Standard Chartered Bonus$aver: Earn up to 7.05% p.a. with investments and insurance

Savings, Savings Account

By Beansprout • 03 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn how you can earn up to 7.05% p.a. with the Standard Chartered Bonus$aver account and the current sign-up promotion.

What happened?

Many banks have recently cut savings account rates.

Standard Chartered’s (Stanchart) Bonus Saver (Bonus$aver) is no exception, cutting its interest rates for certain criteria starting January 2026.

That said, the Standard Chartered's Bonus$aver still stands out by offering up to 7.05% p.a., which remains relatively higher than what you’d find elsewhere.

As with most savings accounts, you’ll have to meet certain requirements before you can enjoy that top-tier rate.

With Chinese New Year around the corner, Standard Chartered is offering a Bonus Saver Lunar New Year sign-up promotion from 1 February to 31 March 2026, where new customers can receive S$188 cashback.

In this article, I’ll take a closer look at the Standard Chartered Bonus Saver account, including its latest interest rates, what you need to do to unlock higher returns, and the current sign-up promotion.

Stanchart Bonus Saver (Bonus$aver) account

The Standard Chartered Bonus$aver Account is a high-interest savings account offering a high interest rate if you are able to fulfil certain requirements.

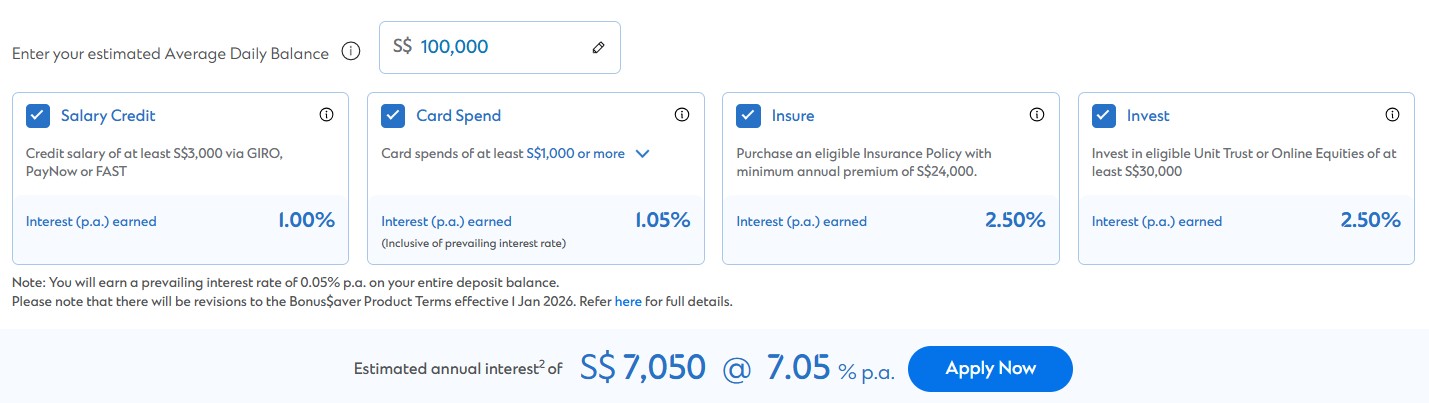

By meeting specific monthly criteria, you can earn interest rates of up to 7.05% per annum. To achieve this, you must:

- Credit Salary: Deposit a minimum of S$3,000 monthly via GIRO, PayNow, or FAST.

- Card Spend: Charge at least S$1,000 monthly on a Standard Chartered credit card.

- Insure: Purchase an eligible insurance policy with a minimum annual premium of S$24,000.

- Invest: Invest a minimum of S$30,000 in eligible unit trusts.

Let me share what I like and dislike about this deposit account in the next section.

What I like about Stanchart Bonus Saver (Bonus$aver) account

#1 - Uniform interest rate regardless of deposit amount

Let’s kick things off on a positive note.

This deposit account stands out because it doesn’t use a tiered system for interest rates. Whether you have $50k or $100k in your account, you’ll earn the same interest rate on all your deposits.

This makes the interest earned on this account fairly straightforward to calculate, so long as you are able to meet the requirements of various categories.

#2 - Multi-currency feature

Also, this deposit account comes with a multi-currency feature, which provides convenience, reduces fees, and gives you the financial agility to manage your money efficiently across borders.

It allows you to hold and transact in multiple currencies without the need for separate accounts or frequent conversions, which means more flexibility and savings.

Whether you’re traveling, investing abroad, or making payments in different currencies, this feature helps you avoid the often hidden costs of foreign exchange fees.

What I dislike about Stanchart Bonus Saver (Bonus$aver) account

#1 - Investment and insurance required to unlock higher interest rates

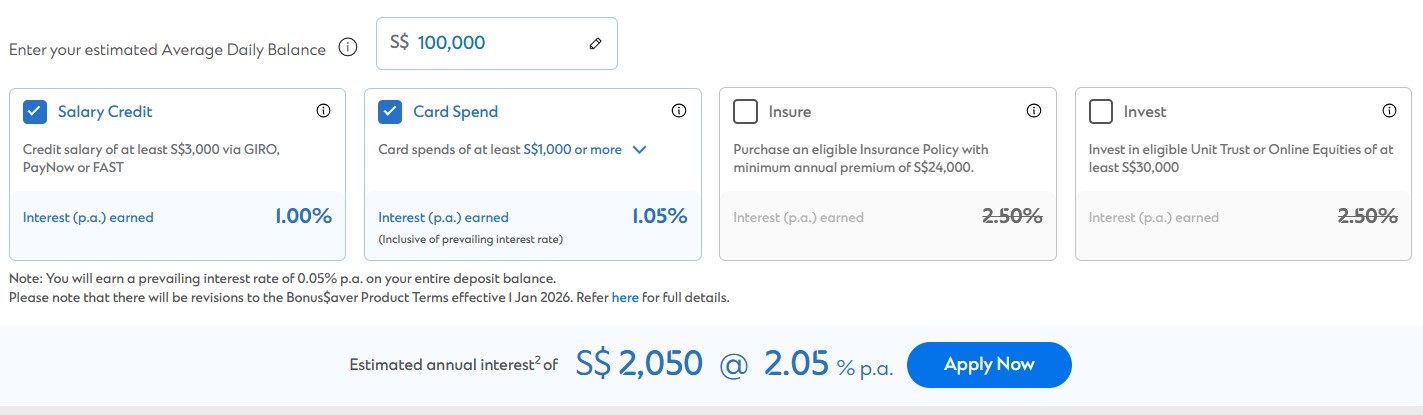

So, what’s a realistic interest rate to expect with the Standard Chartered Bonus$aver (Bonus$aver) account?

If you’re able to:

- Spend at least $1,000 on your credit card

- Credit at least $3,000 monthly salary

Then, the realistic interest rate you can expect will be around 2.05% per annum—much lower than the advertised 7.05%.

And just a heads-up, the $1,000 credit card spend must be on eligible transactions. Unfortunately, things like online bill payments, income tax payments, EZ-link transactions, top-ups, and AXS payments do not count towards the qualifying spend.

To unlock a higher interest on the Stanchart Bonus Saver account, you will need to meet the criteria for the Insure and Invest categories:

- You’ll need to purchase new insurance policies or investments to qualify.

- The bonus interest is only paid for six consecutive months, after which you'll need to make fresh purchases to continue earning the bonus rate.

Comparing the Stanchart Bonus Saver (Bonus$aver) account to the UOB One account

In the high-yield savings account category, I’ll be comparing the Stanchart BonusSaver account with the OCBC 360 and UOB One savings accounts.

When it comes to interest rates, the Stanchart BonusSaver account still outshines the UOB One savings account.

If you can meet these basic requirements such as salary credit and card spend, Stanchart BonusSaver offers a higher interest rate compared to the UOB One.

| Cash available for deposit | Stanchart Bonus Saver (Max EIR) | UOB One (Max EIR) |

| Less than $75,000 | 2.05% | 1.00% |

| $75,000 - $100,000 | 2.05% | 1.38% |

Comparing the Stanchart Bonus Saver (Bonus$aver) account to the OCBC 360 account

If you are able to meet the investment and insurance requirements, then it might be worthwhile comparing with the OCBC 360 account.

For an investor who is able to meet the invest and insure categories, the OCBC 360 account offers an interest rate of up to 5.45% per annum

For those who only meet the salary credit and spending criteria, the Stanchart BonusSaver offers a maximum EIR of 2.05%, while the OCBC 360 provides a higher rate of 2.45%.

If you also meet the Insure or Invest criteria, the Stanchart BonusSaver’s rate increases to 4.55%, the OCBC 360 lags with a 3.95% EIR.

For those who meet all the criteria—Salary, Save, Spend, Insure, and Invest—the Stanchart BonusSaver offers an EIR of 7.05%, whereas OCBC 360 maxes out at 5.45%.

| Categories met | Stanchart Bonus Saver (Max EIR) | OCBC 360 (Max EIR) |

| Salary + Save + Spend | 2.05% | 2.45% |

| Salary + Save + Spend + Insure/Invest | 4.55% | 3.95% |

| Salary + Save + Spend + Insure + Invest | 7.05% | 5.45% |

What are the latest Standard Chartered Bonus$aver promotions?

Standard Chartered is currently running a Lunar New Year Bonus$aver sign-up promotion from 1 February – 31 March 2026.

Get S$188 cashback when you:

- Open a Bonus$aver Savings Account and a Bonus$aver World Mastercard Credit Card.

- Deposit and maintain at least S$50,000 in fresh funds in your new Bonus$aver account upon account opening.

This offer is designed to reward new customers who kickstart their savings with Standard Chartered and pair it with the linked credit card.

Fresh funds means money not existing with Standard Chartered in the recent 30 days.

Read the full Terms and Conditions here.

What would Beansprout do?

The Stanchart Bonus Saver account offers a decent interest rate, with the added benefit of a uniform rate across all deposit amounts, making it simpler than other high-yield savings accounts.

Its multi-currency feature is another plus, particularly for those who travel frequently, invest internationally, or make payments in multiple currencies.

However, to earn the higher interest rate of up to 7.05% p.a., you'll need to meet the Invest and Insure criteria.

If you're unable to meet these requirements, you may want to consider a more basic, no-frills savings account instead.

To find out how Standard Chartered Bonus$aver compares to other savings account in Singapore, check out our guide to the best savings accounts in Singapore.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

1 questions

- Eddy Tham • 07 Dec 2025 08:56 AM