supports CDP-linked buying and selling for SGX-listed stocks, something that isn’t offered by many low-cost online brokers.

Here are several reasons why this feature may appeal to investors.

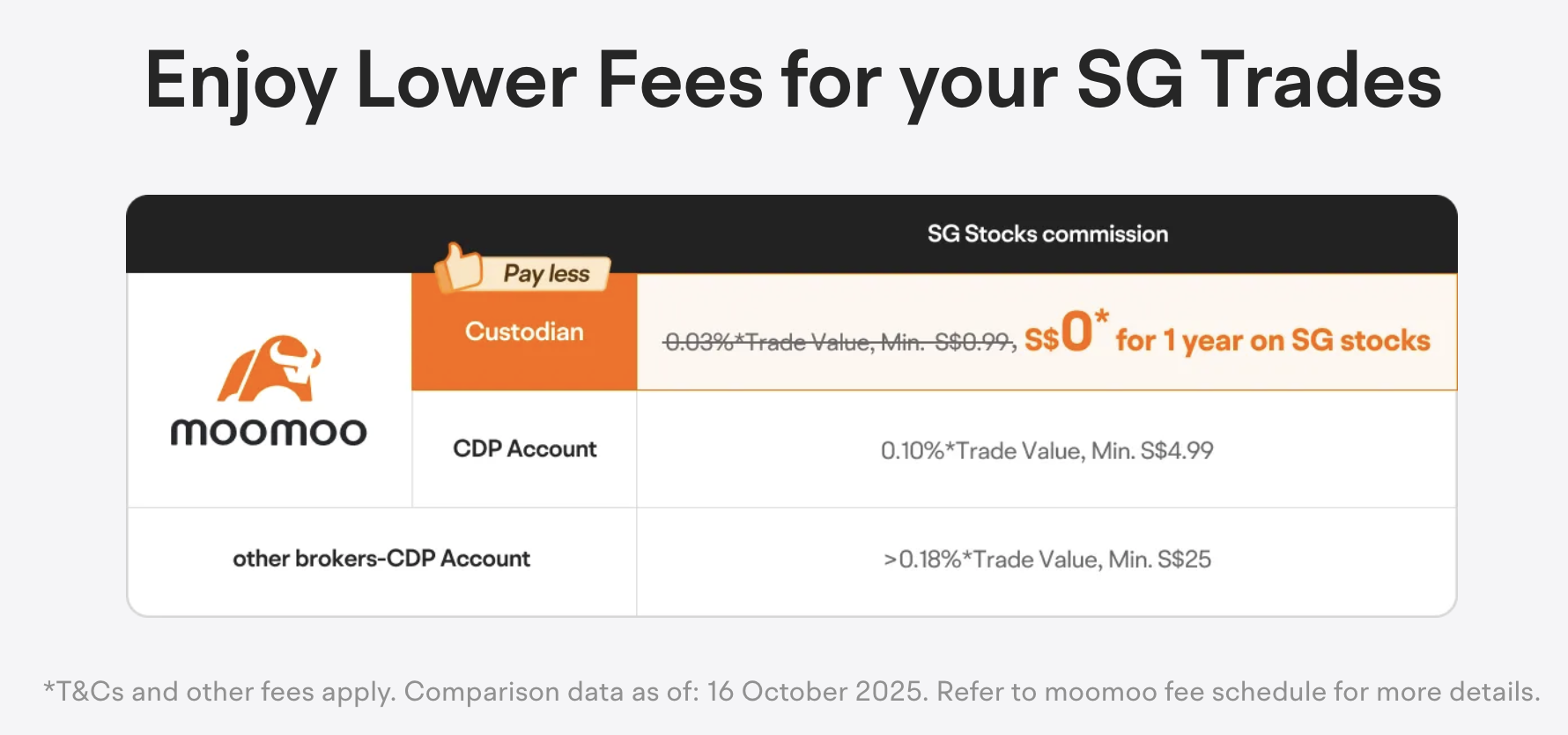

#1 – Lower fees for smaller trades

One of the biggest barriers to CDP investing, especially for beginners and investors who invest smaller amounts, has been cost.

Moomoo charges a commission of 0.10% of trade value, or a minimum of S$4.99 and a platform fee of 0.12% of trade value, or a minimum of S$4.99.

This brings the total fees to 0.22% of trade value or a minimum of S$9.98, for both buy and sell CDP orders.

Most other traditional CDP-linked brokers operate on a tiered commission structure depending on trade size from 0.18% to 0.28%, but they all share a minimum commission of at least S$25 per trade.

Because of this minimum fee, the effective cost for smaller trades is often higher with traditional brokers.

While Moomoo's percentage fee may be slightly higher, its much lower minimum fees make it more cost-efficient for investors are investing smaller amounts.

For example, if you buy 100 units of an Singapore Airlines stock priced at S$6.40 each, the total trade value comes to S$640.

With a traditional CDP-linked broker, the commission of 0.18% works out to S$1.15, but because the minimum commission applies, you would still pay S$25 for the trade.

In comparison, using moomoo’s CDP-linked account, the commission and platform fee of 0.22% would work out to S$1.41, but you would pay the minimum commision and platform fee of S$9.98.

For most retail investors who have smaller trades below S$4,500, the lower minimum fee Moomoo offers tends to be more cost-effective.

Alternatively, if you prioritise the absolute lowest cost over direct ownership, their Universal Account (Custodian) standard commission fee is just 0.03% (or a minimum cost of S$0.99) for each trade, and a platform fee of 0.03% (or a minimum of S$0.99)

They are currently running a new user promotion of S$0 commission* for Singapore stocks through custodian for your first year.

Get a S$50 FairPrice voucher within 5 working days (with promo code BEANSPROUTS1) and up to S$1,315* welcome rewards when you sign up for moomoo through Beansprout and stand a chance to win a Gold Bar* by linking your CDP to moomoo. T&Cs apply. More details on the promo here.

#2 – No need to compromise between direct ownership and platform convenience

Previously, investors who wanted CDP settlement often had to use older broker interfaces with fewer features.

At the same time, investors who liked modern tools had to give up CDP and use custodian accounts.

With moomoo’s CDP linkage, investors can now keep their preferred ownership structure while enjoying a smoother trading experience.

To buy stocks using your CDP account, simply search for the SG-listed stock you want, tap Trade > Buy, and switch the account selection at the top to your CDP Account before placing the order.

To sell stocks held in your CDP account, search for the stock, tap Trade > Sell, and select your CDP Account at the top.

Before selling, ensure that your shares are fully settled in your CDP portfolio to avoid any penalties.

Moomoo also supports both buying and selling directly through CDP on its platform, unlike some online brokers that only allow CDP selling or CDP buying but not both.

One thing to note is that your CDP holdings will not appear in the moomoo app for now. To view your portfolio, you will need to log in to the SGX Investor Portal.

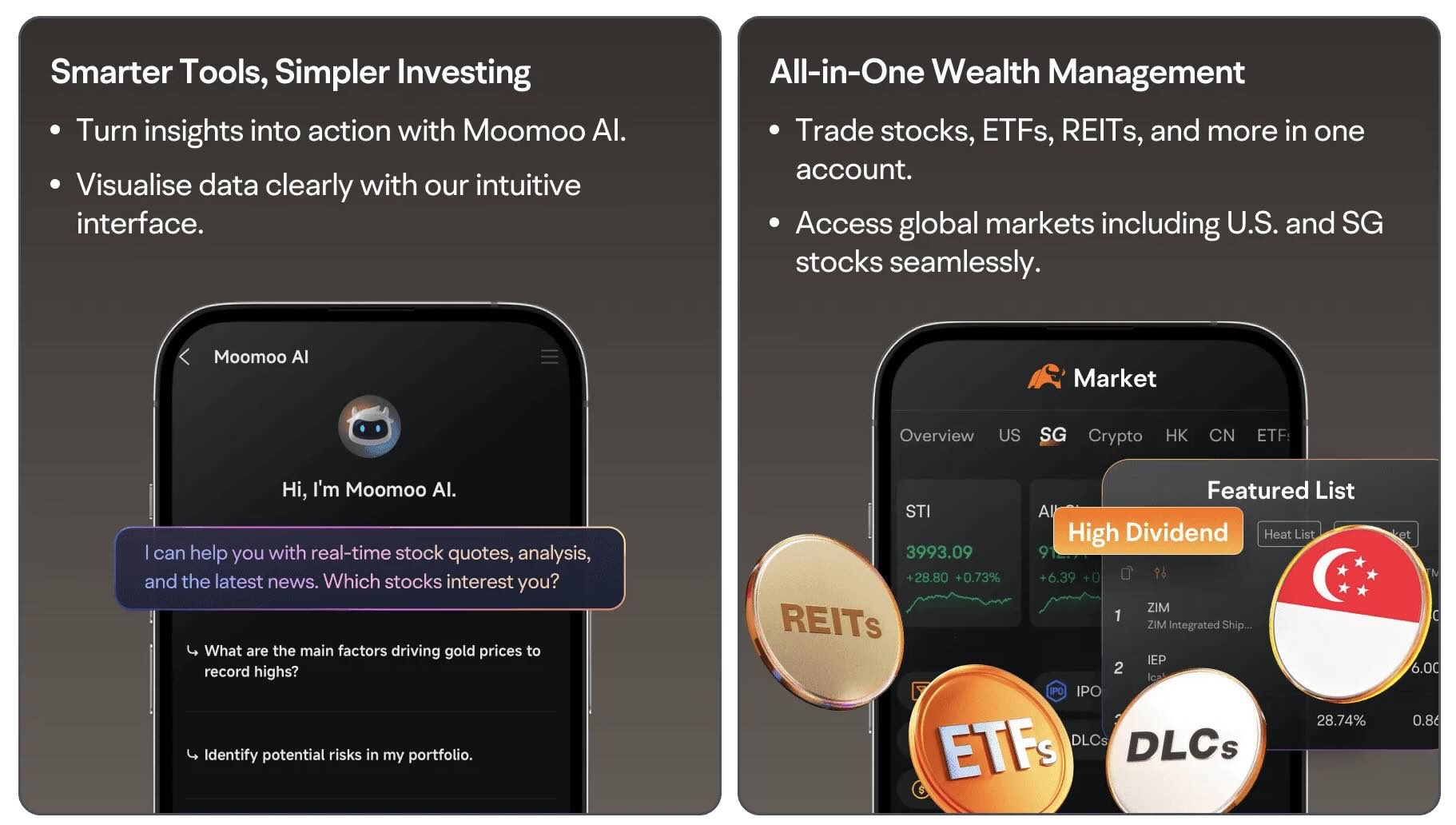

#3 – A user-friendly platform designed for everyday investors

moomoo offers clear charts, fast order execution, and an easy-to-navigate interface.

With the new feature that links your moomoo account to your CDP account, you can now access Singapore, US, and Hong Kong markets from a single platform.

The app supports a range of investment products, including REITs, ETFs, and DLCs.

It also features Moomoo AI, a tool designed to assist with real-time stock analysis and market news.

Whether you are trading High Dividend REITs, ETFs, or DLCs, moomoo has a diverse selection of tools to guide your investment journey.

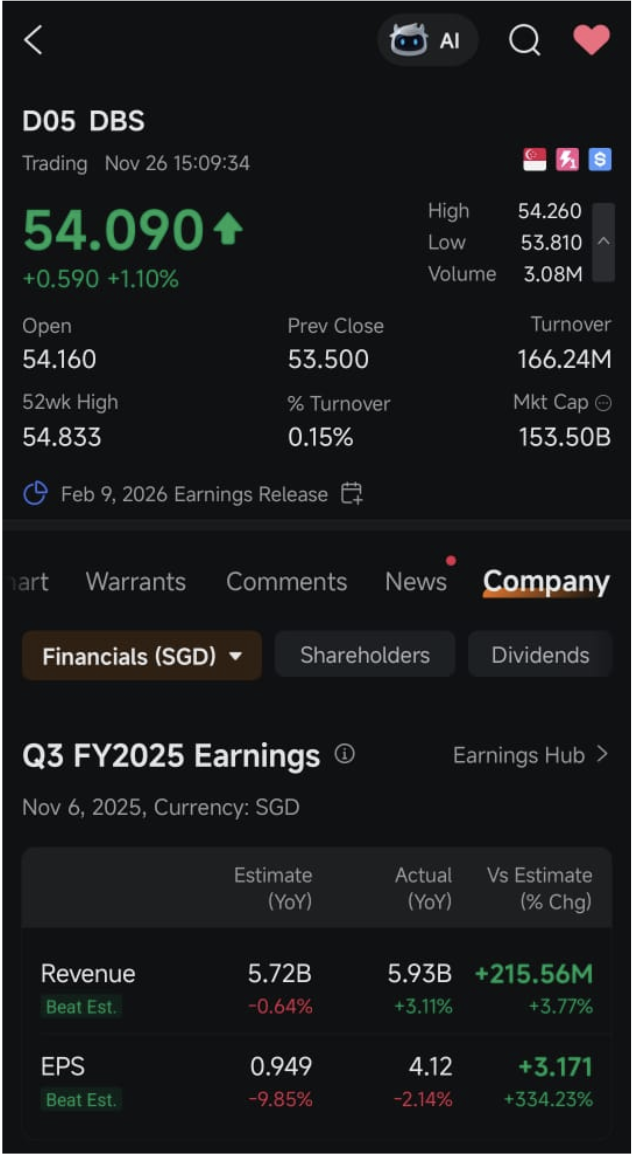

#4 – Tools that income investors find useful

Many dividend investors tell me they track payout dates, ex-dividend dates, and earnings announcements closely.

Here are some features that moomoo provides that I find helpful:

- A dividend calendar to monitor upcoming payouts

- Earnings summaries that highlight key updates from SGX companies

- Alerts for price movements or news related to your portfolio

- Visual tools that help you assess valuations and trading volumes

- These features make it easier to manage a passive income portfolio even if you are not actively trading daily.

#5 – A smoother process for corporate actions

With shares settled in CDP, corporate notices will go directly to you.

Investors who prefer receiving these updates through CDP rather than through moomoo’s platform messaging may find this more comfortable.

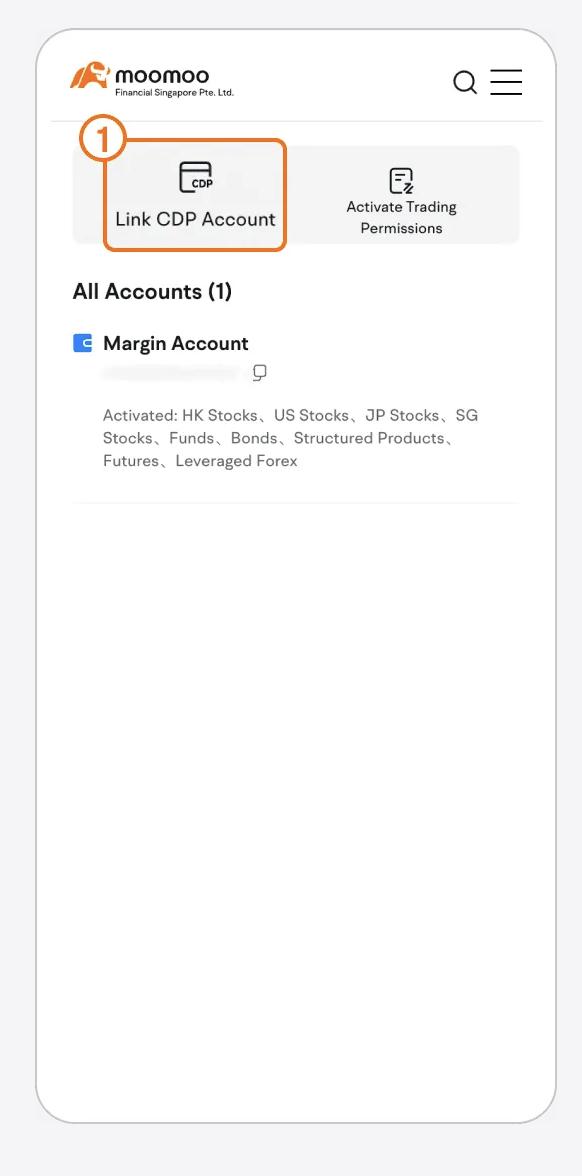

How to link your CDP account on moomoo?

Linking your CDP account on Moomoo Singapore only takes a few steps and is completely free.

Step 1:

After opening the moomoo app, navigate to your “Account”.

Then, select the option “Link CDP Account” to enable CDP linked trading, typically found under account settings.

Alternatively, you can just search “CDP” on the app’s search bar.

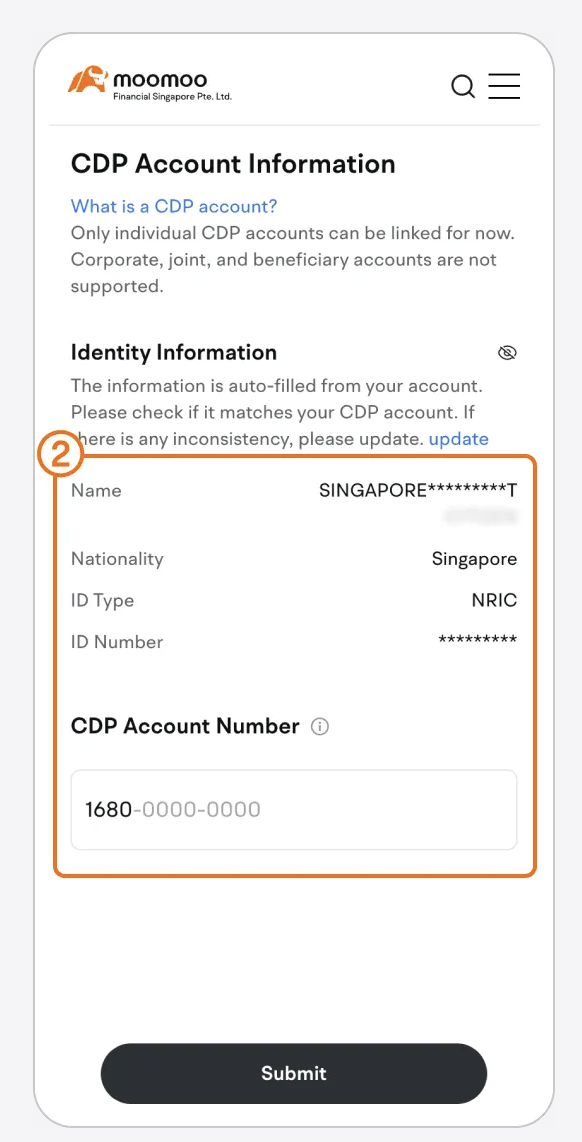

Step 2:

Enter your CDP account number and ensure the details match CDP records.

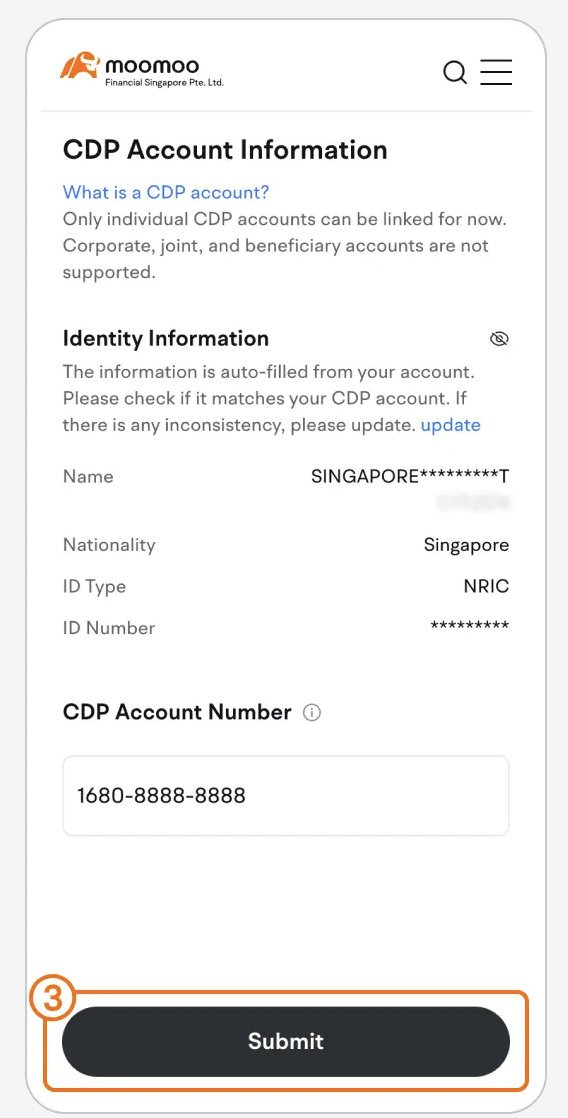

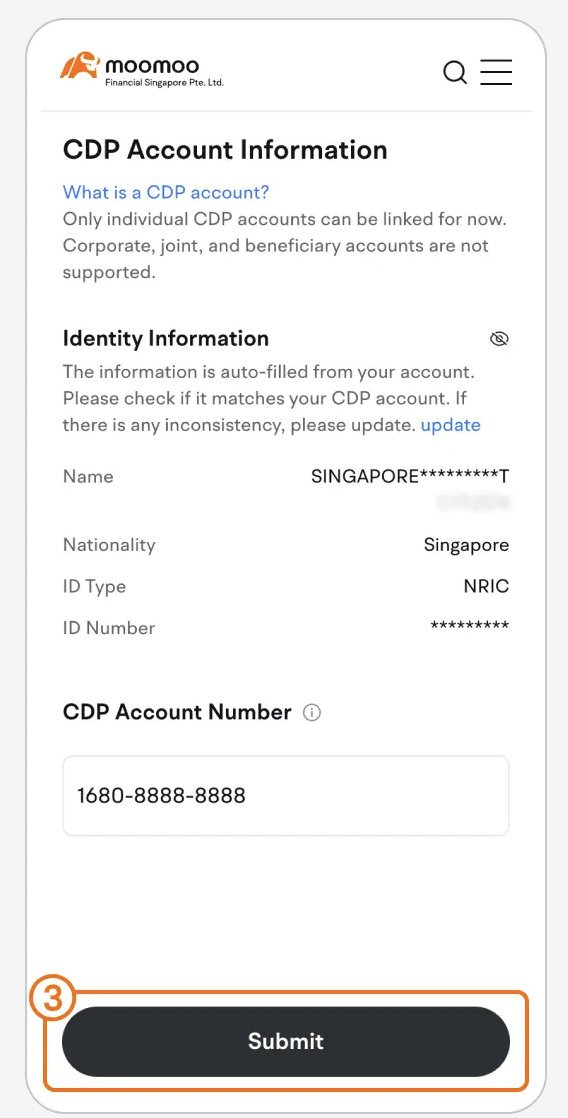

Step 3:

Submit the information to proceed with the linkage.

Step 4:

Sign the consent form to authorise the linkage of your CDP account with moomoo.

Step 5:

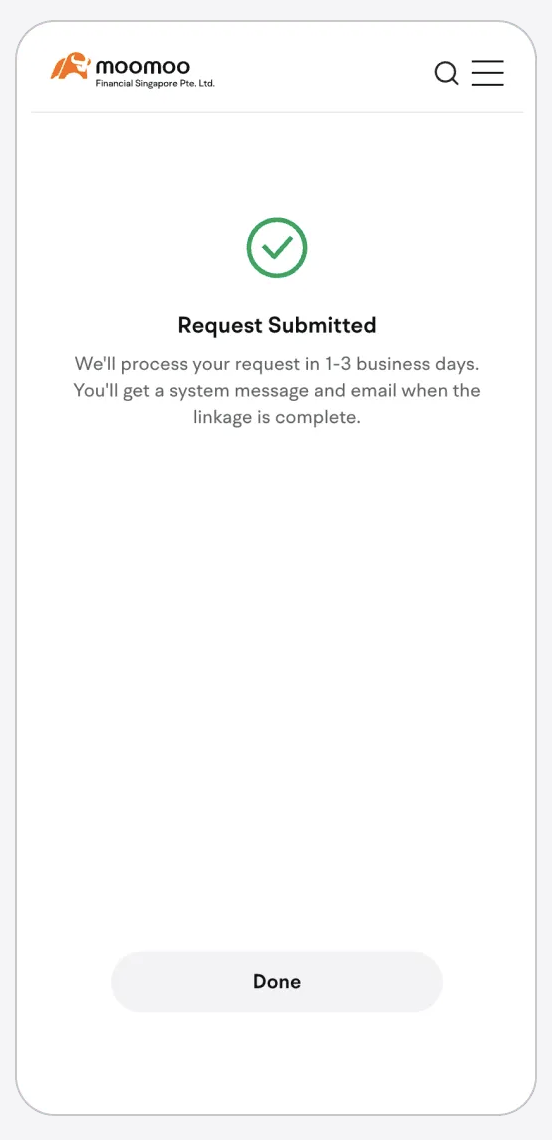

After you have submitted the request, it usually takes about 1-3 business days for verification and approval.

Once approved, your CDP account will be linked, granting you seamless access to your SGX-based holdings through moomoo.

You can then start trading SGX stocks that will settle directly into your CDP account.

What would Beansprout do?

moomoo’s new CDP linkage offers a "best of both worlds" solution by combining the low fees of a modern app with the security of direct ownership.

If you value direct ownership of your Singapore stocks and prefer dividends and corporate actions to come straight to you, moomoo’s new CDP-linked trading feature may be worth exploring.

It allows both buying and selling of SGX stocks via CDP and offers lower fees for trade values below S$4,500 compared to many traditional CDP brokers because of the lower minimum commission and platform fee of S$9.98, which makes it more cost-effective for smaller trade amounts.

Moomoo also brings the convenience of a modern platform with tools that income investors appreciate.

For investors who want to grow a long term Singapore dividend portfolio in CDP but also want a smoother, more affordable way to invest, moomoo’s CDP linkage offers a practical and cost effective path.

Moomoo SG offers an attractive sign-up promotion, which is a bonus for new users who are looking to try out the brokerage platform.

Moomoo Exclusive Promotion

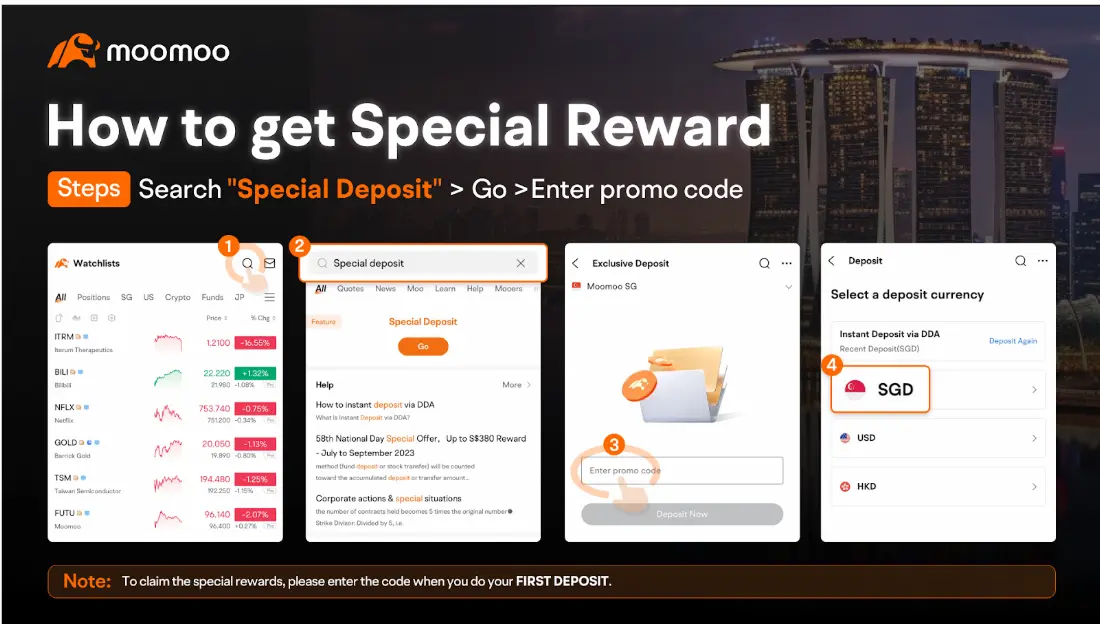

Steps to qualify for the exclusive $50 Fairprice voucher from Beansprout

1. Sign up for an account via Beansprout

2. Go to Moomoo app, search "Special Deposit" > Go > Enter promo code BEANSPROUTS1

Note: The promo code must be applied before funding your account.

3. Fund at least S$2,000

4. Claim your voucher via this form

Learn more about the Moomoo promotion here

Ready to start your investing journey? Sign up for a Moomoo SG account here.

Disclaimer

*T&Cs apply. All views expressed in the article are the independent opinions of Beansprout. Neither moomoo Singapore or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

4 questions

- Lionel • 11 Dec 2025 06:37 PM

- Sophia ng • 07 Dec 2025 06:50 AM

- Beansprout • 24 Dec 2025 04:18 AM

- Sophia ng • 07 Dec 2025 06:43 AM

- Beansprout • 26 Dec 2025 04:44 AM

- Koh Boon Cheng • 06 Dec 2025 09:21 AM

- Beansprout • 26 Dec 2025 04:44 AM