3 Singapore blue chip stocks that raised dividends in February 2026

Stocks

By Gerald Wong, CFA • 14 Feb 2026

Why trust Beansprout? We’ve been awarded Best Investment Website at the SIAS Investors’ Choice Awards 2025

Here are three Singapore blue chip stocks that recently raised their dividends in February 2026. We find out if their dividend yields remain attractive.

What happened?

The Singapore stock market has carried its momentum into 2026.

The Straits Times Index recently reached a new all-time high, exceeding the 5,000 mark. This follows a strong performance in January 2026, with the gains led by Singapore stocks.

With many Singapore blue chip stocks announcing their latest earnings, we have also seen some of them raising their dividend payouts.

This has further helped to drive improved sentiment towards these blue chip stocks.

Earlier, we looked at three Singapore blue chip REITs offering dividend yields above 5%. This has led to discussion in the Beansprout community about blue chip stocks that also offer attractive dividend yields.

In this article, I’ll take a look at the latest earnings of three Singapore blue-chip companies that raised dividends, and whether their yields are still attractive today.

3 Singapore blue chip stocks that raised dividends in February 2026

#1 – DBS Group Holdings Ltd (SGX: D05)

DBS is Southeast Asia’s largest bank by assets and a key component of the Straits Times Index.

Its earnings are primarily derived from consumer banking, wealth management, corporate lending, and treasury activities.

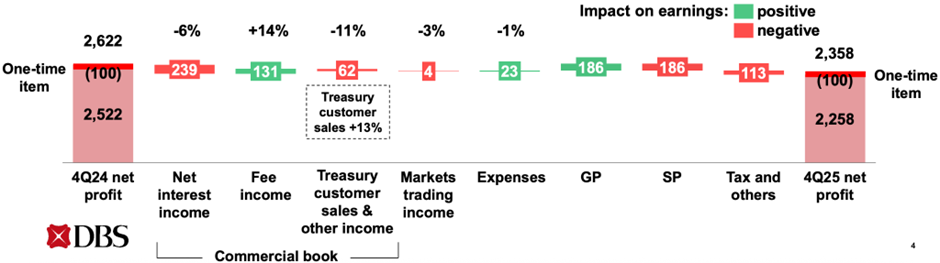

For 4Q 2025, DBS reported net profit of S$2.36 billion, down 10% year-on-year, as net interest margin declined to 1.93% from 2.15% a year ago, reflecting the impact of a lower-rate environment.

DBS' profit was also impacted by an increase in specific allowances to S$415m in 4Q 2025, driven largely by real estate-related exposures.

This was offset by continued strong growth in its fee income, Wealth management fees led the growth, up 24% to S$645 million from growth in investment products and bancassurance solutions.

Despite the decline in its 4Q 2025 profit compared to the previous year, DBS still achieved record full-year income and pre-tax profit for FY2025.

Management flagged that interest-rate headwinds could persist into 2026, which may continue to pressure margins.

At the same time, DBS is leaning on structural growth drivers such as wealth management to drive growth. It has also built up loan-loss provisions, reflecting a more cautious stance on credit risks.

Read also: DBS profit falls 10% but dividend higher in 4Q25: Our Quick Take

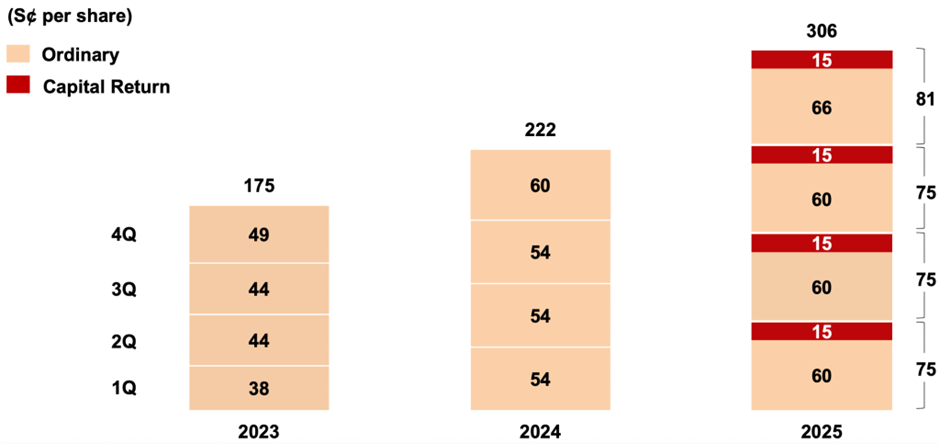

Alongside its latest results, DBS proposed a 4Q 2025 ordinary dividend at 66 cents per share and maintained a Capital return dividend 15 cents per share.

This brings the total FY2025 dividend to $3.06 per share, comprising of S$2.46 ordinary dividend and S$0.60 in capital return, representing a 38% increase compared to FY2024.

Management also reaffirmed that the 15 cent quarterly capital return is intended to be maintained through 2026 and 2027.

Based on DBS' total dividend of 81 cents in 4Q 2025, it offers an annualised total dividend per share of $3.24.

Based on DBS’ share price of about S$57.06 as of 13 Feb 2026, the annualised total dividend of S$3.24 implies a dividend yield of approximately 5.7%.

Find out how much dividends you would have received as a shareholder of DBS in the past 12 months with the calculator below.

Related links:

#2 – Keppel Corporation Limited (SGX: BN4)

Keppel is a global asset manager and operator, with businesses spanning Infrastructure (power and energy transition solutions), Connectivity (including data centres and digital infrastructure), and Real Estate.

In recent years, Keppel has been shifting towards an asset-light, recurring-income model, anchored by growing its funds under management (FUM) and monetising mature assets.

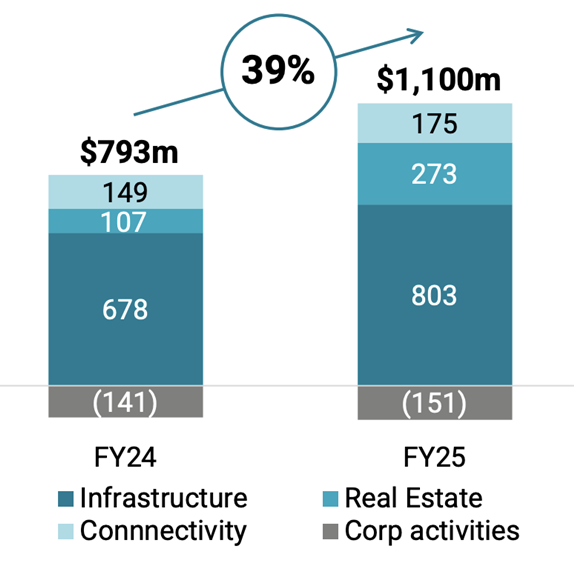

For FY2025, Keppel reported net profit of S$1.1 billion, excluding for divestment and discontinued operation), representing a 39% year-on-year increase.

This was driven by broad-based growth across its business segments and higher recurring income.

Keppel’s Infrastructure segment remained the largest profit contributor, helped by integrated power and sustainability solutions, while its Connectivity segment benefited from rising demand for digital infrastructure.

Operationally, Keppel is also leaning into structural themes such as digitalisation, AI-driven demand for data centres, and energy transition.

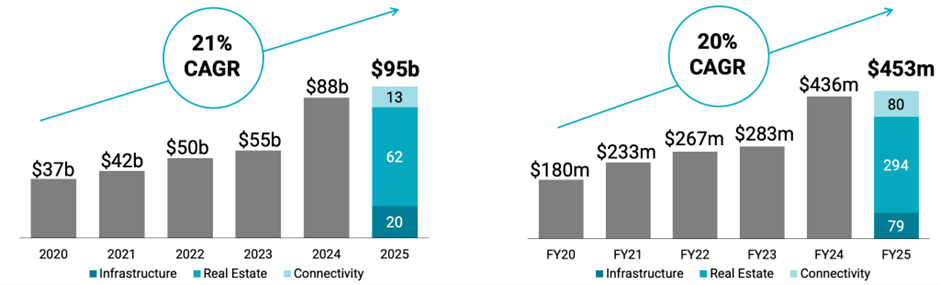

Funds under management (FUM) grew 8% YoY to S$95 billion at end-2025, supported by S$10.1 billion of new FUM added in 2025. Asset management fees also rose, lifting asset management net profit.

Keppel continues to execute on its asset monetisation.

Management highlighted that it announced about S$2.9 billion of divestments in 2025, which helps recycle capital, fund growth platforms, and support shareholder returns.

Keppel has also been returning capital via buybacks. It repurchased 13.2 million shares worth S$116 million in 2H2025 under its S$500 million share buyback programme launched in July 2025.

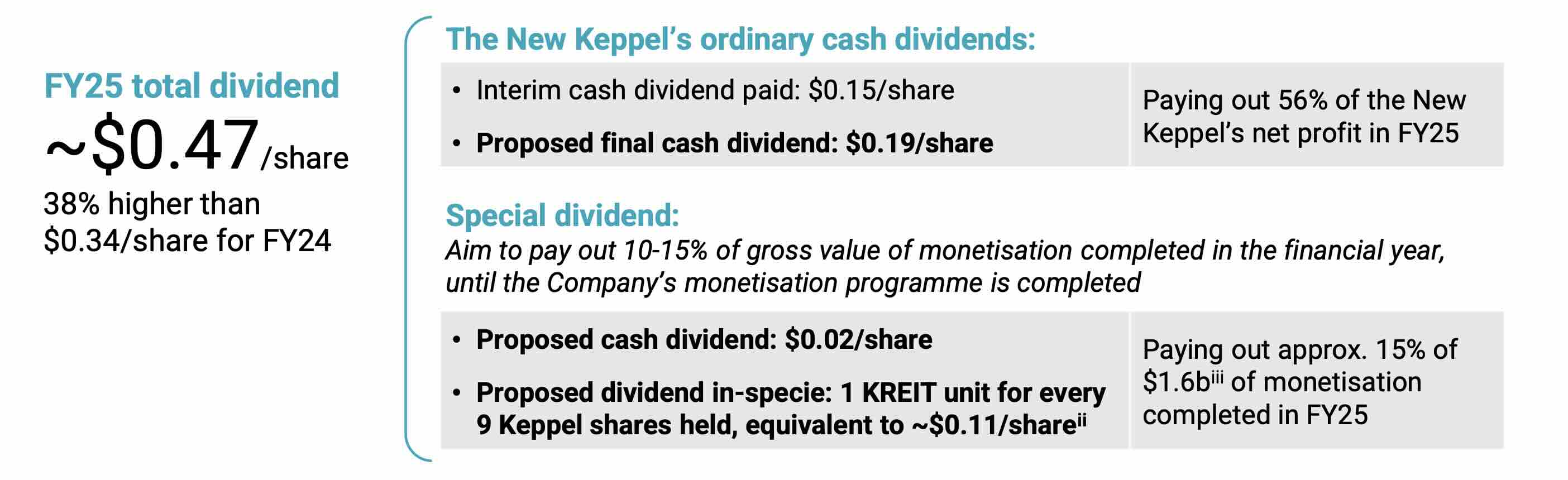

Alongside its FY2025 results, Keppel proposed a final cash dividend of S$0.19 per share.

Keppel also announced a special dividend of S$0.13 per share, comprising $0.02 cash and a dividend in-specie of 1 Keppel REIT unit for every 9 Keppel shares held.

With an interim dividend per share of S$0.15, this would bring total FY2025 dividends to S$0.47 per share, 38% higher than $0.34 in FY2024.

Based on Keppel’s share price of around S$12.61 as of 13 Feb 2026, the FY2025 total dividend of S$0.47 implies a headline dividend yield of about 3.7%.

Find out how much dividends you would have received as a shareholder of Keppel in the past 12 months with the calculator below.

Related links:

- Keppel Corporation Limited share price history and share price target

- Keppel Corporation Limited dividend history and dividend forecast

#3 – Singapore Exchange Limited (SGX: S68)

Singapore Exchange (SGX) is Singapore’s sole securities exchange operator, earning fees across equities cash, derivatives, and a growing Fixed Income, Currencies & Commodities (FICC) franchise.

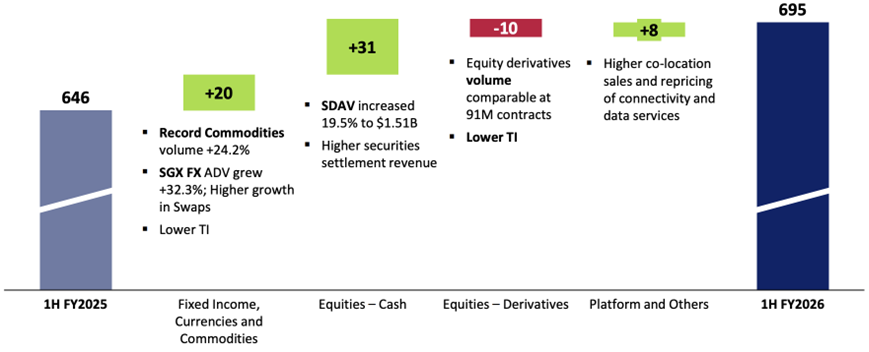

For the first half of FY2026 ended 31 December 2025, SGX reported net revenue of S$695.4 million, up 7.6% year-on-year, while EBITDA rose 9.6% to S$466.1 million.

The improvement was largely driven by stronger market activity, which lifted trading and clearing volumes.

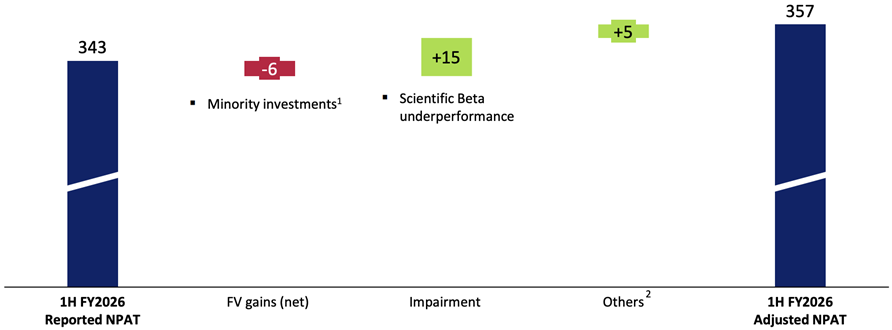

Adjusted net profit after tax increased 11.6% year-on-year to S$357.1 million.

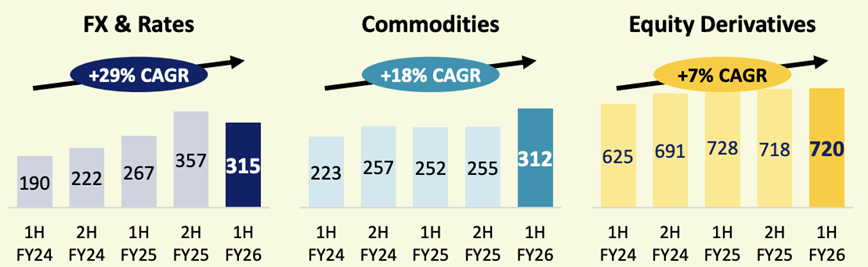

SGX highlighted sustained growth across its multi-asset business, supported by higher market activity.

Securities daily average traded value (SDAV) rose 20% YoY to S$1.51 billion, the highest in five years, alongside a growing IPO pipeline and retail participation at a four-year high.

SGX also highlighted that it saw 15 new equity listings in the half-year, signalling a healthier listing pipeline versus a year ago.

Its derivatives franchise recorded a half-year high of 1.35 million contracts in daily average volume. SGX’s FX business scaled further, with headline average daily volume hitting US$180 billion.

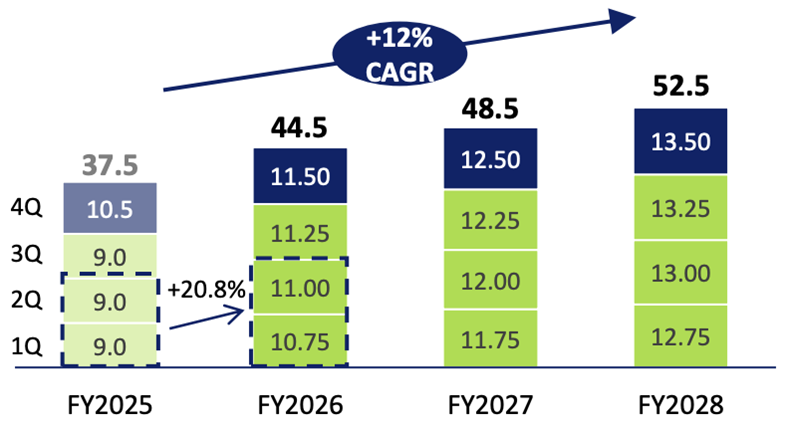

Alongside its latest results, SGX declared an interim quarterly dividend of 11.0 cents per share, up from 9.0 cents a year ago..

This brings total dividends in 1H FY2026 to 21.75 cents, up from 18.0 cents in 1H FY2025.

SGX had previously guided for a 0.25 cents quarterly dividend increase in dividend per share until the end of FY2028.

This would mean that it is guiding for a dividend per share of 44.5 cents in FY2026. Based on SGX’s share price of about S$18.13 as of 13 Feb 2026, SGX offers a 2.5% dividend yield.

Find out how much dividends you would have received as a shareholder of SGX in the past 12 months with the calculator below.

Related links:

- Singapore Exchange Limited share price history and share price target

- Singapore Exchange Limited dividend history and dividend forecast

What would Beansprout do?

With the STI at all-time highs, investors are scrutinising the earnings of companies more closely.

The share prices of DBS, Keppel and SGX also recently broke record highs, as their higher dividend payouts continue to support their share prices.

Across the three names, DBS offers the highest headline dividend yield of 5.7%, based on annualising its 4Q 2025 total dividend per share of S$0.81. Management has also reaffirmed that its S$0.15 quarterly capital return is intended to be maintained through 2026 and 2027.

However, DBS is just expecting its FY2026 total income to be just broadly in line with 2025, as weakness in net interest income is expected to offset further growth in its fee income.

Keppel offers a total dividend yield of 3.7%, if we were to consider its total FY2025 dividend per share of S$0.47, including its special dividend of S$0.13. The increase reflects a strong growth in Keppel's profit in 2025, supported by active capital recycling efforts.

Looking ahead, Keppel's dividends may continue to grow if its is able to continue its asset divestments. Management of Keppel has also noted that the special dividend in FY2025 has yet to incorporate divestment gains from the sale of M1, which has yet to be completed.

SGX offers the lowest dividend yield of about 2.5%. Like Keppel, we have seen strong growth in SGX's 1H FY2026 profit, supported by higher commodities, FX, and equities trading volumes. SGX's equity trading volume may continue to grow, if efforts to revitalise the Singapore stock market leads to more liquidity in the market.

Overall, DBS offers visibility on 2026 and 2027 dividend payouts with commitment towards its capital return dividend, but has a weaker earnings profile compared to Keppel and SGX.

Keppel offers a lower dividend yield, but may see its earnings and dividends support by further asset monetisation. SGX's dividend yield is the lowest, but offers exposure towards higher stock trading activity.

If you’d like to screen for other Singapore stocks with attractive dividend yields and potential upside, you can explore our Singapore dividend stocks screener.

If you prefer broad exposure to blue chips without picking individual names, you can also learn more about the Straits Times Index (STI).

[Beansprout Exclusive Longbridge Promotion] Get bonus S$50 FairPrice voucher within 5 working days, plus 5% p.a. interest boost coupon (worth ~S$100) when you sign up for a Longbridge account via Beansprout. Plus, S$1,380 CapitaVouchers to be won in our exclusive Huat Together Lucky Draw! Promo ends on 28 February 2026. T&Cs apply. Learn more about the Longbridge promotion here.

Check out the best stock trading platforms in Singapore with the latest promotions to invest in Singapore blue chip stocks.

Follow us on Telegram, Youtube, Facebook and Instagram to get the latest financial insights.

Read also

Most Popular

Gain financial insights in minutes

Subscribe to our free weekly newsletter for more insights to grow your wealth

Comments

0 comments