SSB 10-year return at 2.29%. Better than fixed deposits and T-bills?

Bonds

By Gerald Wong, CFA • 24 Jul 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The current issuance of the Singapore Savings Bond (SSB) offers a 10-year average return of 2.29% per year. We compare this to fixed deposits and T-bills to find out if it's worth applying for the SSB.

What happened?

With interest rates trending lower in recent months, many savers are rethinking where to park their cash.

The best 6-month fixed deposit rate in Singapore has slipped to 2.15% p.a, while the yield on the 6-month Singapore T-bill fell further to 1.79%.

Against this backdrop, we recently explored the best place to park our savings to earn a higher yield in light of the fall in interest rates.

One option that we covered was the latest Singapore Savings Bonds (SSB) issuance, which offers a 10-year average return of 2.29%, higher than both the T-bill and fixed deposit rates.

Since then, we’ve received several questions from the Beansprout community: Should you lock in the current SSB now? Or could the next one offer even better yields?

Let's take a deeper look to find out.

What to expect for the latest Singapore Savings Bonds (SSBs)

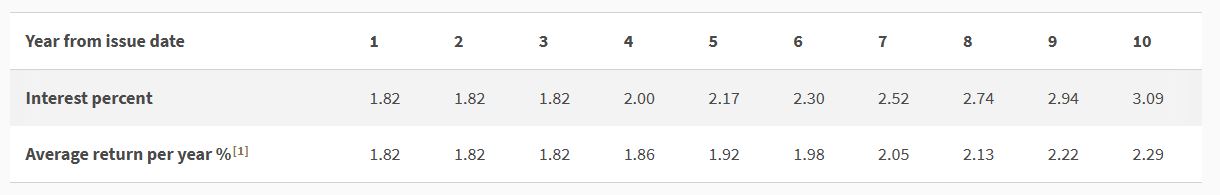

#1 – Current SSB offers 10-year average interest rate of 2.29%

The latest SSB issuance offers a relatively attractive interest rate.

If you hold on to the SSB for 1 year, you will receive an average return of 1.82%.

If you hold on to the SSB for 10 years, you will receive an average return of 2.29% per year.

The 10-year average return of 2.29% p.a is below the rate of 2.49% p.a offered by the previous SSB.

The 1-year rate of 1.82% is lower than the best 12-month fixed deposit rate in Singapore.

#2 – SSB interest rate projected to fall to about 2.10%

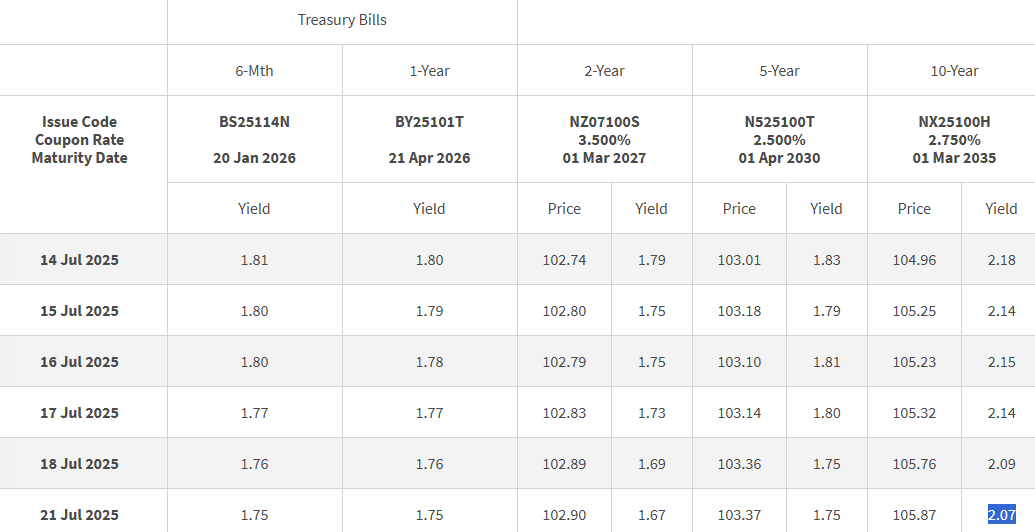

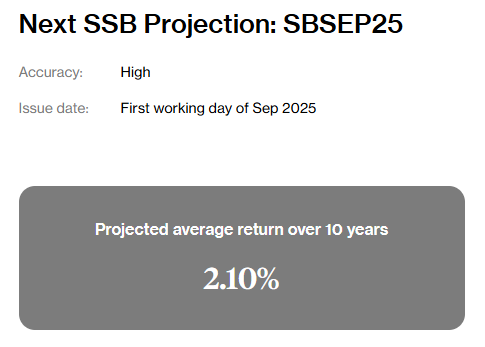

For those new to the Singapore Savings Bond (SSB), it’s important to understand that SSB interest rates are closely tied to the yields of Singapore Government Securities (SGS).

Similar to T-bills, SGS are bonds issued by the Singapore government. But, they have a longer maturity of 2 years to 30 years.

The interest rates on each SSB issuance are linked to the daily average SGS yields as published by MAS in the previous month.

This means that the average annual return from the SSB over a given period (e.g., 10 years) would broadly reflect the yield of a comparable SGS (e.g., the 10-year SGS), but with about a one-month lag.

In other words, the 10-year average return of the upcoming SSB will largely mirror the yield of the 10-year Singapore government bond or SGS observed this month.

As shown in the chart below, the 10-year SGS yield has continued to trend downward from April 2024 through to July 2025.

The ongoing decline could be a sign that investors are becoming more cautious, turning to safer options like government bonds as they navigate a backdrop of geopolitical tensions and shifting monetary policy.

As of 21 July 2025, the closing yield on the 10-year Singapore government bond stood at approximately 2.07%.

This is below the 10-year average return offered by the current SSB.

Based on the average yield observed in July, the 10-year average return for the next SSB is likely to be slightly lower than the current issuance.

As of 20 July 2025, our SSB interest rate projection estimates that the next SSB may offer a 10-year average return of approximately 2.10%.

This estimate is based on the average closing yield of the 10-year Singapore Government Bond recorded so far in July, assuming the yield remains steady at 2.10% for the rest of the month.

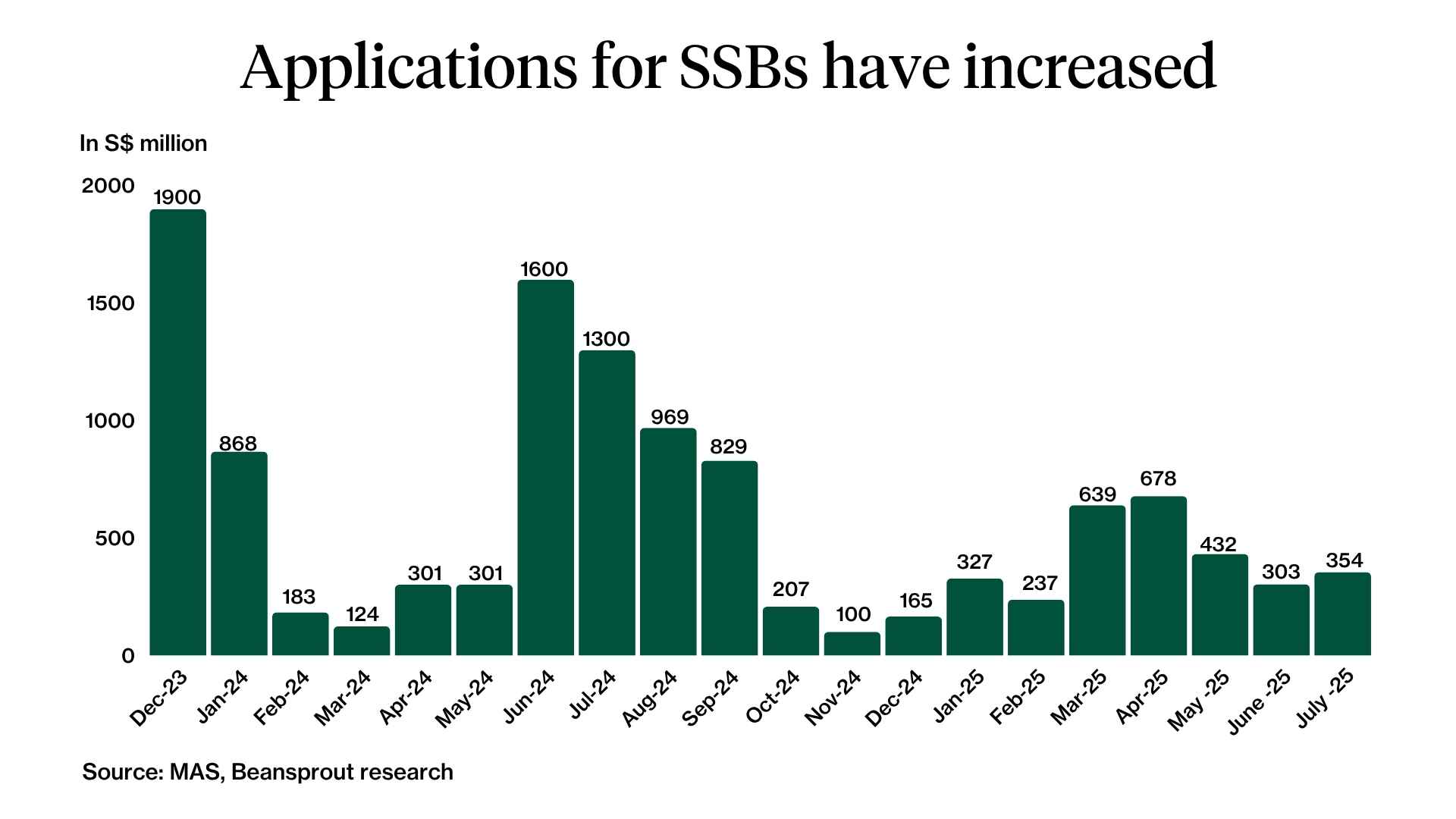

#3 – Demand for SSB has risen in the latest issuance

Despite offering relatively attractive interest rates compared to T-bills and fixed deposits, demand for the July issuance of the SSB remained subdued.

Applications amounted to only S$354 million, slightly higher than the S$303 million in June, but still below the S$432 million seen in the May issuance that offered a 10-year average return of 2.69%.

With an amount offered of S$400 million for the current SSB, investors may receive full allocation if demand remains muted.

What would Beansprout do?

The latest issuance of the SSB offers a 10-year average return of 2.29%.

With the 10-year average return on the next SSB is projected to fall further to about 2.10%, it might be more worthwhile to apply for the current SSB rather than to wait for the next one.

Apart from offering a higher 10-year average return compared to the 6-month Singapore T-bill yield and best 6-month fixed deposit rate, the latest SSB also allows us to lock-in a rate of 2.29% over 10 years, while having the flexibility to redeem prior to maturity.

If you are looking for the best place to park your savings, we compare SSBs to T-bills and fixed deposits to find out how to allow our spare cash to work harder.

To find out how much more interest you can potentially earn by swapping your previous bonds to the current, check out our SSB swap calculator.

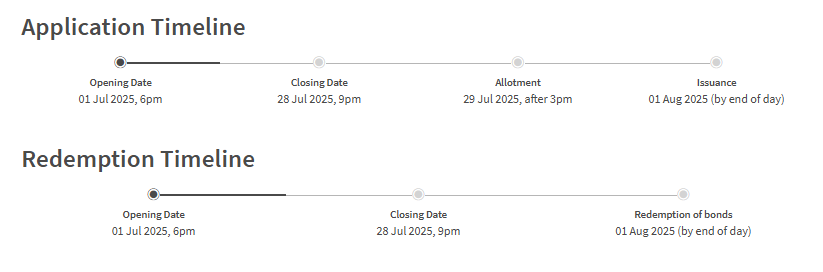

Applications for the latest SSB close at 9pm on 28 July (Monday). Redemptions of SSBs will also close at 9pm on 28 July (Monday).

You can sign up for a email reminder to be reminded of future SSB closing dates.

Learn more about SSBs and how to apply for SSBs using our comprehensive SSB guide.

Join the Beansprout Telegram group and Facebook group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments