Beyond Singapore blue chips: The next growth opportunities in local stocks

Mutual Funds

Powered by

By Gerald Wong, CFA • 21 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Singapore’s stock market is entering a new phase. We explore how shifting economic drivers are broadening opportunities beyond traditional blue chips.

This post was created in partnership with Fullerton Fund Management. All views and opinions expressed in this article are Beansprout's objective and professional opinions.

What happened?

Singapore’s stock market is entering a new phase.

For many years, the market was defined by the a familiar group of blue chip stocks known for their dividends.

The financial sector makes up around 50% of the FTSE ST All-Share Index*, and the real estate sector at about 19% as at 30 January 2026, reflecting how much the market has been anchored by mature sectors.

These companies are still important and continue to play a central role in many portfolios, supported by their scale and income potential.

But the structure of the market is evolving as Singapore’s economy transforms, and new areas linked to technology, sustainability and regional growth are gaining traction.

The investable universe is broadening beyond these traditional blue chip stocks.

This creates opportunities for investors who are willing to look for companies positioned to ride on the new growth drivers.

We previously shared 4 reasons investors are investing in Singapore now. Here, we will walk through what could shape the next chapter of growth for Singapore stocks.

What are the growth drivers in the Singapore market?

Singapore’s economy is entering a new growth phase, where it is building additional value-added outputs across more diversified goods and services.

Several long-term themes are showing up in business activity and, increasingly, in listed company earnings.

#1 – Digitalisation

Digital transformation is accelerating across many industries in Singapore.

Companies across sectors are relying more heavily on cloud computing, data analytics, artificial intelligence and automation.

This shift is not confined to technology firms.

Banks, logistics providers, healthcare groups and manufacturers are all embedding digital tools into their operations to improve efficiency, strengthen risk management and scale regionally.

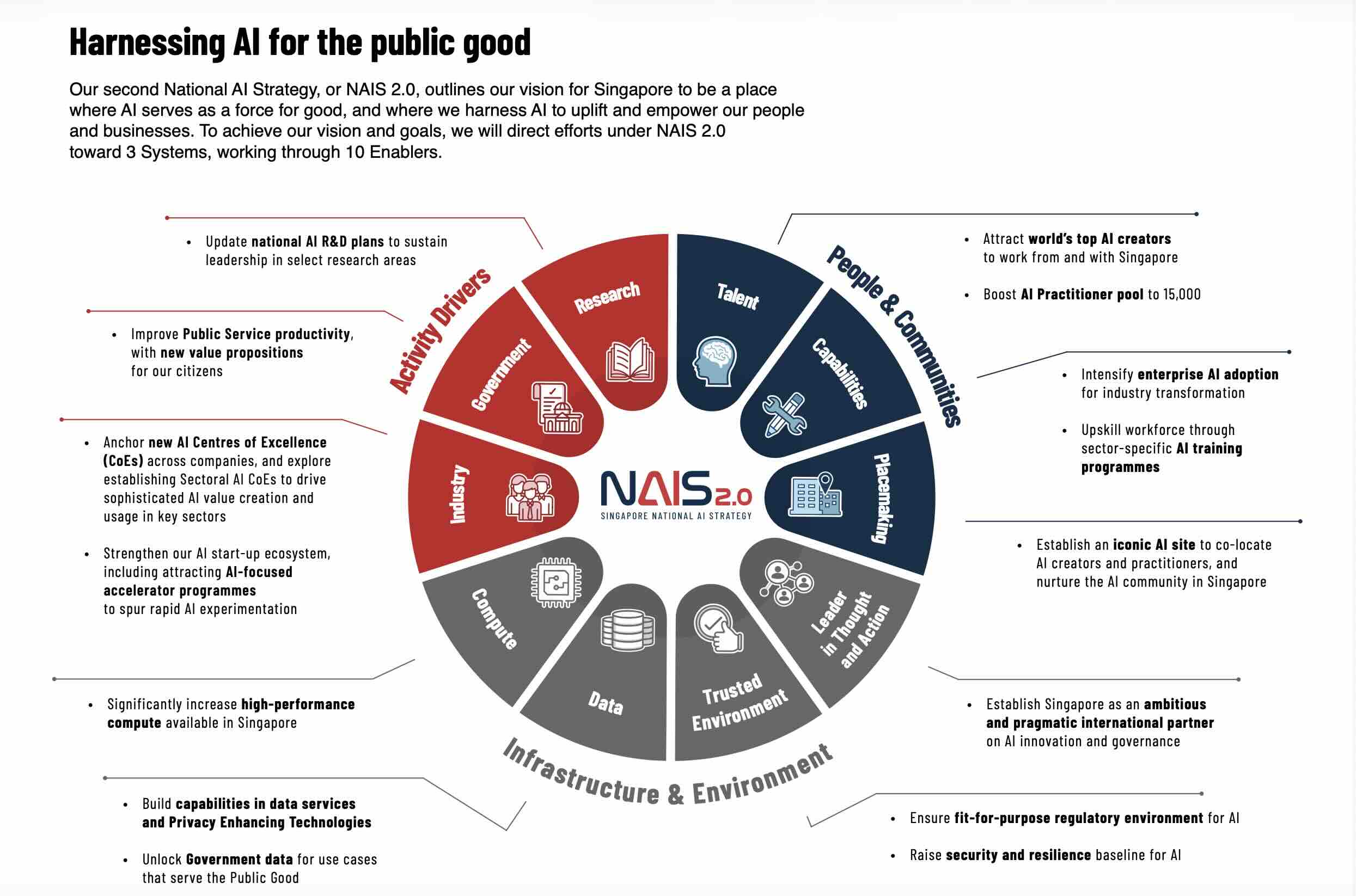

National initiatives have helped to accelerate this transition. Singapore’s National AI Strategy and the Digital Enterprise Blueprint (DEB) have reinforced adoption by supporting enterprises and workers in harnessing digital technologies.

Launched in May 2024, the DEB aims to help at least 50,000 SMEs over the next five years adopt digital tools.

This should lift demand for services like cloud computing, cybersecurity, AI software and automation.

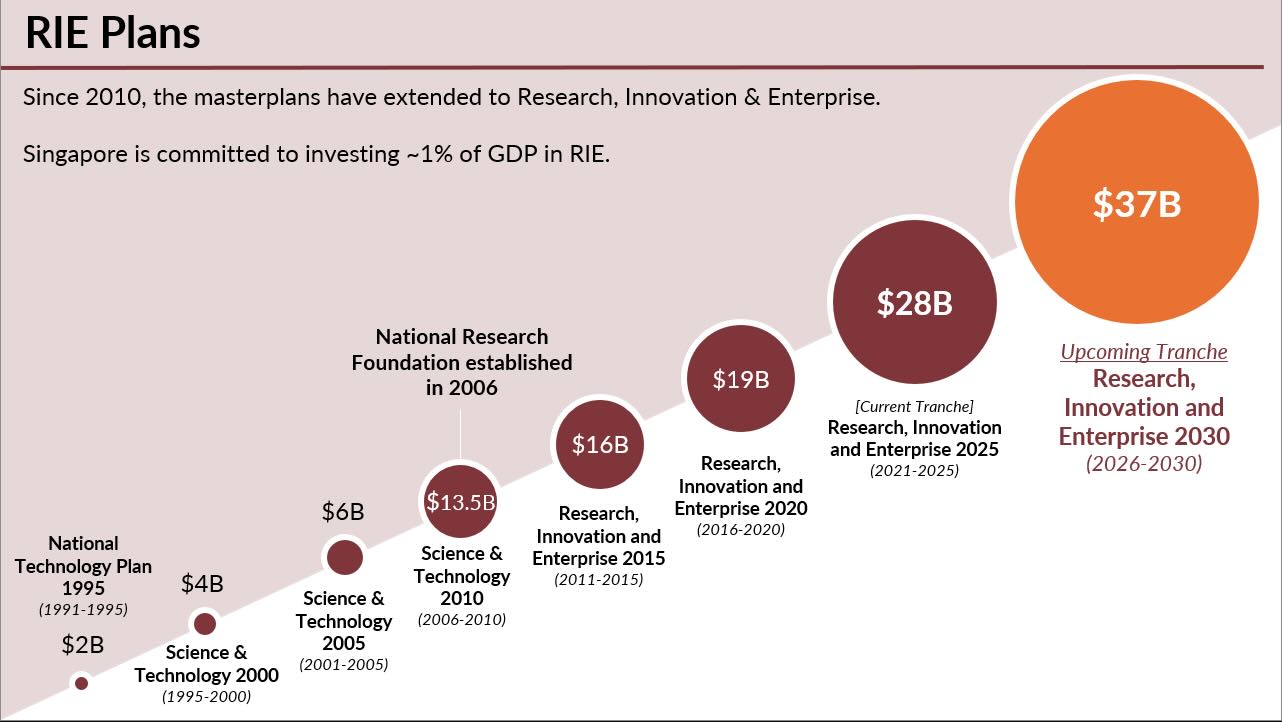

In parallel, Singapore is stepping up its investment to build the next generation of higher value industries under the Research, Innovation and Enterprise 2030 (RIE2030) Plan, which covers 2026 to 2030.**

The Government has committed S$37 billion, which it described as about 1% of GDP (given expected trends to 2030), to deepen research capabilities, strengthen the talent pipeline, and drive innovation aligned with economic and national priorities.

For investors, this matters because it increases the chances that new growth areas can potentially lead to companies that scale over time.

As these areas mature, they are more likely to contribute meaningfully to listed company earnings and eventually create new market leaders.

As a result, demand for data centres, cybersecurity services, industrial automation and digital infrastructure has grown steadily.

These activities are becoming new building blocks of Singapore’s economy, creating a new layer of companies that benefit from recurring demand and long-term contracts.

#2 – Sustainability

Sustainability is also a major growth area.

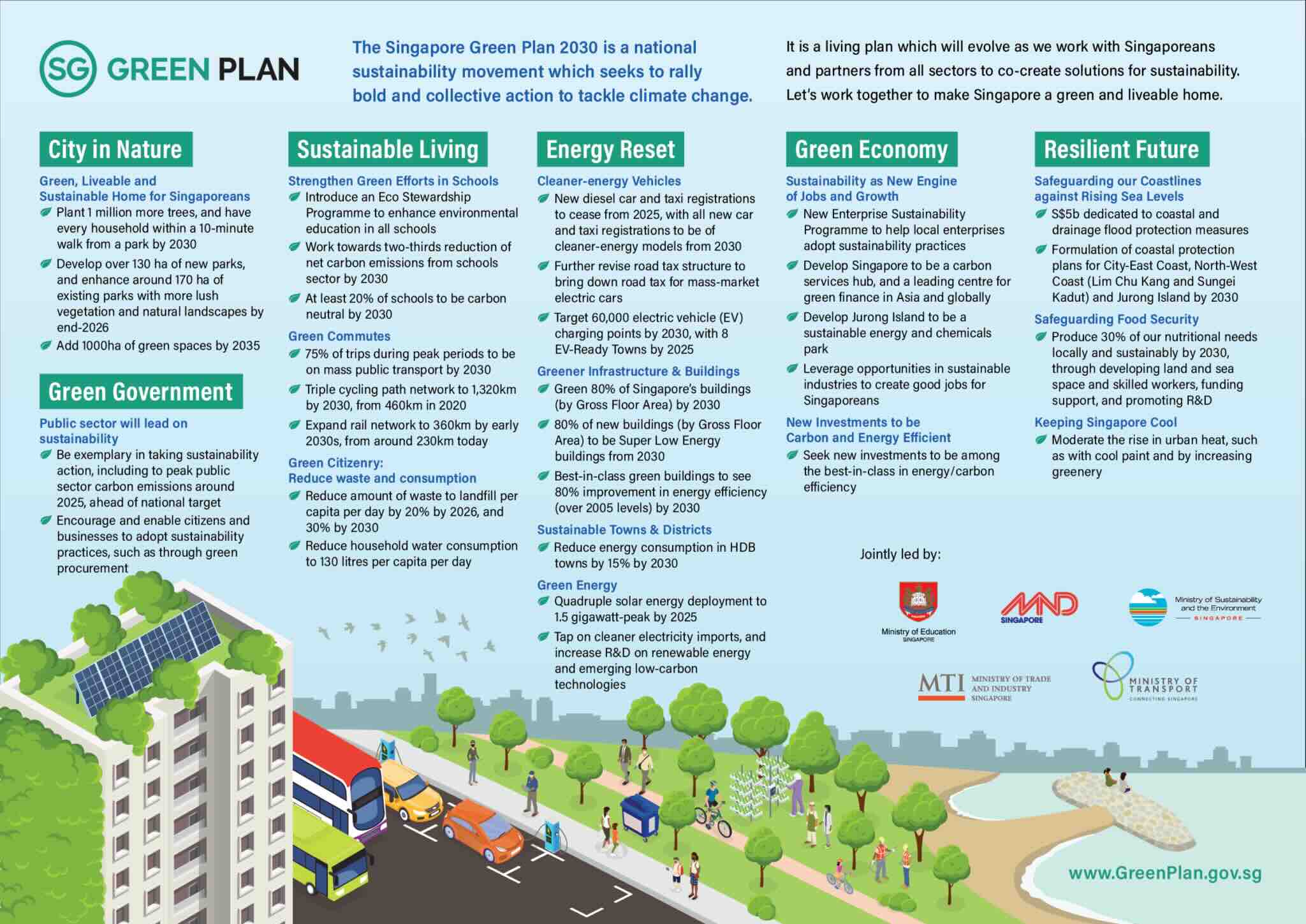

Singapore’s push towards a low-carbon future is shaping investment decisions across multiple sectors.

Under the Singapore Green Plan 2030, there is increasing emphasis on renewable energy, energy-efficient buildings, electric mobility and carbon-management solutions.

What stands out is that these initiatives are moving beyond high-level policy goals.

They are translating into commercial opportunities for companies involved in clean energy, green construction, environmental services and smart industrial solutions.

Over time, this shift could meaningfully change the composition of Singapore’s listed market, with more companies linked to sustainability outcomes and long-term infrastructure needs.

#3 – Regional integration is expanding the opportunity set

Regional growth adds another important dimension to Singapore’s equity story.

ASEAN remains one of the world’s fastest-growing regions, with significant boosts coming from initiatives like the Regional Comprehensive Economic Partnership (RCEP)***, and Singapore continues to strengthen its role as the region’s financial, digital and logistics hub.

This supports companies involved in cross-border trade, digital payments, e-commerce infrastructure and regional enterprise services.

At the same time, rising incomes across ASEAN are driving demand for wealth management, private healthcare and lifestyle services.

Singapore-based companies are often well-positioned to capture this growth, given their access to capital, regulatory stability and regional networks.

As regional integration deepens, more Singapore-listed firms are likely to generate earnings beyond the domestic market, increasing both their growth potential and resilience.

Taken together, these trends are broadening Singapore’s growth base.

For investors, this means the opportunity set in Singapore equities is likely becoming deeper and more diverse, setting the stage for the market’s next chapter.

What sectors could potentially unlock shareholder value?

As Singapore’s economy evolves, we are beginning to see the signs of a new group of listed companies emerging and starting to stand out.

These firms are not only aligned with long-term structural trends, but are also increasingly focused on improving profitability, capital discipline and shareholder returns.

This matters in a market like Singapore, where investors often value both income and stability alongside growth.

#1 – Digital infrastructure sector

The growth in data usage, cloud adoption and digital services has driven sustained demand for digital infrastructure.

Companies involved in data centres, cloud-enablement services and cybersecurity could benefit from long-term contracts, high switching costs and meaningful barriers to entry.

These characteristics could support more stable cash flows, even during periods of economic uncertainty.

As digital services become embedded across the economy, these businesses could move from being peripheral enablers to essential infrastructure providers.

#2 – Fintech and digital finance

Fintech is another area where growth is accelerating.

Digital-payment providers, wealth-tech platforms and new digital banks are expanding alongside rising wealth in Singapore and across ASEAN.

Singapore’s position as a trusted financial centre continues to support innovation in this space, while its regulatory framework provides a degree of stability that helps viable players scale sustainably.

As these platforms mature, some are beginning to shift focus from pure growth toward profitability and capital efficiency, which may improve long-term investor appeal.

#3 – New real estate models

New real-estate models are appearing, too.

Co-living operators, flexible-stay providers and hospitality-technology platforms are responding to evolving lifestyle and work patterns, particularly among younger professionals and mobile regional workers.

Compared with traditional property developers, many of these businesses operate more asset-light models.

This may make it easier for them to scale, adapt to demand and generate returns without tying up excessive capital.

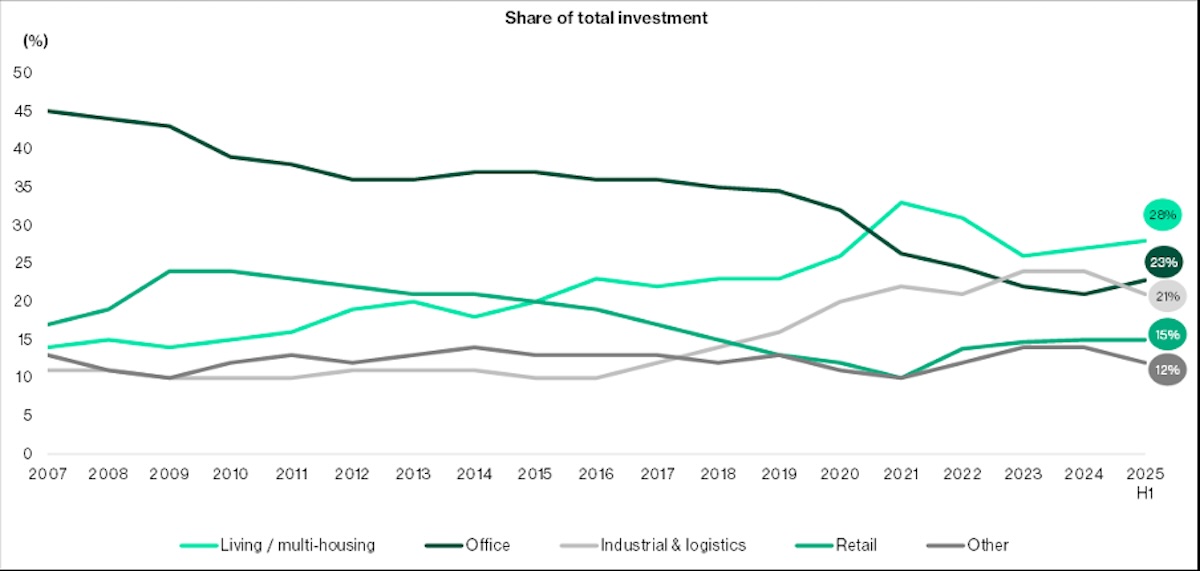

| Real Investment by Sector (%), 2007 – H1 2025 |

|

#4 – Green, logistics and industrial solutions

Beyond technology and finance, companies linked to sustainability, logistics, and industrial optimisation are also gaining traction.

Singapore’s sustainability goals and ASEAN’s supply-chain shifts could create further demand for clean energy solutions, electric mobility infrastructure and smarter industrial processes.

Firms operating in these areas are often positioned at the intersection of policy support and regional growth.

While many of these companies are still small or mid-sized by index standards, they reflect where the economy is heading.

As they grow, improve margins and attract institutional interest, some may become the next generation of market leaders.

What risks investors should consider

#1 – Earnings may take time to materialise

Many of the themes shaping Singapore’s next phase of growth are long-term in nature.

This means it can take time for investments in technology, sustainability and new business models to translate into consistent earnings growth.

Some companies may experience uneven results as they invest ahead of demand or navigate competitive pressures.

#2 – Volatility and liquidity risks remain

Fast-growing companies with an evolving growth trajectory tend to be more volatile than the typical, traditionally established names.

During periods of market stress, these stocks may see sharper price swings or lower liquidity, which can amplify short-term losses even if long-term fundamentals remain intact.

#3 – External risks still matter

Singapore is a highly open economy, and its stock market does not operate in isolation.

Global slowdowns, geopolitical tensions and shifts in risk sentiment can weigh on market performance, regardless of domestic growth trends.

This makes diversification and position sizing important when investing in emerging sectors. That said, investing in Singapore has benefited over time from the government’s top global credit rating and the tendency for the Singapore dollar to appreciate over time.

What would Beansprout do?

Singapore’s equity market is becoming more dynamic as new sectors emerge alongside traditional pillars.

Digitalisation, sustainability and regional expansion are structural forces that are likely to shape the economy, and the market, for many years.

Investors who recognise these shifts early may be able to benefit from a combination of steady income and long-term capital growth.

To position for this, we would focus on companies that are still reasonably valued today and aligned with Singapore’s future direction and growth evolution.

This includes firms involved in digital infrastructure, fintech, modern real-estate platforms and green or advanced industrial solutions.

Many of these sectors are supported by policy tailwinds, from sustainability targets to the push for more data centres and advanced manufacturing.

At the same time, balance remains important.

Large-cap names such as the banks can provide stability and income potential with their strong balance sheets.

New-economy companies on the other hand, can add growth exposure to long-term structural trends.

For investors looking for a more consolidated approach, funds such as the Fullerton Singapore Value Up Fund focuses on companies listed on the Singapore stock exchange with a core focus on growth and shareholder value creation.

By combining value discipline with exposure to structural growth themes, such strategies aim to balance income today with the potential for growth over time.

Learn more about the Fullerton Singapore Value Up Fund here.

About Fullerton Fund Management

Fullerton Fund Management is a home-grown investment specialist with over 20 years of investing experience in financial markets.

Fullerton helps clients, including government entities, sovereign wealth funds, pension plans, insurance companies, private wealth and retail, from the region and beyond, to achieve their investment objectives through our suite of solutions.

Footnotes

*Source: LSEG FTSE ST Index Series, 30 Jan 2026. Market cap is $504bn across 92 constituents.

**Source: National Research Foundation, Singapore

***Singapore is a key member of the RCEP - it is the world’s largest free-trade agreement, comprising about 30% of global GDP and about a third of the world’s population. See Regional Comprehensive Economic Partnership (RCEP) | Ministry of Trade and Industry

Important Information

No offer or invitation is considered to be made if such offer is not authorised or permitted.

This publication is for information only and your specific investment objectives, financial situation and needs are not considered here. The value of units in the Fund and any accruing income from the units may fall or rise. Any past performance, prediction or forecast is not indicative of future or likely performance. Any past payout yields and payments are not indicative of future payout yields and payments. Distributions (if any) may be declared at the absolute discretion of Fullerton Fund Management Company Ltd (UEN: 200312672W) (“Fullerton”) and are not guaranteed. Distribution may be declared out of income and/or capital of the Fund, in accordance with the prospectus. Where distributions (if any) are declared in accordance with the prospectus, this may result in an immediate reduction of the net asset value per unit in the Fund. Applications must be made on the application form accompanying the prospectus, which can be obtained from Fullerton or its approved distributors. You should read the prospectus and seek advice from a financial adviser before investing. If you choose not to seek advice, you should consider whether the Fund is suitable for you. The Fund may use or invest in financial derivative instruments. Please refer to the prospectus of the Fund for more information.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

This advertisement is the result of a paid partnership between Beansprout and Fullerton Fund Management Company Ltd (UEN: 200312672W).

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments