Sembcorp Industries falls by 14%. What's driving the weakness?

Stocks

By Gerald Wong, CFA • 09 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

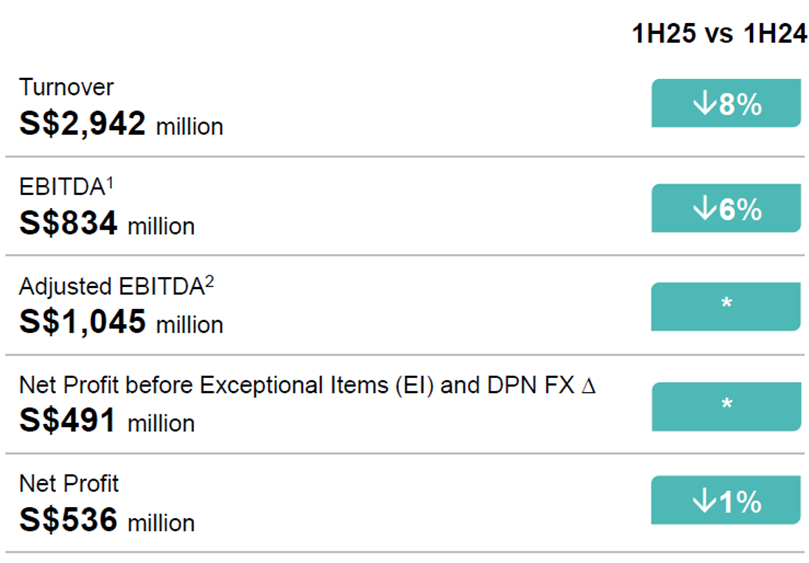

Sembcorp Industries (SCI) reported stable underlying net profit of S$491 million in 1H 2025, and announced an interim dividend of 9.0 cents per share.

Sembcorp Industries 1H25 earnings and dividend highlights

SCI has announced its earnings for first half of 2025. Key highlights include:

- 1H 2025 underlying net profit of SGD 491 million, unchanged from the previous year

- 1H 2025 reported net profit of SGD 536 million, a decline of 1% year-on-year

- 1H 2025 revenue of SGD 2,942 million, a decline of 8% year-on-year

- Interim dividend of 9.0 cents per share for 1H 2025, an increase from 6.0 cents per share for 1H 2024

SCI reported comparable underlying net profit for 1H 2025 of SGD 491 million. This was below average analyst expectation for profit to be at SGD 550 million.

Reported net profit declined 1% year-over-year to SGD 536 million, due to foreign exchange losses as a result of stronger SGD against currencies of operations.

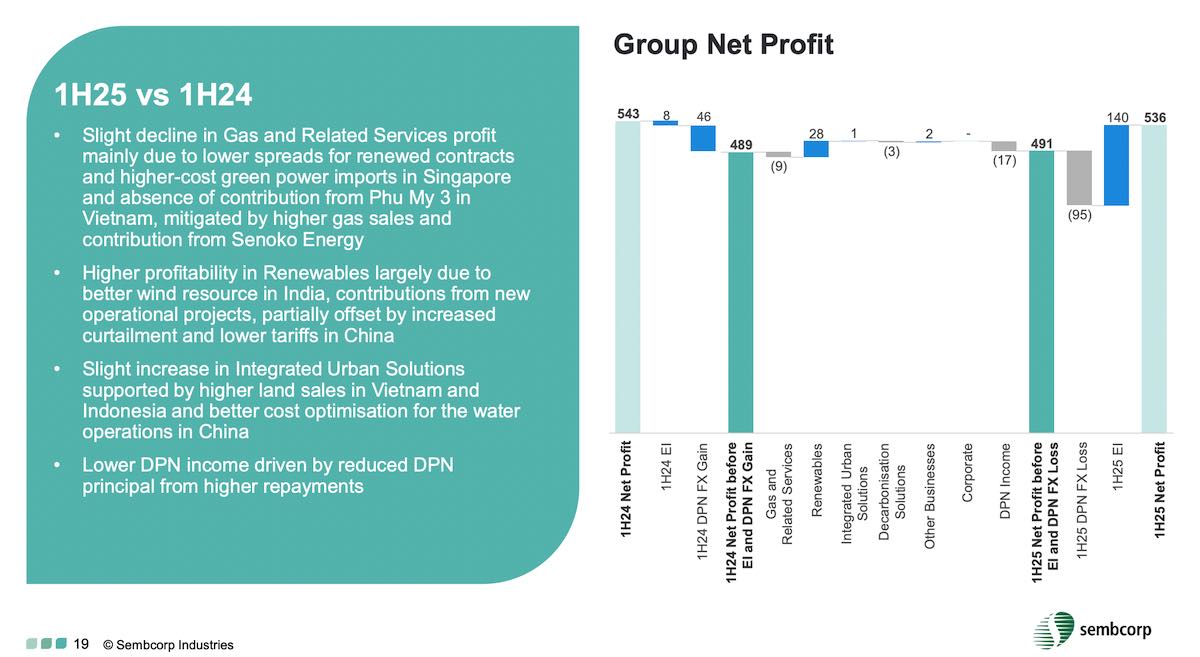

What is driving the weakness in underlying net profit? According to the company, this was due to:

- Weaker performance by Gas and Related Services

- Lower profit for China wind power business

- Currency impact due to weakness in regional currencies against the Singapore dollar

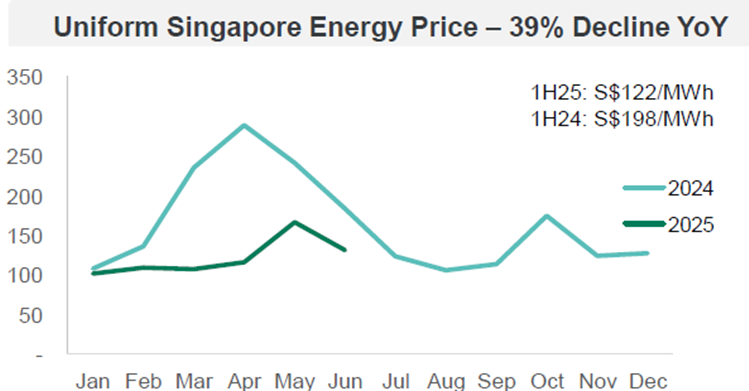

#1 - Weaker performance by Gas and Related Services

Gas and Related Services reported net profit of S$330 million in 1H 2025, a decline of 3% from S$339 million in 1H 2024.

This was due largely to weaker performance for its power assets in Singapore with a 39% decline in wholesale electricity prices, as well as higher cost green power imports.

Profit for the Gas and Related Services was further impacted by absence of contribution from the Phu My 3 power plant in Vietnam, which was transferred to Vietnam Electricity (EVN) after 20 years of commercial operations in March in accordance with the terms of the contract.

At the same time, a major inspection for the Myingyan power plant in Myanmar has taken longer than expected.

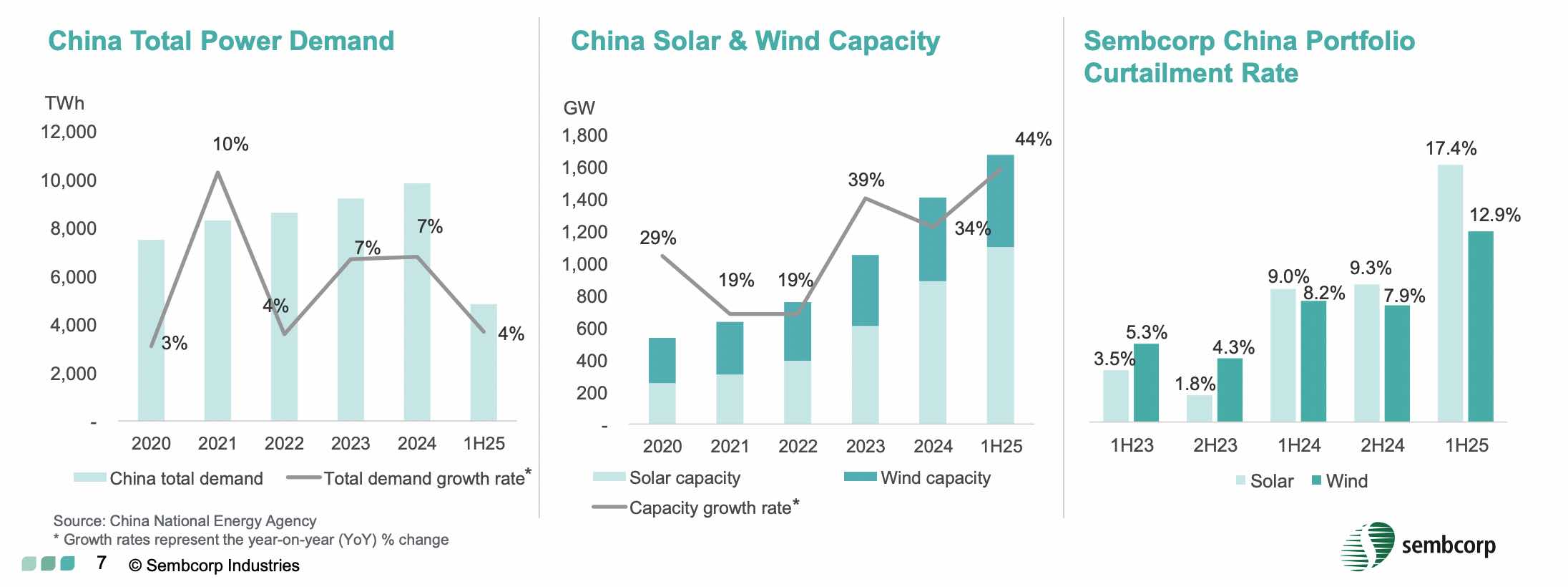

#2 - Renewables segment impacted by lower profit in China.

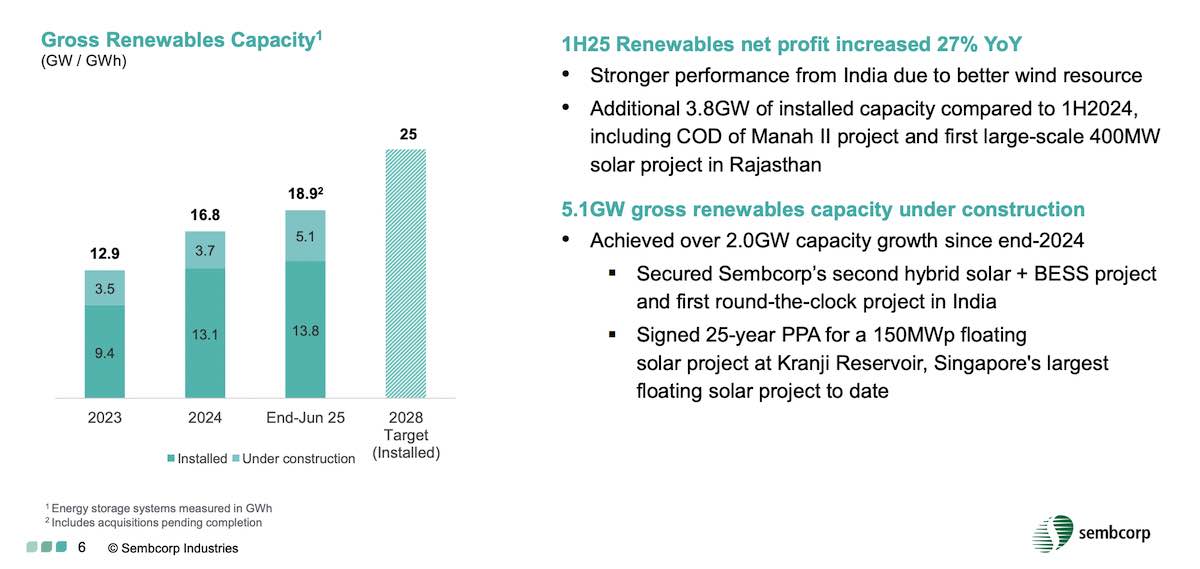

Renewables reported net profit of S$132 million in 1H 2025, an increase of 27% year on year.

The increase was also driven by additional 3.8GW of installed capacity compared to 1H24. The new additions include Manah II project and 400MW solar project in Rajasthan.

However, profit in this segment was impacted by weaker profit for its renewables business in China due to oversupply in the market.

As a result, power prices declined and supply to the power grid was intentionally limited to reduce the output of wind farms below their maximum potential generation capacity.

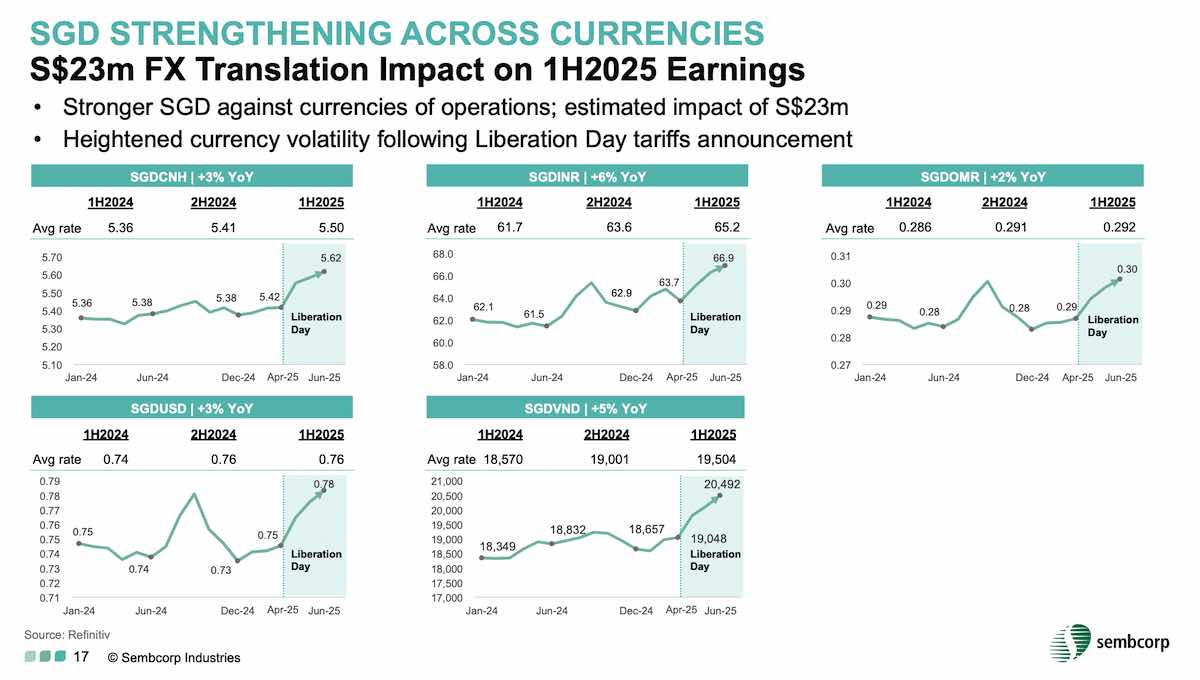

#3 - Currency impact due to weakness in regional currencies against the Singapore dollar

According to Sembcorp Industries, the strengthening of the Singapore dollar agains regional currencies following the Liberation Day tariff announcements led to an estimated impact of S$23 million on its earnings.

In particular, the strength of the Singapore dollar compared to the Chinese Yuan and Indian Rupee, where some of its assets are located, impacted its 1H 2025 earnings.

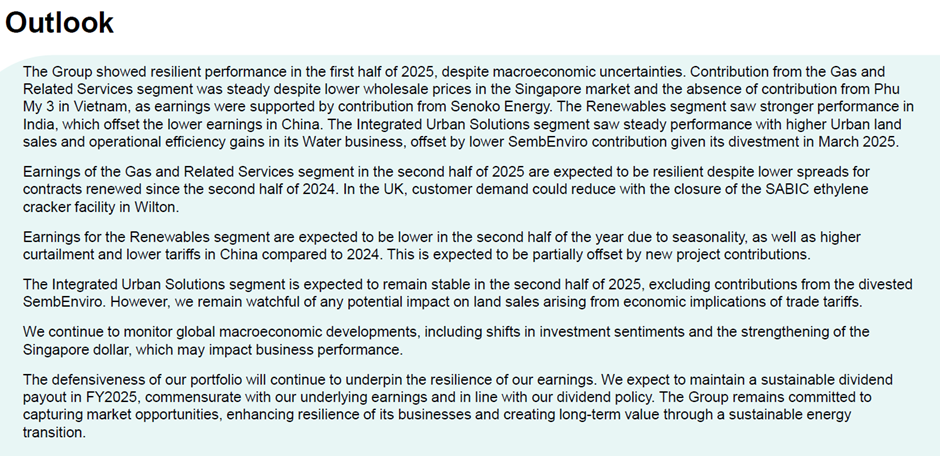

What to expect in 2H 2025?

According to Sembcorp Industries, earnings for it Gas and Related services segment is expected to be impacted by continued weakness in power spreads, or the margin it makes on power sales, since the second half of 2024.

At the same time, customer demand for its power plant in the UK may be impacted by the closure of an existing facility.

Management for Sembcorp Industries expect earnings for the Renewable segment to be lower in the second half of 2025 due to seasonally weaker power production.

Also, its earnings in China is expected to face continued pressure from oversupply in the wind power market.

This is expected to be offset by new project contributions in the Renewables segment

In the longer term, Sembcorp Industries has maintained its targeted to grow its gross renewable capacity to 25 GW by from 16.8 GW in 2024.

The company remains on track to do so with 18.9 GW of gross renewables capacity as at end June 2025, of which 5.1 GW of capacity is under cosntruction.

What would Beansprout do?

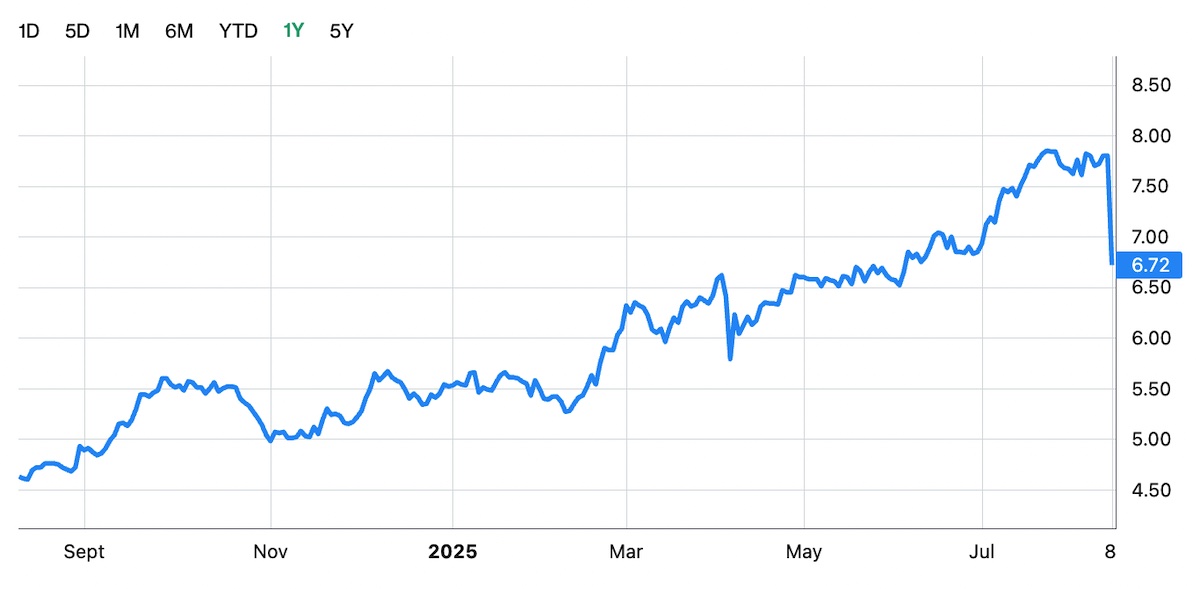

Sembcorp Industries' share price fell by 13.85% on 8 August, following the announcement of the results.

The correction in the share price is likely to reflect disappointment on the earnings in 1H 2025. The weakness is earnings is largely driven by (1) weakness in the Singapore power business with lower electricity prices, (2) weakness in the China renewables business due to oversupply, (3) impact from stronger Singapore dollar compared to regional currencies.

At the same time, there may be heightened expectations that the company will be able to see continued earnings growth.

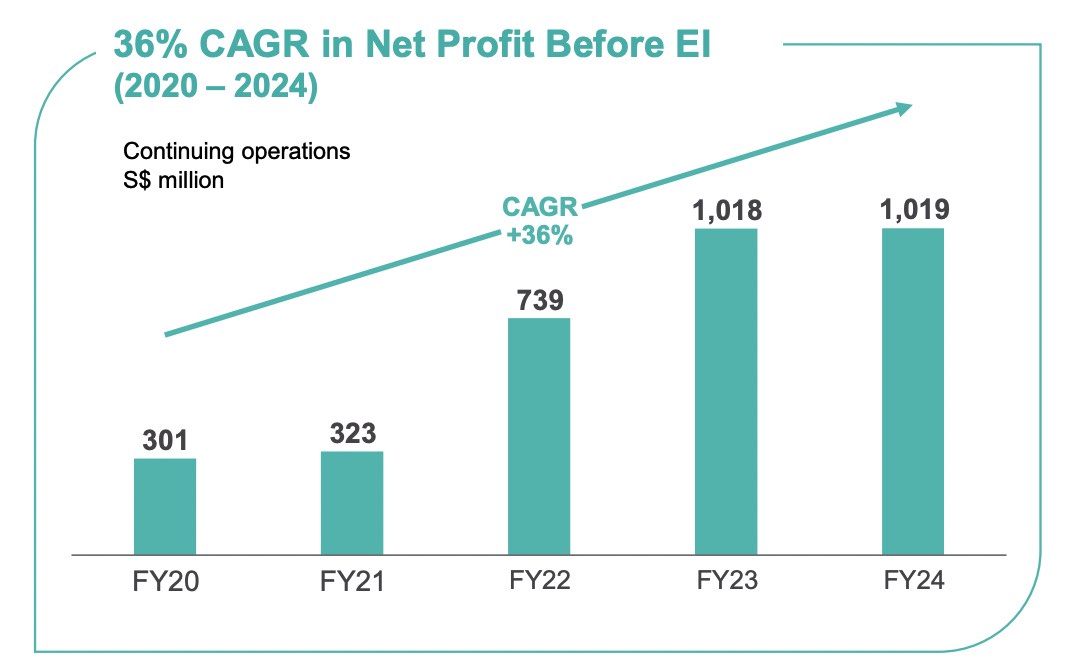

After all, the company has seen an average earnings growth of 36% per year on average from 2020 to 2024.

Hence, the 1H 2025 earnings would represent the first time in several years that we have seen a reversal in the strong earnings growth for the company.

Looking ahead, the company is expecting continued pressure on its Singapore power business and China renewables business. However, this is expected to be offset by continued growth in capacity for its renewables business.

The company remains on track to grow its total renewables capacity to 25 GW in 2028 from 16.8 GW in 2024.

Despite the correction in its share price, Sembcorp Industries' share price is still up by close to 21.5% year-to-date, having risen by as much as 45% to reach a high of S$7.93.

Following the correction in its share price, Sembcorp Industries is trading at a price-to-earnings ratio of about 12.2x, based on its annualised 1H 25 earnings.

Despite the fall in earnings, Sembcorp Industries has raised its interim ordinary dividend per share to 9.0 cents in 1H 2025, and expects to maintain a sustainable dividend payout in FY2025, in line with its underlying earnings

Based on its total ordinary dividend per share of 23 cents 1H 2025 and current price of S$6.72, Sembcorp Industries currently offers a historical dividend yield of about 3.4%.

Related links:

- Sembcorp Industries Ltd share price and share price target

- Sembcorp Industries Ltd dividend forecast and dividend history

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Sembcorp Industries.

Join the Beansprout Telegram group get the latest insights on Singapore REITs, stocks, bonds, and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments