How to start investing with just $100

Robo Advisor

Powered by

By Nicole Ng • 12 Aug 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Think you need thousands to start investing? Here’s how to begin your investment journey with just S$100 using TrustInvest.

This post was created in partnership with Trust Bank. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

A lot of people assume you need thousands of dollars to start investing.

I used to think the same, until I realised that getting started doesn’t have to be complicated or expensive. In fact, you can begin with just S$100.

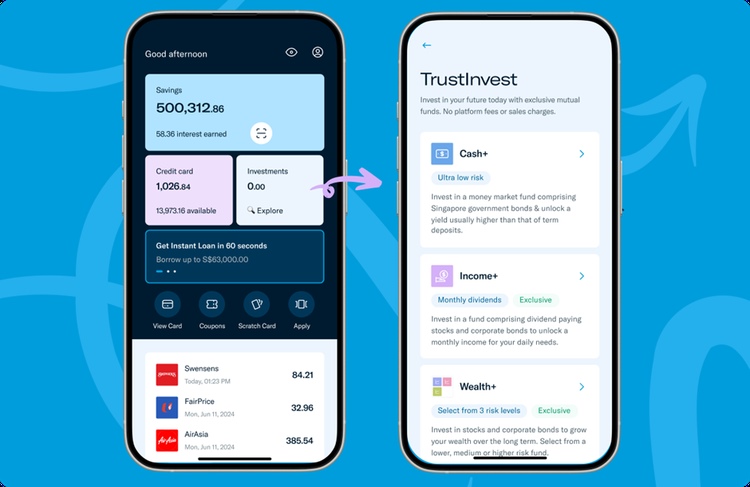

When I saw that Trust Bank had rolled out an investment feature called TrustInvest that allows users to invest with as little as S$100, I was intrigued.

I already use Trust Bank for its savings account and no FX fee credit card in one easy-to-use app.

So when they added investing into the mix, I thought this might be worth a closer look.

The first thing that caught my attention was how they framed the rollout.

No flashy promises. Instead, TrustInvest is positioned as a simple, no-fuss way for everyday people to start investing.

The investment options were grouped by goals and risk levels, which felt a lot more beginner-friendly than scrolling through a long list of options.

It also got me thinking about how platforms like TrustInvest can play a role in building passive income in Singapore, something many of us are looking to grow over time.

In this review, I’ll share my experience using TrustInvest from the fund options to the fees involved and how to get started if you’re thinking of trying it for yourself.

What is TrustInvest?

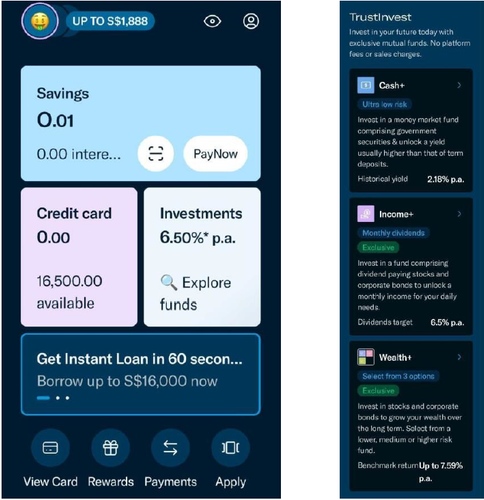

TrustInvest is the new investment feature in the Trust Bank app.

You might already be familiar with Trust Bank, it is one of Singapore’s licensed digital banks and is backed by Standard Chartered and FairPrice Group.

Up till recently, Trust has mainly been known for its everyday banking features like its Trust savings account and a no FX fee credit card.

But expanding into investing seems like a natural next step for the company.

If you’re already managing your spending and saving in the same app, why not streamline your investing too?

The idea is to make investing as fuss-free as possible.

You do not need to download a separate app.

Whether you’re looking to grow your wealth long-term, generate monthly income, or simply put idle cash to work, TrustInvest offers curated funds tailored to different goals, all within the same app.

You can learn more about Trust Savings account and download the Trust app here

What can you invest in with TrustInvest?

TrustInvest keeps things simple by offering five funds to choose from, each tailored to different investment goals or risk appetite.

These funds fall into three categories: Cash+, Income+, and Wealth+ (the Wealth+ category has three risk-based variants). Here’s an overview of each:

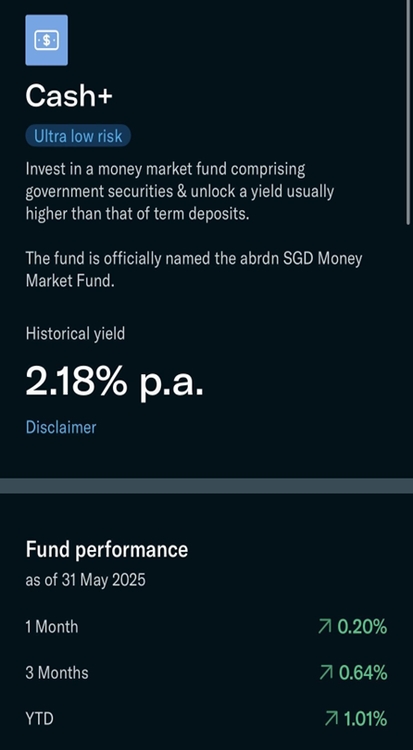

#1 – Cash+ (Money market fund)

Cash+ is the most conservative option.

TrustInvest's Cash+ is a platform feature that lets you invest in the abrdn SGD Money Market Fund, a professionally managed money market fund.

The fund invests in a diversified mix of high-quality short-term debt instruments, including government and corporate bonds, as well as bank deposits.

The aim is to provide capital preservation and daily liquidity, making it an option if you’re looking to park your spare cash while earning a potentially higher yield than a regular savings account.

I found it works well as an alternative to rolling over T-bills or fixed deposits, with the added convenience of being accessible within the Trust app.

Returns are not guaranteed, but the risk level is considered low. There is no lock-in period, and redemptions are typically settled within one to two business days.

The historical yield of the Cash+ fund is 2.18% per annum as of 30 June 2025

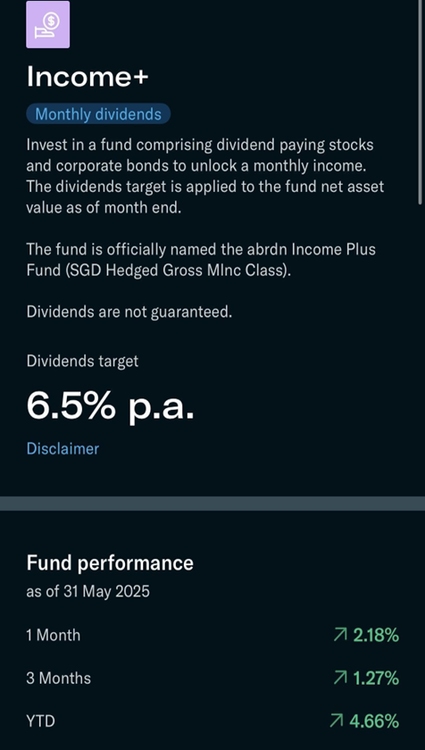

#2 – Income+ (Monthly dividend)

Income+ is a platform feature within TrustInvest that lets you invest in the Trust exclusive abrdn Income Plus Fund (SGD Hedged Gross MInc Class), a professionally managed income fund designed to deliver regular monthly payouts.

The fund invests in a combination of dividend-paying stocks, investment-grade and high-yield corporate bonds, as well as government-linked debt securities.

Because it includes speculative-grade bonds (with an average credit rating of Ba2 as of 30 June 2025), the fund carries higher risk than Cash+.

But in return, it aims to generate a more attractive income stream, making it appealing if you’re looking for monthly passive cash flow.

It’s also globally diversified, spreading your exposure across sectors and regions.

This option can be considered by long-term investors with a higher risk tolerance, who are comfortable with some price fluctuations in exchange for regular income.

I found the fund easy to monitor within the Trust app, with monthly payouts automatically credited to my TrustInvest account.

The dividend payout target for the Income+ fund is 6.5% per annum as of 8 July 2025.

Learn more about TrustInvest and its funds here

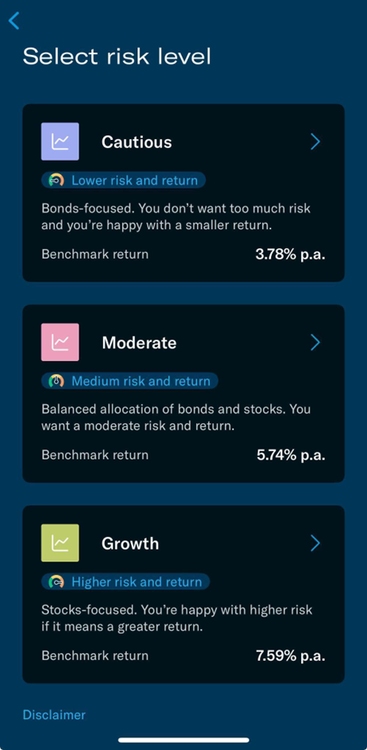

#3 – Wealth+ (Cautious, Moderate, and Growth Funds)

Wealth+ is TrustInvest’s solution for long-term wealth building, offering three different funds by risk appetite:

- Wealth+ Cautious: a lower-risk, bond-heavy portfolio. This fundsholds a larger proportion of bonds and may hold some cash or money market funds, with a smaller equity exposure (~30% equities / 70% fixed income, which is similar to a conservative allocation). TrustInvest's Cautious fund is powered by the abrdn Wealth Plus Cautious Fund, a globally diversified fund managed by abrdn Asia Limited (“Aberdeen Investments”). The benchmark return of the Cautious portfolio is 3.78% as of 8 July 2025.

- Wealth+ Moderate: a balanced portfolio. This portfolio aims for a middle ground (roughly 60/40 between equities and bonds). It’s tailored for a moderate risk tolerance, similar to a classic balanced fund for growth with some stability. TrustInvest's Moderate portfolio is linked to the abrdn Wealth Plus Moderate Fund, which provides global diversification and active management. The benchmark return of the Moderate portfolio is 5.74% as of 8 July 2025.

- Wealth+ Growth: the highest-risk portfolio, focused on maximising growth. This fund is equity-heavy (around 90% in stocks) with a small allocation to bonds for minimal stability. It’s akin to an aggressive allocation that seeks long-term capital appreciation. TrustInvest's Growth portfolio is linked to the abrdn Wealth Plus Growth Fund which provides exposure to a globally diversified set of growth-oriented assets. The benchmark return of the Growth portfolio is 7.59% as of 8 July 2025.

All three Wealth+ funds invest in a mix of global stocks and corporate bonds (the same assets, just in different proportions) and are exclusive to TrustInvest customers only.

Who manages the TrustInvest funds?

All TrustInvest portfolios are created, managed, and regularly rebalanced by Aberdeen Investments, the local arm of global fund manager Aberdeen Group Plc., which manages over S$487 billion in assets globally as of September 2024.

Aberdeen Investments brings decades of experience in managing institutional and retail funds, and is regulated by the Monetary Authority of Singapore (MAS).

While Trust Bank provides the digital platform and user interface, Aberdeen Investments is responsible for the full investment management process.

This includes selecting the underlying assets in each portfolio, monitoring performance, and rebalancing the funds periodically to ensure they continue to align with their respective risk profiles.

The goal is to help investors stay on track with their investment objectives without needing to manage the day-to-day decisions themselves.

What are the fees for TrustInvest?

TrustInvest has a transparent fee structure.

Unlike many traditional banks and even some robo-advisors, there are no sales charges or platform fees. You will only be charged the fund management fee, which is already factored into the fund’s daily price.

For context, here’s a breakdown of the fund management fees for the different portfolios:

- Cash+: 0.3% p.a.

- Income+ and Wealth+: 1.45% p.a.

There’s also a limited-time management fee rebate promotion until 31 December 2025:

- 0.1% rebate on Cash+

- 0.5% rebate on Income+ and Wealth+

To qualify for the management fee rebate promotion, remember to hold your investment until 31 December 2025. The rebate will be credited to your Trust savings account by 31 January 2026.

What stood out to me is how TrustInvest brings together features that many investors appreciate.

With Trust, you get fee transparency, the same ease of use that people love about robo-advisors, plus credibility of a licensed bank in Singapore and access to funds managed by global asset manager Aberdeen Investments.

To illustrate how TrustInvest stacks up, here’s a quick comparison:

| Platform | TrustInvest (Trust) | Traditional Bank Unit Trust | Robo-Advisor |

| Upfront Sales Fee | 0% | ~1.5% (often reduced to ~0.85% online) | 0% |

| Platform/ Advisory Fee | 0% | 0% | ~0.15% to 0.8% p.a advisory fee |

| Fund Management Fee | Cash+: 0.30% p.a. Income+ / Wealth+: 1.45% p.a. | ~1% to 2% p.a. typical for fund | ~0.1% to 0.3% p.a. for underlying ETFs |

| Current rebates / Promotions | 0.10% to 0.50% p.a. rebate until end-2025 | Occasional cashback or voucher promotions | Fee waivers for a certain number of months or referral bonus |

| Source: Trust Bank, various banks and robo-advisor platforms as of 8 July 2025 | |||

What I like about TrustInvest

#1 – All-in-one convenience

The biggest draw for me is how seamless everything is.

Since TrustInvest is integrated directly into the Trust app, you can transfer money from your Trust savings account and start investing almost instantly.

Your savings, card spending, and investments are all housed in one place so there’s no need to juggle multiple apps or logins.

#2 – Simple fund selection

With only five funds to choose from, TrustInvest keeps things refreshingly simple.

This helps reduce decision fatigue, especially for beginners who might feel overwhelmed by too many choices.

Each fund is clearly labelled with its investment goal and risk level, and the app offers guidance to help you find the right fit.

#3 – Low minimum investment

TrustInvest is highly accessible—you can get started with as little as S$100.

That makes it easy to try out the platform without committing a large sum upfront.

Plus, since transferring your money between your Trust savings account and your TrustInvest Account takes just one click, your spare cash can sit in your Trust savings account to earn interest until you are ready to invest it.

#4 – Flexible access with no lock-in

There are no lock-in periods with TrustInvest.

You can sell your investments anytime, and the proceeds are typically returned to your TrustInvest account within a few business days.

This level of flexibility is reassuring if you ever need access to your funds quickly.

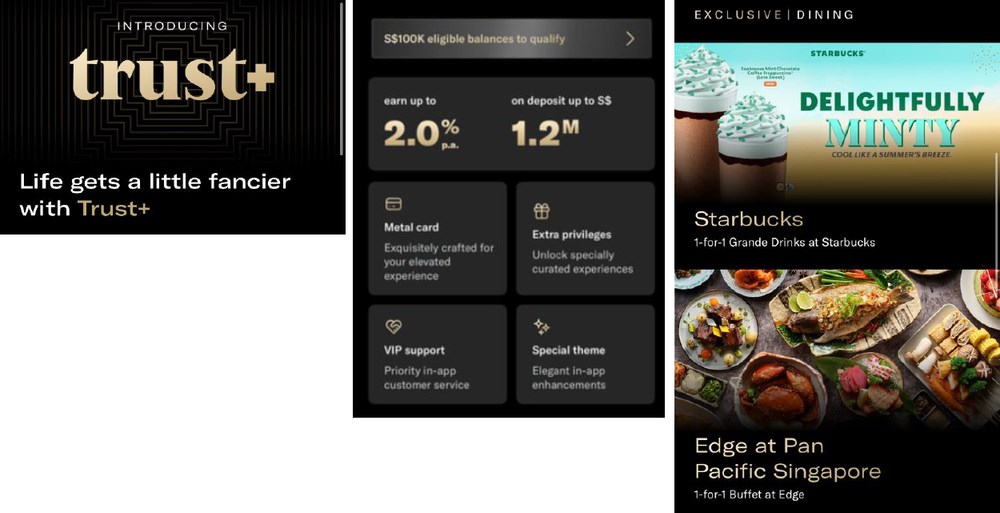

#5 – Unlock additional Trust+ rewards

Investing with TrustInvest also brings added benefits through Trust+, Trust Bank’s tiered rewards programme.

If you maintain at least S$100,000 in eligible balances across your Trust savings account Average Daily Balance ("ADB") and/or your TrustInvest account value, you can unlock perks like:

- Access to exclusive merchant deals

- A sleek metal Trust card

- Priority in-app customer service

Even if you’re not at the S$100,000 mark yet, growing your TrustInvest balance moves you closer to enjoying these extra rewards.

How to get started with TrustInvest

Step 1: Open a Trust Bank savings account:

To open a Trust Bank savings account, you'll need to download the Trust Bank app and use MyInfo with Singpass to pre-fill your application.

The process is quick, taking only a few minutes, but may take up to 5 working days if further verification is needed:

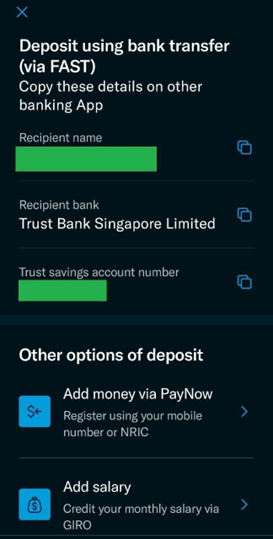

Step 2: Fund account via FAST or PayNow:

Transfer money into your Trust savings account using FAST or PayNow:

Step 3: Choose a fund (Cash+, Income+, or Wealth+) based on risk tolerance:

Tap the “Invest” tab in the app and browse the five available portfolios.

Step 4: Invest with a minimum of S$100:

Once you’ve chosen a fund, confirm your investment in-app:

Source: Trust Bank Singapore

If you place your order or start investing before the cut-off time, it will be executed on the next business day.

You’ll see your position updated by the next business day and your holdings will be visible in full.

What would Beansprout do?

If you’re new to investing and feeling overwhelmed by the number of platforms and options out there, TrustInvest can be a simple way to get started, especially if you just want to put a small amount of money a little at a time on autopilot while you learn the ropes.

The interface is easy to navigate, the funds are clearly explained, and the fees are transparent. For beginner investors, that level of clarity and simplicity can go a long way in building confidence.

And if you’re already using Trust Bank for your savings account, transitioning into investing becomes even more seamless.

Not to mention, you can easily transfer your spare cash from your Trust savings account to your TrustInvest account quickly and seamlessly so your cash can continue in your Trust savings account earning interest until you’re ready to invest.

You don’t need to download another app or move your money across platforms; you can just start with as little as S$100 and build up from there.

Learn more about TrustInvest here

Disclaimer:

This advertisement has not been reviewed by the Monetary Authority of Singapore. All forms of investments carry risks, including the risk of losing all of the invested amount. Such activities may not be suitable for everyone. The value of any investments and the income from them may fall as well as rise. Past performance, historical yield and benchmark returns are not indicative of future performance.

TrustInvest is an investment product and not a bank deposit. It is not insured by the Singapore Deposit Insurance Corporation.

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

The information in this article is not an offer or recommendation to buy or sell units in the fund. It does not consider your specific investment objectives, financial situation or needs. You should get advice from a financial adviser or consider whether the investment is suitable for you before making any investment decisions.

TrustInvest and Management Fee Rebate Programme T&Cs apply. Visit trustbank.sg for more details.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions