Trust Bank: Earn up to 2.50% p.a. interest rate

Savings Account

By Beansprout • 05 Sep 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

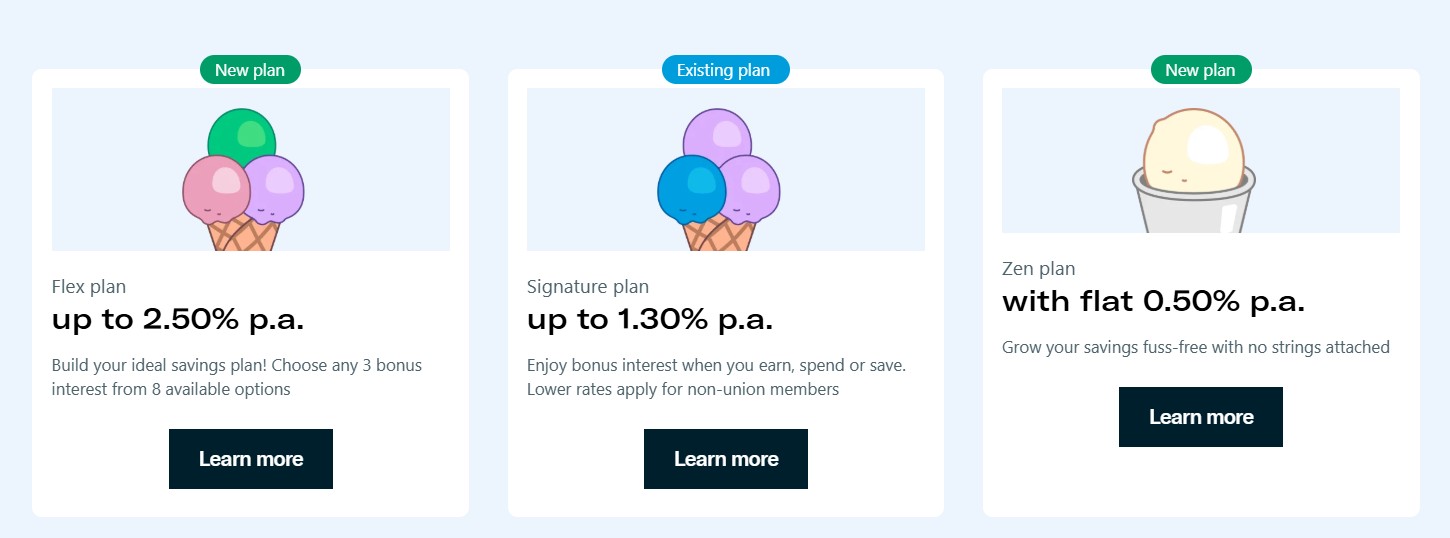

Trust Bank Singapore offers savings account with three plans to choose from that allow customers to earn an interest rate of up to 2.50% p.a.

What happened?

Trust Bank has revised the interest rate for its savings account and introduced three savings account plans that let you decide how you earn interest each month.

With this change, the maximum interest rate has also been increased to 2.50% p.a. from 2.00% p.a. on deposits up to S$1.2 million, offering enhanced potential returns for savers.

Let us find out what is Trust Bank Singapore, and if it might be worthwhile opening a savings accounts with one of the digital banks that have emerged in recent years.

What is Trust Bank Singapore?

Trust Bank Singapore is a digital bank backed by a unique partnership between Standard Chartered Bank and FairPrice Group.

The former owns 60% while the remaining 40% is owned by the FairPrice Group's enterprise arm.

Launched on 1 September 2022, Trust Bank has expanded its range of services beyond just a savings account. Customers can now access a wider selection of financial products, including:

- Debit/credit cards

- Personal bank loans

- In‑app investment platform - TrustInvest Account

- Various types of insurance coverage

Unlike digital banks such as GXS and MariBank, Trust Bank Singapore actually has a full banking licence, complete with 20 ATMs islandwide.

This includes 19 StanChart ATMs and 1 ATM at FairPrice Xtra (Vivocity).

What is the current interest rate on the Trust Bank savings account?

As of September 2025, Trust Bank Singapore offers up to 2.50% p.a. interest on its savings account, applicable to deposits of up to S$1,200,000.

There are now three flexible savings plans to choose from, each tailored to different saving and spending habits.

You can switch between plans every month through the Trust App. If no plan is selected, the Signature Plan will be applied by default.

Let’s take a closer look at each plan.

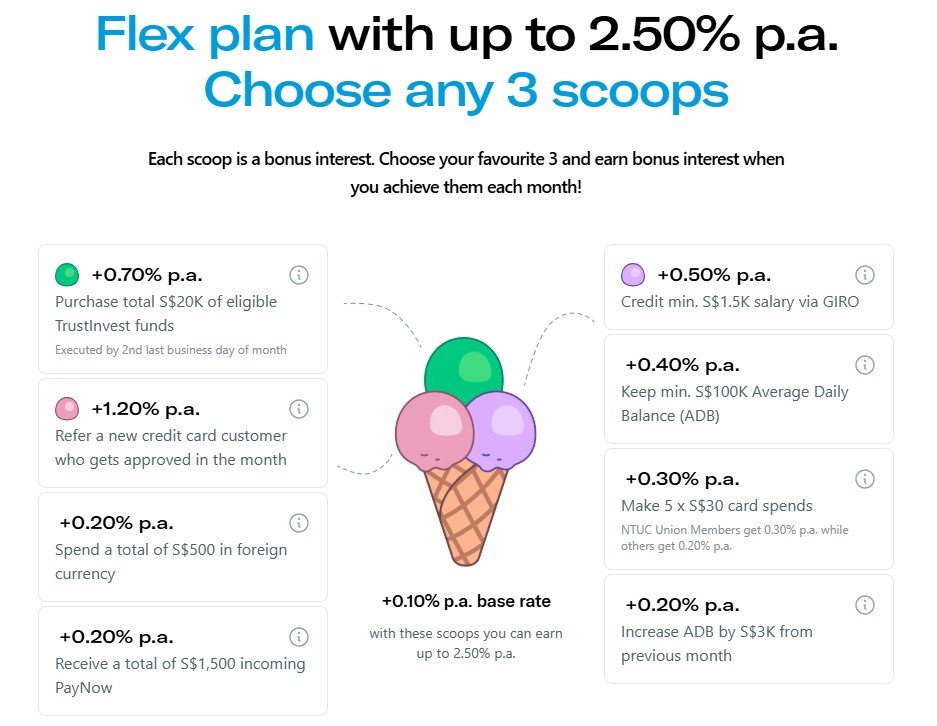

Flex Plan (Up to 2.50% p.a.)

The Flex Plan offers a base interest of 0.10% p.a.. You can boost this rate by selecting any 3 bonus "scoops" each month to earn additional interest:

| Actions/Scoops | Bonus Interest (p.a.) |

| Refer a new Trust credit card customer approved within the month | +1.20% p.a. |

| Invest at least S$20,000 in eligible TrustInvest funds | +0.70% p.a. |

| Credit a minimum salary of S$1,500 via GIRO in a single transaction | +0.50% p.a. |

| Maintain a minimum average daily balance (ADB) of S$100,000 | +0.40% p.a. |

| Receive a total of S$1,500 in incoming PayNow transfers | +0.30% p.a. |

| Increase your ADB by at least S$3,000 from the previous month | +0.20% p.a. |

| Make at least 5 card spends (minimum S$30 each) | +0.30% p.a. (NTUC Union Members) +0.20% p.a (Non-NTUC Union Members) |

| Spend at least S$500 in foreign currency | +0.20% p.a. |

| Source: Trust Bank, as of 5 September 2025 | |

Here are some examples to illustrate how you can customise your bonus interest:

Example #1 - The Active Spender and Salary Earner

- Credit Salary: You receive your monthly salary of at least S$1,500 via GIRO (+0.50% p.a.)

- Card Spending: You use your Trust debit/credit card for at least 5 transactions of S$30 or more (+0.20% p.a.)

- Foreign Currency Spending: You spend at least S$500 overseas or online in foreign currency (+0.20% p.a.)

Total Bonus Interest: 0.50% + 0.20% + 0.20% = 0.90%

Effective Interest Rate: 0.10% base + 0.90% bonus = 1.00% p.a.

Example #2 - The Investor and Big Saver

- Invest in TrustInvest: You invest at least S$20,000 in eligible TrustInvest funds (+0.70% p.a.)

- Maintain High Balance: You keep a minimum average daily balance of S$100,000 (+0.40% p.a.)

- Salary Credit: You credit your salary of at least S$1,500 via GIRO (+0.50% p.a.)

Total Bonus Interest: 0.70% + 0.40% + 0.50% = 1.60%

Effective Interest Rate: 0.10% base + 1.60% bonus = 1.70% p.a.

So, in order to earn the maximum 2.50% p.a. interest as advertised, you will have to combine the three highest scoops which requires you to refer a new Trust credit card customer (+1.20% p.a), invest at least S$20,000 in TrustInvest funds (+0.70% p.a), and have at least S$1,500 salary credited via GIRO (+0.50% p.a).

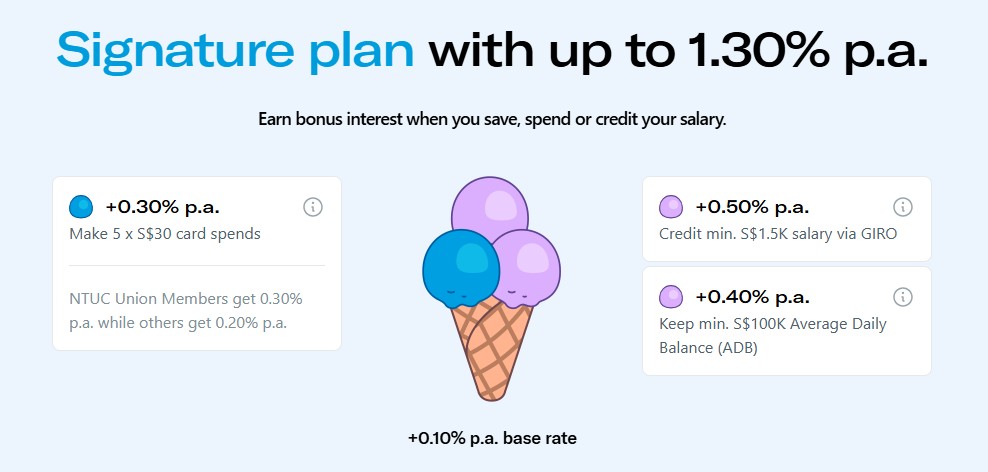

Signature Plan (Up to 1.30% p.a.)

The Signature Plan is Trust Bank’s original offering. It gives you a base rate of 0.10% p.a., with bonus interest awarded for meeting key financial activities:

- Make at least 5 card spends (minimum S$30 each): +0.30% p.a.

- Credit a salary of at least S$1,500 via GIRO: +0.50% p.a.

- Maintain an average daily balance (ADB) of S$100,000: +0.40% p.a.

Zen Plan (Flat 0.50% p.a.)

Prefer something simple and fuss-free? The Zen Plan offers a steady 0.50% p.a. with no conditions to meet.

However, it's worth noting that there are several other fuss-free savings accounts that offer higher base interest rates.

Check out the full list of best savings accounts with the highest interest rates here.

For all plans, any balance above S$1.2 million will earn 0.05% p.a.

Your interest will be calculated on a daily basis (based on each day-end deposit balance using a 365-day per annum basis), and credited on the last day of the month.

There is no lock-in period, no monthly fee, and no account closure fee on the Trust Bank savings account.

However, you will need to be at least 16 years of age to be eligible for a Trust Bank savings account.

What users may like about Trust Bank

#1 – Attractive rewards with your credit card spend

But wait! The savings account is not all that Trust Bank has to offer.

You can also accumulate Linkpoints when you shop with your NTUC Link Card or Trust Link Card, which can be tracked on your Trust mobile app.

There are also savings you can enjoy on FairPrice Group groceries and food:

NTUC Link Card

- With credit card, get up to 21% savings when you hit a minimum monthly spending of S$350

- With debit card, get up to 11% savings when you hit a minimum monthly spending of S$200

Trust Link Card

- With credit card, get up to 15% savings when you hit a minimum monthly spending of S$450

- With debit card, get up to 5% savings when you hit a minimum monthly spending of S$200

What users may not like about Trust Bank

#1 - Lower interest rate compared to best no-frills savings account

Trust Bank's Zen Plan that offers a base interest rate of 0.50% p.a. with no conditions is still lower than what some other no-frills accounts are offering.

Under the Signature Plan and for union members who don't deposit their salary, the current interest rate of 0.80% p.a. offered by Trust is still lower than the interest rate offered by the best savings accounts with the highest interest rates in Singapore.

#2 – Getting the maximum interest may not be realistic for everyone

It is important to note that you’ll need to refer a new credit card customer (+1.20%), invest S$20K in TrustInvest (+0.70%), and credit S$1,500 salary via GIRO (+0.50%) to earn the maximum interest rate of 2.50% p.a. with Trust Bank.

Most of us may find it difficult to refer new customers monthly or invest large sums. Hence, the realistic interest rate you may get would be between 0.90% to 1.80% p.a.

#3 – Active effort and planning ahead needed

One potential downside is that earning meaningful interest may require extra planning and effort.

If you don’t actively choose a savings plan each month, Trust Bank defaults you to the Signature Plan. But without meeting any conditions like salary credit, card spending, or a S$100K balance, you’ll earn just 0.10% p.a.

To avoid this, you’ll need to manually opt into the Zen Plan each month to get the 0.50% p.a. flat rate which, while modest, is still better than the base rate.

This means even earning basic interest requires some planning and action, which may feel like a chore for passive savers.

How does Trust Bank compare to GXS and MariBank?

In case you’re wondering how does Trust Bank compare to GXS and MariBank, I've compiled them in the table below.

| MariBank | GXS Bank | Trust Bank | |

| Savings account interest rate | 0.88% p.a. | Up to 1.38% p.a. | Up to 2.50% p.a. |

| Maximum deposit | S$100,000 | S$60,000 | Maximum deposit of S$1.2 million. Maximum interest rate of 2.50% p.a. only earned on Flex Plan with salary credit, investment and card referral. |

| Eligibility requirements |

|

|

|

| Benefits | 4.5% Cashback on overseas spend and 0.5% unlimited cashback with Mari Debit Card | Nil | Promotional discounts on FairPrice Group spending |

| Physical branches and ATMs | Nil | Nil | 20 ATMs islandwide |

| Source: Company websites as of 5 September 2025 | |||

Is it safe to deposit your money with Trust Bank Singapore?

Trust Bank Singapore holds a full banking license that is issued by the Monetary Authority of Singapore.

As mentioned previously, it is backed by two reputable names–Standard Chartered and FairPrice.

Additionally, all deposits in Trust are fully secured by the Singapore Deposit Insurance Corporation (SDIC) up to S$100,000 per depositor.

Final verdict on Trust Bank Singapore

If you are looking for a fuss-free option to grow your savings, opting for the Zen Plan monthly would give you an interest rate of 0.50% per annum.

This would make the interest rate earned lower than Mari savings account and GXS savings account.

If you are looking for a fuss-free account with no salary credit or credit card spend requirements, UOB Stash Account offers an effective interest rate of 1.50% p.a., and when paired with the UOB Leap of Fortune Savings Promotion, the returns can be even higher.

With both Signature Plan and Flex Plan, you will be able to get a higher interest rate of up to 1.30% p.a. if you are able to maintain an average daily balance of S$100,000 and above, are a NTUC union member with 5 eligible card transactions, and credit at least S$1,500 monthly via GIRO in a single transaction.

If you're willing to take it further, the Flex Plan offers up to 2.50% p.a. for those who tick off the right mix of monthly conditions, and balances up to S$1.2million are eligible to earn interest at this top tier.

In addition, Trust Bank stands out for its wider product offering, particularly rewards earned with the NTUC Link Card or Trust Link Card.

To find out which savings account allows your money to work harder, check out our guide to the best savings account with highest interest rates in Singapore

Join Beansprout's Telegram group to get the latest insights on savings, investing and retirement planning.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions