Singtel's share price at 5-year highs. Worth buying at 4.5% dividend yield?

Stocks

By Gerald Wong, CFA • 05 Jun 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singtel's share price is trading near its 5-year high. We find out if it's still worth buying with a 4.5% dividend yield?

What happened?

Singtel’s share price has climbed to its highest level in five years, and investors are starting to take notice.

We dive into what’s behind the rally, including its strong FY2025 results, a bump in dividends, and ongoing capital recycling efforts.

But with the stock already up, the big question is—can it go higher?

Watch our latest video to unpack the key drivers of Singtel’s performance and what to keep an eye on moving forward.

What you need to know about Singtel's FY25 earnings

- Underlying net profit rose 9% to $2.5B, or 11% excluding FX impact.

- Operating profit jumped 20% to $1.4B, hitting the high end of guidance.

- Revenue remained flat, but profit growth driven by better margins and cost control.

- Regional associate contributions grew 4% to $1.8B, despite FX headwinds.

- Over 70% of profits now come from overseas markets.

Segment Highlights

- Optus in Australia saw a 55% jump in EBIT to $446 million

- Singapore revenue declined 2% due to competition

- Domestic operating profit remained stable at $833 million

Growth Businesses and Associates

- NCS delivered 39% profit growth to $254 million

- Digital Infraco posted higher revenue but lower profit due to AI investments

- Bharti Airtel’s contribution rose from $466 million to $703 million

- AIS and Intouch in Thailand saw a 15% increase in profit contribution

- Telkomsel in Indonesia remained a weak spot

- Currency weakness dampened overall regional growth

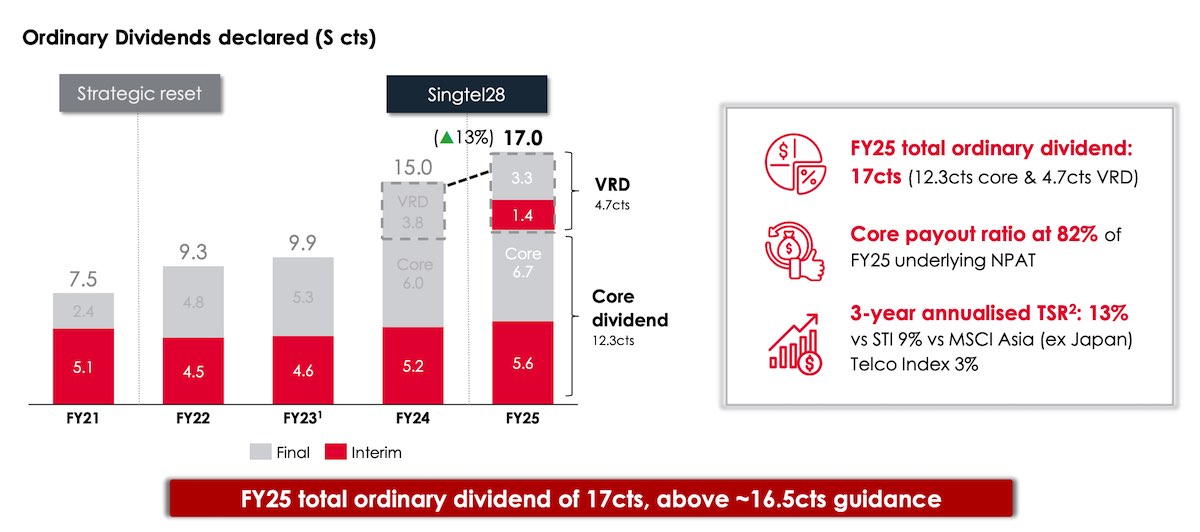

Dividends and Shareholder Returns

- Total FY25 dividend was $0.17 per share

- Core dividend was $0.067, value realisation dividend was $0.033

- Interim dividend of $0.07 had been declared earlier

- Dividend yield stands at approximately 4.5%

Capital Recycling Strategy

- Asset recycling target raised from $6 billion to $9 billion

- $1.9 billion in proceeds secured in FY25

- $2 billion expected from Airtel stake divestment

- Proceeds to be used for growth, debt reduction, and payouts

Share Buyback Programme

- $2 billion share buyback announced through FY28

- Repurchased shares will be cancelled

- Supports long-term shareholder value and capital returns

What would Beansprout do?

Looking ahead, Singtel expects operating profit to grow further in FY26, backed by its continued cost discipline and expansion in growth areas.

With its capital recycling target raised from $6 billion to $9 billion and a $2 billion share buyback programme in place, Singtel aims to enhance shareholder returns.

The total dividend of $0.17 per share in FY25 implies a yield of about 4.5% at recent share price levels.

However, risks remain. Singapore’s mobile segment continues to face competition, and currency weakness in regional markets may dampen reported earnings.

Additionally, Singtel’s valuation now reflects much of its recent strength, with the current price near historical P/E averages and analyst target prices.

Check out Beansprout's guide to the best stock trading platforms in Singapore with the latest promotions to invest in Singtel.

Related links:

Join our Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments