Webull Moneybull Review: My likes and dislikes of this cash solution

Cash Management

By Beansprout • 13 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Read our Webull Moneybull review to learn what we like and dislike about this cash management account, including its features, yields, fees.

What happened?

Interest rates have fallen in 2025.

While the rates aren't as high as they used to be, it still makes sense to make our spare cash work harder.

Leaving cash idle earns zero interest.

But what if you can turn it into another source of passive income?

Webull’s Moneybull is one such option. It helps you optimise your idle cash by making automated investments into cash funds.

In this review, I’ll be taking a look at the Webull Moneybull to see whether it is a cash management account you should consider in the current market environment.

What is Webull Moneybull?

In case you are not familiar with Webull, it is a low-cost broker that has gained significant popularity in Singapore for its user-friendly app and competitive fees. Read our review here.

Moneybull is a wealth management tool by Webull that aims to grow your idle cash with minimal effort.

The yield is generated by automatically investing your idle cash into underlying cash funds.

These cash funds are effectively mutual funds that invest in short-term debt securities and bank deposits that are seen to be low-risk.

What does Webull Moneybull invest in?

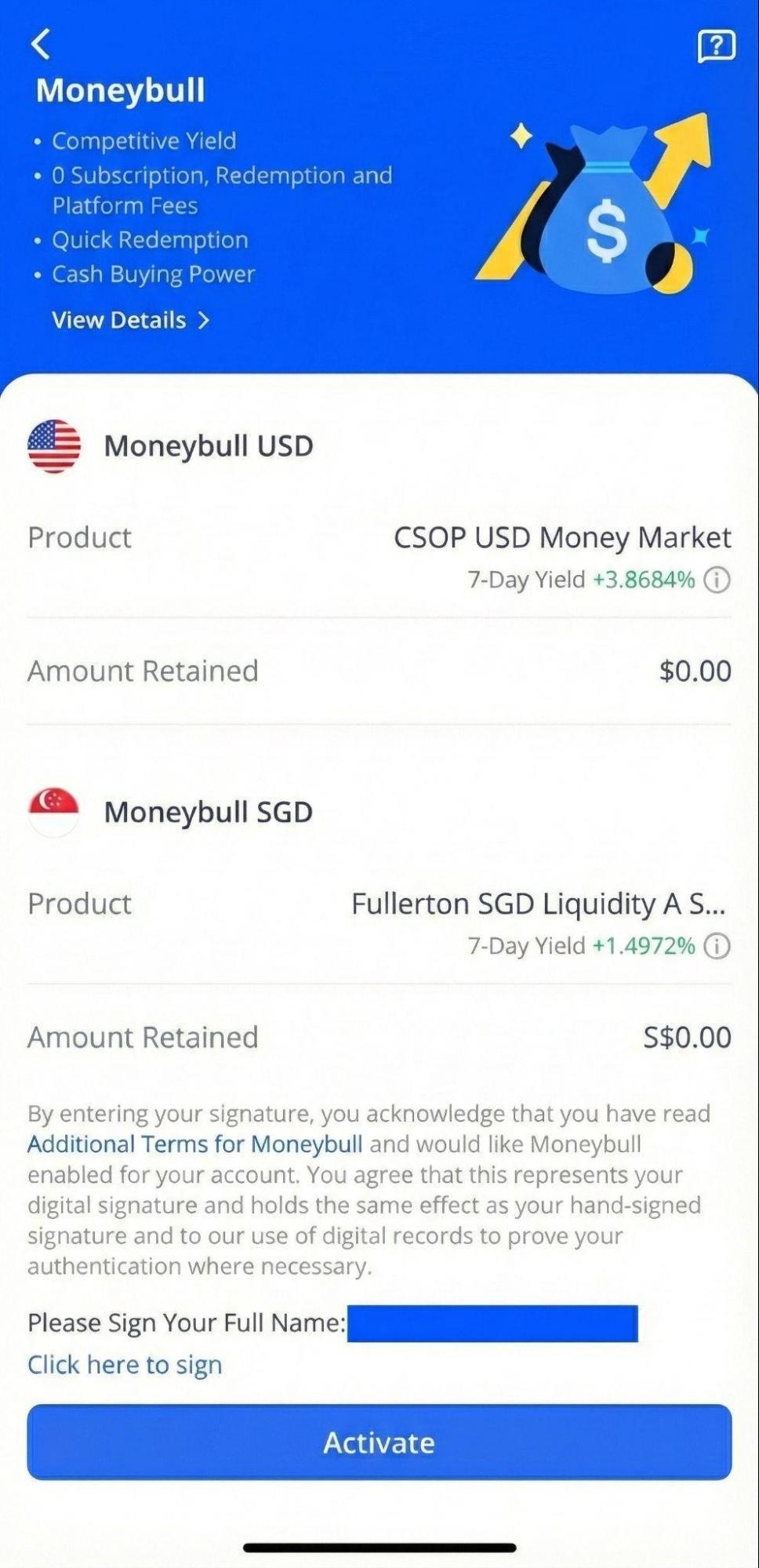

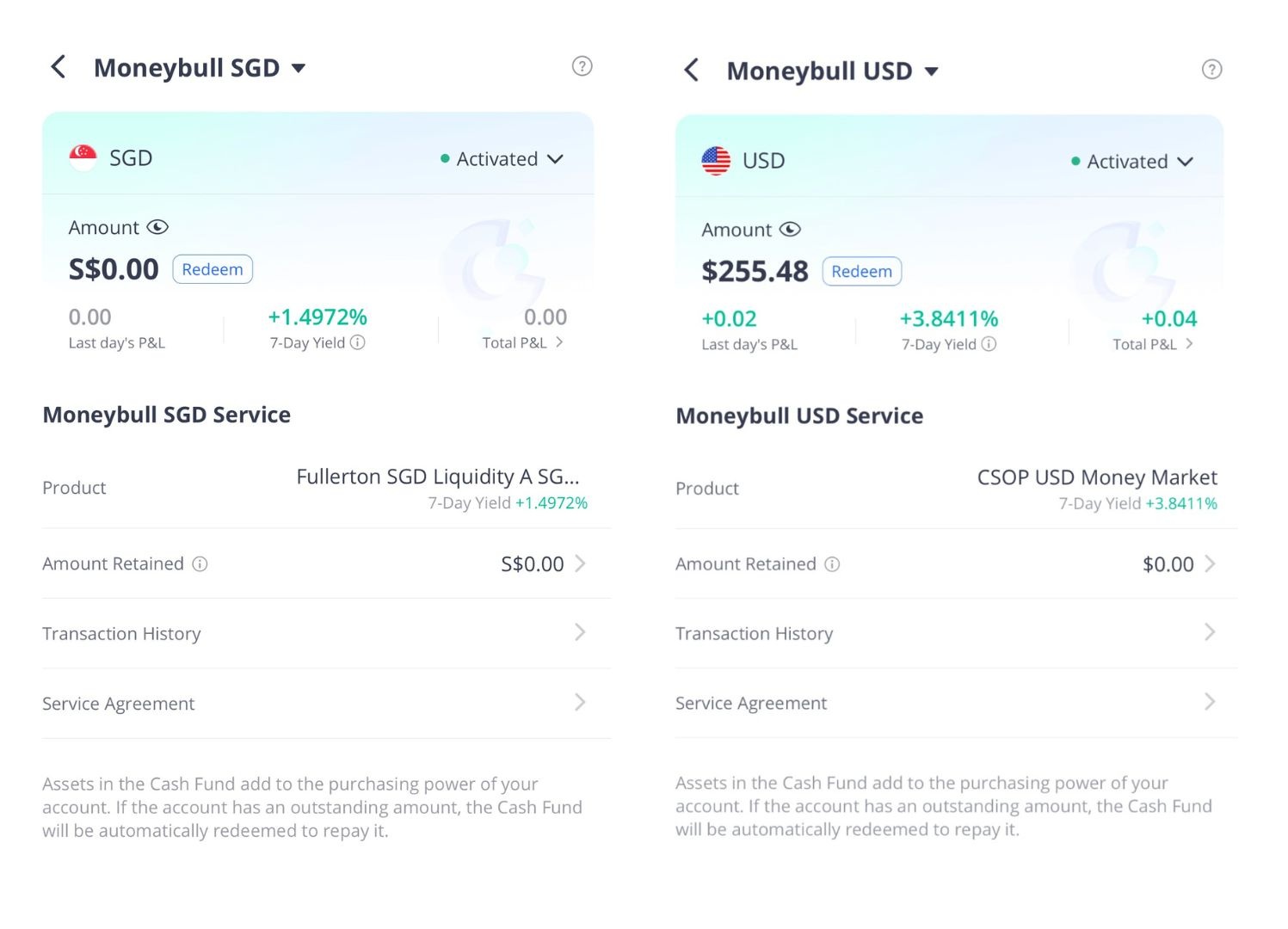

When I checked what these funds are, I found out that they are Fullerton SGD Liquidity Fund A and CSOP USD Money Market Fund.

The investment objective of the Fullerton SGD Liquidity Fund A is to provide investors with same day liquidity by investing in money market instruments, cash deposits and other permissible investments.

The Fullerton SGD Liquidity Fund A generated a 7-day annualised yield of approximately 1.4134% as of 9 December 2025.

The investment objective of the CSOP USD Money Market Fund is to provide liquidity and returns comparable to US Dollar deposit rates.

It does so by investing in high quality short-term money market instruments and debt securities. These may include government and corporate bonds, commercial bills and deposits with eligible financial institutions.

The CSOP USD Fund Money Market Fund generated a 7-day annualised yield of approximately 3.8780% as of 9 December 2025.

What I like about Webull Moneybull?

#1 – Invests in money market funds with same-day liquidity

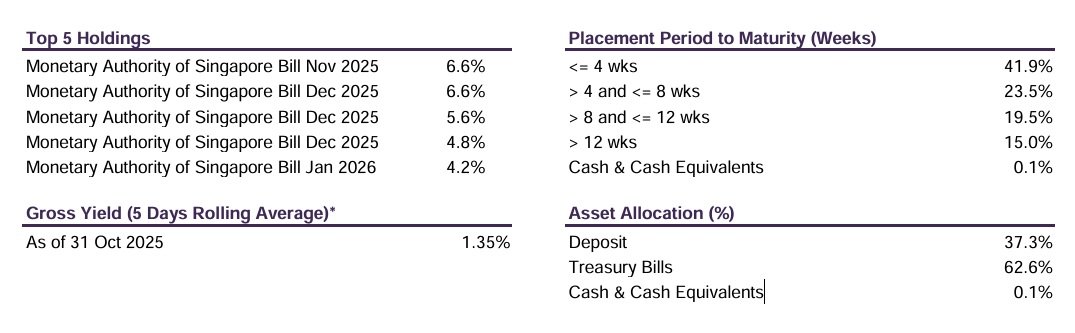

The underlying fund of Moneybull SGD is the Fullerton SGD Liquidity Fund A, with assets under management (AUM) of S$356.52 million as of 31 October 2025.

Based on the fund's latest factsheet, I found that it holds the majority of its assets in MAS Treasury Bills.

The remaining assets are invested in deposits, with a small amount held as cash and cash equivalents (as of 31 October 2025).

This allocation gives me confidence because MAS T-bills are backed by the Singapore government, and the fund's structure allows for same-day liquidity, which is crucial when I need to deploy cash quickly for a trade.

#2 – Earn competitive yield on idle USD

For those of us who are looking to invest in the US markets, maintaining a balance of USD is essential for seizing opportunities quickly.

The Moneybull USD facility allows us to put this capital to work efficiently.

The underlying fund of Moneybull USD is the CSOP USD Money Market Fund, with assets under management (AUM) of US$1,610.04 million as of 30 November 2025.

Based on the fund's latest monthly newsletter, I found that it holds the majority of its assets in commercial paper, followed by deposits and overnight cash.

The remaining assets of 5.9% are held as High Quality USD Bond / Note (as of 30 November 2025).

#3 – Relatively low cost

I appreciate that Webull does not charge any subscription or redemption fees for Moneybull. The fee incurred lies mainly in the expense ratio of the funds. The fee incurred lies mainly in the expense ratio of the funds.

For example, the Fullerton SGD Liquidity Fund A has an expense ratio of 0.29% for the financial year ended 31 Mar 2025. The CSOP USD Money Market Fund has a management fee of 0.30% p.a. as of 30 November 2025.

The good news is that this fee is already deducted from the yield displayed in the app, so I don't have to worry about paying it separately.

#4 – Low barrier to entry

I like that I don't need a huge capital to get started. You can invest your idle cash with as little as USD1 or SGD1.

#5 – Greater flexibility

I can continue trading with my Webull account even when my funds are parked in the cash fund.

Buying Power: I will receive 99% of the market value of my Moneybull position as Buying Power for my trades.

Auto-Sweep: When I do not have sufficient cash to settle a trade in the same currency, the funds from my Moneybull position are auto-redeemed.

This allows me to catch market opportunities while leaving my idle cash with Webull Moneybull.

What are the risks of Webull Moneybull?

#1 – Not capital guaranteed

While the Fullerton SGD Liquidity Fund A is invested largely in Singapore T-bills, it is still not completely risk free.

Moneybull is an investment product, not a bank deposit. This means it is not capital guaranteed, and there is still a possibility that I might lose my money.

#2 – No SDIC insurance

It is also worth noting that deposits into Webull Moneybull are not insured under the Singapore Deposit Insurance Corporation Limited (SDIC).

How to activate Webull Moneybull?

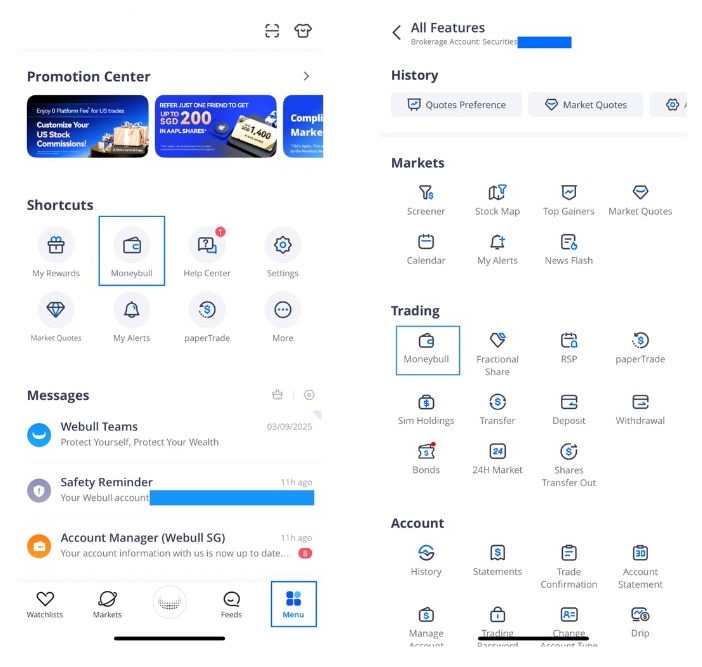

Here is the process I went through to set up Moneybull SGD and USD:

1. If you haven’t got a Webull brokerage account, sign up for one now via this link.

2. Then, I tapped on the "Moneybull" button under the “Menu” tab in the Webull App.

Tip: If you don’t find the “Moneybull” icon under “Shortcuts”, you can find it by tapping on “More” and the “Moneybull” icon would be under the “Trading” section.

3. Then, I simply tap “activate” to activate the Moneybull SGD and USD feature within the Webull App.

4. With that, I have successfully activated Webull Moneybull SGD and USD.

Moneybull is now available to both Cash and Margin account users.

Whether you have a Cash or Margin account, you can now activate both Webull Moneybull USD and SGD.

What would Beansprout do?

As an investor, I find Webull Moneybull a useful tool to earn a potentially higher yield on my idle cash in a relatively safe way.

It prevents my spare cash from sitting idle and earning zero interest, while keeping my funds ready to deploy at any time.

However, I am mindful that as with all investments, it is not capital guaranteed, and not insured by SDIC.

If you are looking to take advantage of the feature, sign up with Webull and receive attractive welcome rewards from Webull.

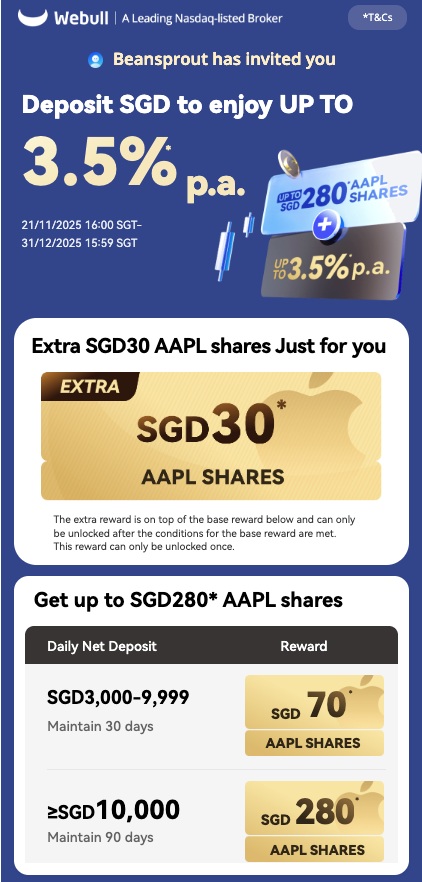

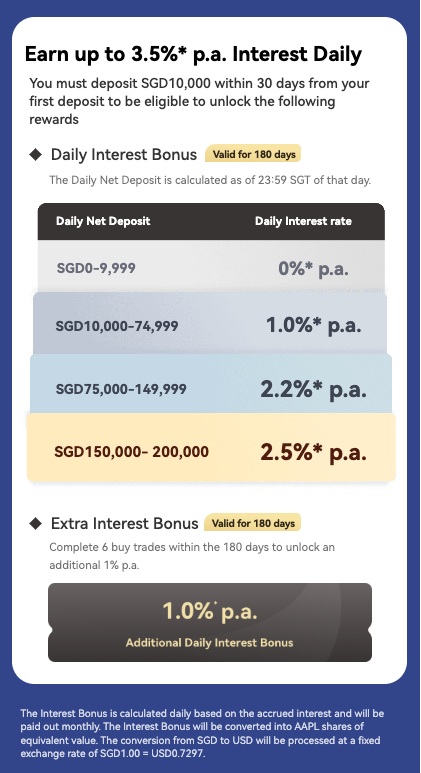

Summary of Webull Promotion

Snatch these exclusive rewards when you sign up via Beansprout

Learn more about the Webull promotion here.

*All views expressed in the article are the objective opinions of Beansprout. Neither Webull or its affiliates shall be liable for the content of the information provided. This advertisement has not been reviewed by the Monetary Authority of Singapore.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Get S$50 Fairprice voucher^ within 5 working days plus earn up to S$280* AAPL shares from Webull.

Sign up nowRead also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

0 questions