T-bill yield rises further to 1.41%. What's driving the bounce?

Bonds

By Gerald Wong, CFA • 04 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

The cut-off yield for the latest 6-month Singapore T-bill auction on 4 December rose to 1.41% p.a.

What happened?

The results of the latest Singapore T-bill auction are out.

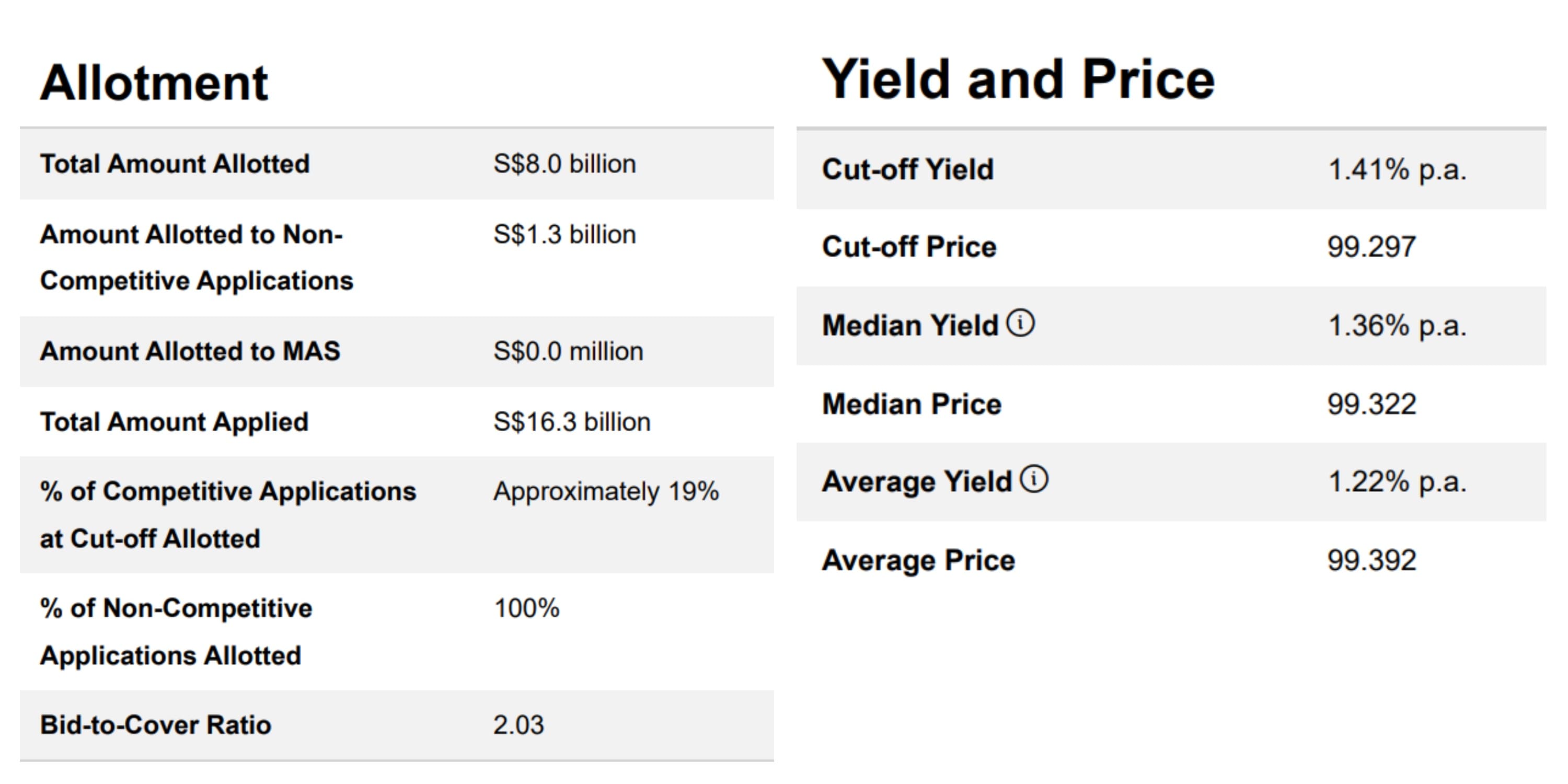

In the auction on 4 December, the cut off yield for the 6-month Singapore T-bill (BS25124F) increased to 1.41% from 1.39% in the previous T-bill auction.

With the fall in US government bond yields in the past two weeks, the latest result may be a surprise to some investors.

In this article, I'll look at what is driving the increase in T-bill yield, as well as how it compares to the best fixed deposit rates as a place to park your cash to earn a higher yield.

What we learnt from the latest 6-month Singapore T-bill auction

#1 - Demand for the Singapore T-bill fell further

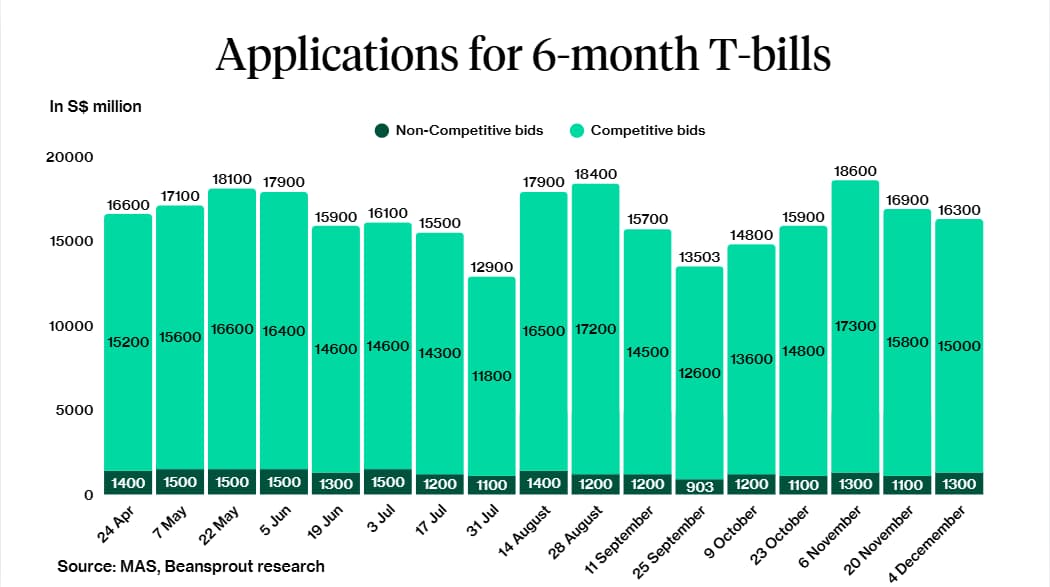

Total applications for the 6-month Singapore T-bill fell to S$16.3 billion in the latest auction on 4 December from S$16.9 billion on 20 November.

The amount of competitive bids decreased to S$15.0 billion.

If you placed a competitive bid below 1.41%, you would receive 100% of your requested T-bill allocation.

If you bid at exactly 1.41%, the allocation would be around 19%.

The amount of non-competitive bids rose to S$1.3 billion on 4 December from S$1.1 billion on 20 November.

Since the amount of non-competitive bids was within the allocation limit, all eligible non-competitive bids received full allocation for the T-bill.

#2 - T-bills issued remain constant

The amount of T-bills issued was same as the previous auction on 20 November at $8.0 billion.

With the lower amount of T-bill applications, the ratio of applications to T-bills issued (bid-to-cover ratio) decreased to 2.03x.

#3 - Median yield of bids submitted rose

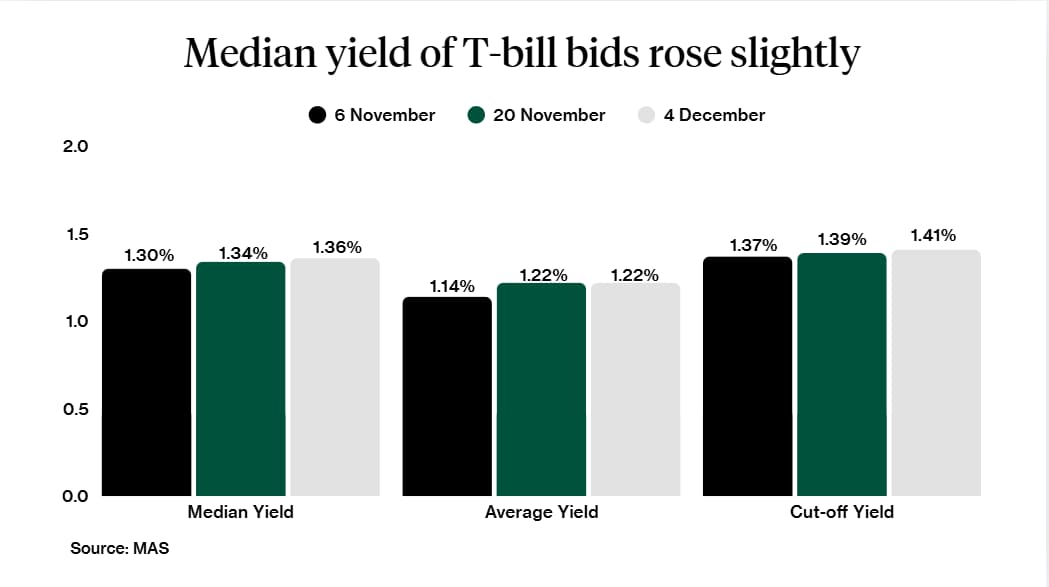

The median yield of bids submitted rose slightly to 1.36% from 1.34% in the previous auction.

The average yield of bids submitted remained at 1.22% from the previous auction.

This may reflect the bounce in Singapore government bond yields in recent weeks following stronger than expected inflation data.

Given the median yield and the cut-off yield, this suggests that a substantial number of bids were placed in the 1.36% to 1.41% range, on par with the best 6-month fixed deposit rate in Singapore.

What would Beansprout do?

The higher T-bill yield is likely driven by the decrease in demand for the Singapore T-bill.

At the same time, we have seen an increase in the median yields of bids submitted, reflecting the bounce in Singapore government bond yields in the past week.

Despite the bounce, we would continue to start to look for other ways to earn a higher yield on our cash.

For example, the best 6-month fixed deposit rate in Singapore of 1.40% p.a. is on par with the cut-off yield of the latest T-bill.

One other option to consider the Singapore Savings Bonds (SSB), which offers a 1-year return of 1.33% and average annual return of 1.99% over 10 years, while having the flexibility to redeem prior to maturity.

We were also able to find savings accounts in Singapore that offer an interest rate of above 1.41% p.a.

To find out other ways to make your savings work hard, check out our guide to best ways to earn a passive income in Singapore.

💰 [Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher, plus 5% p.a. interest boost on S$5,000 with Longbridge Cash Plus for 365 days (worth ~S$250) when you sign up for a Longbridge account via Beansprout and fund S$2,000. T&Cs apply. Learn more about the Longbridge promotion here.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments