The Assembly Place - Leading social community living operator

Stocks

By Goh Lay Peng • 23 Jan 2026

Why trust Beansprout? We're licensed by the Monetary Authority of Singapore (MAS).

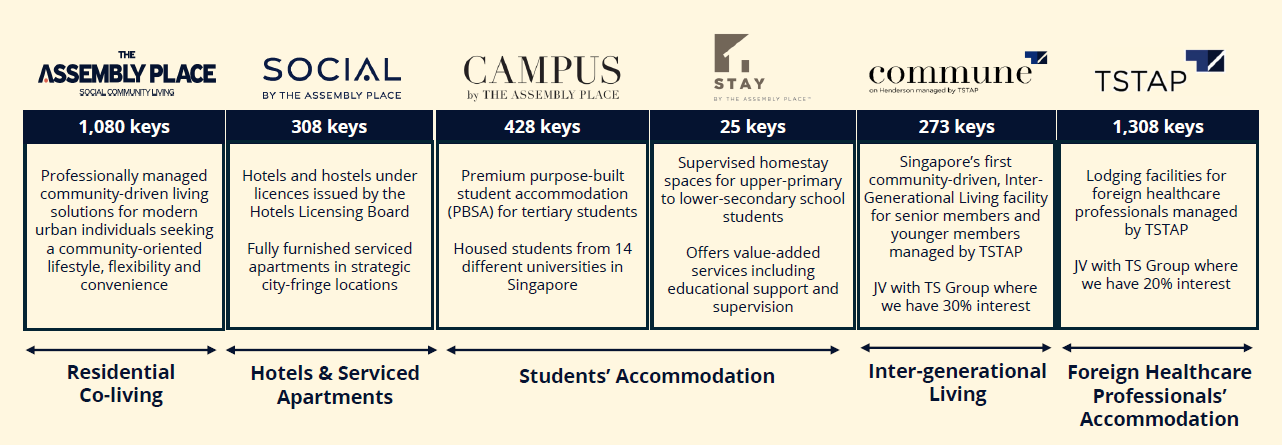

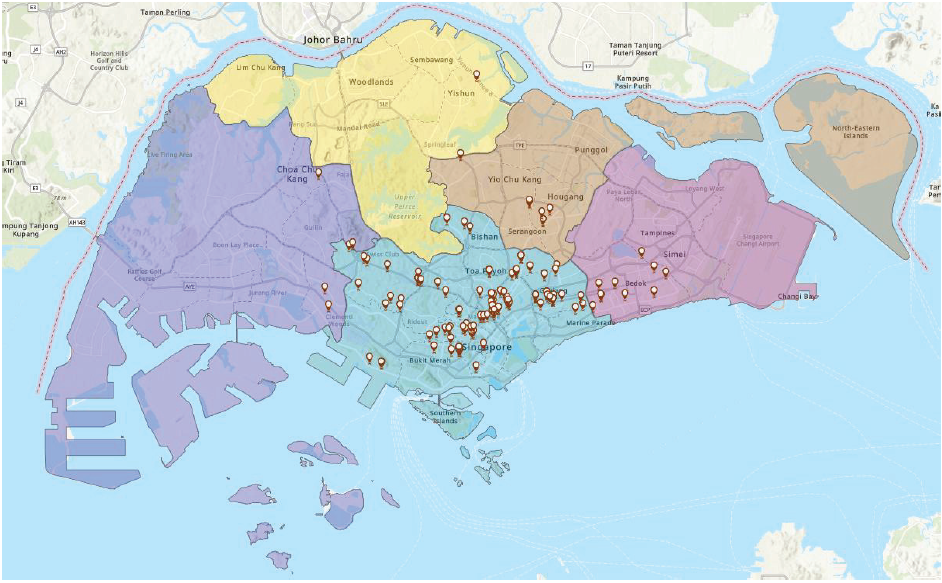

The Assembly Place has a portfolio of over 100 properties located across Singapore. It manages six brands across five living solution segments.

The Assembly Place - Leading social community living operator (Not Rated)

Established in 2019, The Assembly Place is the largest community living operator in Singapore who offers the most diverse type of accommodation.

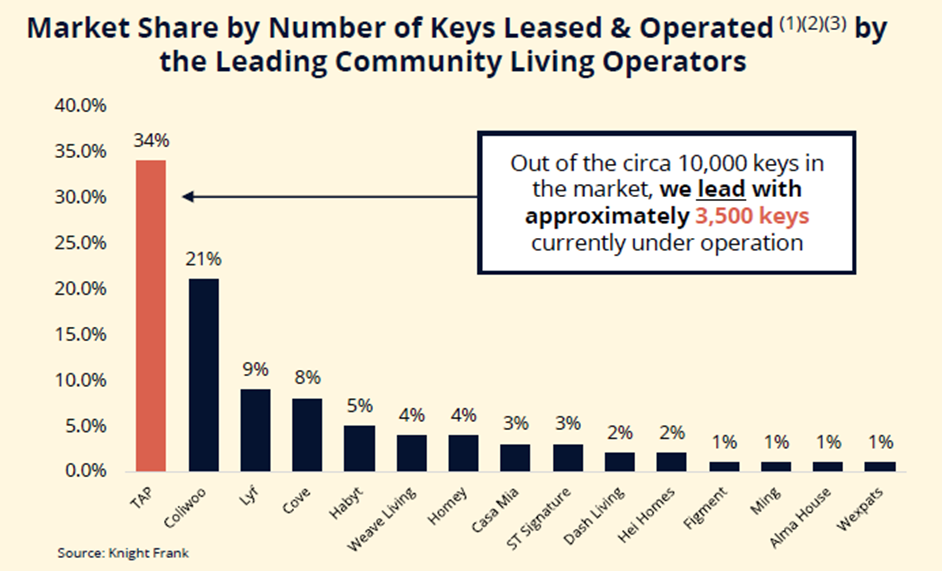

Based on Knight Frank’s research, The Assembly Place has the leading market share at 34% (based on number of keys as of 17 December 2025).

With six brands across five living solution segments, The Assembly Place addresses diverse customer needs across multiple accommodation formats.

The Assembly Place was listed on the Singapore Stock Exchange on 23 January 2026 with a market capitalisation of S$88 million.

Post listing, Founder and CEO Eugene Lim is expected to hold 24.9% of the company. Non-Executive Chairman and Controlling Shareholder, Mr Eric Low, will have 25.7% shareholding.

The Assembly Place has ambitions to expand the portfolio to over 10,000 keys by 2030, while maintaining the asset-light model.

The company will expand the portfolio through direct leases with property owners and strategic joint ventures with established partners.

It has secured additional properties which are expected to add approximately 610 keys to its portfolio over the next two years.

The Assembly Place will also expand across Southeast Asia, starting with a 66-key facility in Bangsar, Kuala Lumpur in 2026.

Key strengths of The Assembly Place

#1 - Largest and diversified across sectors and locations

As the largest operator in Singapore by leased and operated keys with 3,422 keys across 100 property assets in Singapore, representing about 34% in market share.

It derives scale benefits through enhanced bargaining power, operational consistency, and economies of scale.

TAP’s portfolio is diversified and extends through multiple demographic groups – from students to working population and seniors.

The Group’s broad demographic exposure allows it to participate across multiple community living sub-segments, reducing reliance on any single customer group and supporting more stable cash flows.

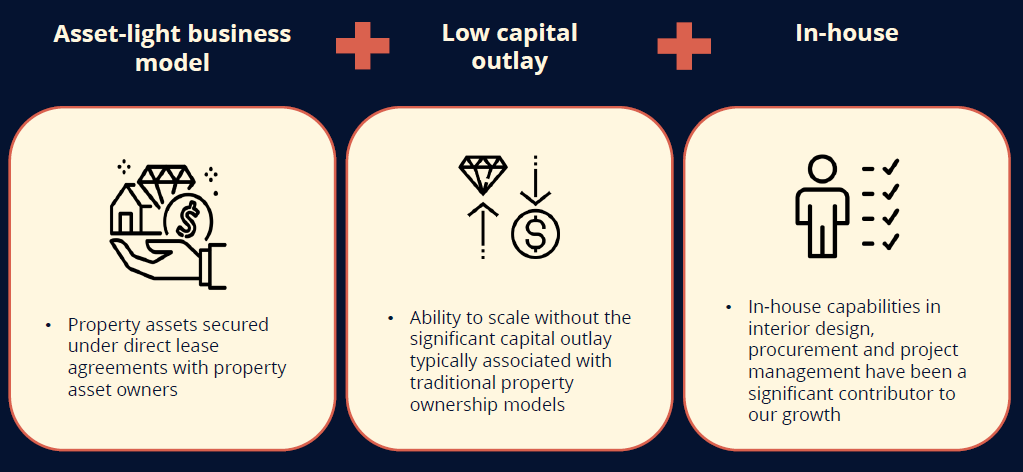

#2 - Scalable growth fuelled by an asset-light model and in-house capabilities

The Assembly Place operates an asset light model where the property assets are leased directly from the property asset owners.

In addition, the in-house capabilities in interior design, procurement and project management enhance the ability to launch new property assets in a timely and cost-efficient manner.

Growing the 311 keys in 2021 to 3,422 keys as at 17 December 2025, representing CAGR of 83.2%.

#3 - Positive outlook for co-living industry

Operators with scale and operational efficiency are better positioned to capture demand and navigate regulatory complexity.

TAP’s diversified portfolio broadens the Group’s market reach across multiple demographics.

Looking ahead, Singapore’s community living sector is expected to benefit from continual increase in housing rental rates, steady inflows of foreign professionals and students, while supply remains structurally limited.

Meanwhile, change demographics and living needs from growing proportion of seniors aged 65 and over is an irreversible structural trend.

In Singapore’s community living sector, the addressable market value of the various segments are forecasted to grow steadily at a modest range of between 1.4% to 2.3% per year in the next five years, according to Knight Frank Consultancy.

Residential Co-living

A steady inflow of employment-pass holders is expected to support demand and rental growth in the residential co-living segment.

The number of employment-pass holders is estimated to increase by 1.0% per year. Based on independent research, residential rental will grow at an average of 1.2% per annum in the next five years.

Hotels & serviced apartments

Growth of international visitor arrivals from Southeast Asia and Asia remains resilient. Year-to-date till November 2025, visitor arrivals reached 15.55 million, an increase of 2.7% year-on-year.

With Singapore Tourism Board’s proactive tourism development plans, the visitor arrivals could continue the modest growth trend.

Market research expects room revenue of economy and mid-tier hotels to grow by 1.5% per annum over the next five year.

Students’ accommodation

Singapore’s position as a regional education hub with world class universities, global institutions and robust government policies attracting international talent, is driving international student enrolment and rising rental rates. International student enrolment is estimated to grow 2.5% per annum in the next five years.

Foreign healthcare professionals’ accommodation

Healthcare facilities and infrastructure in Singapore to be expanded and upgraded to strengthen and expand Singapore’s healthcare system to meet rising healthcare needs.

According to Ministry of Health, to attain a healthcare workforce size of 82,000 nationally by 2030, we will need to recruit about 6,000 nurses, allied health professionals and support care staff annually.

According to industry consultant, at least one-third of the new nurses is expected to be foreign nurses, or 2,000 new foreign nurses per year.

#4 - Community-driven approach and proprietary technology

The Assembly Place operates an asset-light model supported by proprietary, in-house developed CRM system and mobile application – TAP App.

TAP App centralises service requests, occupancy and lease tracking, and member feedback management.

This digital backbone streamlines workflows, improves resource allocation, and shortens response times across the portfolio.

As a result, the Group operates with a lean organisational structure, achieving a low employee-to-key ratio of approximately 1:81, which supports operating leverage and scalable growth.

The Assembly Place’s belief in a strong community-focused approach is a key differentiation.

Member engagement is driven through a combination of shared communal spaces, digital touchpoints via the mobile application and social media channels, and regular community-wide events held at least monthly to foster social interaction and a sense of belonging.

Leveraging on the digital solutions to integrate structured community engagement initiatives across its accommodation portfolio has supported tenant retention and brand differentiation.

#5 - Experienced management with proven track record

Mr Eugene Lim, Founder and CEO of The Assembly Place, brings over 15 years of real estate industry experience spanning brokerage, project marketing, and development sales.

Non-Executive Chairman and controlling shareholder, Mr Eric Low, is a key partner and growth enabler who supported the development of the company’s foundational portfolio. Mr Eric Low brings deep real estate market experience and strong asset origination capabilities.

Mr Eugene Lim built the company from a six-room operation into a diversified platform across residential co-living, student housing, serviced apartments, hostels, and hotel-style assets.

As at 17 December 2025, the portfolio has expanded to approximately 3,422 keys across 100 properties.

Business segments

Beyond its operational expertise, The Assembly Place also offers project and property management services, creating values in the properties under its management.

The business comprises three key segments - Community-driven stays, Other Property related services and Investments.

Community-driven stays

This is the largest revenue contributor, accounting for 94.8% of The Assembly Place’s 1H FY2025 revenue.

The Assembly Place operates and manages residential and alternative accommodation assets under six distinct brands, serving a broad customer base.

In addition, it provides property management services, including marketing, tenant sourcing and screening, and ongoing maintenance.

Other property related services

The Assembly Place offers property asset owners other value-added services such as referral services and project management services where we coordinate the renovation and refurbishment works on behalf of the property asset owner.

This segment contributes to 5.2% of total revenue in 1H FY2025.

Investments

As part of its business, The Assembly Place may invest or acquire minority ownership interests in companies that own the property assets.

After such acquisition, it may enter into tenancy agreements, project management agreements and/or property management agreements with such companies. In addition, The Assembly Place invests in or acquires companies with strategic or synergistic benefits.

Largest co-living operator in Singapore

The Assembly Place is the largest co-living operator in Singapore, with approximately 3,500 keys, or a market share of approximately 34%, as at 17 December 2025.

The Assembly Place targets a portfolio of 10,000 keys by end-2030, representing CAGR of 24%.

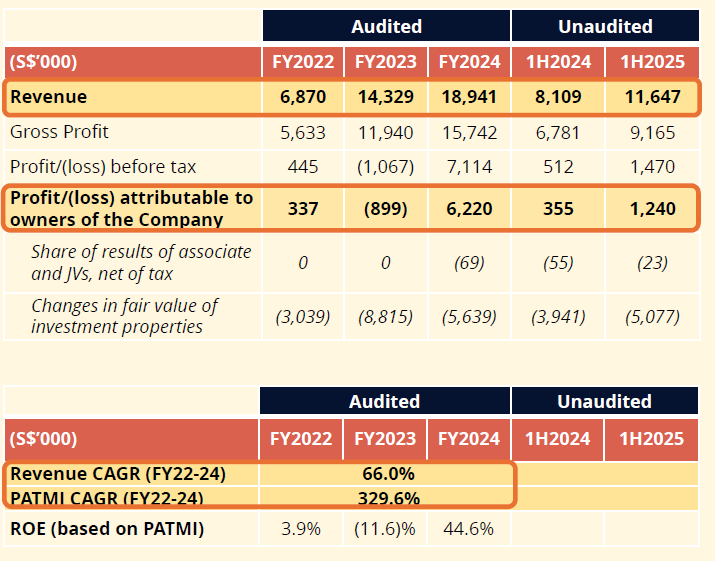

Financial highlights

1H 2025

Revenue increased 43.6% year-on-year to S$11.65 million, driven by the Community-driven segment. Revenue from Community-driven segment increased by 41.5% year-on-year to S$11.05 million.

Revenue from Other property-related services segment increased by 99.4% year-on-year to S$0.6 million.

During the period, The Assembly Place continued to scale up the operation, securing larger properties with higher key counts. The number of keys increased by 62.5% year-to-date to 3,422 keys.

In April 2025, SOCIAL on Outram was launched, featuring 26 keys across a four-storey pre-war shophouse with a land area of approximately 2,200 square feet, combining hotel accommodation with community-oriented living spaces.

In June 2025, COMMUNE on Henderson was launched. An inter-generational living concept located at the former Henderson Primary School.

The 77,000 sq ft development offers wellness-focused amenities for elderly and young adult residents, including a smart gym, communal garden, and multi-purpose court.

FY2024

Revenue increased 31.8% year-on-year to S$18.9 million, led by the Community-driven segment and the Investments segment.

There were conversion of existing management contracts to direct lease agreements and additional pipelines added in FY24, including 121-127 Woodleigh Park, Jalan Wangi, Moonstone Lane, Dunlop Street.

Net profit turned positive to S$$6.22 billion, from a net loss of S$899 million recorded in FY2023. Excluding changes in fair value of investment properties, core profit increased by 64.6% year-on-year to S$12.75 million.

Over FY2022–FY2024, the Group delivered a revenue CAGR of 66.0%.

Key Risks

#1 - Ability to secure suitable property assets

The Assembly Place’s ability to sustain growth is dependent on continued access to suitable property assets.

As at 30 June 2025, properties linked to the Non-Executive Chairman and Controlling Shareholder, Mr Eric Low, and his associates accounted for approximately 61.2% of lease liabilities.

While management is taking steps to broaden its sourcing base, heightened competition or adverse market conditions could limit asset availability and increase sourcing costs, which may adversely impact growth and returns.

As at 17 December 2025, The Assembly Place has secured additional properties which are expected to add approximately 610 keys (including 66 keys at Bangsar, Kuala Lumpur) to its portfolio over the next two years.

#2 - Dependent on direct lease agreements

It faces lease renewal risk given its reliance on direct lease agreements, with early termination or non-renewal potentially leading to site closures, higher relocation costs, and challenges in securing suitable replacement assets on acceptable terms.

#3 - Dependent on ability to maintain a stable member base

The company’s performance depends on having a stable member base which may be adversely affected by external factors. The Assembly Place will continue to pursue pricing, product and service initiatives to maintain and renew a stable member base.

#4 - Dependent on proprietary CRM system and mobile application

The company depends on the in-house developed CRM system and mobile application to operate efficiently.

Changes to mobile operating systems, browser settings, app-store policies, search-engine algorithms or data privacy laws could necessitate material re-engineering of the application or marketing strategies. This could adversely affect the operations.

#5 - Key man risk

The company is highly dependent on the continued services of Executive Director, Chief Executive Officer and controlling shareholder, Mr Eugene Lim and other key Executive Officers for continued success and growth.

The operations and financial performance will be affected if the company is unable to retain or replace any loss of the key executives and employees in a timely manner.

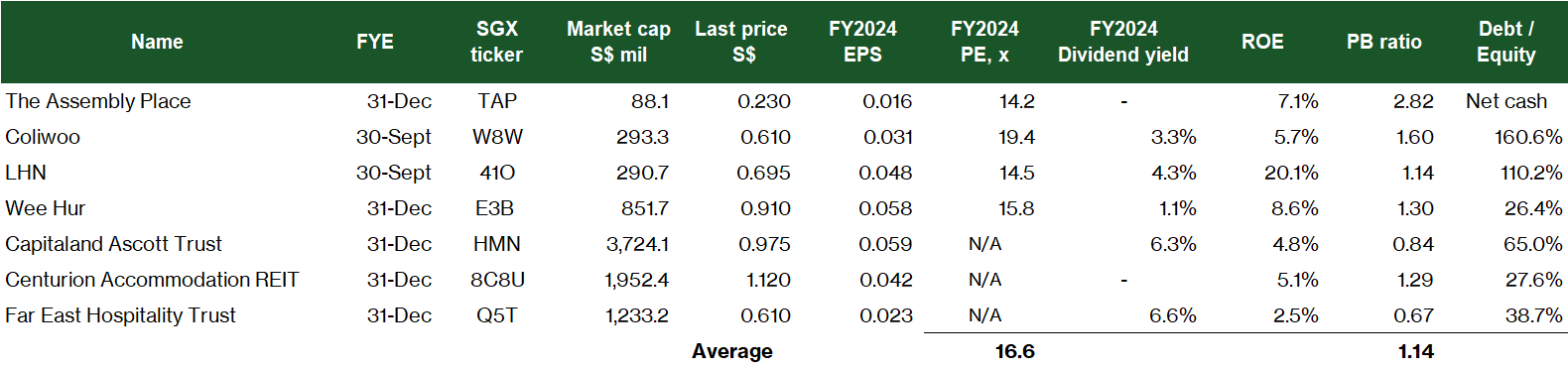

Trading at FY2024 PE 14.2x

Based on its listing price of S$0.23, The Assembly Place is trading at market cap of S$88.1 million and FY2024 price-to-earnings ratio of 14.2x.

Based on the estimated NAV of 8.17 cents as of 1H 2025, the stock is trading at price-to-book ratio 2.82x.

To understand more about the living sector, read our guide to investing in the living sector here.

To find out more, join our upcoming webinar "Investing in the living sector: A growing real estate asset class" at 7.30pm on 28 January (Wed) where we will unpack the key trends shaping the living sector, and discuss the opportunities and risks investors should understand before investing in stocks within this growing real estate segment. Sign up for free here.

Download the full report here.

Check out Beansprout guide to the best stock trading platforms in Singapore with the latestpromotions to The Assembly Place.

Join the Beansprout Telegram group for the latest insights on Singapore stocks, REITs, bonds and ETFs.

Important Disclosures

Analyst Certification and Disclosures

The analyst(s) named in this report certifies that (i) all views expressed in this report accurately reflect the personal views of the analyst(s) with regard to any and all of the subject securities and companies mentioned in this report and (ii) no part of the compensation of the analyst(s) was, is, or will be, directly or indirectly, related to the specific views expressed by that analyst herein. The analyst(s) named in this report (or their associates) does not have a financial interest in the corporation(s) mentioned in this report.

An associate is defined as (i) the spouse, or any minor child (natural or adopted) or minor step-child, of the analyst; (ii) the trustee of a trust of which the analyst, his spouse, minor child (natural or adopted) or minor step-child, is a beneficiary or discretionary object; or (iii) another person accustomed or obliged to act in accordance with the directions or instructions of the analyst.

Company Disclosure

Global Wealth Technology Pte Ltd (“Beansprout”) does not have any financial interest in the corporation(s) mentioned in this report.

Disclaimer

This report is provided by Beansprout for the use of intended recipients only and may not be reproduced, in whole or in part, or delivered or transmitted to any other person without our prior written consent. By accepting this report, the recipient agrees to be bound by the terms and limitations set out herein.

You acknowledge that this document is provided for general information purposes only. Nothing in this document shall be construed as a recommendation to purchase, sell, or hold any security or other investment, or to pursue any investment style or strategy. Nothing in this document shall be construed as advice that purports to be tailored to your needs or the needs of any person or company receiving the advice. The information in this document is intended for general circulation only and does not constitute investment advice. Nothing in this document is published with regard to the specific investment objectives, financial situation and particular needs of any person who may receive the information.

Nothing in this document shall be construed as, or form part of, any offer for sale or subscription of or solicitation or invitation of any offer to buy or subscribe for any securities. The data and information made available in this document are of a general nature and do not purport, and shall not in any way be deemed, to constitute an offer or provision of any professional or expert advice, including without limitation any financial, investment, legal, accounting or tax advice, and shall not be relied upon by you in that regard. You should at all times consult a qualified expert or professional adviser to obtain advice and independent verification of the information and data contained herein before acting on it. Any financial or investment information in this document are intended to be for your general information only. You should not rely upon such information in making any particular investment or other decision which should only be made after consulting with a fully qualified financial adviser. Such information do not nor are they intended to constitute any form of financial or investment advice, opinion or recommendation about any investment product, or any inducement or invitation relating to any of the products listed or referred to. Any arrangement made between you and a third party named on or linked to from these pages is at your sole risk and responsibility.

You acknowledge that Beansprout is under no obligation to exercise editorial control over, and to review, edit or amend any data, information, materials or contents of any content in this document. You agree that all statements, offers, information, opinions, materials, content in this document should be used, accepted and relied upon only with care and discretion and at your own risk, and Beansprout shall not be responsible for any loss, damage or liability incurred by you arising from such use or reliance.

This document (including all information and materials contained in this document) is provided “as is”. Although the material in this document is based upon information that Beansprout considers reliable and endeavours to keep current, Beansprout does not assure that this material is accurate, current or complete and is not providing any warranties or representations regarding the material contained in this document. All opinions contained herein constitute the views of the analyst(s) named in this report, they are subject to change without notice and are not intended to provide the sole basis of any evaluation of the subject securities and companies mentioned in this report. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permissible pursuant to applicable law, Beansprout disclaims all warranties and/or representations of any kind with regard to this document, including but not limited to any implied warranties of merchantability, non-infringement of third-party rights, or fitness for a particular purpose.

Beansprout does not warrant, either expressly or impliedly, the accuracy or completeness of the information, text, graphics, links or other items contained in this document. Neither Beansprout nor any of its affiliates, directors, employees or other representatives will be liable for any damages, losses or liabilities of any kind arising out of or in connection with the use of this document. To the best of Beansprout’s knowledge, this document does not contain and is not based on any non-public, material information. The information in this document is not intended for distribution to, or use by, any person or entity in any jurisdiction where such distribution or use would be contrary to law or regulation, or which would subject Beansprout to any registration requirement within such jurisdiction or country. Beansprout is not licensed or regulated by any authority in any jurisdiction or country to provide the information in this document.

As a condition of your use of this document, you agree to indemnify, defend and hold harmless Beansprout and its affiliates, and their respective officers, directors, employees, members, managing members, managers, agents, representatives, successors and assigns from and against any and all actions, causes of action, claims, charges, cost, demands, expenses and damages (including attorneys’ fees and expenses), losses and liabilities or other expenses of any kind that arise directly or indirectly out of or from, arising out of or in connection with violation of these terms, use of this document, violation of the rights of any third party, acts, omissions or negligence of third parties, their directors, employees or agents. To the extent permitted by law, Beansprout shall not be liable to you, any other person, or organization, for any direct, indirect, special, punitive, exemplary, incidental or consequential damages, whether in contract, tort (including negligence), or otherwise, arising in any way from, or in connection with, the use of this document and/or its content. This includes, without limitation, liability for any act or omission in reliance on the information in this document. Beansprout expressly disclaims and excludes all warranties, conditions, representations and terms not expressly set out in this User Agreement, whether express, implied or statutory, with regard to this document and its content, including any implied warranties or representations about the accuracy or completeness of this document and the content, suitability and general availability, or whether it is free from error.

If these terms or any part of them is understood to be illegal, invalid or otherwise unenforceable under the laws of any state or country in which these terms are intended to be effective, then to the extent that they are illegal, invalid or unenforceable, they shall in that state or country be treated as severed and deleted from these terms and the remaining terms shall survive and remain fully intact and in effect and will continue to be binding and enforceable in that state or country.

These terms, as well as any claims arising from or related thereto, are governed by the laws of Singapore without reference to the principles of conflicts of laws thereof. You agree to submit to the personal and exclusive jurisdiction of the courts of Singapore with respect to all disputes arising out of or related to this Agreement. Beansprout and you each hereby irrevocably consent to the jurisdiction of such courts, and each Party hereby waives any claim or defence that such forum is not convenient or proper.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments