UOB One Account: Interest rate of up to 1.90% p.a.

Savings Account

By Beansprout • 01 Dec 2025

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Learn about the latest UOB One Account interest rates. See how much interest you can still earn.

What is the UOB One account?

The UOB One Savings Account has long been one of the popular high-yield savings accounts among the Beansprout community.

Over the past year, it stood out for offering one of the most competitive rates for everyday savers.

However, with the recent UOB One interest rate changes, many savers (myself included) are wondering whether the UOB One Account still offers good value for parking their money.

According to UOB, the adjustment was made to “align with long-term interest rate environment expectations.”

In this update, I’ll walk through the new interest rates taking effect in 1 December 2025 and explore how we can still make the most of the UOB One Account in today’s lower-rate environment.

What is the current interest rate on the UOB One account?

The UOB One account is the flagship savings account of UOB which allows you to earn a decent interest rate with minimal effort.

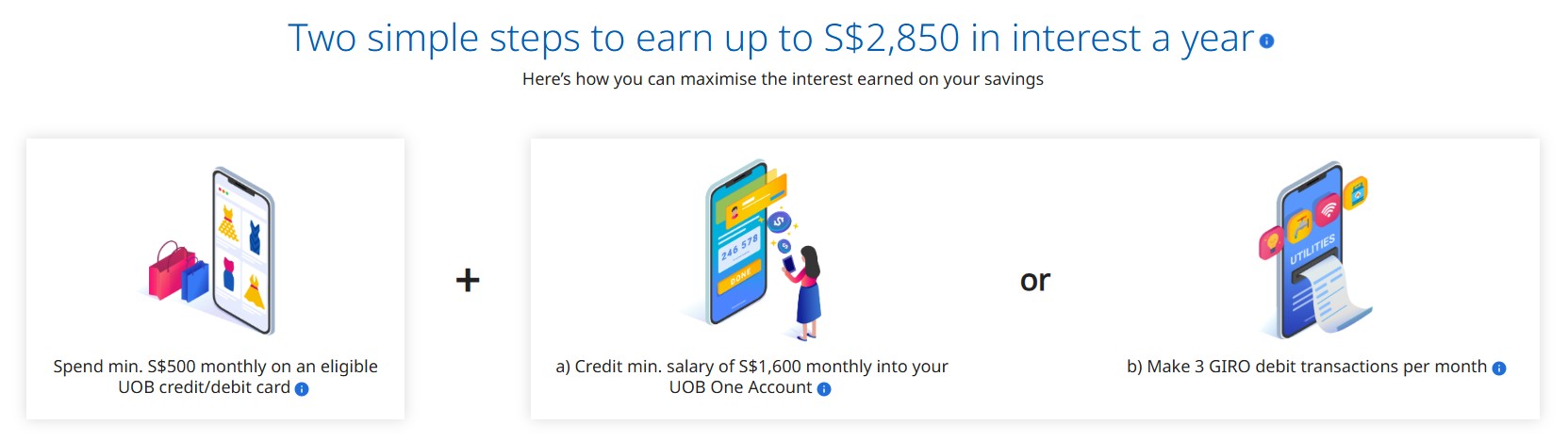

To qualify for bonus interest, all you need to do is:

- Spend at least S$500 each month on eligible UOB credit or debit cards; and

- Either credit your salary of at least S$1,600 through GIRO or PayNow, or make 3 GIRO debit transactions per month.

Unlike some other high-yield accounts, the UOB One account does not require you to purchase insurance or an investment scheme to unlock the highest tier.

If you are in the midst of adulting, you should have an easy time meeting the requirements to earn the higher interest rate on the UOB One account.

To understand how the interest rate on the UOB One account works, let us look at the breakdown below.

Total interest p.a. with effect from 1 December 2025 | |||

| Account monthly average balance | Spend min. S$500 (per calendar month) on eligible UOB Card | Spend min. S$500 (per calendar month) on eligible UOB Card AND make 3 GIRO debit transactions | Spend min. S$500 on eligible UOB Card AND credit your salary via GIRO |

| First $75,000 | 0.65% | 1.00% | 1.00% |

| Next $50,000 | 0.05% | 2.00% | 2.50% |

| Next $25,000 | 0.05% | 0.05% | 3.40% |

| Above S$150,000 | 0.05% | 0.05% | 0.05% |

| Source: UOB One account page as of 1 December 2025 | |||

We shall start by illustrating the interest rate earned on the UOB One account if you are able to credit your salary of at least S$1,600.

For the first monthly average balance of S$75,000 in your account, you earn an interest rate of 1.50% p.a. if you are able to spend a minimum $500 on eligible UOB card and credit your salary.

The interest rate earned rises to 2.50% p.a. on your next S$50,000 of monthly average balance, all the way up to 3.40% p.a. on your next S$25,000 monthly average. Making your balance S$150,000.

| Account monthly average balance | Maximum Interest earned when you spend minimum $500 on eligible UOB card and credit salary of at least S$1,600 |

| First S$75,000 | S$750 |

| S$75,000 to S$125,000 | S$2000 |

| S$125,000 to S$150,000 | S$2,850 |

| Source: UOB One account page as of 1 December 2025 | |

We can also look at the effective interest rate earned on the UOB One account across various tiers. To calculate the effective interest rate, we can add the total interest received across different tiers.

The effective interest rate is the average interest rate you would get by dividing the total interest earned by your average balances.

You might also be interested to know that salary credit transactions made via PayNow reflected as “PAYNOW SALA” will be considered eligible for bonus interest on UOB One Account.

| Account balance | Maximum effective interest rate for saver who meet card spend of minimum $500 AND credit salary from 1 December 2025 |

| First S$75,000 | 1.00% |

| S$75,000 to S$125,000 | 1.60% |

| S$125,000 to S$150,000 | 1.90% |

| Source: UOB One account page as of 1 December 2025 | |

Overall, you will continue earning higher returns than standard savings accounts.

What is the interest rate earned on the UOB One account if I am unable to credit my salary?

If you are unable to credit your salary via GIRO, you can always make 3 GIRO debit transactions in each calendar month to qualify for the bonus interest rate.

The good news is that the interest rates for this tier will remain the same even after 1 December 2025.

If you consistently meet the spend and 3 GIRO requirements, your effective interest rate will stay around 1.175% p.a. on S$150,000 balance, similar to before.

| Account monthly average balance | Interest rate p.a. (before and after 1 Dec 2025) |

|---|---|

| First S$75,000 | 1.00% |

| Next S$50,000 | 2.00% |

| Next S$25,000 | 0.05% |

| Above S$150,000 | 0.05% |

If you are wondering how to make at least 3 GIRO payments, I have some ideas for you below:

- Credit card bills (Yes! I was also amazed to find out that this method counts – say yay to paying credit card bills on time and no to paying late fees)

- Electricity bills

- Mobile phone bills

- Income tax (apply with IRAS)

What are the eligibility requirements for the UOB One account?

To qualify for the UOB One account, you must fulfill the following requirements.

- You will need to be 18 years and above to open a UOB One account.

- The minimum initial deposit for the UOB One account to S$1,000.

- You will also need to maintain a monthly average balance in your UOB One account of at least S$1,000, or a S$5 fall-below fee will be imposed. This fall-below fee is waived for the first 6 months for accounts opened online.

- A S$30 early account closure fee will levied if you close your UOB One account within 6 months from opening.

The full terms and conditions can be found here.

Is there any catch to the UOB One account?

Fortunately, there doesn’t seem to be any catch to the UOB One account. What you see is really what you get!

UOB One does not require you to deposit fresh funds to be eligible for the bonus interest rate.

Also, do note that the interest rate earned on your UOB One account falls to 0.05% per annum for the portion of your monthly average balances above S$150,000.

To maximise your interest earned, you might want to consider the UOB Stash account or another high yield savings account for balances above S$150,000.

Are there any promotions for the UOB One Account?

Learn more about the Leap of Fortune Savings Promotion here.

Which cards are eligible for the UOB One spending?

One thing you need to note is that the S$500 card spend must be done on an eligible card.

The eligible UOB Credit Cards include the UOB One Card, UOB Lady's Card (all card types), UOB EVOL Card, Lazada-UOB Card.

The eligible UOB Debit Cards include the UOB One Debit Visa Card, UOB One Debit Mastercard, UOB Lady’s Debit Card and UOB Mighty FX Debit Card.

If you are looking for a fuss-free card, the UOB One Credit Card offers 10% cashback on dining, online shopping, groceries, transport.

You can find the list of eligible cards here.

UOB One vs OCBC 360 vs DBS Multiplier – Which is the best savings account in Singapore?

With interest rates beginning to ease recently, many are reviewing their savings strategies.

One question that often comes up is: Is the UOB One account still the most rewarding savings account in Singapore?

While DBS simplified its Multiplier Account in August 2023 and OCBC continues to offer attractive rates with its 360 Account, the UOB One Account has long appealed to savers for its simple structure and ease of qualifying for bonus interest.

With the interest rate revision on 1 December 2025, however, UOB One’s advantage is narrowing.

Its effective rates will move closer to what other banks are offering, and may no longer stand out as clearly as before.

To help you make sense of it all, we’ve done the math based on these assumptions:

- You credit your monthly salary into the account

- You save and spend at least S$500 each month

- You meet the minimum credit card spending requirement

- You do not buy insurance or investment products from the bank

Here’s how the interest rates compare across different account balances as of 4 November 2025, so you can decide which bank offers the best return for your savings.

| Account monthly average balance | Maximum effective interest rate (per annum) | Winner |

| First $75,000 |

| OCBC 360 |

| More than S$75,000 Less than $100,000 |

| OCBC 360 |

| More than $100,000 Less than $150,000 |

| UOB One |

| More than $150,000 Less than $250,000 |

| UOB One |

| $250,000 and above |

| OCBC 360 |

| Source: Various bank websites, Beansprout Compare Savings Accounts tool, as of 1 December 2025 | ||

To help you decide between the UOB One account and the OCBC 360 account, use the calculator below to compare how much interest you would get with the UOB One account and the OCBC 360 with the new interest rates.

How to open a UOB One Account

You can open a savings account online here, get approval within minutes and start transacting instantly.

To apply you will require the following:

- New to UOB customers, existing to UOB customers and joint applicants: Retrieve with Myinfo using Singpass login

- Existing to UOB customers: Personal Internet Banking login details

- Existing to UOB customers applying for single-named account application: Credit/Debit card number and PIN

Learn more about the UOB One Account here.

Final verdict on UOB One Account

Despite the upcoming revision in interest rates, the UOB One Account still allows us to earn a relatively decent return on our savings with minimal effort.

Currently, the account offers a maximum effective interest rate of up to 1.90% p.a. if we meet the full criteria of S$500 monthly card spend and salary credit.

While this is lower than before, it remains competitive among major savings accounts in Singapore and is still higher than the latest 6-month T-bill yield of 1.39% as of 20 November 2025.

If we have up to S$150,000 in savings, the UOB One Account continues to offer a convenient way to earn steady interest without needing to buy insurance or investment products.

If we have less than S$150,000 of savings, then we can compare the UOB One account with other savings accounts to find out how we can maximise our interest earned.

The other drawback of the UOB One account is that the interest rate falls to 0.05% per annum for the portion of our monthly average balances above S$150,000.

To maximise our interest earned, we can also consider the UOB Stash account or another high yield savings account for balances above S$150,000.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights on savings, investing and retirement planning.

This article contains affiliate links. Beansprout may receive a share of the revenue from your sign-ups to keep our site sustainable. You can view our editorial guidelines here.

Find out which savings account allows you to earn the highest interest rate on your savings.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Questions and Answers

2 questions

- ling • 02 Dec 2024 08:16 AM

- Carrie • 02 Feb 2024 11:27 PM