3 Singapore blue chip stocks paying special dividends. Are their yields attractive?

Stocks

By Gerald Wong, CFA • 21 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are three Singapore blue chip stocks that recently announced special dividends in November 2025. We find out if their dividend yields are attractive.

What happened?

Many investors have been hunting for yield recently.

With fixed deposit rates in Singapore and T-bill yields falling, this led many in the Beansprout community to look for places to park their cash for higher yield and other ways to earn passive income via dividend income investing.

Some have also started looking at Singapore blue chip stocks as a way to earn a higher potential yield.

Last week, I shared 4 Singapore blue chip stocks near all-time highs and looked at whether their dividends are still attractive.

In this article, I will look at three well-known Singapore blue-chip companies that announced special dividends alongside their latest financial results and find out if they are worth adding to our income portfolios.

3 Singapore blue-chip stocks that announced special dividends

#1 – Singapore Airlines (SGX: C6L)

Singapore Airlines (SIA) is Singapore’s national carrier, operating full-service passenger and cargo services globally through the SIA and Scoot brands.

SIA continues to ride on the recovery in global travel demand.

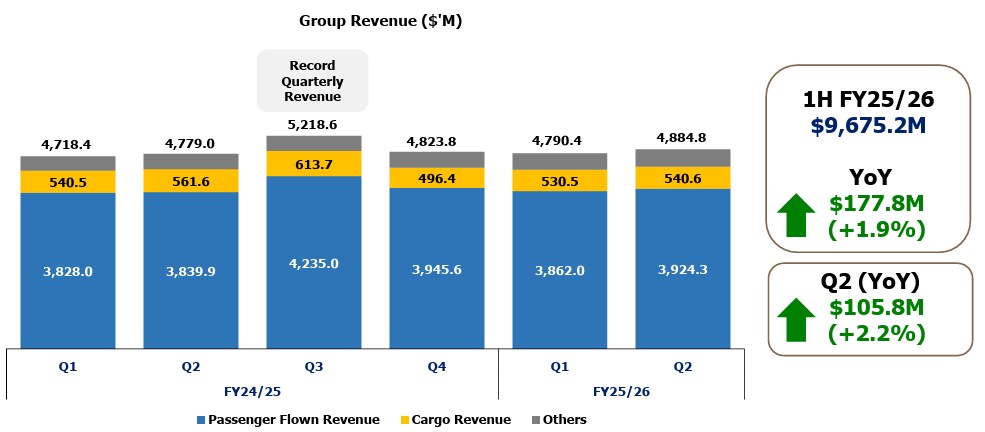

The national carrier achieved record group revenue and a positive operating profit in 1H FY2025/26, supported by healthy passenger growth across both SIA and Scoot.

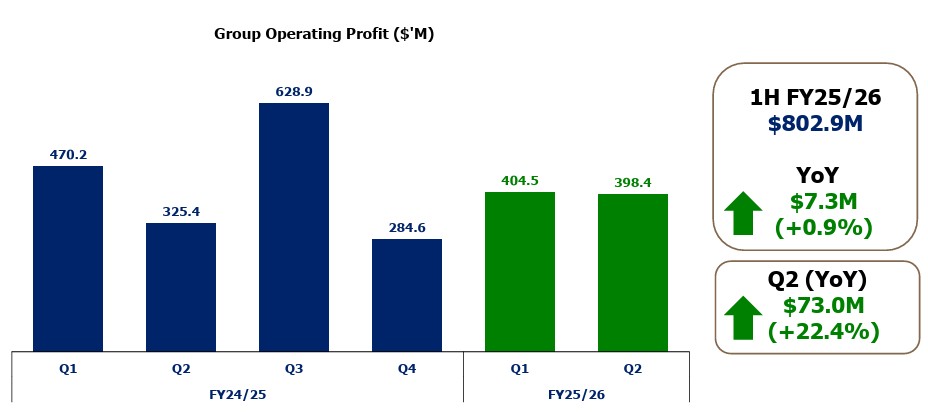

Operating profit in 1H FY25/26 came in 0.9% higher than last year, driven by higher pax flown revenue and lower net fuel cost.

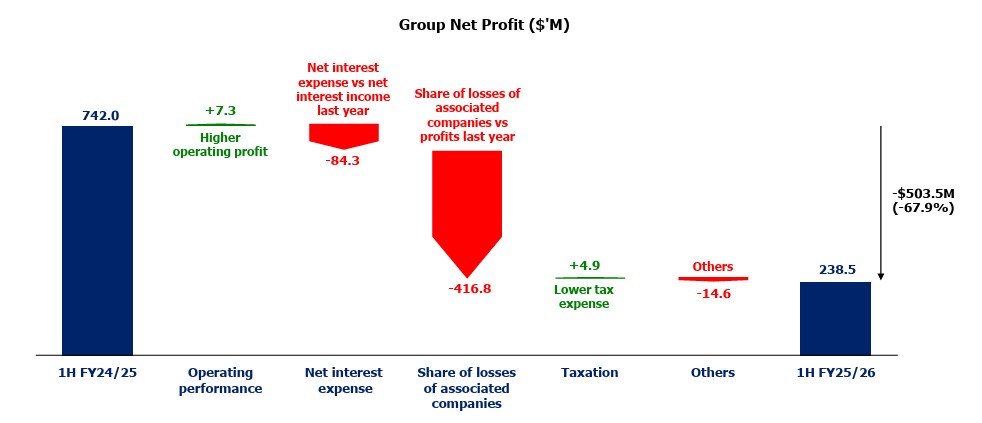

Source: SIA 1H FY25/26 Presentation Slides

However, net profit in the first half declined by 67.9% year-over-year, largely due to associate losses from Air India, and a swing from interest income to interest expense.

Still, overall capacity in 1H FY25/26 rose by 2.9% with passenger capacity up 3.0% and cargo capacity up 2.8%.

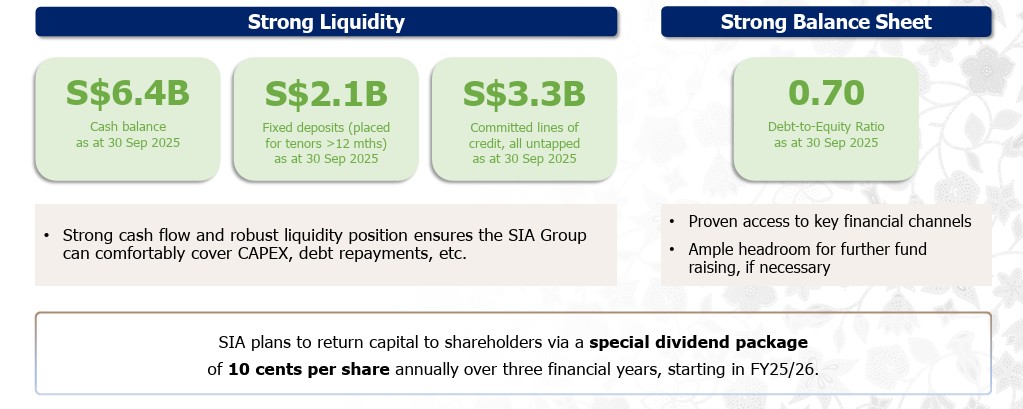

SIA’s financial position also strengthened, with its debt-to-equity ratio improving to 0.7x.

For 1H FY2025/26, SIA declared an interim dividend of S$0.05, down from S$0.10 in the previous year, reflecting the decline in reported net profit.

SIA also introduced a three-year special dividend framework, distributing S$0.10 per share annually over three financial years, starting this fiscal year.. The dividends expected to paid out through this special dividend package will total about S$900 million.

As the first payout of this special dividend framework, SIA announced a special dividend of S$0.03, with an ex-dividend date on 5 December 2025.

The second tranche of S$0.07 is subject to shareholder approval at the upcoming 2026 AGM.

Despite the special dividend, SIA's total dividends in FY2026 is expected to be lower than in FY2025, according to consensus forecasts.

According to analyst forecasts, SIA may deliver a total dividend of S$0.219 per share in FY2026, implying a potential yield of around 3.4% based on its share price of S$6.52 (as of 18 Nov 2025).

Related links:

#2 – ST Engineering (SGX: S63)

ST Engineering is an integrated engineering group operating globally across aerospace, defence, and smart city solutions.

ST Engineering reported a 9% year-on-year revenue growth in the first nine months of 2025 (9M2025) on strong demand across its defence and commercial aerospace businesses.

The group secured S$14.0 billion of new contracts for 9M2025, including S$4.9b for 3Q2025, bringing its order book to a record S$32.6b as of end September 2025.

The robust backlog provides strong earnings visibility heading into 2026.

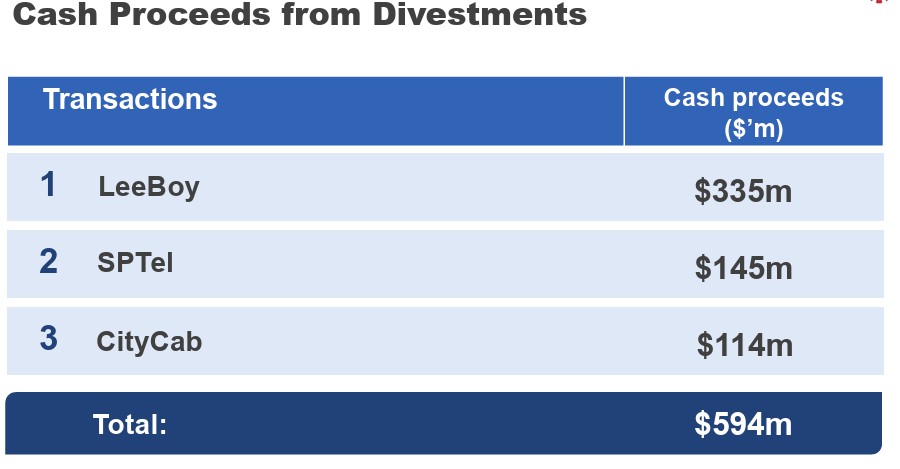

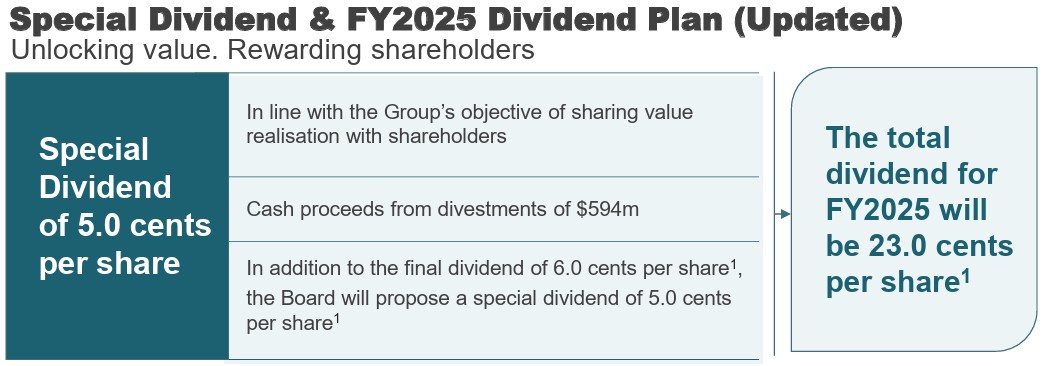

ST Engineering also unlocked shareholder value through asset divestments, including LeeBoy, CityCab and SPTel, generating total cash proceeds of S$594m and S$258m in post-tax gains.

Investors were rewarded with an interim dividend of S$0.04 per share for 3Q2025, bringing their total 9M25 dividends to S$0.12 per share.

Management has proposed a final dividend of 6.0 cents per share and a special dividend of S$0.05, which would bring total FY2025 dividends to S$0.23 per share.

This translates to a potential yield of 2.6% based on its S$8.60 share price (as of 18 Nov 2025).

From 2026, the company has committed to distributing one-third of any increase in net profit as additional quarterly dividends.

Related Links:

- ST Engineering Ltd share price history and share price target

- ST Engineering Ltd dividend forecast and dividend yield

#3 - Singtel (SGX: Z74)

Singtel is Singapore’s largest telecommunications company, providing mobile, broadband, digital infrastructure, and regional connectivity services.

It also owns major stakes in operators across India, Australia, Thailand, and Indonesia.

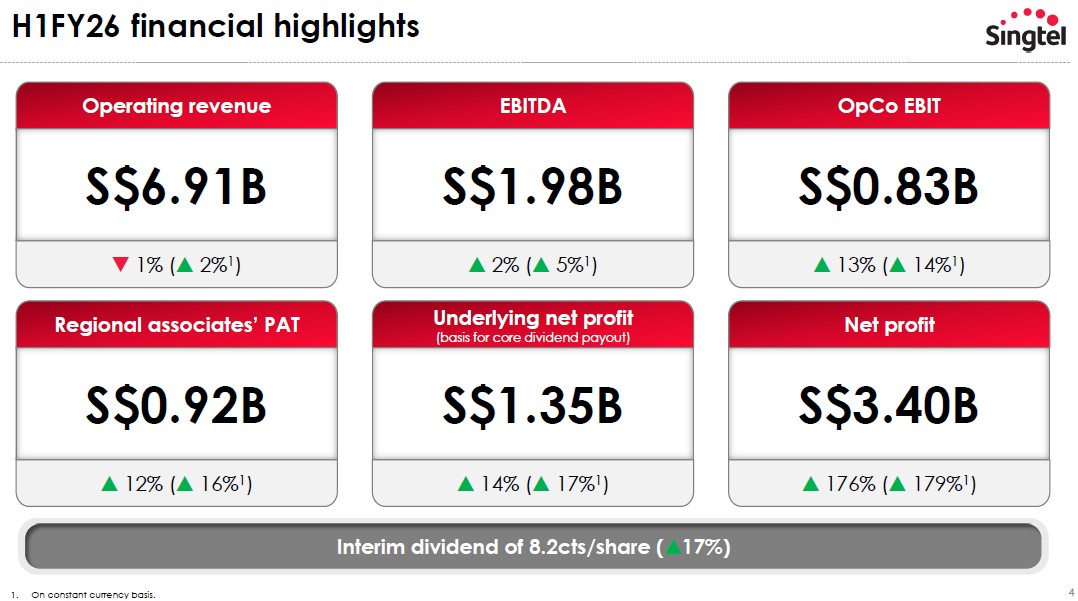

In the first half of FY2026, Singtel reported net profit of S$3.4 billion, mainly boosted by gains from selling part of its stake in Bharti Airtel and the merger of Intouch and Gulf Energy.

Its core businesses also performed steadily.

In Singapore, Singtel maintained strong market leadership, while Optus in Australia delivered higher earnings.

NCS recorded 41% earnings before interest and taxes (EBIT) growth on stronger margins and bookings of S$1.8 billion, and Nxera achieved higher EBIT from demand for data centre and AI-related cloud services.

Regional associates also performed well, with post-tax profit up 12% to S$915 million in the 1H FY 2026.

As of 30 September 2025, the company held S$3.4 billion in cash and fixed deposits and had reduced its debt to S$8.7 billion, from S$9.7 billion a year ago. The reduction came mainly from proceeds raised through its Airtel stake sale.

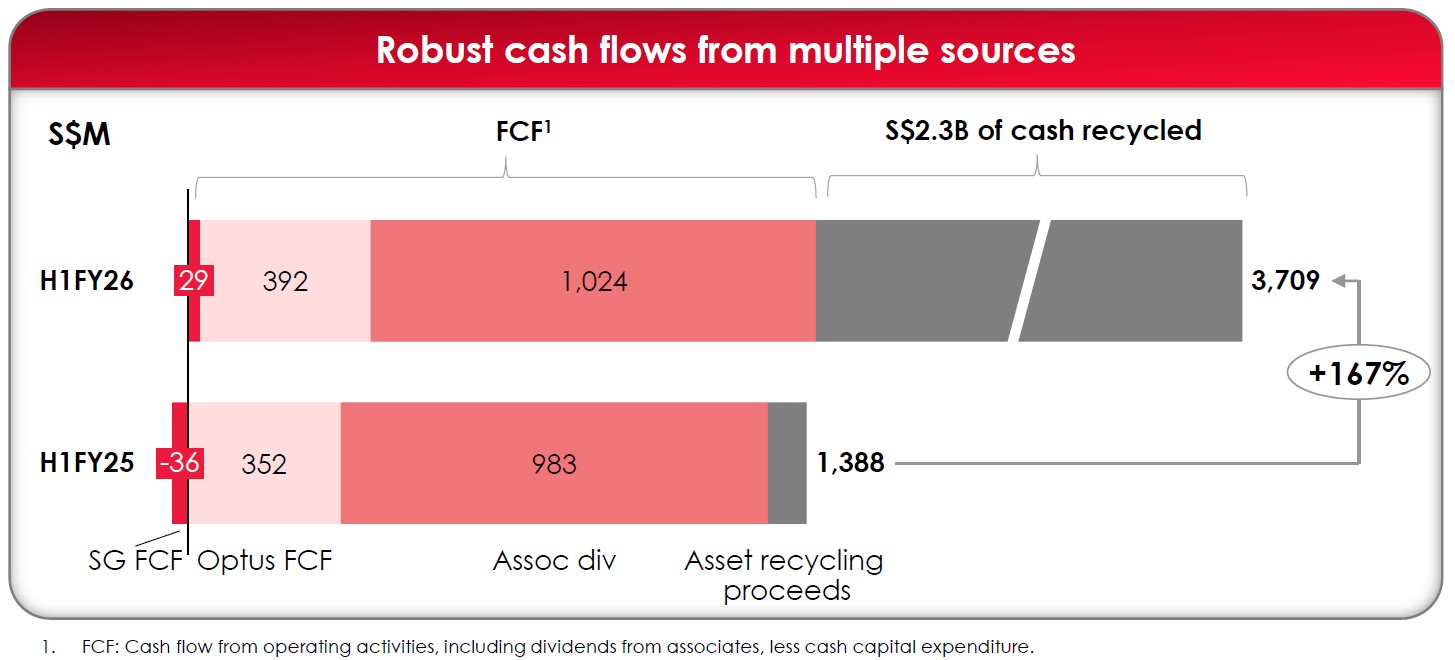

Cash flow also remained strong in the first half of FY2026. Operating cash flow increased from better earnings and asset recycling proceeds.

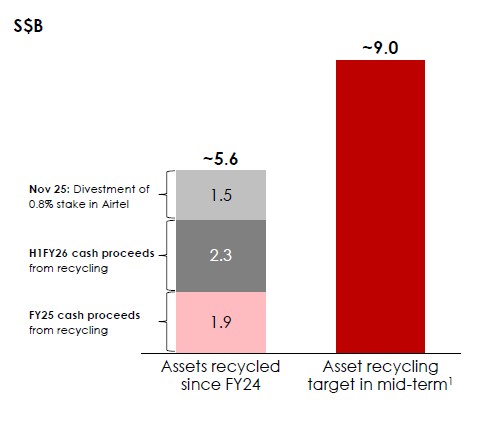

The group’s asset recycling strategy has also gained momentum. Singtel has already achieved S$5.6 billion of its S$9 billion medium term capital recycling target.

In November, it sold another 0.8% of its Airtel stake for S$1.5 billion, bringing total Airtel-related divestments in recent years to about S$3.5 billion. After this sale, Singtel’s effective interest in Airtel fell to 27.5%.

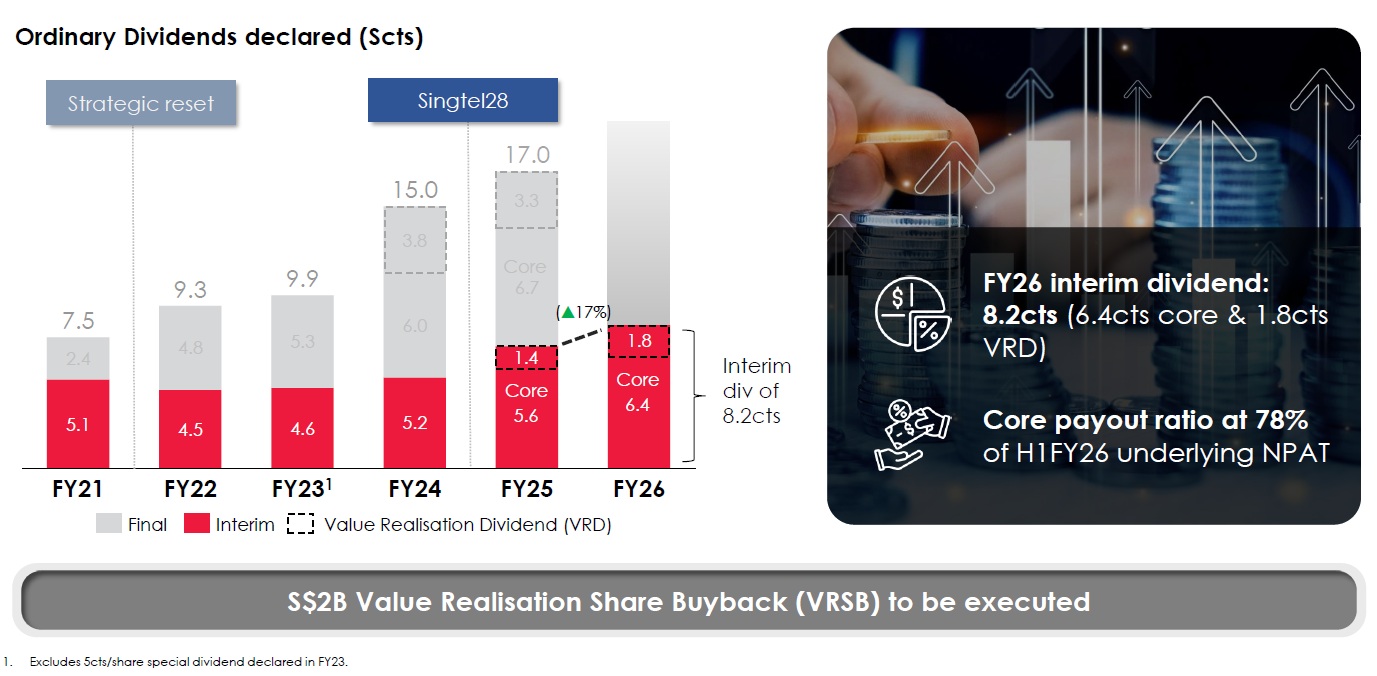

For the half year, Singtel declared an 8.2-cent interim dividend, up 17% from last year.

This includes a 6.4-cent core dividend and 1.8-cent value-realisation payout (a form of special dividend) which was funded by divestment proceeds.

Based on the consensus estimate of S$0.186 dividend for FY26, Singtel offers an implied dividend yield of 3.8% based on its closing price of S$4.87 as of 18 November 2025, still below its long-term average of 5.1%.

Related Links:

What would Beansprout do?

With falling interest rates, it may be worthwhile looking for Singapore blue chip stocks for higher dividend income.

Amongst these blue chip stocks, SIA, ST Engineering and Singtel have announced special dividends on top of their regular payouts.

SIA has introduced a three-year special dividend framework to return additional capital alongside its regular payout.

ST Engineering has proposed a one-off special dividend from recent divestments and plans to pay out a third of any incremental net profit from 2026 onwards.

Singtel has been recycling its assets, especially its Airtel stake, to unlock value and boost dividends through a combination of core dividend and value realisation dividend (a form of special dividend).

While SIA has announced a special dividend, its total dividends in FY2026 is still expected to be lower than in the previous fiscal year due to the decline in its net profit.

ST Engineering's dividend yield is expected to be at 2.6% in FY2025 despite the special dividend announced, as its share price has gone up sharply in the past twelve months.

Among the three names, Singtel currently offers the highest potential dividend yield 3.8% and provides a balanced mix of growth and income supported by its improving core operations and solid dividend profile.

While special dividends may increase short-term shareholder returns, it is also important to follow the business developments to assess the sustainability of their payouts in the coming years.

If you’d like to identify other Singapore stocks with attractive dividend yields above 3% and potential upside to analyst target, you can explore our Singapore dividend stocks screener.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments