Starhill Global REIT - Steady cashflow profile from prime retail assets

REITs

By Goh Lay Peng, CFA • 22 Dec 2025

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

Starhill Global REIT provides investors a stable income anchored by Singapore’s prime Orchard Road assets. The portfolio consists nine properties valued at about S$2.8 billion as at 30 June 2025.

About Starhill Global REIT

Established in 2005, Starhill Global REIT is listed on the Singapore Stock Exchange with market capitalisation of S$1.33 billion. The single largest shareholder, YTL Corporation Berhad, owns 38% of Starhill Global REIT’s issued units.

YTL Corporation Berhad is listed on the Bursa Malaysia since 1985 and currently trades at a market capitalisation of about S$7.6 billion. YTL’s continued involvement as sponsor and master tenant aligns its interests with those of unitholders, reinforcing confidence in the sustainability of cashflows and long-term asset value.

Starhill Global REIT is managed by an external manager, YTL Starhill Global REIT Management Limited, a wholly owned subsidiary of YTL Corporation Berhad.

Portfolio

Starhill Global REIT owns a portfolio of retail and office properties across Singapore, Australia, Malaysia, and China. The portfolio consists nine properties valued at about S$2.8 billion as at 30 June 2025.

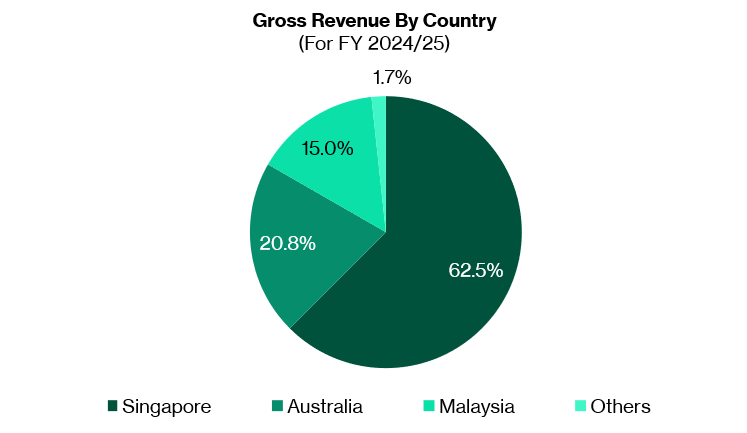

Singapore remains the core holdings, contributing 62.5% of revenue are concentrated along the Orchard Road stretch. The two flagship assets — Wisma Atria and Ngee Ann City – remains the main contributors. Both enjoy high visibility, long-standing tenant relationships, and strategic positioning in Singapore’s prime shopping district.

Outside Singapore, the REIT also owns the Myer Centre Adelaide, Plaza Arcade in Perth; The Starhill and Lot 10 in Kuala Lumpur, Malaysia; Ebisu Fort in Tokyo; and a property in Chengdu, China.

Strategy

Starhill Global REIT focuses on asset management and growth through acquisitions and capital management. The REIT stays focused on sourcing strategically attractive property assets in the Asia Pacific region.

Starhill Global REIT also aims to drive organic growth and maintain healthy occupancy in its current portfolio through proactive leasing and cost management strategies.

Portfolio tenure

The portfolio comprises 57.1% freehold and 42.9% leasehold properties, based on net lettable area. The weighted average unexpired lease term of the leasehold portfolio is approximately 42 years.

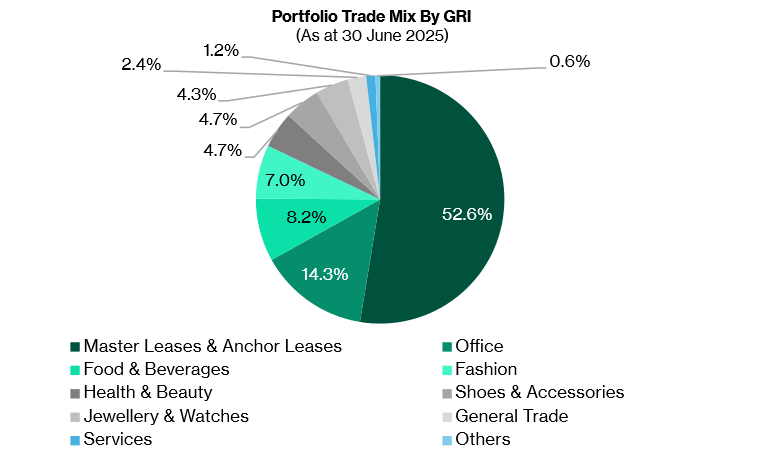

Master leases and actively-managed leases

A unique strength of the portfolio is the balanced between master and anchor leases and actively-managed leases. Master and anchor leases partially mitigate impact of rising operating costs. Master and anchor leases, incorporating periodic rental reviews, represent approximately 52.6% of gross rental income (GRI) as at 30 June 2025.

Strong sponsor with proven track record in property development

YTL Corporation is one of Malaysia’s largest conglomerates with a diversified portfolio spanning utilities, power generation, infrastructure, property development and hotels. Its scale and recurring income base provide strong financial backing and credit support. YTL provides income certainty through long master tenancy agreements for The Starhill and Lot 10. These leases are backed by YTL group of companies, significantly reducing leasing and cashflow risk for the REIT.

Started developing high-profile property projects in the 1990s, YTL has a long operating history in developing and managing large-scale, high-quality assets, particularly in prime urban locations.

Portfolio performance

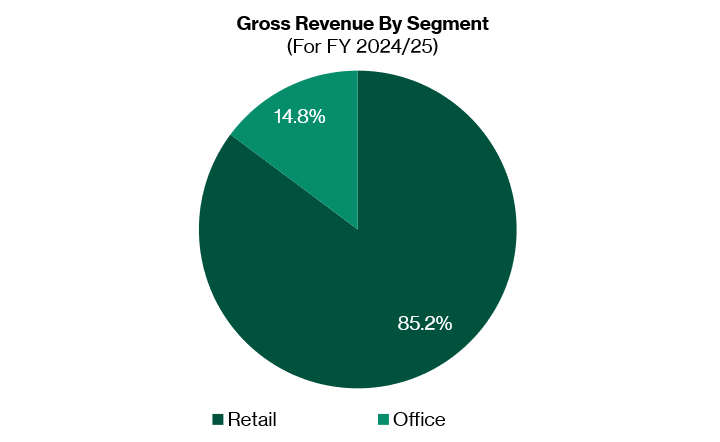

Established in 2005, Starhill Global REIT owns nine mid- to high-end retail properties in six key Asia Pacific cities. Retail space is the main revenue contributor, about 85%. The remaining balance of 15% is derived from the Office segment. As of 30 June 2025, the portfolio is valued at around S$2.8 billion.

Strategic location

The flagship assets — Ngee Ann City and Wisma Atria, accounts for 63.4% of net property income in FY2024/25. They sit along the most prominent stretch of Orchard Road, a shopping district that remains one of the world’s leading retail destinations. The properties enjoy 190 metres of prime street frontage and a critical advantage that few malls can replicate: direct basement access to Orchard MRT and seamless linkages to the wider Orchard network through underground pedestrian connections. This connectivity supports steady footfall from both tourists and locals, reinforcing the assets’ appeal to global luxury brands and driving long-term tenant demand.

In Australia, Myer Centre Adelaide is located along the prime shopping precinct of Rundle Mall. Myer Centre Adelaide is the city centre’s largest shopping mall and benefits from close proximity to major office buildings and key educational institutions.

In Perth, David Jones Building and Plaza Arcade are within a short walk of Perth Train Station with David Jones Building enjoying direct covered linkage to an adjoining major shopping centre. Both are well-positioned to capitalise on the development of a new luxury precinct at the corner of Murray Street and William Street.

Malaysia portfolio comprises The Starhill and Lot 10, two prime retail assets anchored in the heart of Bukit Bintang, Kuala Lumpur’s premier shopping and lifestyle district. Both malls benefit from excellent connectivity, with direct access to Bukit Bintang MRT, placing them along one of the city’s highest footfall tourism corridors.

Income visibility from long-dated master lease

The portfolio provides strong income visibility, underpinned by long-dated leases, particularly the 12-year master lease with Toshin at Ngee Ann City and the master tenancy agreements for The Starhill and Lot 10 in Kuala Lumpur.

Toshin’s Master lease was successfully renewed ahead of its expiry in June 2025. The 12-year lease will expire only in 2037 with option to renew for another six years by either party. The terms of the new agreement includes an annual profit-sharing arrangement, providing upside for Starhill Global Trust.

The Starhill’s 19.5 years master tenancy agreement (MTA) will expire only in 2038.

Lot 10’s 9-year master tenancy agreement will expire in 2028.

The payment from these assets are guaranteed by the sponsor, YTL Corporation. With built-in rental escalation, these master leases are structurally attractive, securing predictable income for the REIT.

These leases provide a stable cashflow base, supported by high portfolio occupancy and strong tenant retention. To recap, around 52.6% of gross rental income (GRI) are derived from master/anchor leases.

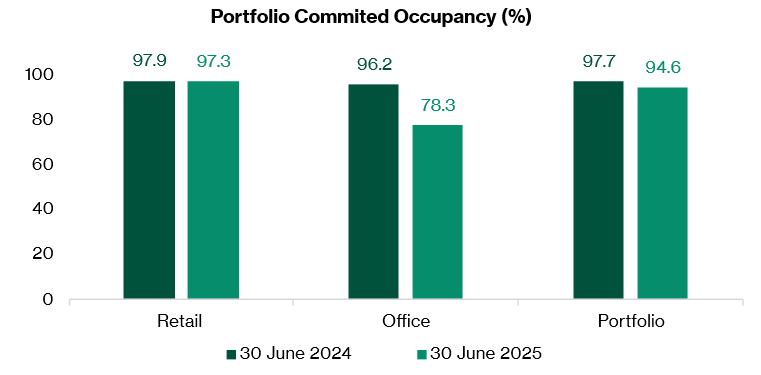

High occupancy

Retail portfolio occupancy remains elevated, at above 97% in recent years. As of 30 June 2025, the REIT reported committed retail portfolio occupancy of 97.3%.

As at 30 September 2025, occupancy was exceptionally strong at 100% across the Singapore Malaysia, Japan and China assets. Portfolio occupancy in Australia fell below 90% as at 30 June 2025. This was due to lease termination of Technicolor at Myer Centre Adelaide Office. The REIT has been filling up the vacated office space.

Extended weight average lease expiry

With the new Toshin master lease which commenced in June 2025, the portfolio weighted average lease expiry (WALE) by gross rental income, has extended to 7.4 years as at 30 September 2025. Prior to the renewal of Toshin master lease agreement, the WALE was 6.3 years as at 30 September 2023.

The combination of prime retail assets and long lease expiry profile is rarely seen and generates strong cash flow to unitholders. The new Toshin master lease incorporated a profit-sharing agreement which provides further upside for the REIT.

In Malaysia, Katagreen extended the master tenancy agreement of Lot 10 Property for a third three-year term. The agreement will commence on 1 July 2025 and included a rental step-up of 6.0%. This outpaces Malaysia’s projected headline inflation of 1.0% to 2.0% in 2026. According to Bank Negara Malaysia, the headline inflation is expected to range between 1.3% and 2.0% in 2026.

Asset enhancement works

The REIT regularly reviews the assets for asset enhancement works that could elevate the consumers’ experience. In FY 2025, the asset enhancement initiatives include rejuvenating Wisma Astria level 3 taxi stand, converting level 7 car park into commercial space. The S$4.0 million project has a return on investment of above 8.0%.

Other examples of asset enhancement initiatives are Myer Centre Adelaide’s store space expansion for Uniqlo, to 19,041 square feet; and conversion of three upper floors of The Starhill into an extension of the adjoining JW Marriott Hotel Kuala Lumpur.

Capital Management

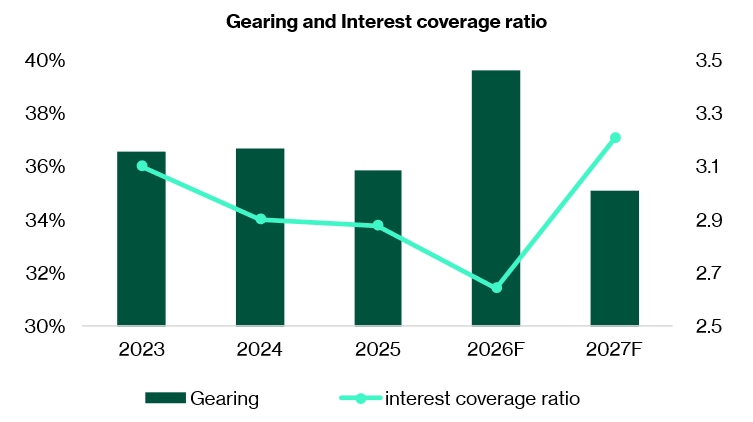

As of 30 September 2025, 77% of the total debt is fixed or hedged. With easing interest rates in 2026, Starhill Global REIT could benefit from lower interest expenses as hedges roll off over FY2026 and FY2027.

As of 30 September 2025, the weighted average debt maturity extended to 3.9 years, from 3.1 years as at 30 June 2025. This was due to drawdown on unsecured debt facility ahead of the debt maturities in 2026 and 2027.

Interest coverage ratio of 2.9 times is broadly in line with S-REIT peers and sits comfortably above the regulatory minimum of 1.5 times.

In February 2025, Fitch Ratings affirmed the REIT’s “BBB” credit rating with a stable outlook, reflecting its resilient financial position.

Average cost of debt fell to 3.49% as at 30 September 2025, from 3.67% as at 30 June 2025. Upcoming refinancing cycles should drive incremental savings as interest rates continue to ease. Year-to-date, Singapore Overnight Rate Average (SORA) has declined by about 180 basis points to 1.21% as of 12 December 2025.

Starhill Global REIT took advantage of the lower interest rates to refinance its unsecured term loans ahead of their maturities in 2026 and 2027.

In October 2025, the new S$100 million perpetual securities was issued at 3.25% per annum. The proceeds was used to redeem the outstanding perpetual securities issued in December 2020 at 3.85%.

Thus, with pre-emptive refinancing and active capital management, we expect the interest expenses to decline in the next two years.

FY2024/25 Financial Results

Portfolio valuation as at 30 June 2025

Starhill Global REIT’s portfolio valuation remained stable at S$2.8 billion as at 30 June 2025, despite the divestment of 13 strata office units at Wisma Atria. Following the divestment, the REIT’s strata title interest in Wisma Atria decreased to 68.81% as at 30 June 2025, from 74.23% as at 30 June 2024.

Excluding this divestment, the portfolio would have recorded a 0.9% year-on-year uplift, driven by upward revaluations of Ngee Ann City, The Starhill and the Australia properties, partially offset by foreign exchange movements.

The Australia properties were valued at S$331.9 million (A$398.7 million) as at 30 June 2025, down 4.2% year-on-year, mainly due to the weaker Australian dollar against the Singapore dollar. In local currency terms, valuations rose by A$13.9 million mainly due to capitalisation rate compression for Myer Centre Adelaide.

The Malaysia properties were valued at S$420.8 million (RM1,392.0 million) as at 30 June 2025, up 7.3% year-on-year, driven by cap rate compression at The Starhill and a stronger Malaysian ringgit.

The Japan property was valued at S$35.3 million (JPY3,990.0 million) as at 30 June 2025, up 6.2% year-on-year, largely due to Japanese Yen appreciation against the Singapore dollar. Excluding currency effects, Ebisu Fort recorded 1.3% increase in value in local currency terms.

The China property’s valuation fell 9.9% year-on-year, mainly due to the shortening land tenure. As at 30 June 2025, it was valued at S$22.2 million (RMB125.0 million).

FY2024/25 Financial performance

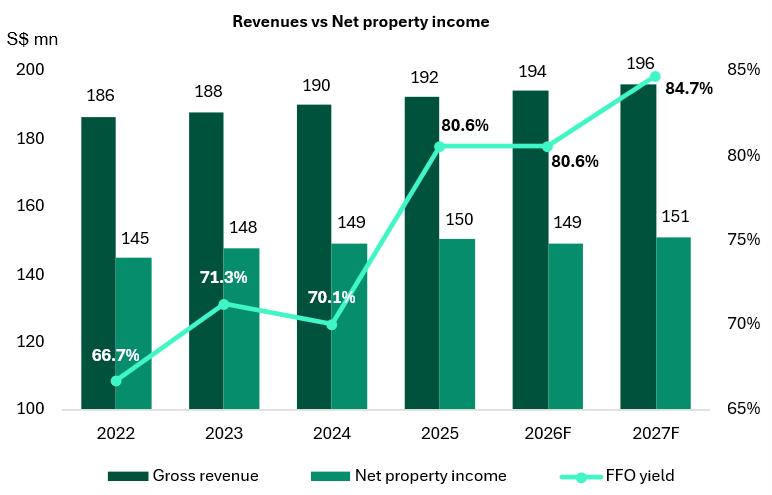

Revenue increased by 1.2% year-on-year to S$192.1 million in FY2024/25, driven by contribution from retail segment at Wisma Atria and Ngee Ann City. The uplift was driven mainly by stronger performance at the Singapore retail assets and the Malaysian properties. Offsetting factors included the absence of Wisma Atria Office contributions, rental arrears from the Chengdu asset, and A$ depreciation impacting Australian income.

Meanwhile, impact from foreign currency movement remains manageable. Overall performance reflects stability across the core Singapore retail segment, which continues to act as the ballast for group earnings.

Net property income increased by 0.8% year-on-year to S$150.2 million in FY2024/25, showing year-on-year improvement despite currency headwinds, China arrears, and the absence of contribution from divested Wisma Atria office strata units.

Wisma Atria reported revenue at S$53.5 million, up 0.6% as higher retail revenue was partly offset by loss of contribution from the divested office strata units. With higher rent and lower operating expenses, net property income improved by 1.8% year-on-year to S$41.0 million.

In FY24/25, Wisma Atria’s shopper traffic improved by 5.0% year-on-year, while tenant sales decreased by 5.2% year-on-year. The decline in tenant sales could be partly attributed to global macroeconomic headwinds and increased outbound travel motivated by the stronger Singapore dollar.

Ngee Ann City reported revenue at S$66.5 million, up 1.5% year-on-year. Net property income increased 1.3% year-on-year to S$54.4 million as higher rents were offset by higher operating expenses.

Australia assets reported revenue of S$40.1 million, decreased by 1.1% year-on-year, due to deprecation of Australia dollar. Net property income fell by 3.1% year-on-year to S$25.3 million, amid higher operating expenses for Myer Centre Adelaide Retail.

Malaysia properties outperformed due to the appreciation of Malaysia Ringgit. Revenue up 5.3% year-on-year to S$28.8 million and net property income up 5.2% year-on-year to S$27.9 million.

Distributable income and Distribution per unit (DPU)

With lower tax expenses and net finance costs, distributable income increased by 3.7% year-on-year to S$87.8 million in FY24/25. The REIT declared distribution per unit at 3.65 cents for FY24/25, equivalent to S$83.8 million, or 0.6% year-on-year increase. Approximately S$4.0 million of distributable income as retained for working capital requirements. Based on the closing unit price of S$0.575 as at 19 December 2025, this represents a DPU yield of 6.3%.

With pre-emptive refinancing and active capital management, the REIT will benefit from lower interest expenses upon the debt rollover in the next two years.

Industry outlook

Retail in Singapore has stabilised, helped by strong tourism flows and demand for luxury goods. Supply along Orchard Road remains limited, which supports pricing power for prime landlords.

Overseas, Australia is still digesting pockets of office softness, while China remains a drag — but both are manageable in scale relative to SGREIT’s core portfolio.

For REITs in general, falling funding costs over the next 18 months will likely drive sector-wide multiple expansion. SGREIT should participate meaningfully given its long WALE and stable income base.

Singapore

Singapore’s retail REIT sector remains resilient, supported by a steady recovery in tourism, stable employment conditions and sustained consumer spending.

Prime retail assets along key shopping belts continue to benefit from strong footfall and tenant demand, while new retail supply remains limited in the near term.

Between 2H 2025 and 2028, total new retail supply is projected at 1.2 million square feet. Supply along Orchard Road remains tight, with the only major addition being the new Comcentre, scheduled for completion in 2028 and adding about 71,200 square feet of retail space. On average, annual retail completions between FY2025 and 2028 are expected to be around 0.38 million square feet, only slightly above the five-year historical average of 0.32 million square feet.

Although operating costs and selective retailer consolidation persist, landlords with well-located assets, strong brand mix and proactive leasing strategies are well positioned to maintain high occupancy and deliver stable rental income over the medium term.

Australia

Australia’s retail property market is gradually stabilising as inflation moderates and interest rates peak, supporting improved business and consumer confidence. Prime city-centre malls in key capitals continue to benefit from urban revitalisation initiatives, population growth and improving tourism activity.

Stronger retail trade growth in Adelaide over the past year has supported higher effective rents. Lower incentive rates drove a 1.9% year-on-year increase in CBD super prime net effective rents. Net face rents for CBD super prime assets have remained stable, averaging A$3,275 as at 3Q 2025.

Perth CBD net face rents were stable over the past year, averaging A$2,830 per square metre per annum for super prime assets. Net effective rents, however, moved higher as tightening vacancies and strong retail spending in Western Australia led to lower incentive levels. Super prime net effective rents rose 10.0% year-on-year.

Rent growth for CBD super prime assets is likely to continue over the next year, supported by much tighter vacancy levels along the core Murray Street Mall retail strip compared with the broader market.

Malaysia

Malaysia’s retail property sector is supported by a recovery in domestic consumption and strong tourist arrivals, underpinned by improving labour market conditions.

Prime retail assets in key urban locations such as Bukit Bintang continue to benefit from high footfall and limited new supply.

Average rental rates for prime REIT-managed malls in Klang Valley have steadily recovered since the pandemic-led downturn in 2020–2021. In Kuala Lumpur, average monthly rents reached RM31.64 per square feet in 2024, surpassing the pre-pandemic level of RM29.20 in 2019.

Malls outside Kuala Lumpur rebounded earlier, supported by more affordable rental levels that reduced tenancy risk and allowed faster re-occupancy. Average rents rose from RM14.55 per square feet per month in 2020 to RM15.74 in 2021, before reaching RM19.10 in 2024.

The broader rental recovery across Klang Valley has been underpinned by rising international and domestic tourist arrivals and a pickup in footfall, particularly at high-traffic urban retail hubs such as Bukit Bintang. Well-located malls with strong brand positioning and stable leasing structures are expected to deliver resilient occupancy and steady rental income over the medium term.

Initiate at Buy

We initiate coverage on Starhill Global REIT on the back of its diversified portfolio of prime retail assets across Singapore, Malaysia and Australia, managed by an experienced retail asset manager with a proven track record.

The REIT is supported by a strong sponsor, YTL Corporation Berhad, whose continued involvement as sponsor and master tenant aligns its interests with those of unitholders, reinforcing confidence in the sustainability of cashflows and long-term asset value.

Unitholders could benefit from high income visibility underpinned by long master leases, including the renewed Toshin lease at Ngee Ann City and the Malaysia Master Tenancy Agreements (MTAs).

A long WALE provides earnings stability and reduces near-term leasing risk, while improving retail fundamentals across its key markets support a constructive outlook.

Starhill Global REIT offers sustainable cash generation from Asia’s prime retail corridors.

Target price of S$0.65 offers FY2026E distribution yield of 6.0%

Currently, Starhill Global REIT is trading at S$0.575, implying FY25/26E distribution yield of 6.7%, FY26/27E distribution yield of 7.3% and FY25/26E price-to-book of 0.8x.

Our target price at S$0.65 is based on the dividend discount model. At S$0.65, Starhill Global REIT offers FY25/26E distribution yield of 6.0%. In comparison, Lendlease Global Commercial REIT and Suntec REIT are trading at consensus forecast FY2025f distribution yield of 6.2% and 4.4%, respectively.

At S$0.65, Starhill Global REIT is trading at FY2025 price-to-book 0.91x, versus Lendlease Global Commercial REIT FY2024 price-to-book 0.82x and Suntec REIT Trust’s FY2024 price-to-book 0.74x.

Key risks include concentrated exposure to single tenant, foreign exchange risk, exposure to economic cyclicality, amongst others.

Related links:

- Starhill Global REIT share price history and share price target

- Starhill Global REIT dividend history and dividend forecast

Check out Beansprout guide to the best stock trading platforms in Singapore with the latest promotions to Starhill Global REIT.

Download the full report here.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments