US stock indices at record high. Here's how to trade the momentum.

Trading

By Nicole Ng • 08 Oct 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

US stocks are rallying. Explore how you can use US index futures to trade the momentum, hedge your exposure, and position for volatility.

What happened?

Volatility has been brewing in the US markets in 2025.

Rate cuts, headlines of geopolitical uncertainty, and the whiplashing optimism of AI and tech stocks have sent portfolios soaring one week and declining the next.

For many retail investors, the question isn’t whether their portfolio is growing, it’s how to protect those gains from being whipsawed by every new headline.

Previously, I discussed how futures allow trades to capture opportunities and manage downside exposure.

Here, I will go one step further to explore how US index futures like the S&P 500, Nasdaq 100, and Russell 2000 index futures can allow you to hedge your exposure without selling your stocks, react to news around the clock, and take positions on broad market moves with a single trade.

In today’s environment of constant volatility, they can be a useful tool to potentially turn the market turbulence into a strategy.

What are US index futures?

Think of a US index futures as an agreement on what price a US index will trade in the future, months ahead.

In simple terms, you’re locking in today’s price for something that will be settled later.

Rather than owning the shares themselves, you’re trading a contract that mirrors the index’s movement.

This makes index futures a flexible way to take a view on the market, whether it’s to hedge your portfolio or to trade short-term moves.

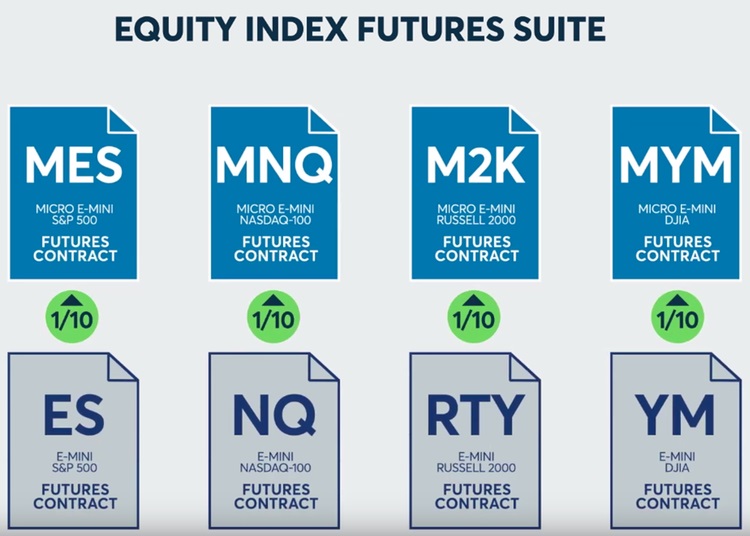

Futures contracts come in different sizes such as E-mini contracts, and Micro E-mini contracts.

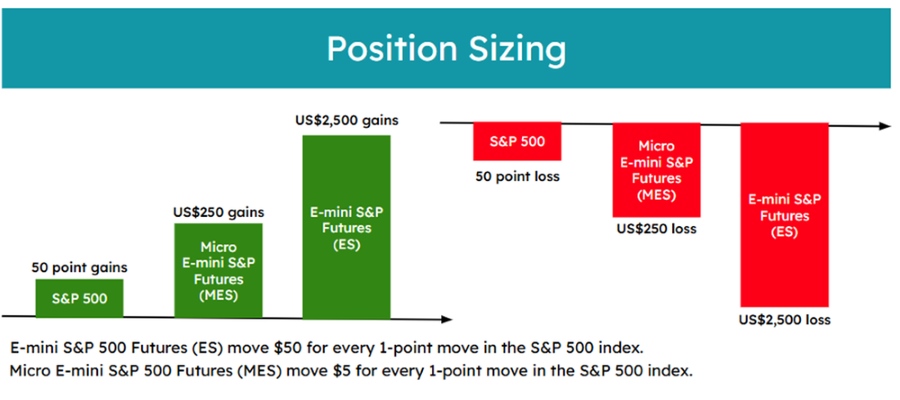

For example, for every 1-point move in the S&P 500 index, the Micro E-mini S&P 500 (MES) gains or loses US$5, while the E-mini S&P 500 (ES) moves US$50.

This makes the MES one-tenth the size of the ES, allowing traders to scale positions according to their capital and risk appetite.

Explore more about different futures contracts here.

There are several commonly traded US index futures contracts for various indexes, which I’ve listed below.

| Name | Code | Contract Size | Notes |

|---|---|---|---|

| E-mini S&P 500 | ES | US$50 × S&P 500 Index | Most actively traded equity index futures contract globally |

| Micro E-mini S&P 500 | MES | US$5 × S&P 500 Index | 1/10th the size of ES — designed for retail traders, offering greater precision and flexibility. |

| E-mini Nasdaq 100 | NQ | US$20 × Nasdaq-100 Index | Tracks top 100 non-financial Nasdaq stocks, heavy in tech |

| Micro E-mini Nasdaq 100 | MNQ | US$2 × Nasdaq-100 Index | 1/10th the size of NQ — popular for active retail traders |

| E-mini Russell 2000 | RTY | US$50 × Russell 2000 Index | Benchmark for US small-cap stocks |

| Micro E-mini Russell 2000 | M2K | US$5 × Russell 2000 Index | 1/10th the size of RTY — offers flexible exposure to small-cap stocks. |

| E-mini DJIA | YM | US$5 x Dow Jones Industrial Index | Tracks 30 large US blue-chip stocks |

| Micro E-mini DJIA | MYM | US$0.5 x Dow Jones Industrial Index | 1/10th the size of YM — accessibility to trade the Dow |

| Source: CME Group | |||

Each equity index provides exposure to different sectors.

The S&P 500 (SPX) covers 500 large US companies across all sectors, including Apple, Microsoft, and JPMorgan.

The Nasdaq 100 (NDX) is tech-heavy, featuring Apple, Microsoft, Amazon, and NVIDIA.

The Dow Jones Industrial Average (DJI) tracks large-cap industrial, financial, and consumer companies such as Boeing, Goldman Sachs, and Coca-Cola.

The Russell 2000 (RTY) represents smaller-cap companies across diverse sectors, offering broader US market exposure.

Grace Chan, Executive Director at Phillip Nova noted that clients use CME's US index futures and options as a versatile tool to sharpen their trading strategies.

"Many rely on them to gain instant exposure to the US equity markets, manage portfolio risk more effectively, or take advantage of market-moving events such as FOMC meetings and major earnings releases," she says.

She also shares, "Some clients use these futures to hedge their existing stock positions, while others deploy them tactically to express short-term market views or diversify beyond local equities."

Explore your trading options with Phillip Nova

Why consider US index futures?

#1 – Around-the-clock access

One of the biggest advantages of S&P 500 Futures is the ability to trade nearly 24 hours a day, five days a week.

This means investors can react to news and global events in real time, instead of waiting for the U.S. market to open.

This gives greater flexibility and control over managing positions.

#2 – Tight spreads, competitive pricing

Spreads matter — every extra point eats into returns.

ES Futures continue to offer tight spreads, typically ranging from 0.25 to 0.5.

With deep liquidity, S&P 500 Futures enable traders to enter and exit positions efficiently.

#3 – Leverage

Futures allow control of a large notional value with relatively little capital upfront.

Suppose the Nasdaq 100 index is trading at 20,000 points.

One E-mini Nasdaq-100 (NQ) contract would give you US$400,000 notional exposure (US$20 x index level).

To trade this futures contract, you may only need to post a margin of ~US$20,000 (around 5%), instead of buying an ETF with the full US$400,000 upfront.

While leverage can amplify gains, it also magnifies losses. So it’s critical to size contracts appropriately and stay disciplined about risk management.

#4 – Flexibility in any market condition

Perhaps the most valuable feature of S&P 500 Futures is their versatility.

They can be used to hedge downside risks, capture short-term opportunities, or diversify exposure to the U.S. equity market.

This adaptability makes them a useful tool in both calm and volatile market environments.

Where to trade US index futures

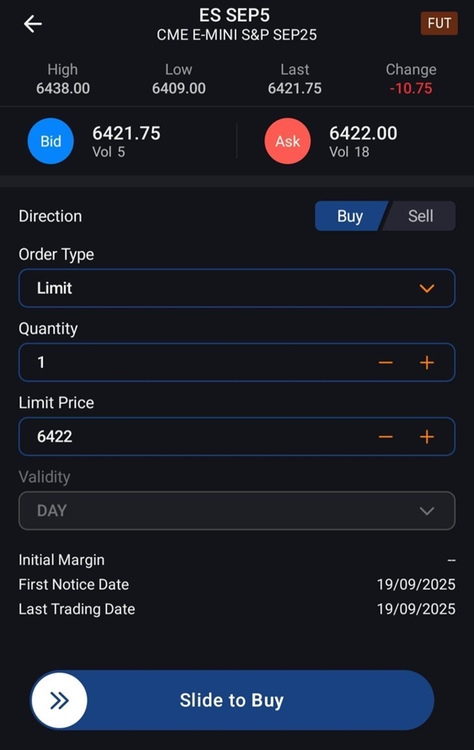

S&P 500 futures and other US index futures like the Nasdaq 100 futures are available on most broker platforms, such as Phillip Nova, which provide access to both E-mini and Micro E-mini contracts on CME Group.

Brokers like Phillip Nova also offer a demo account, which gives me the chance to practice and get comfortable with the platform before transitioning to a live account.

Practical ways to trade US index futures

#1 - Shielding a portfolio

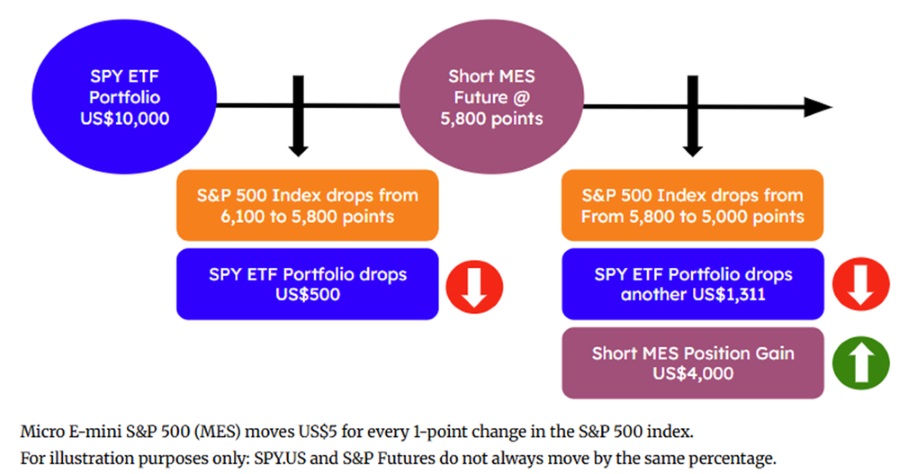

One of the most straightforward ways to use S&P 500 Futures is for protection.

Let’s take the April “Liberation Day” market event as an example.

As you can see from the S&P 500 chart above, the market first dropped from about 6,100 points to about 5,800 points starting from 20 February 2025 until 4 March 2025, followed by another sharp decline of more than 10% from 2 April to 8 April 2025.

If I were holding a US$10,000 portfolio that mirrors the S&P 500 during this period, I would have a paper loss of nearly US$2,000.

Now, suppose after the first 5% dip, I short one Micro E-mini S&P 500 Futures (MES).

If the market keeps sliding, that short position could generate gains that offset the portfolio’s losses and, in some cases, even leave me ahead.

In this scenario, the futures position acts like an insurance policy against this sharp market decline.

#2 - Positioning for swings

A swing position typically spans weeks to months, giving investors the opportunity to ride broader price movements compared to the quick in-and-out of intraday trading.

This year alone, we saw both a sharp decline and a strong rebound in the Russell 2000 index.

For example, a trader taking a swing position on the Russell 2000 (RTY) in 2025 might enter after a pullback in small-cap stocks.

Holding a position to benefit from a sector rebound over several weeks, aiming to profit from the overall trend rather than short-term fluctuations.

The key isn’t hitting the exact top or bottom. It’s about having a clear plan with defined take-profit and stop-loss levels, then sticking to it.

Futures give traders the ability to play both directions of the market without second-guessing.

#3 - Capturing short-term momentum

Finally, some opportunities are best captured within the day.

Intraday futures trading means traders can benefit from short-term momentum without worrying about overnight risk.

For instance, every 1-point move in the Nasdaq 100 index, the Micro E-mini Nasdaq-100(MES) gains or loses US$2.

With discipline and a solid risk-to-reward ratio, those moves can add up quickly.

Day trading requires focus and control, but the benefit is flexibility, where investors can react to market catalysts and close out before the session ends.

How to manage risks when trading US index futures

#1 - Understanding position sizing

Starting with MES lets you test strategies and understand your own risk tolerance without taking on excessive exposure. As confidence grows, you can scale up into larger contracts like the ES.

On average, the S&P 500 index moves about 0.5% to 1% per day, which is roughly 30 to 60 points.

For the MES, every 1-point move in the index equals US$5, which translates to about US$150 to US$300 of daily movement on typical days.

That’s manageable for testing strategies while staying in control of risk.

Now, imagine trading the larger E-mini S&P 500 (ES).

Each point there equals US$50, so the same 30–60 point daily move can mean US$1,500–US$3,000 in swings.

That kind of exposure can quickly overwhelm you if you’re not prepared.

This is why understanding position sizing is critical. Start small, scale up only when ready, and always know how much risk each contract size carries.

Larger contracts carry significantly higher risk, and that risk can heavily influence your trading behavior if not managed properly.

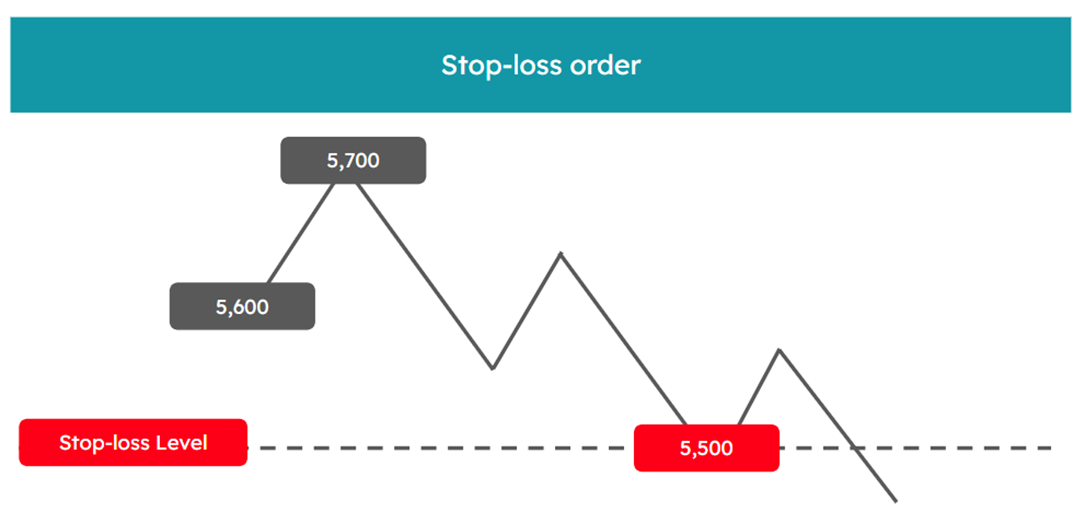

#2 - Setting stop-loss

Setting up a stop-loss is one of the most important risk management practices that every trader needs to do.

Futures can move fast, and without a clear exit plan, it’s easy to let emotions take over.

For example, you might set a stop-loss at 20 points away.

If the market moves against you, the position closes automatically, capping your loss at US$100 on an MES or US$1,000 on an ES.

Stop losses don’t just limit damage, they help preserve capital and keep your head clear.

Stop-losses also act as feedback: if you keep getting stopped out, it tells you that you need to rethink your strategy or refine your entry points.

In this way, risk management becomes part of the learning process.

What would Beansprout do?

US index futures like the S&P 500 futures, Nasdaq 100 futures, and Russell 2000 index futures are versatile instruments that allow investors to hedge portfolios, capture medium-term swings, and trade short-term momentum.

However, they also carry significant risks that should be carefully managed through proper position sizing and disciplined use of stop-loss orders.

You can start with a demo account with a MAS-regulated broker like Phillip Nova, which offers access to CME Group’s regulated futures products and their own educational resources to help you deepen your understanding of futures trading.

Learn more about CME Group here and futures here.

If you are new to futures, our futures guide covers the basics of how futures work, including leverage and margin.

If you want a non-equity example, our gold futures guide explains how gold futures work and the main practical considerations for trading them.

If your priority is portfolio risk management, our hedging with CME futures article explains how to think about exposure, position sizing, and monitoring a hedge over time.

If you are comparing tools for downside protection, our futures and options guide compares ETFs, futures, and options using the S&P 500 as a case study.

Disclaimer

Any information provided in this article is meant purely for informational and investor education purposes and should not be relied upon as financial or investment advice, or advice on corporate finance.

This article is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to purchase any financial product or subscribe or enter any transaction. This article also does not take into account your personal circumstances, e.g. investment objectives, financial situation or particular needs and shall not constitute financial advice. You should consult your own independent financial, accounting, tax, legal or other competent professional advisors.

The information provided in this article are on an “as is” and “as available” basis without warranty of any kind, whether express or implied. Beansprout does not recommend any particular course of action in relation to any investment product or class of investment products. No information is presented with the intention to induce any person to buy, sell, or hold a particular investment product or class of investment products.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments