4 Singapore blue chip stocks near all-time highs. Are dividends still attractive?

Stocks

By Gerald Wong, CFA • 13 Nov 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are four Singapore blue-chip stocks trading near all-time highs. We find out if their dividend yields remain attractive with the rally in their share prices.

What happened?

Singapore’s stock market has been hitting new highs.

Back in October, we looked at four Singapore blue-chip stocks that were trading near their record highs.

Since then, DBS, Keppel and Singtel have climbed even higher on positive earnings and corporate news.

This has led to questions about whether it might still be worthwhile investing in these blue chip stocks for passive income, or to explore Singapore REITs that offer dividend yields of above 5%.

In this article, I look at four blue chip stocks that are at all time highs, and find out if their dividend yields remain attractive after the rally.

4 Singapore blue chip stocks close to all time highs. Are their dividend yields attractive?

#1 - DBS Group Holdings (SGX: D05)

DBS is Singapore’s largest bank and recently became the first company in the country to surpass S$150 billion in market capitalisation.

As of 11 November 2025, its share price has climbed about 25% year-to-date, reaching a new high of S$55.35 after release of its third-quarter 2025 results.

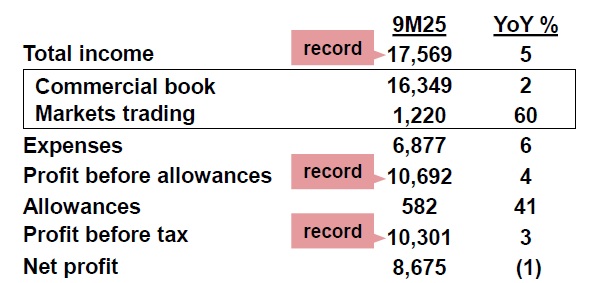

DBS reported a resilient 3Q 2025 despite a softer interest rate environment.

Net profit came in at S$2.95 billion, up 5% from the previous quarter and 2% lower than a year ago.

Profit before tax rose 1% year-on-year to S$3.48 billion, while total income increased 3% to S$5.93 billion, both record highs.

The growth came from strong fee income, higher treasury sales, and a 33% rise in markets trading income.

Fee income jumped 20% year-on-year, supported by a 31% rise in wealth management fees to a record S$796 million.

On the balance sheet, deposits rose 9% in the first nine months of 2025, led by healthy CASA inflows.

Asset quality remained solid with a non-performing loan ratio of 1%.

DBS’s CEO noted that the bank’s hedging strategy and strong fee income helped maintain profits despite lower interest rates.

For 2026, DBS guided that total income to stay near current levels, supported by growth in wealth-management fees even as interest rates decline.

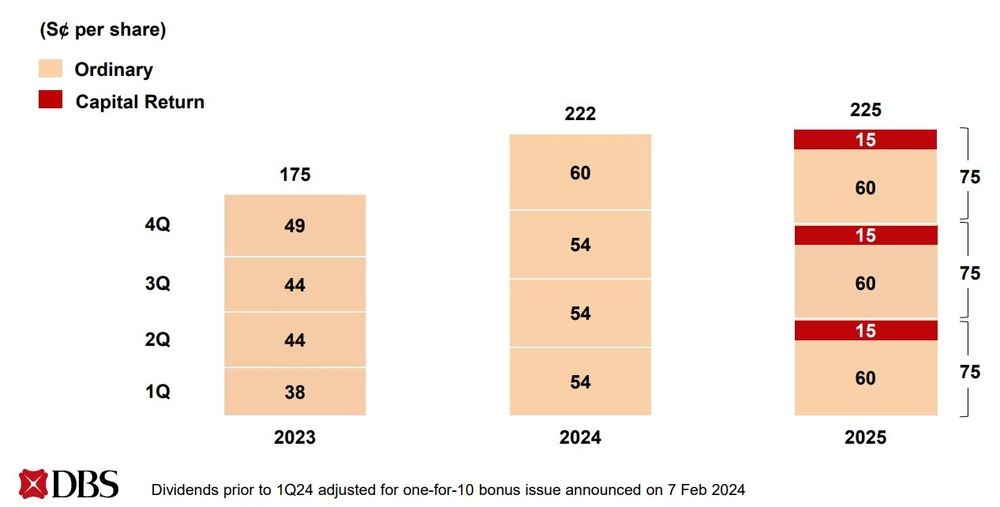

DBS declared an ordinary dividend of S$0.60 per share and a special dividend of S$0.15 for 3Q 2025, bringing total dividends for the first nine months to S$2.25 per share, up 39% from a year ago.

At the current share price of S$55.10, the potential annualised dividend of S$3.00 implies a 5.4% dividend yield.

This remains above DBS’s historical average dividend yield of 5.2%.

Related Links:

- DBS Group Holdings Ltd price history and share price target

- DBS Group Holdings Ltd dividend forecast and dividend yield

#2 - OCBC Ltd (SGX: O39)

OCBC is one of Singapore’s largest banks, offering a full range of consumer, corporate and wealth management services across the region.

Its share price has climbed about 12% year-to-date in 2025, recently trading near its all-time high of S$18.55 after reporting a strong set of third-quarter results.

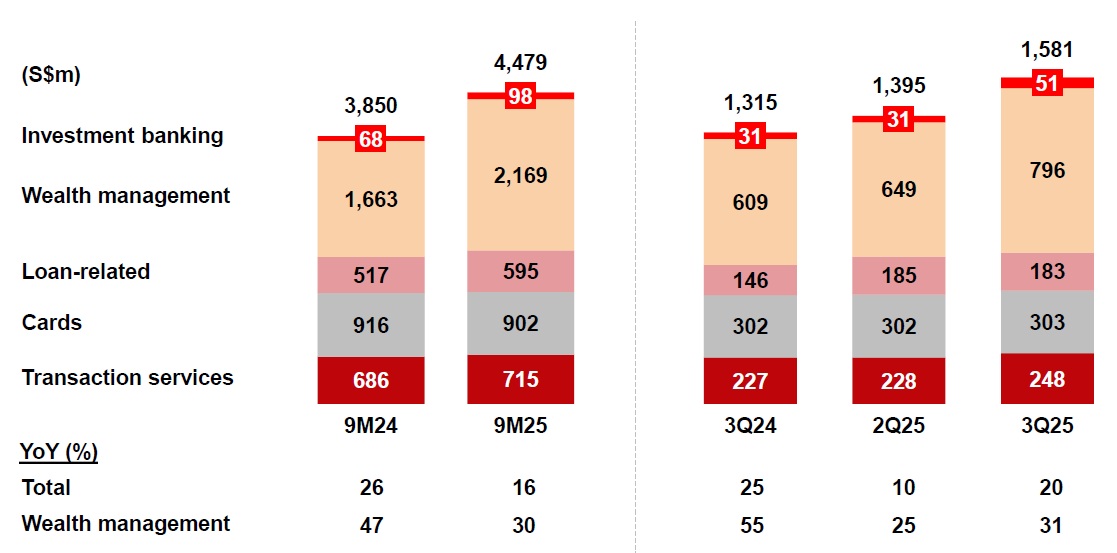

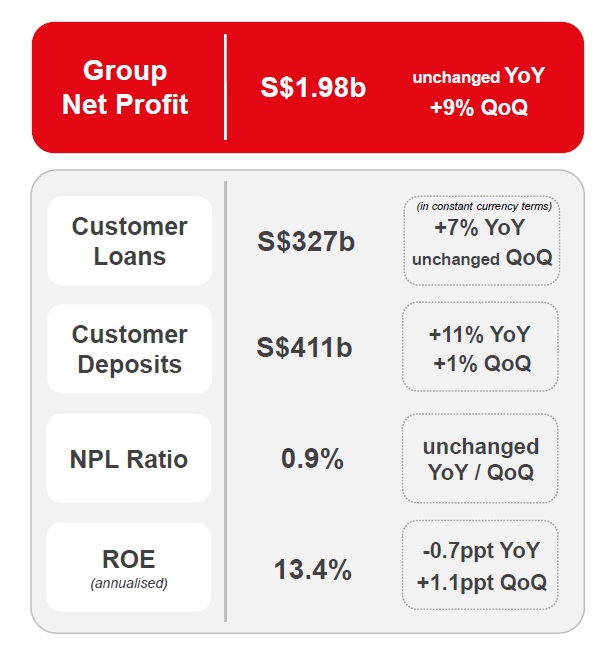

Net profit rose 9% from the previous quarter to S$1.98 billion as fee, trading, and insurance income reached record highs.

Total income grew 7% quarter-over-quarter to S$3.8 billion, supported by strong contributions from wealth management and treasury activities, which helped offset lower interest income caused by softer market rates.

Non-interest income rose 24% from the last quarter to S$1.57 billion, led by higher wealth management fees, stronger trading performance, and improved insurance investment returns.

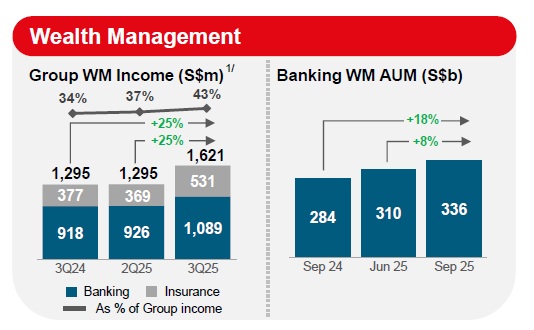

Wealth management income hit a record S$1.62 billion and now makes up 43% of OCBC’s total income, while total assets under management (AUM) reached S$336 billion.

Its insurance arm, Great Eastern Holdings, also delivered higher profits as investment performance improved.

Operating expenses increased by 9% from the last quarter as OCBC continued to invest in technology and people, though the cost-to-income ratio stayed healthy at 40%.

Asset quality remained stable with a low non-performing loan ratio of 0.9% for the past six quarters.

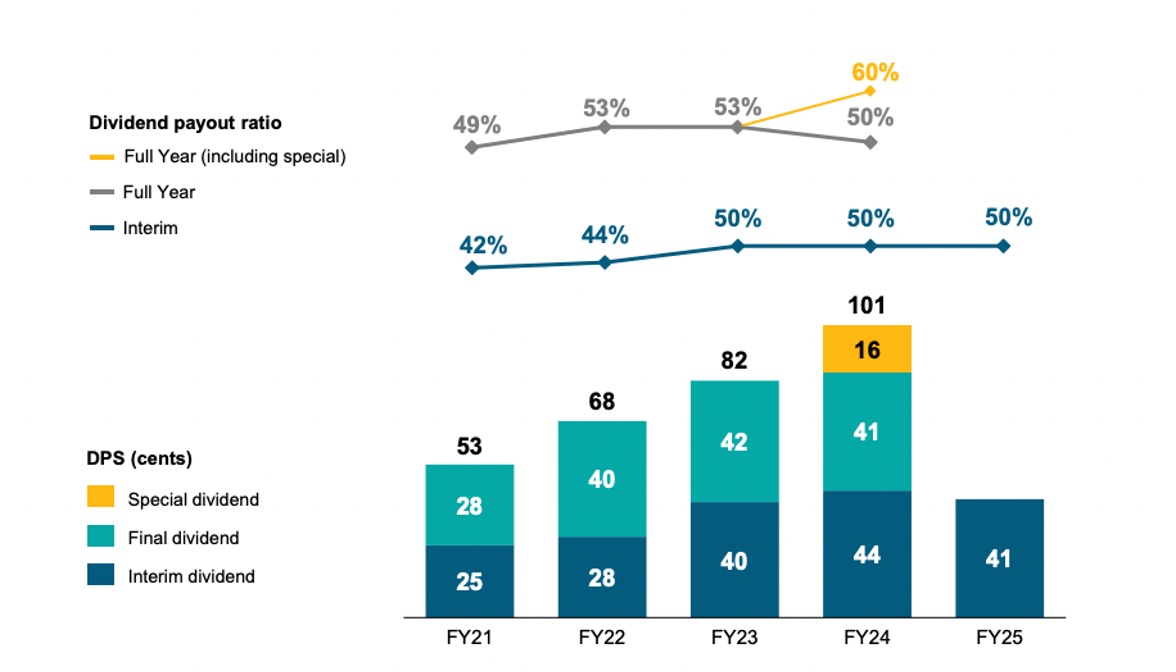

Looking ahead, OCBC expects to maintain a 60% dividend payout ratio in 2025 and continue share buybacks.

Based on OCBC's interim dividend of S$0.41, OCBC’s annualised dividend yield stands at about 4.4% at the current share price of S$18.55.

This is roughly close to its historical average dividend yield of about 4.6%.

If we were to assume a total dividend of S$1.01 like in FY24 based on a payout ratio of 60%, OCBC offers a dividend yield of 5.4%.

Related links:

- Oversea-Chinese Banking Corporation Ltd price history and share price target

- Oversea-Chinese Banking Corporation Ltd dividend forecast and dividend yield

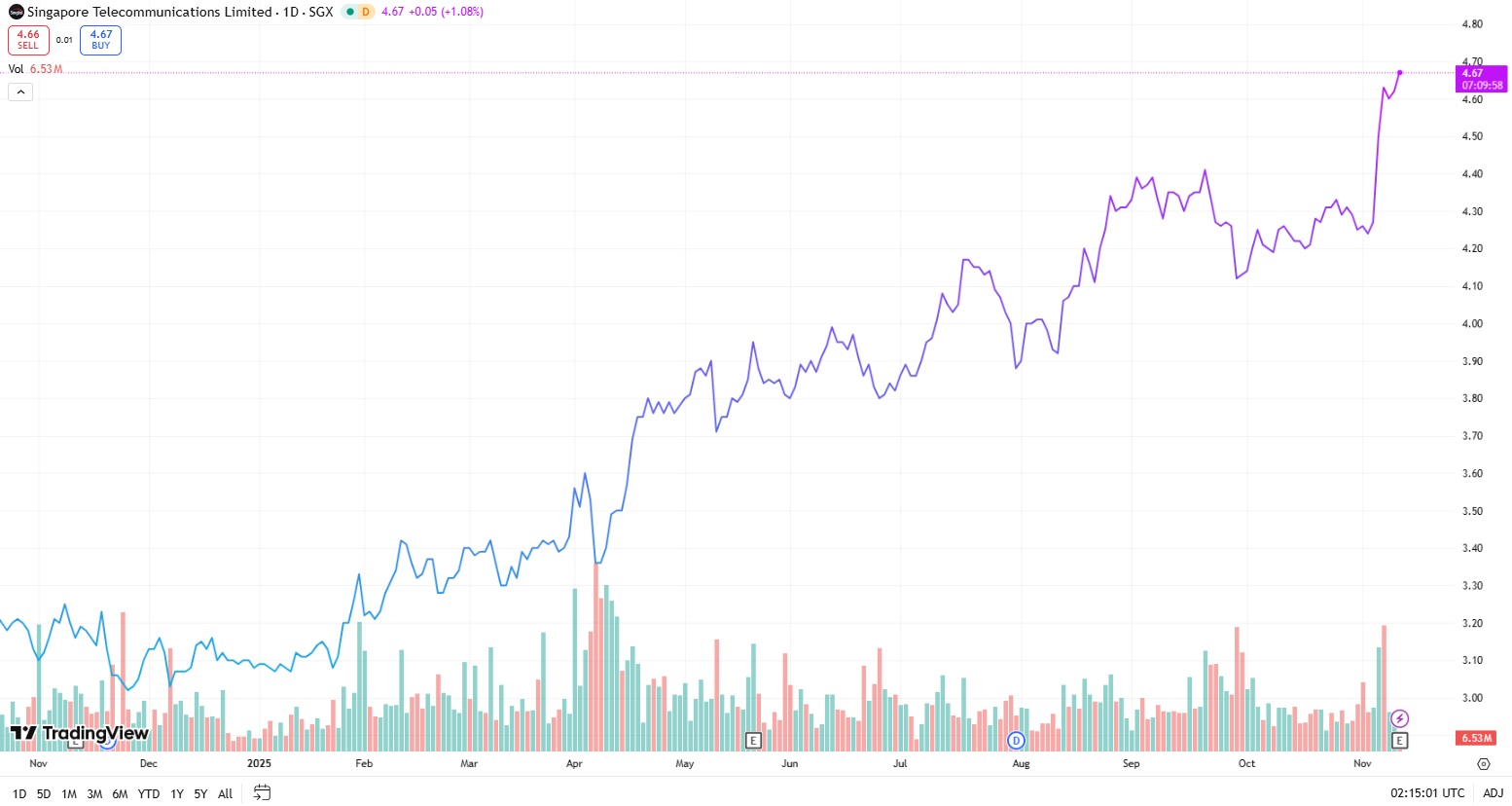

#3 - Singtel (SGX: Z74)

Singtel is Singapore’s largest telecom operator, with expansive regional reach across digital infrastructure and connectivity.

Singtel’s share price recently hit an all-time high of S$4.73 and is up 50.8% year-to-date.

Singtel’s net profit jumped to S$3.4 billion in the first half of FY2026.

This was mainly due to the sale of part of its stake in Airtel and the merger of Intouch and Gulf Energy.

Underlying profit rose 14% to S$1.35 billion, lifted by stronger results from Airtel, AIS, NCS, and Optus. Excluding currency impact, profit growth would have been 22%.

Group EBIT increased 13%, showing broad recovery across key businesses.

In Singapore, Singtel’s revenue was stable. Growth in SME and enterprise demand helped offset weaker consumer spending.

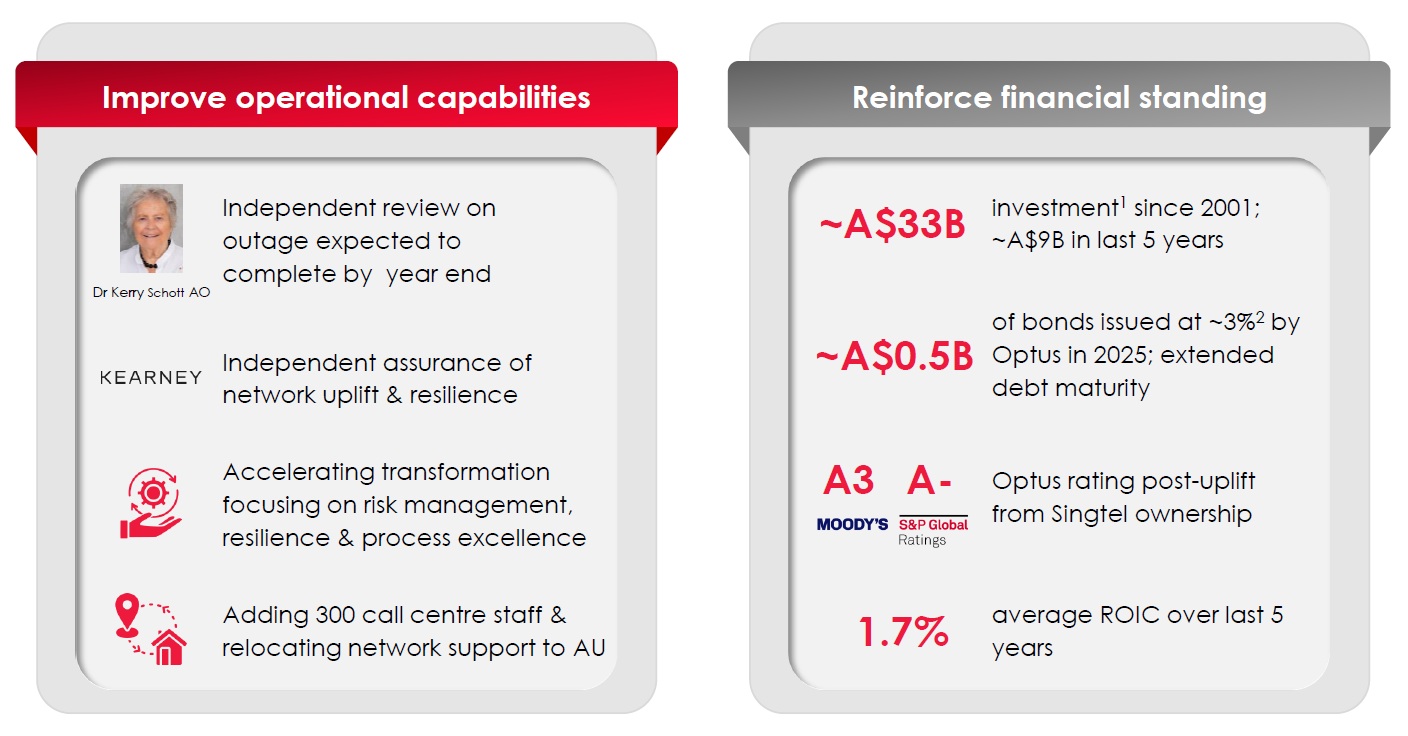

In Australia, Optus delivered 2% revenue growth and a 27% rise in EBIT, driven by stronger postpaid mobile and network-sharing income.

NCS remained a key growth driver with EBIT up 41%, helped by margin gains and higher bookings of S$1.8 billion.

Nxera, Singtel’s regional data-centre arm, grew EBIT by 6% as it expanded capacity and saw rising demand for AI cloud services.

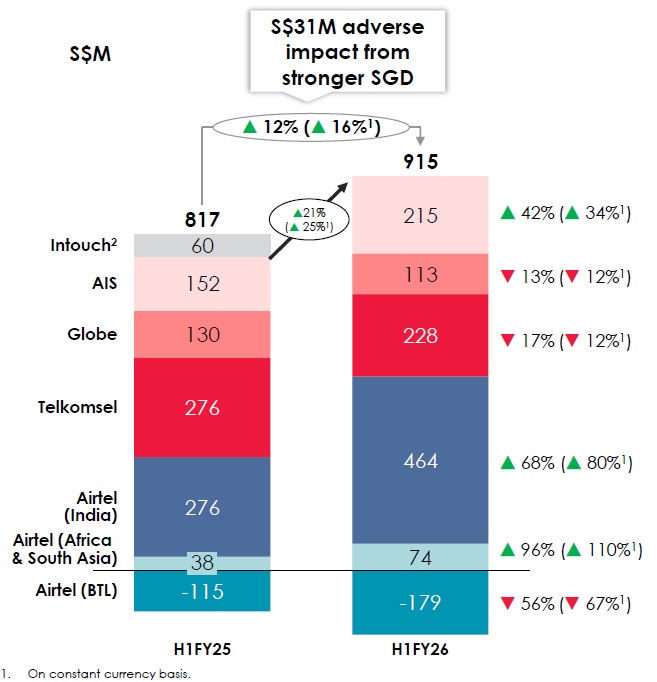

Regional associates’ post-tax profit rose 12% to S$915 million, led by Airtel and AIS.

Singtel recently sold 0.8% of its Bharti Airtel stake worth S$1.5 billion. This marks Singtel’s second stake reduction in 2025, following a 1.2% sale in May, and adds to earlier divestments in 2022 and 2024 that have together raised about S$3.5 billion.

Post-transaction, Singtel’s effective interest in Airtel will fall to 27.5% from 28.3%, with its remaining stake valued at approximately S$51 billion.

The sale is part of Singtel’s ongoing capital recycling strategy, through which it has already met S$5.6 billion of its new S$9 billion medium-term capital recycling target.

Proceeds will go toward capital returns to shareholders, including its value realisation dividend and share buyback programmes.

According to Reuters, Singtel and KKR are reportedly in discussions to acquire the remaining stake in ST Telemedia Global Data Centres (STT GDC), in a deal estimated to exceed S$6.4 billion.

Singtel continues to focus on delivering shareholder value through steady dividend growth and disciplined capital management.

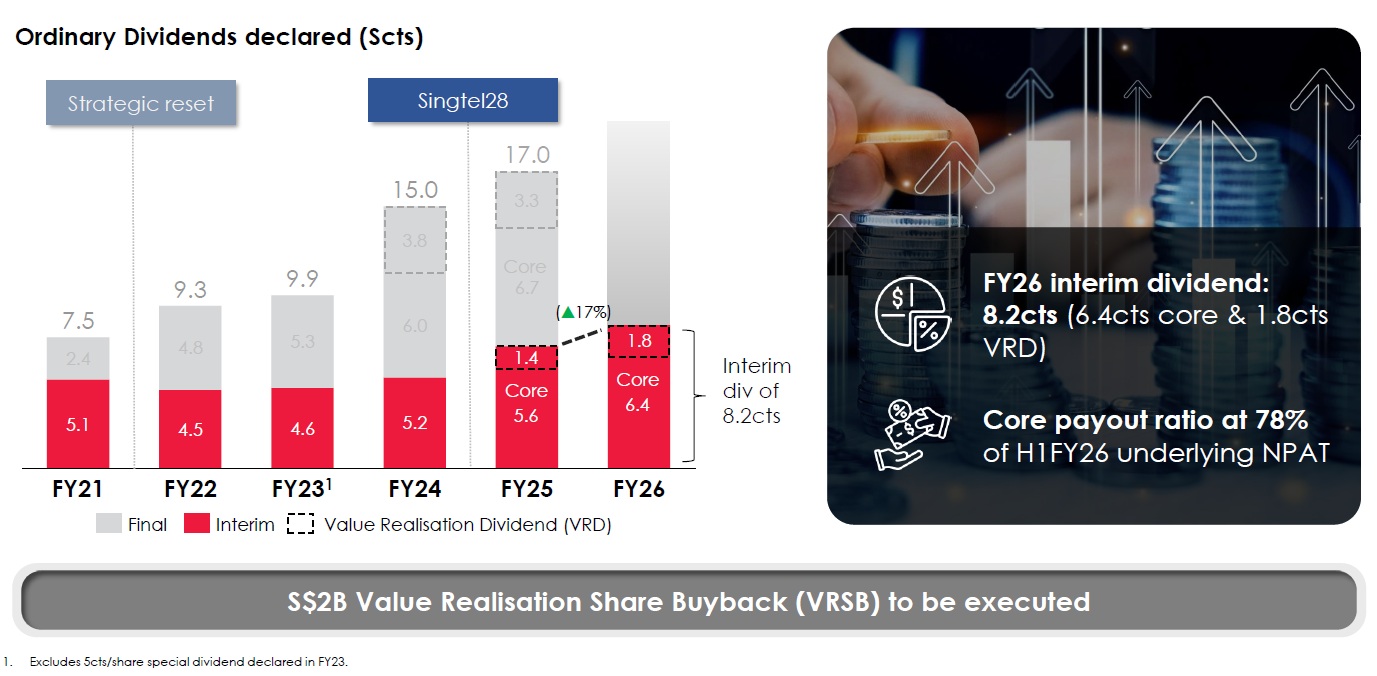

Singtel declared an interim dividend of 8.2 cents per share, up 17% from a year ago.

This includes a 6.4-cent core dividend and 1.8-cent value-realisation payout.

Based on consensus estimate of S$0.186 dividend for FY26, at the current share price of S$4.62, the implied dividend yield is 4.0%, still below its long-term average of 5.1%.

Related Links:

#4 - Keppel Limited (SGX: BN4)

Keppel Limited is one of Singapore’s largest conglomerates, managing assets across energy, infrastructure, and real estate worldwide.

Keppel’s share price has continued to rise, reaching close to its all-time high of S$10.38 as of 7 November 2025.

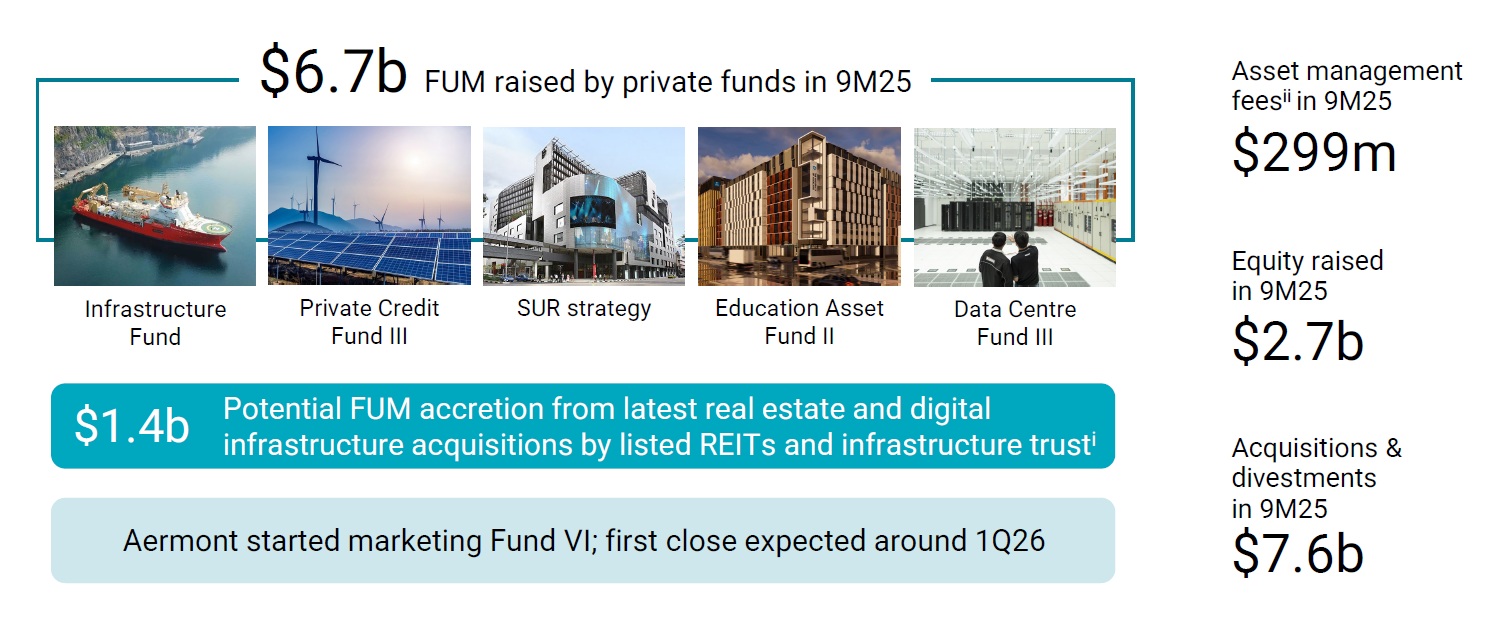

In its latest 9M 2025 update, Keppel reported over 25% year-on-year growth in net profit.

This was driven by stronger recurring income from both asset management and operating businesses.

Recurring income rose close to 15%, underscoring the stability of its diversified earnings base.

The group also unlocked S$2.4 billion of asset monetisation, including the proposed divestment of M1’s telco business and waste-management firm 800 Super.

Since 2020, Keppel has generated about S$14 billion of total proceeds through its asset monetisation programme.

It raised S$6.7 billion across private funds in 9M 2025, with new acquisitions that could add another S$1.4 billion to its Funds Under Management.

This reflects steady investor demand for Keppel’s real assets platform.

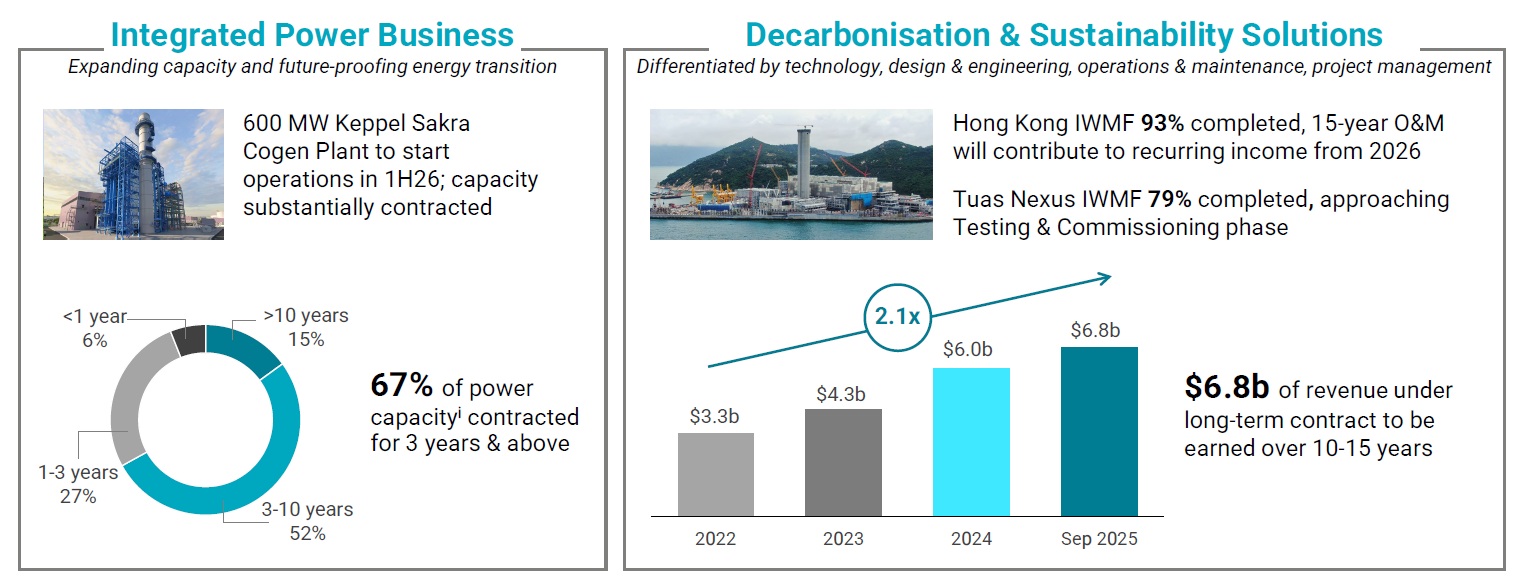

Meanwhile, its integrated power and infrastructure projects continued to progress well.

The company has S$6.8 billion of long-term contracted revenue to be earned over the next 10 to 15 years, providing visibility of future cash flows.

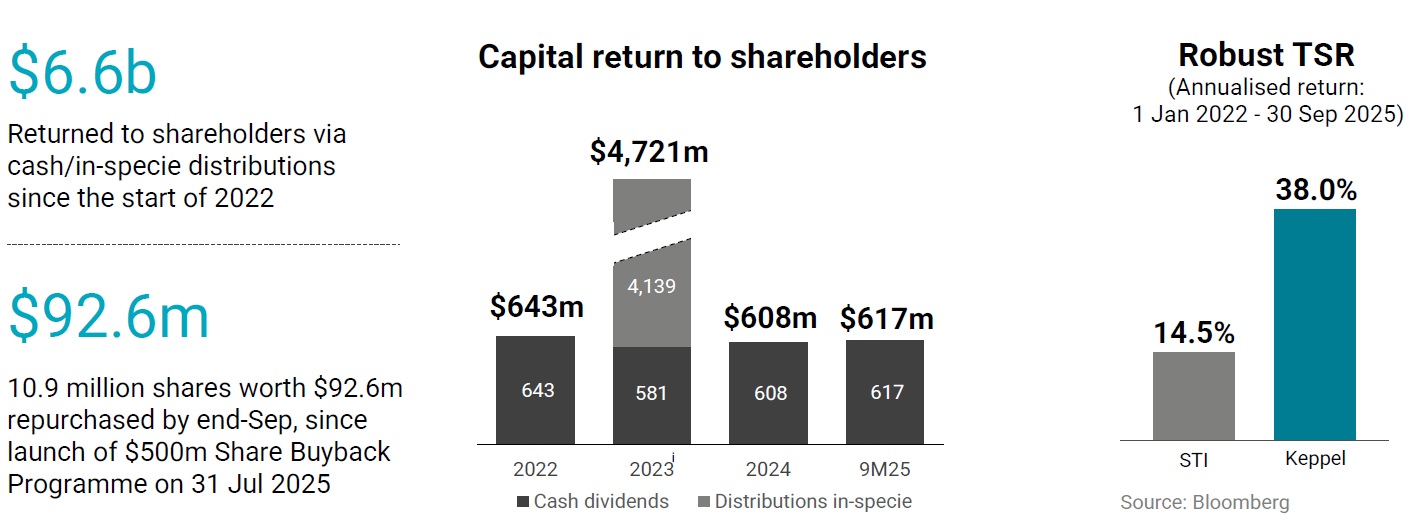

On the capital return front, Keppel distributed S$617 million in cash dividends and repurchased S$92.6 million worth of shares under its S$500 million buyback programme.

The group reaffirmed that future dividends will be tied to annual net profit, with part of the cash unlocked from asset sales also used to reward shareholders.

Based on its consensus estimate of S$0.36 per share, at the current share price of S$10.15, Keppel Limited's implied dividend yield is 3.5%, lower than its historical average of 5.9%.

Related Links:

What would Beansprout do?

DBS, OCBC, Singtel and Keppel have seen significant share price gains this year, reflecting resilient earnings and capital management initiatives.

For income-focused investors looking to earn their passive income, we can compare their dividend yields to understand how they stack up.

Despite the share price rallies, DBS and OCBC continue to offer the most attractive dividend yields, and stand out for those looking for blue chip stocks to generate passive income.

On the other hand, the dividend yields of Singtel and Keppel now stand at 4.0% and below, based on the consensus estimates.

With the lower dividend yields that they now offer, investors looking for income can also explore Singapore REITs that offer dividend yields of above 5%.

If you’d like to identify other Singapore stocks with attractive dividend yields above 3% and potential upside to analyst target, you can explore our Singapore dividend stocks screener.

If you’d prefer broad exposure to the Singapore market, you can also consider learning more about the Straits Times Index (STI), which tracks the performance of Singapore’s largest blue chip companies.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments